Health

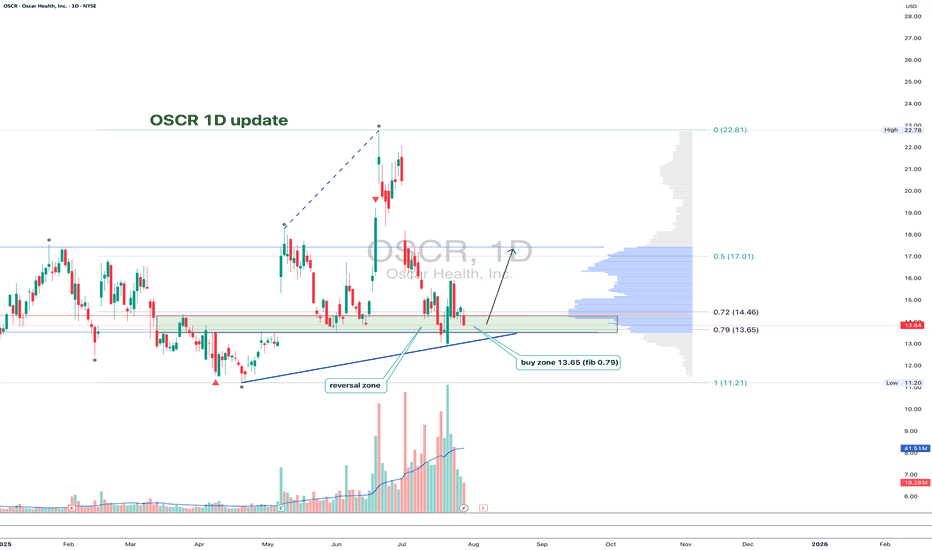

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the level again. If support holds and we get a bullish confirmation, the next target is 17.01, followed by a potential breakout toward the high at 22.81.

Volume remains elevated, the overall structure is healthy, and the correction is controlled. A break below 13.00 would invalidate the setup - until then, it’s a clean, high-reward zone with tight risk.

Fundamentally, Oscar Health has revised its 2025 guidance: revenue is expected in the $12–12.2B range, with operating losses projected between $200M and $300M. Despite softening topline growth, earnings per share are improving, and investor sentiment has been shifting. Technical strength is also reflected in the recent rise in RS Rating to 93, confirming that the stock is showing relative leadership even as the market cools.

This is one of those setups where both technicals and narrative are aligning - now we just need confirmation from the chart.

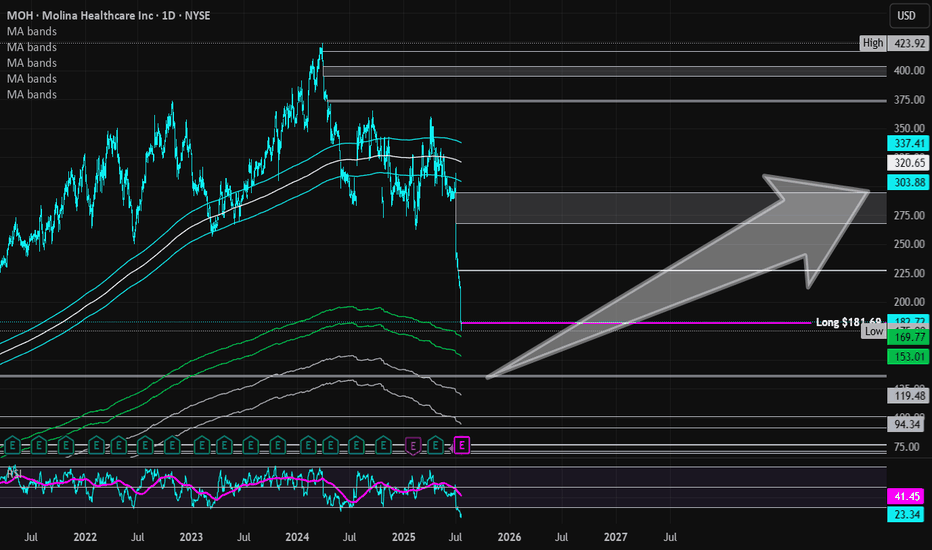

Molina Healthcare | MOH | Long at $181.69Healthcare providers and services are at a major discount right now: and may be discounted even more this year. I am personally buying and long-term holding the fear, knowing the baby boom generation is going to utilize our healthcare system at a rate unseen in modern times. While the price discounts are valid "right now" given the current political administration's cuts, long-term it is far from valid... The strategy I am using with healthcare stocks ( NYSE:MOH , NYSE:CNC , NYSE:UNH , NYSE:ELV , etc) is cost averaging: not buying one single large position in an effort to predict bottom but buying smaller positions over time to create a cost average "near" bottom. If you are a day trader or want a quick swing in healthcare, I don't think it's going to happen for a bit. But those not entering in the coming months / year will likely miss out on a very large healthcare boom - especially when AI truly enters the picture in this sector...

