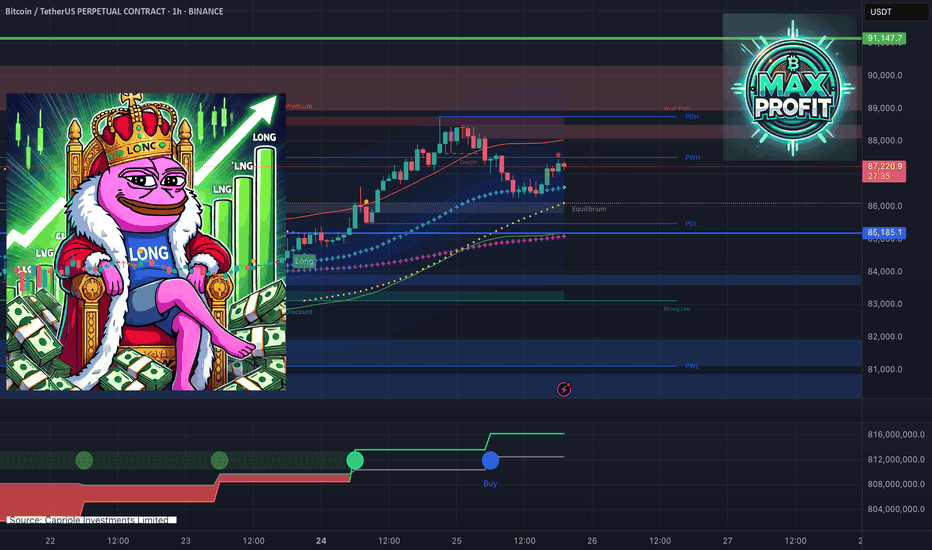

Hash Ribbon Buy Signal + CHoCH Structure and Holding Equilibrium

💥 The Hash Ribbon indicator has flashed a buy signal for the first time in 8 months. On the chart, we see a clear CHoCH (Change of Character) and price holding above the Equilibrium level — adding confluence for a bullish setup.

Chart Highlights:

- Key support at 85,185 USDT (PDL zone).

- Parabolic SAR & EMA trendlines are confirming bullish bias.

- Resistance near 88,000–89,000 USDT could trigger short-term sell-offs.

Conclusion:

If BINANCE:BTCUSDT.P holds above the PWH level, momentum may push it toward the 90K zone. Bulls still in control — for now.

Hashribbons

BTCUSD: Time for a correctionOutlook for the remainder of the year. The ETF inflows have generally remained positive at new ATH levels, while volume remains low and price remains flat. This suggests considerable distribution from OTC sellers, namely longer-term holders, per HODL waves analysis.

It's been 3 months since breaking ATH in March, with price unable to move higher. The consolidation at higher levels remains bullish until $60K is broken to the downside (foodgates moment), which would confirm the current range ($60K-70K) as longer-term distribution, rather than accumulation.

First stop will likely be a re-test of the 50 Week MA around $50K after the floodgates for selling opens below $60K. With relatively low accumulation volume, I'm not expecting it to hold as support, but instead return to the 200 Week MA around $40K, likely after a re-test of previous support in order to confirm it as new resistance (around $60K). The 20 Week MA is currently around $63K, so below this level, there will already likely be an increase in selling pressure.

The Weekly RSI is otherwise facing rejection from overbought levels >70, similar to late 2021 (minus the strong bearish divergence back then). The culmination of breaking the 20 WMA and confirming RSI rejection by returning to $60K, would be the catalyst for the break of support. As also noted (N.B.) the Mid Pi Cycle Top occurred in march, around $68K-$70K, with price unable to maintain the momentum above this rising MA multiplier, unlike in December 2020 at $21K.(1) The post-halving "Miner Capitulation" has also been signalled by Hash Ribbons indicator, not so dissimilar to summer 2020 that encouraged consolidation and a miner correction.(2)

I'm not particularly expecting Path B to play out, unless there is a catalyst for a more full-blown capitulation, leading to a 65% haircut in price. Examples include ETF holders getting cold feet leading to panic as price goes below opening ETF prices , or otherwise some negative regulatory news. A -45% move down to $40K should otherwise be more then sufficient to build up momentum for a 2025 bull market reaching $100K+. Should price reach GETTEX:25K to $30K levels (path B), there could be a "delay" within the usual cycle, with higher parabolic prices nearer to $200K. After the 3x from 2017 to 2021 ATH, 2x seems reasonable in 2025 however ~$138K.

