Memecoin with potential for purchase.Hello friends🙌

Considering the decline we had in the weekly timeframe, you can now see that with the good growth we had, it gives us a good signal to buy, of course in a stepwise manner and with capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

Hodl

ETH Breakout and potential bullishness expected for a monthETH has broken out from downtrend and market sentiment has turned bullish overall. So it is expected to go up until it reaches 4000$ (70%) where a long term resistance is found.

Any further bullishness post 4000$ depends on future market conditions and price action at that point of time, as it is a long term resistance which would be more difficult to break.

Fibonacci retracement is used to find potential temporary selloffs in this up move. This move could potentially end the medium term bearish sentiments in ALT Coins.

Note: For educational purposes only. DYOR before investing or trading.

When does Bolran start?Read carefullyhello friends👋

💰Many of you are asking when Bolran will start or if it will start at all, we decided to explain it to you in a full post.

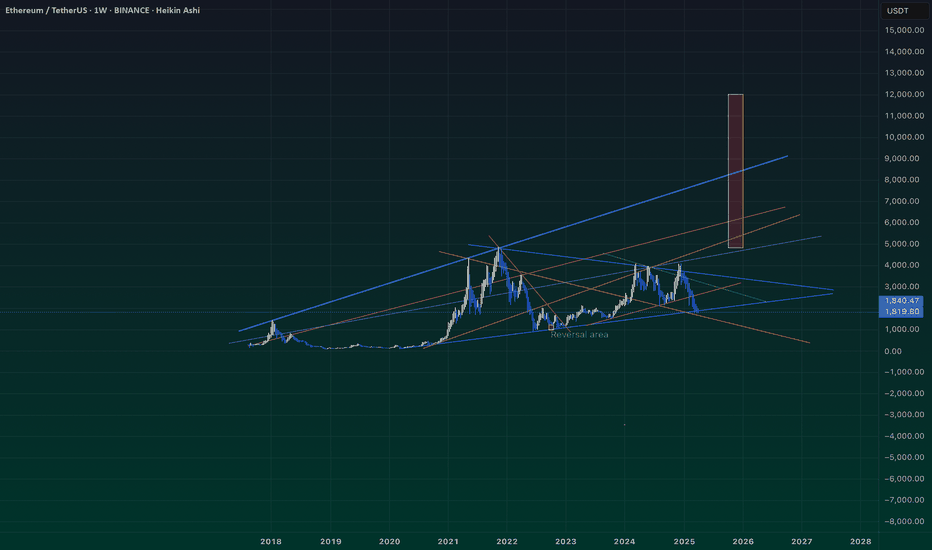

Well, you can see the Ethereum chart moving in a channel, and with a drop, it created a big fear that a fall is coming, and meanwhile, the buyers returned the price to above 2000 dollars with a strong and unexpected return.

✅️Now the price is stuck in the specified box between 2200 and 2500, and if this range is maintained, the price will easily move up to the range of 3200 in the first wave, and if it fails to maintain this range, the price will fall below 1500 dollars.

🧐Now, in our opinion, due to the rapid return of the price from the channel, this failure is a fake channel and the range will be maintained, and we are likely to see Ethereum rise in the coming weeks.

🤔You know that Ethereum is the leader of altcoins, and if it grows, important altcoins will grow, which is the beginning of Bolran, and there are important altcoins that can be used for good profit.

🌟You can join us if you like.🌟

🔥Follow us for more signals🔥

*Trade safely with us*

Bitcoin's at ALL TIME HIGHS and I'm going ALL IN!!As Bitcoin surges to new all-time highs, I've made a pivotal decision: to stop saving in dollars and start holding Bitcoin.

Why Bitcoin? Self-Custody:

Owning Bitcoin means true ownership. With self-custody, I control my private keys, ensuring my wealth isn't subject to third-party risks like bank failures or government seizures.

Declining Dollar Value: The U.S. dollar continues to depreciate due to inflation and economic policies. Holding Bitcoin, a deflationary asset, offers a hedge against this erosion of purchasing power.

Global Accessibility: Bitcoin transcends borders, providing financial inclusion for anyone with internet access, especially in regions with unstable currencies.

Security and Privacy: With proper self-custody practices, my Bitcoin holdings are secure from hacks and offer enhanced privacy compared to traditional financial systems.

As I monitor the BTC/USD daily chart, the trend is clear: Bitcoin isn't just a speculative asset; it's a movement towards financial sovereignty.

History Repeats: Bitcoin Bounces from Weekly 50 EMA-$150K Next!!MARKETSCOM:BITCOIN continues to show exceptional strength and bullish momentum. If we look back at the charts from 2023 and 2024, a clear pattern emerges — every time BINANCE:BTCUSDT touched the 50 EMA on the weekly chart, it led to a significant rally and eventually new all-time highs. That same setup seems to be unfolding again right now.

