USD/HKD Uptrend Established LongClear trend presenting itself with the US dollar vs Hong Kong Dollar

With most of April crushing the USD it appears we are now turning the tables

with a curved bottom and a clear uptrend painted thus far for this pair.

I have outlined the green box for LONG entries which is sitting at the point of control

with a fib pull from previous swing high to low for confluence with the above mentioned factors.

Resistance levels have been drawn using standard Fibonacci pulls and align well with volume Profile.

Ensure you have a trading plan and know your invalidation .

Support my work with a Like and a follow for Regular analysis and signals

Hongkongdollar

Hang Seng Index - Supply & Demand AnalysisRecently Hang Seng Index reversed on a strong monthly Supply Zone finishing it's external bullish cycle

The price decided make an external bearish cycle.. now it's advised to SELL at long term basis.

Next destinations:

A) DEMAND (26908.14 - 26021.63)

Here price need to decide: if reverse in order to back to SUPPLY (32004.32 - 31126.20) OR BREAKOUT , retest and go to next DEMAND (23622.97 - 23204.17)

B) DEMAND (23622.97 - 23204.17)

Final external bearish cycle destination

Enjoy the Profits!

Hang Seng : One Country - One System (log chart long term)Given recent newsflow I wanted to look into Hang Seng HK equities index - feels like that the zone just below 22,000 is critical long term - a break below would be extremely bearish. Together with the general reliance on what is a rigged real estate market I think it is one of the most fragile indices out there.

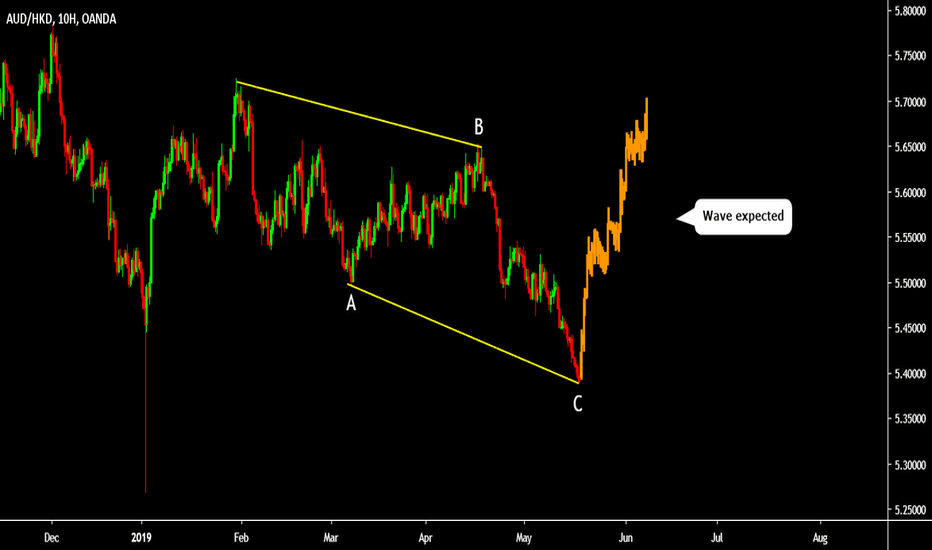

SGDHKD: Long term Buy opportunity on the 1W Support.The pair marginally broke the 1W Support but so far only on a candle wick. Since it has rebounded back above that danger level, we can consider that the Support is holding. The 1W chart has turned nearly oversold (RSI = 27.767, MACD = -0.073, ADX = 36.545) and we treat this as the optimal buy opportunity for the long term.

The long term pattern is as you see a Descending Triangle and besides the 1W Support, the Lower Highs are also clear. The first time the price touched the 5.3350 1W Support in January 2016, it rebounded to the 0.5 Fibonacci level of its last Lower High. The 0.5 level is at the moment at 5.6650 and this is our Target.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

China drives our Markets more than we do?Just an observation that I have brought up in the past. The link to that post is below. But, I do find it interesting to note that China is the only reason that our Markets haven't nose dived into the ground yet. They keep saving it. Probably because of that "Trade Deal" that is supposed to happen right? Like two weeks ago....."Biggest Trade Deal Ever", remember?

