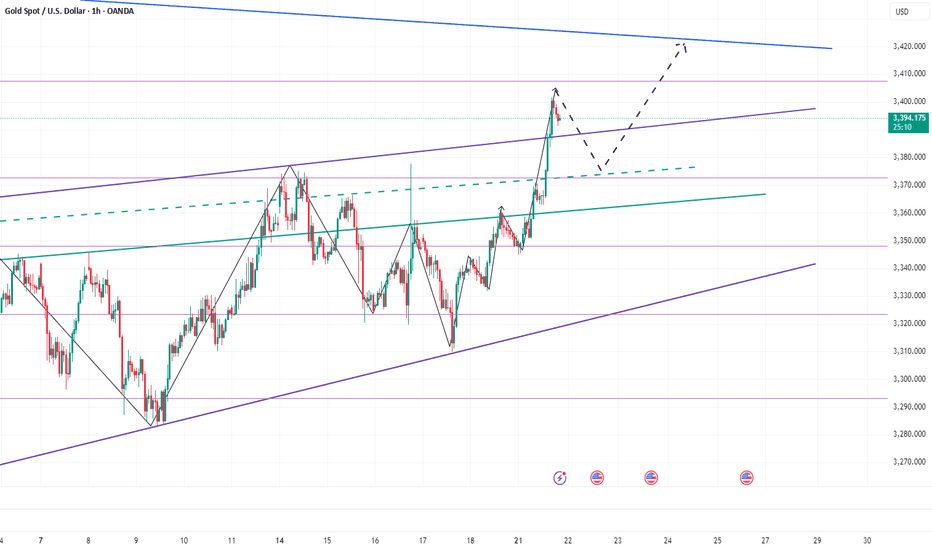

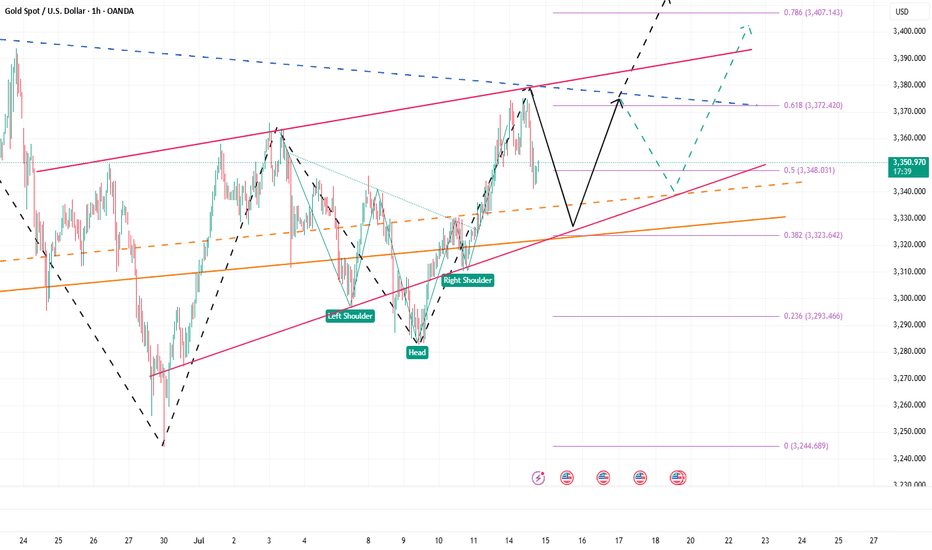

Gold’s Rapid Surge: A Trap Before the Drop?Gold finally showed signs of retreat. We are still holding a short position near 3400. So far, we have made a profit of 50 pips. However, I will still hold it to see if gold can fall back to the 3385-3375 area as expected. We have completed 2 transactions today, and there is still 1 transaction left to hold.

