$GBINTR -BoE Cuts Rates as Expected (August/2025)ECONOMICS:GBINTR

August/2025

source : Bank of England

- The Bank of England voted by a 5–4 majority to cut the key Bank Rate by 25bps to 4% in August, in line with expectations.

This marks the fifth rate cut since August of last year and brings borrowing costs to their lowest level since March 2023.

However, the decision followed an initial three-way split, the first time that two rounds of voting were required to reach a conclusive decision on interest rates.

Greatbritain

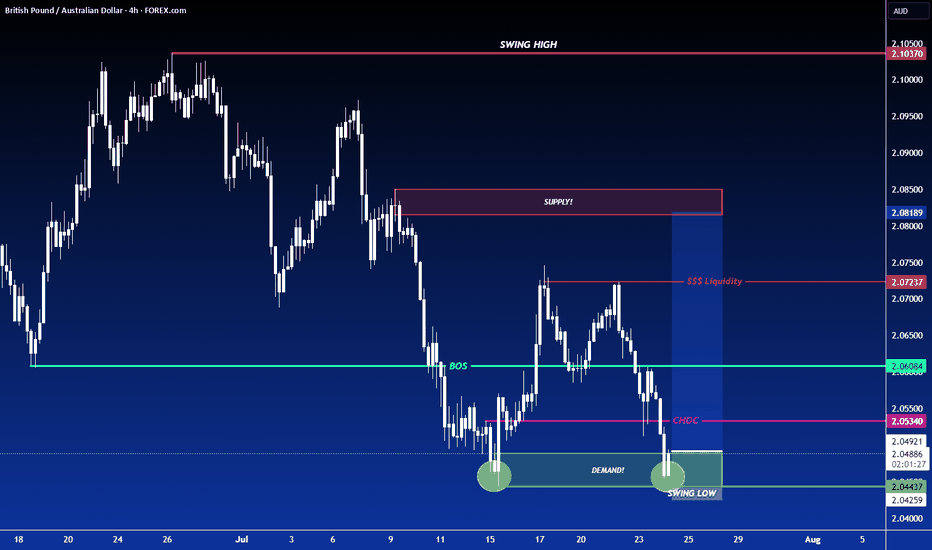

LONG ON GBP/AUDGA has given us a CHOC (change of character) to the upside after making a new low.

Price has since pulled back to the demand area that created that change leaving us with a possible double bottom forming.

I expect GA to rise to sweep buy side liquidity at the equal highs then reaching the previous supply level / previous High.

Looking to catch 200-300 pips.

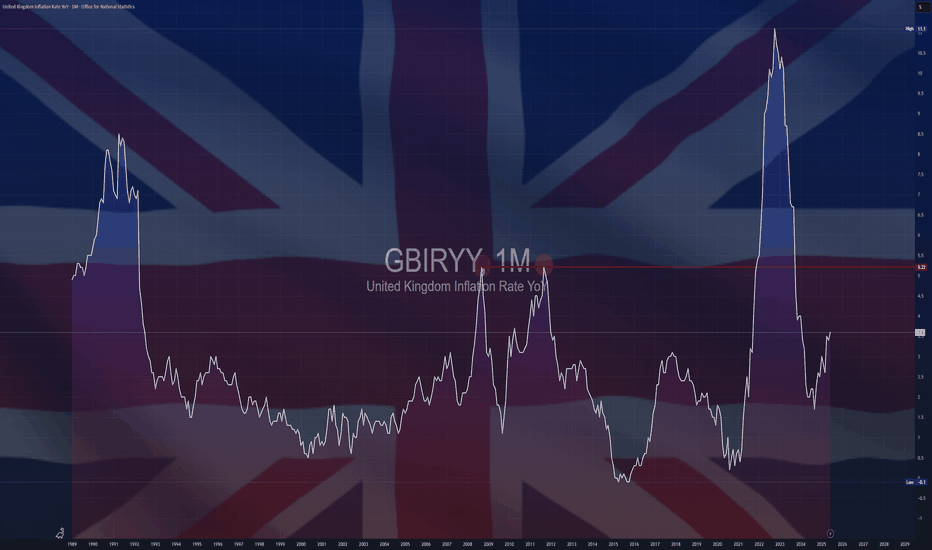

$GBIRYY - U.K Inflation Rises to a 2024 High (June/2025)ECONOMICS:GBIRYY

June/2025

source: Office for National Statistics

- The annual inflation rate in the UK rose to 3.6% in June, the highest since January 2024, up from 3.4% in May and above expectations that it would remain unchanged.

