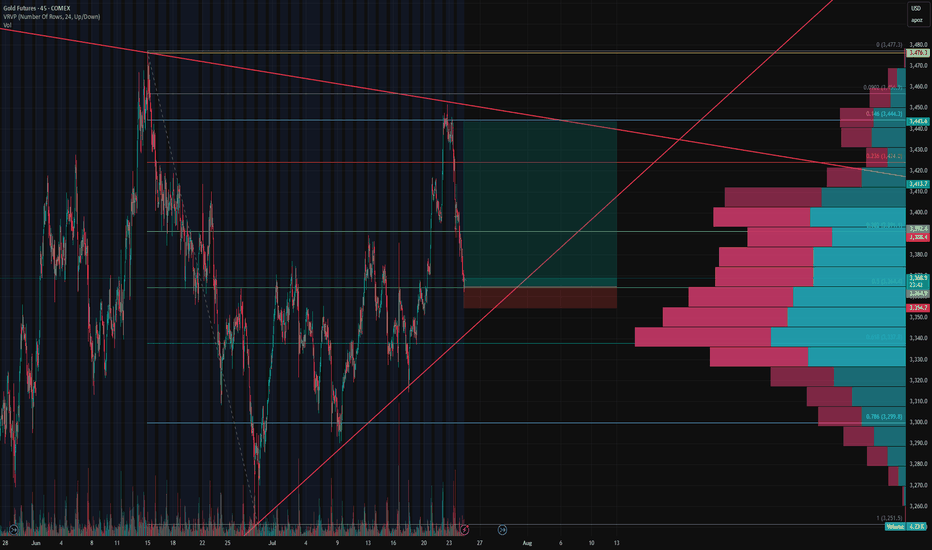

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile.

📈 Entered long at 3,365 with a tight stop below 3,354 (0.3% risk), targeting the descending trendline near 3,444 for a clean 7.7R setup.

🧠 Context:

Price reacted hard at resistance, but volume support and structure still lean bullish.

Clear invalidation if we break trend and lose 3,350 support cluster.

Let’s see if this bounce gets legs. 🚀

Highrr

GBPJPY Just Hit the Sweet Spot — High RRR or Fakeout Trap?💷 GBPJPY 30-Min Chart Breakdown — May 14, 2025

This setup is a banger for traders following structure, zones, and risk-reward logic. Let’s dissect the trade logic:

🔍 1. Market Structure

Price has been moving within a well-respected ascending channel (see black trendlines).

We just printed a short-term bearish pullback, with price dipping into a refined demand zone (highlighted pink/red).

The most recent bearish impulse looked like a liquidity sweep, not a structure break.

🧱 2. Smart Money Zone

Demand zone aligns with:

✅ Previous OB (order block)

✅ Mid-channel support

✅ Equal lows & trendline liquidity just below

Dark gray box = the exact entry block

Bulls stepped in right on time — classic mitigation + reaction setup

🎯 3. Risk-Reward

Entry: Around 195.380

SL: 195.110 (tight below the block)

TP: 196.575

RRR ≈ 1:5 — beautiful sniper entry with minimal exposure and max gain

🧠 4. What to Watch Next

Break above 195.900 = confirmation of bullish continuation

If price stalls again below midline, re-entry could come after another liquidity push

Clean break of 195.100 = invalidation (watch for potential short setups below)

🔁 Trade Management Tips:

Trail stops aggressively above 195.900

Scale out partials every 50 pips if you're trading it like a swing

Add confluence from DXY/Yen strength for better context

This one checks all the boxes: structure, zone, confirmation, and a clean RRR.

🚀 Tag a trader who loves tight stop, high-RR plays.

📲 Follow @ChartNinjas88 for more Smart Money scalps & swing setups!

EURUSD 1:25R setupThe price action that has developed has presented an opportunity for a long position at this exact price point I placed my buy limit order.

I am taking it to the top of liquidity on the opposite side of the order as my target.

Risk is small and reward is very high, just as it should be.

I am personally risking 4% on this setup for a potential 100% gain.

If you are on a funded account, you should definitely consider risking less.

The setups that I take are very low frequency. This is actually designed to keep my trading down to a minimum AND keep my trade setups highly selective.

I do this because I have found that sustaining loss after loss after loss on a day to day basis is not good for your trading account OR your mental health.

Trade with an open mind and free of any past trading trauma you may have developed on your journey.

It's a journey of you vs you. You only lose if you quit!

Happy trading traders :)

EURGBP 1:15 setupI am documenting every single one of my live trades to track my progress and help make an impact on the trading world.

I took this particular trade based off my understanding of price action and market cycles.

Today should be a reversal day.

Yesterday was bullish, Thursday can present opportunities to take price to the opposite side.

I am targeting major liquidity that was created at the beginning of the month.

I believe that EUR CPI tonight will give it that push in the direction that I am looking for and give me the volume that I want to see.

If not, oh well, that's the game!

I will still be in the game to play when the next opportunity presents itself.

Potential Sniper Entries on EURUSDHello Traders!

First, 95% of traders are wrong and everyone's analysis outside of yourself should be taken with a grain of salt and a gulp of discernment.

With that being said, here is my current outlook on EURUSD based on current economic conditions and price action that has developed.

Due to the outcome of NFP last week, the current USD Unemployment Rate raising from 3.5% to 3.7% seemed to be the dictator, we saw bullish price action on beginning on Friday for EU.

With the current economic data priced into the market, I am anticipating more bullish activity as the week unfolds.

Therefore, I am expecting a pull back during London session for a continuation of bullish momentum during New York session tomorrow.

Due to the fact that smaller stop losses typically mean lower accuracy for trades, I like to take multiple shots with these setups and risk small for insanely high risk to reward setups.

The point for me isn't to win every trade. The point for me is to win HUGE on the trades that I do win so I can come out with a positive ROI in the long run.

Happy trading investors!

Two Potential Setups on XAUUSDThe fundamentals over the past week have been coming out as strong catalysts for bullish momentum on the DXY to continue. Therefore, I am currently still looking for SHORTING opportunities on XAUUSD. So if or when price returns to 1940 / 1945, I will be paying attention to price action as it develops and if it starts to look like buying pressure is fizzling out, I will be executing my short positions from these areas.

I am keeping my risk very minimal on both of these orders at only 10 pips, reward is going for 218 pips on the first potential setup for a 1:21.83 RR and the second setup is going for 268 pips for a potential 1:26.8 setup.

I am expecting the 1st setup to potentially fail because it is so close to a fair value gap that was left by the imbalanced selling pressure left after the FOMC meeting yesterday but there is a small risk on the setup so I will take that risk.

The best thing that I have done for my trading is stop trying to trade every single day and wait for the setup Tuesday-Thursday only.

I keep my risk to reward at a 1:10+ so if I lose, I lose small and when I win, I win big.

At this risk to reward, I can hit 9 stops in a row, then hit one target profit, and still be profitable.

The hard part is moving through those losses and not letting it shake my trading fortitude.

I've learned that win ratio is not the most important key performance indicator when you are trading.

99% win ratio sounds better than a 13% win ratio to inexperienced traders but if that 13% win ration has a much higher risk to reward than that 99% win ratio, then the trader who has a 13% win ration will be the more profitable trader.

With that being said, if you decide to take this trade, please do not risk any more than 1% on either one of these setups.

A tight stop loss is great and can be enticing to risk more, however, the tighter the stop loss, the more often you will hit that stop loss.

Please trade intelligently.

LUPIN - Consolidation and Breakout, High RR swing tradeHi traders,

Lupin has given a good opportunity after staying in a tight range for good amount of time. Now, as we can see that Lupin has given a re-test and the previous resistance has become a support.

I have already initiated the position at 1175 with a stop loss below the support i.e 1167.

1st target: 1205

2nd target: 1220

The Reward-Risk is 5:1 (Considering the first target)

This seems to be a high probable trade because there is a gap which is supposed to be filled. Also, the pharma sector is strong.

Feel free to comment your queries. I would love to respond to them.

Thank you,

Keshaw H. Agarwalla

Happy trading :)

Watch This If You Are Not Profitable In The Forex Market!!I am teaching the institutional methods of trading rather than trading the normal retial concepts such as support resistance. I trade using institutional strategies.. If you guys want to learn how to think and trade like an institution follow me i will be dropping some real gems here for free !!

I will be dropping videos on my new youtube channel soon

Subscribe if u dont want to miss out

www.youtube.com

GBPUSD Long - Fallind Wedge PatternLet's dive into the setup:

After completing the 5th elliott wave, which I have happily traded and you can see how it went on my twitter account, and a double bottom so clean that I didn't take advantage of, it went on to touching the higher trend line of a falling wedge pattern. The astonishing speed with which it arrived there, led me to believe that last LL and its subsequent rebound is just the lull before the storm.

As you can see from the chart of the DXY, it looks as if the dollar is retracing after a big downside symmetric triangle breakout; if it also breaks the lower trend line of this pennant pattern, we could be heading south.

Moreover, tomorrow is NFP day, so keep a close eye on the market if you have open positions or plan to open one. It's not like the old wild days of huge movements, but it could pose some risks.

Lond Idea12/Feb/2020 08:23 PM AUTHOR: Brandon Gum

--

i think the first entry is gonna be at the 19.40 annd 21.25 levels. buy in there. risk a dollar to make 5 up to 26.50

======================

Long Idea11/Feb/2020 10:57 AM AUTHOR: Brandon Gum

--

Not my typical idea, but if looking for momo, this is a candidate.

Expect price to stall a bit at 93.25

I have low expectations for this one and have no position.

On that note--> that has a RR over 3 yet stock is so extended. Is that rr of 3 realistic??? Or is there really more downside risk here?

======================

Long Idea29/Jan/2020 09:19 AM AUTHOR: Brandon Gum

--

Has been struggling recently.

Here is a decent oppurtunity to put on risk.

Up big pre-market right now.

======================

ONEBTC Bullish Wedge>7 R:R

RSI is super low, generally pretty safe for an entry.

Fundamentals: AMA with Chainlink tomorrow.

Long Chainlink on 15m- 15% pump could be comingOn this chart, we have a crypto specialty, the symmetrical triangle, where the target is generally the height of the triangle. However, these have not been the most reliable in recent times, so I'd recommend taking some profits on the way up.

Everything is looking good for the next few hours. MACD crossed over. RSI ticking up, and lots of volume. Target is equal to a fib level which is always a little confirmation as well. Stop is below a fib level and previous low, which is very conservative for a pattern like this, but still great R:R. Feel free to set it just below the triangle if you don't want to risk so much of your capital.

On the fundamental side of things, what's not to like as well? Twitter has been increasingly active by the day and so much faith is being restored and entering into the project.

Please don't forget to leave a like!

Previous link analysis:

LONG BTCUSDTSwing Trade (Weekly, Daily)

On daily Buyers are pretty aggressive as the bounced back for the 5961 Support area and they wiped out the strong Demand (7401 USDT) area which is holding for a while and holding above the Demand level, So, technically it is a buy but the area to watch is 7954, if price hits this area so aggressive with much power then we can tell that Big Boy is doing his purchase and so, we do.

Entry: 7688 USDT

TP 1: 8500, TP 2: 9500

Stop loss: 6619

Position Size: 1% Risk on your capital/1069

Risk/Reward: 1:6 So, HH RR.

If TP is hit then we will be at 19% profit.

Buy from Sellers and Sell from Buyers.

USDCAD FOR BETTER Risk/ Reward ENTRY AT STRUCTURE!Looking at USDCAD we see that the RSI is heavily oversold. I am long in the gartley pattern since 1.2837.

For those traders how might have missed this pattern, you get a second chance with much better RR ratio.

Remember you follow your plan!

Best of luck, Felix.

Website: www.ogtpartners.com

Twitter: goo.gl

Facebook: goo.gl