NXU & Lynx: Could we see a merge/acquisition in the future?Nxu's Strategic Partnership with Lynx Motors

Nxu, Inc. (NASDAQ: NXU), a company specializing in innovative EV charging and energy storage solutions, has announced a strategic partnership and investment in Lynx Motors. This partnership is outlined in a letter of intent (LOI) and represents a significant step in Nxu's commitment to electrification and the future of electric vehicles (EVs).

Key Details of the Partnership

Strategic Investment: Nxu's investment in Lynx Motors is structured as a share exchange, with $3 million in Nxu shares being exchanged for $3 million in Lynx shares. This investment will be reflected as an asset on Nxu's balance sheet.

Board Representation: As part of the transaction, Nxu will receive a seat on Lynx's Board of Directors, indicating a deep level of involvement and influence in Lynx's strategic direction.

Collaborative Development: Nxu aims to assist Lynx in leveraging its vehicle and charging technology to expedite the development of electrified products. Lynx Motors is known for reimagining classic vehicles with modern amenities and powertrains, blending tradition with innovation.

Financial Support: Lynx will issue an interest-free promissory note of $250,000 to Nxu in exchange for a $250,000 bridge loan, further solidifying the financial collaboration between the two companies.

Professional Analysis

Complementary Strengths: This partnership leverages Nxu's expertise in EV charging and energy storage with Lynx's focus on electrifying classic vehicles. It's a strategic alignment that combines technological innovation with a unique market niche.

Market Positioning: Lynx's approach to electrifying popular classic cars, coupled with its robust reservation list, suggests strong market demand. Nxu's involvement could accelerate Lynx's path to significant revenue and profitability.

Impact on Nxu's Market Compliance: The partnership is a step towards Nxu's compliance with Nasdaq's listing standards, potentially increasing shareholder equity and market confidence.

Future Prospects: The collaboration between Nxu and Lynx, especially in the realm of EVs, aligns with the broader trend towards electrification in the automotive industry. This partnership could position both companies favorably in a rapidly evolving market.

Conclusion

The strategic partnership between Nxu and Lynx Motors represents a synergistic collaboration that could enhance both companies' positions in the EV market. By combining Nxu's charging technology with Lynx's innovative approach to vehicle electrification, this partnership holds the potential for significant advancements in the EV sector, offering promising prospects for both companies and their stakeholders.

Growth

SNOW Finds Support at 200-Day SMASnowflake has been trading within a wide range between 108 and 240 over the past three years. During this period, revenue growth has remained steady, but operating and R&D expenses have consistently increased. This is a company that prioritizes growth and invests heavily in research, expanding its product offerings and business relationships.

However, the recent downturn, driven by tariffs and the broader selloff in AI and cloud-related stocks has exposed Snowflake's vulnerabilities.

The company reports reflect this caution. Recently, SNOW has received both downgrades and buy signals, highlighting analyst and market indecision. In such an environment, the stock’s performance will likely lean heavily on broader index movement. With a beta above 1.5, SNOW is expected to react more sharply to market swings. The consensus 12 month target still shows 38% upward potential.

Currently, Snowflake is finding support at the 200-day simple moving average. If the market manages to weather the impact of the April 2 tariffs and potential countermeasures, SNOW could stage a solid rebound. On the downside, the 130–135 zone stands out as a key support area just below the moving average.

Next Era trade ideaA company dedicated to clean energy, focusing on solar and wind. With a large market cap and operating throughout Canada and the US, this company has proven itself being able to be profitable and grow. It looks like price has found support at the trend line and its possible we can get a second leg up.

XRP’s Path to Dominance: A Forecasted Price Per TokenAs of March 30, 2025, XRP, the cryptocurrency powering the XRP Ledger (XRPL) and Ripple’s On-Demand Liquidity (ODL) solution, is poised for a potential surge in adoption and value. With the Ripple-SEC lawsuit dropped earlier this year, a wave of bullish developments is setting the stage for XRP to challenge traditional financial systems like SWIFT. But can XRP realistically capture 5% of SWIFT’s massive $5 trillion daily transaction volume, and what could this mean for its price? Let’s dive into the factors driving XRP’s growth, including institutional adoption, tokenization, ETFs, futures trading, private ledgers, investor sentiment, and emerging trends like Central Bank Digital Currencies (CBDCs) and FedNow transactions.

The Dropped Ripple-SEC Lawsuit: A Game-Changer

The Ripple-SEC lawsuit, which had cast a shadow over XRP since 2020, has been dismissed, removing a significant regulatory hurdle. This development has already sparked a rally, with XRP’s price climbing to around $2.50 from earlier lows, driven by renewed investor confidence. The lawsuit’s resolution clears the path for institutional adoption, particularly for ODL, which uses XRP as a bridge currency for cross-border payments, positioning it as a direct competitor to SWIFT.

