WC: 33.03 Target: 1800-2400 MOASS: 47k-100K: TICK TOCKIt would be easy to be really hyperbolic with my tone and words right based on the latest price action...but I'm NOT going to be

I am a TRADER and in order to extract profit consistently over time its important to manage the PSYCHOLOGICAL aspect of trading well i.e. your emotions

That's why I going to focus on only the TECHNICALS because THAT, for me, is what's going to ensure that I see as much PROFIT as possible from this trade:

Heartbeattrading

TESLA: A Good Trade for Bulls AND BearsTesla has an Elon problem aka a SENTIMENT problem

I am a 100% Technical Trader

I am an avid believer in Elliott Wave Theory and Socionomics

From those perspectives its clear to me that Tesla is in trouble...long term

Tesla went from essentially a meme like stock to a media and Institutional darling

The meteoric rise in the stock was largely because of belief in Elon..the person

Yes his companies have done some pretty amazing things..but if we are honest there are tons of failed promises in their past and now we are seeing competitors start to really make ground

This is showing up in vehicle pricing and units delivered..both trending down

The problem Tesla stock truly has though is that soooooo much of the company sentiment is tied into a belief in Elon- the person..versus the fundamentals of the company and their actual products (cmon we all know LIDAR is better smh)

As his popularity wains... so will Tesla

So with that said the charts are setup to provide opportunities for BOTH BULLS and BEARS over the next few years.

The chart show really clean places to take and hedge positions... but long term BULLS need to be keely aware of the "Trouble" line because if and when it breaks Tesla will be in serious trouble

TLT Is Yelling at UsYou typically see a migration to TLT when people are looking for a safe haven from troubled markets

I posted about TLT previously and thought we were about to see a rush to the trade because of potential market weakness

Well as we know this Bull market continued to show legs and subsequently TLT has been grounded on the launching pad

The market is yet again showing classic signs of topping

Are we saying that the market is about to crash? NO..not yet

What we are saying is that liquidity is leaving the equities markets in droves and TLT will most likely be a place where that liquidity finds a home

So pay close attention to TLT over the next 6 months because its going to tell you everything you need to know about this bull market

BITCOIN: $150k by Oct 2025...then PAINThe rise of Bitcoin and the crypto space as a whole has been one of the most fascinating parts of this last Bull Market run.

From a socioeconomic perspective the rise of speculative assets, including Bitcoin, often coincides with bull markets and economic cycles. These speculative booms tend to cluster near periods of excessive liquidity, investor euphoria, or the final stages of economic expansion.

Below are comparisons highlighting how Bitcoin's behavior aligns with previous speculative asset bubbles and economic cycles:

1. Bitcoin and the Dot-Com Bubble (1995-2000)

Similarities:

Speculation Driven by Innovation: The internet in the 1990s and blockchain technology in the 2010s both promised transformative potential.

Parabolic Price Action: Many dot-com stocks exhibited exponential price growth, similar to Bitcoin during its 2017 and 2021 bull runs.

Euphoria at the Peak: Both saw significant retail and institutional participation near the top.

Collapse: The NASDAQ dropped ~78% after 2000; Bitcoin saw >80% declines after 2017 and 2021 peaks.

Economic Context:

The dot-com bubble coincided with a strong economy, low unemployment, and expansive monetary policies before the Fed began raising rates in 1999.

2. Bitcoin and the Housing Bubble (2002-2007)

Similarities:

Access to Cheap Credit: Just as low-interest rates fueled the housing market, easy liquidity and ultra-low interest rates from 2008 onwards helped Bitcoin's rise.

Speculative Investments: Both periods saw retail investors flock to perceived high-return assets—real estate in the 2000s and cryptocurrencies in the 2010s/2020s.

FOMO and Leverage: Use of leverage amplified returns and risks in both markets.

Economic Context:

The housing bubble inflated during a period of economic growth and low rates, culminating in the 2008 financial crisis.

3. Bitcoin and Gold During the 1970s

Similarities:

Hedge Against Inflation: Bitcoin is often called "digital gold," much like gold was a refuge during the stagflation of the 1970s.

Speculative Mania: Gold's rise in the late 1970s was driven by fear of inflation and geopolitical instability, paralleling Bitcoin's role as a hedge during monetary expansion.

Economic Context:

Rising inflation, energy crises, and global uncertainty contributed to gold's rise, peaking in 1980. Bitcoin's 2021 peak coincided with fears of monetary debasement and high inflation.

4. Bitcoin and the Roaring Twenties Speculation (1920s)

Similarities:

Technological Innovation: The 1920s saw the rise of automobiles, radios, and electrification, much like blockchain innovations in the 2010s and 2020s.

Excessive Leverage: Margin trading drove speculative stock purchases in the 1920s, akin to the leverage seen in crypto markets during Bitcoin bull runs.

Economic Context:

An economic boom and loose monetary policies fueled the 1920s stock market until the 1929 crash.

5. Bitcoin and Oil During the Early 2000s

Similarities:

Scarcity Narrative: Oil's rise during the 2000s due to geopolitical concerns and growing demand mirrors Bitcoin's scarcity-driven valuation.

Speculative Price Movements: Both experienced rapid growth as speculative capital piled in.

Economic Context:

Oil's rise coincided with economic growth, peaking before the 2008 financial crisis. Bitcoin has also seen peaks before macroeconomic downturns.

Common Themes of Speculative Peaks:

Liquidity Abundance: Speculative asset bubbles often form during periods of loose monetary policy or fiscal stimulus.

Retail Participation: Peaks are marked by significant retail involvement, media hype, and euphoric sentiment.

Late-Cycle Phenomenon: The speculative peak often aligns with the late stages of economic expansion, just before a contraction.

Leverage and Risk: High leverage amplifies price volatility and magnifies both gains and losses.

EL: "I May Be Early...But I'm Not Wrong"Having a little fun with this one since Burry's EL position is getting so much attention

With that said I see why its in his portfolio

Expect to hold this for 5-10 years to see it to fruition but yeah...I think Burry has another winner on his hands

As always time will tell and price is king

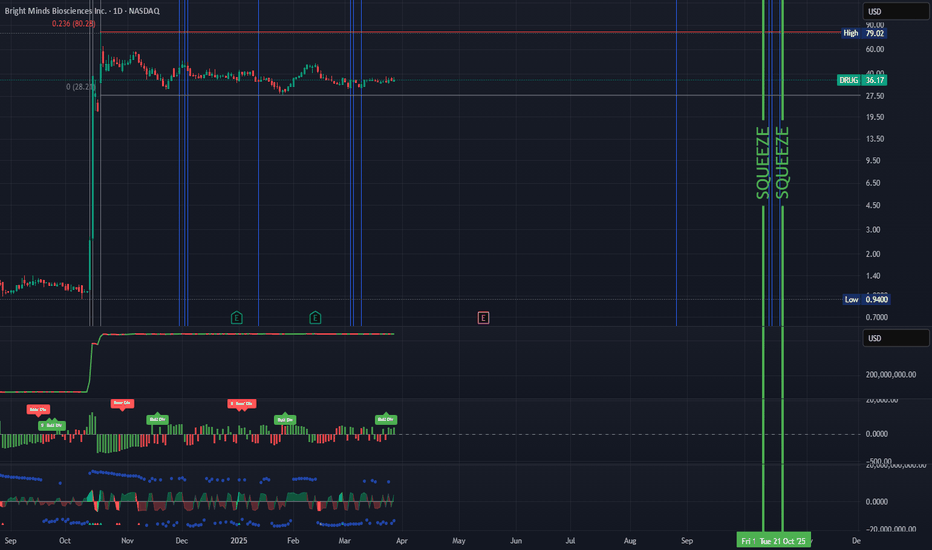

FNGR: You Had My Curiosity, Now You Have My AttentionI have received a ton of requests to provide a chart on FNGR

I'll keep this simple:

Yes, based on the structure this has HIGH potential for a massive break higher aka squeeze

Every Fib is a target but as I mentioned in my latest GME video on targets I ALWAYS use the 1.00 Extension as my first and main target

Lets see if it happens

GOOD TRADING TO YOU

WC: 27.54 Target: 1800-2400 MOASS: 47k-100K: #GME20WeekCycleLast weeks post, Gamestop Decoded, laid bare everything that I'm fully confident on related to the timing of settlement cycles and The Cats plays

To summarize, GME moves on a 20 week settlement cycle that in its current iteration kicked off the week of Nov 27, 2023

The Cat seems to be amplifying price improvement thru strategic options/ share buying during Low IV periods within the settlement periods

I'll talk about some other interesting aspects of this in my next video on, 05/17

Whats Next?

As explained in the Gamestop Decoded video, from the WEEK ( not day ) of 05/12 thru the WEEK of 06/02 I anticipate volume to pick up significantly due to The Cat starting to receive his ORIGINALS which are WHATS IN THE BOX

That will lead to the WEEK of 06/09 which equates to the EXPLOSION EMOJI in the EMOJI Timeline

P.S. I will be GOING LIVE on my YT channel on 06/09 if you care to hear me ramble about whatever price action we see lol

GOOD TRADING TO YOU ALL!!!

MPW- About TImeMPW has been taking its swwwweeeetttt time overlapping and making lower lows

This is absolutely related to that insane borrow fee and the shorting taking place

But as with everything else, all things must come to an end :)

Shorts are about to get wrecked for the next couple months most likely

This should fly right along with the other stuff that squeezes from now throughout the summer

I'll most likely end up making this part of my "Squeeze Me" series

Squeeze Me: ZAPPI do not have a crystal ball

But what I do have is enough

Trade What You See..Not What You Hope For

WC: 27.46 Target: 1800-2400 MOASS: 47k-100K: LETS GO!GME is in a great position to RUN from a technical perspective

Since the April low, GME has seen price improvement of 30%+..right in line with our prediction that May/June will see MAJOR VOLUME and potentially EXPLOSIVE PRICE IMPROVEMENT (no crystal balls and no guarantees people..smh)

Will GME DIP to SUB 20 before MOASS? Possible but Highly Unlikely and would require a significant move lower in the Broader Market to facilitate such a move.

That festering thought in the community is just more REDDIT NON-SENSE (e.g. "TA is bad", "Options is bad", "Price Anchoring!") and is NOT based on any real TA that i've seen. Again Is it possible? YES!...but so is GME going to $5..the question is if its PROBABLE

Near Term Expectations

Continued positive price improvement that takes us up to the Convertible Bond conversion level near 30

Once that level is breached we should see a move to 34ish and then some sort of retracement back to near 29/30 ish

After that we should see pretty aggressive price action that sees us head up the Fib Pair Elevator as described in the last video

MOASS Rocket Fuel

MOASS Rocket Fuel

MOASS Rocket Fuel

GOOD TRADING TO YOU!

SPX: Eye of The StormIn a hurricane the EYE of the storm is region of "calm" and even blue skies

To the unaware, the break in the clouds and the blues skies may bring a sense of relief that "the worst is over"

But the informed know that the OTHER SIDE of the storm is coming and the worst has yet to happen

IMO the aforementioned scenario accurately describes what we are about to see in markets

The Administration is slowly backing off the more severe of the tariffs

Over the weekend they removed tariffs on major electronics and associated components coming from China which should bring a sense of relief to markets

We will most likely see continued softening on the worst of the tariffs as the administration grapples with the true reality of things: MARKETS ARE IN TROUBLE

This softening will give the appearance that things will be OK and we may even see markets rally to new ALL TIME HIGHS

But a rally to new ATHs will be akin to the "eye of the storm" as just like with a Hurricane..the other side of the storm is coming