How brokers provide zero commission trading? You've probably heard of many zero commission trading platforms being established.

Robinhood is probably the most well known one, actually.

Historically, brokers have made their money by facilitating trades in the market between buyers and sellers and collected a fee for their extremely hard work...

Since markets have become larger, with greater trading volume and more participants, commissions per trade have fallen drastically, and the industry has had to change for your poor broker to earn a living.

With the rise of the smartphone, this has led to brokers being able to target a new type of trader...

This trader tends to be less informed than a professional...

Trading off a phone...

A lack of experience...

And more of a gambling mentality rather than understanding what is truly driving markets.

Firms have realised that.

'Commission free' is a marketing tool, and a very good one.

See, what is happening now is that market makers and dealers - and by extension, exchanges - are willing to pay brokers for their uninformed clients' order flow.

High frequency trading firms, such as Citadel, Apex, Renaissance, Virtu and DRW conduct market making on extremely low timeframes, providing liquidity to exchanges - that's their primary goal - and exchanges pay them rebates based on volume for doing so - note the chart of the CME Group above.

Their share price has increased massively since high frequency trading (market making) has driven 'liquidity' to the exchange.

Since their business is focused around volume, they welcome HFTs providing liquidity and therefore do not mind paying them volume based rebates - HFTs are kind of like introducing brokers.

But what's a market maker?

Market makers are delta neutral.

They do not necessarily care about the direction of a market, they simply want to sell higher at the bid and buy at a lower offer, thus capturing the 'spread' (the difference between the bid and the offer).

By paying brokers for the uninformed flow, this means that they believe they can capture asset misvaluations, and therefore turn a profit.

And it's very lucrative business.

Robinhood recently got fined for not routing orders adequately to allow for best execution for clients.

The adverse selection that they committed is an example of how a client can be at detriment.

However, it isn't necessarily bad to trade with a zero commission broker, since your explicit costs can be low (although implicit - the costs you don't see - could be higher and likely are).

What matters massively is their execution policy and whether you are being filled at the bid or offer that the market will allow you, or if you're receiving the price that the broker wishes you to get as part of their routing relationships with market makers.

The former is good, the latter is bad!

I hope that's cleared up a bit for you...

HFT

SPY is selling off. People want their cashUsing the Cash in/cash out indicator (CICO) one can see the major shift from buying to selling. The CICO indicator measures a rolling sum of new money in and out of the market. The user can set the desired time frame to measure. The code is open source and directions on how to use the indicator are within the comment sections of the indicator. Don't let the 1% take your money, they don't need anymore.

WALL STREET (DJI): HFT counterattackThis is about HFT's and a counter offensive against market manipulators on the DJI.

It is an unconventional and risky strategy. I share with everybody. But if carefully studied and managed can be quite profitable in relatively short periods of time, like a few hours.

To appreciate and engage this:

1. Multi-timeframe analysis is a must.

2. Trend following skill is required.

3. You must have 'nerves of steel'.

4. High levels of attention to detail.

5. In live trading you must have cash that you can afford to lose. (Your losses are your own as usual).

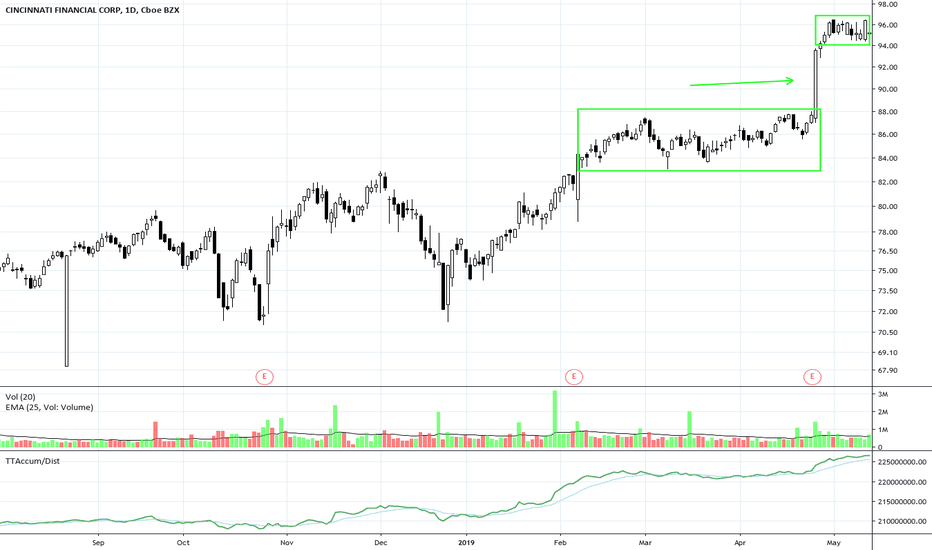

CINF Platform Pattern Hidden AccumulationCINF is an S&P 500 index component. The chart shows a platform sideways pattern typical of Dark Pool hidden accumulation. This was followed by a long white candle that was not HFT driven. The stock is now in another consolidation, at a new high with more hidden accumulation.

ECPG Has Rare HFT PatternHFTs rarely trade a stock more than one day. ECPG has 2 days of HFT action moving the stock with strong momentum with high volume. Often VWAP orders from smaller funds will trigger after an HFT run day. The stock breached resistance but is at risk for professional traders taking profits. ECPG is an S&P 500 index component.

XOM: Consolidating as oil prices rise, watch for pro tradersXOM is in a consolidation as oil commodity prices are rising. This offers incentives for pro traders to enter ahead of any HFT activity. The bottom has some buybacks in the candlestick structure as well. The goal is to generate speculation among the retail crowd.

QCOM: Pro traders' end of day reaction to AAPL newsThe huge candlestick yesterday was NOT HFT activity. A run occurred toward the end of the day, driven by pro traders who received early news regarding the settlement of a 3-year lawsuit with AAPL. Pro traders initiated the end-of-day run and smaller funds’ VWAPs triggered to continue the end-of-day run on high volume.

NFLX: Volume needs to increase to break up through resistanceNFLX is currently resting after a strong speculative momentum run out of its low of December. The sideways pattern is just below previous high resistance levels. Volume needs to increase before it can test the resistance for a breakout move. HFTs run this stock rather than gap it.

NTAP: Filling gap, solid candlestick patterns ahead of earningsNTAP has moved into the gap area, and is now poised to challenge the next resistance level. This stock has had recent HFT activity and is likely to have more HFT attention on the day of its earnings release. The candlestick patterns are solid ahead of earnings. Watch for pro traders setting up for a pre-earnings run.

LULU: Volume rising after HFT gap up above a support levelLULU has a consolidation that moved up above the previous recent new high. The stock gapped up on HFT action to the current level. Volume is rising. The support levels for the recent gap are the Sept high and the February high. This is weak support for swing trading or momentum style trading. Earnings are expected at the end of May.

NVDA: Filled gap down, watch for pro trader pre-earnings runNVDA has filled the gap down from the negative earnings reaction in November 2018. The stock is likely to consolidate or shift sideways at this resistance level if it is to build energy to move higher. There is some Dark Pool accumulation in the bottoming pattern. HFTs have gapped this stock on earnings news in the past. Earnings will be reported May 9th. A month out is a good time to start watching for the pro trader patterns that lead to momentum in a pre-earnings run.

NKE: Early reporting stocks set the tone for earnings seasonNIKE is reporting earnings today AFTER the market closes. How the stock behaves will help determine how to trade this earnings season as we can begin to determine which of the HFT algorithms are being used and the expectations of the pro traders on how they are managing the pre-news they receive ahead of the retail crowd. Currently there is no viable pre-earnings run setup. The stock is bouncing around the previous all-time high area, without breaking to the upside.

HFTs have been in this stock on earnings report days in the past. The report needs to be very positive this time. The next few charts I use for analysis will be about studying these very early reporting companies and the HFT algo reaction. Stay tuned…

BA: Speculative at New All-time High with Contrarian Long-term POnly 2 of the DJIA components are currently at new all-time highs: BA and PG. Boeing gapped and ran up on earnings news with a boost from HFTs and buybacks. Currently, the number of shares held by institutions is dropping. Vanguard, Blackrock, Price T Rowe, State Street, Capital World Investors, Northern Trust, all giants of the Buy Side, have lowered held inventory in recent months. The stock is at a speculative price as smaller funds buy heavily and buybacks of up to $14 billion move price up. Whether this will be a good strategy for BA this year remains to be seen. The chart is the Long-term Trend Monthly chart showing the severity of the speculative buying. Also you can see the Cycle chart pattern using the DPO indicator with a failure to trough V shape. Volume shows a steady decline as well. These are contrarian indicators to what price is doing.

NTAP Earnings: Short-term Bottom, HFT, Pro Traders, BuybacksNetApp is a Data Storage company for Cloud Technology. The Financial Services Industry is reporting a huge increase in Cloud Services usage that is starting in 2019 after a very conservative interest in Cloud Based Storage and services. This could potentially help NTAP complete this short term bottom and begin a new business cycle for the next couple of years. NTAP topped around $88 and declined to a low of about $56 before starting this first attempt at a bottom. HFTs are likely to be targeting this stock tomorrow as it reports its earnings. NTAP technically has stopped just below resistance for a completion of bottom. It is technically in a sideways pattern at this level. BOP shows HFTs were the drivers for the stock to drop in price to the short term bottom low of $56. BOP is not yet showing any quiet accumulation. Some pro traders are in the mix. The stock may also be under buyback mode as well.

INTC: Earnings, 5G and HFT Gap RiskIntel is moving rapidly to capture the 5G market, along with Verizon. This was discussed in detail in our recent annual Virtual Course, this time on Emerging Displacement Technologies for the Next Decade. INTC stock has been struggling at a support level, not moving down much but also without a strong pre-earnings run as many blue chip companies enjoyed. The reason is there are some institutions selling, as seen in rotation patterns and other institutions buying in accumulation patterns. Hence, the trading range pattern on the daily chart. For now the sellers have more dominance, but that can change. The Earnings report is due today after the market close. HFTs are likely to be all over it, which means there is gap risk, and they will trigger either way on earnings news.

NFLX: Pre Earnings Run The speculative gains of what we call a “pre earnings” run ended ahead of the market open on Friday. Netflix is reporting an increase in the number of users but had a decline in revenues, which is a worrisome pattern that is occurring in many big-name companies thus far—many banks and the early tech stock reports. NFLX was being sold on the professional side ahead of Friday's open and was down about 3% in the premarket. How and IF the HFTs trigger to the downside on the earnings news this week will tell us what to expect for other stocks with similar earnings to revenues numbers for the 4th quarter of 2018.

Earnings for C, Citigroup Bank: HFT Gap ExpectedCitigroup reported ahead of open today which indicates it hoped that the market open would inspire buying of its shares of stock. HFTs are set to trigger on earnings news. How it might gap depends on the algorithm focus, retail crowd reactions, retail broker expectations, and the triggers set ahead of open. C has the same negative divergence as AAPL has on the weak “rally run” up after bouncing off of technical support levels best seen on a weekly chart. Today’s chart is a daily chart to show that the run is weak and poised for a potential gap.