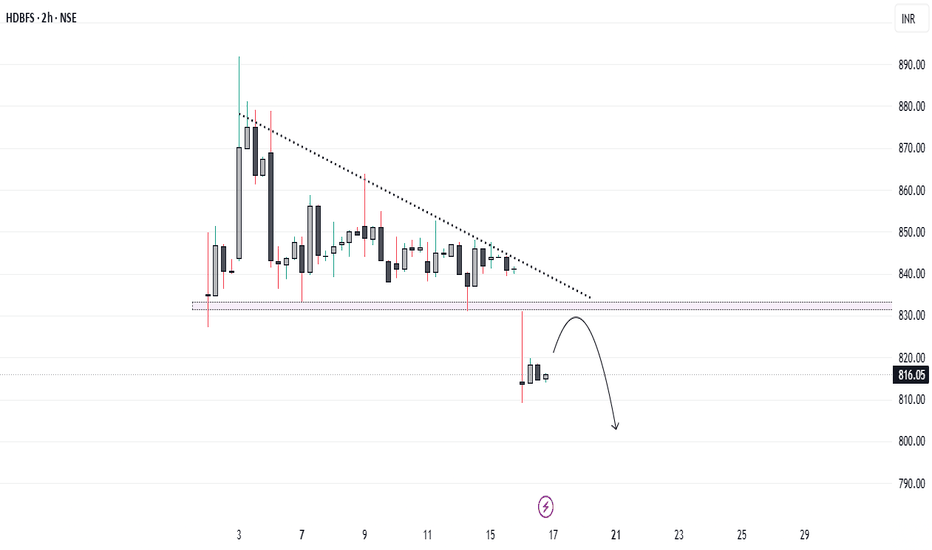

HDB Financial: Strategic Entry Near IPO Price After Breakout...!HDB Financial Services, recently listed at a 12.8% premium over its issue price of ₹740, has shown promising technical movement. After a period of sideways consolidation, the stock has broken out of a descending triangle pattern—an encouraging sign for potential downside momentum.

For long-term investors and swing traders, the ₹740 level presents a strategic entry point. This level, being the IPO issue price, is likely to act as a strong support zone. Investors looking to accumulate quality stocks can consider initiating a position near this level, with a long-term perspective or for a medium-term trade setup, depending on individual risk profiles.

HDB

HDB NYSE | ELLIOTT WAVE COUNTS...Hey guys

Please have a look at the chart of HDB (HDFC BANK), it seems to be in the 2nd wave of its primary degree.

your inputs are highly appreciated.

pls follow and like share.

This chart is not a buy sell recommendation pls ask your advisor before any investment decision.

Regards

HDB, waiting for a buying opportunity in Indian BanksModi's demonetization effort has bit the Indian economy quite hard. Perhaps there is a case to be made from a long term perspective that the banking sector is a buy after the recent sell off. Given the technicals and on going chaos, I'm going to wait and see if a better buying opportunity emerges. Possible targets are the parole black lines.