(1) www.lookintobitcoin.com

(2) capriole.com

Mastering Crypto: A Beginner's Playbook for Success!When I dipped my toes into the crypto world, it was post-COVID, smack in the middle of those two epic highs. Like any rookie, I made all the classic blunders. One in particular stood out - trying to be a short-term trading wizard. Let's face it, it's a rollercoaster ride of excitement, but it demands a truckload of sweat and time. Something... that most newbies are usually short on.

Now, picture this: a more chill and composed medium-term approach. I've got three trusty tools in mind:

1- The BTC halving and the cycles (Jump in between the halving finale or kickoff, and exit before the halfway marker)

2- Dive in when the fear and greed index is in the chill zone below 10, and make your grand exit when it's rocking above 80.

3- If the hash ribbon turns a delightful shade of blue... well, that's a delightful green light.

And the grand finale... DCA... Google is your wingman for that one!

Supertrend + Hashribbons Showing a Long Term Trend for BTCIn this Video we discuss all the criteria I'm looking at right now for a bitcoin long position.

This includes:

- Hash ribbons smashing all time highs again after looking fairly weak a few days ago.

- Supertrend AI Indicator looking like it's giving a decent trending signal after the last few months of sideways action and traps.

- VWATR Bands expecting a retest/reclaim of the line after losing it(And why).

- And general structure looking a lot better for bitcoin.

Thanks and have a great day :)

HASH RIBBONS - Bullish Indicator 📈🐂Understanding the HASH RIBBONS Signal:

The HASH RIBBONS signal is based on the interplay of two essential moving averages: the 30-day Simple Moving Average (SMA) and the 60-day SMA. When these moving averages cross in an upward direction, it generates a bullish HASH RIBBONS signal.

The Strength of HASH RIBBONS Signal on Weekly Time Frame:

The HASH RIBBONS signal's significance amplifies when observed on the weekly time frame. Here's why it's considered a potent bullish indicator:

Confirmation of Bullish Momentum: A bullish HASH RIBBONS signal on the weekly chart confirms the presence of strong bullish momentum. This suggests that the cryptocurrency's price may experience a sustained upward trend.

Long-Term Perspective: The weekly time frame provides a broader view of market trends, filtering out short-term noise. A bullish signal here reflects a potential shift in long-term sentiment, which can be a precursor to a substantial price rise.

Market Sentiment Reversal: A HASH RIBBONS crossover indicates a possible reversal in market sentiment. This shift can attract more buyers, resulting in increased demand and upward price movement.

Conservative Traders' Choice: Many conservative traders rely on signals from longer time frames like the weekly chart to validate their trading decisions. A strong HASH RIBBONS signal can provide the necessary confirmation for these traders.

Potential Entry Point: A bullish HASH RIBBONS signal on the weekly chart often serves as a compelling entry point for traders seeking to ride a prolonged bullish trend.

Conclusion:

The HASH RIBBONS signal on the weekly time frame holds immense potential as a bullish indicator. Its confirmation of bullish momentum, long-term perspective, and ability to signal market sentiment reversals make it a formidable tool for traders and investors alike. However, like all indicators, it's essential to combine the HASH RIBBONS signal with other forms of analysis and maintain proper risk management practices.

As you navigate the dynamic cryptocurrency market, keep in mind that signals provide guidance, but market conditions can change rapidly. Staying informed, adapting your strategies, and using reliable indicators like the HASH RIBBONS on the weekly time frame can empower you to make more informed and confident trading decisions.

❗See related ideas below❗

Follow + Like this post and leave a nice comment, it will allow me to move faster and make more useful content! 💚💚💚

Bitcoin Hash Ribbons Have Confirmed [price analysis] + GC signalOver the span of the last six years, there have been eight consecutive occurrences where each time a hash buy signal was given, it was followed by a confirmed increase in the market.

There have been 15 total over the total history, 13 were successful.

Also BITCOIN didn't close below prior-LOW (The 13 successful iterations)

GC also turned green first time in 4 years.

#NFA & Happy Trading!

www.youtube.com

Bitcoin BUYThis may be the shortest but one of the more exciting ideas I've posted. Bitcoin since making its higher high at 31818 has shown signs of bullish strength on the daily and smaller time frames. And although we have seen some bullish price action, the follow thru has been at a minimum until possibly now.

The higher time frames, that being the 3 day and the weekly, are showing that we have just entered an extremely profitable time period for the bitcoin miners. According to the hash ribbons, we have a buy signal and these are signals that do not flash often. The last one that appeared on the higher time frames occurred in January, 8 months ago. It is at that time when this entire rally up to 31818 began.

Keep an eye on the close today as it will close both the 3 day and the weekly.

If the supply wall I have illustrated can be broken, we have a lot of strong bullish confluence to take a trade off of going to the last part of Q3.

BITCOIN LOOKING STRONG AF!The increasing volume is a clear indication that buyers are stepping in and pushing the asset up. And it's not just any buyers, it's miners! The Hash Ribbons indicator is flashing a buy signal, which has been a historical indication of miner capitulation and big bull runs in the past. This is a rare and powerful signal, one that we haven't seen in a while. The asset has also just broken out of a descending wedge pattern, further confirming the bullish momentum. All these signs are pointing towards a potentially massive price movement in the near future. Don't miss out on this opportunity, the time to act is now!

This Indicator is Screaming "BUY"! Traders,

I recently dove a bit deeper into the Puell Multiple indicator. In this video, I want to share what I have discovered. We'll discuss: what the Puell Multiple is, what it calculates, and how that calculation is made. We'll also closely examine what this valuable indicator tells us about the current Bitcoin price. Enjoy.

Stew

Bitcoin's weekly OBV, NVT and Hash Ribbon Bear Market ChecklistTL:DR: The Bear market inflection is NEAR, it has not occurred. More time to accumulate (or get wrecked using margin). QRD: Bottoming structure not yet clear, OBV 10 has not bullishly crossed the 20 below 100 yet. Price still below blue resistance line. NVT shows bear market inflection, as does the Hash Ribbon. Inflection score is 2/6.

Introduction

There are two major concepts this post is broadly dealing with. The first one volume and its interpretation and the second is looking at bitcoin as a payment network with its own native currency. The United States has a payment network and it uses dollars. The European Union has a payment network and it's currency is creatively called the Euro. Similarly, the bitcoin network currency is as creatively named: bitcoin. A trite saying is bull markets end with a roar and bear markets end with a whimper. I am looking for the point where the bear market whimpers its last and we are getting pretty close on a robust set of criteria. With a sorter list of criteria, I think one could already call it based on the Hash Ribbon firing its buy signal while the NVT is green and the OBV 10 and 20 SMA were both under the 100 SMA but I personally can't do that without a bottoming structure and while price is still below the blue trend line.

Volume analysis

There are several proper ways of looking at volume. There is the standard volume by timeframe that many people use, with red or green bars stacked across the bottom of their chart. The volume profile is also very useful for determining where price action support and resistance is supported by volume. Lots of price action with very little volume behind it suggest that the next move could move through that price action quite quickly.

The volume indicator I have spent a couple of years tinkering with is the On Balance Volume with Moving Averages. To keep the charts visually simple I have made the decision to just focus on the moving averages.

A common phrase in trading is exhaustion. Bear markets end when sellers are exhausted. There is no real indicator I know off that spits out a buy signal when sellers have been exhausted so I have been working on a system to determine that. Bitcoin and crypto is very volatile and so the weekly time frame, so far, has back tested quite well. Equities and commodities still need some tinkering with for this system to work.

The bold green line is the 100 SMA of the On Balance Volume. When the OBV is at the 100 it is a sign of some significant sideways movement or a prolonged period of selling from a previous all time high. When the 10 or 20 OBV SMAs go below the 100 we are deep in a bear market where we can expect to get the best value should price recover.

Previous bear Markets

The 2015 bear market had a massive W bottom with the second low being lower than the first low. That would have been very painful for anyone setting their stops for a high low W reversal. The OBV SMAs crossed several times down there and very certainly a lof of traders got whipped out of their positions while investors and smart money did what they could to buy the lows.

The 2018 and 19 bear market bottom was a beautiful ascending trianle that had massive amounts of over-performance to the upside. I spent most of that uptrend waiting for a pullback that never came and that is why looked at creating this system, so I could predict such impulsive moves before they come.

