Howtotrade

GBPUSD Follow up Analysis and education 12-02-2022This is a follow up analysis for the GBPUSD. what we saw last week from the technical perspective was price going up to fill up liquidity before heading down. fundamentally, the news impact from the US and earlier raised interest rates from UK Caused lots of mixed sentiments and reaction

in the market.

If price breaks the demand zone below, we can expect the price to fall further, otherwise lets look for swing term sell opportunities. Let us trade with caution. Lets go take some risks, lets go make some money.

How Flytheus Trade The Markets In An UpTrend Using Break&RetestWatch for a close above a horizontal resistance level or a diagonal resistance level. A close above a resistance level turns level into support. Next watch for bullish price action at support in the form of a rejection candlestick like a pin bar; an engulfing bar; or an inside bar. Enter the market after the candlestick closes.

WHAT IS AN ETF? (Exchange-Traded Fund)📚

✅An ETF is an exchange-traded investment fund. The fund's management company draws up a strategy and acquires assets in its portfolio, and then issues shares - small shares of this portfolio. When selling an ETF, the investor pays tax in the same way as if it were ordinary shares.

✅If 40 years ago only 6% of American families invested money in investment funds, now they are about 46%. At the end of the third quarter of 2020, $29.5 trillion was invested in open-ended investment funds in the United States — this is almost half of all assets managed by funds around the world.

⚠️What instruments are included in the ETF

🟢The fund's portfolio may consist of any instruments traded on the stock exchange. For example, stocks, bonds, currency, precious metals. Their ratio depends on the fund's strategy. Once in a certain period, the management company reviews the portfolio and rebalances, that is, sells some assets and buys others.

🟢All actions are subject to strict rules, from which managers cannot deviate. All information about the composition of the ETF and the frequency of portfolio rebalancing is available in the fund's documentation.

🟢ETFs can consist of securities, precious metals, derivatives - there are practically no restrictions. Therefore, today there are thousands of funds with very different structures. For example, there is the Global X Millennials ETF— which is a fund for shares of brands beloved by millennials. Or Direxion Work From Home ETF - it invests in services that benefit from the widespread transition to remote work.

❗️What are ETFs

🔴When a fund copies a stock index, it applies replication, that is, it exactly repeats the composition of the index. There are two types of replication — physical and synthetic. If an ETF uses physical replication, it buys the index assets themselves - stocks, bonds, and everything else.

🔴If a fund uses synthetic replication, it does not buy the index assets themselves. Instead, the fund uses an index derivative — an agreement between the parties that the transaction will be executed. A change in the value of the index entails a change in the value of the derivative. On the one hand, this is beneficial for the investor, but on the other hand, a complete repetition of the index may be inaccurate. In addition, there is a risk that the derivative provider will not fulfill its obligations.

🔴In index ETFs, the investor should pay attention to the error of following or tracking error. Let's say the IMOEX index has gained 12% over the year, and the ETF for this index has only 11%. The management costs in this fund are 0.5%, which means that the remaining 0.5% is a follow-up error. This indicator should not be too large, because, in the end, it affects the profitability of the fund. If the fund deviates greatly from the index, the managers do not do their job well.

‼️How the price of an ETF is formed

🔴Shares in ETFs are called shares, they have a market and settlement price - iNAV.

🔴The estimated price is the value of all assets included in one share of the ETF. It can be viewed on the fund's website and the stock exchange.

🔴The market price depends on the supply and demand in the market and differs from the estimated price. It is not profitable for the Fund that the difference between them is too large, otherwise, investors will not buy shares. The market maker makes sure that the price on the stock exchange does not fluctuate much. He puts out large bids in a certain range. The current market price of the fund's shares can be viewed on the stock exchange or in the terminal.

🔴ETFs are a convenient and simple solution for investors who want to get "all in one". For example, they do not want to make a portfolio with their own hands or buy index assets separately. This tool is easy to buy and sell at any time. We can say that an ETF is trust management without red tape with documents and time limits.

❤️ Please, support our work with like & comment! ❤️

FEW SIMPLE TIPS TO IMPROVE YOUR TRADING PERFORMANCEToday we prepared for you few simple tips that may help you improve your trading performance.

Please feel welcome to share your own tips in the comment section.

Educate yourself.

No trader can become successful without spending plenty of time studying charts, fundamentals and technicals. Nowadays, there are plenty of financial gurus and trading courses which claim to offer knowledge that will transform you into a professional trader in just a short amount of time. Unfortunately, most of these services offer only shallow information that has no use in the real trading world. In our opinion, literature written by renowned traders and economists offer more profound knowledge and usually at better cost.

Analyze your trades and strategies.

Analyzing your past trades and strategies can help you learn from your mistakes. Additionally, it can help you recognize what you did correctly and what works for you.

