IBM Stock Forecast and Technical OutlookIBM Stock Forecast and Technical Outlook.

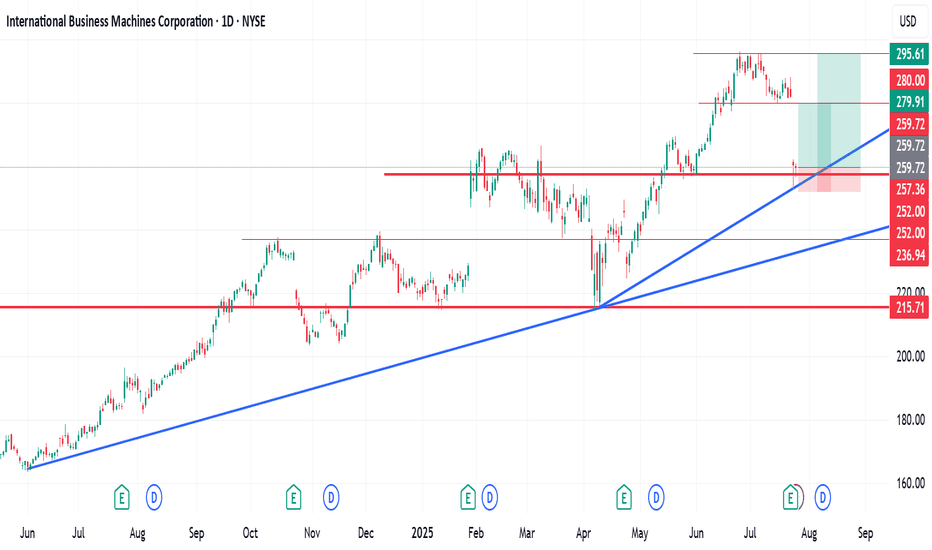

International Business Machines Corporation (IBM) reached a recent peak in June 2025 before experiencing a gradual decline. On July 24th, the stock saw a significant drop of over 10%, likely triggered by investor reaction to recent company news or broader market sentiment.

Despite this sharp decline, technical indicators on my chart suggest the potential for a short- to medium-term recovery. Based on my analysis, there are two potential setups with favourable Risk-to-Reward (R:R) ratios:

Scenario 1: R:R of 1:2.63

Scenario 2: R:R of 1:4.65

I bought some shares at $260.17

These figures indicate that for every unit of risk taken, there is a potential return of 2.63x or 4.65x, respectively, depending on the chosen entry and exit strategy.

As always, investors are advised to conduct their due diligence and apply proper risk management techniques before entering any position.

Hey friends, if this is helpful, kindly like, follow, subscribe, share and comment

Ibmlong

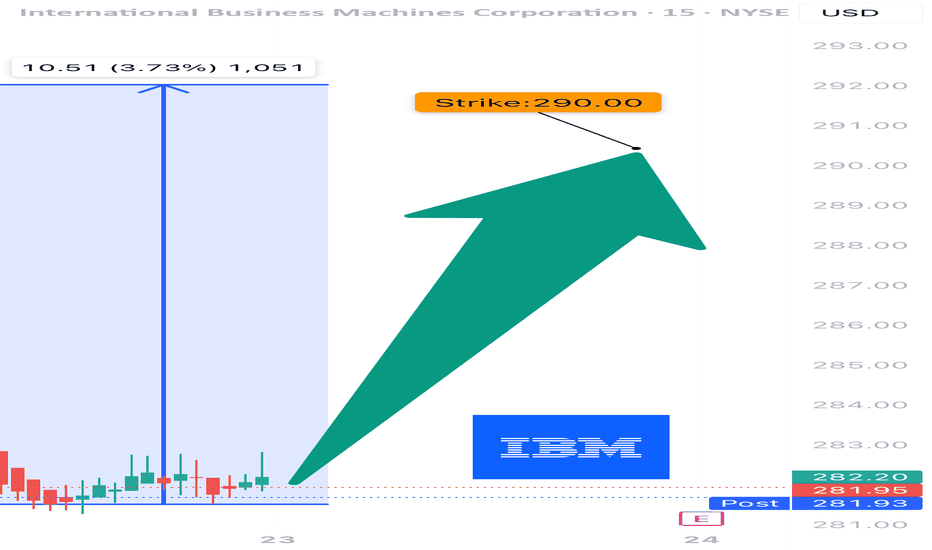

IBM Earnings Trade Setup – JULY 22, 2025

📡 IBM Earnings Trade Setup – JULY 22, 2025

💼 IBM: Big Blue’s Rebound or Breakdown? Earnings Play Incoming

⸻

🔍 1. FUNDAMENTALS SNAPSHOT

📊 Revenue Growth: +0.5% YoY — flat in a fast-moving tech landscape

💰 Margins:

• Gross: 57.0%

• Operating: 12.4%

• Net: 8.7%

⚠️ Debt-to-Equity: 247.98 – Very high

🎯 EPS Beat Rate: 8/8 (Avg +3–5%)

📉 Analyst Sentiment: Mixed → PT = $273.36 < Current ($284.71)

🧠 Fundamental Score: 7/10 – Steady but slow

⸻

💣 2. OPTIONS FLOW SNAPSHOT

📍 Key Strikes:

• $280 Puts

• $310 Calls → Divergent sentiment

📉 IV: Moderate → ~5% expected move

📊 VIX: 16.65 → Favorable macro backdrop

🧷 Gamma Positioning: Volatility expected post-earnings

📟 Options Flow Score: 6/10 – Neutral bias, light commitment

⸻

⚙️ 3. TECHNICAL SETUP

📉 RSI: 33.17 → Oversold zone

📍 Support: $281.25 📍 Resistance: $287.96 (20MA)

📊 Volume: 0.84x average – Low conviction

📈 Technical Score: 6/10 – Setup for rebound, but watch for follow-through

⸻

🌐 4. MACRO & INDUSTRY CONTEXT

🚀 Tailwinds: Hybrid cloud & AI transition → long-term catalyst

⚖️ Risks: High rates + weak enterprise spend = potential margin drag

🌐 Low VIX = Calm backdrop, but high post-earnings reactivity

🌍 Macro Score: 8/10

⸻

🎯 DIRECTIONAL CALL

🟡 Moderately Bullish – 70% Confidence

→ Conservative management, solid margins, oversold technicals… but revenue flat and sentiment split

⸻

🛠️ TRADE IDEA

🔹 BUY $290 Call exp. 07/25 @ $6.00

🎯 Target: $12.00+ (→ stock > $296)

⚠️ Stop Loss: $3.00

📅 Entry: Before Earnings Close (Jul 23, AMC)

💰 Risk/Reward: 1:2 (100% risk, up to 200% reward)

⸻

🔐 RISK PLAN

💼 Max Risk = 2% Portfolio → 2 contracts (for $100k acct)

📉 Exit if down 50%

⏱️ Time Stop: Exit by 10AM EST post-earnings if flat

⸻

🧬 TRADE DETAILS (JSON Format)

{

"instrument": "IBM",

"direction": "call",

"strike": 290.0,

"expiry": "2025-07-25",

"confidence": 70,

"profit_target": 12.00,

"stop_loss": 3.00,

"size": 2,

"entry_price": 6.00,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-07-23",

"earnings_time": "AMC",

"expected_move": 5.0,

"iv_rank": 0.50,

"signal_publish_time": "2025-07-22 14:58:35 UTC-04:00"

}

⸻

#IBM #EarningsPlay #OptionsFlow #TechStocks #HybridCloud #CallOptions #VolatilitySetup #TradingView

Breaking: International Business Machine (NYSE: $IBM) Tanks 6% International Business Machine Corporation, (NYSE: NYSE:IBM ) together with its subsidiaries, provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally Plummets 6% in early premarket trading on Thursday albeit reporting better-than-expected earnings and revenue for the first quarter on Wednesday.

Earnings Overview

a. Earnings per share: $1.60 adjusted vs. $1.40 expected

b. Revenue: $14.54 billion vs. $14.4 billion expected

Revenue increased 0.6% in the quarter from $14.5 billion a year earlier, according to a statement. Net income slid to $1.06 billion, or $1.12 per share, from $1.61 billion, or $1.72 per share, in the same quarter a year ago.

For 2025, IBM reiterated its expectation for $13.5 billion in free cash flow and at least 5% revenue growth at constant currency. At current exchange rates, currency will provide 150 basis points of benefit for 2025 growth, down from the company’s forecast of 200 basis points in January.

IBM has been an outperformer this year as the broader market has sold off due largely to concerns around President Donald Trump’s tariffs and their potential impact on the economy. As of Wednesday’s close, IBM shares were up 11%, while the Nasdaq was down almost 14%.

The stock slipped 6% in extended trading on Wednesday, extending the loss to Thursday's premarket session. NYSE:IBM shares need to break pass the $266 resistant to negate any bearish barriers. Failure to break pass this level could resort to consolidatory move to the $216 support point.

IBM - Move Up to Trend LineTrend Line in green shows a place where price likes to move along

Right now price is under this line, and looking to move back up towards the line for another test

The smaller structure to the left is very similar to the one we are experiencing now hence why I have made this comparison with the bars pattern tool

Bullish up towards the Green solid line on this Weekly timeframe

IBM - The Forgotten StockHello Traders, welcome to today's analysis of International Business Machines.

--------

Explanation of my video analysis:

All the way back in 2012 IBM created a major top formation by breaking below strong support at $180 and we saw a significant decline in stock price from there. After we then saw a reversal and a breakout in 2022, IBM is certainly back to a bullish market. I am now waiting for a retest of the breakout level mentioned in the analysis to then look for long continuation setups.

--------

I will only take a trade if all the rules of my strategy are satisfied.

Let me know in the comment section below if you have any questions.

Keep your long term vision.

BM Unveils) Ground-breaking AI Chip: North PoleThe team is already several years into developing the next iteration of the potentially revolutionary NorthPole chip.

NorthPole achieves an astounding 25 times higher energy efficiency metric and boasts 22 times lower latency metrics compared to relevant benchmarks.

This implies the potential for post-GPU performance at significantly reduced energy costs.

Researchers have described NorthPole’s energy efficiency as “mind-blowing,” as reported in Nature

IBM: Navigating the Cloud and AI Era for Smart InvestmentsIBM: Navigating the Cloud and AI Era for Smart Investments

When Arvind Krishna assumed the role of CEO at IBM in 2020, he embarked on a transformation journey for the iconic tech giant, steering its focus towards cloud computing and artificial intelligence (AI). As this transformation reached its fruition, the rejuvenated IBM experienced a notable surge in its share price on September 20, following an "outperform" rating bestowed upon it by Matthew Swanson, an analyst at investment bank RBC Capital.

A Strategic Pivot for the Future

Considering the company's strategic pivot towards the thriving domains of cloud computing and AI, alongside the recent endorsement with an "outperform" rating, the question arises: Is investing in Big Blue a logical choice? Several compelling factors support the notion of acquiring IBM shares. However, it's worth noting that IBM's stock price has experienced an upward trajectory in recent months, currently hovering close to its 52-week high.

Warren Buffett's Wisdom

As the venerable Wall Street figure Warren Buffett has articulated, "For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments." With this sage advice in mind, let's delve deeper into the company to assess whether IBM constitutes a prudent and promising long-term investment.

Dominating Cloud and AI

IBM stands out as an enticing investment option primarily due to its unwavering focus on two dynamic domains: cloud computing and artificial intelligence (AI). The company has honed its specialization in the hybrid cloud market, catering to clients seeking a blend of dedicated IT infrastructure for heightened privacy and shared infrastructure for cost efficiencies.

Within the cloud computing landscape, IBM ranks among the top six companies in terms of market share, positioning itself advantageously to harness the robust growth of the hybrid cloud sector. In 2021, this market was valued at $85 billion, and experts predict it will surge to an impressive $262 billion by 2027.

IBM's extensive experience spanning decades has propelled it to the forefront of the AI arena. Notably, IBM made history in 1997 when its AI technology defeated the reigning world chess champion. The company's latest AI offering, Watsonx, which was launched in July, has rapidly found favor with over 150 businesses, including prestigious institutions like NASA. Watsonx even played a pivotal role at Wimbledon by generating tennis commentary.

Quantum Leap in Technology

Moreover, IBM is actively involved in the development of quantum computers, which hold the key to unlocking more powerful iterations of AI. Quantum computers possess the ability to process vast volumes of data at unprecedented speeds, and IBM holds a prominent position as a leader in the burgeoning field of quantum computing.

Revenue Growth and Resilience

IBM's strategic technologies have propelled the company's revenue growth over the past three years, showcasing its resilience and adaptability. In the second quarter, which concluded at the end of June, the Red Hat division, the core of its cloud computing business, experienced an impressive 11% revenue surge. Simultaneously, the data and AI segment recorded a commendable 10% increase. Both segments fall under IBM's software business unit, which contributed significantly with $6.6 billion in Q2 revenue.

Strong Free Cash Flow and Dividend Track Record

IBM's prowess in technology adoption among its clientele also fuels revenue expansion in its consulting division, which aids clients in integrating the company's technical solutions. This segment achieved a 4% increase in Q2 sales, reaching $5 billion. Collectively, IBM's software and consulting divisions accounted for a substantial 75% of the Q2 revenue totaling $15.5 billion.

Furthermore, IBM boasts the capacity to generate dependable free cash flow (FCF), a crucial metric representing cash available for business investments, debt servicing, and dividend disbursements. By the close of Q2, the company had accumulated $2.1 billion in FCF and anticipates reaching $10.5 billion for the year, marking a substantial increase from the previous year.

IBM's robust FCF empowers it to maintain an attractive dividend yield, currently exceeding 4%. Impressively, IBM has consistently paid dividends since 1916, boasting 28 consecutive years of dividend increases.

Assessing the Share Price

Notably, while IBM has seen growth in its software and consulting divisions, its Q2 revenue of $15.5 billion experienced a marginal 0.4% decline compared to the preceding year's quarter. This dip was primarily attributed to a reduction in sales within its infrastructure segment, responsible for hardware sales like computer servers.

However, IBM anticipates year-over-year revenue growth of at least 3% in 2023, adjusting for currency fluctuations. In fact, when currency fluctuations are accounted for, Q2 year-over-year revenue exhibited a 0.4% increase.

Yet, investors may scrutinize IBM's share price, which currently hovers near its 52-week high. Nevertheless, RBC Capital analyst Matthew Swanson has set an optimistic price target of $188, marking a 30% increase from the current price.

Conclusion

To gauge IBM's potential, let's consider its forward price-to-earnings ratio (P/E), factoring in consensus price estimates from various analysts. In comparison to cloud competitors Microsoft and Oracle, IBM holds the lowest forward P/E, potentially indicating that its stock is undervalued relative to its peers.

However, it's worth noting that the average price target from analysts currently stands at $147 for IBM shares, aligning closely with the stock's current valuation. Therefore, substantial appreciation in IBM's stock price at its current level seems unlikely.

Nonetheless, IBM's high-yield dividend offers the prospect of consistent passive income over the years. With its strong foothold in the cloud computing and AI markets, coupled with robust FCF generation, IBM presents itself as an appealing long-term income stock.

Our preference

Above 132.00, look for 146.00 and 150.00

$IBM reached previous ATH from 2013I frankly forgot IBM still exist. Last month it slightly broke the ATH from March and April 2013. Yes, it can take 9 years to get rid of your bags. So, trade carefully and have your stop losses or exit plan in place. It's been in this massive channel on monthly for 9 years. Perhaps time to breakout? Earnings sent the stock slightly lower, but I'll keep my eye on it.

IBM Chart Forcast -- Bull From current Chan chart of IBM, we can tell, there is possible uptrend spike towards $145 -- previous high. Do leave comment if you have any idea about it's earning or financial information update. I am just reading from chart structure at this time. Overall, IBM is in a bull trend (short-mid-long term ) . If this time, it stand above $145, expecting next (2nd) price level @ 175 and 3rd price target @ $200.

IBM earnings todayIBM expected to report its Q4 earnings of $3.39 per share, a 60% YoY growth, from $2.07 per share seen in the same period a year ago.

Taking into consideration also the 14K Calls and less than 1K Puts from last Friday, i think that $136 should be the price target.

looking forward to read your opinion about it.

IBM: Inverse Head and Shoulders Opportunity?IBM - Intraday - We look to Buy at 125.98 (stop at 122.20)

A bullish reverse Head and Shoulders has formed. The formation has a measured move target of 134.63. Closed above the 50-day MA. The stock is currently outperforming in its sector. Further upside is expected and we look to set longs in early trade.

Our profit targets will be 134.53 and 138.15

Resistance: 130.00 / 138.00 / 145.00

Support: 125.00 / 120.00 / 115.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

IBM IS SET TO ROCKET?IBM is set to rocket if it can break $140 in 2022.

Create a massive green leg, still is looking pretty long.

Fundamentally they have done the work to focus strictly on cloud business which is expected to grow year over year.

Daily MACD continue green yesterday . Shares to borrow and short has dried up.

Moving in a triangle strenght to 140$, then looking for small retracement and then we will waiting for triangle breakout and conirmation for 150$ and more.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

IBM Idea - Restoring TrendlineCurrently price is sitting just under a major trendline that can be drawn

Similarities can be drawn between a dip in the early movement of IBM and one that has occurred recently

Post this dip, the price rose and retook the trendline

I expect this to be the case again

Weekly Chart

IBM 1M The history of the corporation is worthy of respectInternational Business Machines Corporation is an American electronic corporation, one of the world's largest manufacturers of all types of computers and software, one of the largest providers of global information networks.

IBM owns more patents than any other technology company.

The story begins in the 19th century.

If you have been following us for a long time, you should notice that we decided to make a portfolio of ideas from assets in the stock market for the long term.

And of course, it would have been blasphemy if we hadn't written a review of such a powerful company as IBM.

The corporation has been actively developing for more than a century, making our life easier and better by introducing new technologies into it.

Looking at the chart, you can name one dark period in their history - this is the beginning of the 90s, when the price of IBM shares fell to a critical $10.

In the early 1990s, the mainframe market crisis began, which peaked in 1993. And you guessed it - the main developer of mainframes was the IBM corporation. In 1993 Many analysts talking about the complete extinction of mainframes just now, and about the transition from centralized information processing to distributed (although the last mainframe was turned off in 2013).

In 1993, IBM posted a $8bn loss - the largest in American corporate history at the time - and it was time for drastic action.

New gene. director Luis Gerstner decides to cut 20% of its employees, which is 60,000 people. It was the largest cut in American history, but helped the IBM corporation survive from 1993-1994. From 1993 to 2002, when Gerstner left the Big Blue, the company's market capitalization rose from $29 billion to $168 billion . This man is considered the savior of IBM.

The next interesting period is the beginning of 2013 , then a protracted correction in the value of IBM shares began, with which the price is now trying to start going up.

An interesting coincidence is that the price of Gold went into its 6-year correction also at the beginning of 2013.

Such a correlation might suggest that long-term investors have so much faith in IBM that they can view their stock as a defensive asset on par with Gold?)

By the way, below is our global thought in relation to Gold.

So, now let's talk about the prospects that we assume looking at the chart.

The maximum correction that we are now admitting is a fall to $110.50-112.50 , from which we expect a solid rise in the value of IBM shares.

We consider the critical level - $180

Fixing the price above this level will open the way for a long-term growth perspective to $500-530

If the market will be negative, and the price cannot break through above $180, then unfortunately, then it will already be necessary to look towards $70 per IBM share

What do you say, about such material, comes in?

Share your thoughts and expectations in the comments on IBM stock

IBM is hot again! Swing trade.IBM weekly chart is currently in a downtrend but bullish cross of moving averages and potential break of the trend line could signify a change of trend and a profitable long trade .

I would wait for for the price to break the trend line (black line on the chart) to enter a long swing trade with a stop loss not too far to protect from a failed break.

Levels and targets on the chart.

Trade safe.