HIVEUSDT Forming Falling WedgeHIVEUSDT is starting to attract notable attention from traders and investors who are seeking solid opportunities in the altcoin space. With good volume backing recent price movements, HIVE appears to be consolidating in a healthy range that could soon give way to an upward breakout. The project’s fundamentals, combined with its strong community engagement, make it an interesting prospect for short- to medium-term gains. Analysts are eyeing a potential price rally of around 40% to 50%+ if market sentiment remains supportive.

One of the key reasons behind the growing interest in HIVE is its consistent development activity and use case within the decentralized social media and content creation space. As blockchain-based social networks gain momentum, HIVE stands out as a pioneer with an active user base and proven on-chain activity. This makes it a compelling option for investors who want exposure to utility-driven tokens with tangible adoption.

On the technical side, traders should watch for breakouts above significant resistance levels and monitor how volume behaves during these moves. A strong surge in buying activity could confirm that bullish momentum is taking over, offering an attractive risk-reward setup. With the broader crypto market showing signs of recovery, HIVE’s setup looks promising for traders looking to capture gains in the coming weeks.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HIVEUSDT

HIVE: When To, How To?I've been tracking HIVE for a while and now I want to show it to you, it will be a good money maker if you decide to "jump in." Let's go back to some basics signals.

HIVEUSDT Technical Analysis

In August 2024 we have the main low and subsequent higher low in November. In 2025 we have a long-term higher low, April & June and also a double-bottom. That's the classic.

The higher low points to a higher high for the new bullish wave that will develop in the coming days and weeks; the double-bottom points to the low being in and current prices being good for a trade setup with low risk vs a high potential for reward.

When to sell

I have a friend and he is a scientist, he asked, "Hey Alan, when should I sell? Should I go for 400% or 660%?" It is always the same question.

I said, "You can do whatever you want of course..." He wasn't satisfied. Imagine, the scientific mind. "Yes, but how do I know if the right target is the one where you placed 400% or the 660%?" He said. You know, the scientific mind is never satisfied unless supplied with specific answers.

"Well..." I am preparing myself to give a reply that will require no additional questions. "How you approach the targets will fully depend on your trading style, that is, your goals, your capital, your risk tolerance and how confident you feel about my analysis, the targets and the chart."

"What?" Listen, you just buy and hold and contact me after three months. You'll know what to do when prices are up... Just kidding of course.

Namaste.

Hive Breaks Above Resistance, Easy 190% Jump In The MakingI don't have to describe the signals because it is already happening, the results will speak for themselves.

I have to describe the signals because we cannot post a chart without adding some text. So some times you will see me writing just to meet the requirements but I would just love to say, "It is going up."

Sometimes no words can give a stronger message than too many words, but the rules say that we have to write so, here we go:

» HIVEUSDT is trading within a long-term higher low. Long-term for me is 6 months or more for Cryptocurrency pairs, and here the main low happened in early November 2024, so this higher low can be called long-term. Of course, the second low happened recently, 7-April 2025, when the correction reached its end marketwide.

» A broken downtrend, based on an internal trendline and a move above resistance is also taking place. I can guess a strong RSI and move and close above some moving averages, in this case, EMA34 has been conquered.

» A nice and easy 190% bullish jump is in the making, this can happen within days or weeks, short-term. Within 30 days (one month). There will be more growth but this is for another day. This chart analysis is for those trading short-term.

Namaste.

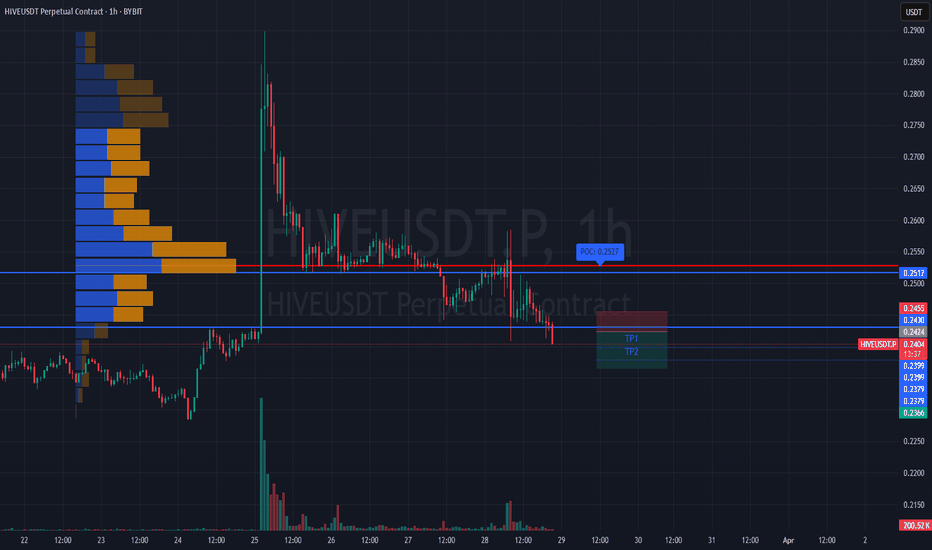

#HIVEUSDT is maintaining a bearish structure📉 Short BYBIT:HIVEUSDT.P from $0.2424

🛡 Stop loss $0.2455

🕒 1H Timeframe

⚡️ Overview:

➡️ The POC (Point of Control) is at 0.2527, marking the area with the highest trading volume and now acting as major resistance.

➡️ The 0.2455 level serves as local resistance — price has already started to decline from that zone.

➡️ Price BYBIT:HIVEUSDT.P is steadily moving lower and staying below volume clusters, confirming the bearish structure.

➡️ A breakdown below $0.2424 could lead to acceleration toward target zones.

🎯 TP Targets:

💎 TP 1: $0.2399

💎 TP 2: $0.2379

💎 TP 3: $0.2366

📢 Watch for confirmation of the $0.2424 breakdown — it’s key for continuation.

📢 If price reclaims $0.2455, the short setup becomes invalid.

BYBIT:HIVEUSDT.P is maintaining a bearish structure — expect quick target reaction if the signal confirms.

HIVE buy/long setup (4H)Two trigger lines have been broken, and there is a bullish iCH on the chart. We have also seen a strong move, and at the origin of this move, buy/long positions can be considered.

This setup is mostly suitable for spot trading.

Targets are marked on the chart.

The closure of a 4-hour candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

HIVEUSDT – Support & Resistance Levels Marked! Time to Make Some Money – But Smartly! 🔥

📊 Key Levels to Watch:

🟢 Green Box = Strong Support – This is where buyers may step in.

🔴 Red Box = Major Resistance – Sellers are likely waiting here.

💡 The Plan:

✅ At Support? – Look for LTF bullish confirmations & CDV divergence before entering long.

✅ At Resistance? – Wait for LTF breakdowns & CDV confirmation for potential short plays.

✅ Break & Retest? – If price breaks a level with volume, trade the retest—not the breakout itself.

📌 Final Words:

Patience + Confirmation = Profitable Trades. We don’t gamble, we execute!

🚀 Follow me for high-probability setups—let’s get this money! 🔥

✅I keep my charts clean and simple because I believe clarity leads to better decisions.

✅My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

✅If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

HIVEUSDT Sees 570% Daily Volume Spike! Next Big Move!?HIVEUSDT Analysis

Massive Volume and Key Bullish Zone

"HIVEUSDT is making waves with a 570% daily volume increase. This kind of surge doesn’t go unnoticed, and neither should these levels."

Why It’s Exciting:

Blue Box Zone: Around the blue box, I see a prime opportunity for bullish entries. These levels? Far from bad – they look great.

Volume Surge: This explosive volume increase is a clear sign of strong market interest and potential upside momentum.

Key Observations:

"As always, I’ll wait for confirmation with upward market structure breaks on lower time frames, supported by CDV and volume profile. The blue box isn’t just a zone – it’s a strategy."

