Goldtradingstrategy

Buy gold, expect a rebound to 3000Gold just fell to 2958, but quickly rebounded to above 2965. The short-term support of 2965-2960 was not effectively broken. Gold quickly recovered above the short-term support, proving that bulls still have room to fight back. I expect gold to at least rebound and test the 3000 position again, so in short-term trading, we should not be too bearish on gold.

I actually reminded everyone in the last article update that we can buy gold when gold falls. In this extremely fierce market, with a cautious trading mentality, I actually do not expect too much about the rebound space of the bulls. Once gold touches around 3000, I will leave the market safely and lock in profits!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold still has the potential to bounce back to 3070!Gold has been experiencing significant volatility driven by fundamental factors. While bearish sentiment appears to remain dominant, the recent downside move has already priced in much of the negative risk. As such, traders should avoid an overly one-sided bearish bias in the current environment.

After bottoming out near the 2970 level, gold staged a strong rebound. During the ensuing consolidation phase, the 3010–3000 zone has provided consistent support, signaling the emergence of a short-term demand zone. This indicates that the bulls have not completely capitulated and may attempt to stage a corrective rally toward the 3050 level, or potentially even as high as 3070.

From a short-term trading perspective, we may consider initiating long positions within the 3015–3005 range, aiming for an upside target of 3050, with a possible extension toward the 3070 resistance area.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

GOLD ROUTE MAP UPDATEHey Everyone,

Great start to the week with our 1h chart route map playing out, as analysed.

We started the session with our Bearish targets 3034 and 3034 and then the retracement range targets at 2999 and 2975, followed with our Bullish target at 3055, perfectly inline with our plans to buy dips.

The range is currently big and we will continue to see play and test between the weighted levels. A re-test and break below the retracement range will open the swing rang. However, continuous support above the retracement range will see a further test at 3055 weighted Goldturn level and lock above 3055 will see the range above open.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3055 - DONE

EMA5 CROSS AND LOCK ABOVE 3055 WILL OPEN THE FOLLOWING BULLISH TARGET

3078

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3094

EMA5 CROSS AND LOCK ABOVE 3094 WILL OPEN THE FOLLOWING BULLISH TARGET

3119

EMA5 CROSS AND LOCK ABOVE 3119 WILL OPEN THE FOLLOWING BULLISH TARGET

3148

BEARISH TARGETS

3034 - DONE

EMA5 CROSS AND LOCK BELOW 3034 WILL OPEN THE FOLLOWING BEARISH TARGET

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999 - DONE

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2975 - DONE

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2922

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Master swing trading! Both long and short sides can profit!The current fundamental environment: tariff issues and geopolitical conflicts are on opposite sides, so there are both bearish and bullish factors for the gold market, which have triggered fierce competition between long and short forces to a certain extent, exacerbating market volatility!

At present, overall, the short forces have the upper hand, but the longs still have a certain ability to fight back! If the short energy is fully released during the process of gold falling to around 2970, then gold may still usher in a wave of rebound opportunities in the short term. First of all, the areas worthy of our participation in trading are mainly concentrated in the following:

1. The short-term support area below: 3010-3000; secondly, the important defensive area for bulls is: 2975-2965.

2. The short-term resistance area above: 3040-3050; secondly, the important defensive area for bears is: 3070-3080.

This is the key area that we must pay attention to in the short-term, and it is also an important reference for our next short-term trading!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

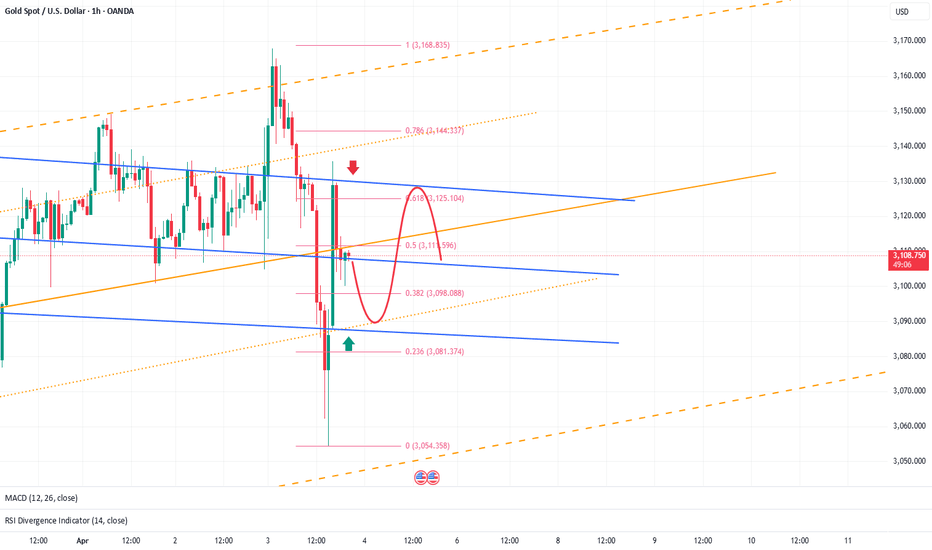

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3055 and a gap below at 3034. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3055

EMA5 CROSS AND LOCK ABOVE 3055 WILL OPEN THE FOLLOWING BULLISH TARGET

3078

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3094

EMA5 CROSS AND LOCK ABOVE 3094 WILL OPEN THE FOLLOWING BULLISH TARGET

3119

EMA5 CROSS AND LOCK ABOVE 3119 WILL OPEN THE FOLLOWING BULLISH TARGET

3148

BEARISH TARGETS

3034

EMA5 CROSS AND LOCK BELOW 3034 WILL OPEN THE FOLLOWING BEARISH TARGET

3015

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2975

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2922

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

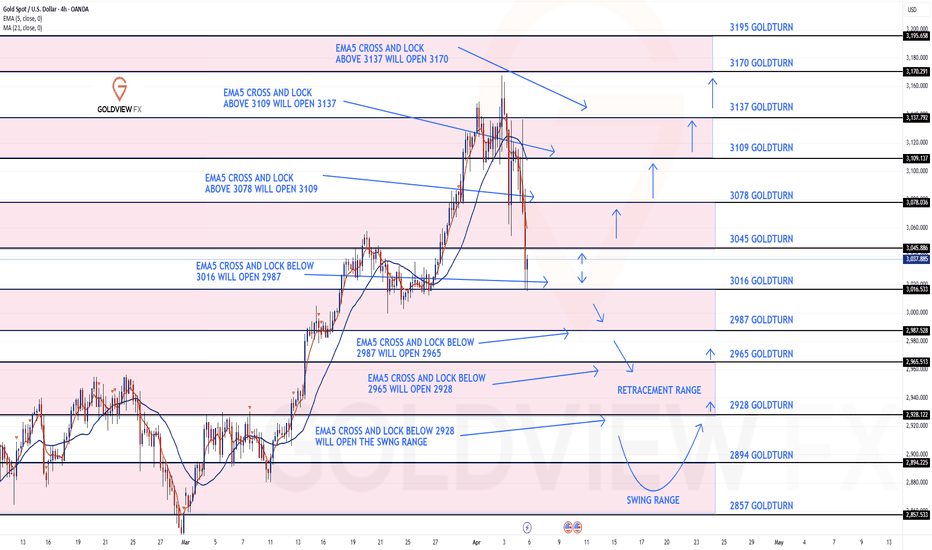

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3045 and 3078 due to ema5 lagging behind and a gap below at 3016. We will need to see ema5 cross and lock on either weighted level to determine the next range. We have a bigger range in play then usual.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3045

3078

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3109

EMA5 CROSS AND LOCK ABOVE 3109 WILL OPEN THE FOLLOWING BULLISH TARGET

3137

EMA5 CROSS AND LOCK ABOVE 3137 WILL OPEN THE FOLLOWING BULLISH TARGET

3170

BEARISH TARGETS

3016

EMA5 CROSS AND LOCK BELOW 3016 WILL OPEN THE FOLLOWING BEARISH TARGET

2987

EMA5 CROSS AND LOCK BELOW 2987 WILL OPEN THE FOLLOWING BEARISH TARGET

2965

EMA5 CROSS AND LOCK BELOW 2965 WILL OPEN THE FOLLOWING BEARISH TARGET

2928

EMA5 CROSS AND LOCK BELOW 2928 WILL OPEN THE SWING RANGE

SWING RANGE

2857 - 2894

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

This is an update on our daily chart idea that we have been tracking for a while now and finally completed last week. However, I wanted to continue to share an update on this, as its still playing out by falling back into the range on Fridays drop in price.

Historically, whenever we see a breakout outside of our unique Goldturn channels; I always state that, when price does a correction, we look for support outside of the channel top. This is playing out to perfection with Fridays drop finding support on the channel top, as highlighted by us on the chart with a circle. This was done with precision!!

We will now look for a test above at 3052 and a body close above this will follow with continuation to 3103 or a break below inside the channel top wall with ema5 will re-activate the levels below inside the channel, which we can then continue to track back up level to level, like we did before. I have also updated the levels above the channel to cover the new range.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

This is an update on our weekly chart ideas, which we have been tracking, as our long term route map.

After completing 3094 target no further body close or ema5 lock above this level. Therefore no further gaps left above and followed with a rejection. We are now looking for support and bounce on the channel half line or a cross and lock below the half line will open the lower range for the channel low Goldturns.

We expect the range play between the channel half-line and 3094 and will need a break on either of these levels to determine the next range.

This is the beauty of our channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Snipper plan ideeas before NFP and Powell Speech - April 4th📌 Macro & Market Context

Gold remains in a strong HTF bullish market structure, with recent highs around $3,160 acting as a key resistance.

NFP data, Unemployment Rate and Powell's speech will add increased volatility later today.

The market is currently correcting after liquidity grab above $3,160, showing signs of distribution.

📊 Market Structure Overview (4H & 1H)

Bullish/Sell bias remains neutral, but a temporary retracement is underway.

Premium supply zones are positioned above $3,140–$3,160.

Discount demand zones are around $3,080–$3,050.

📍 Setup 1 SELL

Scenario: Bearish retest to this zone

Entry: $3,135 - $3,145 (if price returns to this zone).

Confirmation: Rejection wick + Bearish Engulfing on 15M or 5M.

Stop Loss: Above $3,153

TP1: $3,125

TP2: $3,110

TP3: $3,090

📍 Setup 2 SELL

Scenario: Wait for price to push back into 3,091–3,095 zone (M5 imbalance retest).

Entry: 3091-3095

Confirmation: Entry on rejection + BOS or CHoCH M1/M5.

Stop Loss: Above 3,096

TP1: 3066

TP2: 3054

TP3: 3040

📍 Setup 2 BUY

Scenario: If price retraces to key demand zones $3,080–$3,070, look for a long entry.

Entry: Buy at $3,080–$3,075.

Confirmation: Liquidity grab + Bullish engulfing on LTF (1M, 5M).

Stop Loss: Below $3,070.

TP1: $3,100

TP2: $3,120

TP3: $3,135

📍 Setup 3 BUY

Scenario: Bounce/reversal confirmation near 3,054 (last demand block + imbalance edge).

Entry: Buy at 3048-3055

Confirmation: Entry only if M1/M5 shows CHoCH + volume.

Stop Loss: Below 3048

TP1: 3085

TP2: 3115

TP3: 3128

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

If you find the ideas contribute to your views on the market be kind to press boost🚀/like button. Your support is appreciated.

The bearish trend is just beginning: Short Gold!Good morning, bros! With the gold price falling by LSE:100H yesterday, there is no doubt that the market is currently dominated by bears! As the gold high gradually moves down, it is difficult to hold even 3100, further weakening the bullish momentum and exacerbating panic selling to a certain extent!

Obviously, as gold completes the regional conversion, the previous support has been transformed into an important resistance area in the short term, and the short-term resistance effect of the 3115-3125 zone is very obvious; and the current area near 3090 does not play a structural support role, so the area near 3090 is easy to be broken, and the short-term support below is in the 3075-3065 zone.

So in terms of short-term trading, before the NFP market, we can still short gold with the resistance of the 3115-3125 zone, with the first target pointing to the 3075-3065 zone, followed by the 3055-3045 zone.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XAUUSD: Buy or Sell?Today's gold market can be said to have the largest intraday volatility since 2025! After experiencing violent fluctuations, the current trend of gold has once again become anxious.

However, from the perspective of range conversion, it is certain that gold is currently operating in a weak position, and after the brutal and violent fluctuations, the market also needs to recuperate. And there will be NFP tomorrow. It is expected that before NFP, it will be difficult for gold to form a new unilateral market again. So in the process of shock, I think both long and short sides have a certain profit space.

First of all, pay attention to the resistance of 3125-3135 area on the top. If gold touches this area during the shock process, we can still short gold;

And the first focus on the 3095-3085 area on the bottom is that if gold touches this area during the shock process, we can still consider going long on gold.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold price will look new price.XAU longOn the basis of the critical international situation, carrying on Ukraine War and extreme western nations debt. I strongly say that Gold price will look new price this year. next price is between 2500-2600. XAU is on its fifth wave Elliot on the technical logic too.

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

This is an update on our daily chart idea that we are now tracking for a while now. If you have only started following us, please read the updates below at the bottom from previous weeks to see how effectively we have been tracking this.

Once again another great day on the markets with our daily chart idea playing out to completion. Yesterday we updated the completion of our 1H chart route map and today we have finally completed this daily chart idea. Our last update we stated that we had the candle body close above 3052 opening 3103 axis target. This was hit perfectly this week completing this chart idea.

We will continue to update our new multi time frame route maps, as usual, with renewed chart ideas on our usual weekly updates.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

OLD UPDATES ON THIS CHART IDEA

MARCH 23RD WEEK UPDAT E

The half line of our unique channel gave the perfect bounce into the next axis target at 2904, inline with our plans to buy dips just like we stated. We now have a body close once again with ema5 cross and lock above 2904 leaving the range above open. We will continue to look for support at the ascending half-line of the channel, as we climb into the range.

PREVIOUS WEEKS UPDATE

After completing our Bullish targets we stated that the channel top will act as resistance confirmed with ema5 rejection. A break of the channel top with ema5 would confirm a continuation and failure would confirm rejection. This allowed us to identify true breakouts against fake outs.

We also stated that we need to keep in mind the channel half line below to establish floor to provide support for the range, should we continue to track further up. A break below the half line will open the lower part of the channel to establish floor on the channel bottom. The safest way to track this movement is by buying dips.

- Once again this played out perfectly as we got the rejection on the channel top followed with the channel half line test, which gave the perfect bounce like we stated. We will now either look for a continuation from this bounce or a cross and lock below the half line for a break into the lower channel floor.

Continue to short gold after the rebound!Although gold did not fall due to the negative impact of ADP data, this does not mean that the risk of gold falling has been eliminated. As long as gold does not break through the recent highs, and in the fluctuations in recent days, the resistance strength of the 3135-3145 zone has been strengthened, gold still has a considerable risk of falling before breaking through the resistance area, and once gold falls below the 3110-3100 zone, it is bound to retreat to the 3095-3085 zone!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

A rebound is a good opportunity to short goldGold rebounds from 3100, but is the bullish momentum truly revived?

I don’t see it that way. Yesterday’s retracement to 3100 has already weakened the strong bullish structure to some extent, with 3150 likely acting as a key resistance level. I believe the current rebound is merely a technical retest of the 3150 zone, reinforcing it as a potential cycle high and paving the way for a double-top formation, which could provide a bearish technical setup for further downside.

Following the initial 3100 test, a second retest of this support level is likely. If gold fails to hold 3100 on the second attempt, a break lower towards 3095-3085 would become increasingly probable.

I will continue to scale into short positions within the 3132-3142 zone, with an initial target of 3120-3110. If gold approaches 3100, I will closely monitor the price action to assess the likelihood of a further breakdown.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Continue to short gold, there is still huge downside potentialGold fell below the short-term key support of 3120 and extended to around 3100. The short-term raid caught most long traders off guard. Today, I evaluated from both market factors and risk factors, and made a plan to short gold in the 3135-3145 zone, with the goal of a pullback to 3100. The potential profit space is $50. I believe that as long as you pay attention to and follow my trading strategy, you will definitely make a lot of money today!

At present, gold has rebounded slightly after touching around 3100, but I do not recommend going long on gold in this position area; because a sharp drop in gold can easily hit the confidence of long traders, stimulate profit-taking and panic selling, so I think the decline is not over.

Even from a technical perspective, although gold has a certain degree of technical repair after a rapid decline, it is obvious that the 4-hour level has not started to make up for the decline, indicating that there is still a lot of room for correction below. In this round of decline, I think gold is likely to continue to fall to the area around 3085, or even the 3075-3065 zone.

Therefore, for short-term trading, we can still consider shorting gold in batches after it rebounds to the 3115-3125 zone, with the target pointing to the 3095-3085 zone.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the Markets today, with our analysis playing out perfectly completing our 1h chart idea.

After completing 3090, 3103 and 3117, we stated that the lock above opened 3128 and just fell short and we were looking to buy dips to complete this target. This played out perfectly hitting this target and completing the chart idea.

We will update a new 1h chart idea later this week and in the mean time, please refer to our multi time frame chart ideas (weekly), that we shared Sunday, which are still in play.

BULLISH TARGET

3090 - DONE

EMA5 CROSS AND LOCK ABOVE 3090 WILL OPEN THE FOLLOWING BULLISH TARGET

3103 - DONE

EMA5 CROSS AND LOCK ABOVE 3103 WILL OPEN THE FOLLOWING BULLISH TARGET

3117 - DONE

EMA5 CROSS AND LOCK ABOVE 3117 WILL OPEN THE FOLLOWING BULLISH TARGET

3128 - DONE

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Short gold, profit target: 500pipsAfter reaching a fresh high of 3150, gold pulled back and has since been consolidating in a narrow range around 3132. While there is no denying that gold remains in a strong bullish trend, I believe it is now at its peak and could top out at any moment. This is why I continue to look for shorting opportunities rather than blindly chasing long positions—because I must first evaluate whether I have the risk tolerance to withstand a potential long-side drawdown.

Currently, gold is showing signs of exhaustion, retreating from 3150 and stalling near its ascending trend channel resistance. There is a strong possibility that this marks the end of the parabolic uptrend, leading to a rounded top correction, similar to the previous price cycle. A potential retracement zone aligns with a $50 pullback.

From a risk management perspective, going long at elevated levels presents significant challenges in setting a stop-loss (SL). A tight SL increases the probability of being stopped out due to market volatility, while a wider SL or no SL at all could expose long positions to severe drawdowns or liquidation if the market collapses.

On the contrary, short positions allow for better-defined SL placement, and gold tends to correct sharply after an extended rally, offering favorable exit opportunities. The worst-case scenario for short sellers is missing out on further upside gains, but in return, we significantly reduce the risk of capital destruction. This is the primary reason why I remain firmly bearish on gold at current levels!

Gold has retreated from its 3150 high, showing signs of momentum exhaustion. Given this price action, traders can consider initiating short positions within the 3135-3145 zone, aiming for a pullback toward the 3100 level. This setup offers a potential $50 profit per trade.