XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Goldtrading

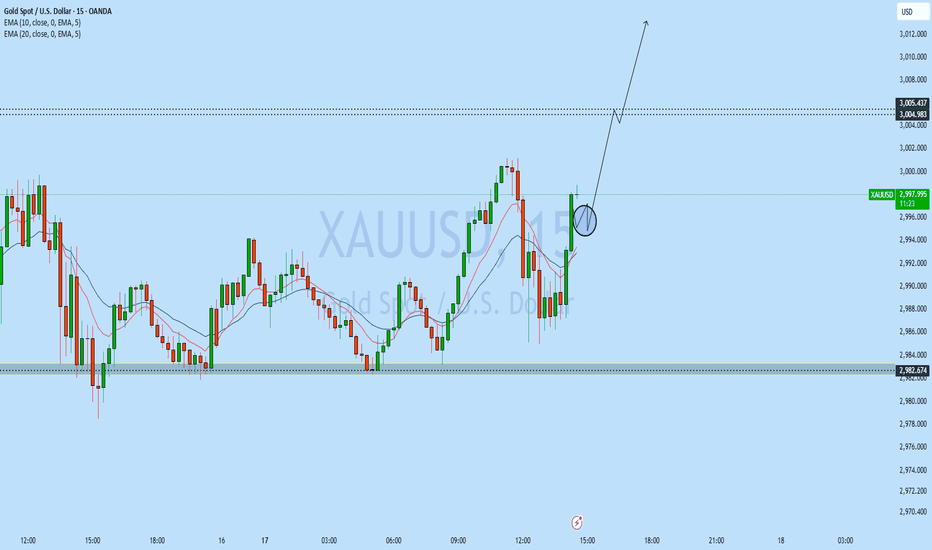

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 2993 and a gap below at 2968. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2993

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3039

EMA5 CROSS AND LOCK ABOVE 3039 WILL OPEN THE FOLLOWING BULLISH TARGET

3049

EMA5 CROSS AND LOCK ABOVE 3049 WILL OPEN THE FOLLOWING BULLISH TARGET

3068

BEARISH TARGETS

2968

EMA5 CROSS AND LOCK BELOW 2968 WILL OPEN THE FOLLOWING BEARISH TARGET

2942

EMA5 CROSS AND LOCK BELOW 2942 WILL OPEN THE FOLLOWING BEARISH TARGET

2922

EMA5 CROSS AND LOCK BELOW 2922 WILL OPEN THE SWING RANGE

SWING RANGE

2906 - 2886

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD (XAUUSD): Correctional Movement Ahead?

After a test of 3000 psychological level, Gold looks overbought.

Analysing a 4H time frame, we can spot a completed head & shoulders pattern.

A bearish movement will be confirmed with a breakout of its horizontal neckline.

If a 4H candle closes below 2978, we can expect a retracement much lower

at least to 2955.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

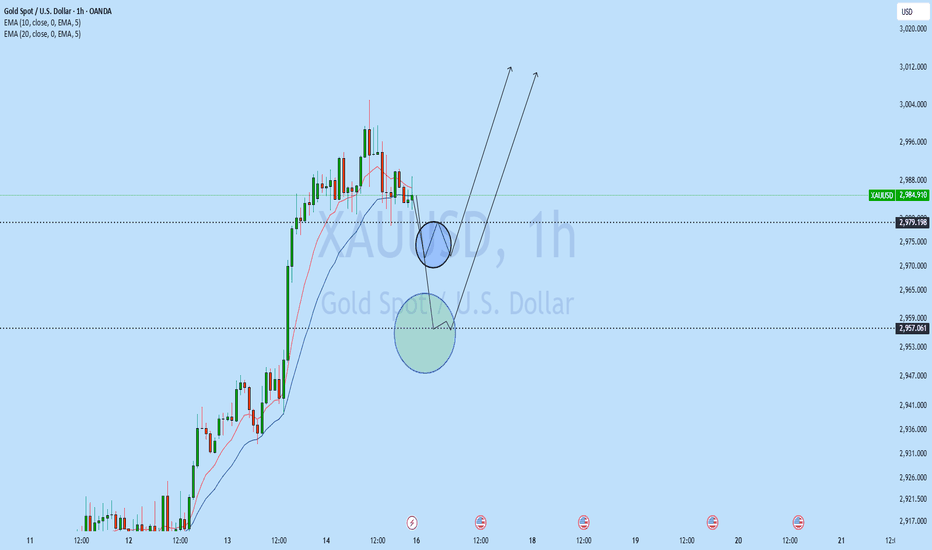

GOLD 4H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3005 and a gap below at 2972. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3005