Recently, COINBASE:BTCUSD tested the 50 EMA around the $75,000 level and has since bounced strongly. The price has reclaimed the $100,000 mark and is now challenging previous all-time high resistance. Historically, after a successful bounce from this key moving average, Bitcoin hasn’t just recovered — it’s exploded to new highs.

Based on this repeating pattern, our current cycle target is set at $150,000. A clean breakout above the current resistance zone could be the catalyst that propels BYBIT:BTCUSDT Bitcoin into uncharted territory once again. The structure remains bullish, momentum is building, and the trend clearly favors the upside.

This is a classic “Buy and HODL” moment. The technicals are aligning, the market psychology is shifting, and all signs point toward a continued bull run. Buckle up — it looks like we’re in for another legendary Bitcoin rally.

ANKRUSDT: A Strong Demand Zone or Breakdown Risk?ANKRUSDT is currently sitting at a crucial demand zone, a level that has historically triggered massive price movements. This same area in February 2021 acted as a springboard for huge gains, leading to a double top formation at $0.21 before experiencing a major downtrend. Since August 2022, the price has been stuck in a sideways range, with no clear breakout in sight—until now.

Why This Demand Zone is Key

The weekly support level within the range has proven to be resilient, holding strong since 2021. Additionally, the Stochastic RSI is in oversold territory, signaling a potential loss of selling pressure. This setup suggests that buyers might step in soon, making this zone a prime accumulation area for long-term holders.

Best Buy Zone:

🔹 $0.015 - $0.022 → A historically strong support level, ideal for long-term positions.

Potential Targets:

📌 Short-Term Target: $0.057 - $0.066 (Top of the current range)

📌 Mid-Term Target: $0.097 (Potential supply zone)

📌 Long-Term Target: $0.21 (Previous all-time high)

Bearish Scenario: What If Support Breaks?

While the demand zone is strong, there's always a chance of a breakdown. If price fails to hold support, the next major demand zone lies at $0.008—a crucial level for long-term investors to watch.

Final Thoughts

✅ The setup is strong, with price at weekly support and indicators signaling a potential reversal.

⚠️ But always have a plan—if the demand zone breaks, be ready for lower levels.

💡 Risk management is key—stick to your strategy, and trade with confidence!

What’s your take on ANKR? Are you bullish or waiting for more confirmation? Let’s discuss in the comments! 🚀

Keep it shiny~!

KinaStar

HODL on a little longer before buying more.... Just an idea of HODL's current pattern. It appears to be built on shaky foundation...still a bunch of noise about CHIA on the boards however the figures are so wildly entertaining it would be a 1 - mil long shot that Tony scored the deal the way people are talking.

Currently we are bleeding based on BTC cost...how long can the soccer star keep up the appearance before he has to unload some to cover costs? I was a fan...now I'm a skeptic....still holding for an exit but not happy with the current situation.

Price rejection at key area of support.The daily candle has closed bouncing of a strong zone of support at ~.945249 which is also an area that is respecting my trendline. There is no official buy signal as of yet to play it safe - the official buy signal is once price reaches past the area of resistance ~1.007413 AND fully engulfs the daily candle that closed today. Large selloff on all cryptos today so potentially some buying pressure will return to the market tomorrow.

The Two Archetypes of TradersIn the trading world, markets move in cycles, and bearish conditions are no exception. Here's an educational breakdown of how traders can navigate these challenging times:

1. The Long-Term Holders (Investors)

Mindset: Patience is their superpower.

Goal: Accumulate assets during bearish trends by buying at key support levels and holding for future gains.

Approach: Use the WiseOwl Indicator to identify areas of strong support and potential accumulation zones for strategic entries.

2. The Intraday Traders (Short-Term)

Mindset: Adaptability and precision are crucial.

Goal: Profit from short-term price movements, capitalizing on market volatility.

Approach: Utilize the WiseOwl Indicator to pinpoint bearish momentum for short entries and clear exit levels, ensuring optimal risk management.

Educational Example: WiseOwl Strategy in Action

Let’s analyze Solana (SOL) on the 15-minute timeframe during a bearish market:

Trend Identification: The WiseOwl Indicator highlights a confirmed downtrend with clear bearish signals.

Entry Points: Short trade signals are generated at moments of significant bearish momentum.

Risk Management: Stop loss and take profit levels, calculated using ATR-based logic, ensure disciplined trading.

Takeaways for Traders

📉 Bearish Markets:

Holders focus on identifying value areas for accumulation.

Intraday traders capitalize on market volatility with precise entries and exits.

Happy trading! 🚀

#WiseOwlIndicator #TradingEducation #BearMarket #SOLAnalysis #CryptoTrading

.702 Fib RetracementXYO is gaining popularity with rumors of tesla and spaceX partnerships. Price climbed 400%+ in 3 days. I see XYO coming back to 2 cents and bouncing off the .702 fib retracement and easily shooting up to the previous all time high if not higher.

Best of luck crypto investors. 2025 has potential to be life changing.

Aevo

📊 Overview Analysis

The AEVO cryptocurrency, after a sharp downward movement, entered a consolidation range. Following a prolonged range-bound movement, the price managed to climb within an ascending channel on the 4-hour timeframe, reaching the top of its consolidation range.

🕰 4-Hour Timeframe Analysis

🔸 Current Status:

The price is challenging both the top of the ascending channel and the range ceiling.

Increased trading volume indicates growing liquidity in this area.

🔸 Bullish Scenario:

A breakout above the ascending channel's ceiling could trigger a parabolic move toward the green target zones.

🔸 Potential Risks:

An RSI divergence on the 4-hour timeframe suggests a possible pullback.

Corrections could extend toward the channel's midline or, in a more severe case, to the channel's lower boundary.

🎯 Price Targets & Key Considerations

🔹 Upside Targets:

Breakout to the green zones following an upward channel breach.

🔹 Downside Risks:

RSI divergence might limit upward momentum, leading to short-term corrections.

Maintaining support at the channel's midline or bottom is crucial for a sustained bullish outlook.

💡 Advice: Always employ risk management and rely on personal analysis when making trading decisions.

💡 Reminder: This analysis is for educational purposes only and should not be considered financial advice.

why i am confident we will hit $124kas long as we stay above mPOC and VAL weekly i expect the trend to simply continue from where it was during the last breakout. during other bull markets the break to new all time highs led to doubling in price. this is a market that will continue to chop around, but remain bullish as long as there isnt a major crash. the last all time high was in the mid to high LSE:60KS region, so i expect the next top to be in the low to mid $120ks. there is a lot of room to work with to keep this momentum alive for bulls.

ADAUSDT LONG TIME SUPPORT HOLDING? Hello, dear HODLers!

This is ADAUSDT on the weekly timeframe. The black line has been a significant level since October 2022, shifting between support and resistance for over two years. In 2024, it began acting as support starting in the first week of July.

Since then, the wicks below this level have started getting shorter, suggesting that selling pressure might be weakening. This level could mark the beginning of the next bull run. If we see another dip that holds with an even shorter wick, I would consider it a confirmation.

Stay safe, and feel free to leave any comments or questions.

Thanks for reading!

gamestop cup and handle whats next?this isnt the strongest pattern for vull continuation, but if it does follow through i expect well see $25 soon. if we dont continue the pattern ill look for a pullback to the $21 region. the stock seems like it is ready to make larger swings now that its held some form of a daily to weekly uptrend. were still battlign a bear trendline of resistance since the last large monthly move and subsequent volatility, but it seems to be subsiding somewhat.

im looking at curred dPOC as the pattern pivot, and if we hold that level forming a range above open id look for the next market structure trailing stop area/VAH region to take profit long. if we break fown below dPOC and form bear momentum under the mPOC id look for lower POC and VAL to take profit short.

BTC - Market Structure 101!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

The BTC market structure has been very clean lately, which I find interesting.

📉Previously, after breaking below the last major lows (marked in red), BTC dipped.

📈Similarly, after breaking above the last major highs (marked in blue), BTC surged.

🔄If history repeats itself, and the current last major low marked in red is broken to the downside, we can expect another dip in BTC towards the $69,000 - $70,000 demand zone.

Meanwhile, as long as the current minor low in red holds, BTC would be overall bullish short-term and further upside is expected.

🕝What do you think?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin PoundLike in recent post I mentioned two possible bitcoin scenarios. My most recent post was a sell around $69,000-$73,000.

Scenario two was a break above 69,000 to 73k

Right now if the rejection right before the all time high goes back to 69k there are two possible scenarios.

Scenario 1: A buy back towards 73k and a break to 79k.

Scenario 2: would be a entry on the sell to 42k

Good luck!

CNVS LONG TERM HOLD PAYING OFF. Looking forward to staying above 2.74 heading to test 3.94 with the momentum. ER COMES NOV 11 they continuously make revenue yoy and have been a positive company thru dark times of covid and stock market reset. Held thru and avd down !

Levels to stay above 2.70

Future tests 3.94 , 5.06

Onward to the volume held on at 10$ potentially with a insanely bullish run.

There could be a deal in the making, not sure but there is massive momentum. Looking to take profit at 4.20$ if trend continues but holding most of the shares for closer to nov 11

USD/CAD GOES BULLISHcurrent market directions are very unclear due to international and domestic news , but one thing i did notice was usd/cad made a higher high . this looks promising because it made the higher high and is currently retracing into the 0.778 level on the fib tool! lets use proper risk management to survive in the markets.