BTC next four yearsThis chart is based off a few assumptions. First, the rate of exponential growth must slow over time. It isn't realistic to expect $100 million per BTC in 10 years. Sorry. Second, as BTC matures the percentage price range between peaks and valleys will also decrease. Third, bitcoin price movements are cyclical and centered around the supply halving events. Fourth, highs and lows in price will occur at roughly the same time frames relative to the halvings as they have in past cycles. Fifth, the shape of the price curve from ATH, to bottom, back to ATH will be roughly in line with the last cycle in timing. Basically we are assuming that bitcoin's price will continue to exhibit similar trends and cycles that it has up to this point but with declining growth rates and volatility.

The green and red lines exhibit a channel of price action, with the widest point (highest volatility) coming at the 2013 bubble peak and declining steadily for the rest of bitcoin's life. This makes sense as the markets mature. If this holds true, we can expect each parabolic rise to the cycle peaks to be less vertical in shape and each resulting crash to be less intense as well. Basically each cycle will be slightly flatter than the last.

The blue curves are rough price trends that the price followed last time. This can give us a guess as to timings. Price hits the bottom about a year or so before the next halving each time, and comes close to the red support line near the halving where it gets a small peak before beginning the bull run in earnest. Last time, price stayed below the blue line until bottoming out, at which point it then rose above the blue line until following it fairly closely and underneath it up to the next ATH. This is basically exactly what we're seeing right now. The yellow line therefore represents a decent guess for the price trend for the rest of the current cycle.

Key takeaways here are that we have already hit bottom for this cycle. We could still decline down to the red line (a little above $4k currently) but overall the trend will be up until the next peak and I wouldn't expect price to ever drop below 4k again. We will likely have a small peak around the time of the halving around 10-12k before falling back closer to the blue trend line. We should reach our previous ATH in early 2021 with a cycle top around the end of 2021 or very early 2022 somewhere around 85-90k. This peak price is also supported by the idea that traders will front run the $100k psychological barrier, followed by panic selling of investors worried they will be unable to hit their 100k targets. I would then expect the next cycle's bottom to be somewhere between 25-30k depending on timing, sometime between mid 2022 to early 2023.

Feel free to follow me on twitter @_jasonblo

Halving2020

BTCUSD price trend until the halvingSince Bitcoin topped out in June 2019 at around $13,000 it has been on a steady pullback.

In this time not only Bitcoin's price but also the volume declined steadily.

The volumes downtrend should potentially end around the end of january, just 4 months before the approx. date of the next halving.

In the last years the months before and after the halving were significant for bitcoins price action.

I am looking for a decline of Bitcoin to $5,350 - $5,800 until the end of december / beginning of january before an expansion of the leg up we saw earlier this year.

The plans of the bulls before halving 2020Hi,

Since halving is incoming for bitcoin, bulls are making moves for a good price to buy big again. I think that's the mean reason of falling price.

Orange diagonal line is the multiyear support. We are close to that one. I've mentioned some important area's in the chart.

I think bulls are planning to buy big before the halving. Therefore was a sharp buying price needed. Most logical one is that the bulls will buy again when the price will be in that small triangle area. If price will hold with good volume and diagonal support will hold, expect a big up. That triangle could be a bounce area with that horizontal support from may '19.

But if they're willing a sharper price move you could expect prices around 3k-4k and make a double button first before big up.

2 ways:

1. price will be lower and will bounce in that triangle area after succesfull testing the diagonal support

2. price will be lower than orange multiyear support and will go to the 3k 4k area

thanks for reading and for your likes.

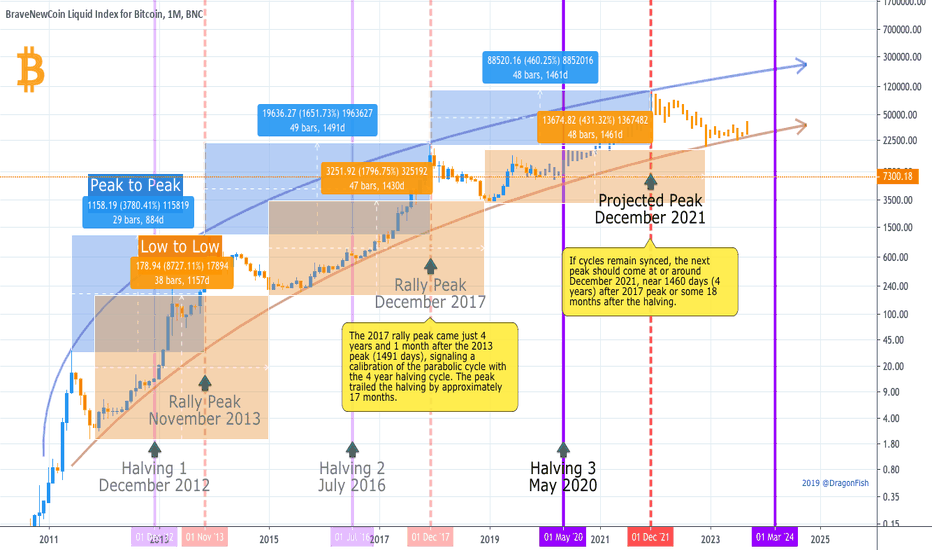

Timing the Peak of the Next BTC Bull RunWhen will Bitcoin reach the peak of its next parabolic advance? Probably at roughly the same time it did in the last rally. This seems straight forward enough, but other trend analysis on this platform has variously projected the next bitcoin price peak from sometime just after the third halving in May 2020 all the way to sometime in 2023. While the earlier prediction is highly unlikely, the extended prediction is supported by the fact that, peak to peak, the third bull run of 2017 was much more extended (1491 days) than the previous bull run (884 days). Therefore, we may assume that subsequent parabolic moves will also play out over longer and longer time frames.

However, the simplest answer is probably the best in this case. If we consider that the halvings are roughly 4 years apart, it is notable that the third peak came just over 4 years after the second peak. This suggests that in fact the peaks have become calibrated to the halvings and that the next all time high will come near the 4 year mark (or day 1460) as well. Bitcoin is unique in that the stock to flow ratio can be very precisely projected, unlike any other traditional market, making this rough prediction of the timing possible.

This probably doesn’t help us predict price discovery, however. Government regulation, current events, technological disruption, etc., etc., all affect market sentiment and make it nearly impossible to guess where the price will go. That said, we do know that the halvings will become more and more priced into market valuations in the future as the market gains a greater awareness of the halving algorithm, and this process has probably already started. Futures markets (CME & Bakkt) will also act as tempering forces on BTC volatility (apparently the intention when futures trading was launched on CME in 2017). And as the value of BTC has become more tagged to store-of-value than currency utility, volatility and price discovery have naturally been tamed (relatively), a process that will also continue. This is to say that conservative predictions may fall closer to the mark. On the other hand, the mere fact that flow is dramatically cut after each halving as demand continues to grow gives BTC bulls a lot of hope.

Whatever the peak of the next parabolic rally, it is likely to be tied closely to the halving cycle and stock-to-flow models, and trend lines will probably remain inside the general channel indicated by history. In other words, we're probably not going to the moon, but we are still holding the best performing asset ever seen.

Hopefully these observations aren’t too obvious. They are just meant to help us all keep our eyes on the big picture as we hodl into the future.

DF

Two possible Bitcoin scenarios - long termScenario 1:

Bitcoin is sitting on a long term support.

If it's gonna hold to it, then It will slowly move to uptrend cycle.

Scenario 2:

Bitcoin won't be able to hold he first support, and will fall to second (lower) one.

After finding this support, bitcoin could bounce really fast to the next one, do a re-test, and then organicly move upwards.

The curve in the spring shows us the halving era. Before halving we could se a pump, and then some retrace, and afterwords, uptrend, which will possibly continue until middle of 2021.

12 Month Bitcoin ForecastTo predict this model, I've had to use a number of techniques and a few assumptions. a. Assuming we're at the bottom or very close. I make this assumption because of recent price action, and Buy/Sell wall volumes, as well as factoring in the upcoming halving. b. I use the confluence of trade channels, along with support/resistance zones, moving averages, halving event trends, & Fib levels, to determine timing of key events.

IMPORTANT - This general pattern could end up starting a little lower than the current range of $7,000, if the 200 WMA (Weekly Moving Average) ends up being the bottom of our current drop . Keep in mind we've never closed a daily below that level so I would expect that to be maintained.

1. We'll trade sideways in the form of an ascending triangle over the next 4 to 6 weeks.

2. We'll break past the upper end of the descending broadening wedge - See pink line NOTE - This will be the first break through trending resistance in over 6 weeks.

3. Next, we'll break up through the triangle sometime late December to early January.

4. This move brings us back to the FIB .618 *Golden Retracement) zone.

5. We test down to the .5 then break up through it to eventually test the $9,300 level.

6. We test sideways until early spring where at some point we test the upper end of the descending channel.

7. For the next several months we trade down into the halving as we normally do.

8. Sometime during the summer we break through the descending channel and then things take off. - Blue Line

9. We eventually break $20,000 in the late summer to early fall, with an overshoot past the target.

10.There's a sell the news event for breaking through 20k. This should be a fairly quick 30% drop .

11.We start testing higher and things get really fun.

I REALLY appreciate constructive feedback. If you're a troll I WON'T respond to you. :)

EOS - INVEST $1000 AND GET $500 NET PROFIT!Everything is possible, we're trying to do the best.

Yes, you can invest $1000 and get $500 net profit. According to fibonacci levels, EOS/USD fallen to $1.55 level as lowest support after it had risen to $23 ( Highest price ). EOS/USD tried to test $9 level, but failed and fallen to $2.5 level a few weeks ago. $1.55 is the worst scenario before uptrending to $5.40 ( $5.40 is the key of next uptrend ). Let's say, you do invest $1000 at $3.40 ( ~ 294 EOS ) and set a sell order at $5.40 ... Congrats, you made $1500 - $1000 ( The investment ) = $500 Net profit. Don't wait $1.55 level to get more profit, no one knows what will happen. We take it as worst scenario, but with $3.40 level you will make a good profit, and of course if you have extra money and the price goes below $3.40 level, you can buy more ( Increase your profit ). Just don't worry and don't be hesitate of taking the decision. Remember, be bold.

NEXT UPTREND $5.40 FOR EOS/USD

SET BUY ORDERS ONE BY ONE TO $1.5 TO BE IN SAFE MODE

BE BOLD AND DON'T PANIC

DECIDE AND TRY TO MANAGE YOUR WALLET WITHOUT LOSING. HAPPY TRADING ;)

I WILL BE HAPPY IF YOU DO JOIN TO MY NEW CHANNEL t.me

CARDANO - CAN I DOUBLE MY INVESTMENT ADA/BTC?Yes, you can!

According to the next halving of Bitcoin, it will happen after ~ 185 days from now. Most of good Altcoins / BTC ( Good crypto projects ) will be increasing slowly. Cardano is one of good crypto projects for long-term investment. You might see the price down little bit to 460-410 sats levels, but eventually the trend will be reversing to 840 sats as first target.

NEXT UPTREND 840 SATS FOR ADA/BTC

SET BUY ORDERS ONE BY ONE TO 410 SATS LEVEL

DECIDE AND TRY TO MANAGE YOUR WALLET WITHOUT LOSING. HAPPY TRADING ;)

ETHEREUM - WILL THE PRICE RISE OR FALL?Downtrending = Buy opportunities

Let's make it clear. Ethereum is second generation of blockchain with +108 million as circulating supply at this time. According to weekly chart, ETH fallen hardly from $1400 level to $350 level to create a new support level at $350. That support level was the resistance level in the beginning of 2017 ( After the second halving of bitcoin, when it was on July 2016 ). The price fallen hardly again from $800 level to $90 level to create a second support level at $85. A few weeks ago, the price raise to $350 level to make " $350 " a new resistance level, YES ( Like what happened in the middle of 2017 ). WAIT... Does you mean, the history will repeat itself?! Nope, but expect the unexpected. So, what will happen? Now, we're below $250 level, for anyone bought at $200 level, DON'T SELL! Set buy orders with different prices to $85. You will not see ethereum below $50 level again. In the worst scenario, the price will down to where... $150, $100, $85 which it was the lowest support after $1400 level. The price will uptrend to $350 at least / USD or / BTC. Let's say, you bought 5 ETH at $200 and set a sell order at $350, you will make $750 net profit. If you buys 50/50 ( 2.5 ETH at $200 + 2.5 ETH at $150 ) and set a sell order at $350, you will make $875 net profit and so on.