EMA5 CROSS AND LOCK ABOVE 3005 WILL OPEN THE FOLLOWING BULLISH TARGET

3033

EMA5 CROSS AND LOCK ABOVE 3033 WILL OPEN THE FOLLOWING BULLISH TARGET

3059

EMA5 CROSS AND LOCK ABOVE 3059 WILL OPEN THE FOLLOWING BULLISH TARGET

3090

EMA5 CROSS AND LOCK ABOVE 3090 WILL OPEN THE FOLLOWING BULLISH TARGET

3117

BEARISH TARGETS

2972

EMA5 CROSS AND LOCK BELOW 2972 WILL OPEN THE FOLLOWING BEARISH TARGET

2947

EMA5 CROSS AND LOCK BELOW 2947 WILL OPEN THE FOLLOWING BEARISH TARGET

2918

EMA5 CROSS AND LOCK BELOW 2918 WILL OPEN THE SWING RANGE

SWING RANGE

2889 - 2857

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

This is an update on our daily chart idea that we are now tracking for a while now. If you have only started following us, please read the updates below from previous weeks.

Last week we stated that we had a candle body close above 2904 opening 2959 with ema5 lock to further confirm this. This played out perfectly completing this target and also perfectly inline with the channel top. We will now expect some resistance here on the channel top to then provide support on the lower levels and slowly ascend up the channel over a longer term. However, if we see ema5 lock outside the channel then we will look for support outside the channel on the channel top for a continuation.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

LAST WEEK UPDATE

The half line of our unique channel gave the perfect bounce into the next axis target at 2904, inline with our plans to buy dips just like we stated. We now have a body close once again with ema5 cross and lock above 2904 leaving the range above open. We will continue to look for support at the ascending half-line of the channel, as we climb into the range.

PREVIOUS WEEKS UPDATE

After completing our Bullish targets we stated that the channel top will act as resistance confirmed with ema5 rejection. A break of the channel top with ema5 would confirm a continuation and failure would confirm rejection. This allowed us to identify true breakouts against fake outs.

We also stated that we need to keep in mind the channel half line below to establish floor to provide support for the range, should we continue to track further up. A break below the half line will open the lower part of the channel to establish floor on the channel bottom. The safest way to track this movement is by buying dips.

- Once again this played out perfectly as we got the rejection on the channel top followed with the channel half line test, which gave the perfect bounce like we stated. We will now either look for a continuation from this bounce or a cross and lock below the half line for a break into the lower channel floor.

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Please see update on the weekly chart idea that we have been tracking for over a while now and now fully complete.

After completing 2856 target, we were left with candle body close above 2856 leaving a gap to 2976 but needed ema5 lock to further confirm this. We then had the ema5 lock last week to further confirm the long range gap above. This gap was completed last week completing this chart idea and with plenty of time for us to get in for the action, just perfect!!!

This is the beauty of our channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will now update a new weekly chart idea for our long term analysis, targets and gaps next week. Please keep an eye out for it.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

BTC/USDT Trade Setup & Analysis – Key Support Bounce & TargetsSupport: The lower purple zone indicates a strong support level where the price has bounced.

Resistance: The upper purple zone marks a resistance area where price has been rejected multiple times.

2. Moving Averages:

200 EMA (Blue): At 82,800.42, acting as dynamic resistance.

30 EMA (Red): At 82,090.72, indicating short-term trend direction.

3. Trade Setup:

A long position is planned from the current support level.

Entry: Around 80,026.98 (near support).

Stop Loss: Around 76,980.09 (below support).

Take Profit Targets:

TP1: 81,636.34

TP2: 82,800.42 (near 200 EMA)

TP3: 84,481.83

TP4: 86,260.26

Final Target: 88,297.36

4. Conclusion:

The setup expects a bounce from support with a target back towards resistance levels.

Breaking 82,800 (200 EMA) is crucial for further bullish momentum.

If the price falls below 80,000, the setup might get invalidated.

