HKD

Forex News: Hong Kong’s 11th Week of ProtestForex News – Hong Kong’s biggest-ever street protest has come to its 11th week, and more are joining the calls for a resolution.

Last week, Hong Kongers took out their money from ATMs. The goal was to prove the city was more than just a cash cow. The movement has further escalated the instability due to the protests. The city’s currency has also suffered.

Meanwhile, US President Donald Trump said that he was “concerned” about the probability of a violent Chinese crackdown. Last week, he seemingly tied up the US-China trade discussions to the HK protests, calling for a humane resolution.

Trump added that he would talk to Chinese President Xi Jinping and urge him to negotiate directly with protesters.

The protests have crippled the city’s currency due to the instability. Such a situation will apparently continue until one of the sides give in.

According to certain reports, China is moving its troops to Hong Kong to intervene. HK police, meanwhile, claimed that their forces were enough without China’s intervention

More on FinanceBrokerage

Hong Kongers want Massive WithdrawalsFX News – As the protests in Hong Kong continue, people are trying out something new to fight back.

Protesters are calling for massive ATM withdrawals, taking out as much money as possible from their banks. They could also change their currency into US dollars to protect their own assets.

The goal is to send the People’s Republic of China and HK Chief Executive Carrie Lam a message. And that message is this: Hong Kong is more than just a city with cash.

According to the student who started the “Cashout HKD to USD,” the people have already withdrawn over HK$70 million.

According to this student, the tactic would work because Lam and the PBOC “care much about the economy.”

The protests have been going on for nearly 11 weeks.

FX News: the Demands of the Protesters

The movement, according to the student, demands five things from the Hong Kong government.

The first one is to completely withdraw the extradition bill, not just suspend it. The bill, which has initially been the center of the protests, would allow extradition to China for criminal offenses. For the Hong Kongers, this would allow the authoritarian China greater control over democratic Hong Kong.

The second demand is to retract the proclamation that the protests were riots. Third, pull out the criminal charges against protesters and investigate police abuses toward them.

Fourth is to dissolve the Legislative Council by administrative order. And lastly, implement the dual universal suffrage. Put simply, this would allow Hong Kongers to vote on their leaders without having to ask China’s permission.

Meanwhile, other activists voiced out concerns over Hong Kong’s currency because of the instability. This is where the rationale of converting their currency into the US dollar comes into play. The goal is to maintain value in US dollars and other foreign currencies.

This is among the biggest protests in the recent history of Asian countries.

EURHKD: Long term sell. Choose the entry carefully.This pair is trading on a long term 1W Channel Down (RSI = 45.188, MACD = -0.052, Highs/Lows = 0.0000) with clear Lower High entries and an obvious 8.7850 Support. The price has just entered the neutral territory so there is still potential to rise a little further before resuming the underlying bearish trend. We estimate the reversal point to be just above the 0.500 Fibonacci level. TP = 8.7850 (the 1W Support).

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

MUCKY FILM TIME...Old strong resistance turned new support and TL been used as good support also, price is currently sat at both of these so we can only see price movement to the upside.

A double setup where 2 things confirm it is a good trade to take cant be ignored, look at it like this.... You are looking for a film to watch ( not a mucky adult 1 ) ;p you come across a film but you cant decide weather you think it will be any good so you ask Tom and he says its good, but you still are not sure so you ask Jess... she also says its good so because 2 people backed it up ( support and trend line ) you decide to watch it... the film ends and.... you hated it and wasted 2 hours of your life you cant get back so you loose 2 friends haha, only joking. You watched the film and love it :) but it was only because of your 2 friends backing it up ( support line and trend line ) you saw it.

So when you see a double setup that fits in you trade setups don't ignore it.

EURHKD 1:5 Risk Reward LONG Europe Quant Score:

Yesterday the score was -32 showing weakness, but a shift of over +32 points showing a dramatic increase in strength overnight gave this amazing long bias. Even though the EUR score is technically neutral, this large shift is showing a change in momentum.

Hong Kong Quant Score:

Consistently weak at -21

- Trade entered already by our team - looking to close whole position soon!

AUDHKD: Taking full advantage of the Channel Down on 4H.The pair is on a standard 4H Channel Down (RSI = 33.623, MACD = -0.012, Highs/Lows = -0.0225, B/BP = -0.0448), which since it crossed the 5.5788 4H support is expected to continue lower. The expected Lower Low is estimated at 5.5380 where a pull back to 5.5788 is expected.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURHKD: Quick buy opportunity.Standard 4H Channel Up (RSI = 60.914, MACD = 0.022, Highs/Lows = 0.0098) but with a clear Resistance zone so far at 9.0630 - 9.0690. This creates the conditions for a short-term long position with TP = 9.0600.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

HSI Bounced Off Support, Potential For A Further Rise!Hang Seng Index bounced off our first support at 25432 (horizontal swing low support, 61.8% Fibonacci extension , 78.6%, 61.8% fibonacci retracement , horizontal swing low support) where a further rise could occur above this level pushing price up to our major resistance at 26320 (100% fibonacci extension , 50% fibonacci retracement, horizontal swing high resistance). Stochastic (21,5,3) is bounced off its support and we might see a further rise in price above this level.