XRP’s 5% SWIFT Ambition: Institutional Adoption Soars

SWIFT processes approximately $5 trillion in daily transactions, and capturing 5% of that—$250 billion/day—would be a monumental achievement for XRP. Recent developments suggest this goal is within reach. Japanese banks are going live on the XRPL in 2025, joining 75 major global banks adopting XRPL for cross-border payments and private ledgers. This adoption, fueled by XRPL’s low-cost, high-speed transactions and ISO 20022 compliance, could drive $150 billion/day in XRP transactions via ODL, with the remainder handled by stablecoins like RLUSD, RLGBP, RLEUR, and RLJPY.

Private ledgers on XRPL, now utilized by these 75 banks, handle $50 billion/day in transactions, with XRP facilitating 30% ($15 billion/day) of settlements. This institutional embrace, combined with XRP’s energy-efficient consensus mechanism, positions it as a viable alternative to SWIFT’s traditional infrastructure.

Tokenization Projects Boost XRPL’s Utility

Tokenization is another key driver for XRP’s growth. Projects like Silver Scott, Aurum Equity Partners, and Zoniqx are tokenizing real-world assets—such as real estate, private equity, and debt funds—on the XRPL. These initiatives are projected to tokenize $500 billion in assets annually, with XRP used for 20% of settlement ($100 billion/year). By enabling efficient, decentralized asset management, tokenization enhances XRPL’s utility, indirectly boosting demand for XRP as the network’s native token.

XRP ETFs, Futures Trading, and Investor Sentiment

Later in 2025, the SEC is expected to approve 10+ XRP exchange-traded funds (ETFs), following the precedent set by Bitcoin and Ethereum. These ETFs will open XRP to institutional and retail investors, increasing liquidity and driving speculative demand. Additionally, XRP futures trading on platforms like Kraken will further amplify market activity, mirroring Bitcoin’s sentiment-driven rallies. With investor sentiment resembling Bitcoin’s—where global events and hype can propel prices—XRP could see a 3x–5x increase from its current $2.50, potentially reaching $7.50–$12.50 in the short term.

Central Bank Digital Currencies (CBDCs) and FedNow

The rise of CBDCs adds another layer to XRP’s potential. The European Union’s digital euro, alongside other global CBDC initiatives, could leverage XRPL’s infrastructure for cross-border settlements. Ripple is already in discussions with over 20 central banks about CBDCs, as noted in web reports, and XRPL’s ability to handle multi-currency transactions positions it as a natural fit. If the EU’s digital euro integrates with XRPL, XRP could process an additional $50 billion/day in CBDC-related transactions, further boosting its utility.

Similarly, the U.S. Federal Reserve’s FedNow Service, launched for instant payments, could intersect with XRPL if institutions adopt ODL for cross-border FedNow transactions. While FedNow focuses on domestic U.S. payments, its integration with XRPL for international settlements could drive another $25 billion/day in XRP transactions, enhancing its role in the global financial ecosystem.

Private Ledgers: Tailored Solutions for Institutions

XRPL’s support for private ledgers allows banks to customize solutions for privacy and efficiency. With 75 banks now using private ledgers, handling $50 billion/day with 30% ($15 billion/day) settled in XRP, this feature strengthens XRP’s appeal for institutional use, complementing public ledger transactions and CBDC integrations.

Forecasting XRP’s Price: A Realistic Outlook

Given these developments, what’s a realistic price forecast for XRP if it captures 5% of SWIFT’s volume ($250 billion/day), plus additional volume from CBDCs, FedNow, tokenization, ETFs, futures, and private ledgers? Let’s model it conservatively:

Daily Transaction Value: $150 billion (ODL) + $15 billion (private ledgers) + $50 billion (CBDCs) + $25 billion (FedNow) = $240 billion/day.

Annual Value: $240 billion * 365 = $87.6 trillion/year.

Tokenization Contribution: $100 billion/year.

Total Annual Value: $87.7 trillion/year.

Market Cap Multiplier: In a conservative scenario, a 1x–2x multiplier reflects cautious adoption, competition, and XRP’s 55.5 billion supply:

At 1x: Market cap = $87.7 trillion, price = ~$1,580.

At 2x: Market cap = $175.4 trillion, price = ~$3,161.

Adjusted for Realism: A $175.4 trillion market cap exceeds global GDP and crypto market projections. Adjusting to 0.5x (conservative, reflecting competition and supply limits): $43.85 trillion, price = ~$790.

Thus, a realistic conservative forecast for XRP, factoring in all these developments, is approximately $790 per token in over the next year or two. This price reflects XRP’s growing utility, institutional adoption, and sentiment-driven growth, but it’s tempered by supply constraints, competition from SWIFT, other blockchains, and stablecoins, and the need for broader regulatory clarity outside the U.S.

Conclusion

XRP’s potential to capture 5% of SWIFT’s volume, combined with Japanese banks on XRPL, tokenization projects, ETF and futures approvals, private ledgers, CBDCs like the EU’s digital euro, and FedNow integrations, positions it for significant growth. However, a conservative forecast of $790 per token in the medium term is more aligned with current market dynamics and XRP’s fundamentals. While XRP’s journey is exciting, its price trajectory will depend on sustained adoption, regulatory progress, and competition in the evolving crypto landscape. Stay tuned as XRP continues to reshape global finance!

Weak US Economic Data Could Drive Prices Higher - 28.03.2025Gold prices have been on a strong upward trend, reaching a high of $3,059. The upcoming US economic data release on March 28, 2025, could provide new momentum for gold, particularly with the following key indicators in focus:

- Core PCE Price Index (MoM)

- Personal Spending (MoM)

- Personal Income (MoM)

Current forecasts suggest a slowdown in inflation and weaker economic activity, which could create a bullish environment for gold.

Economic Data Expectations and Market Implications

The Core PCE Price Index, the Federal Reserve’s preferred measure of inflation, is expected to rise by 0.2%, down from the previous 0.3%. This signals a slowdown in price pressures, increasing the likelihood of the Fed adopting a more dovish stance in the coming months. If inflation continues to decline, expectations for rate cuts could strengthen, which would be supportive of gold prices.

Personal spending is forecasted to increase by 0.3% - 0.5%, a modest recovery from the previous decline of -0.2%. However, this remains a weak rebound, suggesting that consumers are still cautious. Slower spending means less inflationary pressure, which could further encourage the Fed to ease monetary policy.

Personal income is expected to rise by 0.3% - 0.4%, significantly lower than the previous 0.9% increase. A slowdown in income growth could weigh on consumer spending and overall economic activity, reinforcing the case for lower interest rates.

Impact on Gold Prices

The combination of declining inflation, weak spending, and slower income growth increases the likelihood that the Federal Reserve will cut interest rates sooner rather than later. Gold, which tends to perform well in a lower interest rate environment, could see further gains as a result.

Key bullish factors for gold include:

Lower inflation expectations: A weaker Core PCE Price Index supports a more accommodative Fed stance.

Sluggish consumer spending: Less inflationary pressure gives the Fed room to cut rates.

Slower income growth: Weaker earnings could further dampen economic momentum, increasing demand for safe-haven assets like gold.

The main risk to gold prices would be a surprise shift in market sentiment. If the Fed remains cautious and delays rate cuts, gold could face short-term resistance. However, given the current data outlook, the overall trend remains positive.

Trading Idea: Long Position on Gold (XAU/USD)

Given the softer economic data, gold prices could continue their bullish momentum. If inflation shows signs of easing and economic activity slows, traders may start pricing in Fed rate cuts more aggressively, pushing gold higher.

A potential long trade setup could be to enter a buy position around $3,050 - $3,065, targeting $3,080, with an extended upside potential.

To manage risk, a stop-loss below could be placed to account for potential short-term pullbacks.

Conclusion

The upcoming US economic data release suggests a cooling economy, which could lead to increased expectations of Fed rate cuts. This would be a bullish catalyst for gold, reinforcing its role as a hedge against monetary easing.

A long position on gold around $3,065, with targets at $3,080, could be an attractive setup in the short term. Risk management remains key, with a stop-loss set close below.

If economic data confirms a weakening trend, gold could soon test new highs. Stay alert to market reactions and Fed commentary! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

AMD - Perfect timing to grasp great potential ahead!AMD (Advanced Micro Devices) has shown strong potential for growth, and the recent trend analysis using the MACD (Moving Average Convergence Divergence) indicator suggests that the stock remains in a favorable position for continued upside momentum.

Technical Analysis:

The MACD is a powerful trend-following momentum indicator that helps traders identify potential buy and sell signals based on moving averages. For AMD, the MACD indicator is currently showing a bullish crossover, where the MACD line has crossed above the signal line. This suggests that the stock’s momentum is shifting positively, indicating an increasing rate of price change to the upside.

Key MACD Signals for AMD:

Bullish Crossover: The MACD line (typically the difference between the 12-day and 26-day exponential moving averages) has recently crossed above the signal line (a 9-day EMA of the MACD). This is a classic bullish signal, which often precedes further price appreciation.

Strong Momentum: The distance between the MACD line and the signal line is widening, signaling strong momentum in the upward direction. This suggests that buying interest in AMD is gaining strength, and the stock could continue to rise as long as the momentum remains intact.

Positive Histogram: The MACD histogram is currently above the zero line, reflecting that the difference between the MACD and its signal line is positive. This further validates the strength of the bullish momentum, indicating that the stock could continue to experience upward pressure.

AMD’s Fundamental Strength:

Beyond technical indicators like MACD, AMD's fundamentals also support the favorable technical outlook. The company continues to make significant strides in the semiconductor industry with its innovative product lineup, including the Ryzen processors and Radeon graphics cards. AMD has been gaining market share from competitors like Intel and Nvidia, further strengthening its long-term growth prospects.

Our conclusion for this stock.

With a favorable MACD indicator, coupled with the robust fundamentals of AMD, the stock is well-positioned for potential gains. The bullish momentum indicated by the MACD suggests that AMD could experience continued price appreciation, making it an attractive option for investors who are looking for stocks with solid upward potential.

Trade set-up

Entry: 105

Target: 135 - Our target is set up below the weak resistance which used to serve as a support line when the stock was trading at ATH levels.When we reach that key-level we would analyse the stock again to see if it has more favourable data to boost the price towards the strong resistance level of 170+ below the ATH area

Stop Loss: 70 which is an unsustained bottom, utilizing it for protection over the trade

Super Micro Trade IdeaA risky trade, but with great risk comes great reward. We are at the trendline touching for the third time, and we have pivot off it in the pre market. A company who has demonstrated strong growth potential and the AI bubble starting to come together this will be a stock I will hold onto for sometime.

Why Going Long on SoFi Stock SoFi Technologies (SOFI) is at a pivotal moment, presenting a strong long opportunity as it enters the 5th wave of an Elliott Wave cycle. This final leg typically brings explosive upside momentum, signaling a potential breakout.

While a brief dip below $10 is possible, this could act as a springboard for a powerful rally toward $20 and beyond. The stock's bullish structure, combined with SoFi's growing financial services business, makes it an attractive bet for long-term investors.

With momentum building, now may be the perfect time to go long on SoFi before the next surge begins.

🚨 This is not financial advice. Do your own due diligence (DD) before making any investment decisions. 🚨

Long Ahead of U.S. GDP AnnouncementGold could see bullish momentum as the U.S. GDP Growth Rate (QoQ Final) is set to be announced on March 27, 2025. The U.S. economy showed signs of slowing down in Q4 2024, with GDP growth dropping from 3.1% to 2.3%. If this downward trend continues due to actual recession fears and given the market conditions up to today, the report is unlikely to be a major downside surprise. However, it could still fuel expectations of Federal Reserve rate cuts, making gold a more attractive asset.

🔥 Why is this bullish for Gold?

✅ Potential Fed Rate Cuts:

A weaker-than-expected GDP reading would increase expectations for Fed rate cuts in the coming months.

Lower interest rates reduce the opportunity cost of holding gold, making it more attractive.

✅ Falling Real Yields:

Inflation remains at 2.3%, slightly above the Fed’s target.

If the Fed moves towards rate cuts, real yields (nominal rates minus inflation) will decline – a strong bullish factor for gold.

✅ Weaker U.S. Dollar Potential:

A weaker GDP print could weaken the U.S. dollar as traders price in lower rates.

Gold has an inverse correlation with the dollar: a weaker USD typically pushes gold higher.

✅ Safe-Haven Demand:

If economic growth continues to slow, investors may hedge with gold.

Increased demand as a safe-haven asset would further support gold prices.

A stronger-than-expected GDP report could delay Fed rate cuts, pressuring gold.

A strong U.S. dollar due to global risk-off sentiment could weigh on gold.

Short-term technical corrections could trigger temporary pullbacks.

Conclusion: Bullish Outlook for Gold Ahead of GDP Data

With slowing U.S. growth, potential rate cuts, and weaker real yields, gold remains a strong long opportunity ahead of the March 27 GDP announcement. Fundamental data supports an upward move, and the technical setup provides a clear entry strategy.

🎯 Gold remains in a uptrend – dips could offer buying opportunities!

🔎 Key Events to Watch:

U.S. GDP Growth Rate (QoQ Final) – March 27, 2025

Fed policy statements & economic projections

U.S. Dollar Index reaction to GDP data

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Think Like a Pro: Trade with Discipline, Not Emotion **Taming Greed: The Secret to Long-Term Trading Success**

Trading is a battlefield of emotions—**excitement, fear, hope, and greed**. Among them, **greed is the silent killer**, pushing traders to overtrade, overleverage, and chase the market, ultimately leading to disaster.

As the saying goes:

📉 **“Bulls make money, bears make money, but pigs get slaughtered.”**

**Why Greed is Your Worst Enemy**

Fear may hold you back, but **greed pushes you into reckless decisions**. It makes you **ignore your trading plan, risk too much, and hold losing trades for too long**—all in pursuit of bigger gains.

But here’s the truth: **The market rewards patience, not desperation.**

**How to Keep Greed in Check & Trade Like a Pro**

🔥 **Follow a Strict Trading Plan**

A well-defined **plan is your shield against impulsive decisions**. Know your entry, exit, and risk before placing a trade. **Discipline beats greed—every time.**

📊 **Master Risk Management**

Avoid the temptation to **bet big for quick gains**. A strong **risk strategy protects your capital** and ensures survival in the long run. The goal isn’t just to win—it’s to stay in the game.

⏳ **Say No to Overtrading**

More trades don’t mean more profits—**it usually means more losses**. Trade **with precision, not emotion**. If you’re trading just for the thrill, **you’re gambling, not investing**.

**Success = Patience + Discipline**

Greed is an illusion—it promises wealth but delivers ruin. The real path to trading mastery lies in **consistency, control, and calculated risks**.

💡 **Trade smart. Stay disciplined. Build wealth the right way.**

Angi's List | ANGI | Long at $2.00The historical simple moving average (SMA) I've selected for Angi Inc NASDAQ:ANGI is starting to enter stock price. This often means a directional change in price: up in this case. The price drop after the last earnings, I believe, was an algorithmic move for price entry/further consolidation. If true, the two large gaps above may be filled "soon". 70M float, 12% short interest...

Fundamentally, Angi maintains a solid financial foundation with $395 million in cash and cash equivalents. The company's free cash flow increased $29.2 million to $78.4 million for the first nine months of 2024, demonstrating strong cash generation capabilities. The company's transition to a consumer choice model, already successful in its European operations, positions Angi to capture greater market share. Despite revenue headwinds, Angi demonstrates robust financial health with operating income increasing to $7.8 million in third-quarter 2024, a significant improvement from the previous year. The company's adjusted EBITDA grew 27% to $35.4 million, while year-to-date operating income reached $20 million with adjusted EBITDA rising 47% to $114 million, showcasing effective cost management and improving operational efficiency.

Thus at $2.00, NASDAQ:ANGI is in a personal buy zone.

Target #1 = $2.25

Target #2 = $2.50

Target #3 = $3.00

Target #4 = $3.50

Target #5 = $3.70

Ksolves India Ltd: A Software Solutions Powerhouse GrowthIntroduction:

Ksolves India Ltd, a software development and IT solutions provider, has emerged as a promising player in the technology landscape. With a diverse range of services, strategic partnerships, and a growing client base, the company has demonstrated its ability to cater to the evolving needs of businesses across various sectors. As a stock market wizard with expertise in both technical and fundamental analysis, let's dive deep into the key aspects of Ksolves India Ltd and explore its investment potential. Fundamental Analysis:

Business Overview:

Ksolves India Ltd, incorporated in 2014, is engaged in software development, enterprise solutions, consulting, and providing IT solutions to companies across sectors such as Real Estate, E-commerce, Finance, Telecom, and Healthcare. The company is known for its expertise in Big Data, Data Science, Salesforce, DevOps, Java & Microservices, OpenShift, and Penetration Testing, among other technologies.

Revenue Breakdown:

Ksolves' revenue is primarily driven by its software services, which account for 97% of its total revenue. The remaining 3% comes from products and customization. Geographically, the company's largest market is North America, contributing 66% of its revenue, followed by India (23%), Europe (7%), and the Rest of the World (4%).

Clientele and Partnerships:

Ksolves' client base is widely diversified, with over 40 IT services clients across 25+ countries. The company's top 5 clients contribute 33% to its revenue. Ksolves has also forged strategic partnerships with industry leaders such as Salesforce, Adobe, Odoo, and Drupal Association, further strengthening its service offerings and market presence.

Financial Performance:

Ksolves has demonstrated consistent growth in its financial performance. Over the past few years, the company has witnessed a steady increase in its sales, operating profit, and net profit. The operating profit margin (OPM) has remained in the range of 40-45%, indicating efficient operations and cost management.

Technical Analysis:

Fibonacci Retracement:

The Fibonacci retracement drawn connecting the low of Rs. 811 (11-month depth) to the high of Rs. 1,470 shows that the current market price has broken above the 0.5 Fibonacci level, indicating the potential for further upside movement.

Trend Analysis:

The overall trend for Ksolves India Ltd appears to be bullish, with the stock price consistently making higher highs and higher lows. This suggests a strong positive momentum in the stock, which could continue in the near future.

Investment Thesis:

Growth Potential:

Ksolves India Ltd's diversified service offerings, strategic partnerships, and growing client base position the company well to capitalize on the increasing demand for IT solutions across various industries. The company's focus on emerging technologies like Big Data, AI, and Machine Learning further enhances its growth prospects.

Geographical Expansion:

The company's strong presence in North America, coupled with its plans to expand in other regions like Europe and the Rest of the World, presents opportunities for Ksolves to diversify its revenue streams and tap into new markets.

Margin Stability:

Ksolves' consistent operating profit margins, ranging between 40-45%, demonstrate the company's ability to maintain profitability and operational efficiency, which is a positive sign for investors.

Technical Outlook:

The Fibonacci retracement analysis and the overall bullish trend in the stock price suggest that Ksolves India Ltd may continue to see upward momentum in the near to medium term, making it an attractive investment opportunity.

Conclusion:

Ksolves India Ltd, with its comprehensive software solutions, strategic partnerships, and strong financial performance, appears to be a promising investment opportunity. The company's growth potential, geographical expansion plans, and stable margins, combined with the positive technical outlook, make it a stock worth considering for investors seeking exposure to the thriving IT services sector. As a stock market wizard, I believe Ksolves India Ltd is well-positioned to capitalize on the industry's growth and deliver value to its shareholders.

Defensive Sector with Growth PotentialSupporting Arguments

Current Market Uncertainty Sustains Demand for the Defensive Sector. NEE represents the defensive utility sector. Given the current political and economic uncertainty in the market, there could be an additional catalyst for the company's stock price growth.

Demand for Green Energy from the IT Sector. More than 80% of the company's portfolio consists of renewable energy sources (RES). Demand from data centers in the IT sector may allow the company to outperform competitors.

Attractive Valuation Levels and Technical Outlook

Investment Thesis

NextEra Energy (NEE) has strong long-term growth prospects due to the increasing demand for RES and the electrification of various sectors. Their integrated business model, combining the regulated utility business FPL and the competitive renewable energy business NEER, ensures both stability and growth opportunities. NEE's leadership in RES production, along with investments in battery energy storage and gas infrastructure, allows the company to benefit from the growing demand for clean energy solutions.

Current Market Uncertainty Could Drive Stock Price Growth. Tariffs imposed by the administration on imports and their potential impact on the U.S. economy remain in investors' focus. The market has responded to high uncertainty with a significant correction in overheated sectors, and pressure may persist for some time. As a representative of the utility sector, NEE benefits from uncertainty and may continue its growth.

Demand for Green Energy from the IT Sector. The largest public companies continue to increase capital expenditures on AI infrastructure to stay competitive. A key component of such infrastructure is data centers, which consume large amounts of energy and contribute to increased environmental pollution. As a result, data center owners create strong demand for companies that provide access to RES. More than 80% of the company’s portfolio consists of renewable energy sources. Already, the company’s annual profit growth rate is twice as high as that of its competitors.

Attractive Valuation Levels and Technical Outlook. The company's stock is trading at the 200-day moving average and recently rebounded from the resistance line at the 50-day moving average, which could serve as a strong catalyst for movement toward the previous peak of $84.8. Based on the forward PEG ratio, the company is trading at about the same level as companies engaged in traditional energy sources for household supply, while maintaining profitability 5-15% higher than competitors. Based on the forward P/E ratio, the company appears cheaper than its closest direct competitors (18x vs. 20.5x).

Our target price is $82, with a "Buy" recommendation. We recommend setting a stop-loss at $64

Sabah Research Goes Long on Google: EW 2.0 Signals 45% Upside !Sabah Equity Research is taking a bullish stance on Alphabet (GOOGL) as Elliott Wave 2.0 suggests a 45% upside from current levels. With the stock trading at an attractive valuation, this presents a strong opportunity for long-term investors.

Elliott Wave 2.0 Predicts the Next Leg Up

After completing a healthy ABC correction, Alphabet is now primed for a Wave 3 expansion, historically the most powerful phase in the Elliott cycle. The technicals suggest that GOOGL’s recent consolidation is a launchpad for the next move higher.

Catalysts for Growth

Massive Cybersecurity Acquisition

Google’s parent company, Alphabet, is set to acquire Wiz, a leading cloud security firm, for over $30 billion—its largest deal ever. This strengthens Google’s cloud security dominance and accelerates revenue growth.

Undervalued Growth Potential

Despite its leading position in AI, cloud computing, and search, Alphabet trades at a discount compared to peers. This disconnect presents a compelling buying opportunity before sentiment catches up.

AI and Cloud Expansion

Google’s aggressive push into AI and cloud services positions it for massive future gains. With rising demand for AI-driven search, advertising, and enterprise solutions, Alphabet’s growth runway remains robust.

The Trade Setup: Positioning for the Upside

With Elliott Wave 2.0 pointing to a 45% rally, Sabah Equity Research sees Alphabet as a strong long-term play. The combination of cheap valuation, a game-changing acquisition, and a favorable technical setup makes this an ideal entry point.

Smart money is accumulating—will you? 🚀

Going Long on NVDA !NVIDIA (NVDA) has been a powerhouse stock, riding the wave of AI, gaming, and data center demand. Recently, the stock experienced a correction, which might have caused some investors to hesitate. However, from an Elliott Wave 2.0 perspective, this pullback was nothing more than a natural ABC correction following a classic 1-2-3-4-5 impulse wave—a textbook setup for long-term bulls.

Understanding the ABC Correction in NVDA

In Elliott Wave theory, after a strong five-wave rally, the market typically experiences a three-wave pullback (ABC correction) before continuing its long-term uptrend. This correction serves to shake out weak hands, reset overbought conditions, and set the stage for the next bullish impulse.

The A-wave is the initial drop as profit-taking kicks in.

The B-wave is the temporary bounce, often mistaken for a continuation.

The C-wave completes the correction, offering smart investors an ideal entry point.

NVDA’s recent pullback aligns perfectly with this structure, meaning the next leg up could be just around the corner.

Why NVDA Remains a Strong Long-Term Bet

AI Dominance – NVIDIA is at the center of the AI revolution, with its GPUs leading the industry.

Data Center Growth – Demand for high-performance computing continues to surge.

Technical Reset – The stock has worked off overbought conditions and is finding new support levels.

The Opportunity: A Strategic Long Entry

Now that the ABC correction has played out, NVDA presents an excellent long entry for those looking to ride the next bullish wave. With strong fundamentals and a technical reset, the stock is primed for another 1-2-3-4-5 impulse move, potentially leading to new all-time highs.

For traders who understand market structure, this is a golden opportunity to go long before the next explosive rally begins. 🚀

NIKE - will the best sportswear deliver?Nike (NYSE: NKE) remains a strong investment choice, driven by its market leadership, brand strength, and impressive financial consistency. With 95% positive quarters since Q2 2021, Nike has demonstrated resilience, profitability, and long-term growth potential. Here’s why it remains an attractive stock:

1. Consistent Financial Performance

Nike’s ability to deliver 95% positive quarters since Q2 2021 highlights its financial stability and strong management. The company has consistently outperformed expectations, maintaining steady revenue growth and profitability even in challenging economic conditions.

2. Global Brand Power

As the world’s leading sportswear brand, Nike commands strong customer loyalty and dominates the athletic apparel and footwear markets. Its global reach, premium pricing power, and continuous product innovation keep it ahead of competitors.

3. Expanding Digital & Direct-to-Consumer Sales

Nike’s digital transformation is driving significant revenue growth. Its direct-to-consumer (DTC) business, including the Nike app and online sales, has improved margins and strengthened customer engagement, making it less reliant on third-party retailers.

4. Strong Market Position & Innovation

Nike continues to lead in innovation with advancements in sustainability, performance gear, and technology-driven products. With ongoing investments in AI, automation, and eco-friendly materials, the company stays ahead in a competitive industry.

5. Long-Term Growth Potential

Nike’s strong brand equity, global expansion, and continued investment in emerging markets position it for sustained growth. Coupled with its impressive track record of positive quarters, Nike remains a reliable and strategic long-term investment.

Entry: 73

Target 107 (the target is set up around the very strong resistance area, if that area is broken we can deffinetely see more momentum to the upside!

SL:55 (Below the strong support area so we can protect the trade)

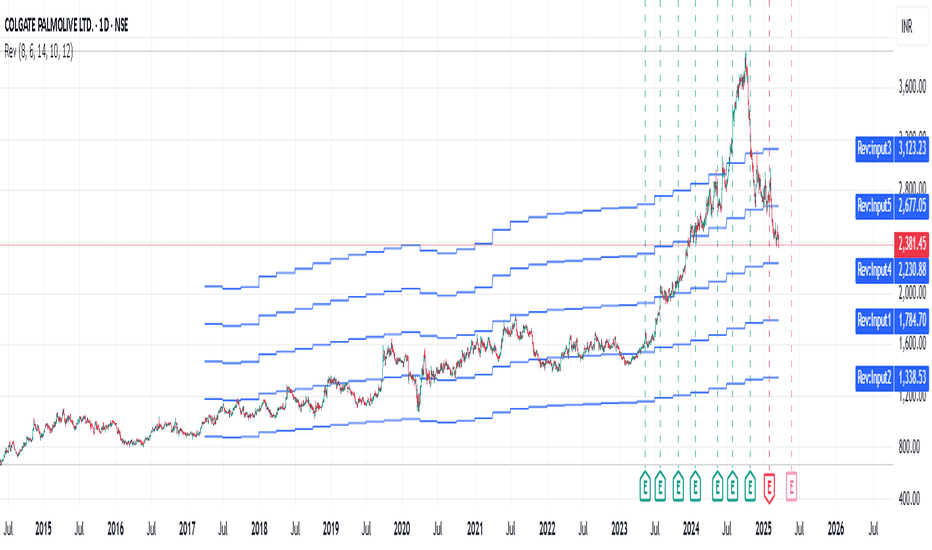

Neutral or sell COLPALThis is a clear case of raised valuations across most of the stocks. As seen in the Revenue Grid indicator, this stock was trading at 8 to 10 of Price to Revenue ratio, but from July 2023 it suddenly started going up and went to 18 times it's Revenue per share. Why? God knows! :)

Now naturally coming back to it's historic valuation. To get to it's fair price, within a short duration, such as couple of months, levels of 2230 can be seen. Happy Trading :)

XAUUSD WEEKLY ANALYSIS Hey everyone 👋🏾 Happy new week here’s my weekly analysis for Gold this week still bullish on Gold and if you check the chart you will see my buys projection of the zone am interested on for more buys so I will be waiting for a pullback to these zones to take buys to the upside or to a new ATH with a confirmation before execution and price might not pullback it might just create another ATH but these are my projections…Let’s see how it goes and and let’s have another win week…

Momentum Trading Strategies Across AssetsMomentum trading is a strategy that seeks to capitalize on the continuation of existing trends in asset prices. By identifying and following assets exhibiting strong recent performance—either upward or downward—traders aim to profit from the persistence of these price movements.

**Key Components of Momentum Trading:**

1. **Trend Identification:** The foundation of momentum trading lies in recognizing assets with significant recent price movements. This involves analyzing historical price data to detect upward or downward trends.

2. **Diversification:** Implementing momentum strategies across various asset classes—such as equities, commodities, currencies, and bonds—can enhance risk-adjusted returns. Diversification helps mitigate the impact of adverse movements in any single market segment.

3. **Risk Management:** Effective risk management is crucial in momentum trading. Techniques such as setting stop-loss orders, position sizing, and continuous monitoring of market conditions are employed to protect against significant losses.

4. **Backtesting:** Before deploying a momentum strategy, backtesting it against historical data is essential. This process helps assess the strategy's potential performance and identify possible weaknesses.

5. **Continuous Refinement:** Financial markets are dynamic, necessitating ongoing evaluation and adjustment of trading strategies. Regularly refining a momentum strategy ensures its continued effectiveness amid changing market conditions.

**Tools and Indicators:**

- **Relative Strength Index (RSI):** This momentum oscillator measures the speed and change of price movements, aiding traders in identifying overbought or oversold conditions.

- **Moving Averages:** Utilizing short-term and long-term moving averages helps in smoothing out price data, making it easier to spot trends and potential reversal points.

**Common Pitfalls to Avoid:**

- **Overtrading:** Excessive trading can lead to increased transaction costs and potential losses. It's vital to adhere to a well-defined strategy and avoid impulsive decisions.

- **Ignoring Market Conditions:** Momentum strategies may underperform during sideways or choppy markets. Recognizing the broader market environment is essential to adjust strategies accordingly.

By understanding and implementing these components, traders can develop robust momentum trading strategies tailored to various asset classes, thereby enhancing their potential for consistent returns.

Source: digitalninjasystems.wordpress.com

Accumulate for Long TermNestle is trading at a little discount as compared to it's historic valuation for last 6-7 years. This is a growing stock, so it will be good to buy some shares now. Some details of it's strategies and products portfolio below - Happy Trading :)

Over the past six to seven years, Nestlé India has demonstrated consistent revenue growth, driven by a combination of strategic initiatives and a strong product portfolio. Key factors contributing to this sustained growth include:

1. Innovation and Product Diversification: Nestlé India has prioritized innovation, launching over 140 new products in the past eight years. These introductions span various categories, including science-led nutrition solutions, millet-based products, and plant-based protein options, catering to diverse consumer needs.

BUSINESS-STANDARD.COM

2. Strengthening Core Brands: The company has focused on reinforcing its flagship brands:

Maggi: Achieved the status of the largest market globally for Maggi, driven by balanced product mix, pricing strategies, and volume growth.

THE HINDU BUSINESS LINE

KitKat: India became the second-largest market for KitKat worldwide, reflecting robust performance in the confectionery segment.

THE HINDU BUSINESS LINE

Nescafé: The beverage segment, particularly Nescafé, has seen significant growth, introducing coffee to over 30 million households in the last seven years.

THE HINDU BUSINESS LINE

3. Expansion into New Categories: Nestlé India is exploring opportunities in emerging sectors such as healthy aging products, plant-based nutrition, healthy snacking, and toddler nutrition. These initiatives aim to tap into evolving consumer preferences and health-conscious trends.

CFO.ECONOMICTIMES.INDIATIMES.COM

4. Focus on Premiumization: The company is enhancing its premium product offerings, including the introduction of Nespresso and health science products. This strategic move aims to have premium products contribute to 20% of sales in the long term, up from the current 12-13%.

GOODRETURNS.IN

5. Strategic Partnerships: A notable collaboration with Dr. Reddy's Laboratories to form a joint venture in the nutraceuticals space underscores Nestlé India's commitment to expanding its health science portfolio and leveraging synergies for growth.

THE HINDU BUSINESS LINE

Collectively, these strategies have enabled Nestlé India to maintain a consistent upward trajectory in revenue, effectively adapting to market dynamics and consumer demands.

Long for Long Term - Discount price in terms of Revenue/shareAs seen in the Revenue Grid indicator, stock is currently trading at 2 to 2.5 times it's Revenue per share, which is a very low valuation historically. It crossed below this valuation, only at covid pandemic crash. Given the consistent Revenue increase, this is a fair value to buy for a long term view.