Healthcare

+2068% : How the Coronavirus impact this companyHello everyone.

Today I will not give a technical analysis, but I just want to show you how the coronavirus can impact the market.

This company, China Health Group , has recently discover that the Ritonavir has Inhibitory effect on the new coronavirus.

What is Ritonavir ?

Ritonavir, sold under the trade name Norvir, is an antiretroviral medication used along with other medications to treat HIV/AIDS. This combination treatment is known as highly active antiretroviral therapy (HAART).

Often a low dose is used with other protease inhibitors.

It may also be used in combination with other medications for hepatitis C.

Also, they are the only producer of Ritonavir in China. Ritonavir

Immediately after the news was spread, this company take, in 2 days, more than 2000% .

I really think that a lot of company related to the health sector, such as this one, can surge very fast.

Better than a lot of shitcoin !

Nasdaq Healthcare: Closing on January 17thFriday's session presented a retracement on the 20 EMA Line, as predicted. I still believe in the continuation of the bullish trend. However, the bearish divergence needs to be monitored, since further price correction could occur.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Nasdaq Healthcare: Closing on January 16thToday's session generated a bearish divergence on CCI. I am still bullish, but always ready for a trend retracement on the 20 EMA Line.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Merck: Ichimoku Clouds on bullish setupIchimoku Clouds still confirm the bullish setup. Today's session will be important, if positive, to manifest further bullish intentions (Break of the $92.10 resistance).

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Nasdaq Healthcare: Closing on January 15thIf you like this idea, don't forget to support it clicking the Like Button!

Positive session for Nasdaq Healthcare that gained 0.39%. However, I still see the possibility of a retracement over the basis of the Bollinger Bands indicator (orange crosses). I was waiting with anxiety today's session to check for a signal of retracement, and it comes with the third candles (17:00 - 19:00)

The situation is also confirmed by RSI and CCI indicators.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

CVS is back!After a press release indicating that CVS Health plans to open 600 new Health Hub stores this year, CVS stock has once again been climbing. I suspect the breakout will continue once CVS pushes through some resistance. I'm looking for maybe $78 per share from this run. CVS's forward P/E of about 10.5 is very attractive for a stock with large growth prospects in the next 2 years. We've got a healthcare cost bubble in the USA, and CVS may be on the leading edge of popping that bubble with its low-cost clinic model. It also boasts a roughly 2.5% dividend.

Nektar is reaching fair valueNektar and Bristol-Myers Squibb announced today the companies have agreed to a new joint development plan to advance bempegaldesleukin (bempeg) plus Opdivo (nivolumab) into multiple new registrational trials (source: Yahoo Finance).

The 19% jump is making Nektar trading around its fair value. Likely, profit-taking will take place in the next sessions. I'm expecting the stock price to consolidate around $23 level.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Don't forget to support this idea, if you liked it, and to follow me here on TradingView.

Investing Fellow

Pfizer: Wide Moat and Interesting Ichimoku CloudsAfter the massive price drop at the end of July, Pfizer is pivoting its strategy selling Upjohn Unit to a new joint venture with Mylan and focusing on the new BioPharma business (mainly focusing on Ibrance, Xtandi, Inlyta, etc.). The new strategy provides Pfizer with a wide economic moat. I think the market currently undervalues the stock.

The current price is above Ichimoku Green Cloud, and it coincides with the Lagging Span. I will expect a bullish progression of the price in the long term with the market correctly evaluating the new strategy. However, I see a risk of profit-taking in the next sessions anyhow, not so significant to let the stock test the upper support of the green cloud.

Please, note that this analysis applies to long term positions.

Don't forget to support this idea, if you liked it, and to follow me, here on TradingView.

If you have another trading plan, please share in comments!

Investing Fellow

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Healthcare: Closing on January 14thGood session for the Nasdaq Healthcare Index, that closed the day with a 1.30% gain. Bullish sentiment is still driving trades. However next session could be characterized by a retracement around the basis of the Bollinger Bands indicator (orange crosses).

This is a daily analysis.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Nasdaq Healthcare: Trend is defined If you like this idea, don't forget to hit the Like Button!

After the rally that started at the beginning of October, the Nasdaq Healthcare Index trend is still defined, and it is approaching a new phase after a short term retracement.

Values above the Ichimoku Green Cloud confirm bullish power. Next days' trading sessions will be useful to understand if IXHC will maintain the support at 911.60 and continue its long term positive trend.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Alexion: Trading around Volume Profile POCIf you like this idea, don't forget to hit the Like Button!

Alexion business depends on patent-protected therapies in ultrarare and rare diseases of high unmet medical needs. While competitors are entering the market with biosimilars, Alexion still maintains an essential share of the market. My long term view is bullish.

However, from a technical point of view, we are in a critical consolidation phase that started at the end of October 2019. The stock price is consolidating around $107.88 level.

What to do now?

I would wait for Alexion to exit the consolidation phase with a breakout. My signal is the break of the $116.61 important resistance. Look at the purple line in the graph (Developing POC) to monitor interesting volumes movements able to push up the price (in the chart Developing POC is overlapping the POC red line). I suggest to not go in with a trade immediately after the resistance breakout since Alexion presents high uncertainty. Thus wait for a confirmation green candle (daily).

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

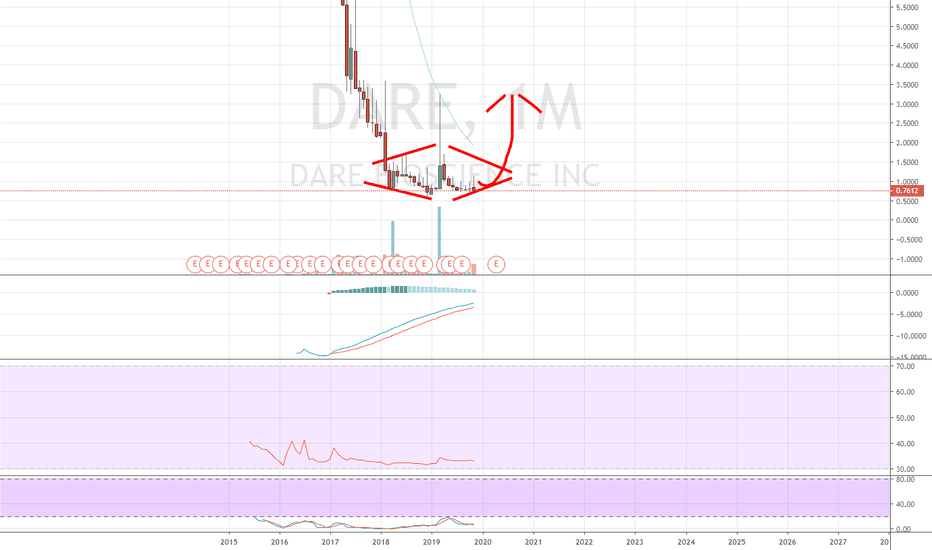

What's The Next Move For DARE?

Big news from Bayer and Dare today . Next thing to watch is for FDA approval and then if/when commercialization begins. Until then I think it's still very speculative. HOWEVER. important to note the chart. Last time it traded this high, it remained the case for a few weeks and then plummeted back down to earth. The last time it consistently traded around this price was way back in 2018. So could this mark a new, higher channel or another head fake?

"However, the fact remains that a commercialized drug in connection with a company like Bayer isn’t something to ignore. Dare could be entitled to as much as $310 million in milestone payments plus a tiered royalty structure. Does this make it one of the penny stocks to buy right now? That will be determined by the market reaction throughout the week, in my opinion. For now, at least, it seems like one of the penny stocks to watch to start the week."

Quote SOURCE: Best Penny Stocks To Watch This Week? 1 Up Over 210% This Year

DARE , OTC:BAYRY

*Speculative* $DARE - Long to $2-$3Women's healthcare company - Lots of upcoming catalysts through 2020. New acquisition this week of Microchips. Could see this fall to .50s if earnings are garbage - which is definitely a possibility, but target is still $2-$3 next year. This is speculative, but I will hold 5k shares from .79 avg.

Intuitive Surgical: expensive and to exit consolidationIntuitive Surgical produces robotic-assisted surgical systems. Currently, the company holds a significant market share in urology and gynecology areas. However, the business model is predicted to expand to other areas such as thoracic, colorectal, and other general soft tissue procedures.

From a technical point of view, the stock recovered the highs registered in April 2019, retracing on the last day of trading to the $581 level. However, the price was not able to overtake the $600 resistance that I consider essential in that case. The last session closed above the green Ichimoku Cloud; however, I see the price too close to the cloud support at $572.71.

An important signal comes from the Chikou Span (Lagging Span) of the Ichimoku Clouds. The "lagging span" is created by plotting closing prices 26 periods behind the latest closing price of an asset. Usually, when the price is above the line, it could be an indication of weakness (price too high). On the other hand, when the price is below the Chikou span, it could be an indication of strength (price too low). I highlighted in the graph the relationship between the Chikou Span and the current price. The last close perfectly matched the Lagging Span price.

Besides, I believe that the market overvalues the company. The stock is currently trading above its normal Price/EBITDA ratio of 32.75, at 50.13 (I used ten years of data). Probably the stock is too expensive.

My strategy is to wait until the green support of the green cloud (orange in the chart) is broken. To be sure of the beginning of a downtrend, however, wait until the red support of the green cloud is overtaken (purple in the chart).

Disclosure: My articles contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Biogen: Further GrowthAfter the stock price touched new highs in October 2019 ( management confirmed rebooting of aducanumab's development), Biogen started a consolidation phase.

I plotted the Ichimoku Cloud on a daily chart, together with the Bollinger bands, to highlight the volatility and confirm the consolidation phase. Currently, from a technical point of view, we are in an exciting phase, testing the high line of the cloud with a bullish configuration, as also confirmed by the Stochastic.

The upward trend is also confirmed by fundamental analysis. Biogen counts on a strong collaboration with Roche in oncology, and on growing revenues thanks to Ocrevus (Multiple Sclerosis), as well as to a significant pipeline.

Furthermore, the complexity of Biogen's drugs makes the production of Biosimilars difficult.

Disclosure: My articles contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

MYL - Worth Keeping on a Watch ListThe weekly chart for Mylan has broken out from a bearish trendline this week. We can see from the VPVR that there is not much volume resistance at these prices either. There is also a bullish divergence on the RSI. Relative strength has begun to improve too.

The price still needs to clear both a 50-EMA & 200-EMA & bulls would want to see a golden cross occur in the future. A lot of hurdles left for this stock to get over but this may be a name worth keeping on a watch list at least.

HIIQ an undervalued growth stock in a sector with political riskHIIQ was already undervalued, with a forward P/E of 4.65, but it just got even moreso today as analysts bumped its earnings forecast by roughly 20%. This is a low-volume stock, so the market hasn't yet noticed or reacted to the upgrade except for a few options traders. The main problem with HIIQ is that health insurance stocks face a lot of political risk going into an election year when the Democratic candidates may be inclined to try to kill this industry altogether.

CVS breached channel top; buy the pullbackCVS has been on a monster run, and today it breached the top of its long-term downward trending parallel channel. CVS is overbought, so it will probably pull back before moving higher, but the channel breach is a bullish signal that strongly suggests the downtrend is over. I expect CVS to see 100 within a year or two.