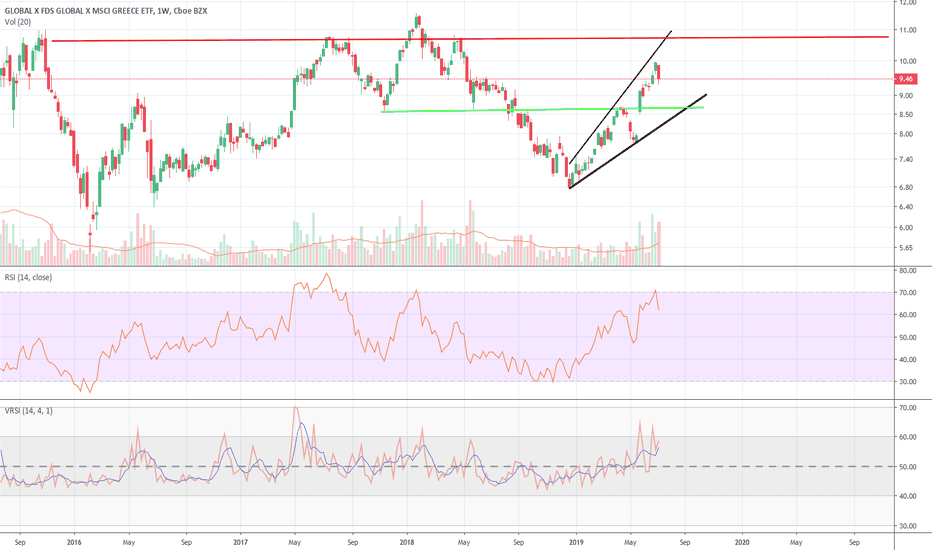

Gain on GREK's uptrendSince the last few months, powered by the new elected government in Greece, GREK has been recovering. This recovery has to do with greater expectations investors have from the new government. GREK shows a clearly established upternd. A reasonable strategy would be to wait until the current swing is over, reaching the support and then to follow the uptrend.

GREK

GREK LONG/SHORT PLAYGet ready ladies and gentlemen, this bad boy is almost at its support, get in set a stop loss just beneath its support line and, it should bounce off, or if it does break the support line, it would head towards the second support line, so it would be a good short opportunity. The open interest for jan 20 calls on this b*tch also looks hella dope. So a rebound on resistance looks more reasonable.

GREK LONG ON THIS BAD BOYGet ready ladies and gentlemen, this bad boy is almost at its support, get in set a stop loss just beneath its support line and, it should bounce off. The open interest for jan 20s on this b*tch also looks hella dope. Lets make some f*ucking money :) (can you swear on this site? I dont really want to censor myself) anyways have a great day fellow traders!

GREK monthly - on something - 11/30/2016November is ending and GREK is able to meaningfully close above 10 month MA the very first time since mid 2014. It made a higher low last month, and its trading volume began to pick up. MACD is positive. RSI still needs improvement (like to see it goes above 45). Also want to see it making a higher high (close above $8.41 monthly).

For risk takers, now might be a time to buy some with a stop at previous low ($7.18), and add more if it closes above previous high ($8.41).

Greece ready to continue back upMy Elliott Count for the Greece ETF is looking ready for an upcoming bull run.

I count us near the end of a wave ii, in an extended wave 3. As all us EW chartists know, this is an ideal spot for entering long, or buying call options.

However, Here is a BEARISH scenario,

where A=C and we are just starting the wave down....

This appears to be in sync with the National Bank of Greece (NBG) in which I have been closely following, here is a chart of that:

Would love to hear from other Elliott wave chartists,