Fundamentally, Molina Healthcare NYSE:MOH is a very strong company. Low debt-to-equity (.9x), P/E of 8.8x, quick ratio of 1.7x, $41 billion in revenue in 2024. Yes, there will be issues in the near-term due to Medicaid and other funding cuts. But long-term, this sector is primed to benefit from an aging population.

So, while NYSE:MOH is in a personal buy zone at $181.69, I don't think this is necessarily bottom. I anticipate this stock to drop even further, eventually closing the daily price gap at $135.00. My next buys are in the $150's and $130's, thus cost averaging into a larger position. For true value investors, those prices and anything below is a steal. Today's negative healthcare sector noise is loud, but it does not represent the future.

Targets into 2028:

$226.00 (+24.3%)

$290.00 (+59.6%)

OSCR 1W — When the Chart Speaks Before the FundamentalsThe Oscar Health chart is currently forming a textbook cup and handle — a long-term reversal structure that has completed its base and is now breaking out of the consolidation zone. The bullish structure is confirmed through price action, volume, and positioning relative to key moving averages.

The price has broken through the upper boundary of the handle, shaped as a descending wedge. The breakout is accompanied by increased volume — a clear sign of capital rotation out of accumulation. All major moving averages (EMA, MA50, MA200, WMA) are trending upward, and the price is holding above them all, confirming the bullish momentum.

According to Fibonacci extension levels, drawn from the historical low of $1.50 to the peak near $23.26, the first wave target stands at $36.71 (1.618 level), with an extended target at $45.02 (2.0 level).

Structurally, the setup suggests a medium-term scenario pointing from current levels toward the $36–45 range, with the potential to repeat the kind of explosive move seen during the 2023 phase, when the price increased more than sixfold.

On the fundamental side, Oscar Health is actively recovering: in 2024, revenue grew by more than 50%, net losses were cut nearly in half, and the client base continued to expand. The company is strengthening its share in the digital insurance market and gaining support from institutional investors, including Morgan Stanley and Capital Group. The latest quarterly report was positively received.

The breakout is technically clean and fundamentally supported. The immediate pullback zones sit at $14.95 and $13.40. Below that, moving averages may act as control zones for reaction.

VERTEX ($VRTX) SHINES IN Q4—PAIN & CF FUEL GROWTHVERTEX ( NASDAQ:VRTX ) SHINES IN Q4—PAIN & CF FUEL GROWTH

(1/9)

Good evening, Tradingview! Vertex ( NASDAQ:VRTX ) is buzzing—Q4 revenue up 16%, new drugs hit the scene 📈🔥. $ 2.91B and a bold 2025 forecast—let’s unpack this biotech beast! 🚀

(2/9) – REVENUE RUSH

• Q4 Haul: $ 2.91B—16% jump from last year 💥

• Full ‘24: $ 11.02B, up 12%—Trikafta’s king 📊

• ‘25 Outlook: $11.75-$ 12B—6-9% growth

NYSE:CF keeps humming—newbies add zest!

(3/9) – BIG WINS

• Journavx: Non-opioid painkiller greenlit Jan ‘25 🌍

• Alyftrek: CF drug for 6+—ships now 🚗

• Cash: $11.2B—loaded for action 🌟

NASDAQ:VRTX storms pain—CF stays golden!

(4/9) – SECTOR CHECK

• Valuation: 11x sales—above 9x avg 📈

• Vs. Peers: Gilead’s 4x, Regeneron’s 8x—premium?

• Growth: 12% beats biotech’s 5-7% 🌍

NASDAQ:VRTX flexes—value or stretch?

(5/9) – RISKS ON TAP

• Payers: Journavx needs coverage—hiccups? ⚠️

• Trikafta: 93% of sales—big lean 🏛️

• Comp: Pain rivals, CF safe—for now 📉

Hot streak—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• CF King: Trikafta, Alyftrek lock it in 🌟

• Pain Play: Journavx eyes $ 4B peak 🔍

• Cash: $11.2B—war chest ready 🚦

NASDAQ:VRTX ’s got muscle and moolah!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trikafta reliance—eggs in one basket 💸

• Opportunities: Casgevy rolls, pain grows 🌍

Can NASDAQ:VRTX zap past the risks?

(8/9) – NASDAQ:VRTX ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Pain pays off big.

2️⃣ Neutral—Solid, but risks linger.

3️⃣ Bearish—Growth hits a wall.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:VRTX ’s $2.91B Q4 and Journavx/Alyftrek wins spark buzz—$11.2B cash backs it 🌍🪙. Trikafta rules, risks hover—champ or chaser?

SOLID BIOSCIENCES—$SLDB CASHES UP FOR GENE THERAPY PUSHSOLID BIOSCIENCES— NASDAQ:SLDB CASHES UP FOR GENE THERAPY PUSH

(1/9)

Good afternoon, Tradingview! Solid Biosciences is stacking cash—no revenue yet, but a $200M raise has tongues wagging 📈🔥. NASDAQ:SLDB ’s betting big on gene therapy—here’s the scoop! 🚀

(2/9) – CASH, NOT SALES

• Revenue: Zilch—clinical-stage vibes 💥

• Q3 ‘24 Loss: $0.61/share, missed $0.58 est. 📊

• Cash Boost: $200M offering just landed

No sales, but NASDAQ:SLDB ’s war chest is growing!

(3/9) – BIG MOVE

• Feb 18 Raise: $200M via 35.7M shares, warrants 🌍

• Cash Pile: Was $171M, now nearing $350M 🚗

• Goal: Fuel SGT-003 trials into ‘27 🌟

NASDAQ:SLDB ’s loading up for the long haul!

(4/9) – SECTOR CHECK

• Market Cap: $500M post-raise 📈

• Vs. Peers: Sarepta’s 13B dwarfs it—revenue rules

• Edge: Low EV ($150M), big therapy dreams

Undervalued biotech bet or long shot? 🌍

(5/9) – RISKS ON DECK

• Trials: SGT-003 flops could sink it ⚠️

• Sentiment: 30% drop from Jan peak—jitters 🏛️

• Burn: $20-25M/quarter—clock’s ticking 📉

High stakes, high risks—can it deliver?

(6/9) – SWOT: STRENGTHS

• Cash: $200M raise powers trials 🌟

• SGT-003: Early data dazzles, Fast Track nod 🔍

• DMD Focus: Huge need, blockbuster shot 🚦

NASDAQ:SLDB ’s got fuel and firepower!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: No revenue, all-in on one play 💸

• Opportunities: $2-4B cap if trials pop 🌍

Can NASDAQ:SLDB turn cash into a cure?

(8/9) – NASDAQ:SLDB ’s $200M haul—your take?

1️⃣ Bullish—Gene therapy gold ahead.

2️⃣ Neutral—Wait for trial proof.

3️⃣ Bearish—Risks outweigh the buzz.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:SLDB ’s revenue-free, but $200M keeps SGT-003 alive—stock’s buzzing 🌍🪙. Low EV vs. peers, yet trials and rivals loom. Cure or bust?

$UNH Bad News Longs.NYSE:UNH Recent news should (I believe will) put an end to the madness imaginary run from the corrupt world of health insurance. News circulating NYSE:UNH was a top denier of benefits and claims, only will get worse. A CEO involved in a hit sh**ting? They won't find the "guy" and I assume they will make an arrest but not the actual one who did it. Mmn, conspiracy, yes. But, similar pattern evolving on the chart as well, almost like it all makes sense. Might be a good time to short the health/insurance sector.. maybe.. BlueCross BlueShield just cut back on paying for patients anesthesia in NY, CT, and MO. They are against the people.. biggest ponzi-scheme ever. $555 target, break $500 I see $530. A lot of bearish flow poured in today as well. Months out puts. Not financial advice.

wall street .. loser

ELI LILLY has at least +50% upside from here.Eli Lilly (LLY) has been trading within a 5-year Channel Up and last week closed below its 1W MA50 (blue trend-line) for the first time since the week of March 06 2023. Despite the bearish pressure of this Bearish Leg since July 15 2024, that last 1W MA50 closing was the previous Higher Low at the bottom of the Channel Up.