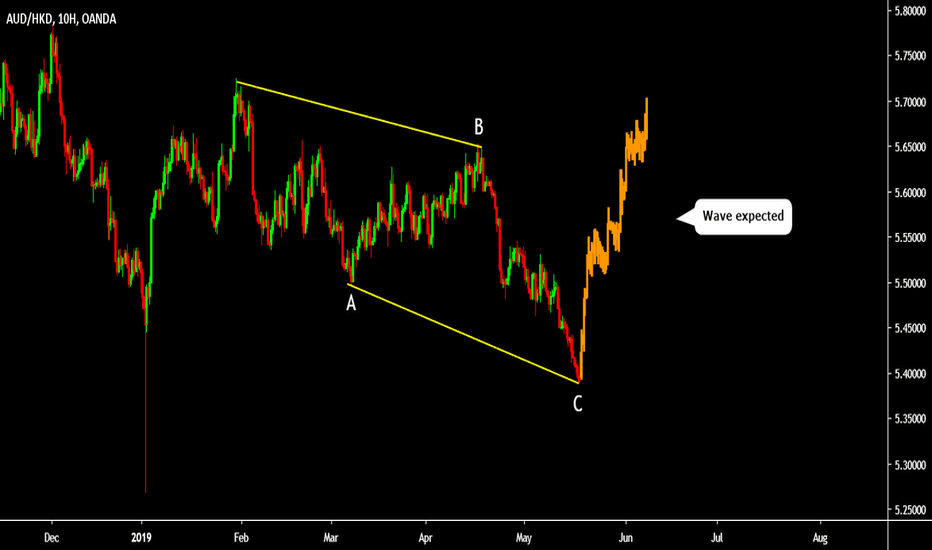

AUDHKD Possible trend Change, Inverse H&STrying to play a long term trend change here. Had a dropping trend channel from the start of 2018 and this month we have had the first breakout of this channel. We had a nice double bottom in Oct which already reached it's target. At the moment it has dropped but it could potentially make a right shoulder for an inverse H&S. I am going to scale in several orders. Doing two 25% of a normal position at those yellow circles and i will increase on the way.

So risking a small amount here with the potential of a very big win when playing it right.

SGDHKD: Target hit. Channel Down continuation. Short.TP = 5.6600 hit as the 1D Channel Down expanded but on a lower gradient (MACD = -0.006, B/BP = -0.0102) with RSI and Highs/Lows neutral. Nevertheless there are two optimal short opportunities presented on the chart depending on which pattern prevails. TP = 5.63050.

HKDJPY: Target hit. 1W Channel Up intact. Long.TP = 14.41427 hit as the 1W Channel Up (RSI = 56.437, MACD = 0.090, B/BP = 0.2883) rose to a 14.6150 Higher High. The price has since pulled back in order to price a new Lower Low, which should be near 14.200 (Highs/Lows = 0.0000). We will be going long on HKDJPY with TP = 14.600.

1W Channel Up. Long.HKDJPY is rising having made a Higher Low on the long term 1W Channel Up (RSI = 59.227, MACD = 0.035, Highs/Lows = 0.0546, B/BP = 0.1578). We expect to crosse the pivot (blue dotted line) swiftly as the buying pressure on 1D (RSI = 60.972, overbought on 3) accelerates. Consequently we are going long, TP = 14.41427 (previous Higher High) and 14.51650 (potential new Higher High) in extension.

Target hit. Channel Down intact. Short on new Lower High.TP = 5.66170 hit as the 1W Channel Down (MACD = -0.073, Highs/Lows = -0.0245, B/BP = -0.1173) made a new Low just below the target. The price jumped to a new Lower High and is now set to price a new technical Lower Low. The 1D Lower Low line supports earlier however, so our new short's TP is 5.58718.

Target hit. Lower High on the 1W Channel Down. Short.TP = 9.2050 hit as EURHKD moved sideways before the Channel Down selling pressure pushed the price lower. The pair is still being traded within a long term 1W Channel Down (RSI = 41.770, MACD = -0.084, B/BP = -0.2478) with the neutral Highs/Lows = 0 suggesting that a Lower High has been priced. As you see on the chart that value was probably yesterday's 9.1235 High. As a result we are going short now with TP = 8.9500. See how for the time being the pivot line supports.