Would you like a deeper breakdown on any part? 🚀

GOLD ROUTE MAP UPDATEHey Everyone,

What a PIPTASTIC finish to the week with our chart idea now complete with our final target at 3005 now done.

We started the week with our 2918 Bullish target hit, followed with cross and lock in each stage of the range, completing 2947 and 2978 and now today confirmed a further lock opening 3005, which was hit and completed perfectly!!

The power of our algo levels, even at a new range is being respected to perfection!!

BULLISH TARGET

2918 - DONE

EMA5 CROSS AND LOCK ABOVE 2918 WILL OPEN THE FOLLOWING BULLISH TARGET

2947 - DONE

EMA5 CROSS AND LOCK ABOVE 2947 WILL OPEN THE FOLLOWING BULLISH TARGET

2978 - DONE

BEARISH TARGETS

2889 - DONE

We will now come back Sunday with our updated Multi time-frame analysis, Gold route map and trading plans for the week ahead and also a new Daily chart long term chart idea, now that this one is complete.

Have a smashing weekend!! And once again, thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

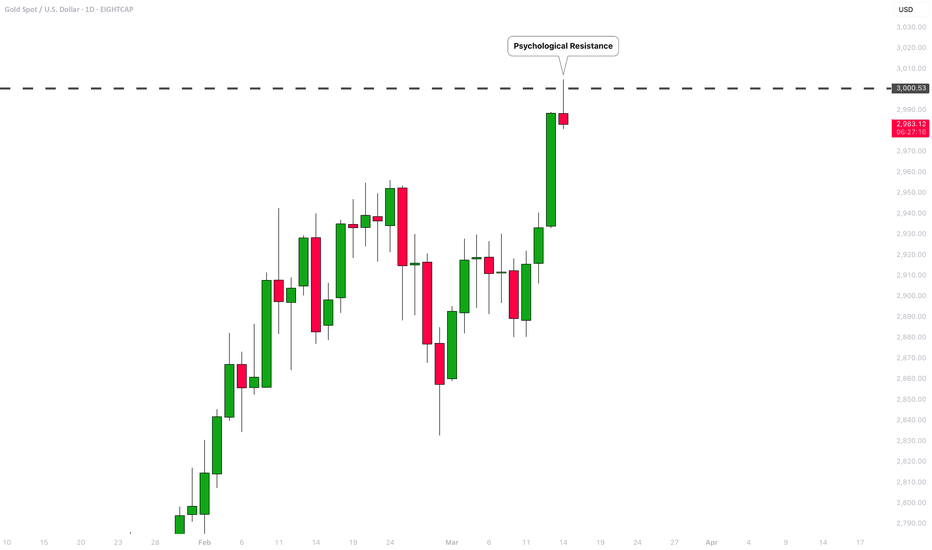

GOLD (XAUUSD): 3000 Level Reached! What's Next?

Well, the most important thing about this week is of course a continuation of a bullish rally on Gold.📈

The price rapidly violated the all-time high and went much higher reaching 3000 level.

Technical analysis skeptics should admit how perfectly the 3000 psychological structure started to absorb the market supply, not letting the price go higher. 📈

What will happen next?

Still not clear, 3000 is definitely not a limit but probably just a local pit stop.

While many traders feel happy about the extraordinary Gold rally, the truth that Gold price action has a very strong correlation with negative global events. Though I am not sure what exactly caused this rally on Thursday, something definitely is going on behind the scenes and I think that it is not good.🧐

Have a great weekend, traders!

❤️Please, support my work with like, thank you!❤️

Gold surges, just $17 away from $3,000 Gold is sprinting to new all-time highs and approaching the $3000 level. The price has just reached $2983 at the time of writing, just $17 away from the key $3000 level.

Alex Ebkarian from Allegiance Gold forecasts “prices to trade between $3,000 and $3,200 this year,”.

Momentum is currently being driven by uncertainty around Trump tariffs and stalled ceasefire talks with Vladimir Putin, who has outlined sweeping conditions for any potential truce.

The upcoming Federal Reserve meeting next Wednesday could also be influencing prices. While the central bank is expected to keep its rate at 4.25%-4.50% until at least June, with the current economic environment, a change in guidance from the Fed might be warranted. A delay in the anticipated June rate cut wouldn't be helpful for the gold price

GOLD 1H AND 4H CHART ROUTE MAP UDATEHey Everyone,

Once again a smashing day on the markets with both our 1h and 4h charts, playing out as analysed.

We got our Bullish targets 2922, 2947 and 2968 all completed on our 1h chart, confirmed with cross and lock, giving us enough time from confirmation to target being hit.

Please see our 4h chart below, also completing our target at 2947, which we confirmed was open yesterday, giving enough time for the target to be hit today and now also finished off with 2978. We will now look for a test and lock for a further continuation or failure to lock above will see a rejection to find support at the lower Goldturns for support and bounce.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2922 - DONE

EMA5 CROSS AND LOCK ABOVE 2922 WILL OPEN THE FOLLOWING BULLISH TARGET

2947 - DONE

EMA5 CROSS AND LOCK ABOVE 2947 WILL OPEN THE FOLLOWING BULLISH TARGET

2968 DONE

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD VIEW 3H READ THE CAPTAINHello 👋 gold traders

3-hour timeframe of Gold Spot (XAU/USD) with technical analysis levels and moving averages. Here’s a breakdown of the key points:

Key Observations:

1. Support & Resistance Levels:

Support Level: Around 2,909.870 - 2,902.340 (marked as the buying zone).

Resistance Level: 2,930.173.

Target Point: 2,960.607.

2. Exponential Moving Averages (EMAs):

30 EMA (Red Line): 2,909.870 (Short-term trend).

200 EMA (Blue Line): 2,884.578 (Long-term trend, acting as strong support).

3. Price Action:

The price is currently in a consolidation phase around the resistance zone.

If the price breaks above 2,930, we might see a bullish move toward the target at 2,960.

If the price fails to break resistance, a pullback to the buying zone (support level at 2,909-2,902) is possible.

Trading Strategy Ideas:

Bullish Scenario (Breakout Above 2,930): Look for long positions targeting 2,960.

Bearish Scenario (Rejection at Resistance): A retest of the buying zone (2,909 - 2,902) before another push higher.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD 4H CHART ROUTE MAP UPDATEHey Everyone,

Another great day on the markets today once again. Yesterday we updated our 1H CHART IDEA and today we update our 4H CHART IDEA.

Great start with our Bullish target hit at 2889 earlier this week followed with no cross and lock confirming the rejection and support for the bounce into 2918 completing our Bullish target. We now have a lock above 2918 opening 2947. We will look for a test and lock for a further continuation or failure to lock above will see a rejection to find support at the lower Goldturns for support and bounce.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2918 - DONE

EMA5 CROSS AND LOCK ABOVE 2918 WILL OPEN THE FOLLOWING BULLISH TARGET

2947

EMA5 CROSS AND LOCK ABOVE 2947 WILL OPEN THE FOLLOWING BULLISH TARGET

2978

BEARISH TARGETS

2889 - DONE

EMA5 CROSS AND LOCK BELOW 2889 WILL OPEN THE FOLLOWING BEARISH TARGET

2857

EMA5 CROSS AND LOCK BELOW 2857 WILL OPEN THE SWING RANGE

SWING RANGE

2813 - 2772

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD: Turning sideways short term but Channel Up intact.Gold remains on very balanced bullish levels on its 1D technical outlook (RSI = 58.055, MACD = 27.200, ADX = 21.896) a direct outcome of its long term pattern, which is a Channel Up. With the late February high made near the top of the Channel Up and the 1D RSI on a decline ever since, this the the kind of behaviour that was previously had Gold consolidate before the next rally. You can scalp this range until the price gets near the 1D MA100 and place a more medium term buy (TP = 3,200).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAU/USD 11 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis/Bias remains the same as analysis dated 07 March 2024.

Price has printed a bullish CHoCH according to analysis and bias dated 28 February 2025.

Price is currently trading within an established internal range.

Intraday Expectation:

Price is now trading in premium of 50% internal EQ where we could see a reaction at any point. Price could also target H4 supply zone before targeting weak internal low, priced at 2,832.720

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis and bias remains the same as analysis dated 03 March 2023.

As mentioned in my analysis dated 28 February 2025, whereby price printed a bullish CHoCH but stated I would continue to monitor price.

On this occasion I have marked the previous bullish CHoCH in red as price did not pull back deeply enough to warrant internal structure breaks, additionally, there was minimal time spent .

Price has printed a further bullish CHoCH which is now confirmed. Price is not trading within an established internal range.

Intraday Expectation:

Price to continue bullish, react at either premium of internal 50% EQ, or M15 supply zone before targeting weak internal low priced at 2,832.720.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

GOLD ROUTE MAP UPDATEHey Everyone,

We started the week with our Bearish target hit first at 2901, which gave multiple weighted level bounces of 30 pips plus. We were able to capitalise on these bounces, inline with our plans to buy dips.

We are now seeing price breakout of the 2901 Goldturn level and ema5 is about to lock. We will wait to confirm a lock for the continuation into the retracement level for further weighted level bounces. Failure to lock below 2901 will see a re-test back into the upper Goldturn.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2922

EMA5 CROSS AND LOCK ABOVE 2922 WILL OPEN THE FOLLOWING BULLISH TARGET

2947

EMA5 CROSS AND LOCK ABOVE 2947 WILL OPEN THE FOLLOWING BULLISH TARGET

2968

BEARISH TARGETS

2901 - DONE

EMA5 CROSS AND LOCK BELOW 2901 WILL OPEN THE FOLLOWING RETRACEMENT RANGE

2878 - 2851

EMA5 CROSS AND LOCK BELOW 2851 WILL OPEN THE SWING RANGE

SWING RANGE

2820 - 2796

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would wait for the 2847-50 level to confirm support, and if it did the opportunity to long the market following KOG’s bias level targets would be available to traders. This worked well during the early part of the week as we managed to complete all targets by Tuesday! Once price confirmed encroaching the resistance we decided not to attempt the swing short, instead, trade the choppy range on the indicators which also worked well for traders.

Pre-NFP we released the KOG Report giving the idea to watch the support level 2910, if given the opportunity to long could be available into the higher levels on the boxes. Although we got the pinpoint long, the move did not complete after a 200pip+ capture, not a bad week at all, not only on Gold but all the other pairs we trade and analyse in Camelot hitting a phenomenal 32 Take profit levels.

Well done again to the community.

So, what can we expect in the week ahead?

It’s a difficult one to decipher this week with the previous weeks range holding into the close on Friday. We have support below at the 2895 with extension into 2885 and resistance at 2930-35 with extension into the 2945 region. We also have the range high and low which you can see on the chart with a slight incline! For that reason, we would suggest best practice for market open is to wait, wait for price to break out of the range with the key levels here being 2920 which needs to break upside to start the move into the 2935 level and above that 2950-55 which is where we may get that potential swing short opportunity from. Please note, here we need to see a daily close above the 2935 region to continue the move upside, ideally, we want to see tap and bounces from these higher levels.

On the flip, if we see resistance at that 2920 level and get a close below our red box support level 2907-10, we can consider the level to level short trades downside targeting the 2885 and potentially below that 2970-75 for now.

As above we'll keep it simple for now, we can’t magic up an idea and hope for the best, when price accumulates like this, we have a fair idea of what it can do, but we need that set up to pull the trigger. Until that comes we can we'll just simply play the range.

You can see from past KOG Reports how extremely powerful the red boxes we share for free are, they almost play price to perfection. So, lets stick with them and let Excalibur lead the way for this week.

KOG’s Bias for the week:

Bullish above 2898 with targets above 2920, 2934 and above that 2945

Bearish on break of 2898 with targets below 2895, 2880, 2874 and below that 2868

RED BOXES:

Break above 2916 for 2920, 2925, 2929, 2933 and 2941 in extension of the move

Break below 2900 for 2885, 2876, 2870 and 2868 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 2922 and a gap below at 2901. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2922

EMA5 CROSS AND LOCK ABOVE 2922 WILL OPEN THE FOLLOWING BULLISH TARGET

2947

EMA5 CROSS AND LOCK ABOVE 2947 WILL OPEN THE FOLLOWING BULLISH TARGET

2968

BEARISH TARGETS

2901

EMA5 CROSS AND LOCK BELOW 2901 WILL OPEN THE FOLLOWING RETRACEMENT RANGE

2878 - 2851

EMA5 CROSS AND LOCK BELOW 2851 WILL OPEN THE SWING RANGE

SWING RANGE

2820 - 2796

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX