IBM Stock Forecast and Technical OutlookIBM Stock Forecast and Technical Outlook.

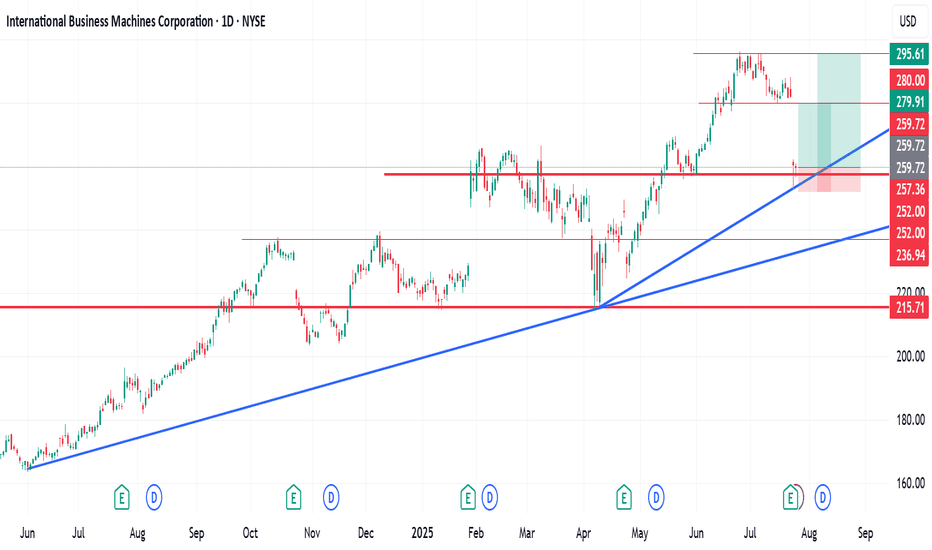

International Business Machines Corporation (IBM) reached a recent peak in June 2025 before experiencing a gradual decline. On July 24th, the stock saw a significant drop of over 10%, likely triggered by investor reaction to recent company news or broader market sentiment.

Despite this sharp decline, technical indicators on my chart suggest the potential for a short- to medium-term recovery. Based on my analysis, there are two potential setups with favourable Risk-to-Reward (R:R) ratios:

Scenario 1: R:R of 1:2.63

Scenario 2: R:R of 1:4.65

I bought some shares at $260.17

These figures indicate that for every unit of risk taken, there is a potential return of 2.63x or 4.65x, respectively, depending on the chosen entry and exit strategy.

As always, investors are advised to conduct their due diligence and apply proper risk management techniques before entering any position.

Hey friends, if this is helpful, kindly like, follow, subscribe, share and comment

IBM

Looking like an immediate buy on IBM! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

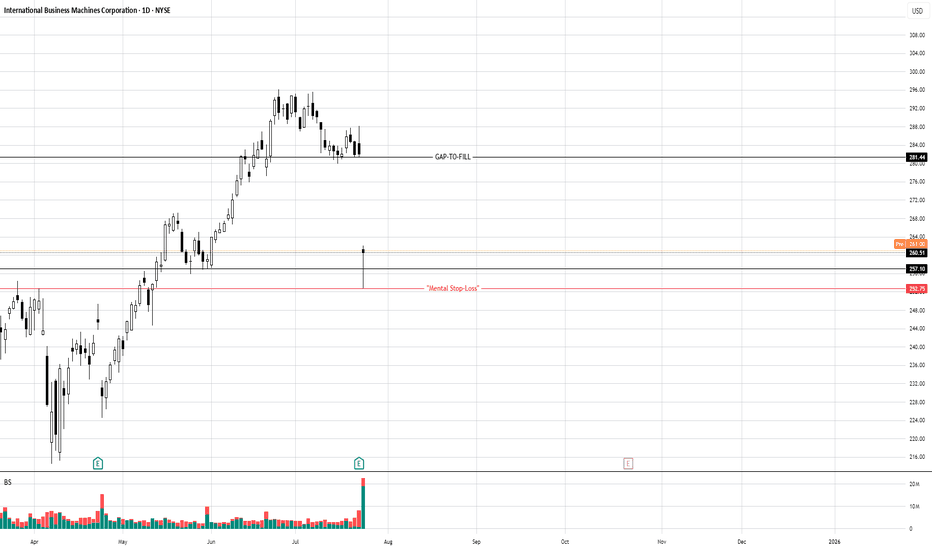

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DVLT falling wedge, TP $1+DVLT a relatively new ticker is already drawing a lot of attention. Up 13% today after hitting new all time low yesterday, sure to catch a lot of eyes from retail investors. With recent news releases such as a licensing agreement with IBM, a lawsuit against naked short selling, and US patent allowances, target prices have been announced ranging from $3 to $11/share.

Disclaimer, this ticker is PRONE TO HEAVY DILUTION, however in order to remain listed on NASDAQ the SP will have to hit $1 and remain there. This being the case, the company must have something in the books to break upward out of this falling wedge and give shareholders a reason to stay with the company long term.

I'm just a cat not a financial advisor.

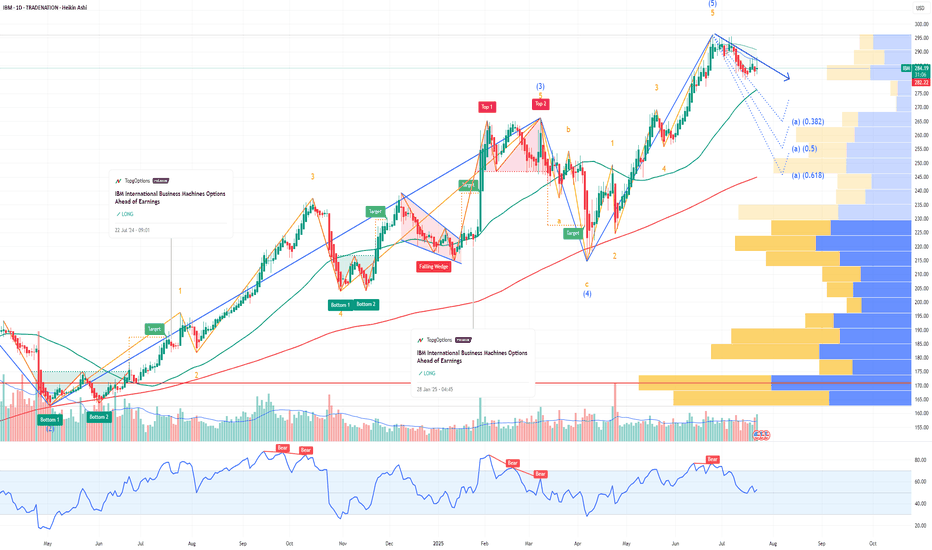

IBM: Still BullishAfter the increases over the recent weeks, we still place IBM within the magenta wave (3) and expect a bit more bullish headroom in the short term. However, in our medium-term alternative scenario, we would see a larger pullback with the green wave alt. . Such a detour is considered 30% likely and would be confirmed by a drop below the support at $260.48.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

IBM: Bullish AttemptsIBM has made progress in our scenario: Currently, the price is rising above the crucial resistance at $265.72; clearly surpassing this mark is important in the ongoing wave (3) in magenta. While we cannot entirely remove our alternative scenario with a new low for wave alt. in green, it still holds a 33% probability. We primarily expect that the regular wave in green was already completed at $211.52 and are therefore preparing for a direct continuation of the increases in the broader wave in green.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Breaking: International Business Machine (NYSE: $IBM) Tanks 6% International Business Machine Corporation, (NYSE: NYSE:IBM ) together with its subsidiaries, provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally Plummets 6% in early premarket trading on Thursday albeit reporting better-than-expected earnings and revenue for the first quarter on Wednesday.

Earnings Overview

a. Earnings per share: $1.60 adjusted vs. $1.40 expected

b. Revenue: $14.54 billion vs. $14.4 billion expected

Revenue increased 0.6% in the quarter from $14.5 billion a year earlier, according to a statement. Net income slid to $1.06 billion, or $1.12 per share, from $1.61 billion, or $1.72 per share, in the same quarter a year ago.

For 2025, IBM reiterated its expectation for $13.5 billion in free cash flow and at least 5% revenue growth at constant currency. At current exchange rates, currency will provide 150 basis points of benefit for 2025 growth, down from the company’s forecast of 200 basis points in January.

IBM has been an outperformer this year as the broader market has sold off due largely to concerns around President Donald Trump’s tariffs and their potential impact on the economy. As of Wednesday’s close, IBM shares were up 11%, while the Nasdaq was down almost 14%.

The stock slipped 6% in extended trading on Wednesday, extending the loss to Thursday's premarket session. NYSE:IBM shares need to break pass the $266 resistant to negate any bearish barriers. Failure to break pass this level could resort to consolidatory move to the $216 support point.

IBM Share Price Falls Following Earnings ReportIBM Share Price Falls Following Earnings Report

Yesterday, after the close of the main trading session, International Business Machines (IBM) released its Q1 earnings report, exceeding Wall Street analysts’ expectations in several key areas. According to FactSet:

→ Earnings per share came in at $1.60 (forecast = $1.42), although this was below last year’s figure of $1.68.

→ Quarterly revenue reached $14.54 billion (forecast = $14.39 billion), marking a 1% increase year-on-year.

Initially, IBM shares rose on the news, but then dropped by approximately 6% during after-hours trading, according to Google Finance.

This suggests that today’s trading session may see IBM shares open below the $230 mark.

Market participants may have been disappointed by the following:

→ IBM’s mainframe business (large-scale computing systems designed for high-volume data processing) continued its decline, falling by 6% year-on-year.

→ Revenue from software and consulting divisions increased, but only by 3% compared to the same period last year.

→ The revenue forecast for Q2 stands at $6.6 billion – a 3% decline relative to the same quarter in 2024.

Technical Analysis of IBM Share Price

The chart shows signs of seller activity above the psychological level of $250. As indicated by the arrows, the price attempted several rallies above this level with varying momentum, but each time retreated back.

At the same time, price fluctuations formed a downward channel, which was extended to the downside in early April amid news regarding new tariffs in international trade.

Price stabilisation observed between 15–17 April suggests that supply and demand were temporarily balanced ahead of the earnings release. However, the negative market reaction to the report may shift sentiment and act as a catalyst for further price movement towards the lower boundary of the channel, around the key support level of $215.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

IBM Earnings PlayTechnical Analysis NYSE:IBM

On the 4-hour chart, IBM’s stock price is currently trading at approximately $260.50. Applying Bollinger Bands, the price is hovering near the 20-period moving average, with the bands moderately contracted, indicating relatively low volatility. The stock has shown resilience above the lower Bollinger Band, suggesting potential for an upward move if bullish momentum builds post-earnings. A recent green candle indicates buying interest, but the stock remains below the upper band, which sits near $270.00, signaling room for upside if catalysts align.

Target

Wait for bullish confirmation post-earnings.

Entry LONG : Around $262.00, Targeting $270.00.

Secondary Target: $275.00.

Resistance Levels: $265.00, $270.00, $275.00.

Support Levels: $255.00, $250.00, $245.00.

The price is testing the 20-period moving average, and a strong earnings report—particularly with positive AI or cloud revenue updates—could push the stock toward the upper Bollinger Band at $270.00 or higher. Conversely, a disappointing earnings report or weak guidance could see the price drop toward $255.00 or lower, especially if broader market conditions weaken.

QuantSignals

Best AI news analysis and signals

IBM - Move Up to Trend LineTrend Line in green shows a place where price likes to move along

Right now price is under this line, and looking to move back up towards the line for another test

The smaller structure to the left is very similar to the one we are experiencing now hence why I have made this comparison with the bars pattern tool

Bullish up towards the Green solid line on this Weekly timeframe

$QTUM Maybe Trying to break out of This Wedge (VCP)I have been long this name for a few months now in my investment account. I have added more today with a stop on the added position size just below today’s low. There are some very big names in this ETF, it invests in AI learning as well as Quantum Computing.

It looks to me to be in a Volatility Contraction Pattern (VCP), more popularly called a wedging pattern. I went long more shares as indicated above in anticipation of a break above the declining upper trendline. It also is supported by both the 8 and 20 EMAs and has consolidated to get more inline with the 50 DMA (red).

If you like it, make the trade your own and make sure it fits your trading plan.

Look at the fund holdings in “More About Fund” link supplied by TradingView. Here are some of the names you might recognize: NASDAQ:KLAC NYSE:IBM NASDAQ:PLTR NYSE:RTX NYSE:BABA

From Defiance ETF Website:

QTUM

Index Description: The BlueStar® Machine Learning and Quantum Computing Index (BQTUM) tracks liquid companies in the global quantum computing and machine learning industries, including products and services related to quantum computing or machine learning, such as the development or use of quantum computers or computing chips, superconducting materials, applications built on quantum computers, embedded artificial intelligence chips, or software specializing in the perception, collection, visualization, or management of big data.

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 230usd strike price Calls with

an expiration date of 2025-1-31,

for a premium of approximately $5.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

IBM: Attention! First signs of the end of the retracement!International Business Machines, abbreviated IBM and nicknamed "Blue Green", the large multinational computer technology and consulting corporation based in Armonk, New York, has a CLEARLY BULLISH technical aspect in its main time frames.

During 2024 it accumulated a rise of almost 50% when it reached the 239 area on December 9. Since then the price took a break and began a retracement phase that took it to the 215 area (61.8% Fibonacci).

--> What situation is it in now?

If we look at the chart, last Friday the price showed us the first 2 bullish warnings (Bull), indicating that the END of the retracement could be very close!!

--> What areas do we have to watch?

An upward break of the 227 area would indicate the END OF THE REVERSE and therefore, a new attack on its historical highs. But if the price loses the 214, it could easily take it towards the 204 area.

--> Is there any risk nearby?

Yes. Wednesday 29th presents results and if there are negative surprises, the price could fall strongly towards the 204 area, putting its medium-long term bullish trend at risk.

If our profile is CONSERVATIVE I would stay out of the value until the results are published, but if we have an AGGRESSIVE profile, we could follow the following strategy.

--------------------------------------

Strategy to follow:

ENTRY: We will open 2 long positions if the H4 candle closes above 227

POSITION 1 (TP1): We close the first position in the 238 area (+4.8%)

--> Stop Loss at 214 (-5.7%).

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-5.7%) (coinciding with the 214 of position 1).

---We modify the dynamic Stop Loss to (-1%) when the price reaches TP1 (238).

-------------------------------------------

SET UP EXPLANATIONS

*** How do we know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the dynamic Stop Loss.

-->Example: If the dynamic Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% in the rises, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very solid and stable price trends can be taken advantage of, maximizing profits.

VAiOT (iBM) $0.012 Think Siri Alexa for Business Enterpriseunder loved under rated ahead of its time

vaiot.ai

size your entries in the next 100days DCA

requirement discipline and time

price can pump to 5x to 10x and shake you down back to previous cost of handler and youll be shaken out

use dead capital or dormant account in metamask or future listed exchanges

good luck and see you come 2024/25 for retirement at Unicorn levels

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 250usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Is IBM's retreat from China a strategic gamble or a harbinger ofIBM's recent strategic decision to shutter its research and development center in China has sent ripples through the global tech industry. This move, coupled with the exodus of other American tech giants, has ignited a heated debate about the forces shaping the future of business in the world's second-largest economy.

Is IBM's retreat a calculated response to changing market dynamics, or is it a canary in the coal mine, signaling a broader shift in the geopolitical landscape? As we delve deeper into the intricacies of this decision, a complex picture emerges, one that challenges our understanding of the delicate interplay between business, politics, and economics.

IBM's withdrawal from China is not merely a corporate decision but a reflection of the evolving tensions between the world's two superpowers. The escalating trade wars, regulatory hurdles, and geopolitical uncertainties have created a challenging environment for foreign businesses, forcing them to reassess their strategies.

However, IBM's decision is also a strategic one, driven by factors such as cost optimization and a desire to focus on core competencies. By relocating its operations to regions with lower labor costs, IBM can enhance its profitability and allocate resources more efficiently.

As we navigate the complexities of this situation, it's imperative to recognize that IBM's retreat is not an isolated incident. It is a symptom of a broader trend, a reflection of the challenges faced by foreign companies operating in China. The economic slowdown, increased nationalism, and regulatory uncertainty have created a perfect storm that is forcing businesses to rethink their China strategies.

The future of business in China remains uncertain. IBM's decision is a stark reminder of the delicate balance between economic opportunities and geopolitical risks. As the world continues to evolve, it is essential for businesses to remain agile, adaptable, and prepared to navigate the challenges and seize the opportunities that lie ahead.

IBM reaches all-time highs amid strategic shiftsIBM captured significant attention in August 2024, driven by pivotal developments that underscore the company’s strategic realignment and technological innovation. The decision to close its research and development centre in China, which will impact over 1,000 employees, is part of a broader global restructuring aimed at sharpening its focus on burgeoning sectors like artificial intelligence (AI) and cloud technology. This move reflects IBM's commitment to consolidating its resources towards high-growth areas.

Adding to the momentum, IBM's presentation at the Hot Chips 2024 conference showcased its latest advancements in processor technology. The introduction of the Telum II processor and Spyre gas pedal marks a significant leap in computing power and energy efficiency, particularly for AI tasks, which are becoming increasingly crucial across industries.

These initiatives indicate IBM's ongoing efforts to fortify its leadership in AI and cloud technologies, signalling a future solid trajectory despite the reductions in other operational areas.

Technical analysis of International Business Machines Corp. (NYSE: IBM)

Exploring potential trading opportunities based on the current technical indicators of IBM's stock:

Timeframe : Hourly (H1)

Current Trend : the daily trend is upward, with the hourly chart showing a correction phase following extended growth

Short-term Target : immediate resistance is at 194.50 USD, which is the current target of the correction phase

Medium-term Target : a break above the resistance at 199.00 USD could pave the way for a rise to 210.00 USD

Key Support : positioned at 194.50 USD

Reversal Scenario : a break below key support at 194.50 USD could negate the bullish outlook, potentially leading to a decline towards 193.50 USD

IBM's shares are experiencing robust growth, hitting all-time highs. The stock's trajectory suggests that with the continuation of a favourable economic environment, there is potential to breach the 210.00 USD mark and achieve further gains. Investors and traders should monitor these levels closely as IBM continues to navigate strategic transitions and capitalise on its technological advancements.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65.68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IBM International Business Machines Options Ahead of EarningsIf you haven`t sold IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $7.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.