Learn How to Trade | Why to Analyse Multiple Time Frames 📚

Hey traders,

In this educational video, we will discuss why Top-Down Analysis

is so important and how to apply it in practice.

The video includes important theory and real market examples.

❤️Please, support this video with like and comment!❤️

Howtotrade

Trading Basics | How to Identify The Market Trend 📈📉

Hey traders,

In this article, we will discuss a proven price action based way to identify the market trend.

❗️And let me note, before we start, that no matter what strategy do you use in your trading, you should always know where the market is going and what is the current trend. Your judgement should be based on strict and objective rules that proved its accuracy.

There are a lot of ways to identify the market trend. One of the simplest and efficient ones is price action based method. This method relies on impulse legs.

The market never goes just straight up or down, the price action always has a zigzag shape with a set of impulses and retracements.

The impulse leg is a strong directional movement, while the retracement is the correctional movement within the boundaries of the impulse.

📈The market is trading in a bullish trend if 3 conditions are met:

1️⃣the price forms an initial bullish impulse,

2️⃣retraces, setting a higher low,

3️⃣then starts growing again and sets a new high with the second bullish impulse.

Once these 3 conditions are met, we consider the market to be bullish, and we expect a bullish continuation in such a manner.

📉The market is trading in a bearish trend if 3 following conditions are met:

1️⃣the price forms an initial bearish impulse,

2️⃣retraces, setting a lower high,

3️⃣then drops lower and sets a new low with the second bearish impulse.

Once these 3 conditions are met, we consider the market to be bearish, and we expect a bearish trend continuation.

➖The third state of the market is called consolidation. The market is trading in a consolidation if the conditions for bullish or bearish trend are not met. The price chaotically forms bullish and bearish impulses, usually trading within the range.

Knowing the current trend, one always knows whether a current trading position is trend-following or counter trend, or it is a sideways consolidation trade.

Learn these simple rules and try to identify the market trend with them.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

WHAT IS DRAWDOWN | 3 Types Of Drawdown Explained 📚

Hey traders,

In my videos, I frequently use the term "drawdown".

Many of you asked me to explain the meaning of that term and share some examples.

The account drawdown is the highest observed loss from the highest

value of the deposit to the lowest value of the deposit at

a certain period of time.

Imagine you started to trade with 10,000$ account.

At the end of the year, your account size reached 15,000$.

However, at some point through the year the deposit value dropped to 6,000$. It was the absolute minimum for the one-year period.

At some point, your net loss was -4,000$ or 40% of your account balance.

The account drawdown is 40%.

❗️Knowing the account drawdown is very important for the risk assessment of the trading strategy. Usually, 50% and bigger drawdown signifies an extremely high risk.

There are 3 types of drawdown to know.

Current drawdown - a temporary drawdown associated

with the negative total value of opened trading position(s)

at present.

Once you start trading with 10,000$ deposit, you open several trading positions. Being opened, with the constant price movements, your potential gains fluctuates from positive to negative.

For examples, with 3 active trades: EURUSD (-500$ at present); GBPUSD (+200$ at present); GOLD (-100$ at present) your current account drawdown is -400$ or 4% of your deposit.

Fixed drawdown - the negative value of the closed trading

position(s) at present for a certain period of time.

While some of your trades remain active, some are already closed.

Imagine the same deposit - 10,000$.

On Monday you opened 6 trades, 2 still remain active and 4 are already closed. Your total loss from your closed trades is -500$. Your fixed Monday's drawdown is 5%.

Maximum Drawdown - the maximum observed loss from

the highest value of the deposit before a new maximum

is reached.

Starting to trade with 10,000$ you are already trading for 5 years.

Your account were growing rapidly and at some moment it reached 25,000$. Then the recession started. You faced a dramatic loss of 12,500$ before you started to recover.

That was the maximum observed loss for the period.

Your maximum account drawdown was 50%.

❗️Different types of drawdown give a lot of insights about a trading strategy. Its proper assessment will help to spot a high risk strategy and to find a conservative one.

Constantly monitor your account drawdown and always check the numbers.

What is your highest account drawdown?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Learn TOP 5 Tips For Trade Management 📖

Hey traders,

In this post, I will share with you my tips for trade management.

But first, let me elaborate on what is exactly a trade management.

Trade management is the set of rules and techniques applied for managing of an already active position.

Trade management is a very important element of any trading strategy that should never be neglected.

1. Never remove a stop loss

Being in a huge loss, many traders refuse to admit that they are wrong. Instead, watching how the price moves closer and closer to a stop loss, they remove stop loss hoping on a coming reversal.