Do not trade without a proper trading plan.

Each trade should have a proper trading plan. This plan should at least consist of entry/exit points and risk/reward evaluation. However, creating different scenarios for each trade can help you navigate the market even better.

Evaluate your risk/reward associated with each trade.

Each trade has a risk/reward ratio tied to it. Generally, a risk/reward ratio of 1:3 or more is preferable.

Do not chase the market when you are not sure where it is headed next.

There are times when the market is very volatile and experiences swings from side to side. Often, in such times, a trader may be unable to tell where the market is headed next. On such occasions it is usually better to take a step back and not to trade. This can help avoid loss of capital due to whipsaws.

Take a time off after the winning streak.

Winning streaks often result in confidence being gained by a trader. However, many traders tend to get overconfident which usually leads to loss of capital that has been amassed through the winning streak. Therefore, it is usually better to take some time off trading after substantial gains were made.

Take a break from trading after the losing streak.

Losing streak can negatively affect a trader's decision making. It can often result in loss of confidence and a needy feeling to make money back. However, a trader should resist these urges and take some break from trading. This is mainly because if a trader does not have confidence, it is much harder to execute trade properly.

Do not overtrade.

Sometimes there are no good trading opportunities. In such times it is usually better to take the role of market observer instead of trying to make money at any cost.

DISCLAIMER: This content serves educational purposes only. It is not financial advice.

MOVING AVERAGE | 4 Efficient Methods To Apply

Hey traders,

The moving average is one of the most popular technical indicators.

It is applied in stocks/forex/crypto trading and proved its high level of efficiency.

There are hundreds of trading strategies based on MA.

In this post, we will discuss the 4 most popular ways to apply the moving average.

1️⃣The first method is applied to identify the market trend.

While the price keeps trading above the MA, one considers the trend to be bullish and looks for buying opportunities.

Once the price starts trading below the MA, the trend is considered to be bearish and a trader is looking for shorting opportunities.

2️⃣The second method applies the combination of 2 MA's: preferably a long-term one and a short-term one.

The point is that once a short-term moving average crosses above a long-term MA, with high probability it signifies the initiation of a bullish trend.

Alternatively, a crossover of short-term and long-term MA's to the downside indicates a start of a bearish trend.

3️⃣The third method applies MA as a structure.

While the moving average is lying above the price, it is considered to be a dynamic resistance.

Staying below the price it serves as a strong dynamic support.

Perceiving MA as the structure, one applies that for trade entries.

4️⃣The fourth method is aimed to track the crossover of the moving average and the price.

The idea is that a bullish violation of the MA by the price gives an early signal for a possible trend reversal.

While a bearish breakout of the MA by the market indicates a highly probable bullish trend violation.

Backtest different MA's inputs and learn to apply that for predicting the future direction of the market and for trading it.

Do you use MA?

❤️Please, support this idea with like and comment!❤️

BTC/USD - SELL - @TradersLounge.USHello everyone!!

Currently short on BTC.

- I took the sell on BTC after the trend line break, EMAs crossover, and retest. Bulls are holding this level for now but we could potentially see a decline to the $31K area to retest the lows.

- This is my first BTC/Crypto trade in a while so I went in with small size to test the waters.

Love to see how this plays out.

Let me know your views on BTC! #HappyTrading

Miajah

Lead Trader @ Trader's Lounge

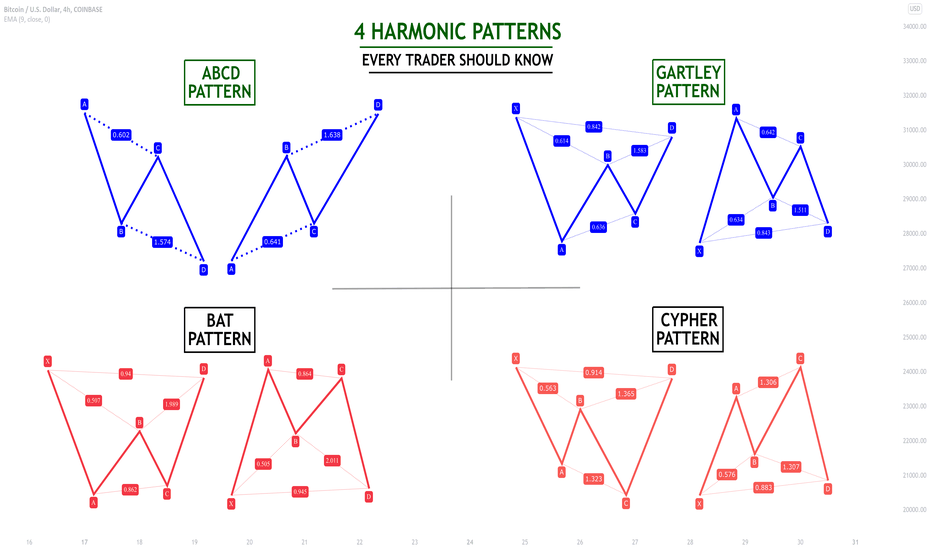

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

How to FIND the BEST PAIRS to trade! Examples and explanations.Here the first part of the lesson: How do interest-rates effect the market and how do I find good pairs to trade?