The main upward pressure came from transport prices, mostly motor fuel costs, airfares, rail fares and maintenance and repair of personal transport equipment.

On the other hand, services inflation remained steady at 4.7%.

Meanwhile, core inflation also accelerated, with the annual rate reaching 3.7%.

$GBINTR - Steady Rates by BoE (June/2025)ECONOMICS:GBINTR

June/2025

source: Bank of England

- The Bank of England voted 6-3 to keep the Bank Rate steady at 4.25% at its June meeting, amid ongoing global uncertainty and persistent inflation.

The central bank noted inflation is expected to remain at current rates for the rest of the year before easing back toward the target next year,

indicating that a gradual and cautious approach to further monetary policy easing remains appropriate.

GBIRYY - U.K Inflation (May/2025)ECONOMICS:GBIRYY

May/2025

source: Office for National Statistics

-The annual inflation rate in the UK edged down to 3.4% in May 2025 from 3.5% in April, matching expectations.

The largest downward contribution came from transport prices (0.7% vs 3.3%), reflecting falls in air fares (-5%) largely due to the timing of Easter and the associated school holidays, as well as falling motor fuel prices.

Additionally, the correction of an error in the Vehicle Excise Duty series contributed to the drop; the error affected April’s data, but the series has been corrected from May.

Further downward pressure came from cost for housing and household services (6.9% vs 7%), mostly owner occupiers' housing costs (6.7% vs 6.9%).

Services inflation also slowed to 4.7% from 5.4%. On the other hand, the largest, upward contributions came from food and non-alcoholic beverages (4.4% vs 3.4%), namely chocolate, confectionery and ice cream, and furniture and household goods (0.8%, the most since December 2023).

Compared to the previous month, the CPI rose 0.2%.

$GBIRYY - U.K Inflation Rate Accelerates (April/2025)ECONOMICS:GBIRYY

April/2025

source: Office for National Statistics

- The annual inflation rate in the UK jumped to 3.5% in April, the highest since January 2024, from 2.6% in March and above forecasts of 3.3%.

The main upward pressure came from higher electricity and gas prices after the Ofgem price cap increase, while new Vehicle Excise Duty on electric cars lifted transport costs, and food inflation also picked up.

Meanwhile, core inflation accelerated to 3.8%, the highest in a year.

$GBGDPQQ -UK GDP Growth Above Expectations (Q1/2025)ECONOMICS:GBGDPQQ

Q1/2025

source: Office for National Statistics

- The British economy expanded 0.7% on quarter in Q1 2025, compared to 0.1% in Q4 and forecasts of 0.6%, preliminary figures showed. It is the strongest growth rate in 3 quarters, with the largest contribution coming from the services sector, gross fixed capital formation and net trade. Year-on-year, the GDP expanded 1.3%.

$GBIRYY -U.K Inflation Rate (February/2025)ECONOMICS:GBIRYY

February/2025

source: Office for National Statistics

- The annual inflation rate in the UK fell to 2.8% in February 2025 from 3% in January, below market expectations of 2.9%, though in line with the Bank of England's forecast.

The largest downward contribution came from prices of clothing which declined for the first time since October 2021 (-0.6% vs 1.8%), led by garments for women and children's clothing.

Inflation also eased in recreation and culture (3.4% vs. 3.8%), particularly in live music admission and recording media, as well as in housing and utilities (1.9% vs. 2.1%), including actual rents for housing (7.4% vs. 7.8%).

In contrast, food inflation was unchanged at 3.3% and prices rose faster for transport (1.8% vs 1.7%) and restaurants and hotels (3.4% vs 3.3%).

Meanwhile, services inflation held steady at 5%.

The annual core inflation rate declined to 3.5% from 3.7%.

Compared to the previous month, the CPI increased 0.4%, rebounding from a 0.1% decline but falling short of the expected 0.5% increase.

GBPNZD SHORTS MOREGBPNZD have been bearish for a while and I am looking forward to continue with the trend. I expect a third touch to the top trendline or a double top formation as an override depending on how reacts on the zone. The third touch will be more preferable for me, with 2.17015 as first target and 2.14440 as the second target.

$GBINTR -U.K Interest RatesECONOMICS:GBINTR

(December/2024)

source: Bank of England

The Bank of England left the benchmark bank rate steady at 4.75% during its December 2024 meeting,

in line with market expectations, as CPI inflation, wage growth and some indicators of inflation expectations had risen, adding to the risk of inflation persistence.

The central bank reinforced that a gradual approach to removing monetary policy restraint remains appropriate and that monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.

The central bank will continue to decide the appropriate degree of monetary policy restrictiveness at each meeting.

$GBIRYY -U.K Inflation Rate Above Forecasts (October/2024)ECONOMICS:GBIRYY 2.3%

October/2024

source: Office for National Statistics

- Annual inflation rate in the UK went up to 2.3% in October 2024, the highest in six months, compared to 1.7% in September.

This exceeded both the Bank of England's target and market expectations of 2.2%.

The largest upward contribution came from housing and household services (5.5% vs 3.8% in September), mainly electricity (-6.3% vs -19.5%) and gas (-7.3% vs -22.8%), reflecting the rise of the Office of Gas and Electricity Markets (Ofgem) energy price cap in October 2024.

Also, prices rose faster for restaurants and hotels (4.3% vs 4.1%) and rebounded for housing and utilities (2.9% vs -1.7%). Prices of services increased slightly more (5% vs 4.9%), matching estimates form the central bank.

On the other hand, food inflation was steady at 1.9% and the largest offsetting downward contribution came from recreation and culture (3% vs 3.8%).

Compared to the previous month, the CPI increased 0.6%. Finally, annual core inflation edged up to 3.3% from 3.2%.

GBPUSD - Daily Bullish signsOANDA:GBPUSD has recently passed an important support zone, indicating potential for higher targets. After a clear pullback to the 1.2830 area, the pair is positioned for a further rise.

The British Pound has been bolstered by a series of positive economic indicators and political stability. According to recent reports, analysts at Investec have raised their forecast targets for the Pound against the Dollar, driven by a more promising economic outlook and favorable political conditions in the UK. This aligns with the technical setup, where GBPUSD is poised for a continuation of its upward movement following the successful retest of the support zone.

Overall, combining the technical and fundamental perspectives suggests a bullish outlook for GBPUSD, with potential for further gains as long as the support zone holds firm.

$GBINTRS - BoE's Snowball - The Bank of England (BOE) decided to deliver its #inflation medicine in a bigger dose

at their recent monetary policy committee meeting.

The bank made the shock decision to raise borrowing costs a half percentage point,

taking the official rate to 5% ;

double the size of the increase anticipated by most economists.

BoE hiking interest rates to 5% ,

it adds further strain to millions of homeowners across the country.

The Central Bank Rates was upped by 0.5% from 4.5% previously

and remains at it's Highest Level since 2008 Financial Crisis.

GBPUSD - 4H rise opportunityGBPUSD has faced three significant bearish pushes right into a major support zone but has failed to break through.

This inability to breach the support, despite repeated attempts, signals strong buying interest at these levels.

Consequently, this consolidation and failed breakdown indicate a potential bullish reversal, with the expectation of a considerable rise from this zone as buyers regain control.

GBPUSDT → USD BECOME WEAK?hello guys...

do you think usd dollar will become weak?

I think the price is on QML now and it will do some corrections! however, it is not a strong Quasimodo pattern due to the head location! so the price will start an upward movement until the MPL level!

MPL level will make the price some (just a little) correction and then the price will go to 1.27$ level that is mentioned!

___________________________

✓✓✓ always do your research.

❒❒❒ If you have any questions, you can write them in the comments below, and I will answer them.

❤︎ ❤︎ ❤︎And please don't forget to support this idea with your likes and comment

$GBIRYY -CPI (YoY)The inflation rate in the United Kingdom remained stable at 6.7% in September 2023,

holding at August's 18-month low and defying market expectations of a slight decrease to 6.6%.

Softer price increases in food and non-alcoholic beverages (12.1% vs 13.6% in August) and furniture and household goods (3.7% vs 5.1%) were offset by a smaller decline in energy costs (-0.2% vs -3.2%) on the back of a monthly rise in motor fuel costs.

Moreover, the core inflation rate,

which excludes volatile items such as energy and food,

dropped to 6.1%, reaching its lowest point since January but slightly exceeding forecasts of 6%.

Both of these figures have remained significantly above the Bank of England's 2% target,

further emphasizing the mounting inflationary pressures in the country and complicating further the task for policymakers who are expected to keep interest rates unchanged at the upcoming meeting.

On a monthly basis, the CPI rose by 0.5% in September, the most substantial increase since May.

source: Office for National Statistics

GBPCAD SHORTSGBPCAD since the beginning of the week have been moving bearish and in respect to this, I plan to stick to the trend, the daily and the weekly also shows the bearish trend, and to follow this I expect this pair to retrace to the 50 Exponential moving average and we short to the 800 Exponential moving average.