AUDCAD: True Bullish Reversal?! 🇦🇺🇨🇦

AUDCAD formed a nice inverted head and shoulders pattern

after a test of a key historic support.

A bullish violation of its neckline with a strong bullish candle

provides a reliable confirmation.

I expect a correctional move at least to 0.8723

❤️Please, support my work with like, thank you!❤️

Head and Shoulders

Bitcoin Head & Shoulders Pattern – Bearish Breakdown Ahead?#Bitcoin is forming a Head & Shoulders pattern on the 4-hour timeframe, signaling a potential bearish move. Currently, #BTC is hovering near the neckline—a key level to watch!

Bearish Confirmation: If #BTC breaks below the neckline and the support zone, it will confirm the bearish trend, potentially leading to further downside.

Trading Plan:

Wait for a clear break & retest of the neckline.

Enter a short trade with proper risk management.

Keep an eye on volume for strong confirmation.

Will #BTC hold or break down? Drop your thoughts in the comments!

$BTC Inverse Head and Shoulders Finally FormedAnd just like that, the Death Cross has formed the right shoulder for the Inverse H & S idea I formed on March 14th

We may sit a bit more downside to retest the 50WMA at $76k for confirmation

If we get a V-shaped recovery tomorrow, this very well could be the bottom for CRYPTOCAP:BTC

USDCAD, Bearish Bias, Fundamentally and TechnicallyFundamental Analysis

1. Endogenous and Exogenous factors indicates bearish trend in USDCAD.

2.USD is getting weaker in previous months while CAD is stronger

3. Seasonality also shoes bullish trend in CAD in April and Bearish in USD

4. COT report of USD indicates continuous reduction in long positions by NON-COM

5. Sentiments of USD and CAD are both bearish due to Tariffs but CAD will improve in coming days.

Technical Analysis.

1. Weekly chart shows Bearish RSI divergence with consolidation Box

2. Daily chart shows breakdown of consolidation box with Head and Shoulder pattern with retracement/retest

3. Entry of short sell in 2 parts

i. Enter at current price with 1% risk

ii. Enter at 1.43769

4. Stoploss above right shoulder 1.45597

5. Initial target at weekly support 1.39497

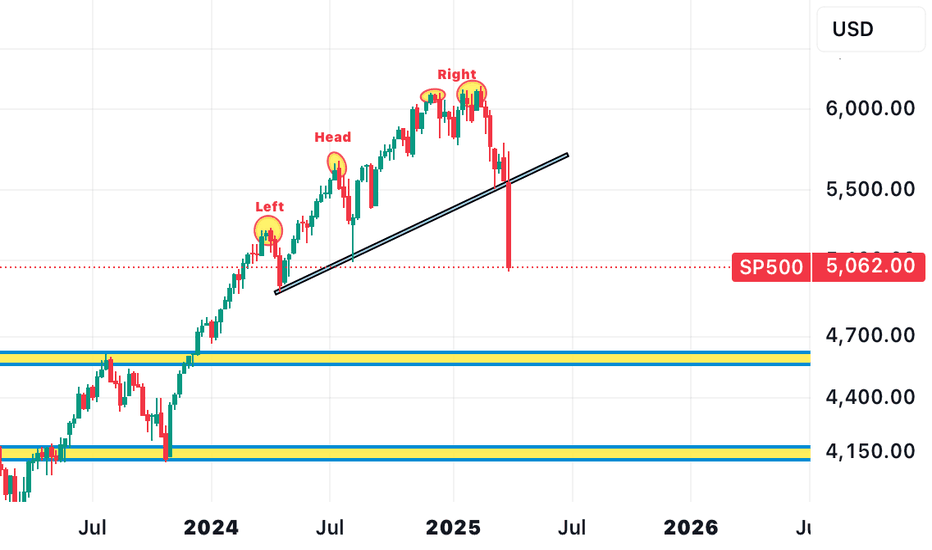

SP500,A BIRTH OF A NEW TREND (FURTHER DECLINE EXCEPTED)Sp500 has given birth a to new trend after forming bullish pattern from our previous analysis to give us ATH of 6k. It has form another bearish reversal pattern on weekly timeframe. We might see further declines in coming weeks. Overall target $4700 a $43,00

INVERTED HEAD & SHOULDERS ON 4HR TFSupport and resistance trap the market, forming a left shoulder, then breaking out of the support zone, forming an inverted head. The market now breaks back into the zone; wait for a retest and buy to the resistance. If the market breaks back out of support and closes, wait for a retest and sell at the support area. Collect your losses and look for the next setup.

Head & Shoulder Pattern in Making in NIfty 50 IndexI can see a clear Neck & shoulder Pattern in Making.

all international Markets are down and now on their Support Area.

Mostly all international Market should bounce back from here.