The market offers you 5 main asset-classes:

1️⃣ Bonds

2️⃣ Stocks

3️⃣ Commodities

4️⃣ Metalls

5️⃣ Financials

What we want to indeifity as a trader is the cashflow, means where big players are buying or selling.

They don`t buy breakouts or an obvious momentum that already happened, instead they accumulate or distribute for days / weeks as they have a lot of capital to invest and cause support / resistance aswell as bottoms / tops.

Important for them are always the fundamentals such as Economic data, Inflation and so expectations for the monetary policy of central banks they price in.

Before we start the journey we need to understand the effect of Interest-Rates

I explain that simplyfied and in short as I its a complex topic:

The Interest-rate is the rate a central-bank lends money to privat credit institutions for. So your bank aswell as mine has a bank-account at the central bank of your country.

They give them money in order to have enough capital to hand out credits to privat customers aswell as companies. The lower the interst-rate is the more demand is in the market.

I mean, if you want to buy a car would you rather finance it with 5% or 2% interest-rates? You have the opportunity to buy a car with less debts at the bank.

Same for companies, if you need a second office, goods, more capital for production etc. you rather take that opportunity when rates are low.

Credit-business has a huge competition and banks will offer lower and lower interst-rates to attract more customers.

The longer lent term the more risk is involved as you could for example lose your job and won`t be able to pay back the credit anymore, means interest-rates are usually higher due to the risk than short-term-lendings.

The yields are shown in the bondmarket👉

This is why everyone talks about a "reversed rate-curve" as a sign for a recession. Because your bank gets money in the short-term from the Centra Bank on order to hand them out in the long-term to make money. If the risk of an upcoming recession is present the short-term involves more risk, thus short-term yields are higher than long-term-yields and banks can`t give out any credits anymore as they pay more to the central bank than they make.

Here a quick overview of interest-rate-effects:

Higher interest-rates

1️⃣ Increased cost of borrowing 👉 Reduced investment 👉 Lower economic growth and bad for stocks

2️⃣ Higher mortage interest 👉 Reduced consumption 👉 Lower economic growth and bad for stocks / house prices

3️⃣ Increased return for savings 👉 Less spending 👉 Lower economic growth

4️⃣ More demand in the currency due to higher interests / returns 👉 Lower inflation

Vice versa with lower interest-rates. The lower the interest-rate, the more consume and investment is in the market.

You see there is a lot to learn and to understand and to give you all information I`d have to finish a course.😆

Let`s start with the corona-crises:

The FED has just started to raise interest-rates after the financial crisis in 2008. And as you probably understand now, they lowered them back in the days to provide more money to the market and to boost consume / investment to rescue companies.

After the raise corona came and shocked the market. The first reaction of the FED was to lower interest-rates. They do this because they want you not to keep your money on your bank-accound and instead spend it to boost the economy and of course to use the chance to get a credit for better conditions.

Additionally they have raised their total balance-sheet, continued with quantative easing (printing money to buy bonds) and we`ve got the stimulus-package.

Demand and Supply regulates a price ... now we have tons of supply and fear of inflation.

Now ask yourself: What is the best trade here?

Probably to short the US-Dollar and to BUY stocks!

What currency has the strongest weight in the US-DOLLAR-BASKET? 👉 Euro with ca. 57%. Euro will have the strongest rally due to the weak US-Dollar.

What is asked when the stockmarket pumps? Australian Dollar aswell as New Zealand Dollar 👉 Both will fly, but even more than EURO because of the USD weakness.

Most attractive pairs:

1️⃣ AUD/USD long

2️⃣ NZD/USD long

Also good pairs:

1️⃣ EUR/USD long

2️⃣ GBP/USD long

We know AUD and NZD are both stronger than EURO due to the risk-on in the stockmarket means:

1️⃣ EUR/AUD long

2️⃣ EUR/NZD long

Whatlese do we know? We know Crude OIL pumping due to risk-on in the market. It goes up as a pre-indication for inflation and a healthy economy. Who exports OIL? Ah yeah... CANADA.

So if there is more demand in OIL and the market buys in CANADA investors have to exchange their currency into the Canadian Dollar.

USD falls due to low interest-rates 👉 Canadian dollar moves up due to pumping OIL 👉 USD/CAD SHORT

Just a few examples here how to think.

Central-Banks are independed institutions and have the following task:

1️⃣ Provide economic growth

2️⃣ Price-Stabillity

Central Banks aim for an Inflation of 2% a year (compared the year before) because they consider this as a healthy level.

They basically define this as a fine line of "prices are not going crazy" and "companies make more money." A little bit of inflation, or higher prices increase earnings of companies that can as a result expand, offer more jobs etc. 👉 Which defines the first task economic growth.

The problem is.. they can provide money to the market in case of fiscal support is needed, but they can`t take it back and SAY GUYS WE NEED OUR MONEY, its too much floating and inflation is too high.

1️⃣Healthy economy:

Rising inflation and a growing economy

"Rate hikes getting likely as economy doesn`t need fiscal support"

2️⃣Unhealthy economy:

Stable inflation but a stagnation of the economy

"Rate hikes getting less likely as economy needs fiscal support."

Now we have a dilemma here.....

3️⃣ Disaster and current situation

High inflation but a stagnation or even a slowdown in economy

"Rate hikes are tricky as the economy needs fiscal support while inflation is already HIGH."

Either price-stabillity or the economy suffers❗️

Now keep this in mind: Jerome Powell promised Biden to fight the inflation at all costs in order to get his second term in office.

It is tricky to know what he is gonna say, but we know he promised it to the President. This is why the market is so shaky.

The market hopes to see a dovish Jerome after the Sell-Off in stocks.

At the same time the market knows we will see a year with rate-hikes.

What do you think will be the best pair to trade after the FOMC?!

RISK : REWARD. Visualized breakdown

⚠️Regardless of whether you prefer day trading or swing trading, you need to understand the fundamental concepts regarding risk. They form the basis of understanding the market, managing trading activities, and investment decisions. Otherwise, you will not be able to protect and increase your balance.

We have already discussed risk management, position size, and stop-loss setting. But if you are actively trading, answer two important questions. How does the growth potential relate to potential losses? In other words, what is your risk-reward ratio?

In this article, we will discuss how to calculate the risk-to-profit ratio for any transaction.

✅What is the ratio of risk and profit?

🟢The risk-reward ratio (risk/reward or R/R ratio) allows you to understand what risk a trader is taking for the sake of a potential reward. In other words, it shows what the potential profit is for every dollar you risk when investing.

🟢The calculation itself is very simple. The maximum risk is divided by the net target profit. How exactly? First, think about where you want to enter into the transaction. Decide where you will take profit (if the trade is successful) and where to place a stop loss (if it is a losing trade). This is extremely important for effective risk management. Good traders set profit targets and stop-loss before entering a trade.

Now you have entry and exit points, that is, you can calculate the ratio of risk and profit. To do this, you need to divide the potential risk by the potential profit. The lower this coefficient is, the more potential profit you will receive per "unit" of risk. Let's figure out how it works.

✅How to calculate the ratio of risk and profit

🟢Let's say you want to open a long position on bitcoin. You perform an analysis and determine that your take profit order will be 15% of the entry price. Next, you have to answer the following question: where your position will be closed in case of a market reversal. This is where you will have to set a stop loss. In this case, you decide that your cancellation point will be 5% of the entry point.

It is worth noting that it, as a rule, should not be based on arbitrary percentage numbers. The profit target and stop loss should be determined based on market analysis. Technical analysis indicators are very useful for solving this problem.

🟢So, our profit target is 15%, and the potential loss is 5%. What is the ratio of risk and profit? 5/15 = 1:3 = 0,33. Everything is simple. This means that for each unit of risk we potentially win three times more. In other words, for every dollar we risk, we can get three dollars. Thus, if we have a position worth $100, then we risk losing $5 with a potential profit of 15.

🟢You can also move the stop loss closer to our entry to reduce this ratio. However, the entry and exit points should not be calculated arbitrarily, but solely based on analysis. If a trading position has a high risk-to-profit ratio, it is probably not worth "arguing" with the numbers and hoping for success. In this case, we recommend choosing another position with a good risk-reward ratio.

‼️Please note: positions with different sizes may have the same risk-to-profit ratio. For example, if we have a position worth $10,000, we risk losing $500 for a potential profit of $1,500 (the ratio is still 1:3). The ratio changes only if we change the relative position of our target and stop loss.

❤️ Please, support our work with like & comment! ❤️

CANDLESTICK PATTERN TRADING | Engulfing Candle 📚

Hey traders,

In this post, we will discuss a classic candlestick pattern formation each trader must know - the engulfing candle.

Key properties of this pattern:

🔑 Engulfing candle is a reversal pattern.

🔑 Engulfing candle can be bullish or bearish.

❗️Also, remember that this candle demonstrates the highest accuracy when it is formed on a key level (support or resistance).

⬆️Bullish Engulfing Candle usually forms after a strong bearish impulse.

Weakening, the market keeps going lower forming bearish candles.

However, at some moment, instead of forming a new bearish candle the market reverses. The price forms a bullish candle that engulfs the range of the previous bearish candle and closes above its opening price.

Such a candle we call a bullish engulfing candle.

The main feature of this pattern is the fact that its total range (distance from the wick high to wick low) & body range (distance from body open to body close) exceed the ranges of a previous bearish candle.

Being formed on a key support level or within a demand zone it signifies a highly probable pullback or even a trend reversal.

⬇️Bearish Engulfing Candle usually forms after a strong bullish move.

Reaching an overbought condition, the market keeps going higher forming bullish candles.

However, at some moment, instead of forming a new bullish candle the market goes in the opposite direction. The price forms a bearish candle that engulfs the range of the previous bullish candle and closes below its opening price.

Such a candle we call a bearish engulfing candle.

The main feature of this pattern is the fact that its total range (distance from the wick high to wick low) & body range (distance from body open to body close) exceed the ranges of a previous bullish candle.

Being formed on a key resistance level or within a supply zone it signifies a highly probable pullback or even a trend reversal.

📝Engulfing candle can be applied for scalping lower time frames, for intraday trading, or even for swing trading.

Personally, I apply this candle on daily/4h time frames as one of the confirmations of the strength of the structure level that I spotted.

Do you trade engulfing candle?

❤️Please, support this idea with like and comment!❤️

WHAT IS MARGIN? Traders must know this📚

✅Significant investments are required to gain access to foreign exchange markets. Not everyone who wants to try their luck in the world of trading has such funds. However, thanks to brokers that act as intermediaries and provide loans to traders, trading has become available to everyone. Thus, the essence of margin trading is to conclude transactions in financial markets with the use of borrowed funds provided by a broker.

🟢The second name of margin trading is trading with leverage. Leverage is the ratio of your deposit to the amount of the working lot. To obtain this kind of credit, the trader's account must also have his funds. The minimum of the initial deposit is different and depends on the requirements of a particular broker.

🟢The margin on the stock and foreign exchange market is a pledge that is blocked by the broker on the trader's trading account during the opening of the transaction. In margin trading, the broker can issue a loan both in cash and in the form of securities. Margin is usually expressed as a percentage, showing what proportion of own funds must be deposited to open a position on a particular instrument. For example, a margin requirement of 20% means the possibility of opening a transaction with financial instruments if there is a fifth of their total value on the account. And the margin requirement of 50% allows you to open positions for a certain amount, having 50% of it on deposit.

❗️Margin trading allows a trader to sell the market, entering short positions in case of forecasting a decline in the price of a particular instrument. Let's consider the principle of opening a short position on the example of stocks.

❗️Expecting a decrease in the price of Vesta shares, a trader takes ten shares from a broker on credit and sells them on the stock exchange at the current price. After the predicted price drop, he buys ten shares at a lower cost. By returning them to the broker, the trader remains in profit. The lower the stock price falls, the more profit the trader will get.

⚠️The above transactions are actually carried out much easier. Technically, a trader does not need to sell securities and subsequently buy them again. To do this, you only need to instruct the broker to open a short position. If the trader's forecast turns out to be correct and the forecast price decreases, the trader will close the deal, fixing the profit. Otherwise, if the price increases, the trader will receive a loss.

❤️ Please, support our work with like & comment! ❤️

Trading on Financial Markets | Your Guide to Trade Planning 📝

Hey traders,

In this post, we will discuss 6 crucial things in your trade planning and the main elements of trade results assessment.

1 - Before you open a trading position, make sure that you analyzed the chart. You should identify a market trend and spot major key levels.

2 - Once the chart is analyzed, you should identify the safest trading areas for your strategy (preferably the zones of supply and demand).

You should patiently wait until one of these zones is tested.

3 - Once the zone is reached, you should look for a confirmation. You can either look for a reversal candlestick/price action pattern, some fundamental trigger, or some indicator. The point is that you should rely on a trigger that is backtested and that proved its accuracy.

4 - Getting your confirmation, you should have a precise entry strategy. Some traders prefer aggressive entries on spot while others are waiting for a retest of some major/minor level.

5 - You must set a stop loss. Remember that your stop-loss defines the point where you become wrong in your predictions. Be extremely careful on that step and give the market some space for fluctuations.

6- Know your exact target level(s). Know the point where you start protection of your position, where you start profit-taking. Be very strict and don't let your greed and fear intervene.

Only then a trading position is opened.

No matter what will be the end result of your trade, you should assess it:

1 - You should journal the trade outlining its end result, trading instrument, and your entry reason.

2 - Note any peculiar thing about this trade that you noticed.

3 - Record your gain/loss percentage.

4 - Identify whether any mistake was made and if so, learn from that.

Here is your minimum plan to follow. Of course, as you mature in trading your trade assessment plan will be more sophisticated.

Do not underestimate its importance and treat it as the main element of your trading routine.

Do you plan your trades like that?

❤️Please, support this idea with like and comment!❤️

TRADING PSYCHOLOGY | Common Traps You Must Know 🧠💭💫

Hey traders,

Trading psychology plays a very important role in a learning curve of a trader. In this post, we will discuss common biases and traps that every struggling trader is occasionally facing.

⚓️Anchoring Bias

People rely too much on a reference point from the past when making a decision for the future - they are "anchored" to the past.

Imagine you spotted a great trading opportunity & made a nice profit. Encountering a similar setup in the future you trade it again. It turns out that you lose.

Next time - same thing. The setup that initially brought you nice cash refuses to work.

Even though the probabilities indicate that the identified pattern produces negative long-term returns, you keep taking that because you are "anchored" to the initial winner.

🙅♂️Loss Aversion

This is when people go to great lengths to avoid losses because the pain of loss is twice as the pleasure received from a win.

You see a great trading setup. You are 100% sure that it will play out. You open a trade and guess what? The market goes in the opposite direction. You can't believe that you are wrong. Instead, you decide to hold your position just a bit more adjusting your stop loss. And again, the market refuses to go in the direction that you projected. It is a vicious cycle that most of the time leads to substantial losses.

✅Confirmation Bias

The confirmation trap is when traders seek out the information that validates their opinions and ignores any theory that invalidates them.

You spotted a great long opportunity on GBPUSD. Checking the ideas of other traders on TradingView you consider only the ones that confirm your predictions completely ignoring the opposite ones.

👑Superiority Trap

Many traders have lost large sums of money in the past simply because they have fallen prey to the mentality of overconfidence.

Imagine that you caught a winning streak. You feel like the king of the world. You spend less and less time and reflection on each consequent trading decision that you make, you lose your focus. At some moment the reality kicks in and your gains evaporate.

🐮Herding

As a trader, you should execute your own analysis & avoid the temptation to blindly follow the majority.

Analyzing a EURUSD chart you make a conclusion that the market is bearish. However, then you see that 90% of the traders are very bullish on TradingView.

Instead of following your own analysis, you decide to join the herd.

These biases are common and most of the time we fall prey to them unconsciously.

The more you self-reflect, the more you analyze your thoughts and actions, it would be easier for you to avoid them.

Have your ever fallen prey to these traps?

❤️Please, support this idea with like and comment!❤️

Your Success Formula | What Drives a Big Change 🏔️

Hey traders,

There’s a well-known Chinese proverb that says, “A journey of a thousand miles begins with a single step.”

The one thing that prevents you from attaining your goal is hidden in your psyche, deep inside your soul. People usually look for shortcuts and want to accomplish their goals in one night. But the thing about long-term goals is that they can not be accomplished in a single day! It’s not like they require one huge, monumental effort to be achieved.

The only way you’re going to accomplish something really big and ambitious – the kind of goal that will transform your life forever – is by consistently taking one small step at a time in the direction of your dreams.

The importance of small incremental steps should be recognized by everyone, life is full of challenges, ups, and downs, but one should not lose hope or give up during the process. Failure should be considered as a learning point, an opportunity for growth.

Be ready for a journey of thousand miles this year. Be ready to meet the chaos and unknown. That is the only way to evolve and be better.

Remember that nothing is impossible to achieve unless you decide to do it at all costs.

Do you agree with this quote?

❤️Please, support this idea with like and comment!❤️

Jasmy Trading Plan and EducationHello Traders,

Today I wanted to discuss being prepared prior to making a trade. It is quite often I see people asking what to buy but, rarer that people are interested in when to buy or what to do after. Finding a good asset is only half of the battle, knowing when to buy and where to take profits are just as important as what to buy.

Here I have put together a trading plan for the asset Jasmy. What I first noticed about this asset was, the potential declining channel as labeled on the chart. A declining channel is generally a bullish indication that market participants have been selling and buying in a manor that presents this bullish consolidation. Once I have identified market structure on a higher timeframe as I have in this daily chart, I find it helpful to zoom in on smaller time frames and check my indicators for signs that prove my theory as well as signs that disprove my theory as to keep an unbiased opinion, making for a better decision with my potential investment.

Step 1: Labeled in White

Let the chart tell the story, not your emotions! One thing I will often look for is bullish divergence on both the MACD (which my favorite is finding it on the histogram as this seems to be the most accurate to read imo) and the RSI. Other things I will look for is a cross or impending cross of the MACD line over the signal line on the MACD indicator as well as a cross of the signal line over the zero line on the histogram. If you notice on the chart I have labeled both of these for you with arrows pointing to the histogram as well as the MACD line crossing up giving a bullish signal to buy. You can also see the blue line indicating the bullish divergence that I drew on the MACD Histogram which are the green and red vertical bars also labeled on the and pointed out on the MACD indicator. Lastly the oversold RSI bouncing off of the 20 line. These are a few indications that the downtrend may be completed and that the declining channel may be breaking upward.

Here is a labeling of the MACD for further understanding of the indicator.

Step 2: Labeled In Yellow

Now lets get to the structure breakout. As you can see, I have clearly labeled the declining channel and placed an area of breakout shown with a green arrow pointing to it so you can easily identify the price action coming out of the channel. What you want to look for is exactly what is happening now with the current days price action popping out into the small channel that is labeled in green. This is a good buy area.

Step 3: Labeled in Green

Now you will need to set your target. First you will take your measuring tool out from the measurement tool section and measure the length of the top to the bottom of the channel. You can also just draw a line from the top to the bottom of the channel. After you do this, right click and make a clone of the measurement. Now, it is important to find the breakout of the channel and place the bottom of the clone where the price action breaks out. Since we already have price action in the breakout area you can place the measurement at that area.

Step 4: Labeled in Teal

Now it is time to find the best entry points for your trade. I generally enter with 50% of my allocated trade amount at first. My allocated amount is generally 3%-%5 of my overall holding amount in that account. I enter with half as sometimes you will see a false breakout that will come back in the channel and you are able to enter with a better position before the actual breakout. With this I like to add another buy box at the bottom of the channel just in case the price action gives me this opportunity. If a clear breakout and retest present itself I will enter the other 50% of my position.

Step 5: Labeled in Pink

Place your stop loss underneath the last swing low before the bullish breakout of the channel.

Market Update - BULLISH! - And how I trade levels in a downtrendIn this video:

* A quick review of the current market sentiment

* I am bullish!

* Everything is moving as expected

* I review and instruct on a more advanced trading technique/strategy - How to trade levels in a correcting or bearish market?

* You can make gainz by going long in a bear trend!

Happy New Year Traders!

Risk Management Basics | Retest Trading 💡

Hey traders,

Being breakout traders we have two options for trade entries:

when the breakout is confirmed we can either open a trading position aggressively once the candle closes above/below the structure or we can be conservative and wait for a retest of the broken structure first.

What is peculiar about the second option is the fact that the majority of pro traders prefer the retest entries. In this article, we will discuss the pros and cons of retest trading.

✔️First, let's discuss whether the retest is guaranteed. NO. How often do we see that? Around 50-55% of the time. Does it mean that 45-50% of breakout trades will be missed? YES.

The main disadvantage of retest trading is that a lot of trading opportunities will be missed. Occasionally the breakout triggers a strong market rally not letting the price return back to the broken structure.

So what is the point to wait for a retest then? Why let the market go without us in case if there is no retest?

✔️Most of the time the breakout candle closes quite far from a broken level. Opening the trading position once the candle closes and setting a stop loss below/above the broken structure, one can get a very big stop loss. Such a big stop that its pip value exceeds or equals the potential return.

🖼️In the picture, I drew a classic channel breakout trade.

The aggressive trader opened a long position as the candle closed above the channel's resistance.

His stop loss is lying below the lower low of the channel.

Analyzing his risk to reward ratio, we can see that his reward equals his risk.

On the right side is the position of the conservative trader.

His stop loss in lying on the same level.

However, instead of opening a trading position on a breakout candle, he decided to wait for a retest of the broken resistance of the channel. Just a slight adjustment of his entry-level gives him a completely different risk to reward ratio.

❗️Patience pays in trading. Missing some trades a retest trader will outperform the aggressive trader in the long run.

Trading is about weighting your potential gains & losses. Paying commissions and swaps for every trade, it is much better for us to trade less but pick the setups that give us a decent potential reward.

What type of trading do you prefer?

❤️Please, support this idea with like and comment!❤️

What you trade is just as important as how you trade!Hey Traders!

WOW! What a Monday! Excellent moves in the markets today at the US open, I don't want to sound like I am bragging, but we kinda prepared ourselves very well for today by working our asses off on creating our watchlist, we knew what could be moving and we made sure that they focused on the best setups, setups that had the highest rewards and the lowest risks!

Aside from a big miss on WTI, we aced EURUSD, NASDAQ, DAX and EURJPY.

Preparation of a watchlist is vital for us day traders and we make sure to invest time into creating our day trading watchlists!

This video explains a little better what we did to make today a BIG SUCCESS for ourselves and our members!