Current Bear Market

The On balance Volume 10 and 20 SMAs are deep under the 100 which suggest a great time to accumulate The 10 has not crossed the 20 yet so the bear market inflection, based on volume, has not happened just yet. Bitcoin does not appear to have a long-term reversal structure yet, a W bottom or ascending triangle seem most likely. It does not seem like we are going to have anything resembling saucers and so far a inverted head and shoulders doesn't seem likely.

NVT Analysis

As stated above, bitcoin is a payment system, called bitcoin, and the currency of the bitcion network. When someone buys bitcoin they are buying currency of that network to use that currency network at a later point in time or to sell to someone else that wants to use that currency network.

This marvelous version of the NVT is very useful as it can help us determine when the currency is relatively cheap compared to how much the network is being used. If we want to use the network for payments this is the time to do it. Likewise, if we want to get a good price on the currency to use later, either by sending bitcoin or selling it we would do that now.

The system is pretty simple with the NVT. If the NVT is green and is moving sideways, not down) we have reached an inflection point with the NVT.

Hash Ribbon

The hash ribbon can be pretty noisy with all of the different signals you can have it spit out. For this system there is only one signal we want, the buy signal, and we only want it at one time. when the OBV 10 and 20 are below the 100 while the NVT is deep in the green. Since we have this the Hash Ribbon inflection has occurred.

After All Signals Fire

Once all signals for a bear market inflection are in we will be in the early stages of the bull market. For me, that will be as the NVT goes into the yellow but before the first flash of red. Around the same time the OBV 10 and 20 SMAs will be crossing above the 100 SMA. This is the area between the black and orange lines on the chart.

What I am doing

I am looking to shovel quite a bit of money into some of my preferred alts so long as bitcoin is below the black line. And by shovel I mean I am selling leave at work as it comes by, picking up overtime, eating more oatmeal and eggs because they are cheap and filling, reducing my vice purchases (only the most affordable box wines for me now). I do see a stall occurring around 46,000 (the orange Line) but I don't think it will be similar to the C19 dump. But I do intend to take off some profit there for pay myself back for the quality of life I have been deferring.

It is still way to early to tell, but I have a suspicion that Optimism might be this upcoming bull markets Solana. I definately have a position on and if it goes above the 2.618 I will be quite happy. If it approaches the 3.618 as Solana did I will be retired by next July.

PUMP TRACKER vs Hash Ribbons: the best crypto indicator🔥Hi friends! In this idea we compare two famous indicators:

1️⃣ Pump Tracker daily indicator

2️⃣ Hash Ribbons indicator which is famous among the retail traders and some newbies at crypto trading

For the experiment we will take the amount of money that is available for every trader. We will use $1000 to compare profitability of 2 indicators.

📊 PUMP TRACKER

Pump Tracker is a daily Bitcoin indicator which give the signals to buy and sell crypto in time. This indicator use foundamental and technical data to give you the best entry point to open a long on spot or futures. I think it works better in a bear market than Hash Ribbons even in a bull market:) Image, what if BTC will start PUMP now? What the profit you can get? Here the stats per last 3 year.

🚩 Using $1,000 of the initial deposit you would have gotten $18,000. Using $10000 you would get $180000. It`s "just" 18x to your deposit per 2019-2021 bull and bear markets with -70-80% dumps(!). Wow!

📊 HASH RIBBONS

Hash Ribbons is a famous indicator which help some traders to find entry point to buy crypto. It`s use the change of the hash rate of BTC network in its calculations. When 2 MA are crossing it show the green or blue "BUY" signal. But a lot of traders don`t pay attention to statistic of this indicator.

If you were using this indicator with $1,000 you would get ..... $3,700 in 2.5 years.

🚩That means Hash Ribbons has made 3.7x in the same period. It's worth to add that you wouldn't have been able to use leveraged trading , as the maximum loss is more than 50% and your deposit would have simply been liquidated.

Yes, the main advantage of Pump Tracker is a possibility to open the trades with leverage up to x1 on Coin-M and x2 on margin or USDT-M Futures , which would give you x116 to your deposit per last 2,5 years. Here is a proven statistic👇

🚩 That is mean that you would get $116,000 from just $1000 initial deposit and $1,180,000 profit using $10,000 initial deposit.

📊 SUMMARY

I recommend you to use Hash Ribbons as additional indicator to understand the current market situation, crypto fundamental data.