Nifty 50 once touches 22800 and if takes a support from here it should then proceed toward 23800 to complete H&S pattern.

There is a resistance @ 23800. If market break that resistance then 23800 should act as a Support and Market should Advance for 24800 levels.

"Otherwise"

if Market Crashes below 22800 and doesn't take support here next major support will be 22000 but this is less likely.

Hope for the best!

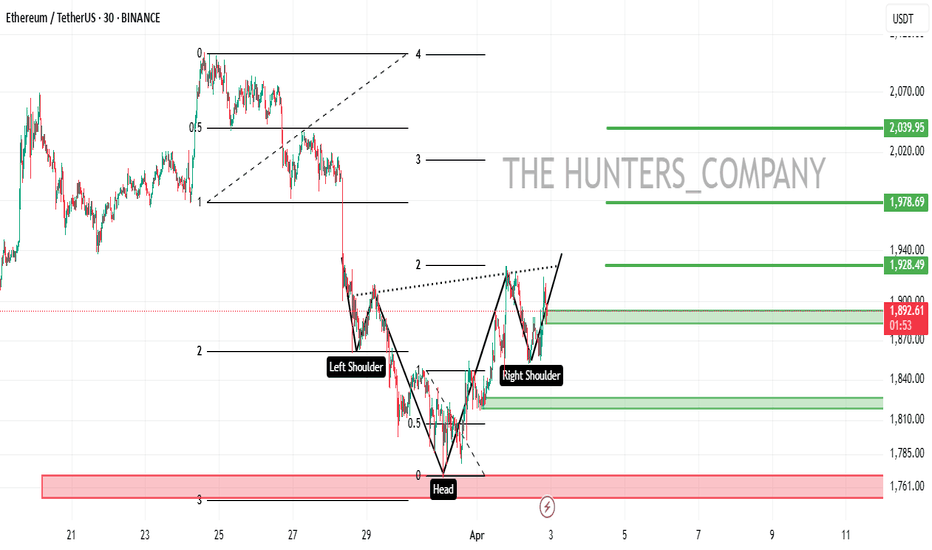

ETH/USDT:UPDATEHello dear friends

Given the price drop we had, a head and shoulders pattern has formed within the specified support range, indicating the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified targets.

*Trade safely with us*

Trump Tariffs are Wrecking the MarketTrump’s disastrous right-wing policies continue to wreak havoc, with the latest victim being AMEX:XLC $XLC. His reckless tariff strategy is proving to be one of the greatest self-inflicted economic blunders in American history, harming industries, investors, and consumers alike. These tariffs have weakened the economy, disrupted markets, and imposed unnecessary burdens on businesses. The long-term consequences of these policies will be felt for years to come as the American economy struggles to recover from this avoidable crisis.

Head and shoulders top has been completed today, 4/3/25. The price objectives are 88.6 and 84.60

UPS looking DOWNSNice head and Shoulders on the United Parcel Service

#UPS and FEDEX are the new dow transport indicator.

An underlying determinant of how the consumer is faring

Since the US is a consumer economy and Online shopping is the majority of retail

if we see new highs on the Indicies, and the home delivery carriers continue to deteriorate

it would give your non confirmation Top

Similar to Dow theory of new High's in the Industrials , but the transports lagging and indeed falling.

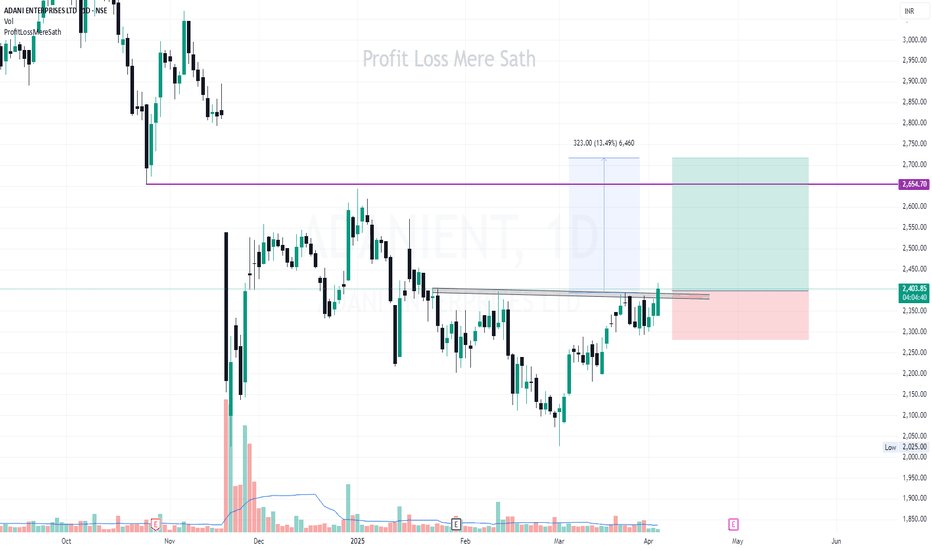

Adani Enterprises - Breakout in Progress?The stock has been consolidating below a resistance level for several weeks. Today, it has given a breakout above the trendline resistance with good volume. This breakout could trigger a potential uptrend.

🔹 Target & Resistance:

Target: ₹2,654.70 (+13.49%)

Resistance Level: ₹2,654.70 (marked in purple)

🔹 Volume Confirmation:

The breakout is supported by increasing volume, indicating strong buying interest. If the stock sustains above the breakout level, we might see a strong upward move.

🔹 Trading Plan:

✅ Entry: On breakout retest or sustained move above resistance

🎯 Target: ₹2,654.70

🛑 Stop Loss: Below breakout zone

📢 Conclusion:

A successful breakout and close above this level could confirm bullish momentum. However, traders should watch for retest and price action confirmation before entering.

GOLD: May fall below 3100So far, gold has continued to fluctuate in the 3110-3136 range. Although the candle chart has many long lower shadows, the high point is moving down. If this trend is not broken, the probability of falling below 3100 today is very high, so when trading, everyone must be cautious. Personally, I suggest selling as the main method.

Dow Jones Industrial Average (DJI) - Technical Analysis🧠 Dow Jones Industrial Average (DJI) - Technical Analysis

📅 Chart Date: April 2, 2025

🔍 Pattern Observations

Previous Uptrend (Left Section of Chart):

The chart shows a classic Head and Shoulders (H&S) pattern that formed after a strong uptrend.

Left Shoulder, Head, and Right Shoulder were clearly formed and confirmed.

The price reversed strongly after completing this H&S, indicating a bearish reversal.

Current Pattern Forming (Right Section of Chart):

A new H&S pattern is now forming, suggesting another potential bearish setup.

The Left Shoulder and Head are already in place.

The price is currently moving upward toward what may become the Right Shoulder.

Expected completion of Right Shoulder around the 40,000 level.

A trendline support from the prior lows aligns with this area, strengthening this level as a possible resistance zone.

📉 Bearish Breakdown Scenario (Pattern Confirmation)

If price reaches ~40,000, forms the Right Shoulder, and then starts to decline, the pattern will be complete.

A decisive breakdown below the neckline (drawn from the lows of Left Shoulder and Right Shoulder base) would confirm the bearish H&S pattern.

In that case, projected target zone would be calculated as:

Target=Neckline−(Head−Neckline)

Target=Neckline−(Head−Neckline)

Depending on exact neckline placement, target could be around 38,000 or lower.

🚫 Invalidation Scenario (Pattern Failure)

If price breaks above the Head region (~42,500 - 42,800), then the current H&S pattern gets nullified.

In this case, the structure becomes bullish again, potentially leading to new highs beyond 43,000+.

📌 Key Levels to Watch

Level Significance

42,500-42,800 Head Resistance / Pattern Invalidation

40,000 Expected Right Shoulder Peak

38,000 H&S Breakdown Target

41,000 Interim Support

39,500 Neckline (approx.)

⚠️ Risk Factors

H&S is a reliable reversal pattern, but like all technical patterns, confirmation is key.

Right Shoulder is still under formation; premature trading before confirmation could lead to false signals.

Market sentiment, macroeconomic news (like inflation data, Fed announcements), or geopolitical events could override technical patterns.

✅ Conclusion

DJI has already completed one H&S pattern post-uptrend and saw a bearish reversal.

Now, it's potentially forming another H&S, and 40,000 is a key level for the Right Shoulder.

If the price rejects at 40,000 and breaks below neckline, bearish trend may resume, targeting 38,000 or lower.

If the price breaks above the Head (~42,800), the bearish structure is invalid, and we may see a bullish continuation.

📢 Disclaimer

This analysis is for educational and informational purposes only and does not constitute investment advice. Trading involves substantial risk and is not suitable for every investor. Please consult your financial advisor before making any investment decisions. The chart patterns discussed are based on historical price action and do not guarantee future performance.

NASDAQ INDEX (US100): Great Opportunity to Sell

NASDAQ Index formed a strong bearish pattern after a test of a key daily

resistance area.

I see a head & shoulders pattern on an hourly time frame

and a confirmed breakout of its horizontal neckline.

The index can continue decreasing.

Next support - 19240

❤️Please, support my work with like, thank you!❤️

MEW Looks Bullish (4H)From the point where we marked start on the chart, MEW appears to be forming a bullish QM.

As long as the green zone holds, it can move toward the targets.

A 4-hour candle closing below the invalidation level will invalidate this pattern.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You