1. First, we bought gold near 3345 and ended the transaction by hitting TP: 3370, making a profit of 250 pips, with a profit of more than $12K;

2. We shorted gold near 3385 and ended the transaction by hitting SL: 3395, with a loss of 100 pips, a loss of nearly $5K;

3. We are still holding a short gold transaction order near 3400, with a current floating profit of 60 pips and a floating profit of nearly $4K;

The above is the detailed transaction situation today. To be honest, today's rebound strength far exceeded my expectations, and after our first long position hit TP, the market never gave any chance to go long on gold after a pullback, but accelerated to around 3401. But obviously, the accelerated rise of gold is suspected of catching up with the top, and in the short term it faces resistance in the 3405-3410 area, and secondly pressure in the 3420-3425 area. So I don't advocate chasing gold at the moment. On the contrary, I am still actively trying to short gold around 3400, first expecting gold to pull back to the 3385-3375-3365 area.

And I think if gold wants to continue to test the 3405-3415 area, or even sprint to the area around 3425, gold must go through a pullback to increase liquidity to accumulate upward momentum. I think it will at least pull back to the 3385-3375 area.

Goldtradingsignals

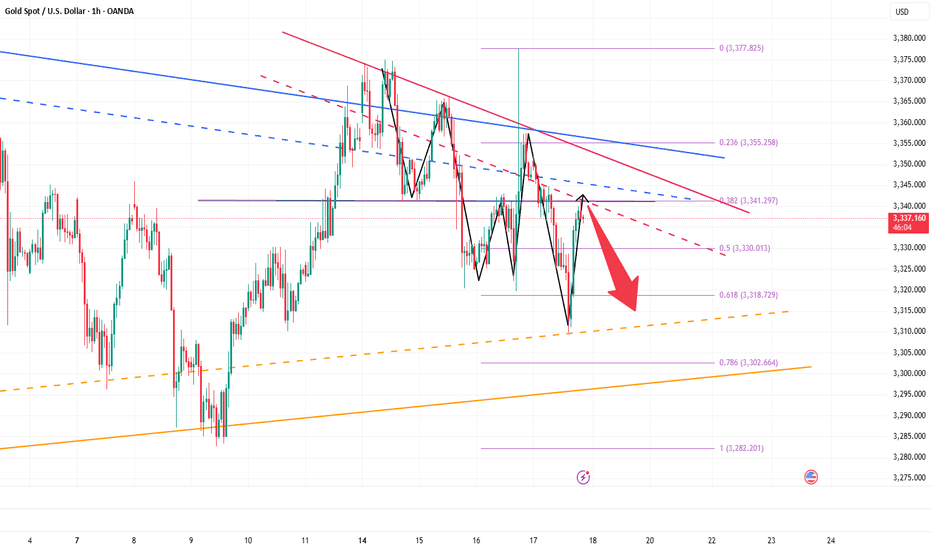

Gold’s Last Stand? Major Retest at 3310–3300 Under the influence of negative news, gold today fell below the recent low of 3320 and continued to fall to around 3310. The current gold structure looks particularly obvious, the center of gravity of gold gradually moves downward, and the short trend is extremely obvious; however, as gold repeatedly probes the 3320-3310 area, we can clearly see the resistance of gold to falling, and multiple structural supports are concentrated in the 3320-3300 area. So as long as gold does not fall below this area, gold bulls still have the potential to rebound.

However, for now, after experiencing discontinuous sharp rises and falls, gold needs to undergo a short-term technical repair, so it may be difficult for a unilateral trend to appear in the short term. So I have reason to believe that gold will focus on rectification and repair next. The important resistance area we have to pay attention to above is in the 3340-3350 area; and the important support below is in the 3310-3300 area.

Currently, gold is fluctuating in a narrow range around 3340, and the short-term rebound momentum is sufficient, but I still believe that gold will fall back again and test the support of 3320-3300 area after consuming the bullish energy. So for short-term trading, first of all, I advocate shorting gold in the 3340-3350 area, and expect gold to retreat to the 3320-3300 area during the consolidation process.

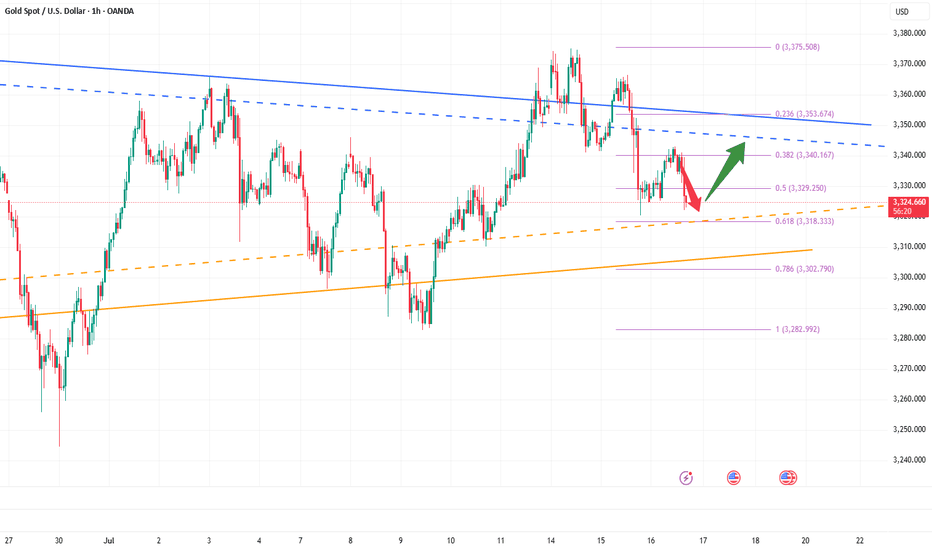

3325–3315: Potential Bullish Reversal ZoneGold maintained a volatile trend today, but the highest intraday price only touched 3343. Overall, gold is still weak, but the bulls have not completely given up, and there is still a certain amount of energy, which limits the retracement space of gold. The current short-term support is in the 3325-3315 area. If gold cannot fall below this area in such a weak situation, the market may reach a consensus that 3325-3315 is the support area, thereby attracting a large amount of buying funds to flow into the gold market, thereby boosting gold to regain the bullish trend again and is expected to hit the 3350-3360 area.

So for short-term trading, I currently prefer to start long gold with the 3325-3315 area as support, first expecting gold to recover some of its lost ground and return to the 3350-3360 area!

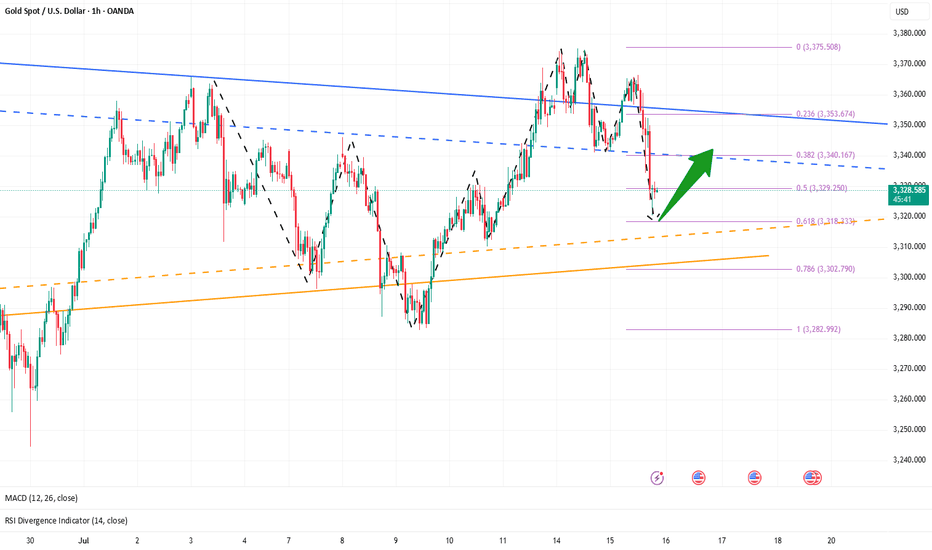

Golden Support Holds — Bulls Poised for Another Leg Higher"If gold cannot break through the 3365-3375 area, gold will fall under pressure again, or refresh the recent low of 3341, and continue to the 3335-3325 area." Gold's performance today is completely in line with my expectations. Gold just retreated to a low of around 3320, but soon recovered above 3325, proving that there is strong buying support below.

From the current gold structure, the short-term support below is mainly concentrated in the 3320-3310 area. If gold slows down its downward momentum and its volatility converges when it approaches this area, then after the gold bearish sentiment is vented, a large amount of off-site wait-and-see funds will flow into the gold market to form strong buying support, thereby helping gold regain its bullish trend again, thereby starting a retaliatory rebound, or a technical repair rebound.

Therefore, for short-term trading, I still insist on trying to go long on gold in the 3330-3320 area, first expecting gold to recover some of its lost ground and return to the 3340-3350 area.

Eyes on 3335–3325: Next Bullish Launchpad!!!Today, gold hit 3375 several times and then fell back after encountering resistance. The lowest has reached 3341. Although the rising structure has not been completely destroyed, and the technical double bottom structure and the inverted head and shoulder structure support resonance effect still exist below, since gold fell below 3350, it has not even been able to stand above 3350 in the current rebound. The gold bull pattern has been weakened to a certain extent, and the market has begun to diverge in the long and short consciousness.

Gold encountered resistance and fell back near 3375 three times, proving that the upper resistance is relatively strong. Gold must increase liquidity by retracement to store more energy for breakthrough, so the short-term correction of gold is actually within my expectations, which is why I advocate brave shorting of gold today! However, according to the current retracement range and the fact that gold has been unable to stabilize above 3350, I believe that gold has not fallen to the right level and there is still room for retracement below. So I think gold will continue to pull back to test the 3335-3325 area. If gold retests this area and does not fall below, we can boldly go long on gold in this area.

Once gold rebounds after testing the 3335-3325 area, as liquidity increases, the market may form a strong bullish force to support gold to continue its rebound and continue to the 3380-3390 area, or even the 3400-3410 area.

Gold’s Uptrend Is a Mirage,Bears Are Lurking Beneath!Gold has rebounded to around 3336, and seems to have tried to stand above 3335, but it has not stood firm. Therefore, it cannot be considered that the bulls have an advantage just because gold has tried to break through 3335. Recently, I have been reminding everyone that before gold stands above 3335, the bears still have the spare power to dominate the market, so I fully believe that the gold bulls and bears will fight fiercely for control around 3335!

Why do I think it is difficult for gold bulls to have a good performance in the short term? Because since gold fell and touched 3285, it has fallen below many key supports. The market is short-selling. The previous support has become a key resistance under the effect of technical top and bottom conversion, and multiple resistances are concentrated in the 3335-3345-3355 area. Under the suppression of multiple resistances, it is difficult for gold bulls to make any progress in the short term.

So before the resistance is effectively broken, I think any rebound may be an opportunity to short gold, so I will try to find the band top and short gold based on the resistance area, and now I think it is still worth a try to short gold in the 3330-3340 area as originally planned! And look at the target area of 3320-3310

Short gold ,the downside potential is far from over.After we waited patiently for a long time, the gold bears finally showed signs of strength and began to fall as expected. Why do I insist on being optimistic about the gold retracement and wait patiently for it to retrace? !

In fact, it is very simple. Gold started to rebound from around 3283 and touched around 3330, which only recovered 50% of the decline. When facing the 50% retracement level, the bulls were unable to do so and could not stand above 3335, and could not even stabilize above 3330. The bulls' willingness was obviously insufficient. Then it can be determined that the gold rebound is only a technical repair of the sharp drop, and it cannot be completely regarded as a reversal of the trend. Then after a certain degree of repair, the gold bears will counterattack again.

Moreover, from the perspective of market psychology, the recent gold bull and bear markets have been discontinuous, and Trump often stirs up the gold market, making it difficult for the market to stand unilaterally on the bull side. Therefore, before gold stabilizes in the 3330-3340 area, there is limited room for rebound in the short term. Once gold falls below the 3310-3305 area again during the retracement, gold may test the area around 3280 again, or even around 3270.

So the above is why I insist on shorting gold, and I have shorted gold at 3320-3330 as planned, and patiently hold the position to see its performance in the 3310-3305 area, which is also the target area of our short-term short position.

Don’t be too optimistic, gold may change its face at any time!Gold continued to rebound to around 3320, and it seems to have completely stood above 3300. The bulls are recovering. Should we chase gold in a big way? In fact, due to the disruption of news such as the Federal Reserve's interest rate decision and tariffs, the gold market has clearly shown the characteristics of frequent switching between long and short positions and discontinuity between long and short positions. Therefore, even if gold rebounds to a certain extent, it is difficult for the market to stand unilaterally on the bull side.

In the short term, gold began to retreat from around 3366, reaching a minimum of around 3283, with a retracement of $83; and currently it has only rebounded from the low of 3283 to around 3320, and the rebound is even less than 50%. Gold bulls are not as strong as imagined; although gold continues to rebound, before regaining the 3325-3335 area, it can only be regarded as a technical repair of the sharp drop, and cannot be completely regarded as a reversal of the trend. So after the rebound of gold, gold bears may counterattack strongly at any time.

Therefore, in short-term trading, after gold rebounds, you can consider shorting gold with the 3325-3335 area as resistance, and the first entry area worth paying attention to is 3320-3330.

Start buying gold, a rebound may come at any time!Gold is undoubtedly weak at present, and bears have the upper hand. However, since gold touched the 3290-3280 area, gold bears have made more tentative moves, but have never really fallen below the 3290-3280 area, proving that as gold continues to fall, bears have become more cautious.

From the perspective of gold structure, multiple technical structural supports are concentrated in the 3285-3275 area, which makes it difficult for gold to fall below this area easily. After gold has failed to fall below this area, gold is expected to build a short-term bottom structure with the help of multiple supports in this area, thereby stimulating bulls to exert their strength and a rebound may come at any time.

Therefore, in the short term, I do not advocate chasing short gold; instead, I prefer to try to find the bottom and go long gold in the 3290-3280 area; but we should note that because gold is currently in an obvious short trend, we should appropriately reduce the expectation of gold rebound, so we can appropriately look at the rebound target: 3305-3315 area.

The rebound is an opportunity to short goldAfter the ceasefire agreement between Iran and Israel and Powell's hawkish remarks that strongly refuted the possibility of a rate cut, gold fell sharply and hit a low near 3295. Although gold has rebounded, it is particularly difficult during the rebound process, which shows that the bulls are not willing to attack, and the rebound is only a technical repair of the decline.

Since gold fell below 3300 yesterday, the current bull structure has been changed in stages and the confidence of the bulls has been greatly weakened. As gold falls, it will be under pressure in the 3345-3355 area in the short term. Before gold breaks through this area, any rebound may give us an opportunity to short gold; in addition, after gold falls below 3300 once, in order to move downward and test support, gold has the need to retreat again.

So in the next short-term trading, we can try to use the 3345-3355 area as resistance, short gold appropriately, and look to the 3315-3305 area.

Gold is expected to hit 3410-3420 againBecause of the news that Iran hopes to ease the hostile relationship with Israel, gold fell sharply in the short term, then rebounded after touching 3383, and quickly recovered above 3390. From this point of view, the buying support below is strong, and the market sentiment is still high, which limits the downside of gold, and the support of 3390-3380 area is still valid.

Although the bullish momentum of gold has weakened relatively due to the retracement in the short term, as long as gold remains above 3380, it still maintains a strong upward structure; and the retracement only exacerbates the short-term shock trend. Gold is still likely to maintain a shock upward structure and try to touch the 3410-3420 area again. Once gold breaks through 3420 strongly, it is expected to hit the area near 3450 again.

So for short-term trading, I still hold a long position in gold, and there is still a certain profit now. I have to say that if gold can reach the 3410-3420 area as expected, our profits will increase significantly!

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest structure analysis and

important supports & resistances for GOLD XAUUSD

for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD (XAUUSD): More Growth Ahead?!

Gold violated a significant intraday horizontal resistance on Friday.

The broken structure and a rising trend line compose a strong

contracting demand area now.

It will be a perfect spot to try to buy Gold after a pullback.

Next goal for the buyers will be 3400.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD (XAUUSD): Strong Bullish Signs?!

Gold strongly corrected from 3500 psychological level.

After a test of the underlined intraday support cluster,

the market started to leave strong bullish clues.

After a false violation of the support, the price accumulated a bit

and broke a resistance line of a falling wedge pattern on an hourly time frame.

With that move, Gold also managed to confirm a local Change of Character CHoCH.

All these bullish signals indicate a highly probable continuation of a growth.

The price may move up at least to 3377 level easily.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we wanted to see price dip into the lower support and give us the opportunity to long into the higher levels targeting the red box targets and the bias levels given. We manged to get this trade and started the week well! We then suggested traders play caution as the set up just wasn’t presenting itself for the short, instead, we updated our plans and published the long idea again which played out well giving us a decent end to the week. The ranging gave us conflicting signals and choppy price action towards the end of the week, so not 100% to plan, but we played it and adapted.

We managed another stellar performance on Excalibur, 6 targets on Gold and another trunk full on the other pairs we trade and analyse in Camelot. Difficult, but consistent nevertheless.

So, what can we expect in the week ahead?

Ideally we would like to wait for the market to open and break out of the range before picking the direction. We have lower support at 2930 and the extension level 2918-14 which needs to be watched for the break in the early part of the week, while the key level above 2950-55 with extension into the 2960 region should act as a barrier which will need to break.

We’ll start by saying if the price does support that 2930-25 level on the open, then the opportunity to long into the 2943 and above that 2950 levels should be available to those looking to go long. We have marked a RIP point 2960-65 but that will only give us the flip so scalps into the lower support region are potentially all we will get.

Above that we have marked our area of interest, this is ideally where we want to be monitoring the price action and looking for signs of a potential reversal, which, if given should give us a nice swing short into the lower levels which will be published on morning reviews and KOG’s bias of the day.

On the flip, If we glitch and make a move downside on the open, look out for the levels of 2920-16 and below that 2910! These region need to hold us up to go higher in order to clear the liquidity from above before another attempt at lower.

It’s the last week of the month, it’s going to be choppy and ranges will form. Indications of lower pricing are on the horizon, the set up just isn’t clear at the moment so play it level to level, keep an eye on the red boxes, look back at the KOG reports and see for yourself how well they play with price. Take it easy, “if it’s exciting, you’re doing it wrong”. We’ll update as through the week as we usually do with the red box targets, KOG’s bias of the day and the indicator levels.

KOG’s bias of the week:

Bullish above 2920 with targets above 2945, 2949. 2952 2955 and above that 2970

Bearish below 2920 with targets below 2916, 2910, 2906, and below that 2898

RED BOX TARGETS:

Break above 2943 for 2947, 2950, 2955, 2962, 2966 and 2977 in extension of the move

Break below 2930 for 2923, 2920, 2910, 2906 and 2899 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Best Strategies to Identify a Bearish Reversal in Gold Trading

In this article, I will explain to you 4 efficient strategies to identify a bearish reversal with technical analysis in Gold trading.

You will learn price action, SMC and technical indicator strong bearish signals.

First, let me remind you that different bearish signals may indicate a different magnitude and a degree of a potential reversal.

While some signals will be reliable for predicting short term reversals, some will be more accurate in projecting long-term ones.

One more thing to note is that one of the best time frames for bearish reversal confirmations on Gold is the daily. So, all the cases that will be explained will be on a daily time frame strictly.

XAUUSD Bearish Reversal Signal 1 - Bearish Price Action Pattern.

One of the perfect indicators of the overbought state of a bullish trend on Gold is bearish price action patterns.

I am talking about classic horizontal neckline based patterns like head & shoulders, inverted cup & handle, double/triple top and descending triangle.

Typically, these patterns leave early bearish clues and help to predict a coming downturn movement.

A strong bearish signal is a breakout of a horizontal neckline of the pattern and a candle close below.

The price may continue falling at least to the next key support then.

Above is the example of a head and shoulders pattern on Gold, on a daily. Its formation was the evidence of the overheated market. Bearish breakout of its neckline confirmed that, and the price continued falling.

Bearish Reversal Signal 2 - Rising Channel Breakout.

When the market is trading in a healthy bullish trend, it usually starts moving with the boundaries of a rising channel.

It can be the expanding, parallel or contracting channel.

Its support will represent a strong vertical structure , from where new bullish waves will initiate after corrections .

Its breakout will quite accurately indicate a change of a market sentiment and a highly probable bearish reversal.

Look at this rising parallel channel on Gold chart on a daily. The market was respecting its boundaries for more than 3 months.

A bearish violation of its support was an accurate bearish signal that triggered a strong bearish movement.

Bearish Reversal Signal 3 - Change of Character & Bearish Price Action.

One of the main characteristics of a bullish trend is the tendency of the market to set new higher highs and higher lows. Each final high of each bullish impulse is always higher than the previous. Each final low of each bearish movement is also higher than the previous.

In such a price action, the level of the l ast higher low is a very significant point.

The violation of that and a formation of a new low is an important event that is called Change of Character CHoCH.

It signifies the violation of a current bullish trend.

After that, one should pay attention to a consequent price action, because CHoCH can easily turn into just an extended correctional movement.

If the market sets a lower high and a new lower low then, it will confirm the start of a new bearish trend.

That is the example of a confirmed Change of Character on Gold on a daily. To validate the start of a new bearish trend, we should let the price set a lower high and a form a bearish impulse with a new lower low.

Bearish Reversal Signal 4 - Death Cross.

Death cross is a strong long-term bearish reversal signal that is based on a crossover of 2 moving averages.

On a daily time frame, it is usually based on a combination of 2 Simple Moving Averages: one with 50 length and one with 200 length.

The signal is considered to be confirmed when a 50 length SMA crosses below 200 length SMA.

It is commonly believed that it signifies that the market enters a long-term bearish trend.

On the chart, I plotted 2 Moving Averages. When the blue one crosses below the orange one, a global bearish trend on Gold will be confirmed

The 4 bearish signals that we discussed will be useful for predicting short term, mid term and long term bearish reversals on Gold.

While price action patterns will indicate local bearish movements, Death Cross will confirm a global trend change.

Learn to recognize all the signals that we discussed to make more accurate trading and investing decisions.

❤️Please, support my work with like, thank you!❤️

GOLD (XAUUSD): One More Bullish Confirmation?!

After the release of the yesterday's US news, Gold went up again

Analyzing a 4H time frame, I see a completed inverted head and shoulders pattern.

Probabilities are high that growth will continue.

Goals: 2931 / 2942

❤️Please, support my work with like, thank you!❤️

GOLD (XAUUSD): One More Bullish Signal

Gold continues growing, as I predicted in the beginning of this trading week.

The market perfectly reached the first goal.

Analysing a price action on a daily, I see one more bullish signal now.

The market violated a strong horizontal resistance and closed above that.

With a high probability, the rise will continue.

Next resistance - 2716

❤️Please, support my work with like, thank you!❤️

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the levels of resistance above at the 2670-75 region where we anticipated the short trade to come from and the lower levels of support standing at 2630 where we wanted to see a reaction in price. We managed to get the short just below around the 2665 region giving us a nice start to the week in Camelot, targeting lower and breaking through 2630. We then continued to short completing the bias target levels as well as the red box targets which were shared with the wider community.

Pre-FOMC we suggested traders pause and wait for the reversal which we managed to get based on the indicator and the FOMC report enabling us to capture the move upside into the close of the week, giving us a phenomenal pip capture on Gold. Add to that the other pairs we’ve traded and analysed through the week, and it was a nice end to week giving us an opportunity to now take it lightly for the remainder of the year.

So, what can we expect in the week ahead?

For this week we will be expecting thin volume so potential for ranging and slow movement with sudden burst of unexpected volume. We again have the key level of 2630-35 above which is a reasonable target region for the start of the week as long as the support level just below here holds us up 2610. If we can start the week with a move into that region we feel an opportunity to long is there with the first region being 2630 and above that 2635. 2635 is the level we’re anticipating a break of into the higher levels of 2650-55 and above that 2660-6, which is where we ideally want to be waiting for the short opportunity to take this back down into the lower levels with potential to then break below the 2600 level.

We say it a lot but this week and most probably for the remainder of the year we will be taking this level to level, hence the report is showing you’re the 4H red boxes which together with our 15min and 1H indicators work well to capture the moves for intra-day trading across all pairs.

KOG’s bias for the week:

Bearish below 2660 with targets below 2610, 2596, 2580 and 2578

Bullish on break of 2660 with targets above 2667 and above that 2670

RED BOXES:

Break of 2625 for 2630, 2635, 2645 and 2660 in extension of the move

Break of 2610 for 2606, 2590, and 2680 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - ELECTION SPECIAL - UpdateQuick update on our Election special chart which we posted prior to the election giving our view of what to expect in terms of movement in Gold.

The Red arrow was the projected path, the green arrow is real time movement.

Can quite honestly say it's worked well for us, not exact, but close enough when fine tuned with the red boxes, Knights inid, and of course Excalibur.

We'll keep tracking this.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we gave the resistance levels above and said if they held, we would see an opportunity to attack the support levels of 2470-75. It’s that support level we wanted to the long trades up into the 2520 and above that 2530 levels for the week. We gave KOG’s bias of the week and bullish above with target levels 2510 (complete), 2525 (complete) and 2540 which hasn’t been achieved as yet.

We completed numerous gold targets, the red box strategy gave us some extremely decent entries and exits for the scalps and once again, we managed to trade this following it’s path.

So, what can we expect from the week ahead?

We’ve had a nice close which hasn’t quite confirmed a further move upside as yet, so we’ll play the bank holiday with caution. We would like to see how price reacts at the 2520-22 region, and if rejected, there is potential there for this to correct back down into the 2500-5 price region. It’s this support level that is important, if held, we see an opportunity to then long back up towards the 2530-35 region as the first target.

It's those higher levels, 2530-35 and above that 2540 that we want to keep an eye on. If we see any sign of a structure change there, we'll want to short this again.

For this week we want to play a little defence on the markets, as it’s a bank holiday week and the last week of the trading month. The weekly and monthly close are really important to determine future price on this precious metal, so please, if you’ve followed us, you should have had a decent month, take a little step back this week and monitor price. We’ll be looking at key and extreme levels expecting the repercussions of Jackson Hole on Tuesday onwards.

KOG’s bias of the week:

Bullish above 2490 with targets above 2420 and above that 2430-35

Bearish on break of 2490 with targets below 2465

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for that lower support level of 2420-25 to target, and if it held we felt the opportunity to long into the 2450-55 region and the extension of the move into the 2465-8 price points would be available. We got that move almost to the pip from the open, completing the move in the early part of the week.

During the week we update traders with the short potential trade from the order region, which again completed and then suggested going long again once we saw the structure support 2430-25 form. This move here gave traders the opportunity to target that all time high, completing numerous Excalibur targets along the way. One of which we had highlighted last week on the chart.

So, what can we expect in the week ahead?

For this week we’re going to keep it simple. Due to the lack of data up here we’ll have to modify and adapt as the market continues. We have potential resistance above sitting around 2515-20 and we now have the support level below sitting around the 2480-75 region which could be a potential target level for the retracement of this move, but price needs to hold this level. Breaking below it can correct this whole move to the downside, so if you are going to attempt going long, please make sure the set up is clean, and please, try not to go long up here unless there is that retracement. As you’ve seen, Red boxes help in identifying the key regions and give bounces a majority of the time. If the level is held, we see an opportunity to continue this move back up towards the 2520 and above that 2530 regions with extension of the move into 2540-45. These levels above we’re going to label as order regions but that’s yet to be confirmed.

Nice and easy this week, take your time with the trades, make sure the set up is right and clean. Try not to jump in just because you’ve identified a target, as we’ve said above, they can correct this whole move so lets play defence this week.

KOG’s bias of the week:

Bullish above 2475 with targets above 2510, 2525 and 2540

Bearish on break of 2475 with targets below 2450

As always, we’ll update you during the week.

Look out for:

KOG’s daily bias and targets

Red boxes – Our strategy which is proving to a huge hit with our traders and team

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG