Gush

How does WTI Crude look in terms of looming economic crisis?We all know it is coming. To chart the pattern of the crisis look to the incoming 5g technology deadlines. 2020 is the deadline. Go back to 3/4 g deadlines and upgrades. 3g=1999-2000. 4g=208-2009. Look it all up and do the math. Everything is at the top in terms of the market. Commodities are coming off bottoms. How hard is this to see? Not hard unless you are blind.

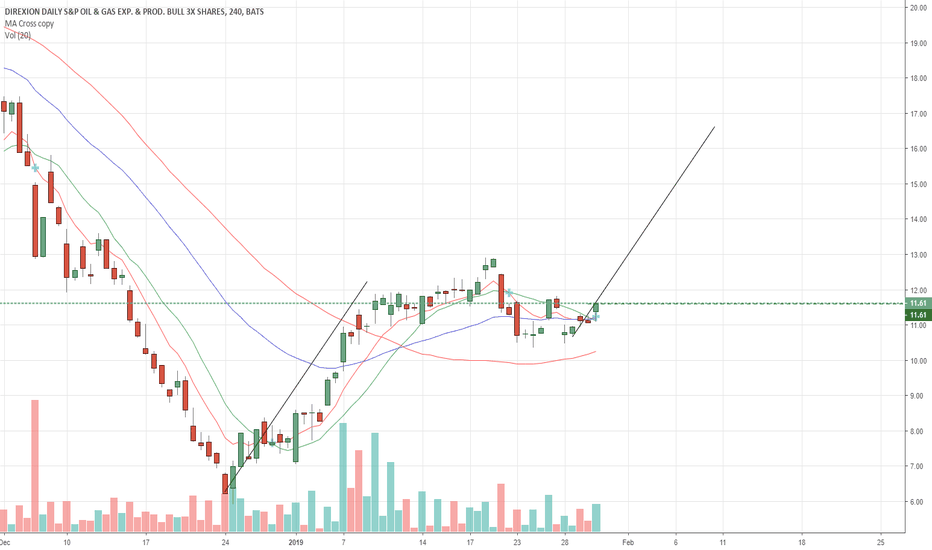

Oil, The Bull within the BullI love love love setups like this. What you see here is a classic symmetrical breakout from a classic cup and handle. Each with time frames of significance. Of course the more powerful move will be the Symmetrical triangle. The cup and handle however should give us our initial bottom trend line for this bull run set up. I drew an imaginary line to give and example of what I expect if this plays like it should. CLASSIC!

Big set up for oil! Is oil headed to new highs!?When charting oil it becomes very clear that the symmetrical triangle has formed. I have been saying this all year long. I expect big moves in both directions in the markets as volatility continues its treacherous path. Let us see how this huge pattern plays out. Patterns that are produced over longer periods of time tend to bare more weight and strength in their moves. ENJOY!

CUP AND HANDLE ON WTI CRUDECup and handle pattern showing on WTI CRUDE.

Fundamental news of 12.8M real vs 2.8M estimate drawdown of US inventory jump starts the bull case for oil. Although there is resistance line starting from beginning of June, that trend has a short history and upcoming global events may help the break through this resistance. The G-20 summit is currently happening. With US/China trade war at an all time high, it is very hard to imagine an escalation resulting from this meeting. Rather a postponement or a reduction would be more probable, causing some stimulation in global economic outlook and thus higher oil prices.

Secondly OPEC+ will meet the following week. Saudi Arabia is still in the red and will have to do whatever it can to increase oil prices. Tensions with Iran/US is causing disruptions in supply. Though China seems to be using Malaysia as a conduit to circumvent sanctions, Iran's oil supply to the world will inevitably be reduced. Perhaps Saudi Arabia will make concessions at the OPEC+ meeting now and increase output later as Iran is forced to decrease supply. With major corporations dipping their toes in US shale, the US accounted for 98% of oil production growth in 2018 at mostly unprofitable levels. When the small players are driven out, the big players will likely decrease shale production.

$GUSH ; Could this be it?TraderNoxtreme here. $GUSH has been falling HARD the last two weeks roughly and people have been longing this hard on the way down. The media is now really starting to HYPE the trade war which is leading to increased uncertainty in oil/nat gas. $GUSH is a 3X ETF that has a bunch of oil and NG companies in it.

It just bounced off a 3 YEAR low this week at around 5.90...

Trump just tweeted this

"BIG NEWS! As I promised two weeks ago, the first shipment of LNG has just left the Cameron LNG Export Facility in Louisiana. Not only have thousands of JOBS been created in USA, we’re shipping freedom and opportunity abroad!"

i.imgur.com

Oversold on the hrly, 4hr, and daily!

I will likely double down at the pink line if we break it first thing tomorrow.

SRE Long ideaSRE. I like this trade. The energy market is heating up. OIL is moving higher which will drive this sector. Not the curling higher MA's on the 4 hr chart. The price is above them all. This is a good looking chart. I'd set my stops at $111, and 1st target at last significant high around $123. I also took a position in 3x GUSH.

OIL LONG IDEAI've been watching OIL for a while now. I think the time is now to get on board. Keeping it simple. The cycle timing is right. The MACD is above zero, the PSAR is positive and the long term trend line is broken. Putin meets with OPEC today I believe. I am buying OILU instead of GUSH because the markets keep selling off, which could drag GUSH down despite improving oil prices.