The 1W RSI is on a similar level (just below 40.00) with all previous 4 major bottoms and the common characteristic of all was that the stock broke below the 1W MA50 but managed to keep clear and hold the 1W MA100 (green trend-line), practically the most important Support level of the market.

If you want a confirmed buy entry, you might want to wait for yet another Bullish Cross on the 1W MACD (as it happened on all previous bottoms), otherwise this buy opportunity is good to go for at least +58% from the bottom (minimum rise among those 4 Bullish Legs). Our Target is $1135.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JOHNSON & JOHNSON Excellent confirmed sell signalJohnson & Johnson (JNJ) gave us the most optimal buy entry on our last call (April 17, see chart below) and easily hit our 157.50 Target:

Having been rejected early in September exactly at the top (Lower Highs trend-line) of the 2-year Channel Down and now establishing price action below its 1D MA50 (blue trend-line), this is a confirmed sell signal and the start of the Channel's 5th Bearish Leg. The RSI Lower Highs are common on all previous Channel tops.

Our Target is 141.00, which is on the Internal Lower Lows trend-line (formed by the last 2 Lower Lows) and still above the 1.236 Fibonacci extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ELI LILLY Always a solid buy below its 1D MA50.Eli Lilly (LLY) broke on Friday below its 1D MA50 (blue trend-line) for the first time since August 09. As the stock trades within a long-term Channel Up since the March 01 2023 bottom, every time the price was below the 1D MA50, it didn't stay for long, thus providing the most effective buy entry.

Even though it could dip some more as with July's decline (only such case though out of 6 corrections), as long as the 1D MA200 (orange trend-line) holds, we expect the Channel Up to be extended.

The initial Higher Highs were closer to the 1.5 Fibonacci Channel extension, the last one however was exactly on the 1.0 Fib. As a result, we will take a more conservative Target on that trend-line, thus turning bullish now and aiming at $1100 by the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

UNITED HEALTH forming a bottom.United Health (UNH) gave an excellent dip buy opportunity last time (March 29, see chart below), with the price even breaking above the long-term Resistance Zone eventually:

The price has since entered a Channel Up pattern with the price now below its 1D MA50 (blue trend-line), having already topped and attempting to form a new Higher Low at the bottom of the pattern.

Like the previous one in June, this bottoming process can take another 3 weeks, so we will time it accordingly and target 675.00 (+21.00% rise, similar to both previous Bullish Legs).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CVS - CVS Health: If the stock drops a few points, I'll be buyiIf the stock drops a few points, I'll be buying very heavily...

CVS and WBA are in the same sector. And both have been decimated. CVS, however, is doing better. And they're paying a dividend.

Target, at least +10%.

Trading at 70% below estimate of its fair value

Earnings are forecast to grow 9% per year

Earnings grew by 140% over the past year

DIVIDEND = Pays a high and reliable dividend of 4.75%

Trading at good value compared to peers and industry

Analysts in good agreement that stock price will rise by 20%

HIMS EARNINGS CHART, DO BULLS HAVE ANY UPSIDE REMAINING? Short answer, yep.

LOTS.

Longer answer, this is a key price zone.

Take a look back at the chart as a whole.

It almost looks like it wants to hit 12.5 tomorrow and GAP up earnings.

Hard to say for sure because it's not a stock I watch often.

BUT, it's flashing some bullish signals.

Good luck!

Investors Await Q1 ReportKey arguments in support of the idea.

▪ UNH stock has come under pressure from a series of adverse events,

though Q1 earnings may improve investor sentiment regarding further

UNH business growth potential.

▪ A good moment for buying, both fundamentally and technically.

Investment Thesis

UnitedHealth Group (UNH) engages in the provision of health insurance,

software, and related consulting services. UNH is the largest provider of

healthcare plans in the US.

In Early 2024, UNH’s Stock Came Under Pressure from Several

Adversities at Once . First, it is a cyberattack on Change Healthcare

services, that led to a temporary freeze on payments from medical

organizations. At the time of finalizing this report, UnitedHealth informed

that services were restored, and that it did not expect big implications for

financial results. However, market participants fear a one-time negative

impact on profitability in Q1 2024.

Shortly after the cyberattack, it was reported that the US Department of

Justice had initiated an antitrust investigation for examining the strength of

relationship between UnitedHealth’s insurance and medical business

divisions. The impact of the investigation is uncertain, and we do not

believe it to influence the stock in the short term.

Investors Were Disappointed by CMS’ Final Decision on Medicare

Advantage (MA) Payment Rates. On April 2, MA plan rate rises for 2025

compared to 2024 became finally known. The payout rate remained at the

proposed level of 3.7% y/y, disappointing investors looking for a bigger

increase. This caused a negative market reaction: UNH, the largest player,

ended the April 2 trading with a 9.3% drop. Some other major stocks

reacted that day accordingly: HUM (-13.4%), CVS (-7.2%), ELV (-3.3%).

The worsened MA business revenue expectations for 2025 are already

reflected in prices. However, the Optum segment’s organic growth

(OptumHealth, OptumInsight, and OptumRx) remains a strong point of the

Company and may support its Q1 2024 results that will be released on

April 16.

Expectations for Q1 Report. We think that investors will be focused on the

guidance for 2024. Management’s confirmation or improvement of the

existing guidance could dispel investor worries. Besides, we expect a

detailed commentary on the impact of the cyberattack and the MA rate

decision on financial results.

Now Is a Good Time to Buy. The P/E NTM ratio has decreased to 15.8,

which is lower than the Company’s all-time average of 18.8. The RSI has

dropped below 30 points, signaling a likely reversal. We consider UNH

shares’ current weakness as a good opportunity to buy, assuming that (1)

the impact of the approved MA 2025 rate is already reflected in prices, (2)

the cyberattack will have a one-time insignificant implication for UNH, and

(3) there is still a high demand in the MA market, and UNH remains the

largest and growing provider of healthcare plans.

The target price for UNH over a 2-month horizon is $495, which

corresponds to P/E NTM of 18. We recommend Buying and setting a

Stop Loss at $415.

Gaxos Acquires Rights to AI-enabled TechnologyGaxos.ai Inc., ( NASDAQ:GXAI ) a pioneering force in artificial intelligence (AI) applications, has announced a significant strategic move to bolster its presence in the health and wellness sector. The acquisition of rights to AI-enabled technology from the top biohacking app, Ultiself, marks a pivotal moment in Gaxos' journey towards revolutionizing the human-AI relationship.

Unlocking Enhanced Customization and User Experience:

The integration of Ultiself's proprietary technology into Gaxos Health's ( NASDAQ:GXAI ) product offering signifies a leap forward in personalized health solutions. By harnessing the power of AI, Gaxos aims to deliver unparalleled customization and efficiency to meet the evolving demands of modern consumers. This strategic move is poised to accelerate the development of Gaxos Health's AI-enabled application, paving the way for innovative diet, nutrition, and tracking capabilities.

CEO's Vision for Innovation:

Vadim Mats, CEO of Gaxos.AI, underscores the significance of securing the rights to this cutting-edge technology. With a focus on delivering value to customers and stakeholders, Mats envisions a future where Gaxos ( NASDAQ:GXAI ) redefines the human-AI relationship across diverse sectors, including health, wellness, and gaming. The commitment to leveraging AI solutions underscores Gaxos' dedication to addressing critical aspects of human well-being and entertainment.

Collaborative Integration Process:

The integration process between Gaxos ( NASDAQ:GXAI ) and Ultiself teams has commenced immediately, highlighting a collaborative approach to ensure a seamless transition. With both teams working in tandem, Gaxos endeavors to leverage Ultiself's technology to its fullest potential, driving innovation and enhancing user experiences. The synergy between Gaxos and Ultiself sets the stage for groundbreaking advancements in AI-enabled health solutions.

Gaxos.ai's Vision for the Future:

Gaxos.AI ( NASDAQ:GXAI ) isn't merely developing applications; it's pioneering a paradigm shift in the human-AI landscape. With a steadfast commitment to redefining health, longevity, and entertainment through AI solutions, Gaxos sets its sights on transformative innovation. The expansion into health and wellness represents a strategic pivot towards addressing fundamental human needs and shaping the future of AI-driven technologies.

Technical Outlook

Prior to the news, ( NASDAQ:GXAI ) stock surged by a whopping 50.38% trading above its 200-day Moving Average with a Relative Strength Index (RSI) of 63.54.

AMN: Bullish Divergence at the 0.786 RetraceAMN after the Bearish breakdown of the 3 Falling Peaks seems to be trying to form a bottom around the 0.786 Retrace with Bullish Divergence on the MACD and RSI. I am uncertain if it will result in the stock making a significantly higher high, but I do think it could at least come back up to test the resistance that sits at around the $70 area esepcially if the IWM and Small Cap Indexes continue to rally.