The alternative situation may happen when the price is going sharply in the desired direction. Watching the increasing profits, traders remove a stop loss, being afraid to miss bigger profits.

Both situations may lead to substantial, higher than initially planned losses. Driven by many factors, the market can easily burn all gains and move against the desired direction much longer than traders stay solvent.

For these reasons, never remove a stop loss. It must be always set.

2. Never modify your stop loss if a position is in loss

Watching how the price moves closer and closer to a stop loss is painful. Instead of removing stop loss, some traders move it and give the market more space for reversal.

Even though such a technique is safer than the complete stop loss removal, it is still a very bad habit.

Each stop loss adjustment increases the potential loss, not giving any guarantees that the market will reverse.

It is highly recommendable to keep your stop loss fixed and let the price hit it and admit the loss.

3. Know in advance your profit protection strategy

Where do you take your profit?

Do you have a fixed tp level or do you apply trailing stop?

You should always know the answers.

Coiling around take profit level but not being able to reach it, the price makes many traders manually close the trade or move take profit closer to current price levels.

Another common situation happens when the market so quickly reaches the desired TP level so the traders remove TP hoping to make bigger than initially planned profit.

Such emotional interventions negatively affect a long-term trading performance. TP removal may even burn all profits.

Do not let your greed intervene, and always follow your rules.

4. Never add to a losing position

Watching how the price refuses to go in the intended direction and cutting a partial loss, many traders add to a losing trade in hopes that the market will reverse and all the losses will be recovered.

Again, such a fallacy usually leads to substantial losses.

Remember, you can add to a position only AFTER the market moved in the desired direction, not BEFORE.

5. Close the trades manually only following rules

Quite often, newbie traders manually close their trades because of some random factors:

they saw someone's opposite view, or they simply changed their mind.

Remember, that if you opened a trade following your trading plan, you should always have strict rules for a position manual close. Do not let random factors affect your trading.

Following these 5 simple tips, your trading will improve dramatically. Remember, that it is not enough to spot and accurate entry. Once you are in a trade, you should wisely manage that, following your plan.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Learn How to Trade Fibonacci Levels | Full Guide 📚

In this short video, I will teach you to apply Fibonacci retracement tool.

We will discuss the common levels to apply.

I will show you real market examples and we will discuss important theory.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Trading Psychology | How to Perceive Your Trades 👁

Hey traders,

In this post, we will discuss a common fallacy among struggling traders: overestimation of a one single trade.

💡The fact is that quite often, watching the performance of an active trading position, traders quite painfully react to the price being closer and closer to a stop loss or, alternatively, coiling close to a take profit but not being managed to reach that.

Fear of loss make traders make emotional decisions:

extending stop loss or preliminary position closing.

The situation becomes even worse, when after the set of the above-mentioned manipulation, the price nevertheless reaches the stop loss.

Just one single losing trade is usually perceived too personally and make the traders even doubt the efficiency of their trading system.

They start changing rules in their strategy, then stop following the trading plan, leading to even more losses.

❗️However, what matters in trading is your long-term composite performance. A single position is just one brick in a wall. As Peter Lynch nicely mentioned: “In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

There are so many factors that are driving the markets that it is impossible to take into consideration them all. And because of that fact, we lose.

The attached chart perfectly illustrates the insignificance of a one trading in a long-term composite performance.

Please, realize that losing trades are inevitable, and overestimation of their impact on your trading performance is detrimental.

Instead, calibrate your strategy so that it would produce long-term, consistent positive results. That is your goal as a trader.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

How to trade Support and Resistance levels? BINANCE:BTCUSDTPERP

Support and resistance levels - are price areas on the chart where the price has ever changed its direction. This place always attracts traders, because near the levels there are obvious places for setting stop losses and entering a trade. Also, there are always limit orders of large buyers or sellers near the levels.

We can say that the level is the price area in the market, where traders consider the price to be too high or too low, depending on the current market dynamics. Therefore, it is always important to pay attention to key levels at which support and resistance have reversed roles or there has been a strong price rebound. We can designate support and resistance levels as the place in the market where traders are more willing to buy or sell, depending on current market conditions. This creates a collision zone between buyers and sellers, which often causes the market to change direction.

What are levels?

Support level is an area on the chart with the potential strength of buyers. The moment when buyers enter the market. The resistance level is an area on the chart with the potential strength of sellers. The moment when sellers enter the market with a large volume, which allows them to take advantage of the buyers and stop the price increase.