TRIPLE TOP PATTERN. Tips on how to trade it 📚

🟢The triple top is a very powerful reversal pattern. Visually, it represents three consecutive peaks approximately equal in height. Formally, it can be considered as a special case of the head and shoulders formation, whose head height is approximately equal to the shoulders. Moreover, the differences between them are purely academic, since, from a practical point of view, both of them indicate a change in the uptrend to a downtrend.

✅The pattern reflects three consecutive unsuccessful attempts to break through a certain resistance level. At the same time, each subsequent unsuccessful attempt indicates a weakening of the bulls and increases the likelihood of a future reversal.

❗️To correctly identify the pattern, the analyst should pay attention to the following conditions.

1️⃣The formation of a triple top should be preceded by a solid upward (bullish) trend, which should last at least a month, and preferably several months.

2️⃣Three consecutive tops must be clearly expressed and be approximately the same height. Through their maxima, the upper resistance level is built. The maxima should differ from each other by no more than 1-2%.

3️⃣ The lower support level is built through the minimum of the retracement after the first and second peaks depending on which of them will be lower.

4️⃣ As the triple top forms, there should be a gradual decline in trade volumes. At the same time, a local increase in trading volumes in the area of a top formation is considered acceptable. This is a confirmation of the gradual weakening of bull pressure on the market and a sign of an approaching trend reversal.

5️⃣ The triple top gives its final confirmation only after breaking through the lower support level after the formation of the third top. The breakout should be accompanied by a significant increase in trading volumes, and the appearance of price gaps on the chart is also desirable. After breaking through, the support level becomes the resistance level, in the area in which subsequent corrective price movements are possible.

6️⃣ To determine the goal of the price movement, it is necessary to measure the distance between the lower support level and the maximum point of the triple top. Then this distance should be projected from a broken support level to the downside.

7️⃣ The reliability of the patterns directly depends on the duration of the period during which it was formed. It should be at least several months.

⚠️In technical analysis, the triple top is one of the most difficult to recognize and "insidious" figures for an investor. Until the third top is formed, this figure looks like a classic double top. Also, three consecutive peaks of approximately equal height are characteristic of the ascending triangle and rectangle patterns, which are trend continuation formations. Thus, the final confirmation of the triple top is received only after a consequent breakout of the lower support level, which should be accompanied by a sharp increase in trading volumes.

Do you trade triple top?🤔

❤️ Please, support our work with like & comment! ❤️

WHY 95% OF TRADERS FAIL | Top 6 Mistakes to Avoid 🙅♂️🙅♀️

Hey traders,

That is the absolute fact:

95% of traders will fail.

Working with hundreds of struggling traders from different parts of the world, studying their trades & following their reasoning I found a lot of commonalities. In this post, we will discuss the top 6 mistakes to avoid to succeed in trading.

🤖 Rather than studying the market structure, rather than learning price action, many traders are looking for a "secret indicator". The one that will accurately indicate when to buy or sell the market.

Failing to find the one, they start looking for a set of indicators giving them magic profit formula. At some stage, they stop analyzing the chart at all. They become obsessed with the indicators.

Remember, naked chart analysis always goes first.

The indicator is the tool in your toolbox that is applied as one of the confirmations.

💫 The expectations & mindset play a very important role here as well.

Many people come in trading with a desire to become rich quick. To buy a subscription to some signal service promising them thousands of pips monthly and quite their 9:5 job.

Or to watch a couple of educational videos about trading and after a couple of days of practicing become a whale of Wallstreet making thousands of dollars with a single trade.

Such a mindset is completely wrong. Instead, you must realize that trading is extremely hard. It will take many years and a lot of blown trading accounts before you get how to trade properly.

Moreover, even once you mature, you won't make millions of dollars. Professional trading is simply about winning slightly more than you lose and then living on a margin.

📉 Poor risk management is the primary reason for blown trading accounts. And here I am not talking about some "advanced" risk management techniques.

Many traders simply trade with oversized lots.

Having high leverage & 1000$ deposit at hand the one can simply open a trading position with 1 standard lot and be kicked in by a spread.

Or they open a trading position without a stop loss. Being wrong in their predictions instead of closing a losing position they keep holding it. And while the market keeps going against them they pray the God for a market reversal. At some moment they get the margin call.

You must learn to calculate a lot size for all your trades. Instead of risking a huge portion of your trading account, learn to set a stop loss and risk no more than 1% of your deposit.

📝 Lastly, discipline plays a crucial role in your success in trading. Once you developed a trading strategy & backtested that you must learn to follow its rules no matter what. Usually, once traders catch a losing streak they start changing their rules, they start adjusting their trading strategy. Remember that losses are inevitable. The only correct way to stay afloat is to be consistent and don't break the rules.

Avoiding these common mistakes your chances to succeed in trading will increase dramatically. I wish you be among 5% of traders who made it.

Did you make these mistakes?

❤️Please, support this idea with like and comment!❤️