SET BUY ORDERS ONE BY ONE TO $85 LEVEL

NEXT UPTREND WILL BE $350 FOR ETH

DECIDE AND TRY TO MANAGE YOUR WALLET WITHOUT LOSING. HAPPY TRADING ;)

BITCOIN - CAN I MAKE $6,500 IN 6 MONTHS?Yes, you can make $6,500 as profit from BTC. HOW?!

Everybody are waiting the next halving 2020 for selling their Bitcoins above $20k, $50k or $1 million.. whatever the price will be. I see $15k is totally fair price for the next halving 2020, as a new support level for next 3 years. The demand will be increasing, for sure we can't expect what will happen exactly, but we're trying to collect profit from lowest price. Most of traders and investors are hesitating, no... don't buy, wait the price will down again, no wait, wait... and what?! You missed the opportunity. ( Fortune favours the bold ) . Let's say, you have enough money to buy 1 BTC and don't sure what the price will be. Don't hesitate, set a buy order at $8,500 then set a sell order at $15k. Wait ~ 6 months from now ( ~ $1k per month as profit ). Be bold and don't panic. Once the order confirmed, congrats.. you made $6,500 as profit. What can I do, if I see the price goes below $8,500?! Don't worry, if you have extra money, buy more. You must have the feel of worry and see the price in lowest low. That's the price you pay in crypto market. Eventually, the price will uptrend to $15k.

NEXT UPTREND $15K FOR BTC/USD

SET BUY ORDERS ONE BY ONE TO $6K TO BE IN SAFE MODE

BE BOLD AND DON'T PANIC

DECIDE AND TRY TO MANAGE YOUR WALLET WITHOUT LOSING. HAPPY TRADING ;)

BTC HALVING VS LTC HALVING... AMAZING R:R HEREThere are less than 182 days to BTC halving.

Halving is a fundamentally bullish event because of supply cut off by %50.

IT MEANS cost of BTC doubling.

How much money to mine 1 BTC?

It depends on which city you are in, or what kind of setups are you using. All i know is BTC traded not below than $3170 at 2018 bear market.

After halving this price doubling up and no one even miners dont sell their BTC's under $6340. (From my perspective)

BTC trading @$8700 right now. It means risk is $8700-$6340 : $2360

Target is depends but i assume that we wil see at least local high again. Which is $14000 (My real bias is much higher than that but i am trying to be fair)

So reward is $14000-$8700 : $5300 for 1 BTC

R:R is 2.25

This is how i approach to halving event other than elliot wave theory.

Also you can see LTC halving period and you can compare them in 1 chart.

According LTC halving period we should not see BTC below than $7300. So new R:R turn to 3.79 :)

This is not a financial advice. Follow, share and like for more. Thanks.

Bitcoin weekly outlook 11/6/2019Just taking a quick look at the weekly zoomed out. It helps you gain perspective. I havent paid it any attention until now but the end of this triangle pattern is almost dead nuts with the halving. Not saying it will hit a million dollars after this. All I am saying is this is something we should all watch. The Halving occurs on May 14 2020 and that is when this triangle would end. Coincidence? Only time will tell... But WTFDIK?

Let's go back to the idea that "Today is October 1st, 2012!"I am on the weekly BLX chart because I need very old data. I want to get back to the idea that 2017-2019 cycle is not equivalent to 2013-2015, but to 2010-2012 one (Yes, it is not originally my idea and I am kinda sure you have already heard about it, but I want to work more on it here).

On a big time scale, I see two big cycles (orange lines in RSI chart) where each has two sub-cycles (green lines).

I think the parabolic run started in Feb2019 is the one we had in May2012 and we just completed it (see the arrows in RSI chart as well). The only difference is that in 2012 we bottomed on 21-WMA while in 2019 we bottomed on 100-WMA (Because we had stronger parabolic run from the bottom in 2019?? So, stronger correction?). I agree that the price pattern is not exactly matched but my point sees the overall/general/big-picture movement only.

I copied the price pattern from 2012, scaled the time and put it over 2019 cycle, how nice the pick of copied pattern matched with 2020 halving! (Again, forget about the price number, I am not saying we are heading 100K-200K!!). HOWEVER, there is one possibility that we go almost sideways (slightly upward) with some minor pumps and dumps till May 2020 and then the major bull run (I mean parabolic run) starts afterwards.

If this theory plays out well, then we probably have to major parabolic runs ahead, one in 2020 and one in 2021, like those we had in April2013 and Nov2013.

What do you think?

Cheers,

What To Expect After BTC Block Halving in 2020Hello my dear friends!

Today I am here to provide you with some insights regarding the Bitcoins block halving in May 2020 and how it will affect the overall Bitcoins performance on the market. I believe everybody should be aware of this so it is my pleasure to share this with you. The information below is constructed from various research articles and personal knowledge based from experience. Hope you enjoy the read, I promise not to waste your time!

On May 20th 2020, the third Bitcoin halving will occur. 50% less Bitcoins will be generated every 10 minutes and this could change the value of Bitcoin forever. The halving is an anti-inflationary function that “Satoshi Nakamoto” (creator/s of Bitcoin) put in place to make sure the value of bitcoin was never pushed down by the supply increasing too fast. This function is described in the white-paper. Block halving tends to have long-term positive effects on the price of Bitcoin (just like in previous halving’s). This is mainly due to supply and demand. If fewer bitcoins are being generated, the newly increased scarcity automatically makes them more valuable, but this doesn’t happen right away unfortunately.

After the first halving, bitcoin went from around $11 to around $1,100 and back down to $220. Second time, Bitcoin went from around $230 to around $20,000 and back down to around $4,000. So for the next halving, majority of people are expecting history to repeat itself, only this time, sending bitcoin to perhaps a six-digit price. The biggest changes in the crypto ecosystem this time, will be the higher public awareness around bitcoin and the interest of institutional investors (hedge funds, banks, pensions, etc.). Increased public awareness could also lead to a wave of FOMO buying, which could push the Bitcoins price higher. When more financial institutions begin taking big positions, it could affect bitcoin in ways investors have never seen before.

What does this mean for the Bitcoin Mining Industry:

The acceptance of cryptocurrency by retails, investments by large semiconductor companies in mining-specific hardware, and the increasing demand for equipment manufactured in China are the emerging trends expected to gain traction by 2022. These trends will further add to the growth of the cryptocurrency mining hardware market size during the forecast period. The global cryptocurrency mining hardware market is expected to grow over USD 2.2 billion between 2018-2022. In fact, over 50% of the market’s growth will come from Asia-Pacific as the region is witnessing steady growth due to the extensive adoption of blockchain technology and cryptocurrency.

When the block reward halves, the price per Bitcoin compensates along with it. We have seen this process occur after every halving. Mining is a self balancing machine seeking to always be in equilibrium. The increasing number of product launches are expected to trigger the market growth during the forecast period. Vendors are making significant investments in research and development for developing innovative technologies and new products. It is safe to assume that after the block halving, there will be a high chance of large influx of new miners on the network, ultimately pushing the Bitcoins price higher.

Bitcoin is still at it's very early stages of growth and unfortunately we have to be patient with seeing it reach its new higher highs. Although now may seem like the perfect opportunity to acquire bitcoin for long term holding, in my personal opinion we can still expect multiple draw downs of the price, perhaps even reaching down to the $6,000 support areas. Usually at the end of the year we see huge volatility in the overall cryptocurrency market, ultimately pushing the Bitcoins price to either direction, creating potential investment opportunities.

Hope you enjoyed the read!

Note: I am not a financial advisor and am not responsible for you placing any trades on the digital asset.

It can be called today: The Bitcoin BullRun has started! BullishOn the weekly Time Frame, You will notice this symmetrical triangle created by the 2017 XBT Explosion. Triangles are continuation patterns which means: since BTC was on a move up to create this triangle, let the price bounce around against the walls of the triangle for a bunch of months. Between mid fall to mid winter, Expect a bounce from 4K to 5K and then ultimately a 20K retest.

What this means is to find a good place to short this and then go long at the bottom and enjoy the ride. Be sure to take out profits on the way down and on the way up. The Bitcoin HALVING which is taking place in MAY 17, 2020, would provide a great catalyst to propel the price to at least 20k again.

Do not long until btc hits the bottom between 4k - 5k! There is a (blue) 786 Fibonacci line around $4800 which it should bounce of and can use it as support But be careful, because this could even wick to 2700. Layer in your longs and never go all in!