When the price breaks the support level, the support becomes resistance.

Conversely, if the price breaks through the resistance level, the resistance becomes support.

- On higher timeframes, support and resistance levels gain more strength. It is important to pay attention to the nature of the price movement from the level:

- If the price immediately turned from the level into the opposite trend, then this level can be considered significant.

- If the price tests a certain area several times, making a small pullback, most likely, this level will be subsequently broken.

How to draw levels on the chart?

Support and resistance levels are not lines on the chart, but areas or zones. No need to try to draw them exactly according to the shadows or bodies of the candles. Strive to achieve the maximum possible number of price touches of the levels. This will usually require you to move the level up and down until you find a spot where the market touches that level the maximum number of times.

You do not need to rewind the chart far to mark all the important levels. Most often, traders look only at the current monitor screen. Therefore, 100-150 candles will be enough. Most of the levels you will need will be based on price action over the past six months.

Focus on key levels that are immediately visible. Don't draw too many levels on the chart. Try to keep only the main ones and discard the secondary ones. If you find yourself wasting too much energy looking for levels, you are probably drawing more levels than you really need.

How to use support and resistance levels in trading?

A level is a place for a possible entry into a trade. If an additional confirming signal appears at the level, you can think about opening a position. Stop losses are placed by levels and possible targets for profit fixation are determined.

In books on technical analysis and on the Internet, you can often read that the more often the price tests the level, the stronger it is. But this is a gross mistake. In fact, the more the price touches the level, the weaker it becomes.

Imagine that we have a support level. The price bounces from this level because there are buyers in the market. If the price often returns to the level, this means that buy orders are gradually being executed. And when they are fully executed, then who will buy? Therefore, when there are no buyers at all, the price breaks through the level.

It is important not to forget that support and resistance levels are, first of all, zones, and not exact lines on the chart. Otherwise, you may encounter two problems in your trading: the price does not reach the level and the price goes beyond it.

When the market gets close enough to the level without hitting it, you may miss the trade because you were expecting a trading setup to appear exactly at the level you chose.

In a situation where the price goes beyond the level, you think that the level has been broken out and you try to trade the breakout, but this often turns out to be a false breakout.

How to solve these two problems? Very simple. Always treat support and resistance as zones on your chart, not exact lines.

How to find out what will break the level?

As we already know, support is an area with potential buying pressure. Therefore, when the price approaches the support level, it should turn into the opposite trend. But what if this does not happen and the price starts consolidating at the support level?

This is a sign of weakness as the bulls are unable to forcefully push the price up. Or there is strong selling pressure in the market. In any case, this situation does not look optimistic for the bulls and the support will probably not be able to resist.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

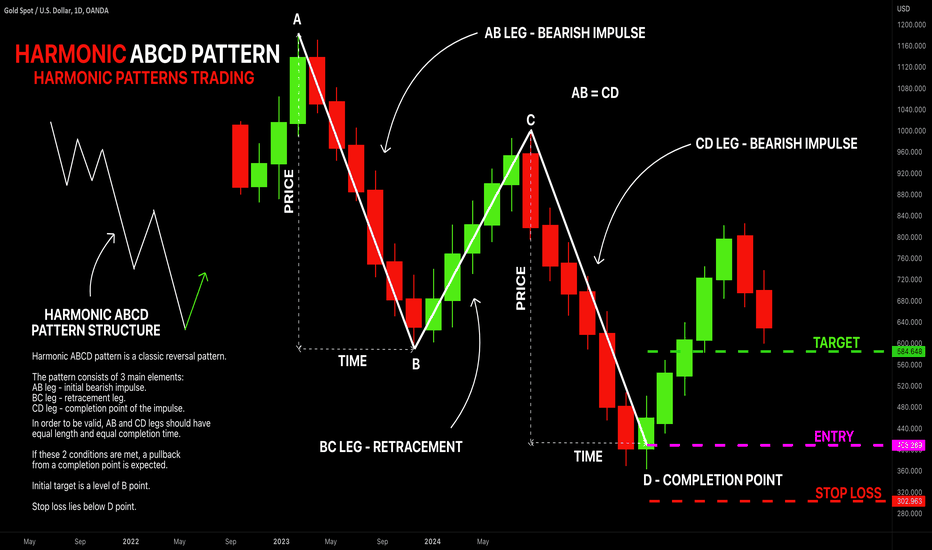

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

WHAT IS BULL TRAP?📊

⚠️A bull trap is a false signal about an uptrend in stocks, indices or other stock assets, in which, after an impressive rally, the rate reverses and breaks through the previous support level. Such a change seems to "catch" traders or investors who acted on a buy signal, and brings losses on long positions. A bull trap can also be called a "saw" trend.

