GOLD (XAUUSD): Detailed Support Resistance Analysis

Here is my latest structure analysis for Gold.

Vertical Structures

Vertical Support 1: Rising trend line

Horizontal Structures:

Resistance 1: 3149 - 3151 area

Support 1: 3099 - 3104 area

Support 2: 3048 - 3057 area

Support 3: 3024 - 3036 area

Support 4: 2997 - 3001 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Goldtrading

Gold (XAUUSD) 30-Minute Trade Setup: Bullish Reversal from SuppoThis chart represents a trading analysis for Gold (XAUUSD) on a 30-minute timeframe. Here are the key points from the chart:

Technical Indicators:

EMA (30, close) - Red Line: 3,124.52 (shorter-term trend)

EMA (200, close) - Blue Line: 3,090.41 (longer-term trend)

Trade Setup:

Entry Point: 3,108.21

Stop Loss: 3,098.52 (just below the support zone)

Target Point: 3,149.04 (potential profit level)

Analysis:

The price is currently bouncing from a purple support zone, which aligns with a short-term retracement.

The 30 EMA (red) is currently above the price, indicating short-term resistance.

The 200 EMA (blue) is significantly lower, showing that the overall trend is still bullish.

A potential long (buy) trade is suggested, as price is expected to reverse from the support level towards the target point of 3,149.04.

Risk-to-Reward Ratio:

The stop loss is set below the key support level to minimize risk.

The target price provides a significant profit potential.

Conclusion:

If price holds above 3,108.21, there is a strong bullish case.

If price breaks below 3,098.52, the bullish setup may become invalid.

Monitoring the 30 EMA resistance will be crucial for confirmation.

XAUUSD: Flashing a strong sell signal.Gold is highly overbought on its 1D technical outlook (RSI = 75.258, MACD = 52.020, ADX = 63.587) and today is having its first strongly bearish 4H candle. This is because the price hit the top of March's Channel Up and got rejected. The HH should now give way to a bearish wave for a HL on the 4H MA50. This is a validated sell opportunity to go for yet another -1.80% decline and target the bottom of the pattern (TP = 3,093).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

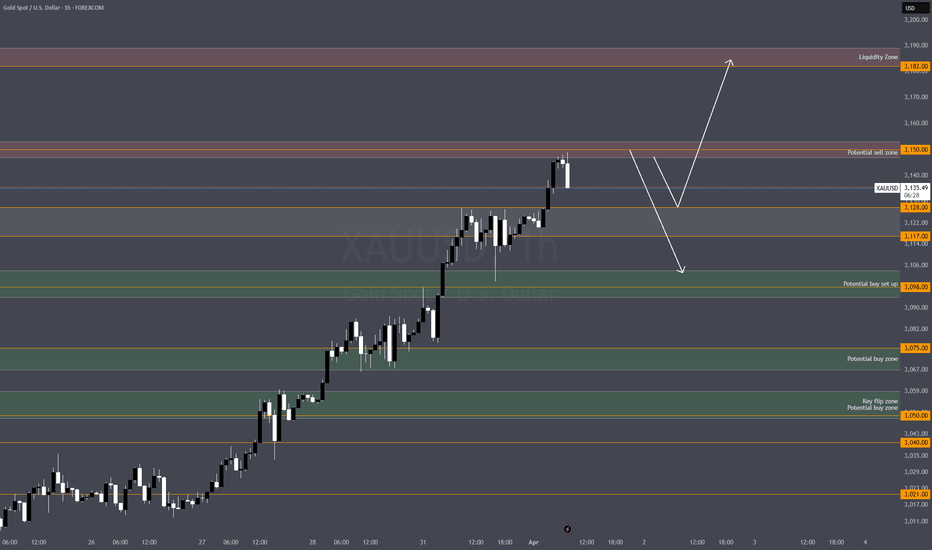

Gold extended higher, look for signs of exhaustionGold is extending higher, tapping into untested liquidity above. However, signs of exhaustion are creeping in. Watch for potential liquidity sweeps before reversals.

