Corn Short, Based on COT data and TAZC1!

Commercial accounts are currently net short on corn futures contracts (-355k contracts), while as noncommercial accounts aka, Retail traders, are net long (+411k contracts). These two positions are at extreme polarized ends of the play. Usually commercials tend to be net short on any asset but its the extremes one should keep an eye on.

Corn is currently at a basing pattern, with a previous impulsive move to the downside. Entering at a base is relatively risky, since the pattern can either turn into a drop base drop or a drop base rally pattern. So one can play this two ways, enter short at the base with a tight SL so if an impulsive move to the upside were to occur, you will stop out with minimal damage. Or, wait for the pattern to play out and if the pattern is a drop base rally, then short a potential double top. The play I am making is short at the base of this pattern with a SL at 407'5.

Targets for the short are

- 0.5 retracement

- 0.618 retracement

- 0.786 retracement

- 305'4

I will be taking profits at each target, with the last target being a runner position.

Grains

Socialist Oil Countries are going to starveThe price is dropping very rapidly, as I want it too. So I better make this quick.

Demand is up because of humans but also animals, production not great.

"A wet winter and dry spring in the UK is set to yield its smallest crop since 1981, Carr’s Flour said in its monthly market report."

I watch some agricultors on youtube, west europeans barely make money if they are not industrials, and 1 guy had a poor harvest that caused him to be in the red for the year.

The European Commission came up with a decline of surplus exports of 5.7% for the EU + UA + RU.

Argentina had low yields because of poor rainfall.

The USA also had a bad harvest, and their stocks are almost empty last I checked.

Socialist Oil country must be panicking, maybe they make some orders before the price gets even higher, for example Algeria is emptying its forex reserves that have been on a decline for 20 years already, the Oil prices are really finishing them off. Only a few years to "this was not real socialism".

Could go higher and then even higher. Could be a monster. If I get filed. Got maybe a bit greedy with the far away entry and tight stop I can't help it.

The price is bouncing but maybe the next candle fills me doing something like this here:

Let's profit off starving socialists! There is no better feeling.

Wheat breaking out of important resistancesThose that have been following me for a while know that I've had my eye on commodities and as we keep printing currencies, inflation shall follow. I expect some good moves from grains and sugar in months to come and I keep building my positions. We have a descending triangle mixed with a reversed head and shoulder pattern. This combination could lead to explosive moves short term and perhaps the establishment of a longer term trend as we move forward.

Lots of price actionAlot of action from the price. Should I call it price action? This is already its own expression. Price action action?

If you followed some of my previous ideas you will have noticed I missed out on USDCNH and it went way down.

It could do a small pullback then flush down but I am not sure this is likely. Have the feeling USD is going to recover and I know to listen to my intuition.

Making money comes as much as my intuition as from my quantitative approach (thousands of hours of backtesting and compiling stats), and my quant trading itself is the result of intuitions that I looked into.

There is no magic formula :( All I can say is my gut feeling is that the USD will recover. If there was a formula to be sure, all the nerds in universities would be billionaires.

But instead guys like Nouriel Roubini have predicted 8 of the last 2 recessions & are bearish on Bitcoin since 2010 :D

There are logical reasons for me to think the USD could recover, including it has a record number of people selling it.

Ah ye also why there is no secret formula is that this exact situation never happened before. There is always something that makes it the first time.

It is never the exact same. Intuition > all because it is the only thing that can give you decent confidence you'll still be around in the long run (unless you risk 5% per trade or sell naked calls) as opposed to finding a system.

The USD pairs are going to change phase, maybe not a complete reversal into an uptrend, but the downtrend I think will stop, and shift to sideways at least.

Euro pairs

GBP pairs

Then even more is moving, in particular the Australian pairs

Apart from FX there are some notable things going on. I crack up when I look at those 😆

Geez what is up with this? I hope no retail inverse ETF "investor" bought or there will be an investigation.

Also copper is continuing its trend up and I was sure I was in it but apparently not, it got closed Friday afternoon and not re-opened.

I don't understand I don't remember... Misclic maybe? Or I was drunk? maybe I thought "this is not a perfect setup" and I exited early with small profit?

I don't even remember yikes. Well, going to have to wait for the next pullback now...

Nickel also continues to skyrocket, tradingview does not have the chart but they have the ETF ones, so I'll show this

Yes commodity ETF are bad (if used wrong) especially leveraged. If you think you can make easy money shorting them, yes maybe, but you have to think, how much alpha will I generate?

Will you make better than the risk free return? Just because it looks like free money does not mean it is good. I did not even look into it I doubt it is really worth it.

That's it for FX & the commodities I watch.

I can't be bothered looking at stocks nor crypto nor real estate nor fixed income.

Rally in Wheat will continue. Possible entriesYou know I am a big fan of commodities and especially tight markets like wheat, live cattle, etc. These instruments are less manipulated and less speculative. Usually, they follow their setups very well. Getting above Friday’s high is potential swing entry. We have a triangular formation on the daily chart. Sometimes price makes false breakdown before the rally. So, it is another potential entry, if that happens. Wheat has a strong seasonal tendency to rally till September.

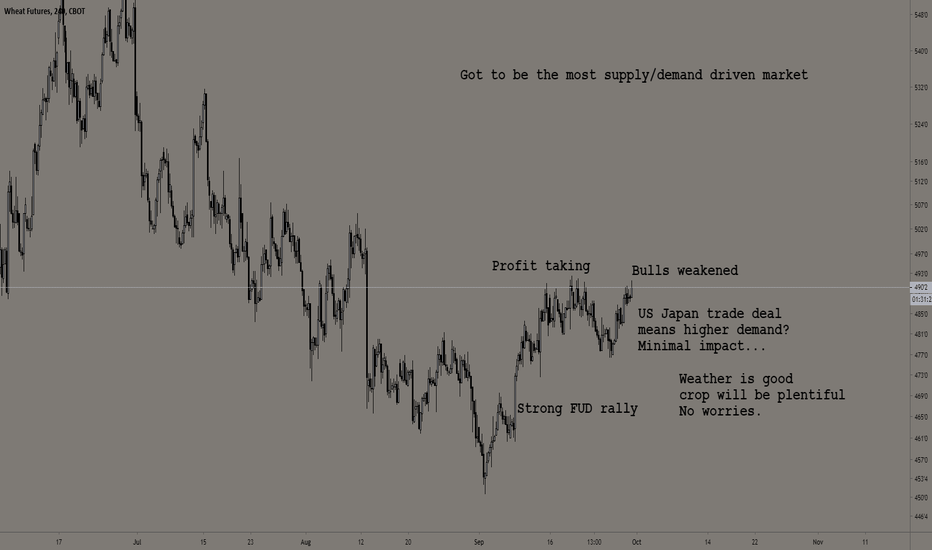

Wheat on the side while riding goldHey, I've been looking at grains a bit and I think wheat could be going down.

On a pullback there is a good r to r.

It is on a global downtrend and it convincingly broke to new lows on the lower TF.

It sort of always goes down around this period

Global trade & weather have a big impact I guess.

Here you can see the past weather: www.timeanddate.com

Here are averages: www.holiday-weather.com

Chicago is in the averages. Most places are below, France has had a freezing summer brrr.

The weather data is obviously run by climate deniers.

The CME website: www.cmegroup.com

The biggest producers of wheat are the same old same old... China USA India Europe South-South-America. And to a lesser extent pretty much everywhere except Africa.

Some of the top biggest exporters are Russia Canada the USA France Argentina Ukraine...

Argentina I think is the biggest net exporter there is in % of what they produce. India is self sufficient, China is barely I think.

I could list all the net exporters but it's easy to remember. It's the white countries.

Basically the most important weathers I think are NA & Europe.

And China news/catastrophic crop ==> boom.

Probably will trend down, hopefully without too much choppy pullbacks.

Would be nice to look at something other than gold here and there.

Cycle is down for Wheat until August 31st.Wheat has just finished a corrective move and because of its nature (Wheat is a very volatile instrument) it may seem to an untrained eye that the trend is up. However, that is not the case in my opinion - cycle is down. To approach this trade now we go long September PUT options, strike 475. The approximate price target is 435 at the point when the cycle bottoms. Later on I will upload ideas giving out recommendations to trade the futures contract, for now we want to limit our risk. Fundamentally, Russian farmers this year are expecting a record crop since the late 1980s, according to the head of Russian agricultural department (Russia is the largest producer and exporter of the grain). Despite this fact, I would avoid reading the news regarding wheat as a trading strategy. There is a lot of misleading information and I just read it for entertainment, not for trading. Please do remember that futures trading involves a substantial risk of loss and is not suitable for all investors.

Don't listen to the noise and I know that you will make a success.

Have a good weekend, fellow traders!

Corn Looking Aneamic - But How Low Is LowWith the breakdown in ethanol needs, general and feed lot demand, corn has suffered immensely. Recent favorable weather has also pushed the shine off the this juicy grain. From a fundamental point of view demand and exports looking to offer more support into later part of year, TA was looking good until recent sell off. The rally on 29th June shows how quickly the buyers can come back to market though. The drop 11th July however, shows how quickly contracts can fall. Overall, looking at 4 hour, long is my preference, given the higher lows, and higher highs since around the 29th April (from each large move not just the candles). That said I am careful of my entry point. For a riskier trade I would buy at today's price around $3.20, but I am also considering a wait and watch approach for a re-visit of $3 based on upcoming news. Fundamentals may produce more favourable yield results, but demand is set to return, and this may bring the buyers back for a snap rally - which is why I will avoid short positions at this multi year lower price point at this time.

Corn Futures - Area Chart Analysis - Monthly ViewHello everybody,

Here is my chart analysis for Corn Futures.

Monthly timeframe & long-term vision.

Since its historical top at 806'4 Corn is on a downtrend.

Its bearish potential is really interesting.

Nevertheless, 300'0 price level could be the next support.

Indeed, Corn has been drifted in a range area between 320'0 & 440'0 since July 2014.

If the actual price breaks this level, Corn could reach the 200'0 price level which has been hit several times.

Between August 1998 & October 2005 but before also, I just don't have more space to show you that in this publication.

However, Pay attention for a possible pullback on the 300'0 price level !

I hope you'll like it !

Follow me for Futures Chart Analysis !

Thanks & see you !

Weekly Oat Futures ReversalComplex overlapping corrective structure is defined by the orange median line study. Mathematical symmetry and momentum divergence at blue line $319 can signal price exhaustion as this level has been tested 3 times.

The final swing looks to be developing in 5 waves of (c) and a break of wave 4 signals a reversal with a turn down in momentum target red line wave B at $255 with a break measuring black line wave (B) for the entire swing at $224'4.

Food prices to keep getting cheaper [+Photosynthesis tuto]Seems like an easy prediction.

With rising levels of CO2 agri prices will keep going down.

And I guess interest in soft commodity futures will keep going down.

Especially noobs, they could not care less, they want to chase the next high tech big thing that will make them rich, er typo I mean that will make them lose their shirt. Statistically they are better off playing lottery or going to the casino.

Until we run out of fertilizers (At current consumption levels, we will run out of known phosphorus reserves in around 80 years, but consumption will not stay at current levels). Unless we replace those by a new type of fertilizer OR find more phosphorus. Brace yourselves for yet a new mass hysteria clownery "the world will end soon because we will run out of phosphorus".

Remember "we will run out of water" "world will get overpopulated" "co2 will cause mass extinctions" "acid rains will destroy everything" and so on.

I think fertilizers support half of the planet population, this means they double yields.

And CO2 increased yields by something like 20% I think.

I can 100% guarentee without a single doubt there will be a "science settled very serious" mass hysteria fear about fertilizers (P) levels getting low in the future lmao.

This is what plants need:

Plants also need magnesium and sulfur. Not sure what else.

I think they can synthesize all vitamins from C H O N but I really don't know for sure. I just know those are the typical atoms in vitamins.

Expressed in dollars, the monetary benefit:

www.co2science.org

An extract:

I think that to produce 1kg of grain something like 100 liters of water is required.

Just because that's how it has been for centuries does not mean it is "normal".

If one is actually able to think out of his little box and little dogmas, he would realize agriculture uses huge amounts of water, and also, many plants (C4 type - not to be mistaken with the explosives) have even evolved to be more water efficient and to survive with very little CO2. I think also when you measure the CO2 around crops during the day you notice they sucked it all up (concentration is down a big amount maybe 50%).

So anyway, as CO2 goes up, plants will use less water (or use the same amount to grow bigger).

There is going to be possibly new plants evolve, the old world plants will make a comeback, and alot more but I'll save this for another idea.

The CO2 famine is over for plants they're going to take over.

Here is corn & sugar:

I don't know how agr companies work...

Better productivity means they get more productive? But prices drop so they make less?

They probably are undervalued right? At least compared to high tech for sure.

Of course this is all cancelled if primitive monkeys of abysmal stupidity remove CO2 from our atmosphere "to save the planet".

Wheat down to $5.70 and then up to $5.81, Long Term BullI am long term bullish but I see a nice test of the trend line which may act as resistance. Potentially a drop just below to grab a little liquidity and then a continuation move to the higher side back to $5.81. I am seeing the 4hr macd dropping and RSI within range to drop more.

This is my first wheat chart, dont get too excited.

This is not trading advice.

Bearish on grains & wheatBeen a while since I posted about agri.

Price is around its average now, I see no reason for it to skyrocket.

I don't think this little rally is a new trend, I see it as a correction.

And the short term uptrend is probably just noise that kindly comes fill my shorts.

Technically the price around 490-495 is a sweet spot to short this which makes it interesting.

We let the amateurs trade everything to make sure they don't miss out.

Market can stay irrational longer than you stay solvent so use a stop loss.

And also, it's not 100% sure the price is supposed to go down, might be wrong.

So in any case, stop loss (or something else) is good.

Corn bottomed?Corn bounced right off the range I mentioned on my last idea, Aggressive traders might go long here but it's probably best to wait for MACD signal and further strength. Seasonally corn is Not bullish at this time of the year, so it's best to be careful with longs

**If you're interested in joining a group of like-minded traders, send me a PM. This is NOT a subscription service, just bunch of average traders sharing insights in a FREE group

Corn - Looking Stronger BuyI have been hovering over the buy button on corn past week. Wasn't convinced enough to enter, and now heading back to Fib retracement towards $4. The closer to this the stronger chance of a rally - from either fundamentals coning out due to crop damage and lower yields, and also some technical short closing since last rally. Keeping in mind the August report, there could be some positioning before here too from fund managers, adding to volatility. That said, if crops are seen as doing well, with ample inventories, and no substantial buying even though China tariff waiver, prices could continue the current short term bearish trend and breeze through $4 down to $3.80. RSI already showing oversold on shorterm though with possible technicals support current prices and allow for some upside. Overall still see risk to upside despite last week's drop.

corn trading analysisthis is an idea based on fundamental and technical analysis, we are at a potential buy setup as the fundamentals(the report referred) suggest a minor supply and bad planting timing of the crop.

it has to be remarked to read the comment of the acreage report at the end of the document and understand how the crop grows.

if focused only on the first page of the acreage report (acreage of corn +3%) you can see that at the date the market receipted as a major supply(a sharp drop of price) but it did not account for the very late planting time and it can affect the developing of the crop.

all the important reports:

USDA acreage acrg0619 pdf (28/06/2019)

USDA crop progress prog2919 pdf (15/07/2019)

(search by your self)

the setup is a buy if do not drop significantly below the parallel channel and watch the further development of the crop to maximize the profits in the closing of the positions.

the latest report of the USDA indicate an improvement of the growing stage of the corn, but it is still significantly below compared year on year, also the crop quality has this deficit.

Broad Market TA. 26 May 2019.Oil

> Not in an uptrend anymore

> Expecting it to go down but not in a straight line

> Not biased towards holding past the next resistance

> A buy but not yet, maybe in a few days

Price would decline like this:

Gold

> In a downtrend but a weak one

> Wall street cheat sheet

> I do not want to touch it yet

> Wait, and look for a buy around $1200

Copper

> In a downtrend

> Do not want to short

> Close to support area & almost full retrace

Grains

> I smell fear

> Absolute bubble starting (again)

> Can end at any time

> Not sure how to enter right now

USDJPY

> Waiting for the downtrend to continue before I consider entering

> I see no buy. Chart is just not interesting just like EURUSD

> If we start going down it will be interesting

Brexit

> I smell fear...

> In a downtrend but extended way past its moving averages (emotional move)

> Waiting for things to calm down before shorting

AUDUSD

> Reached multi year lows

> Waiting for a pullback higher and then I short it

> Big downside potential but also at a support level bulls might defend it could spike higher

> AUD minor pairs same story

USDCHF

> FOMO crew is trapped after the fake break & in complete denial

> Expecting a flush of bulls that cannot admit they were wrong

> Probably V shape recovery after a large dump, around the lows of the running wedge

EURJPY

> Missed it, now I have regrets for the rest of my life (jk I am not a crypto investor)

> Expecting the downtrend to continue

> If the selling continues a while and we extend, I will short on a new pullback

EURAUD

> Euro not convincingly going down, australian dollar down down down

> This could be the start of a beautiful uptrend

> Will buy a leg down, if the FOMO community will let me

GBP Minors

> I see only red except GBPAUD

> GBPCAD bouncing, rest all down

> Interested in going short

NZDUSD

> Another sucker's rally potentially

> Wait for it to stop for a day or two

> This could be a big bounce, so patience is key

EURCHF & EURNZD

> Just a little lower and I buy

S&P 500 & Bitcoin

> Still keep going down, the FED I think has hopes they can contain things until the economy catches up

> Good luck with that

> The uptrend is DONE. Trade war news are awful.

> Bitcoin big FOMO rally "quick I have to buy as fast as possible" has calmed down

> Bitcoin went up because of some MA cross & trendlines. It's now priced in.

Corn Futures? A big question mark.What is going to happen with ag commodity futures in the coming months. Where are we going?

We are getting closer to the ever so important growing season in the United States, and ag futures have been stuck in a rut. Specifically corn.

February 8th, the USDA released another one of their important reports and traders saw a decrease in stocks/yield as well as other juicy information. Overall the report was nothing to get the market too excited. After the close us traders saw yesterday, it leaves me even more curious of where these futures are going to go.

From a chart prospective, we have seen strong congestion in corn futures. Looking at the chart here for CZ9 (dec 19), you can see a possible ascending triangle. I am not completely convinced.

I am torn fundamentally with the idea of larger acres coming and then throw in the size of the corn carry out, which is lower than we have seen in a while.

Off the cusp there are a few very interesting variables at play in the ag futures world. Throw in the continuing trade negotiations and every analyst prediction is radically altered.

For now it will be interesting to sit back and watch how this unfolds.

Comments always encouraged.

Everything here is purely my opinion, and in no way advice or recommendations on making trades. I may or may not hold positions in the instruments I analyze.

L.R.