The opposite of a bull trap is a "bear trap", it occurs when sellers cannot push the price below the resistance level.

❗️A bull trap is a reversal of the exchange rate, due to which market participants hoping for an opposite price movement close positions with unexpected losses.

❗️Bull traps occur when buyers fail to continue the rally that has broken through the resistance level.

❗️Traders and investors may fall into bull traps less often if they analyze the probability of further growth after the breakdown using technical indicators and/or divergence patterns.

✅The essence of the concept

⏺A bull trap occurs when a trader or investor buys an asset that has broken through the resistance level – a generally accepted strategy based on technical analysis. Although there is often a rapid growth of the exchange rate after the breakdown, the price can quickly change direction. This situation is called a "bull trap" – traders and investors who bought the breakdown are "caught" in a trading "trap".

⏺It can be avoided if you observe additional signs of a level breakdown. In particular, the growth of above-average trading volume and the appearance of bullish candles after the breakdown can confirm that the price is likely to continue to rise. And a breakdown in which the volume decreases, or candlesticks with a small body – for example, the doji star – may be signs of a bull trap.

⏺From the point of view of psychology, bull traps occur when bulls are unable to continue the rally after the breakdown of the level, this may be due to the lack of momentum and/or profit taking. Bears, if they see discrepancies, may seize the opportunity to sell the asset and thereby push prices below the resistance level, which may trigger stop-loss orders.

⏺The best way to deal with bull traps is to recognize warning signs in advance, such as a low breakdown volume, and exit the deal as soon as possible. Stop losses, especially if the market is moving fast, can help in this and prevent you from making a decision under the influence of emotions.

❤️ Please, support our work with like & comment! ❤️

Triangle Patterns 📐

❗️The triangle is one of the most common and reliable figures of graphical analysis. This is a strong pattern that can bring you a lot of points of profit if you approach its trading correctly.

✅What is a triangle pattern?

⚠️A triangle pattern is a pattern formed on a price chart. It is usually identified when the tops and bottoms of the price move towards each other, like the sides of a triangle. When the upper and lower levels of the triangle interact with the price, traders expect a possible breakdown. Thus, many breakout traders use triangle formations to find entry points.

✅Symmetrical Triangle

A universal pattern can act both as a trend continuation figure and as a reversal figure. A symmetrical "Triangle" is formed by two converging support and resistance lines. It turns out such a picture - "bears" are gradually pushing the price down from the resistance line, "bulls" are pushing quotes up from the support line. As a result, one of them turns out to be stronger and the price breaks through the border of the symmetrical "Triangle", simultaneously collecting protective orders (Stop Loss / Stop) and pending orders. The position should be opened in the direction of the breakdown, after the price closes outside the boundaries of the symmetrical "Triangle".

If the upper limit of the "Triangle" is broken, we buy, limit losses — we put a Stop Loss for the nearest minimum of the "Triangle", the benchmark for working out is the value of H (in points) — the base of the "Triangle" (the largest wave in the "Triangle"). If the lower limit of the "Triangle" is broken, we sell, limit losses — We put a stop for the nearest maximum of the "Triangle", the benchmark for working out is the value of H (in points) — the base of the "Triangle" (the largest wave in the "Triangle").

✅Ascending Triangle

The pattern is a continuation of the upward trend, but sometimes it is possible to work in the opposite direction. An ascending "Triangle" has been formed between the horizontal resistance level and the ascending support line. In the course of the upward trend, the "bulls" rest against a strong resistance level, which they cannot immediately overcome. From this level there are pullbacks downwards — waves of an ascending "Triangle". But gradually the pullbacks become smaller and at some point the bulls, having bought all the bearish sell orders, break through this level up, collecting Stops and pending buy orders. After breaking through the upper boundary of the ascending "Triangle", purchases are recommended, the Stop is placed below the nearest minimum of the "Triangle", working out is the value of the base of the "Triangle" H (in points), this is the largest wave of the "Triangle".

✅Descending Triangle

The pattern is a continuation of the downward trend, but sometimes it is possible to work in the opposite direction. A descending "Triangle" is formed by two lines — a descending resistance line and a horizontal support level. During the downtrend, the "bears" stumble upon a strong support level, which they cannot break through immediately. This is followed by several pullbacks up from this level, during which a descending "Triangle" is formed. In the end, the "bears" sweep away all orders for the purchase of "bulls" and break through the support level down, collecting buyers' stops and pending sales orders. After breaking through the lower boundary of the descending "Triangle", sales are recommended, the Stop is placed above the nearest maximum of the "Triangle", the value of working out H is the size of the base of the "Triangle" — its largest wave.

