HSBC

HSBC Pushing Upwards...HSBC is the best bank stock to buy and hold right now. Note the hold element in that statement. Take security in the support level mapped out @ 20.50. This is very likely to hold, but we could be in for some consolidation here. It's very likely that HSBC will hit the target in the 'entry price'. From there, we have two scenarios.

One is that it lifts off from that target due to the local support within the range charted. If this happens, then we can expect HSB to hit our target with very little effort.

The second scenario is that it consolidates and goes slightly below our entry, before potentially falling through/holding that level and sitting tight for a week or two. We need sufficient volume in this situation and we should be looking to get a safe entry at all costs. Whilst the volatility is residing, we can take a technical outlook and chart onwards from there. For now, however, I think the idea presented works perfectly in conjunction with what the chart says to us here. I would expect this target to be hit by the 1st June at the latest, but as early as next Tuesday.

HSBC Holdings is near the Mirror Level!The price bounced several times from Mirror Level 39.72.

This is a good example of how to use levels for making money.

Dear followers, the best "Thank you" will be your likes and comments!

Before to trade my ideas make your own analysis.

Thanks for your support!

HSBC Bank and RBS Groups on Launching New Digital Banking PlatfoRecently, British banking big names HSBC and RBS indicated they have launched new digital banking platforms.

The launch happened after a competition for digitally savvy customers steps up in the face of a wave of online startups.

Last Monday, HSBC has also rolled out a new app-based business banking service. This service was previously known as “Project Iceberg.”

Currently, it is now labeled as “HSBC Kinetic.”

Meanwhile, RBS is placing the finishing touches to its latest digital bank called Bo ahead of a public roll-out later this month.

Moreover, Bo has already arranged a public launch this month from offices in London’s West End.

The Bo app is to urge customers to have a financial plan and save better. This plan will also alert if you have made some overspending.

There is a target of 16.8 million Britons with less than 100 pounds ($128) of savings.

Prospects of Leaner Banking Platform

HSBA trending downwards, currently holding supportJust throwing some lines on HSBC (HSBA) .

We have a broadening channel, higher highs and lower lows on a 20 year timeframe.

Currently in a downward trend on the monthly, just about holding historical support.

This would probably be a good place to exit if we are expecting a market downturn.

"These formations are relatively rare during normal market conditions over the long-term" - Investopedia

HSBC Bullish For Stock Market ReboundHSBC is trading this month in congruence with the current global stock market pullback by offering a time-relative discount in share prices.

HSBC target $43 for a 5.4% difference from the current quote of $40.78. The S&P 500 is off 7.5% from doubly tested but not yet broken all time highs which renders this parallel HSBC trade idea as conservative and defensive. The duration for this trade is 1-3 months.

HSBC Bounced Off Support, Potential Further Rise!HSBC bounced off its support at 36.98 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support) where it could potentially rise to its resistance at 46.16 (50% Fibonacci retracement, horizontal pullback resistance).

Stochastic (89, 5, 3) has bounced off its support at 2.4% where a corresponding rise could occur.

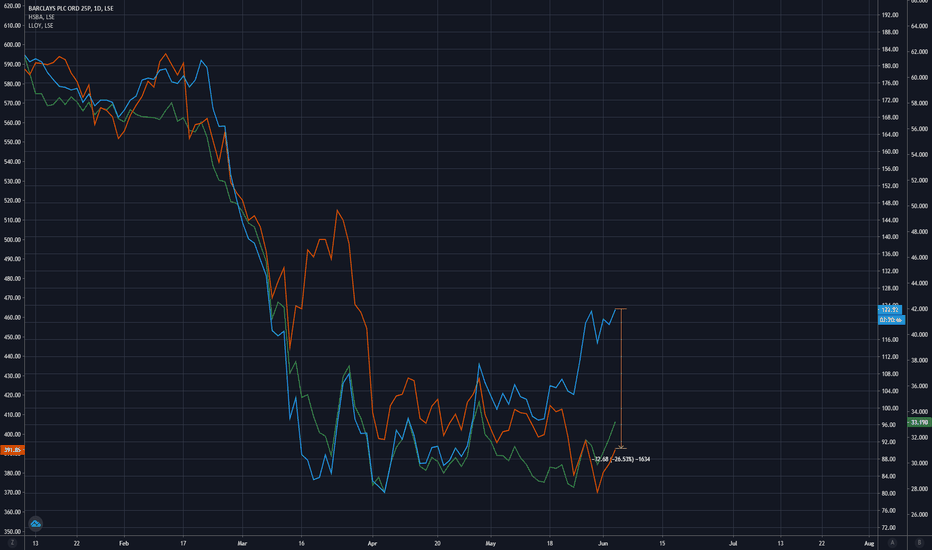

UK banks outperform FTSE 100 before stress test resultsUK banks outperformed the benchmark for UK shares during the rout in global stock markets that began in October. UK bank share prices are down over the past two months, but by less than the FTSE 100 index.

Positive expectations for stress test results have played a role in limiting the damage to UK bank shares.

$HSBC | Multi-Year Consolidation | Targeting Near 10-Year LowHello Traders,

HSBC has been in a large consolidation since the Financial Crisis of 2008. Based on my model, this is still 60% probability that 25.21 will be hit before this Multi-Year Consolidation is over. There have been two sell signals both pointing to the same target of 25.21 from my model, therefore, this chart is worthy of a share.