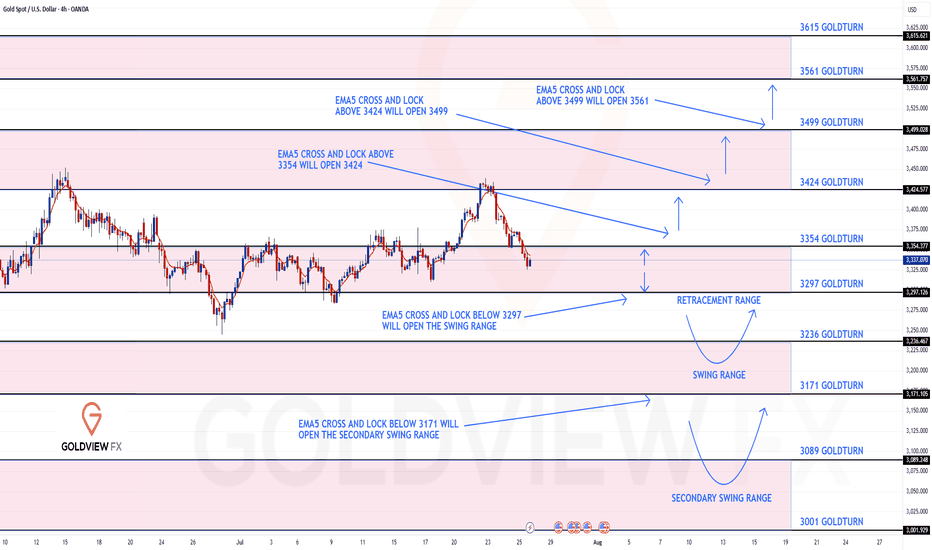

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3371 and a gap below at 3293. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3371

EMA5 CROSS AND LOCK ABOVE 3371 WILL OPEN THE FOLLOWING BULLISH TARGETS

3424

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

EMA5 CROSS AND LOCK ABOVE 3499 WILL OPEN THE FOLLOWING BULLISH TARGET

3561

BEARISH TARGETS

3293

EMA5 CROSS AND LOCK BELOW 3293 WILL OPEN THE SWING RANGE

3236

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

3001

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Goldtrading

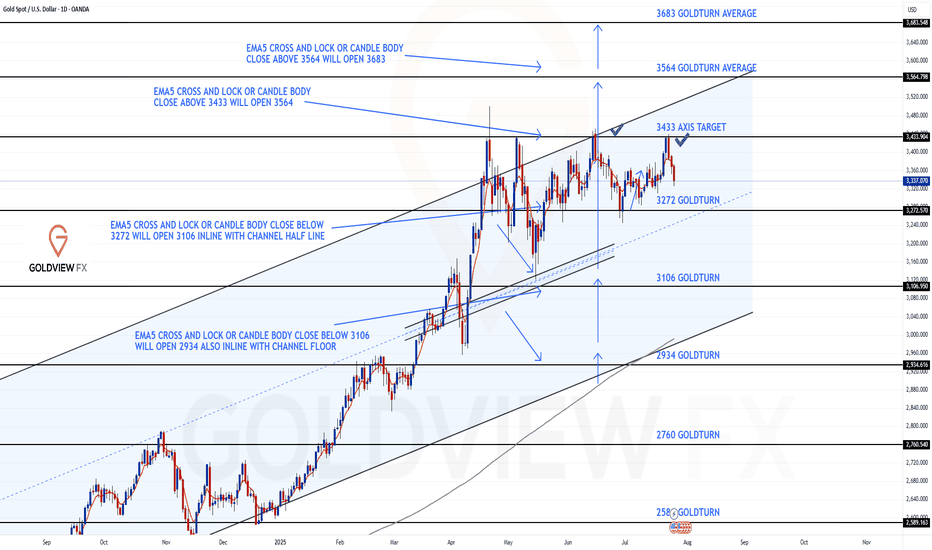

GOLD DAILY CHART ROUTE MAPHey Everyone,

Daily Chart Update – Another Clean Rejection: Structure Still Dominates

Following up on the recent price action last week after hitting the 3433 resistance level, we got exactly what the chart warned us about.

There was no confirmed break above 3433, which led to a clean rejection right back into 3272. Interestingly, the move aligned perfectly with the channel half-line, giving us another bounce right off that zone.

We remain in the same structured range, with price still rotating between 3262 and 3433, a 170+ pip zone that continues to deliver high probability trade setups.

Here’s where we are now:

🔹 Range Still Active

Price is respecting the 3272–3433 boundaries with precision. Until we get a decisive break and hold outside this range, range bound strategies remain in play.

🔹 No Breakout = Clean Rejection

The failure to sustain above 3433 confirms resistance is still valid. We're watching EMA5 for potential breakout confirmation, until then, the bias stays neutral within the range.

🔹 Channel Half-line Bounce

That rejection into 3272 also matched the channel half-line and the bounce there further cements this area as critical support.

Updated Key Levels

📉 Support – 3272

Still the major pivot. Buy zones remain valid here unless we see a confirmed breakdown.

📈 Resistance – 3433

Now clearly tested and rejected again. Any clean break and hold above could change the dynamic, but until then, it's solid resistance.

Thanks as always for your support.

Mr Gold

GoldViewFX

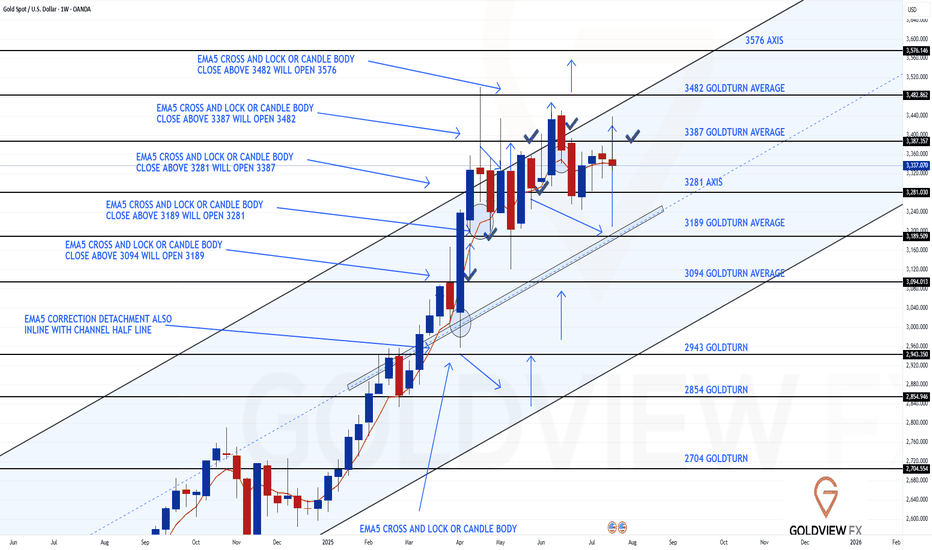

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Weekly Chart Update – Another Clean Rejection + Bounce: Range Still in Play

Just a quick follow up on the ongoing weekly structure. We continue to see incredible respect for levels, with price action playing out exactly as mapped.

After the initial rejection at 3387, we got another test of support at 3281, and once again, the level held perfectly, delivering a clean rejection and bounce. Price is now rotating back upward, currently heading toward 3387, which remains the upside magnet and still open for a retest.

We remain firmly inside the 3281–3387 range, and as long as neither boundary breaks with confirmation, the structure remains our dominant guide.

Updated Structural Notes:

🔹 3281 Rejected Again

Support doing its job to the pip. This latest bounce further reinforces the strength of this level within the weekly channel.

🔹 Back Toward 3387

With 3281 holding once more, price is now tracking toward the 3387 resistance zone, which remains the key level to break for further upside continuation.

🔹 Channel Structure Unchanged

No breakdown below support, no confirmed breakout above resistance. The rising channel remains fully respected, and EMA5 still leans constructive.

Updated Levels to Watch:

📉 Support – 3281

Key weekly pivot tested and held again. Continues to offer solid dip buy opportunities unless decisively broken.

📈 Resistance – 3387

Still our major resistance. It’s been tested and rejected, but remains open for another challenge.

📈 Resistance 2 – 3482

Unfilled gap and broader weekly target. Only comes into focus if we get a proper breakout and hold above 3387.

Plan:

We stay range focused between 3281 and 3387 until proven otherwise. No breakout = no change. Watch for signs of momentum as we approach the top again a confirmed close above could shift the game toward 3482. Until then, structure is king.

Appreciate all the continued support.

Mr Gold

GoldViewFX

GOLD (XAUUSD): Move Up Ahead?!

Friday's fundamentals made Gold very bullish during the New York session.

The price formed a high momentum bullish candle on a daily,

breaking a minor daily resistance area.

It gives us a confirmed Change of Character CHoCH and indicates

a highly probable bullish continuation next week.

I think that the price will reach 3400 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The trend is clear, why do I choose to be firmly bullish on goldGold Trend Analysis: Yesterday, the gold market demonstrated strong upward momentum, opening near 3290 before falling slightly to a low of 3281 before fluctuating upward. Boosted by the non-farm payroll data, the gold market surged during the US trading session, reaching a single-day gain of 2.02%, reaching a high of 3363 and closing there. The daily chart formed a long bullish candlestick with a long lower shadow, forming a Morning Star pattern, reinforcing the bullish trend. From the perspective of the cycle structure, the daily level is clearly in the 5-wave upward stage, and the upward trend of the large cycle has not changed. At the indicator level, the daily MACD momentum column (the column below the zero axis) represents the short-selling momentum. Its "gradual shortening" means that the short-selling force is weakening and the downward momentum is gradually fading. It is a potential signal of stopping the decline or rebounding. KDJ is about to form a golden cross between 20-50, which is a signal that short-term bullish power is beginning to increase, and the overall trend is bullish.