❤️ Please, support our work with like & comment! ❤️

What is Spread in Trading | Trading Basics 📚

Hey traders,

It turned out that many newbie traders completely neglect spreads in their trading.

In this post, we will discuss what is the market spread and how it can occasionally spoil a seemingly good trade.

💱No matter what financial instrument we trade, in order to buy the asset we need to have a counterpart that is willing to sell it to us and vice versa, if we want to sell the asset, we need to have someone to sell it to.

The market provides a convenient exchange between buyers and sellers. The asset price is determined by a current supply and demand.

However, even the most liquid markets have two prices: bid and ask.

🙋♂️Ask price represents the lowest price the market participants are willing to sell the asset to you, while 🙇♂️bid price shows the highest price the market participants are willing to buy the asset from you.

Bid and ask price are almost never equal. The difference between them is called the spread.

📈The spread size depends on liquidity of the market.

📍Higher liquidity implies bigger trading volumes and greater number of market participants, making it easier for them to make an exchange.

On such markets we see lower spreads.

📍From the other side, less liquid markets are categorized with low trading volumes, making it harder for the market participants to find a counterpart for the exchange.

On such market, spreads are usually high.

For example, current EURUSD price is 1.0249 / 1.0269.

Bid price is 1.0249 - you open short position on that price.

Ask price is 1.0269 - you open long position on that price.

The spread is 2 pips.

❗️Spreads must always be considered in a calculation of a risk to reward ratio for the trade. For scalpers and day traders, higher than usual spread may spoil a seemingly good trade.

Always check spreads before you open the trade.

In 2020, for example, we saw unusually high spreads on Gold during UK/NY trading sessions. Spreads were so high that I did not manage to open a trade for a couple of days.

Not considering spreads in such a situation would cost you a lot of money.

Do you consider spread when you trade?🤓

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

WHAT TYPE OF TRADER ARE YOU?👨🎓👩🎓

⚠️Who is a Trader?

✅A trader is a trader, a speculator, acting on his own initiative and seeking to profit directly from the trading process. This usually means trading securities (stocks, bonds, futures, options) on the stock exchange.

✅Traders are also called traders in the foreign exchange (including forex) and commodity markets (for example, "oil trader"). Trading is carried out by a trader on both the exchange and over-the-counter markets.

✅The trader should not be confused with other traders who carry out transactions at the request of clients or in their interests (dealer, broker, distributor).

❗️What kind of traders are there? Types of traders:

1️⃣Scalper

Scalping is a trading strategy that involves making a large number of transactions within a day. Scalpers make at least 10 trades a day. With an active market, professionals can make up to 100 trades. Scalpers play on small price fluctuations to get a small profit from each transaction. Often, a transaction can last less than a minute.

Scalping can be considered a profession. The scalper's workplace is his scalper terminal. Here he spends a full working day. Scalpers analyze the market by the glass, the tape of transactions and clusters, less often by charts. As a rule, scalpers do not use technical analysis indicators for analysis. The main working timeframes of the scalper are from 1m to 5m.

Many traders start with scalping. In theory, a scalper can seriously disperse a small deposit within a short time. Also, making a large number of transactions allows you to “fill your hand" faster. However, scalping requires a trader to be stress-resistant, disciplined and willing to learn from losses.

2️⃣Day Trader

Day traders also trade within the day. They do not transfer transactions “through the night”, closing positions during the day or trading session (depending on the type of market, stock or cryptocurrency). As a rule, day traders make 5-10 trades a day.

The market is analyzed through a glass, a tape of transactions, clusters and charts. Sometimes technical indicators are used. The working timeframes of day traders are from 5m to 1h.

This type of trading is less demanding on the trader than scalping. But it also requires stress tolerance and willingness to spend your day at the computer. It will not be possible to fully trade inside the day via the phone.

For successful trading, scalpers and day traders must adhere to strict risk management. They set the daily drawdown and determine the drawdown for each trade. As soon as a trader reaches the daily drawdown level, trading for the current day ends for him.

3️⃣Swing Trader

Swing trading is based on capturing one major movement in the market (one "swing" of the price). Its essence is to exit the transaction before the price goes back to correction.

Swing trading is different from day trading, which usually involves more frequent short positions and more active trading. It is also different from long-term investments and buy-and-hold strategies that take place over a long period of time.

Swing trading refers to medium-term trades ranging from a few days to weeks. This technique got its name because of the determination of the maximum and minimum of each oscillation. Its essence consists in opening medium-term positions on the asset, which are held from several days to weeks.

Choosing the time to hold a position in the market at the bottom or height of each medium—term trend is what distinguishes a swing trader from a day trader. Swing traders conduct extensive market research, be it fundamental or technical analysis.

Anyone can become a swing trader. Start by understanding the definition of what swing trading means, learn all the basics. and then start researching whether swing trading is right for you.

What type of trading do you prefer?

❤️ Please, support our work with like & comment! ❤️

EURGBP: Bearish Outlook For Today 🇪🇺🇬🇧

EURGBP has recently broken and closed below a solid demand area on a daily.

Retesting the broken structure, the price formed a double top and then broke its neckline

on an hourly time frame.

I expect a bearish continuation to 0.837 / 0.835

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

THE MOST IMPORTANT FOREX FUNDAMENTALS 📰

Hey traders,

Even though I am a pure technician and I rely only on technical analysis when I trade, we can not deny the fact that fundamentals are the main driver of the financial markets.

In this post, we will discuss the most important fundamentals that affect forex market.

📍Unemployment rate.

Unemployment rate reflects the percentage of people without a job in a selected country or region.

Rising unemployment rate usually signifies an unhealthy state of the economy and negatively affects the currency strength.

📍Housing prices.

Housing prices reflect people's demand for housing. Rising rate reflects a healthy state of the economy, strengthening purchasing power of the individuals and their confidence in the future.

Growing demand for housing is considered to be one of the most important drivers in the economy.

📍Inflation.

Inflation reflects the purchasing power of a currency.

It is usually measured by evaluation of the price of the selected basket of goods or services over some period.

High inflation is usually the primary indicator of the weakness of the currency and the unhealthy state of the economy.

📍Monetary policy.

Monetary policy is the actions of central banks related to money supply in the economy.

There are two main levers: interests rates and bank reserve requirements.

Higher interest rates suppress the economy, making the currency stronger. Lower interests rates increase the money supply, making the economy grow but devaluing the national currency.

📍Political discourse.

Political discourse is the social, economical and geopolitical policies of the national government.

Political ideology determines the set of priorities for the ruling party that directly impacts the state of the economy.

📍Payrolls and earnings.

Payroll reports reflect the dynamic of the creation of new jobs by the economy, while average earnings show the increase or decrease of the earnings of the individuals.

Growing earnings and payrolls positively affect the value of a national currency and signify the expansion of the economy.

Pay closes attention to these fundamentals and monitor how the market reacts to that data.

What fundamentals do you consider to be the most important?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

What is LEVERAGE in Forex💰

❗️Leverage is a brokerage service that is a loan in the form of cash or securities provided to a trader to secure a transaction. The loan amount may exceed the amount of the trader's deposit by 10, 20, 100 or more times. By analogy with the law of physics, leverage works as a lever, enabling a trader to make deals that he would not be able to with his own funds alone. The maximum leverage on the exchange does not depend on the trader's desire and the broker's capabilities. It is calculated based on the risks established by the clearing center for each asset. For example, if the risk amount for any stock is set at 10%, a trader will be able to trade it with a leverage of 1 to 10. If the risk value is 30%, then it is impossible to get a leverage greater than 1 to 3.

Making transactions on the exchange using leverage is called margin trading. It is the conclusion of purchase and sale transactions using borrowed funds issued against the security of a certain amount, which is called margin. In other words, in order to use the leverage service, you must have a minimum amount on the deposit (set by the broker), which will be the collateral.

The amount of leverage in trading is the ratio of the amount of the trader's own funds to the amount of the transaction (1:100, 1:1000). For example, if this indicator is 1:500, it means that the broker provides a loan amount 499 times higher than the investor's deposit. At the same time, one part of the investor's funds and 499 borrowed funds are used in the transaction.

The word "credit" scares many away, but in fact there is nothing terrible in this concept. Leverage can indeed be called a loan in the usual sense of the word, but the interest on the use of borrowed assets is significantly less than the usual bank. When transferring the positions of the transaction to the next day, a commission is withdrawn from the account in the amount of the difference in the interest rates on the loan and the deposit - the so-called swap, which can be considered an analogue of the fee for using leverage.

The loss on the transaction is deducted from the trader's own funds, if as a result their volume becomes less than the permissible minimum margin value, the broker will send a notification that the money is running out and the bidder needs to either replenish the account or close the position. Such an alert is called a Margin Call. If no action is taken, the transaction will be closed automatically (Stop out).

✅How to trade with leverage

Leverage is a financial instrument that, with a competent approach, allows you to make large transactions and get a good profit even on small deposits. In order to use this tool correctly, follow the simple recommendations:

Focus on your own deposit. Calculate the risks based on the available amount.

It is better to use a small amount of borrowed funds, which will not allow you to lose all the money at once.

With any leverage size, never trade for the entire deposit. Ideally, one operation should account for 1-2% of the deposit amount.

Be sure to set Stop loss levels, this will help reduce risks.

⚠️IMPORTANT! Stop loss is an order that fixes the financial result when the price of the selected instrument reaches a certain level. The Stop loss parameter can be set before opening a position or after. But there is one important point: in a sale transaction, the specified level should be no less than the current price on the market, and in a purchase transaction - no more.

❤️ Please, support our work with like & comment! ❤️

Trading Sessions in Forex | Trading Basics 🕰🌎

Hey traders,

In this post, we will discuss trading sessions in Forex.

Let's start with the definition:

Trading session is daytime trading hours in a certain location.

The opening and closing hours match with business hours.

For that reason, trading hours are varying in different countries because of contrasting timezones.

❗️Please, note that different markets may have different trading hours.

Also, some markets have pre-market and after-hours trading sessions.

In this post, we are discussing only forex trading hours.

The forex market opens on Sunday at 21:00 GMT

and closes on Friday at 21:00 pm GMT.

There are 4 main trading sessions in Forex:

🇦🇺 Australian (Sydney) Session Opens at 21:00 GMT and closes at 06:00 GMT

🇯🇵 Asian (Tokyo) Session Opens at 12:00 GMT and closes at 9:00 GMT.

🇬🇧 UK (London) Session Opens at 7:00 GMT and closes at 16:00 GMT.

🇺🇸 US (New York) Session Opens at 12:00 GMT and closes at 21:00 GMT.

Asian trading session is usually categorized by low trading volumes

while UK and US sessions are categorized by high trading volumes.

Personally, I trade the entire UK session and US opening and usually skip Australian and Asian sessions.

What trading sessions do you trade?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Types of Orders & Their Features📚

⚠️One of the first things that novice traders should learn is how to use different types of orders. The exact number of orders available to you often depends on which broker you are going to use.

Learning how to use different types of orders correctly is part of comprehensive trading training.

❗️The most popular types of forex orders:

✅Market orders

A market order is probably the simplest and most common type of order. It is usually executed immediately by the broker if it has not arrived in too large a size or has been placed in fast-moving markets.

As the name implies, market orders include buying or selling a currency pair at the current market rate. Market orders can be used by a trader for long or short positions. They can also be used to close current positions by buying or selling.

One of the main advantages of market orders is that they are almost always executed. The disadvantage of using market orders is that you can get an unexpectedly unfavorable price if the market moves quickly against your position.

✅Limit orders

Whenever a trader wants to specify a lower or higher price at which an order should be executed, this type of order is called a limit order. Limit orders can be used to stop losses, as well as to fix profits.

The name of this type of order arises from the fact that the trader demanded that transactions concluded on his behalf be limited to transactions executed at the specified exchange rate or better.

In practice, however, limit orders are usually executed at the specified price, although a broker may offer a better order execution rate to impress a particularly good client.

Some traders like to use a certain type of limit order, which is called a Fill or Kill or FOK order. The first type of FOK order tells the broker to either fully execute the order at a certain price, or cancel it. The second type of FOK order instructs the broker to immediately execute all orders at the specified price, and then cancel all others. This last type of Fill or Kill order is most often used when trading large amounts.

✅Take Profit orders

The take profit order is one of the most common types of limit orders. As the name suggests, it is usually used by a trader who wants to liquidate an existing position with a profit. Therefore, the price level indicated in the take profit order should be better than the prevailing market rate.

If the trader's initial position is short, the take profit order will include the redemption of this short position at a price lower than the prevailing one in the market. Conversely, if they held a long position in accordance with the take profit order, it would be liquidated if the market moved up.

Traders may sometimes indicate that their take profit orders are of the "All or Nothing" or AON type. This means that the order must be either fully executed or not executed at all. AONs are used to prevent partial execution of orders, which may be considered undesirable.

Alternatively, traders can choose to partially fill in a smaller amount than the entire amount of the take profit order. This can be useful if the broker trying to execute the order can only execute part of the order at the exchange rate specified in the order.

✅Stop loss orders

A stop loss order is another very common type of order, usually used to liquidate an existing position. Such orders are usually executed as market orders as soon as the stop loss level is triggered when trading currency at this level.

In fact, when the market has gone against an existing position to a point and the exchange rate has reached the specified stop loss level, the stop loss order is executed and causes the trader to incur a loss.

However, a stop loss order limits the trader's further losses if the price continues to move in the same unfavorable direction. This makes stop loss orders an important part of risk management strategies for many traders.

❤️ Please, support our work with like & comment! ❤️

Types of Orders In Trading | Trading Basics 🤝💱

Hey traders,

In this post, we will discuss types of orders that we use in Forex trading.

➖ Market order.

Trading position is opened at a current price level.

Buying the asset, you will open a trading position at a current ask price.

Selling the asset, you will open a trading position at a current bid price.

Even though market order is the most preferable type of orders among newbie traders, I highly recommend not to use that, especially if you are a day trader.

❗️The main problem is that prices constantly fluctuate and there is a certain delay between order execution and position opening. For these reasons, the position will be opened from a random price level within the range where the market is currently staying, affecting a risk to reward ratio.

➖ Limit order.

Trading position will be opened only from a desired price level.

With buy limit, you will buy the asset from a certain level.

(current price remains above the order)

With buy stop order, you will buy the asset from a certain level.

(current price remains below the order)

With sell limit, you will sell the asset from a certain level.

(current price remains below the order)

With sell stop, you will sell the asset from a certain level.

(current price remains above the order)

That is the order type that I prefer. Limit order helps you to trade from a desirable level, automatically executing the order once it is reached, letting you preliminary set it.

❗️However, remember that there is one big disadvantage of that order type: there is no guarantee that the price will reach the desired price level to activate a trading position. For that reason, occasionally you will miss the trades.

Try these order types on a demo account to learn how they work in practice.

Which order type do you prefer?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

FALSE BREAK | Price Action Trading📊

⚠️How often have you opened a key level breakout trade, and then the price turned against you? False breakout happens quite often and it is a problem for many traders who buy at highs and sell at lows.

Breakout trading is a fairly popular and viable trading strategy. However, some breakouts often turn out to be false. This can be quite frustrating, not to mention that it can often lead to a losing trade.

However, in many cases, an experienced trader can analyze the market situation and react to it accordingly. False breakouts can make a profit if you know how to trade them correctly.

❗️A false breakdown is a situation when the price violates an obvious level, but then suddenly changes direction. When the initial breakout of the level occurs, many traders open a trade in the direction of the breakdown. These traders are trapped when the price reverses, which triggers a series of stop losses. New traders are also entering the market, and this puts additional pressure on the price. This often turns the price into a new trend, the opposite of the initial breakout.

A breakout that turns out to be false is a sign of strength in a downtrend or weakness in an uptrend.

As you can see, a false breakout can easily cause significant losses for any trader.

Some traders develop their entire strategy around trading false breakouts, as this can be a very powerful trading approach. Some of the best trades happen when market players fall into a trap and their stops start to work.

✅How to find patterns of false breakouts?

🟢If you do not learn how to correctly identify false breakouts, you will not be able to trade them profitably. For example, there will be situations when the price returns to the breakout point, and only then continues its movement.

🟢One of the ways to detect false breakouts is to monitor the volume. Real breakouts are usually accompanied by strong indications of trading volume at the time of the breakout. When this volume is absent, there is a higher probability that the breakout will not happen.

🟢Thus, if the trading volume is low or it decreases during the breakout, a false breakout is likely to occur. In contrast, if the volume is large or it increases, a real breakdown is likely.

🟢It is also useful to monitor not only the trading volume but also the price movement on the lower timeframe. In many cases, you will see that the price makes a very sharp pullback on the lower timeframe, which is not visible on the higher timeframe.

✅False Breakout Trap

🟢After all, many trading textbooks say that a breakout can be considered confirmed when a candle closes above the resistance level. However, the price moves in your direction for a while and then turns 180 degrees. As a result, you have a stop loss triggered.

🟢The false breakout trap includes several candlesticks, usually 1-4, that go beyond the key support or resistance level. Such breakouts occur after a strong movement, as the market has reached an important level, but the price momentum still retains its strength.

Have you ever been trapped by a false breakout?

❤️ Please, support our work with like & comment! ❤️