Hvf

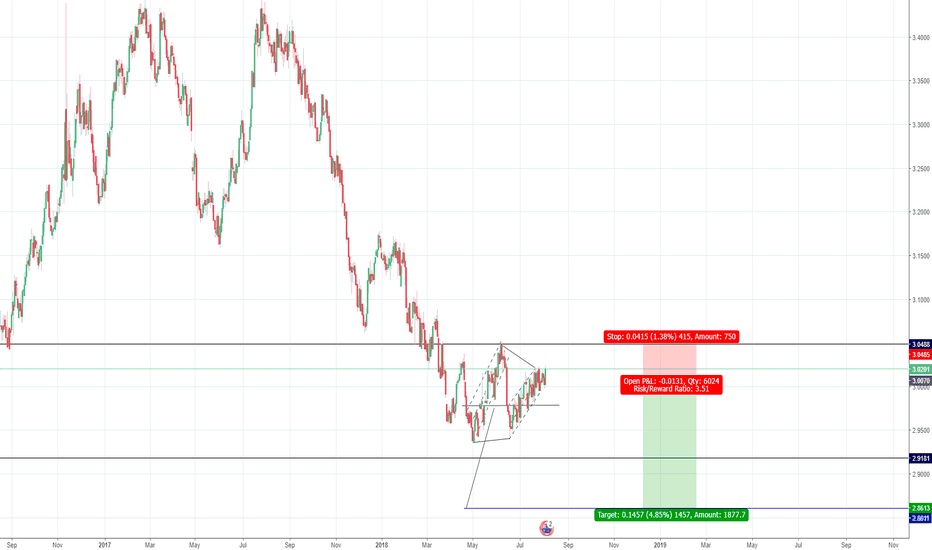

XMRUSD - INV HVF - BEARXMRUSD - INV HVF - BEAR

- Set up orders this morning, back to check on it and target almost met

- Closed trade 80/90% at target, mainly due to second big dip on only small volume (15min time frame)

- Will watch to see if target is made

Looking for indicators/methods/strategies for better predicting breakouts, want to increase the quality of the setups i trade, if anybody has any suggestions please leave a comment =P

BTCUSD BTCUSD

- BTCUSD broke down in a failed setup, buy orders were not triggered

- Had a small hedge short that was triggered when structure was invalidated but sold at 7k

- BTCUSD could now trade within the range of a previous funnel

- hopefully will lead to another setup with a probable bear bias

All in all, reiterates to me the importance of getting into trades using pre set orders as last few setups have gone against me but no money lost because of it.

The hedge against BTC on the other hand, was more of a gamble on that if the setup failed 7k would be a likely target.