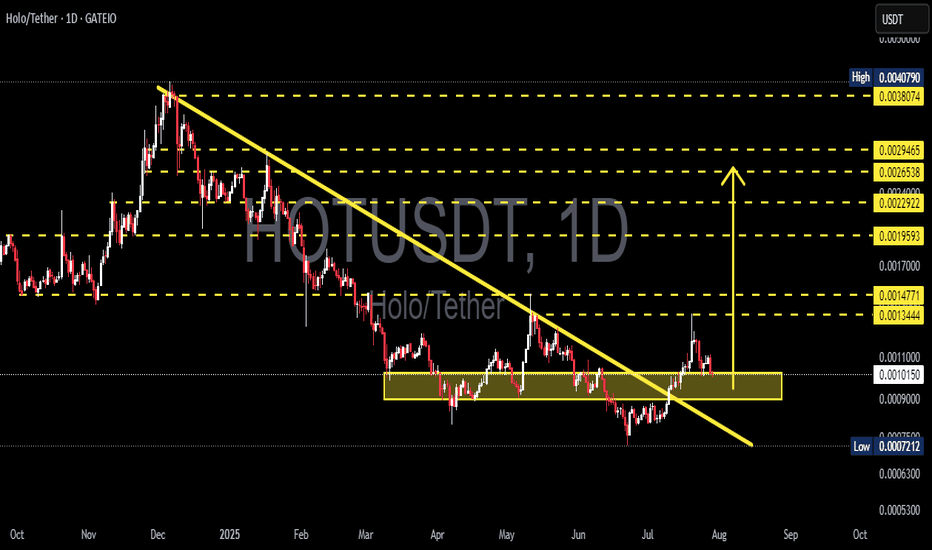

HOT/USDT Breakout Confirmation or Bull Trap? Critical Retest!🧠 In-Depth Technical Breakdown (Daily Timeframe):

HOT/USDT (Holo vs Tether) is currently at a crucial inflection point, following a confirmed breakout from a long-standing downtrend. The price is now retesting a major demand zone, and how it reacts here will determine its next big move.

Let’s dive deeper into the technical structure, chart patterns, and the possible bullish and bearish scenarios:

---

🔻 1. Trend Structure & Major Breakout

Since peaking in late December 2024, HOT/USDT was trapped in a descending trendline (yellow diagonal line).

In mid-July 2025, price successfully broke above this downtrend, signaling a potential trend reversal.

This breakout suggests a shift in market sentiment from bearish to neutral-to-bullish.

---

🟨 2. Retesting the Key Demand Zone (Support Flip)

Price is currently testing a critical demand/support zone between 0.00090 – 0.00110 USDT (highlighted in the yellow box).

This area served as a major consolidation base in the past and is now being tested as support after the breakout.

A successful retest will validate the breakout and could spark a continuation to the upside.

---

📐 3. Chart Pattern: Falling Wedge Breakout

Price action clearly formed a Falling Wedge pattern, typically a bullish reversal setup.

The breakout from the wedge confirms bullish momentum and the potential start of a new trend.

---

🔮 4. Price Scenarios Moving Forward

✅ Bullish Scenario:

If the price holds above the 0.00090–0.00100 zone:

1. Potential upside targets:

TP1: 0.00134 (minor resistance)

TP2: 0.00147 (key structural level)

TP3: 0.00159 (breakout continuation zone)

TP4: 0.00229 – 0.00246 (historical range highs)

TP5: 0.00380 – 0.00407 (major highs from previous cycle)

2. This structure could mark the beginning of a higher low + higher high uptrend, if confirmed.

❌ Bearish Scenario:

If the price breaks below 0.00090 with strong volume:

1. Likely a return to previous support at:

0.00072 USDT (historical low and major support level).

2. This would invalidate the breakout and possibly confirm a bull trap, resuming the downtrend.

---

🧩 Other Key Technical Notes (Not Shown in Chart but Useful):

Volume: Look for high volume on the breakout and retest to confirm validity.

RSI/Divergence: Check for hidden or bullish divergence on the last swing low.

EMA 50/200: If price crosses or holds above these EMAs, it adds further confirmation of trend reversal.

---

📊 Summary & Trading Strategy:

HOT/USDT is in a critical phase of retesting a major breakout, offering traders a great opportunity to either buy the dip or wait for confirmation.

Suggested Strategy:

Conservative Entry: Wait for a bullish candle close above 0.00100 with strong rejection from the support zone.

Aggressive Entry: Buy near 0.00090–0.00100 with a tight stop loss below 0.00087.

Use resistance levels for scaling out profits or setting targets.

#HOTUSDT #HoloToken #AltcoinAnalysis #CryptoBreakout #TechnicalAnalysis #ChartPattern #BullishReversal #FallingWedge #SupportZone #CryptoTA

HOT

#HOT/USDT#HOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 000873.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.000888

First target: 0.000910

Second target: 0.000933

Third target: 0.000958

#HOT/USDT#HOT

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.000945, acting as strong support from which the price can rebound.

Entry price: 0.000948

First target: 0.000984

Second target: 0.000998

Third target: 0.001020

#HOT/USDT#HOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.001240.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.001346

First target: 0.001415

Second target: 0.001500

Third target: 0.001607

#HOT/USDT#HOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.01018.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.01086

First target: 0.001118

Second target: 0.001155

Third target: 0.001200

#HOT/USDT#HOT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.001065

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.001148

First target 0.001194

Second target 0.0001255

Third target 0.001320

#HOT/USDT#HOT

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.001950

Entry price 0.002000

First target 0.002107

Second target 0.002210

Third target 0.002346

HOT-4h - Ascending triangle in progresHOT-4h - Ascending triangle in progres

REMEMBER that a lot of investors sell stocks or crypto for fiscal conditions in 2024 to close the year.

For that, we have low buy liquidity , and even with that pressure on the price , HOT is trying to remain in the same range as 1 week ago, so a breakout can restart a new HH , so patience.

Im bullish on it if the 0.0027usd resistance its broken and became a support.

#HOT (SPOT) entry ( 0.0019- 0.0024) T.(0.0083) SL(0.001835)BINANCE:HOTUSDT

#HOT/ USDT

Entry ( 0.0019- 0.0024)

SL 1D close below 0.001835

T1 0.0036

T2 0.0061

T3 0.0083

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT

#HOT/USDT Ready to go higher#HOT

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0078

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.002423

First target 0.002543

Second target 0.002695

Third target 0.002844

#HOT/USDT Ready to go up#HOT

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.002700

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.003323

First target 0.003700

Second target 0.004027

Third target 0.004440

HOTUSD - Bull Target 0.01Price likes to double bottom along the lower solid green line, last time this was seen a large bull move followed. Right now this double bottom is presenting itself again so I assume a bull move is following.

The dotted green line is the target for bulls, I have shown my price action thoughts with the bars pattern tool.

Daily timeframe.

Hot Coin Breakout Confirmed Getting Ready For 400% Bullish Rallyholochain is one of the well known blockchain in crypto industry recently hot coin breaks its long multi year symmetrical triangle and bouncing from trendline area after successful breakout hot coin can move like doge coin in midterm seems like 300% will be an easy target for midterm after successful retest

#HOT/USDT#HOT

The price is moving in a descending channel on the 4-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.001500

Entry price 0.001712

First target 0.001830

Second target 0.001919

Third target 0.002034

#HOT/USDT Ready to go up#HOT

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.001880

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.002180

First target 0.002234

Second target 0.002372

Third target 0.002540

HOLO (HOT) TECHNICAL ANALYSIS + TRADE PLANTechnical Analysis for HOLO (HOT) Cryptocurrency

Chart Overview:

The chart shows HOLO (HOT) trading within an ascending channel, which is a bullish continuation pattern. The ascending channel is characterized by two parallel trendlines: a support line at the bottom and a resistance line at the top, with the price generally moving upwards within these boundaries.

Key Observations:

Ascending Channel Pattern: HOLO (HOT) is trading in an upward-sloping channel, suggesting a bullish sentiment. The price has recently tested the channel's resistance line, facing a minor pullback, but remains within the channel, indicating potential continuation of the uptrend.

Support and Resistance Levels:

Support: The lower boundary of the ascending channel serves as the primary support level. If the price tests this line, it may present a buying opportunity.

Resistance: The upper boundary acts as resistance, where traders may take profit or anticipate pullbacks.

Volume Analysis: The recent volume spike aligns with a test of the upper channel resistance, suggesting stronger interest from traders. A sustained increase in volume on upward movements could confirm bullish momentum.

Technical Indicators:

VMC Cipher B Divergences: Indicates bullish divergences, which may signal a continuation of upward momentum.

RSI (Relative Strength Index): RSI is above 60, but not in the overbought zone, suggesting room for potential upward movement.

Stochastic Oscillator: Shows a minor pullback, with potential for reentry if the oscillator reverses from oversold levels.

HMA Histogram: Momentum appears to be weakening slightly, as indicated by a minor decline in the histogram. Continued monitoring is needed to confirm whether this trend is reversing.

Price Prediction:

If the ascending channel pattern holds, HOT may continue its upward trajectory. The next price targets are:

Short-term Target: $0.0022 - Near the top of the channel.

Medium-term Target: $0.0024 - If price breaks out of the ascending channel with strong volume.

Trading Plan:

Entry Points:

Rebound from Support: Consider entering long positions if the price tests and rebounds from the lower channel support.

Breakout Confirmation: Enter long if the price breaks above the resistance line of the channel with strong volume.

Exit Points:

Take Profit: Near the resistance line within the channel or at $0.0022 to $0.0024 if momentum is strong.

Stop-Loss: Set below the support line of the ascending channel to limit downside risk, around $0.0018.

Risk Management:

Position Sizing: Adjust based on risk tolerance, considering a stop-loss just below the support line.

Trailing Stop: Use a trailing stop if the price exceeds the channel's upper boundary to capture potential upside.