The 4-hour level shows typical bullish characteristics: the moving average system is arranged in a bullish pattern, but there is a certain deviation between the short-term price and the moving average. The technical side needs to correct the deviation rate through a callback before continuing to rise. The short-term support below is focused on the line near 3330-3335. This position is both the relay support level in the previous rise and the intersection of the 4-hour moving averages MA10 and MA20, which has strong support strength; the short-term resistance above is focused on the line near 3370-3383. This area is a pressure-intensive area near the previous high point. If it can be effectively broken through, it will further open up upward space. A successful breakout would open up further upside potential. A breakout would further open up the 3400 mark.

For gold trading, the short-term strategy is to buy on dips. If the price pulls back to the 3330-3335 support level, consider entering a long position with a target of 3355-3365. If it reaches 3370-3380, consider a short-term short position with a target of 3350-3340.

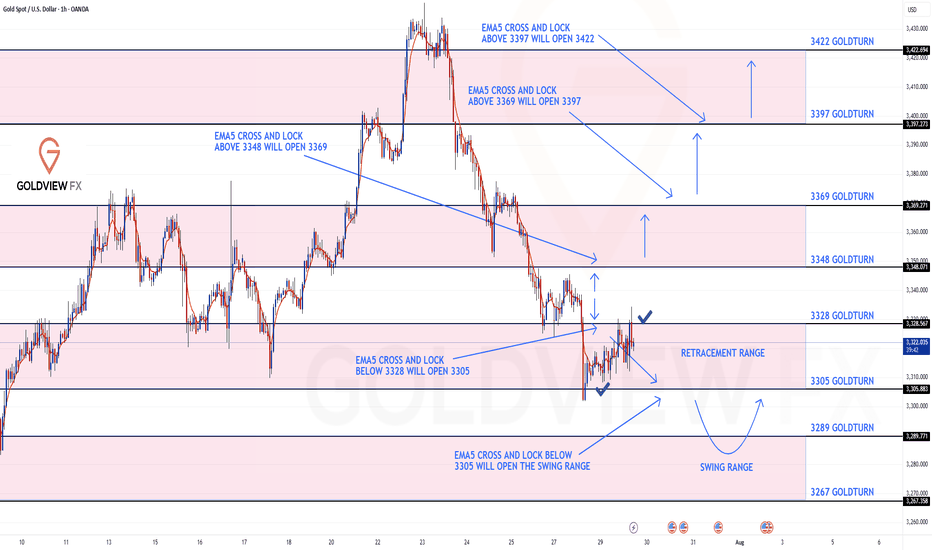

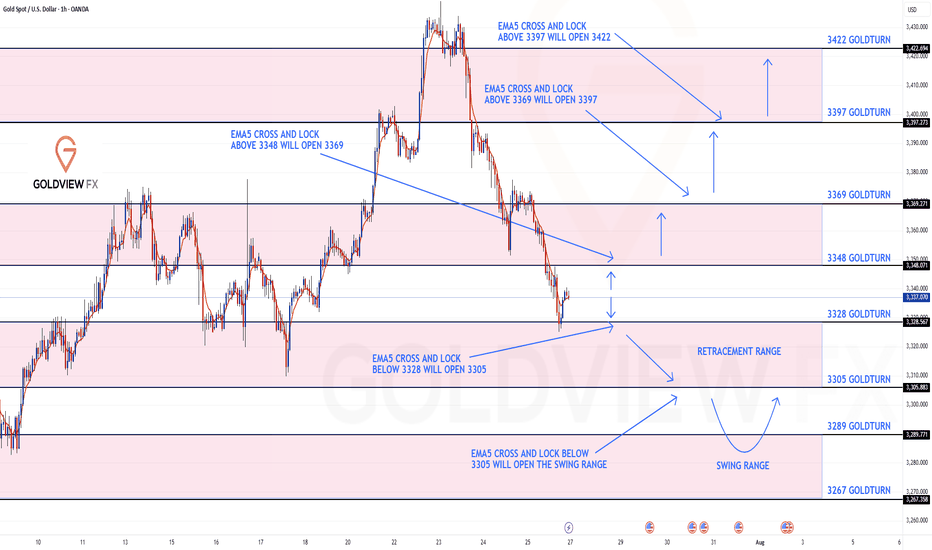

GOLD ROUTE MAP UPDATEHey Everyone,

What a PIPTASTIC finish to the week! 🚀. We tracked the move down with precision durung the week and then rode the momentum right back up.

Yesterday, we confirmed the swing range activation and bounce, and that bullish follow through carried beautifully into today, completing our Bullish Target at 3348. Just perfect execution all around.

BULLISH TARGET

3348 - DONE

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289 - DONE

3267 - DONE

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

GOLD (XAUUSD): Bearish Continuation Ahead?!

Gold retested a recently broken significant liquidity cluster.

I see a clear sign of strength of the sellers after its test

with multiple intraday confirmation.

I think that the price will retrace to day to 3276 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bounce From Final Liquidity or Start of a Bullish Move? Bounce From Final Liquidity or Start of a Bullish Move?

After the FOMC event, gold completed a sweep of the final liquidity zone at 3269–3271 and rebounded strongly, in line with the broader bullish trend. The price has now recovered sharply and is gradually returning to the liquidity zones left behind after yesterday’s sharp drop.

📍 At the moment, gold is reacting around 3295, which aligns with a CP (Compression Point) Zone on the M30 chart. We're seeing a slight pullback here, and another retracement could occur before a strong upward continuation — potentially breaking out of the descending trendline that’s formed over recent days.

📊 Trading Plan & Key Levels

✅ BUY ZONE – Trend Continuation Setup

Entry: 3286–3284

Stop Loss: 3278

Take Profits:

3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → …

💡 This is a prime area to look for re-entries into the dominant bullish move. Price action left a clean liquidity zone below after the aggressive upside reaction — ideal for riding the next wave.

❌ SELL ZONE – Only Valid Below VPOC

Entry: 3328–3330 (Volume Point of Control)

Stop Loss: 3335

Take Profits:

3324 → 3320 → 3315 → 3310 → 3305 → 3300

🔻 This is a high-probability short only if price stays below 3330. If gold closes above this VPOC region, the structure shifts to bullish and we should look for sells higher up — around 335x–337x zones.

📅 Monthly Candle Close – Watch for Indecision

As it’s the last trading day of the month, note that the past two monthly candles have printed doji-like wicks, signalling indecision and liquidity grabs. The market is still waiting for a clearer signal from the Fed on the first potential rate cut of the year.

🚫 Avoid emotional trading. This is a highly reactive environment, so careful risk management is key.

🧭 Final Thoughts

Gold continues to respect market structure and liquidity theory. The first major test lies at the 3313 resistance level — if broken, it opens the door to stronger bullish momentum toward the broader VPOC zone.

⏳ Be patient and only act when price confirms your bias.

GOLD ROUTE MAP UPDATEHey Everyone,

Quick follow up on our 1H chart route map:

What can I say.....pure perfection on our chart analysis as everything played out exactly as expected.

Yesterday, we identified the first level of the swing range at 3289, which delivered a clean full swing into 3305.

Today, we hit Level 2 of the swing range at 3267, and once again, it played out flawlessly with another full swing up to 3305.

A perfect finish to the day. Great work all around!

We are now looking for support above the swing range and a break above 3305 to track the movement up or further retest and break below the 1st level of the swing range may open the the 2nd level at 3267 again.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289 - DONE

3267 - DONE

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

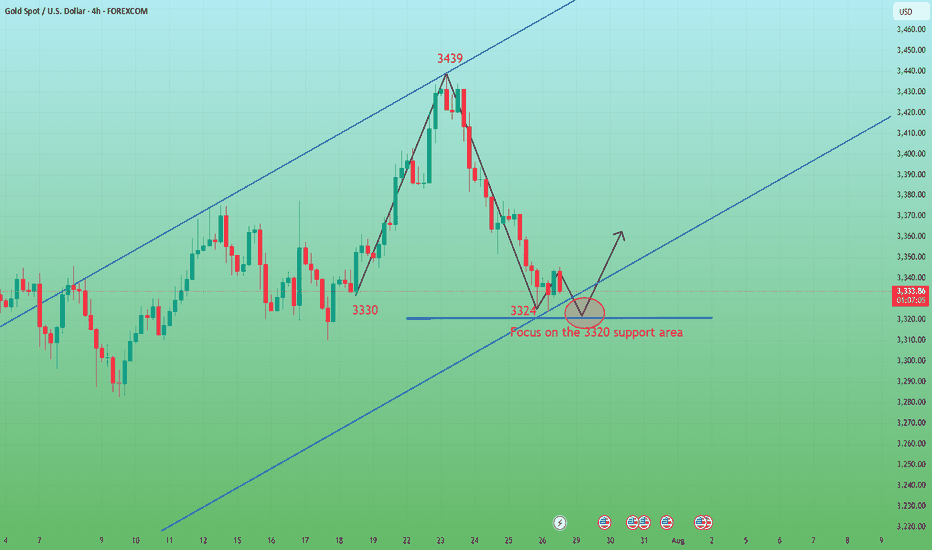

XAUUSD Analysis : Channel Break, Demand Zone + SR - Interchange"High-Probability Zone Reaction & SR Flip Confirmation"

Gold (XAUUSD) is currently reacting from a significant support zone after completing a bearish breakout from a well-established ascending channel. The market structure indicates both threat and opportunity depending on how price behaves around key levels ahead.

🔍 Structure Breakdown & Price Behavior:

🔹 1. Rising Channel Violation

Over the past few weeks, price was comfortably moving inside a well-respected ascending channel, making higher highs and higher lows.

Recently, however, price broke below the lower boundary, which is often a bearish signal—indicating a possible trend reversal or a deeper correction phase.

Such breakdowns suggest buyers are losing control, and bearish sentiment is gaining strength.

🔹 2. Supply Zone Reaction & Drop

Before the breakout, we observed a sharp rejection from a high point, triggering a sell-off.

The price completed its move into a previously defined supply zone, resulting in a strong bearish impulsive leg that pushed it outside the channel.

This move shows clear institutional distribution—where large sellers unloaded positions around that zone.

📍 Key Zone Focus:

🟩 Previous Reversal / Demand Zone (Green Box)

Price is now sitting in a historically strong demand zone, which acted as a major reversal point in the past.

This area is marked as the first zone of interest where buyers might step back in to defend.

The green box represents a liquidity pocket where institutions previously accumulated positions—hence it’s a strong bounce candidate.

🟦 SR Interchange Zone (Blue Box)

The next major level above current price is the SR Interchange zone, around 3,320–3,340.

This level was previously broken and now acts as resistance.

It's crucial because it represents the battle zone where the market will decide whether to continue bearish or shift back bullish.

🧠 Market Psychology & Order Flow Insight:

The recent aggressive selling pressure from the highs, followed by a bounce from the demand zone, shows a shift from euphoria to fear.

Sellers are active at supply, while buyers are attempting to defend the previous demand.

The market is currently in decision mode—and the SR flip zone (3,320–3,340) will be the judge.

A break and retest above this level signals strength and potential for a trend resumption.

A failure to reclaim it would confirm bearish dominance and open doors for deeper targets.

🔄 Possible Scenarios Ahead:

📈 Scenario 1 – Bullish Rejection & Breakout:

If buyers successfully hold the 3,280–3,260 demand zone and push price above the SR Interchange zone, we can expect:

📍 Target 1: 3,360 (mid-term resistance)

📍 Target 2: 3,400–3,420 (previous high & upper trendline)

This would confirm a fakeout from the channel and a bullish continuation pattern.

📉 Scenario 2 – Failure at Resistance & Drop Continuation:

If price fails to reclaim the interchange zone, expect a retest of the green demand, followed by a potential drop toward:

📍 3,260 – local support

📍 3,240 – major support (unfilled demand below)

📍 3,220–3,200 – ultimate downside target

This would solidify a bearish market structure, confirming the sellers are in control.

🧭 Key Levels To Watch:

Level Type Price Range Significance

Supply Zone ~3,400–3,420 Major institutional selling area

SR Interchange (Blue) ~3,320–3,340 Critical resistance / flip zone

Current Price ~3,297 Watching reaction for momentum shift

Demand Zone (Green) ~3,280–3,260 Key support / bounce zone

Major Demand Pending ~3,240–3,220 Next support level if drop continues

✅ Conclusion:

Gold is at a critical inflection point.

The recent bearish breakout signals weakness, but the current support zone may provide a short-term bullish setup if buyers defend it effectively. A successful reclaim of the SR flip zone will shift sentiment bullish again. Otherwise, a deeper correction is likely.

This setup is ideal for both swing and intraday traders—look for confirmation signals at the current support and SR zone before executing trades.

Gold Market Update: Major Support at and Supply atGold is recovering after a strong drop from the previous range high. Price is approaching a 4H Order Block near the 3300–3310 zone, which may act as a supply area. A minor liquidity zone has just been tapped, suggesting a potential short-term rejection.

The major support lies at 3269, which sparked the recent bullish move. If price rejects from the OB zone, a pullback toward this support is likely. However, a clean break and hold above the OB may signal further upside.

📌 Key Levels:

Supply Zone: 3300–3310

Support: 3269

🧠 Wait for clear confirmation before executing trades.

GOLD ROUTE MAP UPDATEHey Everyone,

Quick follow up on our 1H chart route map:

We had the break below 3305 Goldturn, opening and hitting the 1st level of the swing range at 3289, which did exactly what it says on the tin and gave us the perfect swing bounce into 3305.

We are now looking for support above the swing range and a break above 3305 to track the movement up or further retest and break below the 1st level of the swing range may open the the 2nd level at 3267. Ema5 cross and lock will confirm this.

From here, we’re watching for:

Support to hold above the swing range, followed by a clean break above 3305, which would suggest upward continuation.

Alternatively, if we retest and break below 3289, that opens the path toward the second level of the swing range at 3267.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289 - DONE

3267

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD – A Bottom in Place or Just the Calm Before the Storm?GOLD – A Bottom in Place or Just the Calm Before the Storm?

Gold has recently shed nearly $50, indicating sustained bearish pressure. But here’s the real question:

👉 Is this simply a liquidity sweep before a bullish reversal?

👉 Or are we witnessing the early stages of a broader bearish continuation?

Let’s break it all down – step by step – to map out smart, reaction-based trading opportunities.

🌍 Macro & Fundamental Overview

The US–EU trade and defence agreement has dampened gold’s role as a safe haven in the short term.

The US Dollar and equity markets remain strong, driven by solid macroeconomic data.

Overall market sentiment leans “risk-on”, pushing capital into riskier assets and away from precious metals.

📆 Upcoming Key Events:

Tuesday: ADP Employment Data

Friday: FOMC Statement & Nonfarm Payrolls (NFP)

These events could drastically shift market expectations around Fed policy, impacting gold’s direction.

📊 Technical Picture (Timeframes H1–H4)

Gold has rebounded from recent lows and is currently moving within a parallel bullish channel.

However, price is now nearing a critical resistance level at 3342 – a potential turning point.

🔎 Key Technical Zones:

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + Fair Value Gap + Fib 0.5–0.618)

🔻 High-Liquidity Support Zone: 3293–3290

🔻 Key Demand Zone (FVG): 3275–3273

🔺 High-Level Resistance: 3416

🧭 Trading Plan – Based on Price Action (Not Prediction)

We don’t guess the market. We wait, watch, and react based on price confirmation.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Ideal for intraday scalps within high-liquidity zones.

✅ Scenario 2 – Buy from Deep Demand (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great opportunity if price absorbs selling pressure at the FVG zone and reverses.

❌ Scenario 3 – Short from Key Resistance (3342)

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Use if price fails to break and hold above 3342.

❌ Scenario 4 – Short from Major Supply Zone (Swing)

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher-risk setup; enter only on strong rejection or bearish candlestick confirmation.

⚠️ Risk Management Guidelines

Avoid entries during the London and NY open – fakeouts and stop hunts are common.

Always wait for clear price reaction within zones – avoid impulsive entries.

Respect your stop-loss levels, especially with this week’s major data releases.

🎯 Final Thoughts for UK & Global Traders

Let the market come to you – never chase price.

Stay disciplined, especially in volatile weeks like this one.

The best trades are reactionary, not predictive.

💬 Found this plan useful?

Feel free to comment your views or follow for more structured gold analyses throughout the week.

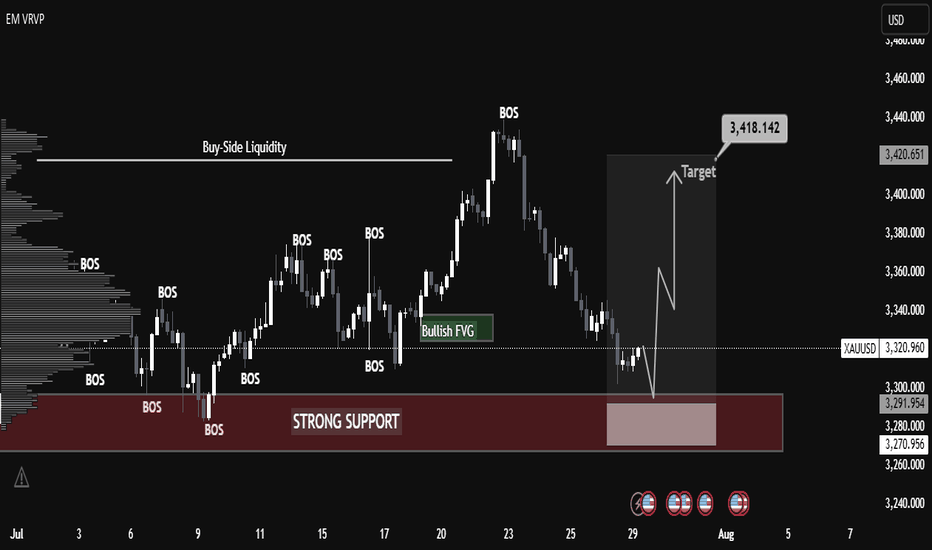

XAUUSD Technical Analysis – Strong Bullish Move Expected XAUUSD Technical Analysis – Strong Bullish Move Expected from Support Zone

Date: July 29, 2025

Chart Type: Price Action | Smart Money Concept (SMC) | Volume Profile

🧠 Educational Breakdown:

1. Strong Support Zone (Demand Area):

Price has entered a clearly marked strong support zone around $3,270 - $3,292.

This zone has previously acted as a major demand level, where buyers stepped in to reverse bearish pressure.

High volume node from the Volume Profile on the left confirms significant historical interest in this price region.

2. BOS – Break of Structure:

Multiple Break of Structures (BOS) throughout the uptrend confirm bullish market intent.

The recent decline appears corrective, not impulsive, suggesting a potential bullish continuation.

3. Bullish Fair Value Gap (FVG):

A Bullish FVG is visible just above current price, acting as a magnet for price action.

This imbalance is often targeted before further market movement, supporting the idea of an upcoming bullish move.

4. Liquidity Grab Setup:

Price dipped into the support area likely to sweep liquidity (stop losses) before a reversal.

This is a common Smart Money trap, where institutional players grab liquidity before moving the market in the intended direction.

5. Target Zone:

A clear target is set around $3,418, aligning with previous highs and potential Buy-Side Liquidity.

The projected move represents a clean higher high, following the higher low formed at the support zone.

Confirmation: Wait for bullish engulfing or displacement candle on lower timeframe (M15-H1).

Volume Support: Look for rising volume during the reversal to confirm smart money participation.

📘 Conclusion:

Gold (XAUUSD) is showing a textbook bullish reversal setup from a high-demand zone. With strong structural support, fair value gap targeting, and buy-side liquidity above, the setup favors bullish continuation toward $3,418.

GOLD ROUTE MAP UPDATEHey Everyone,

Following yesterday’s move into the 3305 retracement range, we got the expected reaction without an EMA5 lock, which further confirmed the rejection from that level and led to a clean bounce into 3228 just like we analysed.

From here, we anticipate price to range between 3328 and 3305. EMA5 cross and lock above 3328 or below 3305 will be key to confirming the next directional move.

We’ll continue to monitor for that confirmation and adjust accordingly.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289

3267

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD: Bottoming Out or Just the Calm Before the Storm? – GOLD: Bottoming Out or Just the Calm Before the Storm?

Gold has dropped nearly $50 over the last 4 sessions, showing clear bearish momentum. But is this just a liquidity grab before a reversal — or are we simply pausing before another leg down?

🔍 Market Context:

Recent US–EU defence and trade agreements may have weakened gold’s short-term appeal as a safe haven.

The US dollar and equities have both gained on strong macroeconomic data, redirecting capital flows away from metals.

Overall market sentiment has tilted risk-on, putting additional pressure on gold prices.

📊 Technical Overview (12H Chart):

Price has broken below the 3342 key support zone and rejected the retest — turning it into short-term resistance.

Current range sits between:

Sell-side liquidity zone: 3301–3292

Major demand/FVG zone: 3272–3270

Above price:

Resistance at 3342, and a broader sell zone at 3370–3388 (OB + FVG + Fib 0.5–0.618)

🔧 Trade Plan (Reaction-Based — Not Predictive):

🟢 Scenario 1 – Buy (Scalp Reaction)

Entry: 3292 – 3290

Stop Loss: 3285

Targets: 3296 → 3300 → 3305 → 3310 → 3315 → 3320 → 3325 → 3330

📍 Intraday bounce play from a high-liquidity zone

🟢 Scenario 2 – Buy (Deeper Reversal Swing)

Entry: 3272 – 3270

Stop Loss: 3265

Targets: 3276 → 3280 → 3284 → 3288 → 3292 → 3294 → 3300 → Trail

📍 Potential mid-term bottom setup if liquidity is fully swept

🔴 Scenario 3 – Sell (Short-Term Rejection)

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

📍 Clean rejection setup if price fails to reclaim key resistance

🔴 Scenario 4 – Sell (Higher Supply Zone)

Entry: 3370 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

⚠️ Higher risk; only valid with strong confirmation

⚠️ Risk Notes:

Be mindful of fakeouts around London and NY opens, as liquidity sweeps are common.

Wait for price to enter your zone, then react — don’t anticipate.

Strict risk management is key in a volatile environment like this.

🧭 I’ll continue monitoring how price reacts around these zones.

If this kind of structured planning resonates with your approach,

feel free to stay connected — or share your perspective in the comments.

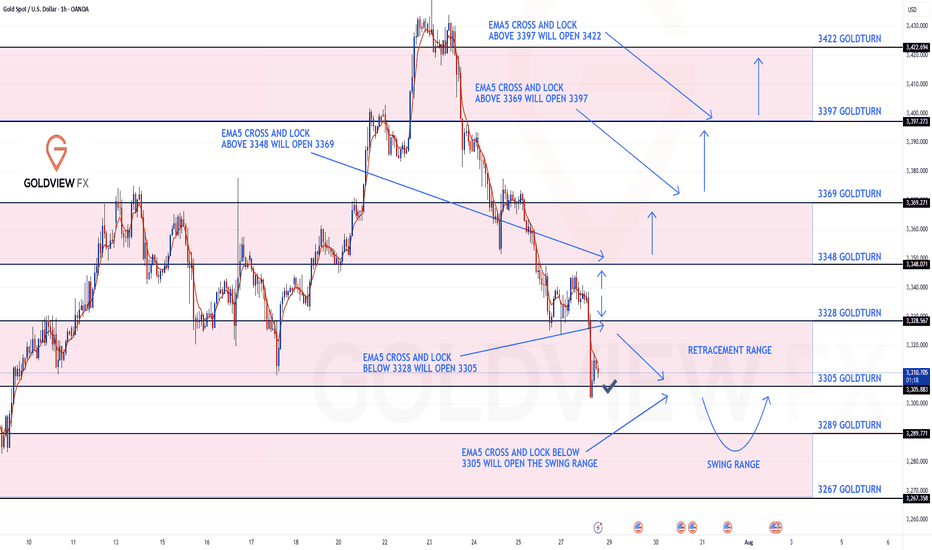

GOLD ROUTE MAP UPDATEHey Everyone,

Please see update on our 1H chart route map.

Gold continued its bearish momentum into today, hitting our bearish target at 3238, while leaving the 3348 bullish gap still open.

After a break below 3328, price followed through and hit 3305, entering our key retracement range, which gave the bounce to manage any premature positions on the top. We’re now watching closely for a reaction at this level.

A clean EMA5 cross and lock below 3305 will open the path toward the swing range.

However, failure to lock below this level could trigger a bounce from here.

This is a pivotal area for the next directional move.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289

3267

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

After continuous decline, oversold rebound opportunity.Last week, gold showed a trend of rising and falling. The weekly line closed with an inverted hammer and a long upper shadow, continuing the cross-line pattern of the previous week. The short-term rise was obviously blocked. Although the trend line connecting the daily lows of 3247-3282-3309 has been substantially broken, it may continue to fall after testing and sorting. In the short term, we need to focus on the 3348 suppression level and the 3324 support level. If they fall below, they may fall to the 3300/3285 support area. From the current trend, the overall bearish and lack of rebound momentum, the weak pattern may continue, and only when the price falls to a specific position to complete the bottoming will it attract entry.

Therefore, it is recommended to maintain a bearish mindset. The hourly line shows that the long and short conversions are relatively frequent. The upward trend channel was maintained in the first three days, but all gains were given up in the next two days and the downward channel was rebuilt. Given that both the 4-hour and daily lines have fallen below the key support level, 3348 has become the key point for today's bearishness, and it is necessary to change the mindset in time and go short.

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3348 and a gap below at 3328 . We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289

3267

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3354 and a gap below at 3297. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3354

EMA5 CROSS AND LOCK ABOVE 3354 WILL OPEN THE FOLLOWING BULLISH TARGETS

3424

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

EMA5 CROSS AND LOCK ABOVE 3499 WILL OPEN THE FOLLOWING BULLISH TARGET

3561

BEARISH TARGETS

3297

EMA5 CROSS AND LOCK BELOW 3297 WILL OPEN THE SWING RANGE

3236

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

3001

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD DAILY CHART ROUTE MAPHey Everyone,

Daily Chart Update – Bounce + Rejection: Structure Still Dominates

Just a quick follow up on our range structure, we got exactly what we were anticipating.

Price gave us the perfect bounce off 3272, launching into 3433 for THE test of resistance. That move delivered another clean 160+ pip rotation, once again showing how laser accurate the structure has been.

As expected, 3433 held as resistance, and the lack of a break and hold above confirms another clean rejection. The range between 3272 support and 3433 resistance remains firmly in play, and structure continues to govern price action to the pip.

Here’s where we are now:

🔹 Range Still Active

Price continues to rotate inside our 3272–3433 box. Until we see a clean break and close beyond either boundary, we’ll keep playing the range.

🔹 No Breakout = No Change

The failure to break and lock above 3433 confirms rejection. We’re still looking for EMA5 lock for potential breakout confirmation, until then, range trades rule.

🔹 Precision Holds

Both 3272 and 3433 have now been tested and held perfectly. The respect these levels continue to show reaffirms their importance in our roadmap.

Updated Key Levels

📉 Support – 3272

Continues to act as a major pivot. Valid long entries remain on dips into this zone, unless a breakdown occurs.

📈 Resistance – 3433

Now officially tested and confirmed. Watching closely for any future breakout attempts or another rotation lower.

Thanks again for all the amazing support. Sticking to the plan, trading the structure, and staying disciplined.

Mr Gold

GoldViewFX

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Weekly Chart Update – 3387 Tested, Channel Top Rejected

Quick follow up on our Weekly Chart roadmap – price continues to respect the structure with precision.

As anticipated, we got the test of 3387, completing the short term magnet move we've been tracking. That level aligned perfectly with the channel top, and true to form, we saw a clean rejection right on cue just short of the full channel top leaving that open.

Importantly, there was no close or lock above that zone, reaffirming it as valid resistance for now. As a result, the range remains active, with price still oscillating between 3281 support and 3387 resistance.

Key structural notes:

🔹 Structure remains intact

No weekly close above 3387, no breakdown below 3281. The rising channel is still fully respected, and EMA5 has yet to turn bearish.

🔹 3281 Holding Strong

This level continues to act as a key weekly pivot. As long as it holds, we maintain a constructive outlook within the current range.

🔹 3387 Tested + Rejected

First test gave us the expected reaction. Until we see a confirmed close above, it remains the top of the current range.

Updated Levels to Watch:

📉 Support – 3281

Weekly pivot and current range low. Still our key area for dip buys within this structure.

📈 Resistance – 3387

Now tested and confirmed. No break or lock above = valid rejection level.

📈 Resistance 2 – 3482

Unfilled weekly gap. Still the broader target, but we need a proper breakout above 3387 first.

Plan: We continue to treat 3281–3387 as the active weekly range. If 3281 fails, we reassess at the midline of the channel. If 3387 breaks and holds, we shift focus toward 3482.

Thanks again for all the incredible engagement and support, it means a lot to us here at GoldViewFX. Stay focused, stay disciplined.

Mr Gold

GoldViewFX