Guys?

EURHKD: Sell opportunity towards the 1D Support.The price was rejected on the 1D MA50 within the wider 1M Channel Down (RSI = 41.549, MACD = -0.053, Highs/Lows = -0.0844, ADX = 50.328). The continuation of this 1D bearish sequence should lead to a new Lower Low but the first target is the 1D Support at 8.5320.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

SGDHKD: Short opportunity near the 1W Resistance.The pair stopped the uptrend near the 1W Resistance Zone (5.77540 - 5.78100) with the 1D RSI hitting 74.000. Based on that we are expecting a rejection to the nearest Support which is 5.71500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDHKD: Best sell opportunity.The pair is trading near the 7.85000 1M Resistance which has been rejecting every upside break out attempt since April 2018. The RSI on 1D, 1W, 1M is surprisingly stable around 55.000 and last time that pattern formed on 1D a strong selling sequence followed. We are bearish on USDHKD aiming primarily at the 7.81700 1D Support.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Hong Kong Dollar Showing ExhaustionUSDHKD looks good on both the 4 and 2 hour charts.

We have had an uptrend with higher lows and higher highs and then we stopped making new higher highs. This range and even double top here shows us the trend may be exhausting.

From here, we need to see a break and close below 7.8360 zone. First target would be 7.8300 zone.

Also want to share some information from hedge fund manager Kyle Bass. He has come out saying in a recent interview that he still expects things in Hong Kong to get worse. He used the term "bloody".

October 1st is the Communist Partys 70th anniversary. Big celebrations planned. Military parade too of course.

Kyle Bass has said that the CCP cannot afford to have protests in Hong Kong for this celebration. He has said that he thinks the CCP will do something about it. Let us see what happens in the next 24 hours.

USDHKD formed a bearish BAT pattern | A good short opportunityPriceline of US Dollar / Hong Kong Dollar forex pair has formed a bearish BAT pattern and entered in potential reversal zone.

MACD turned weak bullish from strong bullish.

Stochastic has given bear cross.

I have used Fibonacci sequence to set the targets.

The long position can be taken between 0.382 to 0.786 Fibonacci projection of A to D leg coz we have a strong support of 200 SMA withing that zone however soon i will post a buy back plan soon insha Allah.

Sell between: 7.83560 to 7.84230

Enjoy your profits and regards,

Atif Akbar (moon333)

US and China make back room deal on Hong Kong?Just want to update on the USDHKD peg idea I spoke about awhile back. A bit controversial I know, but I gave reasons on why this is likely to happen. Hong Kong does not have the US Dollars to maintain the peg. The PLA marching into Honk Kong may be what breaks the peg.

Looking at the chart, you can see where the buyers are stepping in. We are seeing buyers at the 7.83500 zone indicated by the long wicks. Buyers are still there. Just this analysis indicates that perhaps we will be seeing this break of the Peg.

I am hearing from sources that there has been a deal between the US and China behind the scenes. That the CCP will allow President Trump to sell the trade war as a minor victory for the US...meanwhile the Americans will give the CCP a carte blanche when it comes to what they do in Hong Kong. If they decide to send in the army, the US will look away. This is what I am hearing.

The 4 hour chart can also give us a short signal if we do break below the mentioned zone. We have had a nice uptrend, and now a range displaying 2/3 market structures.

On a side note, I just watched the documentary "Banksters" on Amazon Prime which is about HSBC , Hong Kong and China. It really explains what is REALLY going on in Hong Kong currently.

There was a twitter rumour that was substantiated by many solid minds including Kyle Bass, about the PBoC needing to borrow money from HSBC to maintain the Yuan where it is at. The HSBC President was fired and other high up executives were fired. Rumours have it that the CCP will look to control HSBC ...the documentary gives evidence about this already happening in 2017.

Forex News: Hong Kong’s 11th Week of ProtestForex News – Hong Kong’s biggest-ever street protest has come to its 11th week, and more are joining the calls for a resolution.

Last week, Hong Kongers took out their money from ATMs. The goal was to prove the city was more than just a cash cow. The movement has further escalated the instability due to the protests. The city’s currency has also suffered.

Meanwhile, US President Donald Trump said that he was “concerned” about the probability of a violent Chinese crackdown. Last week, he seemingly tied up the US-China trade discussions to the HK protests, calling for a humane resolution.

Trump added that he would talk to Chinese President Xi Jinping and urge him to negotiate directly with protesters.

The protests have crippled the city’s currency due to the instability. Such a situation will apparently continue until one of the sides give in.

According to certain reports, China is moving its troops to Hong Kong to intervene. HK police, meanwhile, claimed that their forces were enough without China’s intervention

More on FinanceBrokerage

Hong Kong to break US Dollar Peg?What a week so far. This week we saw the USDCNH break above the 7.00 level, something I have mentioned in my posts for Bitcoin strength.

China has said this was normal, due to tariffs and fundamental reasons, while President Trump and the US Treasury think it is an act of currency manipulation.

I have spoken about the US and China trade war on my blog. China is in it for the long game. They will be patient for a weaker US President from the Democrat side. They know the US stock markets are President Trump's Achilles Heel. He needs them up to win re-election ('Keeping America Great"). If markets continue to tumble it will be President Trump who is forced to the trade table to take a China dictated deal. China does not need to worry about elections.

So as the Yuan devalues, Chinese money is running into Gold and Bitcoin as mentioned in my previous posts. All governments are devaluing their currencies. New Zealand just cut rates 50 basis points yesterday!

Mainland China has been coming down hard on Hong Kong, attempting to get rid of the British Law. This is a way to stop money leaving from China (generally money from mainland goes to Hong Kong and then from there to Australia or Canada etc) and was also a way for China to get away from tariffs by shipping from Hong Kong (not under tariffs).

Hong Kong is in trouble. It is the most expensive city in the world with a large real estate bubble and there are some credit and debt problems there now.

If you listen to Kyle Bass, he has said that Hong Kong has used 80% of their US Dollar reserves to maintain the peg under 7.85. Will this peg be broken? Many think so. They are running out of US Dollars and not in the best position to buy more Dollars.

If the Chinese army does march into Hong Kong, which is probable, expect the HKD peg to break. Probably will peg to the Yuan. As Kyle Bass has said, shorting Hong Kong is the best play right now. Many hedge fund managers have spoken on this as well. Shorting the Hang Seng and the Hong Kong Dollar are ways to play this trade.

Why will China march into Hong Kong? If the people are up in arms due to Yuan devaluation, and the Chinese Communist Party feels threatened, they will go to war. The CCP will not give up control over China. War is the best way to unify the people and also blame others for domestic problems. When all else fails, they take you to war.

When this peg breaks, I expect MORE Hong Kong money to run into Bitcoin and Gold and Silver. So I am still bullish on Bitcoin but remember, as discussed previously, it is all about CHINESE MONEY.

EURHKD: Long term sell. Choose the entry carefully.This pair is trading on a long term 1W Channel Down (RSI = 45.188, MACD = -0.052, Highs/Lows = 0.0000) with clear Lower High entries and an obvious 8.7850 Support. The price has just entered the neutral territory so there is still potential to rise a little further before resuming the underlying bearish trend. We estimate the reversal point to be just above the 0.500 Fibonacci level. TP = 8.7850 (the 1W Support).

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

AUDHKD: Taking full advantage of the Channel Down on 4H.The pair is on a standard 4H Channel Down (RSI = 33.623, MACD = -0.012, Highs/Lows = -0.0225, B/BP = -0.0448), which since it crossed the 5.5788 4H support is expected to continue lower. The expected Lower Low is estimated at 5.5380 where a pull back to 5.5788 is expected.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.