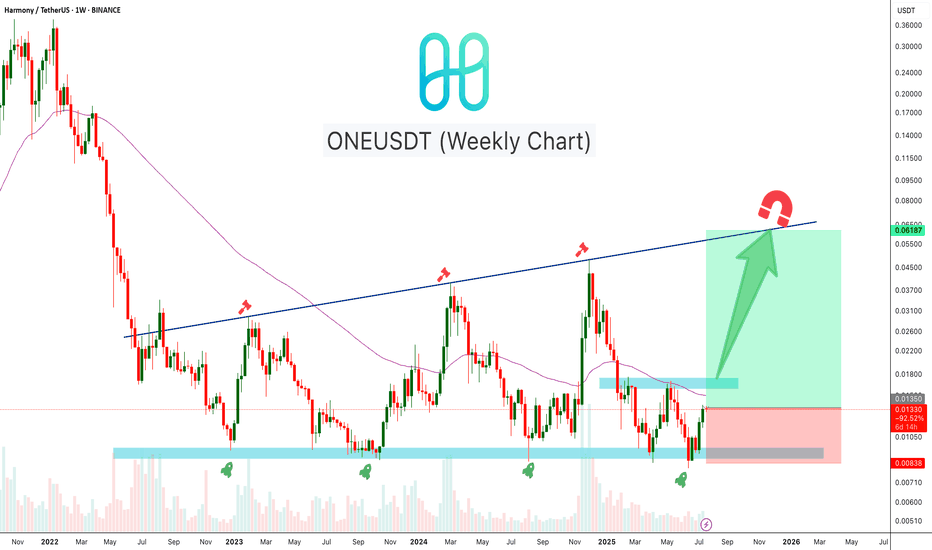

ONEUSDT Reversal BuildingONEUSDT is forming a strong base near the weekly demand zone around $0.009–$0.010, which has held multiple times over the past two years. The chart shows a clear accumulation pattern with higher lows forming. Price is now approaching the mid-range resistance near $0.017. If momentum continues, ONE may revisit the long-term trendline resistance near $0.065–$0.070.

Cheers

Hexa

Harmonyone

$ONE - HarmonyOne recovery will be EPIC, great devs/communityThey had a rough battle in 2021 after an incident that has been remediated but has strived to make things right with their Recovery ONE project. This was one of the most promising projects back then with insane transaction speeds and low fees. Looking very forward to where they go. This is my opinion only and should not be taken as investing advice. I do have a stake in HarmonyOne.

CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:ADA

ONE 900% potential BINANCE:ONEUSDT

Possible Targets and explanation idea

➡️Would like to see drop to 0.5 of M FVG

➡️After retest of FVG we can see uptrend to First M Bullish FVG around 900%

➡️On Monthly timeframe ADZ indicator in biggest accumulation stage ever

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

$ONE Break Out downtrend lineBINANCE:ONEUSDT

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets

➡️Marked 2 zones. Buyers zone green box, with strong support level since 2021

➡️Broke downtrend line since April (November was just double top and fake out)

➡️Next local possible target minimum 0.045 and if we will see good volume we can test even 0.08 price target

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

ONEUSDT Signals Trend ReversalONEUSDT Technical analysis update

ONEUSDT has been trading within a channel for the last 150 days, which is considered an accumulation stage. We can see high volume as the price moves toward a breakout, and today, the price has crossed the 200 EMA. This is considered a strong bullish signal, indicating a potential trend change to bullish.

Regards

Hexa

ONEUSDT Bullish Breakout After 150 DaysONEUSDT Technical analysis update

BINANCE:ONEUSDT has formed a parallel channel at the bottom, and the price broke the channel resistance line with high volume on the daily chart. The price is trading above both the 100 and 200 EMAs, confirming a trend change. This breakout occurred after 150 days of a ranging market

BINANCE:ONEUSD

Harmony One TP zones approaching Bull run 2024-25Looking for Harmony One to complete the top of cup pattern edge here to reach TP1. Showing considerable strength as we approach the end of the year. Looking for continuation.

HARMONY ONE - TRADE PLAN + TECHNICAL ANALYSIS Technical analysis and trading plan for Harmony (ONE) cryptocurrency.

Technical Analysis

Ascending Channel: The price is moving within an ascending trading channel, indicating a bullish trend. This channel provides both support and resistance levels.

Current Resistance Levels:

Primary resistance is around 0.01528. A break above this could signal further bullish momentum.

Secondary resistance around 0.01800, which aligns with the upper limit of the anticipated channel and is a key psychological level.

Support Levels:

Immediate support is around 0.01363, providing a cushion if the price retraces.

Additional support is observed at 0.01287, acting as a lower boundary if the bullish channel is broken.

Volume Analysis:

The volume appears to be increasing alongside upward price movement, which is typically a positive sign for sustaining bullish momentum.

Indicators:

VMC Cipher B: Shows bullish divergences, supporting further upward movement. However, a close eye on divergences is necessary to anticipate potential trend reversals.

RSI: Currently around 63.64, indicating a mildly overbought condition but with room for further upside.

Stochastic Oscillator: Around 69.85, approaching overbought levels; this could signal a short-term pullback.

HMA (Hull Moving Average): The histogram is neutral to slightly bearish, suggesting caution as momentum could slow down.

Trading Plan

Entry:

Consider entering a long position if the price holds above the current support level of 0.01363 and begins to show upward momentum.

Alternatively, an aggressive entry can be made if the price breaks above 0.01528 with a retest, confirming a bullish continuation.

Targets:

First Target: 0.01528 (short-term resistance).

Second Target: 0.01800 (upper boundary of the ascending channel).

Stop-Loss:

Place a stop-loss slightly below 0.01363 if entering at this level or at the lower boundary of the ascending channel.

For a more conservative stop-loss, consider 0.01287 as a threshold, indicating a potential trend reversal if breached.

Exit Strategy:

Consider partial profit-taking at the first target level to secure gains, and adjust the stop-loss to break-even to manage risk.

If the price reaches the second target and there is no sign of bearish divergence or weakening volume, hold a portion of the position for further upside.

Risk Management:

Manage position size to ensure the risk per trade does not exceed your pre-determined threshold.

Regularly monitor the volume and indicators (especially RSI and Stochastic) for signs of a potential reversal.

This analysis suggests that while Harmony (ONE) is in a bullish channel, careful attention should be paid to the resistance levels and indicators to manage potential pullbacks.

HARMONY ONE TECHNICAL ANALYSIS AND TRADE PLANE BY BFTechnical Analysis (4-hour chart) + TRADE PLAN by BF

Pattern Identification:

Falling Wedge Formation: The price is moving inside a falling wedge, typically considered a bullish reversal pattern. The wedge has defined support and resistance lines converging as the price moves downward, indicating potential upcoming breakout to the upside.

Key Support and Resistance Levels:

Support Level: Around $0.01287, highlighted as a solid base where buyers have historically stepped in.

Resistance Level: Around $0.01528, marking a level where sellers may become more aggressive. This is a significant target if the wedge breaks to the upside.

Volume Analysis:

The volume seems to have been decreasing as the price has been moving within the wedge, which is common before a breakout. A surge in volume will be a strong confirmation of any potential breakout.

Indicators:

VMC Cipher_B Divergences: There are green dots visible at the bottom, indicating possible bullish divergences. These divergences suggest price momentum weakening on the downside, aligning with the falling wedge’s bullish potential.

RSL (Relative Strength Level): The current value is 38.54, below the neutral 50 mark, which indicates bearish momentum. However, it's near the oversold territory, and any uptick from here could support a reversal.

Stochastic RSI: At 5.65/8.79, indicating that the asset is in an oversold condition. This adds to the potential for a bullish reversal once the stochastic begins to turn upwards.

HMA+ Histogram: The current histogram shows a shift toward a neutral or slightly bullish sentiment. The transition from red to green would be a strong indicator to enter long positions.

Time and Potential Breakout Catalyst:

There is a clock icon indicating a potential timing window, which may suggest that the breakout could be imminent. The combination of indicators and the falling wedge pattern suggests that a bullish move could be expected soon.

Trading Plan:

Long Scenario:

Entry Point: A breakout above the wedge's resistance line and a confirmation above $0.01365 with a strong increase in volume.

First Target: $0.01528 (immediate resistance level). This would likely be a conservative target as it corresponds to previous highs and the upper boundary of the range.

Second Target: If the momentum continues strongly, the price could test the next level near $0.01600.

Stop Loss: Place a stop loss below the current support at around $0.01250, to limit downside risk in case of a false breakout.

Short Scenario (Alternative if Breakout Fails):

Entry Point: If price breaks down below $0.01287 and volume increases on the downside.

Target: Look for a decline towards $0.01200, which is a psychological round number and could act as support in a bearish scenario.

Stop Loss: Above $0.01350, as a recovery above this level could negate the bearish breakdown.

Risk Management:

Risk no more than 1-2% of your trading capital per trade.

Wait for clear confirmations such as volume spikes or candlestick pattern validation before entering trades.

Harmony (ONE) is showing signs of potential bullish reversal with the falling wedge pattern supported by multiple indicators pointing towards oversold conditions. However, waiting for a breakout confirmation is essential before entering long positions. Proper risk management and trade discipline should be applied to navigate potential volatility.

Harmony one is going up! Technical analysis + trade plan by BFChart Overview

Timeframe: 4-hour (Binance Exchange)

Price as of Analysis: $0.01346

Volume: 3.744 million ONE

Formation: Falling Wedge pattern

Chart Patterns and Indicators:

Falling Wedge:

A falling wedge pattern is typically a bullish reversal pattern, indicating that the current downward trend is weakening and a potential breakout to the upside could follow.

The narrowing of price action shows a decline in both support and resistance levels, with lower highs and lower lows.

The breakout is anticipated above the wedge resistance, potentially marking the beginning of an uptrend.

The VMC Cipher B indicator is similar to the MACD and shows signs of bullish divergence, meaning that while the price has been declining, momentum is building for a potential reversal.

The RSI is hovering around 50.25, which is neutral but can indicate momentum is shifting. If RSI starts increasing above 55, it will confirm bullish momentum.

Stochastic Oscillator is currently at 35.30, this shows the asset is near the oversold zone but still in neutral territory. A move above 40 may confirm a bullish trend reversal.

The HMA histogram shows early signs of turning bullish as the color changes and bars are in the process of shifting positive.

Volume has decreased over the wedge formation, which is typical of such patterns. An increase in volume after the breakout will serve as confirmation for a stronger upward move.

Potential Price Targets:

Immediate Resistance: $0.01360 - This is the wedge resistance. A breakout above this level confirms the pattern.

First Target: $0.01550 - Based on previous price levels, this area is the next resistance once the breakout occurs.

Second Target: $0.01750 - This aligns with the previous significant high and could be a target after the first resistance.

Risk Factors:

Stop-Loss: It’s crucial to place a stop-loss below $0.01200 (below the previous support levels) to manage risk in case of a false breakout.

Volume Confirmation: Ensure that the breakout occurs with significant volume, as low-volume breakouts may lead to a reversal back into the wedge.

Trading Plan

1. Entry:

Enter a long position after a confirmed breakout above the $0.01360 resistance with strong volume confirmation. A 4-hour candle close above this level should confirm the breakout.

2. Stop-Loss:

Place a stop-loss slightly below $0.01200 to manage the downside risk in case the falling wedge pattern fails and the price reverses.

3. Profit Targets:

First Target: Set a take-profit around $0.01550 to capture the first major move after the breakout.

Second Target: For those with a higher risk appetite, target $0.01750, which aligns with the next resistance.

4. Position Size:

Risk only 1-2% of your trading capital on this trade. Given the potential volatility and the falling wedge pattern, it's essential to manage position size conservatively.

5. Monitoring:

Keep an eye on the volume and the RSI/Stochastic Oscillator. If RSI rises above 55 and Stochastic confirms the upward movement, the breakout should gain more strength.

Monitor for any potential fake breakouts. If the price fails to close above the resistance on the 4-hour chart, consider delaying the entry until clear confirmation is given.

The Harmony (ONE/USDT) chart is showing a potentially bullish falling wedge formation, indicating that a reversal from the recent downtrend could occur soon. A breakout above $0.01360 with confirmed volume is crucial for confirming the uptrend. If confirmed, Harmony could target $0.01550 and $0.01750 in the near term, but it's important to employ tight risk management through proper stop-loss placement.

Technical analysis and trading plan for the ONE/USDT by BFTechnical analysis and trading plan for the ONE/USDT 1-hour chart (on Binance) by Blaž Fabjan

Descending Trading Channel:

The price is currently moving within a descending trading channel, with lower highs and lower lows. This is a bearish pattern but can lead to a bullish breakout when the price breaks the upper boundary (resistance line).

The price is testing the upper boundary of the channel, which, if broken, could signal a potential upward movement.

Resistance Line:

A key resistance line is visible near 0.0120 USDT. The price has struggled to break above this level in previous attempts.

A breakout above this level with significant volume could signal a trend reversal and potential bullish momentum.

Indicators:

VMC Cipher B Indicator: Showing potential bullish momentum building up as the red momentum wave has bottomed out, signaling a possible trend reversal.

RSI (Relative Strength Index): Currently at 54.30, indicating that the market is neutral but leaning slightly bullish. It’s above the 50 line, which suggests a shift from bearish to bullish sentiment.

Stochastic RSI: Near the overbought zone, sitting at 84.47. This could mean that there might be a small correction before the price pushes higher.

HMA+ Histogram: Shows neutral sentiment, suggesting no strong trend currently. But with a bullish setup on other indicators, this could shift positively.

Volume:

Volume is moderate at 1.879M, and increasing volume during the breakout would provide confirmation of upward movement.

Trading Plan:

Bullish Scenario (Breakout Trade):

If the price breaks out above the resistance level of 0.0120 USDT with an increase in volume, this could signal a strong move upward.

Entry Point: Buy at the breakout above 0.0121 USDT with confirmation (strong bullish candle close above the resistance line and higher volume).

Target 1: 0.0140 USDT (short-term resistance).

Target 2: 0.0150 USDT (next major resistance).

Stop Loss: Set a stop loss below 0.0110 USDT (below the previous low and support of the descending channel).

Bearish Scenario (Rejection at Resistance):

If the price fails to break above the 0.0120 USDT resistance level and reverses, it could move back into the descending channel.

Entry Point: Consider shorting if the price rejects the resistance and starts to move lower, below 0.0118 USDT.

Target 1: 0.0110 USDT (previous support level).

Stop Loss: Above 0.0122 USDT (in case of a sudden bullish breakout).

Consolidation Scenario:

If the price consolidates between 0.0115 - 0.0120 USDT, wait for a clear breakout either upwards or downwards before entering a trade.

Risk Management:

Consider using a risk-reward ratio of at least 1:2 for your trades.

Position sizing should be managed to avoid overexposure. Only risk a small percentage of your portfolio on each trade.

This plan provides both bullish and bearish scenarios, with specific entry, exit points, and risk management strategies. Always ensure you monitor the price action and volume to confirm breakouts or rejections.

Harmony (ONE/USDT) technical analysis and trading plan.Harmony (ONE/USDT), technical analysis and trading plan by Blaž Fabjan:

Price Channel:

The price is moving within a rising channel, marked by support and resistance lines.

The price is currently near the lower part of the channel (support zone), which suggests potential upside movement if the support holds.

Volume:

There's a visible increase in volume, especially around the recent moves to the downside. This could indicate some volatility and buyer/seller activity.

Keep an eye on whether the volume increases near the support area for a confirmation of buying interest.

Indicators:

VMC Cipher B Divergences:

The green dots at the bottom may suggest some bullish divergence, meaning that the price could bounce from this support level.

RSI (Relative Strength Index):

RSI is around 50, suggesting the market is neutral but possibly gearing up for a momentum shift. A move above 60 could confirm bullish strength.

Stochastic RSI:

Stochastic RSI is currently near oversold levels (below 20) and showing signs of a potential upward crossover, which usually signals a buy opportunity.

Support & Resistance:

The support line of the ascending channel acts as the immediate buy zone.

Resistance is around the upper channel limit, which could be a take-profit target.

Upward Projection:

The blue arrow shows a bullish trend, with price potentially moving upward toward the resistance of the channel.

If the price breaks above this channel, we could see further bullish continuation.

Trading Plan:

Entry Point:

Consider entering a long position near the support line (around $0.0135–$0.0140) within the price channel.

Look for confirmation signals such as increasing volume and bullish divergence on the indicators (especially RSI moving above 50 and Stochastic RSI crossover).

Take-Profit Targets:

Target 1: At the resistance line of the channel around $0.0160–$0.0165.

Target 2: If price breaks above the channel, set an additional take-profit around $0.0180 as indicated by the upward projection.

Stop Loss:

Place a stop-loss just below the channel’s support, around $0.0130. This level ensures protection against a breakdown of the current uptrend.

Risk Management:

Use proper position sizing, risking only 1–2% of your capital per trade.

Trailing stop-loss could be employed if the price continues to move in your favor.

Watch for Confirmation:

Ensure RSI and Stochastic RSI both signal momentum shift, and volume should accompany any move upwards for confirmation of the trend.

By following this technical setup, you can navigate the current market conditions for Harmony (ONE/USDT) efficiently.

Technical Analysis of Harmony (ONE/USDT) BY BLAŽ FABJANTechnical Analysis of Harmony (ONE/USDT) BY BLAŽ FABJAN

Chart Pattern:

Falling Wedge Pattern: The chart shows a classic falling wedge pattern, which is a bullish reversal pattern typically indicating the end of a downtrend and the potential beginning of an upward move. This pattern is characterized by a contracting range between support and resistance lines, with the price eventually breaking out above the resistance line.

Current Price Action:

Entry Point & Stop Loss: The chart suggests an entry point around the current price level with a stop loss slightly below the recent low. This aligns with a strategy to enter a trade after a breakout from the falling wedge pattern.

Volume Analysis: The volume appears to be decreasing during the formation of the wedge, which is typical in such patterns. A surge in volume upon the breakout would confirm the bullish sentiment.

Indicators:

VMC Cipher B Divergences: The indicator below the chart suggests a positive divergence, meaning the momentum could be shifting from bearish to bullish, further supporting the potential upward movement.

RSI (Relative Strength Index): The RSI is hovering around the 50 mark, indicating a neutral zone. The RSI is likely to push higher if the price continues upward, confirming bullish momentum.

Stochastic RSI: The Stochastic RSI appears to be in the oversold region and is crossing upward, which typically signals a potential entry for a long position.

Trading Plan:

1. Intraday Trading:

Entry: Enter a long position at the current price level around $0.01130 after confirmation of the breakout.

Target: Look for a quick target around $0.01250 to $0.01300, which aligns with previous resistance levels.

Stop Loss: Place a stop loss slightly below the entry, around $0.01050, to protect against downside risk.

Exit Strategy: Monitor the trade closely. If the price struggles to break above $0.01250, consider closing the position to secure profits.

2. Scalping:

Entry: Enter long on minor dips around the support line near $0.01120 to $0.01100.

Target: Set tight profit targets at $0.01160 and $0.01190.

Stop Loss: Use a very tight stop loss, around $0.01100, to limit potential losses.

Exit Strategy: Quick exits are essential in scalping. If momentum slows or reverses, exit immediately to secure gains.

3. Swing Trading:

Entry: Enter a long position around the current level, confirming the wedge breakout.

Target: Target a swing move towards $0.01400 to $0.01500, where the next major resistance is expected.

Stop Loss: Place a stop loss below the recent low, around $0.01000, to account for potential volatility.

Exit Strategy: Hold the position as long as the price continues to trend upwards. If there is a significant rejection at the target levels, consider taking profits.

Conclusion and Advice for Long Position:

Bullish Bias: The chart indicates a bullish bias with a strong potential for upward movement, especially after the breakout from the falling wedge pattern. The RSI and Stochastic RSI also support this outlook.

Advice: For a long position, consider entering now with a target towards $0.01400 or higher. However, it's crucial to maintain a disciplined approach with proper stop-loss settings to protect against potential downside risks.

Risk Management: Ensure proper risk management by not over-leveraging and sticking to the stop-loss levels. The market can be volatile, so staying cautious while capitalizing on the potential uptrend is key.

Harmony (ONE/USDT) on the 1-hour timeframeTechnical Analysis by Blaž Fabjan

Price Action:

The price is currently trading around 0.00928 USDT, showing a slight decline.

The chart indicates a possible downtrend that has been ongoing, but there is a blue arrow suggesting a potential bullish reversal.

Support and Resistance Levels:

Several resistance levels are marked in orange bands, indicating potential selling zones as the price moves up.

The nearest support level is around the current price, with historical data suggesting that price action has interacted with this level multiple times.

Volume:

The volume is relatively steady, with a recent uptick suggesting some buying interest at lower levels.

Indicators:

WMG Cipher & Divergences: Shows a mix of signals, but the green dots at the bottom indicate potential bullish divergence, suggesting a possible upward movement.

RSI (Relative Strength Index): The RSI is at 26.78, which is in the oversold territory, suggesting a potential bounce or reversal.

Stochastic RSI: The Stochastic RSI is also in the oversold area, with a value of 31.87, suggesting the market may be due for a bullish correction.

Overall Sentiment:

The chart suggests a possible end to the bearish momentum with signs of potential bullish reversal. The combination of oversold RSI and Stochastic RSI, along with bullish divergence signals, supports this view.

Trading Plan:

Intraday Trading:

Strategy: Look for a potential bounce from current levels. If the price action shows a bullish reversal pattern (like a hammer or bullish engulfing), consider entering a long position.

Entry Point: Around 0.00928 USDT or slightly above after confirmation of reversal.

Stop Loss: Set a stop loss just below the recent low or below 0.00900 USDT to protect against further downside.

Take Profit: Consider taking profit near the first resistance level around 0.01000 USDT.

Scalping:

Strategy: Capitalize on small price movements within the range.

Entry Point: Enter long positions on pullbacks or near support levels.

Stop Loss: Use tight stop losses, such as 0.00915 USDT.

Take Profit: Aim for quick exits at minor resistance levels, such as 0.00950 USDT or 0.00970 USDT.

Scalping Tips: Monitor the market closely and exit positions quickly when resistance levels are reached or momentum slows.

Swing Trading:

Strategy: Take advantage of the potential medium-term reversal.

Entry Point: Enter a long position if the price confirms a break above the downward trendline and sustains above 0.00950 USDT.

Stop Loss: Set a wider stop loss below the major support level, such as 0.00900 USDT, to allow for price fluctuations.

Take Profit: Target higher resistance levels, such as 0.01100 USDT or 0.01250 USDT, based on the resistance bands.

Conclusion and Advice:

For Long Positions: The indicators suggest a potential bullish reversal, but confirmation is crucial. Wait for clear signs of a reversal before entering a long position. The overall sentiment leans towards a recovery, but risk management is essential.

Risk Management: Use stop losses to protect capital, and consider scaling into positions gradually rather than committing full capital at once.

Advice: Keep an eye on volume and market sentiment for additional confirmation. Be prepared for potential volatility, especially near resistance levels, and adjust your strategy accordingly.

Technical Analysis of Harmony (ONE/USDT)Technical Analysis of Harmony (ONE/USDT)

The chart shows the 4-hour timeframe for Harmony (ONE/USDT) with various technical patterns and indicators highlighted:

Head and Shoulders Pattern:

A clear Inverse Head and Shoulders pattern is identified, with the left shoulder, head, and right shoulder marked.

This pattern generally indicates a potential reversal from a downtrend to an uptrend.

Triangle Pattern:

A descending triangle is noted before the formation of the right shoulder, indicating consolidation before a potential breakout.

Resistance and Support Levels:

Multiple resistance zones are highlighted in orange.

Key support levels are noted, particularly around 0.012 USDT.

Volume:

Volume patterns should be watched closely, especially during breakout attempts.

Indicators:

VMC Cipher B: Shows divergences and potential momentum shifts.

RSI (Relative Strength Index): Currently around 50.97, suggesting neither overbought nor oversold conditions.

Stochastic Oscillator: Showing values of 57.69 and 64.49, indicating moderate momentum.

Trading Plan

Intraday Trading

Entry: Look for a break above the neckline of the Inverse Head and Shoulders pattern around 0.0148 USDT.

Target: First target is the immediate resistance level around 0.0160 USDT, followed by the next resistance at 0.0180 USDT.

Stop-Loss: Place a stop-loss just below the right shoulder, around 0.0130 USDT.

Indicators to Watch: Monitor the RSI and Stochastic for overbought conditions, and the volume for confirmation of the breakout.

Scalping

Entry: Enter on short-term momentum shifts indicated by the Stochastic oscillator crossing above 60.

Target: Small targets around 0.001 - 0.002 USDT above the entry point.

Stop-Loss: Tight stop-loss around 0.0005 USDT below the entry to manage risk.

Indicators to Watch: Stochastic oscillator and VMC Cipher B for quick momentum changes.

Swing Trading

Entry: After confirmation of the breakout above the neckline of the Inverse Head and Shoulders pattern and retesting of support.

Target: First target at 0.0220 USDT as per the extended arrow, with a long-term target at 0.0240 USDT.

Stop-Loss: Below the right shoulder, around 0.0130 USDT.

Indicators to Watch: Look for sustained RSI above 50 and increasing volume to confirm the trend.

Advice for Long Position

The chart suggests a potential bullish reversal indicated by the Inverse Head and Shoulders pattern.

A breakout above the neckline around 0.0148 USDT would be a strong confirmation for a long position.

Monitor key resistance levels at 0.0160, 0.0180, and 0.0220 USDT.

Ensure risk management with appropriate stop-loss levels and keep an eye on volume and momentum indicators for confirmation.

Given the current market conditions, entering a long position upon the breakout with close monitoring of resistance levels can be considered a viable strategy.

Technical Analysis of Harmony ONE/USDTTechnical Analysis of Harmony ONE/USDT

Chart Patterns:

Falling Wedge: There is a prominent falling wedge pattern indicating a potential reversal. The price is nearing the apex of the wedge, suggesting an impending breakout.

Rectangle and Triangle: Within the larger pattern, there are smaller formations like a rectangle and a triangle that hint at periods of consolidation and breakout opportunities.

Support and Resistance Levels:

Immediate Support: Around 0.00863 USDT, as marked on the chart.

Immediate Resistance: Approximately at 0.01000 USDT.

Target Zones: Multiple target zones are marked, indicating potential price levels to watch for after a breakout. These zones range from 0.015 to 0.035 USDT.

Indicators:

VWMC Cipher B Divergences: Suggests potential bullish divergence, indicating a possible upward movement.

RSI (Relative Strength Index): Currently around 22.23, which is in the oversold territory, suggesting a potential upward correction.

Stochastic RSI: Also in the oversold territory, reinforcing the RSI signal.

Trading Plans

Intraday Trading

Entry Point: Look for a breakout above the immediate resistance at 0.01000 USDT. Confirm this with increasing volume.

Stop Loss: Place a stop loss just below the support level at 0.00863 USDT.

Target: Initial target at 0.015 USDT. Adjust stops to break even once the price reaches halfway to the target to secure profits.

Scalping

Entry Point: Enter trades at small retracements within the larger patterns. For example, when the price dips towards the lower boundary of the triangle or rectangle.

Stop Loss: Tight stop loss around 1-2% below the entry point to minimize losses.

Target: Small gains around 2-3% per trade. Exit positions quickly to lock in profits, considering the high volatility of scalping.

Swing Trading

Entry Point: Enter long positions at the lower boundary of the falling wedge pattern or on confirmation of a breakout above the wedge.

Stop Loss: Place a stop loss below the recent swing low, which is around 0.00863 USDT.

Target: Longer-term targets based on the marked target zones, aiming for 0.020 USDT and 0.025 USDT. Trail stops to protect profits as the price moves in favor.

Conclusion and Advice for Long Position

Given the current technical setup, Harmony ONE/USDT appears to be at a critical juncture. The falling wedge pattern combined with oversold indicators (RSI and Stochastic RSI) suggests a high probability of a bullish breakout.

Advice:

Patience is Key: Wait for confirmation of a breakout above 0.01000 USDT with strong volume before entering a long position.

Risk Management: Always use stop losses to protect against unexpected market moves.

Monitor Indicators: Keep an eye on RSI and Stochastic RSI for potential overbought signals as the price moves higher, indicating potential exit points.

Long-Term Position:

Consider building a long-term position if the price breaks and holds above 0.01000 USDT with significant volume, targeting higher resistance levels as marked on the chart.

This analysis provides a comprehensive approach to trading Harmony ONE/USDT across different strategies. Always adapt your trading plan based on real-time market conditions and updates.

Technical Analysis of Harmony (ONE/USDT) on Binance Technical Analysis of Harmony (ONE/USDT) by Blaž Fabjan

Chart Overview

Harmony (ONE/USDT) on a 4-hour timeframe. The following key technical elements are observed:

Descending Triangle Pattern:

A descending triangle pattern is visible, characterized by a series of lower highs and a horizontal support line around the 0.01380 USDT level. This pattern is often seen as a bearish continuation pattern, but it can also lead to a bullish breakout.

Volume:

The volume is displayed at the bottom, showing a recent spike which may indicate increasing interest and potential for a breakout.

Indicators:

WMG Cipher B Divergences: Shows multiple divergences indicating potential bullish reversals.

RSL (Relative Strength Line): Currently at 36.07, suggesting the market is nearing oversold conditions.

Stochastic Oscillator: At 5.88, indicating the market is in an oversold condition, which could suggest a potential upward movement.

Trading Plan

1. Intraday Trading

Entry: Look for a breakout above the descending triangle's resistance line at approximately 0.01420 USDT with a confirmation candle on the 15-minute chart.

Stop Loss: Place a stop loss just below the recent swing low at 0.01370 USDT.

Take Profit: Initial target at the previous resistance level around 0.01500 USDT. Adjust stop loss to breakeven if price reaches 0.01460 USDT.

2. Scalping

Entry: Enter trades at support and resistance levels within the triangle, focusing on quick in-and-out trades.

Support Levels: 0.01380 USDT

Resistance Levels: 0.01420 USDT

Stop Loss: Tight stop loss of 0.001 USDT below the entry point.

Take Profit: Aim for small, consistent profits of 0.002 USDT per trade.

3. Swing Trading

Entry: Wait for a confirmed breakout above the descending triangle at 0.01420 USDT on the 4-hour chart.

Stop Loss: Place a stop loss below the breakout point at 0.01380 USDT.

Take Profit: Set initial target at 0.01600 USDT and a secondary target at 0.01800 USDT. Use a trailing stop loss to lock in profits as the price moves in favor.

Conclusion and Advice

Given the current chart patterns and indicators, a long position could be considered if a confirmed breakout above the descending triangle at 0.01420 USDT occurs. The oversold conditions indicated by both the RSL and the Stochastic Oscillator support the potential for a bullish reversal. However, traders should be cautious and watch for a confirmation of the breakout to avoid false signals.

Advice for Long Position:

Patience is key: Wait for a confirmed breakout and avoid entering positions prematurely.

Risk Management: Ensure proper stop loss placement to mitigate risks.

Volume Confirmation: Watch for an increase in volume to confirm the breakout.

In summary, Harmony (ONE/USDT) shows potential for a bullish move, but confirmation and proper risk management are crucial for successful trading.

Harmony potential scenario for long-termHarmony is down almost 96% from its ATH and is forming a decent inverse H&S pattern on the HTF. The second shoulder is about to form due to a correction that started in March 2024. The main support for ONE is at $0.01, with the main target at $0.1682 and an optimistic target at $0.98! Let's see how it goes. DYOR

Technical Analysis of Harmony (ONE/USDT) by Blaž FabjanTechnical Analysis of Harmony (ONE/USDT) by Blaž Fabjan

The chart of Harmony (ONE/USDT) shows a falling wedge formation, indicating a potential trend reversal and possible price increase. I will analyze various indicators and identify good entry and exit points for intraday and swing trading.

Indicator Analysis

Volume: Currently, the volume shows a slight increase, which could support a trend reversal if accompanied by further volume growth.

Market Cipher B: This indicator shows divergences, suggesting a possible trend change. We observe green dots, usually a signal for potential upward movement.

RSI (14, close): The RSI is at 46.06, indicating a neutral state. It is not in the oversold territory (below 30), which would suggest a potential upward reversal, but it is in the lower half, indicating a possible trend reversal upwards.

Stochastic RSI (14, 1, 3): The Stochastic RSI is at 86.15, indicating overbought conditions, which could mean a short-term pullback before the trend reverses upwards.

Intraday Trading

Entry Points:

At the current price (around 0.01560 USDT), when volume starts to increase.

At the support line of the wedge (approximately 0.01520 USDT), if retested.

Exit Points:

First resistance level (around 0.01680 USDT).

Second resistance level (around 0.01850 USDT).

Swing Trading

Entry Points:

Upon breaking out of the wedge upwards (around 0.01600 USDT), confirmed by higher volume.

At the current price (around 0.01560 USDT), with confirmation from indicators (e.g., green dots on Market Cipher B).

Exit Points:

First resistance level (around 0.01850 USDT).

Second resistance level (around 0.02000 USDT).

Third resistance level (around 0.02200 USDT), if the trend is strong.

Conclusion

The chart shows potential for a trend reversal due to the falling wedge formation. It is essential to monitor indicator confirmations and volume for entry and exit points. Intraday traders should pay attention to short-term fluctuations and rapid volume changes, while swing traders can aim for larger gains upon confirmation of the trend reversal.

Harmony (ONE) completed a setup for upto 20.50% pumpHi dear members, hope you are well and welcome to the new trade setup of Harmony (ONE) coin with US Dollar pair.

Previously we caught more than 20% pump of ONE as below:

Now on a 4-hr time frame, ONE has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.