This is shaping up to be a fantastic trade setup. Don’t miss the chance to act on strength and data! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

ACTUSDT UPDATEACTUSDT is a cryptocurrency trading at $0.4312. Its target price is $0.8000, indicating a potential 100%+ gain. The pattern is a Falling Wedge, which is a reversal pattern. This suggests that the downward trend may be coming to an end. A breakout from the Falling Wedge could lead to a strong upward move. The current price may be a buying opportunity. Investors are optimistic about ACTUSDT's future performance. Reaching the target price would result in significant returns. The Falling Wedge pattern is a bullish signal, indicating a potential trend reversal. This could be a lucrative investment opportunity.

HIVE ANALYSIS (UPDATE)📊 #HIVE Analysis : Update

✅As we said earlier, #HIVE performed same. Around 96% move done in #HIVE. There was a formation of Falling Wedge Pattern on daily chart with a breakout🧐

Current we can see a little retest and then we could target for resistance 2

👀Current Price: $0.5932

🚀 Target Price: $0.7130

⚡️What to do ?

👀Keep an eye on #HIVE price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#HIVE #Cryptocurrency #TechnicalAnalysis #DYOR

HIVE/USDT Breaks Multi-Year Triangle: Bullish Momentum Ahead?HIVE has broken out of a multi-year symmetrical triangle pattern on the weekly timeframe, with the price currently trading at $0.4456. It is now well above the 50-week EMA, which provides dynamic support around $0.28.

This breakout signals a strong bullish move, with potential resistance targets at $0.50 and $0.65. Watch for a retest of the breakout level for possible re-entry opportunities.

HIVE ANALYSIS📊 #HIVE Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a breakout and currently retesting the major resistance zone🧐

Pattern signals potential bullish movement incoming after a confirmation of breakout

👀Current Price: $0.3480

🚀 Target Price: $0.4788

⚡️What to do ?

👀Keep an eye on #HIVE price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#HIVE #Cryptocurrency #TechnicalAnalysis #DYOR

HIVEUSDT %1500 DAILY VOLUME SPIKEThere is a 1500% daily volume spike in HIVEUSDT, signaling significant activity and attention in this market.

The blue box is extremely valuable from multiple perspectives. I have used heatmap , cumulative volume delta (CVD) , and volume footprint techniques to identify this as a precise demand region , where buyers are likely to step in with strength.

Key Points:

Volume Spike: 1500% increase highlights a surge in market activity.

Blue Box: Carefully identified as a critical demand zone using advanced techniques.

Techniques Used: Heatmap, CVD, and volume footprint for pinpoint accuracy.

If you'd like to learn how I use these tools to determine such precise demand zones, just DM me!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you'd like to learn how I use heatmaps, cumulative volume delta, and volume footprint techniques to identify highly accurate demand regions, feel free to send me a private message. I'm happy to assist anyone interested, with no charge or obligation.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#HIVE (SPOT) entry range( 0.15 - 0.1720) T.(0.4050) SL (0.1467)entry range ( 0.15 - 0.1720)

Target1 (0.2640) - Target2(0.4050)

SL .1D close below (0.1467)

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE ****

HIVE/USDT Bullish move from support?👀 🚀Hive Today analysis💎Paradisers, #HIVEUSDT is currently on the move, showing promising strength at its support level. There's a good chance it could rise above the $0.4136 resistance if it keeps up this positive momentum.

💎In the past, we've seen #HIVE follow a downward trend, consistently hitting lower peaks and troughs. A recent bounce from the $0.3689 support has bolstered the outlook for a bullish turn, especially as it's maintaining its pace at this support level to potentially climb past the resistance.

💎 Should #HIVE struggle to keep its momentum at the $0.3689 support, we're anticipating a bullish recovery from the next support at $0.3348. However, breaking below this point may lead to a further drop. Let's stay alert and ready to adapt our strategies as needed.

HIVE ANALYSIS📊#HIVE Analysis

✅️#HIVE has experienced a Descending Triangle breakout on the weekly timeframe, suggesting the potential gain of more than 100% bullish wave 📉

👀Current Price: $0.4280

🚀 Target Price: $1.0165

⚡️What to do ?

👀Keep an eye on #HIVE price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#HIVE #Cryptocurrency #TechnicalAnalysis #DYOR

HIVE ANALYSIS (1D)From where we put the red arrow on the chart, a double correction has started.

The novelty of this double correction seems to be over.

By maintaining the green range, it can move towards the TPs.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You