As you can see, Pump Tracker is much profitable indicator not even for spot trading but also for leverage trading✅ and you can get much more profit for the same period of time.

🔥 Traders, check the links below the idea or DM to get more info about Pump Tracker indicator. Write in the comments if you found this idea useful and going to use this info in your trading strategy.

💻Friends, press the "boost"🚀 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

BTC/USDHi all,

Hash Rate leads Difficulty in identifying Bitcoin Miner Capitulation.

Hash Ribbons is close to a buy signal and is it would be wise to pay attention.

Usually this indicator has a high probability of success if we analyze the history of buy signals and price action after that.

Since it is a lagging indicator, I frequently take DCA into account before BUY signals.

What do you think about this strategy?

BTC Hash RibbonsThe Hash Ribbons is not an original indicator of mine, but one I coded based on many you can find on the trading view platform and developed by the community.

The 'Hash ribbons' indictor looks at the 30-day and 60-day moving average of the Bitcoin hash rate, which is used to show / approximate when sufficient miner capitulation has occurred (shown as a blue buy signal). It approximates periods where Bitcoin miners are in distress (cost of running mining rigs exceed return) and suggest BTC miners may be capitulating.

The relevance at this point of time is the hash ribbons are now flashing a start of a capitulation region.

Read the bellow articles for more information has there has been a lot set on this indicator.

* www.lookintobitcoin.com

* bitcoinmagazine.com

Hash ribbons triggered a Sell/Capitulation warningAnother bearish signal aligns with current risk-on markets sentiment. This plus price action on Daily for Bitcoin look very alike 2018, although I thought we won't see capitulation until closer to October it seems with likely more aggressive stance from FED over the Summer, it could happen very soon. Will it drop 50% from here? Well its not impossible, my sweet spot range for this would be 12-19k. First sign of what is coming should be on 15th of June. Stay tuned!

Hash Ribbons(Miner Capitulation Period)

Bitcoin Price and Hash Rate Relationship:

The Bitcoin hash ribbons indicator’s core concept is that there is a direct relationship between the hash rate and price. The thought is that the miners will reduce their bitcoin mining efforts when an opportunity to get better results elsewhere occurs, this can happen for two reasons:

(1) Bitcoin price has decreased

(2) Mining costs (electricity) has increased

Looking at all years period for Bitcoin, there seems to be a correlation between when hash-rates are bottoming alongside price to indicate a local or close to local bottom for the bitcoin price.

Miner Capitulation:

The capitulation of miners can be considered a better bottom indicator than retail traders calling it quits. They tend to be one of the last to throw in the towel, which has to do with that they have mining profits to help offset the costs and loss related to a bitcoin price dump.

Grim outlook for BTCI really don't think 14k to 12k is out of the question.

Looking at horizontal support, silver cross to the down side golden pocket and fixed range from previous macro low and high, you have to at least entertain the idea we could head into these price levels.

Hash ribbons giving a capitulation signal.

Also happens to be around an 80% retracement, which is inline with previous bear markets.

If you ask me, I think it's a great accumulation range I'd love to take long position from .

Bitcoin bull marklet idea Plz zoom out as much as you can

As you know halving takes place every 120,000 blocks are mined, 4th halving will take place as soon as the 840,000th block is mined

I came to 3 different possible dates of the 4th halving, the mean of them is ARP.19.24 & 1430 days of cycle; roughly

As if today 2/23/2022 725,000 blocks are mined, 45% mark from 630,000 to 840,000 and 55% to go.

I have highlighted every hash ribbon buy signal and squared up when rsi is above 50.00 line during bull run to ATH.

As you can see hash ribbon buy signal is a great bottom catcher, we essentially never see the price again after the signal flashed

The last signal appeared during the china mining ban.

I say 30k+ will be a very strong support if we ever see that price again.

As of the previous cycles, we saw increase in days of the bullrun after halving and increase in halving cycle days.

Therefore, I would assume we do the same in this cycle. We saw crazy adoption and main stream publicity the previous years.

If 65k is the peak of the cycle, I think its alittle short interms of days in the halving cycle.

I think it just the overall market and political policies that are slowing down the market.

Expecting straight shot to the moon like previous cycles seems too good to be true.

I will post another analysis in the same way, but in terms of percentage increase with the halving cycle