Key Untapped Liquidity Zones

Upside: $3,182 - $3,189

Downside: $3,103 - $3,094

🔴 Sell Setups (Short)

1️⃣ Intraday Reversal Short

Entry Zone: $3,182 - $3,189

Stop Loss (SL): Above $3,193

Take Profit (TP) Levels:

TP1: $3,150 (First reaction)

TP2: $3,128 (Key liquidity)

TP3: $3,103 (Imbalance fill)

📌 Reasoning:

Untested supply at $3,182-$3,189

Price may sweep liquidity above $3,180 before a sharp rejection

2️⃣ Aggressive Short (Scalp)

Entry Zone: $3,150 - $3,153

Stop Loss (SL): Above $3,157

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,117

TP3: $3,103

📌 Reasoning:

Liquidity grab before a possible retrace

Strong momentum-based rejection expected

🟢 Buy Setups (Long)

3️⃣ Safe Long (Key Demand Zone)

Entry Zone: $3,103 - $3,094

Stop Loss (SL): Below $3,089

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,150

TP3: $3,182

📌 Reasoning:

Untested demand at $3,103-$3,094

Imbalance below $3,103 should act as a magnet

Liquidity sitting at $3,094

4️⃣ Deep Liquidity Sweep Buy

Entry Zone: $3,074 - $3,067

Stop Loss (SL): Below $3,060

Take Profit (TP) Levels:

TP1: $3,103

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Liquidity sweep target at $3,074-$3,067

If price taps this zone, a high-probability reversal could follow

Heavy imbalance would need correction

👀 Keep an Eye On:

1️⃣ DXY movements—if the dollar strengthens, gold may struggle to break higher.

2️⃣ News events—major economic data could trigger liquidity grabs before reversals.

3️⃣ Reactions at key levels—watch for wicks, aggressive rejections, and volume spikes.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the Markets today, with our analysis playing out perfectly completing our 1h chart idea.

After completing 3090, 3103 and 3117, we stated that the lock above opened 3128 and just fell short and we were looking to buy dips to complete this target. This played out perfectly hitting this target and completing the chart idea.

We will update a new 1h chart idea later this week and in the mean time, please refer to our multi time frame chart ideas (weekly), that we shared Sunday, which are still in play.

BULLISH TARGET

3090 - DONE

EMA5 CROSS AND LOCK ABOVE 3090 WILL OPEN THE FOLLOWING BULLISH TARGET

3103 - DONE

EMA5 CROSS AND LOCK ABOVE 3103 WILL OPEN THE FOLLOWING BULLISH TARGET

3117 - DONE

EMA5 CROSS AND LOCK ABOVE 3117 WILL OPEN THE FOLLOWING BULLISH TARGET

3128 - DONE

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUS SHORTStubborn XAUUSD, played with my TP1 a few times, almost hitting it but never really reached and instead it went the other way and touched my SL. However Im still on a strong sell in this. Opening at 3078 and still maintaining my previous TP 3005 because I know that's the direction that it will head to, if this reaches, it will cover 3days loss, and setting my SL on a much further rate. Personally, I dont use SL's but for Tradingview Im opting to put one as a good practice

Day12of100

L:4

W:1

Such a shame that my L days are way more than my W's but still believing in my trade and I know this will pick up. let's see how this new trade rolls. XAUUSD is already in it's all time high, so I believe soon enough my much awaited correction will happen, Il be patient :)

Another Good Trade for GOLD (XAUUSD) Today

My overall forecast for this week is that Gold will do classic expansion week where monday will go up then tuesday will most likely go up to sweep mondays high then do the reversal so that wednesday and thursday will be expansion going down and target the daily imbalances below. For today i was expecting a bullish push upwards for GOLD before it will reverse so i followed my steps by combining my multi timeframe analysis. From daily for the overall bias to 1H for that confirmation and alignment then 5m for my entry timeframe. Once i saw those 3 timeframes align with combination confirmation that i saw with the price action then i entered the trade. My original target was 1:3R but then i saw the weakness after price came to my 1:2R level so i manually pulled out with a 1:2R gain for today....

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3090 and a gap below at 3074. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3090

EMA5 CROSS AND LOCK ABOVE 3090 WILL OPEN THE FOLLOWING BULLISH TARGET

3103

EMA5 CROSS AND LOCK ABOVE 3103 WILL OPEN THE FOLLOWING BULLISH TARGET

3117

EMA5 CROSS AND LOCK ABOVE 3117 WILL OPEN THE FOLLOWING BULLISH TARGET

3128

BEARISH TARGETS

3074

EMA5 CROSS AND LOCK BELOW 3074 WILL OPEN THE FOLLOWING BEARISH TARGET

3055

EMA5 CROSS AND LOCK BELOW 3055 WILL OPEN THE FOLLOWING BEARISH TARGET

3039

EMA5 CROSS AND LOCK BELOW 3039 WILL OPEN THE FOLLOWING BEARISH TARGET

3020

EMA5 CROSS AND LOCK BELOW 3020 WILL OPEN THE SWING RANGE

SWING RANGE

2999 - 2985

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

This is a continuation update from last week, which is playing out perfectly clearing first our Bearish target followed with all our Bullish targets with ema5 lock confirmations.

We are now seeing a gap left open at 3089 and will need ema5 to cross and lock above this level for a continuation into the next level. Failure to lock will see price reject into the lower Goldturns for bounces or further cross and locks below the levels to open the levels below.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3045 - DONE

EMA5 CROSS AND LOCK ABOVE 3045 WILL OPEN THE FOLLOWING BULLISH TARGET

3067 - DONE

EMA5 CROSS AND LOCK ABOVE 3067 WILL OPEN THE FOLLOWING BULLISH TARGET

3089

EMA5 CROSS AND LOCK ABOVE 3089 WILL OPEN THE FOLLOWING BULLISH TARGET

3114

BEARISH TARGETS

3018

EMA5 CROSS AND LOCK BELOW 3018 WILL OPEN THE FOLLOWING BEARISH TARGET

2985

EMA5 CROSS AND LOCK BELOW 2985 WILL OPEN THE SWING RANGE

SWING RANGE

2947 - 2918

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

This is an update on our daily chart idea that we are now tracking for a while now. If you have only started following us, please read the updates below at the bottom from previous weeks to see how effectively we have been tracking this.

Now after completing the target to the channel top we stated that if we see ema5 lock outside the channel then we will look for support outside the channel on the channel top for a continuation, which played out perfectly, as the channel top after the breakout provided support for a continuation.

We then stated and expected price to play between 3052 and 3007 until we see a break to confirm our next range. We got the test on 3007 with no body close or ema5 lock, which confirmed the rejection and the bounce perfectly into 3052, which then followed with the body close above 3052 opening the range above, giving a nice clean run of over 300 pips. Gap remains open and ema5 lock will only further confirm this but we are happy with the run already and will now continue to buy from dops only.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

OLD UPDATES ON THIS CHART IDEA

MARCH 23RD WEEK UPDATE

The half line of our unique channel gave the perfect bounce into the next axis target at 2904, inline with our plans to buy dips just like we stated. We now have a body close once again with ema5 cross and lock above 2904 leaving the range above open. We will continue to look for support at the ascending half-line of the channel, as we climb into the range.

PREVIOUS WEEKS UPDATE

After completing our Bullish targets we stated that the channel top will act as resistance confirmed with ema5 rejection. A break of the channel top with ema5 would confirm a continuation and failure would confirm rejection. This allowed us to identify true breakouts against fake outs.

We also stated that we need to keep in mind the channel half line below to establish floor to provide support for the range, should we continue to track further up. A break below the half line will open the lower part of the channel to establish floor on the channel bottom. The safest way to track this movement is by buying dips.

- Once again this played out perfectly as we got the rejection on the channel top followed with the channel half line test, which gave the perfect bounce like we stated. We will now either look for a continuation from this bounce or a cross and lock below the half line for a break into the lower channel floor.

GOLD (XAUUSD): 3100 soon?!

Gold closed on Friday, consolidating within the intraday range.

Probabilities are high that growth will resume next week.

Your signal to buy will be a breakout of the underlined resistance on the hourly time frame.

1H candle close above 3087 will confirm the violation.

A bullish continuation will be expected to 3100 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAU/USD: Pullback Likely After Breakout Above Key ResistanceThe XAU/USD market has broken above last week’s high and is now testing the 3080 resistance level. Following this strong move, a pullback appears likely before any further advance. With bullish momentum still dominant, the market may continue higher or enter a sideways phase into next week.

If a pullback occurs, the previous resistance zone, now acting as support, could offer a buying opportunity—particularly near the 3050 level. With high-impact news on the horizon, the market may either range or retrace before resuming its upward trend. The next key target is the resistance zone around 3085

GOLD ROUTE MAP UPDATEHey Everyone,

A Piptastic day on the markets today with the breakout finally taking off, perfectly inline with our plans to buy dips and then into our Bullish targets.

We had 3 tests on our Bullish target at 3032 this week and then finally a cross and lock opening 3050, which was hit perfectly. We will now need a cross and lock above 3050 for a continuation into the next Goldturn or failure to lock will see rejections into the lower Goldturns for the bounces inline with our plans to buy dips.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3032 - DONE

EMA5 CROSS AND LOCK ABOVE 3032 WILL OPEN THE FOLLOWING BULLISH TARGET

3050 - DONE

EMA5 CROSS AND LOCK ABOVE 3050 WILL OPEN THE FOLLOWING BULLISH TARGET

3065

EMA5 CROSS AND LOCK ABOVE 3065 WILL OPEN THE FOLLOWING BULLISH TARGET

3080

EMA5 CROSS AND LOCK ABOVE 3080 WILL OPEN THE FOLLOWING BULLISH TARGET

3097

BEARISH TARGETS

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2978

EMA5 CROSS AND LOCK BELOW 2978 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2927

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD (XAUUSD): New ATH Soon?!

I see a bullish accumulation pattern - the ascending triangle formation

on Gold on a daily.

In a strong uptrend, such a pattern usually indicates a highly probable

bullish continuation.

The main focus now is on the underlined blue resistance based on a current ATH.

Its breakout and a daily candle close will open a potential for much more growth.

Next resistance will be 3100.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the markets today, allowing us to bounce between the Goldturns, inline with our plans to buy dips. Not much to report as we are seeing Gold range sideways consolidating ready for a breakout.

We still have the gap left open at 2999, which fell short by a few pips. We will continue to use the lower Goldturns to buy dips until we see the weighted levels cross and lock to confirm the next range. Failure to break 3032 will keep seeing rejections into the lower Goldturns for the bounces.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3032 - DONE

EMA5 CROSS AND LOCK ABOVE 3032 WILL OPEN THE FOLLOWING BULLISH TARGET

3050

EMA5 CROSS AND LOCK ABOVE 3050 WILL OPEN THE FOLLOWING BULLISH TARGET

3065

EMA5 CROSS AND LOCK ABOVE 3065 WILL OPEN THE FOLLOWING BULLISH TARGET

3080

EMA5 CROSS AND LOCK ABOVE 3080 WILL OPEN THE FOLLOWING BULLISH TARGET

3097

BEARISH TARGETS

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2978

EMA5 CROSS AND LOCK BELOW 2978 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2927

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAU/USD 26 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Bias and analysis remains the same as analysis dated 23 March 2025.

Price has printed a bearish CHoCH following printing further all time highs.

Price is now trading within an established internal range. I will however continue to monitor price.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or nested Daily and H4 demand levels before targeting weak internal high priced at 3,057.590.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis and bias remains the same as analysis dated 24 March 2025.

As per analysis dated 19 March 2025 whereby I mentioned as an alternative scenario that internal range has significantly narrowed. All HTF's require a pullback, therefore, it would be completely viable if price printed a bearish iBOS.

This is how price printed, by printing a bearish iBOS.

Price has yet to print a bullish CHoCH to indicate bullish pullback phase initiation, however, price has traded into premium of 50% internal EQ, therefore, I am happy to confirm internal range.

Intraday Expectation:

Price has traded in to premium of 50% EQ and has mitigated M15 supply zone.

Technically, price to target weak internal low priced at 2,999.465.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

XAUUSD: Channel Down about to start the new bearish wave.Gold is neutral on its 1H technical outlook (RSI = 52.608, MACD = 1.710, ADX = 25.254) which, as the price test the top of the Channel Down, indicates that it is about to start the new bearish wave. The trigger for that sell trade would be a break under the 1H MA200. Aim for a -1.88% decline (TP = 2,980).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the markets today with out plans to buy dips playing out perfectly. We had the gap left open at 2999 yesterday, which had the move down but just fell short of the full gap. We were able to use the dip to ride back up to our bullish target 3032 once again.

No further lock above 3032 confirmed the rejection again. We are looking for this level to break to confirm a continuation. Failure to break this level will keep seeing rejections into the lower Goldturns for the bounces. We also need to keep in mind the full gap at 2999, inline with our plans to buy dips.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3032 - DONE

EMA5 CROSS AND LOCK ABOVE 3032 WILL OPEN THE FOLLOWING BULLISH TARGET

3050

EMA5 CROSS AND LOCK ABOVE 3050 WILL OPEN THE FOLLOWING BULLISH TARGET

3065

EMA5 CROSS AND LOCK ABOVE 3065 WILL OPEN THE FOLLOWING BULLISH TARGET

3080

EMA5 CROSS AND LOCK ABOVE 3080 WILL OPEN THE FOLLOWING BULLISH TARGET

3097

BEARISH TARGETS

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2978

EMA5 CROSS AND LOCK BELOW 2978 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2927

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX