THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

It’s been an aggressive month on the markets especially this week which has been testing for traders due to the extended movement on gold. We’ve managed to stay ahead of the game and although we missed the move downside, we’ve capture scalps up and down trading it on an intra-day basis rather than a swing.

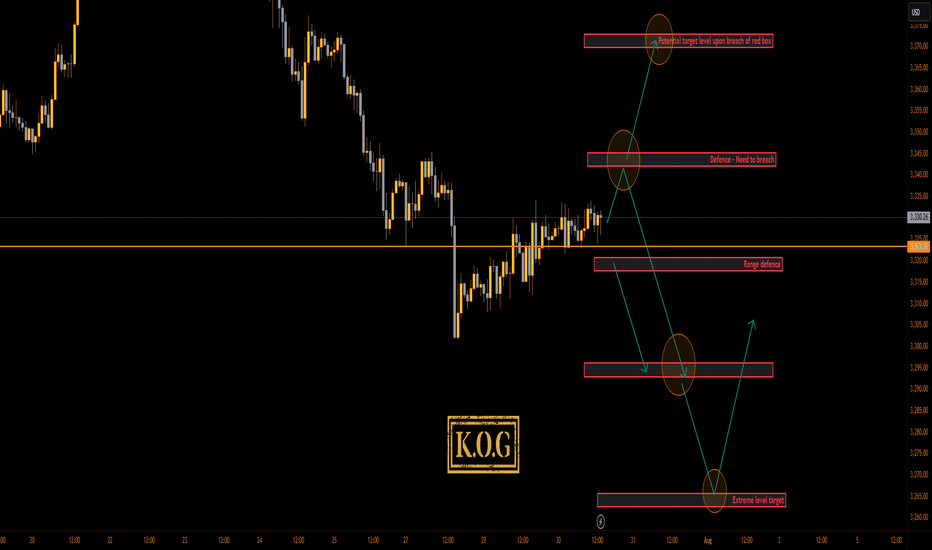

Looking at the 4H chart, we can see we have support forming at the 3310 level which is the key level for this week and will need to be broken to go lower. If we can flip the 3334 resistance, price should attempt higher into the 3355-60 region which is where we may settle in preparation for NFP. on Friday This is the level that needs to be watched for the daily close, as a close above will confirm the structure and pattern test which can form a reversal if not breached.

Now, here is the flip! We’re still sitting below the daily red box but we know this break does give a retracement and with sentiment long, it may not be a complete retracement again. Here 3345-50 is the red box to watch and as above, if not breached, we may see a rejection here which will confirm no reversal for higher and, potentially a further decline into the 3270-5 regions for the end of the month and quarter.

Pivot – 3323-6

RED BOX TARGETS:

Break above 3335 for 3338, 3340, 3345, 3347 and 3357 in extension of the move

Break below 3320 for 3310, 3306, 3302, 3297 and 3393 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Goldtradingplan

Exclusive trading strategy, short gold!From the current gold structure, we can see that gold still needs to continue to retest the 3320-3310, or even the 3305-3295 area; so in the short term, we can still seize the opportunity to consider shorting gold in batches in the 3340-3360 area.

Trading signal:

@3340-3360 Sell, TP:3325-3315-3305

A reliable trader must have an explanation for everything and respond to everything. I have always been committed to the market and insist on writing the most useful core strategies for traders. The transaction details can be seen in the channel!

There are still profit opportunities in short selling!As gold continues to rebound, bulls are reversing their decline. After gold broke through the 3370-3380 area, the current market consensus on 3350-3340 as the bottom area was strengthened. However, as gold fell back under pressure several times after the rebound, it proved that there was still a certain amount of selling pressure above, and it was obvious that the resistance was in the 3395-3405 area; once gold broke through this resistance area, gold bulls would regain the upper hand and are expected to continue to probe the 3320-3330 area. However, before gold effectively broke through the 3395-3405 area, bulls and bears would still fiercely compete for control, so it is still in a wide range of fluctuations.

Therefore, before gold broke through the 3395-3405 area, we can still appropriately short gold in the 3385-3395 area, and expect gold to retreat to the 3375-3365 area in the short term. In trading, we must pay attention to the changes in the rhythm of gold. Once gold chooses a direction and makes a breakthrough, we need to change our trading strategy!

Short gold, gold still has at least one chance to pullback!At present, gold has rebounded to the 3370-3380 area again, which largely confirms that 3350-3340 is the bottom area at this stage. However, what we still cannot underestimate is that even with the support of safe-haven, gold has still failed to effectively break through the resistance of 3385-3395-3405 area, and even fell under pressure several times. To a certain extent, it weakened the willingness and confidence of bulls, so it aggravated the trend of wide fluctuations in the short term. During this period, we must pay attention to the rhythm change of gold.

According to the current bullish strength of gold, I think gold does not have the conditions to directly break through the heavy resistance of 3385-3395-3405 area for the time being, so gold still needs at least one retracement expectation, so I think we can still try to short gold in the 3375-3385 area, but the retracement expectation should not be too large, 3365-3355 is enough!

Perhaps 3300 or even 3280 is foreseeable!Obviously, gold is currently fluctuating downward, and in the short term, there is a certain support in the 3340-3330 area, so gold will not fall below this support area in one fell swoop, and it is still possible to rebound to the 3360-3370 area with the support of this area. If gold encounters resistance and retreats again after touching the 3360-3370 area, if there is no major good news, gold is likely to fall below the 3340-3330 area. After gold falls below this support area, the 3300 and 3280 areas are foreseeable.

So according to the above logic, I still hold a long position executed near 3345, and I am very much looking forward to gold reaching the 3360-3365 area;

If gold continues to rebound to the 3365-3375 area, I will try to short gold again; and look forward to the accelerated downward movement of gold!

The above is a preview of the performance of gold. There may be some deviations in the specific execution of transactions, because in short-term transactions, it is necessary to judge the true breakthrough and false breakthrough in advance, but I will still roughly follow the above preview process to execute the transaction! I also hope that this can provide some reference for everyone!

Gold bulls may restart at any time, buy gold!Although compared with the performance of gold during the day, gold only touched 3452 and then began to retreat, and even failed to approach the previous high of 3500, gold is not strong; but based on the current fundamentals and technical structure, gold is currently in a very strong bullish structure; so I think the gold retracement is not a sign of gold weakness, but to increase liquidity, so that gold can rise better and prepare in advance for breaking through 3500! Gold bulls are ready to restart at any time after the retracement!

So for short-term trading, I don’t think the gold retracement is a reason for weakness, nor is it a certificate for chasing short gold; on the contrary, I think the gold retracement is a good time to buy on dips; first of all, the support area we have to pay attention to is the 3410-3400 area, and the second must pay attention to the 3390-3380 area support.

So in the next transaction, we might as well use these two support areas as defense and start to go long on gold in batches!

THE KOG REPORTTHE KOG REPORT

In last week’s KOG Report we said we would want the lower level red box to be tested and rejected in order to give us the move upside into that 3330-35 region where we wanted to monitor the price for the short. We managed to get a pin point move, however, we had to exit the short trades early due to the support level holding us up. We then continued to follow Excalibur and the red box indi’s which were suggesting higher pricing and by the end of the week we had completed all our bullish above target levels, plus Excalibur trade targets and LiTE again performed at 100% accuracy.

A phenomenal week in Camelot, not only on Gold but the numerous other pairs we trade, analysis and post on.

So, what can we expect from the week ahead?

For this week we can expect some gaps on open which is going to make it difficult due to skewed data. We will however stick with the red box levels and the tools we have to make a plan for the two scenarios we may see potential of.

Scenario one:

Price opens and gaps upside, we’ll be looking for the levels of 3455-60 for a potential reaction in price, if achieved, an opportunity may be available to short there back down into the 3450, 3443 and 3435 levels.

Scenario two:

If we do open and gap downside, we’ll look for the levels of 3430-23 to hold us up, and if achieved, an opportunity to long there back up into the 3450-5 level and in extension of the move 3465 may be available.

It’s a difficult one again as no one knows how the market is going to open and what is going to happen. So we’ll update traders as much as we can during the day and the week with KOG’s bias of the day and red box target levels

KOG’s bias of the week:

Bearish below 3465 with targets below 3425, 3420, 3410 and 3406

Bullish on break of 3465 with targets above 3477, 3485, 3492, 3495 and 3503

Red Boxes:

Break above 3435 for 3443, 3448, 3465 and 3476 in extension of the move

Break below 3420 for 3410, 3406, 3397, 3385 and 3380 in extension of the move

Many of our followers and traders have seen the power of the red boxes, Imagine this on your own TV screen, 4H for swing trading, 1H for day trading and 15min for scalping. Any pair on any chart 23hrs a day. Add to that the Knights indicator giving you swing points, key levels and retracement levels and our custom volume indicator telling you when to long, when to short and when to stand back from your trades.

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Short gold ,it is expected to retreatToday, we accurately seized the trading opportunity of long gold at 3350 according to the trading plan, and hit TP: 3380 in the process of rebounding. We firmly grasped the profit of 300pips in the short-term long trading. At present, gold maintains the trend of continued rise! Now I definitely do not advocate chasing gold in short-term trading. On the contrary, I will actively look for good opportunities for short-term short trading to earn profits from short-term retracement.

In the short term, the suppression area I focus on is the 3390-3395 area, because the gold trend is relatively strong during the European session, and the US session should continue. If gold cannot break through this area in the short term, gold will likely usher in a wave of retracement. I think it should not be difficult to test the 3370-3360 area downward; secondly, we must pay attention to the same suppression area as the short-term high of 3402: 3405-3415; if gold touches this area and stagflation occurs, then it may form a secondary high in the short term, thereby hitting the firmness of the bulls' confidence and ushering in a retracement.

So next, I will test the gold short trade around the two areas of 3390-3395 and 3405-3415. Relatively speaking, the profit and loss ratio is still very favorable to us! But in the process of trading, we must strictly set up protection, after all, it is a counter-trend trade in the short term!

Buy gold, it is expected to continue to rise and test 3380-3390After the Asian session began, gold began to rise rapidly, and the original plan to short gold near 3355 had to be cancelled. After gold touched 3374, it fell back slightly, but after retreating to 3357, it rebounded again and broke through the short-term suppression near 3370 again. At present, gold still has the potential to rise further.

According to the current structure, gold has formed an oscillating upward structure, and the lows have been rising. After breaking through the short-term resistance area of 3360-3370, the willingness to rise has strengthened. Gold is expected to usher in a second rise and test the 3380-3390 area. If it breaks through this area, gold is even expected to continue to the 3410-3420 area. As gold rises, the gold support area rises to the 3360-3350 area.

So for short-term trading, we can try to go long on gold while controlling the risk after gold retreats to the 3360-3350 area!

THE KOG REPORT THE KOG REPORT:

In last weeks KOG Report we said we would wait for the market to open and look for a reaction on the Red box and based on that reaction we would decide where we wanted to go and how to trade it! We immediately opened with a bounce which gave us the opportunity to then get on with the move upside as you can see in last weeks chart completing the move we wanted and the red box targets apart from 3406 (we got as far as 3404). We then identified the red box region we were expecting another RIP from and to the point we got the move down to complete the short. Please look at the chart, you will see how we picked the top, the bottom, and then the range trades within the circled levels with point to point, level to level trades all the way through the week.

A fantastic week in Camelot on not only Gold but all the other pairs we trade.

So, what can we expect in the week ahead?

Looking at the economic calendar there isn’t much going on in the early part of the week so there is potential here for the move to terminate just below before giving a bounce upside into the levels of 3330-35 which is the level to watch for the break this week. A rejection at that level can cause further declines taking us into the 3350 level and possibly 3230-25 before we form a swing low.

There is a flip here as stated above, and that is that 3330-35 region, if we break above there then bulls have that opportunity to drive this upside to clear the NFP move and take us back to target the 3400 level. It all depends on the reactions we get at the levels so we’ll start the week with the plan of action, and of course, in these markets we’ll adapt If we have to.

KOG’s bias of the week:

Bearish below 3336 with targets below 3306, 3299, 3297, 3285 and 3275

Bullish on break of 3336 with targets above 3345, 3350, 3355, 3367 and 3376

Red boxes:

Break above 3310 for 3320, 3332, if held above 3335, 3347 and 3362 in extension of the move

Break below 3306 for 3299, 3295, 3285, 3280 and 3264 in extension of the move

Many of our followers and traders have seen the power of the red boxes, Imagine this on your own TV screen, 4H for swing trading, 1H for day trading and 15min for scalping. Any pair on any chart 23hrs a day. Add to that the Knights indicator giving you swing points, key levels and retracement levels and our custom volume indicator telling you when to long, when to short and when to stand back from your trades.

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

GOLD - one n single resistance , holds or not??#GOLD.. perfect move as per our discussion and now we have one n single resistance area.

That is 3093-94

Keep close that area because that is our key level now and if market hold it in that case we can expect a drop below that..

Note: above 3093-94 we will go for CUT n reverse on confirmation.

Good luck

Trade wisely

Go long gold, target: 3030-3040Gold tested the support of 2985-2975 again during the correction process, but did not fall below this area during the test. Combined with the structural lows of gold yesterday, they were 2970 and 2956. Today, gold did not fall below 2970, so it is very likely that gold will form a head and shoulders bottom pattern at the technical level, which will help gold to continue its rebound momentum with this strong technical support!

So I think the short-term decline of gold is not a risk for us, but the best gift for us. So I advocate going long on gold from now on. After gold repeatedly tests the support, it will rise to the 3030-3040 area without hesitation.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

While gold is relatively new to this range we have to entail some caution if we’re even going to consider trading this FOMC. Markets are a little fragile, we’re at ATH’s and the moves are extremely aggressive. So, we’ll highlight the red box levels and the potential move we’ll be looking for, sticking to the extreme and key levels, ignoring the intermediate levels.

Looking at the chart we have a support region below 3010-15 which if spiked into and held can push this back up this time to break above 3030 and attempt to attack that 3050 region. That in our opinion would be the first point to start looking for price to exhaust, but it will only give us the flip so longer scalps are likely to be all we’ll get.

If we break above the 3055 region we’re likely to go higher giving us a red box resistance level of 3065-75. It’s this level we would ideally like to target from a lot lower down if we can get that entry. For that reason, we have given the level below on the break of 3010 sitting around 2990-80, we’ll have to wait and see, but if we can get down there a nice swing could present itself.

RED BOX INDICATOR:

Break above 3030 for 3050, 3055, 3063 and 3070 in extension of the move

Break below 3020 for 3912, 3006, 2996 and 2990 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said it would be a difficult one to decipher so we suggested traders wait for the break, trade into the levels given and then look for the RIPs. This worked particularly well for us giving us the move into the lower level as analysed on the break, using the red boxes for direction and then giving us the tap and bounce that we wanted to take the long trades back up into the new all time highs we witnessed towards the end of the week.

We managed to compete all of our bias level targets, getting a pin-point move from KOG’s bias and on top of that completing Excalibur targets and the red box targets. Not a bad week at all on Gold.

So, what can we expect in the week ahead?

For this week we’ll be looking for a retracement on the move, however, we are not discounting a curveball move from immediate support to clear liquidity from above. We have the resistance level above 2990 and lower support 2980 which could be the play for the opening. If we break above 2995, we’ll be looking for price to attempt that 3010 and above that 3020 region before attempting to short it again.

On the flip, if we do reject that higher level and can break below 2980, we’ll stick with the plan from last week where we’re looking to continue the retracement back down first into the 2965 level and below that 2950-55. If you look on the chart, we have highlighted a lower level which is sitting around 2935-20, an aggressive move downside can take us there on the manipulation move, so please trade with caution this week and keep an eye on the levels.

KOG’s bias for the week:

Bearish below 2995 with targets below 2970, 2965, 2955 and below that 2950

Bullish on break of 2995 with targets above 3003, 3006, 3010, 3016 and above that 3020

RED BOXES:

Break above 2995 for 2997, 3003, 3009, 3016 and 3021 in extension of the move

Break below 2980 for 2975, 2971, 2965, 2959, 2955 and 2945 in extension of the move

Short and simple this week, let’s see how the week plays out and remember, your risk model is there to protect you, use it, keep your losers small and your winners big!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

The gold long position is trapped, how to save yourself?Bros, gold suddenly continued to fall to the area around 2880. Are you afraid and scared about this?

I would like to ask if your long position is trapped? Brother, I can tell you loudly that I now hold a lot of long positions, and the average price is around 2893. Do you think I will worry about my long position? I am confident to tell you that I am not worried about my long position being trapped at all.

Although the continued decline of gold to around 2880 exceeded my expectations, gold is still in a long structure as a whole. The current decline of gold is only to cooperate with the recent low of 2832 to complete the construction of an effective "W" bottom structure, so I think gold will only fall back to the 2880-2870 zone at the lowest. So I think this is just the last decline of gold. Then gold will stop falling and rebound in the 2880-2870 zone, and is expected to hit 2930, or even around 2950.

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Short gold, Target: 2940-2930Bros, I want to say that 2868 is definitely not the lowest point at the current stage, and the bears have not stopped roaring. After gold falls below 2970, market panic will lead to deep selling, which will drive gold prices further down.

So the bears have not left yet, and any rebound is an opportunity to short gold. As the center of gravity of gold prices moves down, the current resistance has moved down to the 2895-2905 zone again. If gold remains below this area, I think gold is likely to move towards the 2940-2930 zone next!

Bros, profits are the ultimate goal in trading. Accumulating profits is what changes lives and destinies. Choosing wisely is far more important than just working hard. If you want to replicate trade signals and earn stable profits, or if you want to deeply learn the correct trading logic and techniques, you can consider joining the channel at the bottom of this article!

Sorry, I'm shorting gold againYesterday, gold retraced to a low near 2919, but it didn’t reach my expected target zone of 2915-2910, so I didn’t have the opportunity to go long on gold. Currently, gold has rebounded again and extended above 2950. To be honest, while gold maintains its strong bullish position, as long as it stays above 2930, I still don’t recommend chasing long positions. With gold currently trading near 2954, I am even less inclined to go long.

On the contrary, the accelerated rally in gold has a short squeeze potential, so at this level, I am more inclined to short gold. From a cyclical perspective, gold has been prone to showing “Black Thursday” and “Black Friday” patterns recently, so there is a possibility that a reversal could occur today or tomorrow. Therefore, I still recommend continuing to try shorting gold in the short term.

I tend to think that gold may pull back to the 2930-2925 area during the New York trading session today or tomorrow, and may even extend to the area around 2910.Bros, have you followed me to do more gold? If you want to learn more detailed trading ideas and get more trading signals, you can choose to join the channel at the bottom of the article to make trading no longer difficult and make making money a pleasure!

THE KOG REPORT THE KOG REPORT:

I last week’s KOG Report we wanted the lower support level to hold 2710, give us the push up into the higher resistance level where we said watch 2720 and 2730 which needs to break above. It’s those higher levels, in particular 2750 we wanted to attempt that short trade back down into the lower levels. From the open, price resisted 2720, failed to break and gave us the red box trades down into the support levels.

We then had to switch to level-to-level trading due to the ranging which worked well, but we only managed 5 out of 6 Gold targets out of a combined 16 targets completed across the other pairs.

During the week we updated traders with the plans and managed guide them up from the lows to where we closed the week.

It was another successful and consistent week; however, the market didn’t move completely how we wanted it to. The Election special chart however, still on track and working well with our view from the start of November.

So, what can we expect in the week ahead?

Ok, it’s going to be another choppy week, trades are most likely going to be again level-to-level on the red boxes which we will share with the wider community as and when we can. We have the level of 2670 sticking out as resistance with the support level 2650-55 being the key level. With NFP on Friday we would expect most of the movement during the early part of the week before they then settle pre-event into a small range. The weekly key level here is 2620 which will need to break for price to go lower.

We’ll start the week again looking for the higher levels 2662-5 and extension of the move into 2670, if held, an opportunity to short may be available into the lower support level 2650 and below that 2640. We need price to hold above the 2640 region in order to continue higher into the 2675 and above that 2678 price points, so please keep an eye on the support levels.

On the flip, if we continue downside from the open, we will be looking at the 2640-5 region to hold, and if it does, an opportunity to long is on the horizon into the 2665 and above that 2675 region.

KOG’s Bias for the week:

Bullish above 2640 with targets above 2655, 2665 and above that 2670

Bearish on break of 2640 with targets below 2635 and below that 2620-15

RED BOXES:

Break above 2652 for 2660, 2665, 2670 and 2675 in extension of the move

Break below 2640 for 2635, 2630 and 2617 in extension of the move

As usual, we will update traders through the week with KOG’s bias of the day and the Red boxes which have proven to work extremely well on not only gold, but also any other pair you wish to apply them to together with our basket of indicators.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT

In last week’s KOG Report we wanted higher pricing to short again into the lower targets 2665, 2650 and 2620. Unfortunately, we didn’t get the higher level we wanted, so instead, followed Excalibur and the red boxes not only completing the bias targets in one move, but also then completing numerous bearish targets on the week.

The bias was bearish below, the price, once settled moved well and allowed us to navigate the short trades and the bounce for the longs. Another good week in Camelot, completing a staggering 25 targets, 8 of those on gold alone.

So, what can we expect in the week ahead?

For this week we’re only looking for one move, and that’s for the price to attempt the retracement that is needed and stretching out traders. For that reason, we have the lower level of 2550-55 which if attacked and held during the early session may give traders the opportunity to long back up into the 2565-70 region and above that 2600-05 region initially. That’s the trade that we’re looking for early part of the week but please note, breaking below that 2550 level will give us a better opportunity from the 2530-35 region which is also shown on the chart.

Nice and simple this week, we’ll update as we usually do. Potential for more ranging on Monday so maybe best to let Monday play and then look for a decent set up for Tuesday onwards.

KOG’s bias for the week:

Bearish below 2575 with targets below 2555 and below that 2550

Bullish on break of 2575 with targets above 2595 and above that 2605

RED BOXES:

Break above 2575 for 2585, 2587, 2595 and 2610 in extension

Break below 2560 for 2555, 2551, 2541 and 2535 in extension

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

We wanted price to reject the high and give us the short into the red box defence during the early session levels 2730-35. We did get that move but it was achieved via the gap on open giving traders a couple of opportunities to take the long trade from the level following the path. We're yet to complete the first bullish target but we're on our way so we'll stick with the plan!

Based on the structure and range at the moment we're not discounting another dip into the low but will look for pull backs into the 2735 region to hold to continue the move upside.

Support 2735, resistance 2750 could give a reaction for the short scalp. Keep an eye on the red boxes, pinned below, they're working really well.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for that lower support level of 2420-25 to target, and if it held we felt the opportunity to long into the 2450-55 region and the extension of the move into the 2465-8 price points would be available. We got that move almost to the pip from the open, completing the move in the early part of the week.

During the week we update traders with the short potential trade from the order region, which again completed and then suggested going long again once we saw the structure support 2430-25 form. This move here gave traders the opportunity to target that all time high, completing numerous Excalibur targets along the way. One of which we had highlighted last week on the chart.

So, what can we expect in the week ahead?

For this week we’re going to keep it simple. Due to the lack of data up here we’ll have to modify and adapt as the market continues. We have potential resistance above sitting around 2515-20 and we now have the support level below sitting around the 2480-75 region which could be a potential target level for the retracement of this move, but price needs to hold this level. Breaking below it can correct this whole move to the downside, so if you are going to attempt going long, please make sure the set up is clean, and please, try not to go long up here unless there is that retracement. As you’ve seen, Red boxes help in identifying the key regions and give bounces a majority of the time. If the level is held, we see an opportunity to continue this move back up towards the 2520 and above that 2530 regions with extension of the move into 2540-45. These levels above we’re going to label as order regions but that’s yet to be confirmed.

Nice and easy this week, take your time with the trades, make sure the set up is right and clean. Try not to jump in just because you’ve identified a target, as we’ve said above, they can correct this whole move so lets play defence this week.

KOG’s bias of the week:

Bullish above 2475 with targets above 2510, 2525 and 2540

Bearish on break of 2475 with targets below 2450

As always, we’ll update you during the week.

Look out for:

KOG’s daily bias and targets

Red boxes – Our strategy which is proving to a huge hit with our traders and team

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said if we saw price attempt the order region resistance above 2450-55 and held, we say an opportunity to short the market back down into the 2430 level, and if broken the extreme level of 2407-10 which is what we wanted to target initially.

Ideally, we wanted the long trade to come from there, however, our bias target level bearish below was sitting at 2395, so we waited for that to complete, which it did. During the week we managed to get in on the long trade and as updated with the community, followed Excalibur all the way up into where we closed on Friday. It wasn’t an easy week, we stayed out at the right time however, and managed to stay the right side of the move.

So, what can we expect in the week ahead?

We have a lot of news this week which is going to drive the markets, even though we say it most weeks these days, we would suggest traders take it easy on the markets and don’t place all their eggs in one basket.

On the close we can see the 2430-35 region now accumulating the price which is causing a bit of a whipsaw. We have lower support sitting at the 2420-25 level which if held, is likely to continue to push this higher attempting to break above the 2435 price. Our initial level is the 2450-55 which we would like to see completed this week with the extension of the move into the 2465-8 region if they can take it there. This is the level, unless broken above traders may get the opportunity to test the short trade. Based on the above and as the path suggest on the chart, these support levels, if approached and defended first and unless broken can give us opportunities for further increases into but it’s that 2465-70 region that needs to be watched.

Due to a potentially low volume day tomorrow we can expect the whipsawing and choppy price action to continue, so we would suggest traders wait for the market to make it’s move rather than attempt trying to trade the range. Therefore, a break above 2437 would give more confidence in a move upside and a break below 2425 will give us more confidence in the price attempting to take the lower liquidity first.

KOG’s bias for the week:

Bullish above 2406 with targets above 2450 and above that 2465

Bearish on break of 2406 with targes below 2395 and below that 2365

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD - GOLD - Scalping Mode! 8th JulyLet's see what the market has to offer.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!