Gold Continues to Rise, Breaking ResistanceWeak US jobs data has increased expectations that the Fed will cut interest rates, weakening the USD and bond yields, making gold an attractive safe-haven asset. Gold has reached 3,371 USD, with US gold futures at 3,425 USD. Gold is currently facing resistance at 3,450 USD, and if broken, it could continue towards 3,500 USD.

The XAUUSD chart is moving within a clear uptrend channel with higher highs and higher lows. Gold has surpassed key support levels, including the Fair Value Gap (FVG), indicating strong buying momentum. The market is now testing the 3,450 USD resistance. If broken, the next target will be 3,500 USD.

Strategy:

Buy: If price breaks above 3,450 USD, aim for 3,500 USD.

Stop Loss: Place below 3,320 USD to manage risk.

Harmonic Patterns

Bitcoin (BTC/USDT) – Bearish Scenario Remains in Focus4H Chart Analysis – Structural + Price Action Insight

Bitcoin is currently trading inside a descending minor channel (orange), which is part of a larger complex correction pattern, potentially a contracting running flat or diametric in NeoWave context. The sequence A to G may suggest that the market completed its G-leg after bouncing off the lower support.

Now, BTC has reached the upper boundary of the orange channel, which aligns with a strong resistance zone around 116.8K–117K.

⸻

✅ Primary Scenario (Bearish Bias):

As long as BTC fails to break and sustain above 116,800 – 117,000, the current move can be interpreted as a pullback within the correction, with high probability of price heading back toward the green liquidity/support zone near 110,800 – 111,400.

This could be a continuation of the broader corrective structure, or even the beginning of a new downward cycle.

⸻

❗ Alternative Scenario:

If bulls manage to break above 117,000 with strong momentum and confirmation (e.g., breakout + retest), the structure may shift bullish with short-term targets near 118,500 – 120,000.

⸻

🎯 Key Takeaways:

• Watch price action closely at the current resistance zone.

• Bearish confirmation (e.g., bearish engulfing, rejection wicks, or supply absorption signs) is required before considering short entries.

• High R:R setups emerge near channel extremes with clear invalidation levels.

VELVET PERPETUAL TRADE ,Short from $0.10200VELVET PERPETUAL TRADE

SELL SETUP

Short from $0.10200

Currently $0.10

Stoploss $0.15

Targeting $0.08400 or Down

(Trading plan VELVET go up to $0.12

will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Its not a Financial advice

CETUS/USDT 3D — Awaiting a Major Decision at Key Support ZoneCetus Protocol (CETUS) is currently at a highly critical phase, trading just above a strong historical support zone that has repeatedly acted as a key price floor. The chart reveals a tight technical formation, signaling a potential for a significant move in the near term.

---

🔍 Technical Analysis:

Key Support Zone: $0.09000 – $0.10084

Price is currently testing a major demand area that has historically prevented deeper drops since mid-2023.

Ascending Trendline:

A medium-term trendline from 2023 remains intact, supporting a continued higher low structure.

Decreasing Volume:

Shrinking volume suggests the market is in a state of accumulation or awaiting a strong breakout catalyst.

---

🧩 Price Structure & Patterns:

Horizontal Consolidation above support → indicates potential accumulation phase.

Ascending Triangle Support (flat support + rising trendline) → this pattern is often a bullish continuation when followed by a breakout to the upside.

---

🐂 Bullish Scenario:

If price successfully bounces from the support zone, a step-by-step upward movement becomes likely, with the following targets:

Price Level Role Notes

$0.12067 Initial Resistance Minor rejection zone

$0.13967 Flip Zone Needs breakout confirmation

$0.16000 Mid-Range Resistance Key level for further upside

$0.18282 – $0.22329 Major Bullish Target Break above this signals trend recovery

$0.31809 – $0.41317 Long-term Resistance Potential full retracement zone

A clean breakout above $0.22329 with strong volume could signal a resumption of the long-term bullish trend.

---

🐻 Bearish Scenario:

If the price breaks down below $0.09000 and closes beneath the ascending trendline:

The higher low structure will be invalidated.

Potential downside targets:

$0.07000 (minor support)

$0.05500 – $0.04000 (psychological zones)

$0.02154 (historical low)

This would indicate a shift toward distribution and a broader bearish trend.

---

🧠 Suggested Trading Strategy:

🔁 Reversal Traders: Look for bullish candlestick confirmation (e.g., hammer, engulfing) at support zone.

💥 Breakout Traders: Wait for breakout and retest above $0.13967 before entering.

🛡️ Risk Management: Tight stop-loss below $0.09000, targets aligned with resistance levels.

---

📝 Conclusion:

CETUS/USDT is at a make-or-break level, sitting right above structural support and trendline confluence. A strong bounce here could offer a great risk-reward long opportunity, while a breakdown opens the door to further downside.

Patience and confirmation will be key.

#CETUSUSDT #CETUSProtocol #CryptoBreakout #TrendlineSupport #AltcoinAnalysis #ChartPattern #BullishSetup #BearishScenario #CryptoTechnicalAnalysis

COIN Gamma Storm Incoming!!!## 🚨 COIN Weekly Options Setup (Aug 7, 2025) 🚨

**Massive Call Flow vs. Bearish Momentum — Who Wins?**

> 🔍 Multiple AI models conflicted. Gamma risk rising. One day to expiry. Here's the trade...

---

### 🧠 Key Model Consensus (Across Grok, Claude, Llama, DeepSeek, Gemini):

✅ **Bullish Options Flow** from institutional players

📉 **Bearish Price Momentum** and RSI

⚠️ **High Gamma Risk** into expiration

🤔 **Signal Divergence** = Uncertainty + Volatility

---

### 🟩 **Bulls’ Case (Grok, Claude, Llama):**

* Oversold conditions + call buying = Rebound Setup

* Volume spike confirms institutional interest

* Moderate bullish lean with upside potential

### 🟥 **Bears’ Case (DeepSeek, Gemini):**

* Price action still weak

* Distribution pressure detected

* Recommending no trade or puts

---

### 📊 Trade Setup Summary

| Parameter | Value |

| -------------------- | ----------------- |

| 🎯 **Strike** | \$322.50 |

| 📅 **Expiry** | 2025-08-08 (1DTE) |

| 📈 **Direction** | CALL (LONG) |

| 💵 **Entry Price** | \$0.96 |

| 🎯 **Profit Target** | \$1.44 |

| 🛑 **Stop Loss** | \$0.57 |

| 📏 **Size** | 2 Contracts |

| 🔁 **Entry Timing** | Market Open |

| 🧪 **Confidence** | 65% (Moderate) |

---

### ⚠️ Risks to Watch:

* 1DTE = High volatility swings ⚡

* Momentum still leaning bearish 📉

* Gamma moves could trigger sharp reversals

---

📌 **Final Take**:

**Trade if you’re aggressive. Sit out if you’re cautious.**

This is a classic high-risk/high-reward setup driven by **options flow vs. price action divergence**.

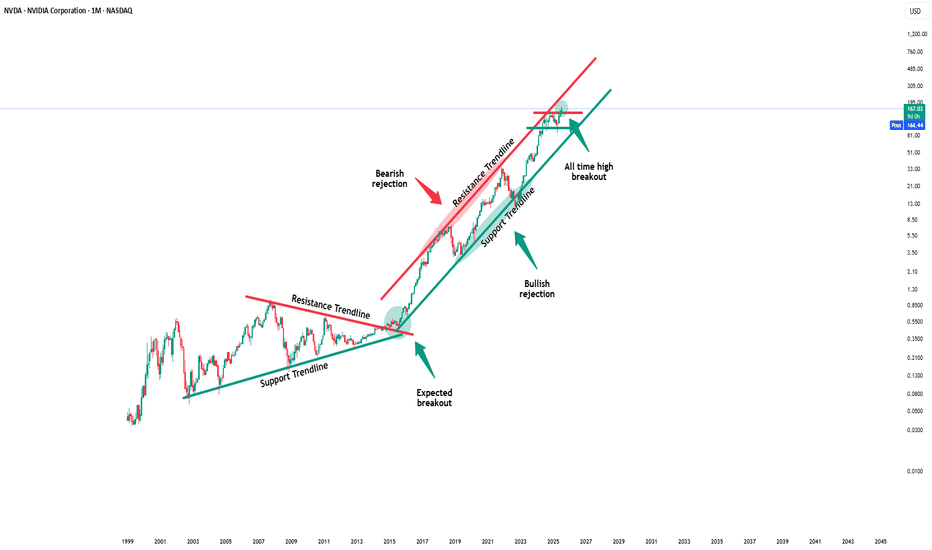

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will confirm the breakout:

🔎Analysis summary:

Over the past couple of months, Nvidia managed to rally about +100%, reaching top 1 of total market cap. Most of the time such bullish momentum just continues and new all time highs will follow. But in order for that to happen, Nvidia has to confirm the all time high breakout now.

📝Levels to watch:

$150

🙏🏻#LONGTERMVISION

SwingTraderPhil

TSLA Facing Key Resistance – Short Setup Targeting 301 SupportTesla is currently testing a key resistance area formed by the intersection of a descending trendline and a previously tested supply zone around 321.

Price action in this region may lead to a potential rejection.

**Forecast:**

If the rejection is confirmed, I expect a move toward the 301–300 support zone.

This area aligns with prior demand and a technical timing window from my harmonic model.

Trade idea based on trend structure, liquidity zones, and time-based forecast methodology.

📅 Watch price behavior around 321 for confirmation.

📉 Target: 301 support area

USDT Dominance – Diagonal Ending? | Wave F in Progress🔸 Market Structure:

Tether dominance is currently unfolding in a contracting diagonal (Diametric) formation, and we are now in wave F of the structure. Diagonals typically alternate in direction and converge toward a terminal point.

⸻

🔸 Key Observations:

• Price has rejected from the top of wave E

• Wave F is now unfolding as a corrective move down

• Two potential targets are identified for wave F completion

⸻

🔹 Scenario 1 (Sc1): 4.40%

• Short-term ascending trendline support

• Possibility of a shallow correction before another bounce

• Less ideal in terms of geometric balance of the diametric

🔹 Scenario 2 (Sc2): 4.28%

• Aligns with the lower boundary of the diametric pattern

• Converges near previous demand/resistance flip zone

• Better symmetry and structure for a completed wave F

• This scenario is currently more probable

⸻

🎯 Expected Path:

Wave F likely targets 4.28% before any significant bounce, aligning with a complete structure.

⸻

📌 Summary:

USDT dominance is likely in the final stages of a Diametric pattern. We’re watching for signs of completion around 4.28%, which aligns better structurally. A bounce from 4.40% is possible, but less favored unless strong bullish evidence appears.

PLTR: Temporal Patterns🏛️ Research Notes

The fact that price touched and reflected up from the curve that mimics exponential growth, forced me to focus on the precursors that could explain the geometry of such decisive move.

Let's strip the chart and document how exactly chronological chain of human emotions were progressing across vast cycles.

Essentially, the composite sub-cycles patterns are the same but stretched towards denser probability point. It's not just percentages that matter, but how it was structured on the way down. Evidently that was enough to trigger exponential growth. (BTW, since that super-bottom price is up 2950%)

So, that force made the time tick differently in the following bigger cycle. Manifests in frequency of reversals of sub-waves and changing scaling laws.

Particular parts of large curves with gradient of last reaction move can be connected to further express how two forces push the price toward some mutual angle.

Publishing interactive chart as low as 1h TF to observe in details.

Bitcoin will reach 128,000 points!Bitcoin is currently trading in a very specific zone that resembles a classic bull flag continuation pattern, similar to the one we saw during last year’s rally.

Back then, a slow-forming bull flag broke to the upside, pushed to new all-time highs, and then retested the top of the same flag before continuing higher.

Now, we are witnessing a similar setup, but this time the formation has developed much faster.

The key difference:

While last year’s bull flag took a longer time to mature, the current one is more compressed, indicating a potentially sharper move if confirmed.

The $108K daily level is critical.

As long as Bitcoin remains above this level, the structure favors a new rally.

This could be the start of another impulsive leg, targeting the $128K Area.

BTC – Bullish Breakout in SightBTC – Bullish Breakout in Sight

Bitcoin recently completed a bullish harmonic pattern near 112K, and the reaction was strong—showing that buyers stepped in around that level.

In just two days, BTC climbed by about 3.5%, reaching 115.7K—and it did so with relatively low trading volume, which highlights quiet but steady buying interest.

Right now, price is pausing between 113.7K and 115.7K, forming a possible accumulation zone.

If momentum picks up again, BTC could launch another bullish move toward:

🔹 116.8K

🔹 119K

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Is It Time for Altcoins to Dump? – OTHERS Dominance Final Wave As predicted in the last update, OTHERS.D reached the 7.20% demand zone precisely, showing a textbook reaction. The price has now rallied back toward the upper boundary of the descending channel and is testing the resistance area near 7.70%, where wave E likely completes within a Diametric structure (ABCDE).

This is a critical juncture: if rejected here, the next bearish wave could trigger an altcoin sell-off.

⸻

🔸 Market Structure:

• Diametric correction (ABCDE), with wave E likely terminating near 7.70%

• Price is testing the confluence of channel resistance and prior supply

🔸 Key Observations:

• Clear rejection signals are emerging around 7.70%

• No evidence of a sustained breakout yet

• Structure typically resolves with a deeper decline (wave F)

⸻

🔹 Scenario:

Base Case:

• Rejection from 7.70% supply

• Bearish continuation toward 7.20% demand

• Potential sweep down to 7.10–7.00% liquidity zone

Invalidation:

• Sustained breakout and acceptance above 7.80%

⸻

📌 Summary:

OTHERS.D is likely finalizing wave E. If this resistance holds, expect a bearish wave F and possible pressure on altcoins. Be cautious with heavy altcoin exposure until a confirmed breakout appears.

⸻

✅ Investment Strategy Selection:

Since declining OTHERS dominance = bearish for altcoins, you’d mark SHORT bias (expecting altcoin underperformance)

Bullish reversal?USD/JPY is reacting off the support level which is an overlap that aligns with the 78.6% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 147.06

Why we like it:

There is an overlap support level that lines up with the 78.6% Fibonacci retracement.

Stop loss: 145.83

Why we like it:

There is a multi-swing low support.

Take profit: 148.95

Why we like it:

There is a pullback resistance level that is slightly above the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

A great opportunity to sell gold!Gold Analysis Short and Medium Timeframe Elliott Wave Analysis Style The gold market has completed five upward waves and is currently at the end of the upward wave. Given the formation of the corner market pattern, it could enter a reversal and decline towards $3,333.

Could the Cable reverse from here?The price is rising towards the pivot and could reverse to the 1st support, which has been identified as a pullback support.

Pivot: 1.3472

1st Support: 1.3366

1st Resistance: 1.3590

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bitcoin (BTC/USDT) – RTM Reversal Pattern in Action🔸 Market Structure:

Bitcoin has formed a descending channel after a prolonged correction. Recently, price tapped the channel bottom and printed a CHoCH (Change of Character), indicating a potential reversal.

The price has now retraced to the left shoulder of a potential inverse head & shoulders pattern—an RTM classic structure—which held as support, suggesting bullish continuation.

⸻

🔸 Key Technical Signals:

• ✅ CHoCH confirmed at demand zone near $112,300

• ✅ Retest of the left shoulder validates bullish structure

• ✅ Holding above the internal bullish trendline

• ✅ Price aiming toward upper channel resistance

⸻

🎯 Target:

$116,200 – Top of the descending channel & next key resistance.

❌ Invalidation:

Break and close below $112,800 would invalidate the current RTM setup and open room for deeper correction.

⸻

📌 Summary:

This is a textbook RTM reversal:

CHoCH → Retracement → Left Shoulder Test → Continuation

As long as the structure holds, we remain bullish toward the channel top.

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to stay. The Ethereum ecosystem hosts thousands of projects; I’d say it’s too big to fail.

- i used Bitstamp exchange to look further back in the chart's history.

- i simplified this monthly chart so much that even a 10 year old kid could understand it, just check the RSI low levels and compare it with previous years. Again, check the max RSI level for the previous ATHs.

- i won't discuss where to buy because, whether you get ETH at $1,800 or $1,500, the bull run for ETH and Altcoins hasn't started yet.

Happy Tr4Ding !

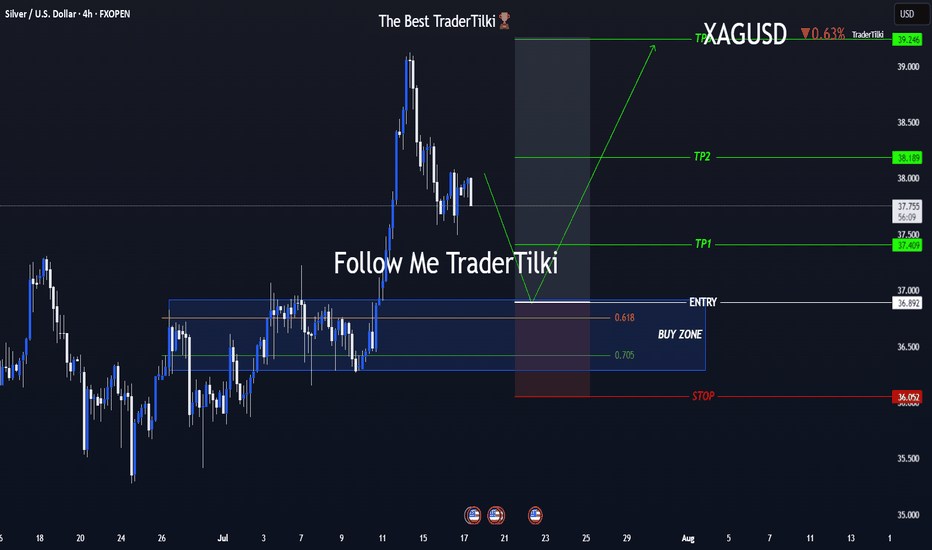

One Shot, Clear Strategy – Silver Buy Zone in SightHey everyone 👋

📌 BUY LIMIT ORDER / XAGUSD-SILVER Key Levels

🟢 Entry: 36,892

🎯 Target 1: 37,409

🎯 Target 2: 38,189

🎯 Target 3: 39,246

🔴 Stop: 36,052

📈 Risk/Reward Ratio: 2,79

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me! Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!