Hologic: Holding Above 200-week SMA Inside of a Cup with HandleHologic is currently Consolidating within the potential handle of a Bullish Cup with Handle pattern and is holding above the 200-week Simple Moving Average. If this pattern plays out successfully, the measured move target would take HOLX up to around $118. n addition to the technical pattern, HOLX seems to be improving its balance sheet on an annual basis, consistently increasing Assets while decreasing Liabilities and Debts. Overall, this stock seems like a stronger stock within the health sector.

Walgreens: Quarterly Bullish Piercing Line at PCZ of Bullish BatThere is a Bullish Piercing Line at the PCZ of a Bullish Bat that is visible on the Quarterly time frame. We also have MACD and RSI Bullish Divergence to go along with it as well as Increasing Volume. This could be the start of something big for the price action and I speculate that shares of Walgreens could rise up to around $58 over the coming months.

Analysis of CVS Stock Trends: A Parabolic Turn on the HorizonFashionable Analysis of CVS Stock Trends: A Parabolic Turn on the Horizon

Introduction:

In the realm of financial fashion, CVS stock is set to make a stylish entrance with a parabolic turn, showcasing a strong formation on the 4D timeframe. This trend is marked by the elegant falling wedge pattern and the chic double bottom overlapping patterns, following a dose of impactful news related to drug patents.

Technical Analysis - CVS Stock:

The 4D timeframe reveals the graceful formation of a falling wedge pattern, signifying a poised parabolic turn in CVS stock. This pattern, complemented by double bottom overlapping formations, is a testament to the stock's resilience, especially against the backdrop of recent drug patent news highlighted on CNBC ( www.cnbc.com ).

Price Targets and Corrections:

The first take profit target stands confidently at $76.78, offering investors a lucrative moment to capitalize on the impending parabolic turn. Following this peak, a correction to approximately $71.07 is expected, providing a brief pause for market adjustments.

Strategic Entry and Second Take Profit Target:

Wise investors can strategically enter the market around $71.07, anticipating a second take profit target at a stylish $82.44. This forecasted move aligns with the rhythm of the stock's recent patterns, emphasizing the importance of timing in the world of financial fashion.

Historical Elegance:

Tracing CVS stock's journey since April 2019, a period marking the middle of the pandemic, unveils a remarkable rally. The stock gracefully formed a strong falling wedge pattern on the 4Day timeframe, echoing a sense of resilience and adaptability. The rally continued, reaching its peak around February 01, 2022, before gracefully correcting until October 25, 2023.

Future Projections:

As the music of the market plays on, further continuation of this trend is expected. The forecasted trajectory anticipates a new level of elegance for CVS stock by the end of 2024, reaching a poised $106.97. This future projection exudes confidence and sets the stage for CVS to make a bold statement in the financial fashion world.

In the intricate dance of stocks and patterns, CVS is poised to captivate investors with its upcoming parabolic turn and a tale of resilience, gracefully crafted on the canvas of market trends.

UNITED HEALTH Buy signal to complete the Cup pattern.United Health is on a green (1w) candle despite the general market sell-off.

This is technically due to the longer term pattern which is shaping up to be a Cup/ Arc, that remains to be seen if at the end of it will give a Handle.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 553.00 (bottom of Resistance Zone 1 which was initially formed on April 11th 2022).

Tips:

1. The MACD (1d) is rising with a Bullish Cross last seen in July and despite being bullish over 0.00, it is still underpriced.

Please like, follow and comment!!

UNH: Complex Bearish Head & Shoulders /Hidden Bearish DivergenceUnitedHealth Group has formed this Complex Head and Shoulders pattern on the weekly time frame and has formed two layers of MACD Hidden Bearish Divergence. The most recent action we got on this stock was a weekly bearish engulfing candle, and now we're expected to see it come down at least to about $300, which would be very bad for the Dow Jones Industrial Average as UNH is the top weighted holding of the index.

CAH: Bearish Crab with PPO Confirmation on the WeeklyCardinal Health has traded up to a Macro Supply Line which happened to align with the BAMM Target of a Bearish Crab and from there we formed MACD Bearish Divergence and got the strongest form of PPO Confirmation, as a result I now expect that we will begin a very deep retracement back down similarly to how Strongly CVS has responded to its own topping pattern which can be seen in the Idea Below: