Alphabet (GOOGL) Stock Chart Analysis Following Earnings ReleaseAlphabet (GOOGL) Stock Chart Analysis Following Earnings Release

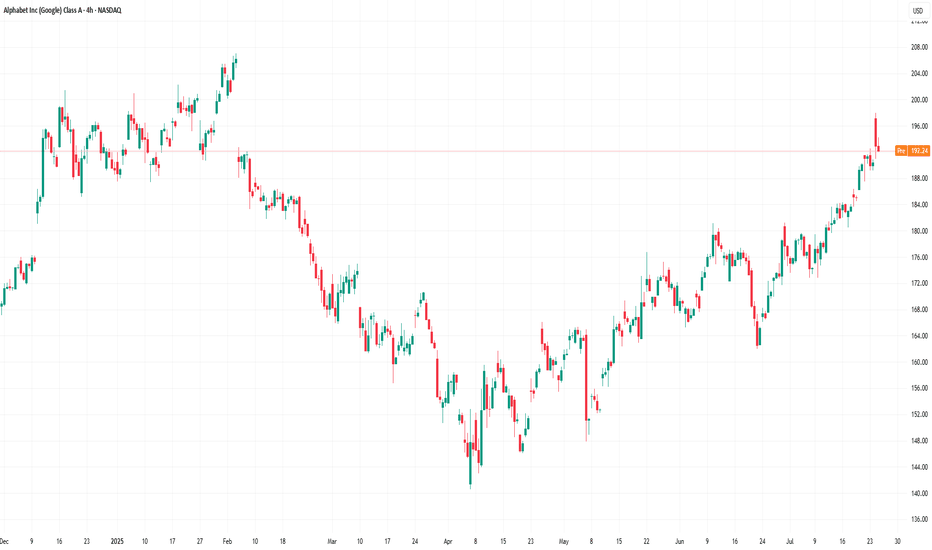

Earlier this week, we highlighted the prevailing bullish sentiment in the market ahead of Alphabet’s (GOOGL) earnings report, noting that:

→ an ascending channel had formed;

→ the psychological resistance level at $200 was of particular importance.

The earnings release confirmed the market’s optimism, as the company reported better-than-expected profits, driven by strong performance in both its advertising and cloud segments.

In his statement, CEO Sundar Pichai noted that AI is positively impacting all areas of the business, delivering strong momentum.

The company is expected to allocate $75 billion this year to expand its AI capabilities.

As a result, Alphabet (GOOGL) opened yesterday’s trading session with a bullish gap (as indicated by the arrow). However, as the session progressed, the price declined significantly, fully closing the gap.

This suggests that:

→ the bulls failed to consolidate their gains, allowing the bears to seize the initiative;

→ the ascending channel remains valid, with yesterday’s peak testing its upper boundary;

→ such price action near the $200 level reinforces expectations that this psychological mark will continue to act as resistance.

It is possible that the positive sentiment following the earnings report may weaken in the near term. Accordingly, traders may consider a scenario in which Alphabet’s (GOOGL) share price retraces deeper into the existing ascending channel. In this case, the former resistance levels at $180 and $184 may serve as a support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Googlesetup

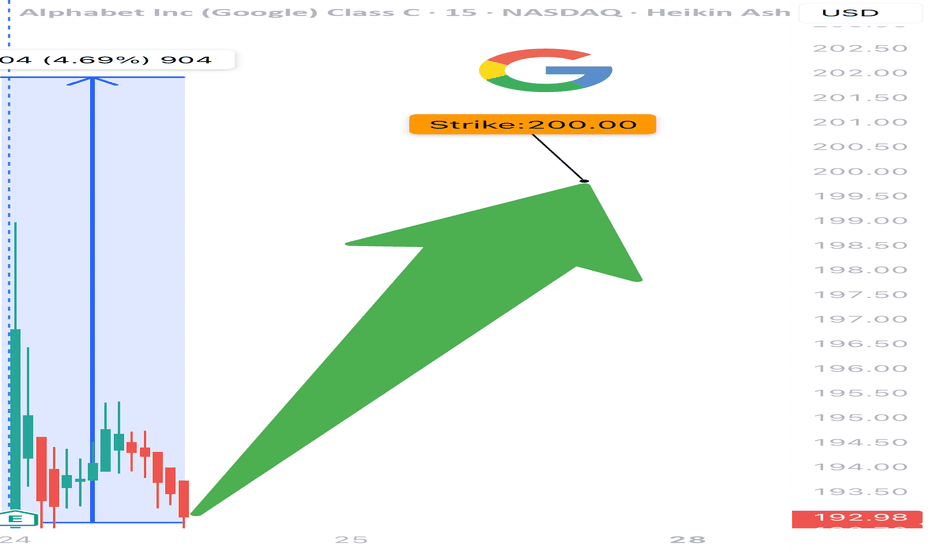

GOOGL TRADE IDEA (07/24)

🚨 GOOGL TRADE IDEA (07/24) 🚨

💥 Big institutional flow. 1 DTE. High gamma = high reward (⚠️ high risk too)

🧠 Quick Breakdown:

• Call/Put Ratio: 2.44 → ultra bullish

• Weekly RSI climbing (67.3) 📈

• Daily RSI falling from 77.5 → 🔻 short-term pullback risk

• Reports split: trade or wait? We’re in.

💥 TRADE SETUP

🟢 Buy GOOGL $200 Call exp 7/25

💰 Entry: $2.09

🎯 Target: $3.14–$4.18 (50–100%)

🛑 Stop: $1.25

📈 Confidence: 70%

⚠️ Expiry in 1 day = tight execution needed. Gamma can cut both ways. Watch it like a hawk. 👀

#GOOGL #OptionsFlow #CallOption #GammaSqueeze #TechStocks #UnusualOptionsActivity #TradingView #StockAlerts #BigMoneyMoves #DayTrading #OptionsTrading

Alphabet (GOOGL) Stock Approaches $200 Ahead of Earnings ReleaseAlphabet (GOOGL) Stock Approaches $200 Ahead of Earnings Release

According to the Alphabet (GOOGL) stock chart, the share price rose by more than 2.5% yesterday. Notably:

→ the price reached its highest level since early February 2025;

→ the stock ranked among the top 10 performers in the S&P 500 by the end of the day.

The positive sentiment is driven by expectations surrounding the upcoming quarterly earnings report, scheduled for release tomorrow, 23 July.

What to Know Ahead of Alphabet’s (GOOGL) Earnings Release

According to media reports, Wall Street analysts forecast Alphabet’s Q2 revenue to grow by approximately 11% year-on-year, with expected earnings per share (EPS) of around $2.17 — up from $1.89 a year earlier. Notably, the company has consistently outperformed estimates for nine consecutive quarters, setting a positive tone ahead of the announcement.

Despite the optimism, investors are closely monitoring two key areas:

→ Cloud computing competition , where Google Cloud contends with Microsoft Azure and Amazon AWS;

→ Growing competition in the search sector , linked to the rise of AI-based platforms such as ChatGPT.

In response, Alphabet is significantly increasing its capital expenditure on AI infrastructure, planning to spend around $75 billion in 2025. These investments are aimed at both defending its core search business and advancing the Gemini AI model, while also strengthening Google Cloud’s market position.

Technical Analysis of Alphabet (GOOGL) Stock

Since April, GOOGL price fluctuations have formed an ascending channel (marked in blue).

From a bullish perspective:

→ the June resistance level at $180 has been breached and may soon act as support;

→ previous bearish reversals (marked with red arrows) failed to gain momentum, suggesting sustained demand is pushing the price higher.

From a bearish standpoint, the price is approaching:

→ the psychological level of $200, which has acted as a major resistance since late 2024;

→ this barrier may be reinforced by a bearish gap formed in early February.

Strong results from the previous quarter, combined with optimistic forward guidance from Alphabet’s management, could provide bulls with the confidence needed to challenge the $200 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

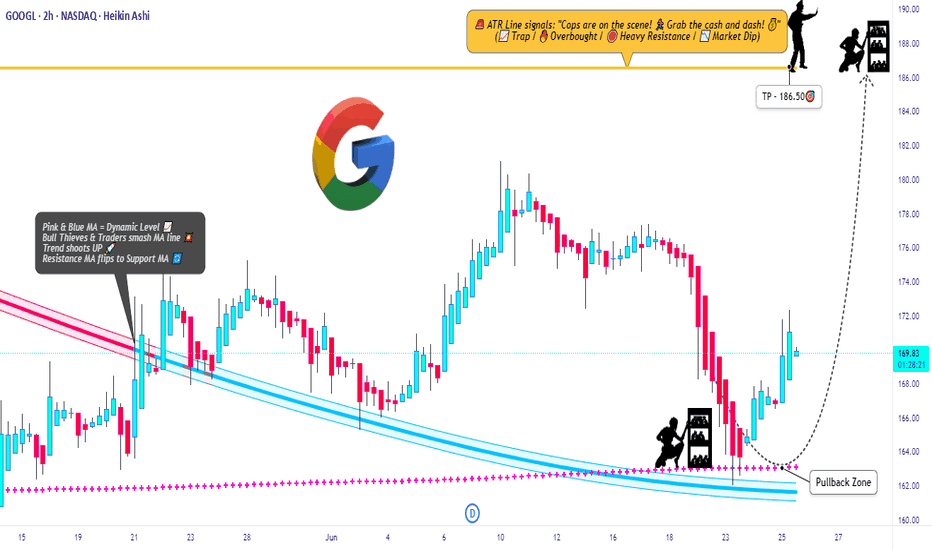

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based on sharp technical intel and subtle fundamental whispers, the setup is clear: the bulls have cracked the code, and it’s time to grab our loot.

🟢 🎯 ENTRY POINT - THE LOOT ZONE

"The vault is wide open!"

Snatch your bullish entry anywhere on the chart, but the pros will place limit buys on recent pullbacks (15m/30m zones), either on swing lows or highs. The pullback is your door in — don’t miss it!

🛑 STOP LOSS - ESCAPE ROUTE

Set the Thief SL at the recent 2H swing low (162.00).

But remember, each robber’s risk appetite is unique — adjust your SL based on your size, cash, and courage.

🎯 TARGET - GETAWAY MONEY

💼 Main Target: 186.50

Or if heat rises early, vanish with your gains before the full score hits. Disappear like a ghost — profit first, questions later!

🧲 FOR SCALPERS – THE QUICK GRAB

Only ride the long wave — shorting is off-limits in this mission.

If your wallet is loaded, dive in. If not, join the swing crew.

Use trailing SL to protect your cash stack 💰.

📈 THE SETUP – WHY THIS RAID WORKS

The GOOGL Market is bursting with bullish energy — a classic Red Zone robbery moment.

Overbought tension, fakeouts, trend shifts — exactly where we love to strike! Consolidation and reversals = opportunity for the brave.

📣 TRADING ALERT - NEWS AHEAD!

🚨 Avoid entries during news releases – they trigger alarms!

Use trailing SL to lock in your stash, especially during high-volatility windows.

🔍 TIPS FROM THE THIEF’S DESK

Stay updated with the latest whispers — from fundamentals to geopolitical noise, COT positioning to sentiment swings. The market changes faster than a thief on the run — so adapt fast!

💖 Show some love: 💥Hit that Boost Button💥

Let’s fuel this robbery plan with more power and precision.

Every day in the market is a new heist — let’s win like thieves, not sheep. 🏆💪🤝❤️🚀

I'll be back soon with another masterplan...

📡 Stay sharp, stay hidden — and always aim for the vault. 🤑🐱👤🎯

Google to $200!NASDAQ:GOOG NASDAQ:GOOGL

We are uptrending back to ATHs on Google here after they have lagged this whole rally and are the CHEAPEST MAG 7 STOCK!

- Volume shelf launch

- Rising Wr%

- Bouncing off key S/R zone

- H5 Indicator is about to flip to green and make a bullish cross

- Volume is climbing

- Bullish engulfing candle

- Daily looks great as well

Target is $200

Is GOOGL Setting Up for a Rebound?The corrective move continues, offering potential opportunities for strategic entries. If the dip extends, these key levels could present buying opportunities:

📉 Entry Points:

🔹 165

🔹 158

🔹 150

🔹 135-130 ⚠️ Possible deeper entry point???

📈 Profit Targets:

🔹 175

🔹 181

🔹 190

Will GOOGL find support at these levels and bounce back, or is there more downside ahead? Stay prepared and manage your risk wisely.

Disclaimer: The information provided is for educational purposes only and does not constitute investment advice. Trading involves significant risks, and past performance is not indicative of future results. Always conduct your own analysis and consult a financial advisor before making any investment decisions.

GOOGLE I Potential growth within the ascending channelWelcome back! Let me know your thoughts in the comments!

** GOOGLE Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

GOOGLE $GOOG | AD DOLLARS & AI POWER, GOOGLE'S EARNINGS Feb4'25GOOGLE NASDAQ:GOOG | AD DOLLARS & AI POWER, GOOGLE'S EARNINGS ALPHABET'S EARNINGS Feb4'25

Google Zones:

Google BUY/LONG ZONE (GREEN): $199.00 - $215.00

Google DO NOT TRADE/DNT ZONE (WHITE): $193.50 - $199.00

Google SELL/SHORT ZONE (RED): $180.00 - $193.50

Google Trends:

Google Weekly Trend: Bullish

Google Daily Trend: Bullish

Google 4H Trend: Bullish

Google 1H Trend: Bullish

NASDAQ:GOOG earnings are set for Tuesday, Feb 4 (post-market), will the earnings report fuel further upside, or is a pullback on the horizon? All of my timeframes on my indicator show bullish trends. NASDAQ:GOOG has been in a strong uptrend since early December, gaining ~15% since Dec 9. Leading up to earnings, price formed an ascending pattern, breaking out past resistance on Jan 30. My bullish zone projects a ~6% upside, while the bearish zone mirrors this range.

I am linking my previous NASDAQ:GOOG analysis, from nearly a year ago.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, fed, federalreserve, fedrate, fedratecut, interestrate, jeromepowell, fedchair, 50bps, volatile, volatility, goog, google, googleearnings, googearnings, googleoptions, googoptions, optionsplay, earningsplay, earningsgamble, googlereport, googlestock, googletrade, googleidea, googlecombo, googlestrangle, googlestraddle, googlevolatility, googleiv, googlesetup, googleanalysis, googanalysis, googleads, googleearningsreport, googleearningsrelease, googleai, gemini, geminiai, googleadsandai, alphabet, alphabetsearnings, alphabetgoogle, alpabetstock,

Google I Potential positive growth in the ascending channel Welcome back! Let me know your thoughts in the comments!

** Google Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

GOOGLE: Where are they going after earnings? Let's talk about itWHERE WILL GOOGLE GO AFTER THEY REPORT EARNINGS ON TUESDAY?!

NASDAQ:GOOG NASDAQ:GOOGL

In this video, we will review 3 key items that give us the best probability of predicting where they will go.

1⃣ See if it meets my "High Five Setup" trade strategy

2⃣ Why it's BUY according to my Valuation Metric Tool (6/6 score) I WANT A DIP!

3⃣ Look aHEAD to find out 👇

Video analysis 4/5. Stay tuned!🔔

Like ❤️ Follow 🤳 Share 🔂

Is this MAG7 name finally going to play catchup to its siblings? Drop a comment below.

Not financial advice.

$GOOG $GOOGL IS A GIFT RIGHT NOW. YOU WILL SEE! NASDAQ:GOOG NASDAQ:GOOGL

IS A GIFT. YOU WILL SEE!👀

1.) High Five Setup

2.) Inverse H&S Breakout/will retest and fill earnings GAP then head to the Measure Move (MM) of $193.

3.) They just demolished earnings and everyone was bullish until the market decided to pull back. Everyone just forgot about the ones who reported first out the MAG7.

What do you think? Is this the easiest trade you've ever seen? IMO it's definitely one of them haha

"BE GREEDY WHEN OTHERS ARE FEARFUL"-WB

NFA

GOOGLE Rockets! 15-Min Surge Hits All Targets – What's Fueling?ALPHABET (GOOGLE) Analysis:

Alphabet Inc. (GOOGL) experienced a powerful upward movement in the 15-minute timeframe, achieving all set profit targets with ease using the Risological Swing Trader.

The momentum from a strong earnings report has aligned with a positive risk sentiment across US equity indexes, sparking increased buying interest in tech giants like Alphabet.

Here’s a breakdown of the trade and supporting market context:

Entry : $164.75

Targets Achieved:

TP1: $167.07

TP2: $170.81

TP3: $174.56

TP4: $176.88

Stop Loss (SL): $162.87

Market Sentiment:

Recent quarterly earnings reports have fortified investor confidence, with broader equity indexes advancing. Alphabet's strong fundamentals and growth projections contributed to the bullish sentiment, encouraging traders to follow through on this aggressive buying trend.

With all targets hit in a single session, this upward momentum for Alphabet highlights robust institutional interest and solid fundamentals. Keep an eye on further tech earnings, which may continue to impact Alphabet's trajectory in the upcoming sessions.

GOOGLE (GOOGL) Breaks Out? Bullish Surge on 15m TimeframeGoogle (GOOGL) has shown a bullish breakout following the entry at 163.31, pushing through the first target (TP1) at 165.51 with significant momentum.

Key Levels

Entry: 163.31 – The entry point aligns with a breakout from a period of consolidation, supported by upward movement across key technical indicators.

Stop-Loss (SL) : 161.52 – Positioned below recent support to minimize downside risk and protect against potential pullbacks.

Take Profit 1 (TP1): 165.51 – Already achieved, confirming the initial bullish momentum.

Take Profit 2 (TP2): 169.07 – Represents the next resistance level where profit-taking may occur as the uptrend continues.

Take Profit 3 (TP3): 172.64 – Should the bullish momentum persist, this is the next key resistance level to watch.

Take Profit 4 (TP4): 174.84 – The ultimate target, signaling a strong upward movement.

Trend Analysis

GOOGL is well above the Risological dotted trendline and shorter-term moving averages, indicating a healthy uptrend.

The breakout suggests continued bullish momentum, with TP2 and TP3 likely in focus if the uptrend sustains.

The bullish momentum in GOOGL is evident, with the price moving swiftly past TP1. With solid support from moving averages and strong buying pressure, the next targets at 169.07 and 172.64 are in sight.

Coffee Is Brewing!!!I don't know folks... again, I ain't nothing but a tier below an amateur beginning options player. There is a lot of learning still to do but I'm ready to be transparent with my thoughts and what I see a bit more often. So here with go with a previous fan favorite of Coffee Is Brewing!

Coffee Is Brewing Idea #2

NASDAQ:GOOGL has earnings coming up 10/22 and has had a little bit of price action these past few weeks with a niiiiiiiiiiice Pogo Stick bounce this past Friday and closed above the previous week... all which are bullish signals, to me! Again, from my perspective I've seen Bullish action for the past few weeks. As evidenced by my NASDAQ:GOOGL 165C options exp 10/18 that I picked up at about 1.65 that ran up just shy of 6.00 and the NASDAQ:GOOGL 170C options exp 10/18, that I'm still holding. That's enough about what I had and have in play... let's talk about what I see. That right there folks looks like a cup and handle, which ultimately gets a Coffee Is Brewing tag! The bonus green drawn lines I added, some might consider a Bull Flag is starting to be established. I see another couple weeks of good runs with this AMEX:SPY small fry playa that's part of The Mag 7!

I don't know about what y'all see but if you see something else, please drop a comment. If you like what you see, give ya boy a BOOST, a Follow, or a comment. I appreciate y'all for taking the time to look and we'll talk soon.

GOOGLE SHORT TIMING? reached important resistance level?

we could see that it is rebounding from an overall downtrend market.

And it's closed to the resistance area of previous lows, which shares the same level with the downtrend line, double confirmed the importance of this resistance area.

So if it be rejected by this area, and start to showing sell signals like bearish engulfing pattern etc, the price may continue to drop.

Alphabet (Google) - 330% Rally ahead!Hello Traders and Investors, today I will take a look at Alphabet.

--------

Explanation of my video analysis:

About 8 years ago Alphabet stock created the first retest and rejection of the long term ascending bullish trendline. Then we had a lot of retests of this trendline, the last one being in the beginning of 2023 and this retest was followed by another decent bullish rejection. Last month Alphabet stock broke out of an ascending triangle formation and is now just very very bullish.

--------

Keep your long term vision,

Philip (BasicTrading)

Google Takes Flight: Soaring Valuation, Strong Earnings, and RewAlphabet Inc., Google's parent company, is experiencing a period of phenomenal growth. The tech giant is on the cusp of a historic milestone – a market capitalization approaching $2 trillion. This achievement comes alongside impressive quarterly earnings that surpassed analyst expectations, solidifying investor confidence. Further sweetening the deal for shareholders, Alphabet recently distributed its first-ever dividend and announced a substantial $70 billion stock buyback plan.

The meteoric rise in market value reflects investor optimism about Google's future. The company's core advertising business remains robust, fueled by the ever-increasing reliance on digital marketing. Google's dominance in search and its expansive network of online properties continue to generate significant advertising revenue. But Google's ambitions extend far beyond traditional advertising.

The company is at the forefront of artificial intelligence (AI) development. Its investments in AI research and applications are paying off, with innovations like Google Assistant and DeepMind showcasing the transformative potential of this technology. AI is being integrated across various Google products, enhancing user experiences and driving new revenue streams.

Another key driver of growth is Google Cloud. This segment, often overshadowed by the advertising juggernaut, is steadily gaining traction. Cloud computing is a rapidly expanding market, and Google Cloud is well-positioned to capture a significant share. With its robust infrastructure, suite of cloud services, and focus on security, Google Cloud is attracting major corporations looking for reliable and scalable solutions.

The recent surge in stock price also reflects the success of Alphabet's first-ever dividend payout. This move signals a shift in the company's strategy, acknowledging the growing base of long-term investors seeking regular returns. The dividend, coupled with the sizable stock buyback program, demonstrates Alphabet's commitment to rewarding shareholders and returning value. The buyback plan will reduce the number of outstanding shares, potentially driving up the stock price further.

However, Google's path to continued dominance isn't without challenges. Regulatory scrutiny over data privacy and antitrust concerns remain significant hurdles. The company faces intense competition from other tech giants like Apple and Amazon, all vying for dominance in the digital landscape. Additionally, the broader market environment could impact Google's performance. Economic downturns or fluctuations in interest rates could dampen investor confidence and affect advertising spending.

Despite these challenges, Google's future appears bright. The company has a proven track record of innovation, a diversified business model, and a strong financial position. With its recent stellar earnings report, soaring market value, and commitment to rewarding shareholders, Google is well-positioned to maintain its position as a tech leader for years to come.

GOOGL : Target 200$ based on Fib ProjectionGOOGL : Target 200$ based on Fib Projection

Previous High of 153$ to 154$ made during Jan end 2024 is overtaken and a new high is made. With this, it looks attractive to target the Fib Projection of 1.78 at 200$

Daily TF :

for understanding the smaller TF than weekly

GOOG Rising Wedge Here is a simple rising wedge pattern on google with bear gap resistance above you dont want to get caught guessing the top because there is no way to tell exactly when price will reverse. Just react and catch the move when it presents itself. Expect to enter after either A) Gap Down, B) intraday Head and Shoulders or C) intraday bear flags.