BTC/USD update on the drop!Good day traders, yesterday I posted the same set up on bitcoin and now I’ve decided I’m gonna update this setup till we hit our Daily lowest low.

1H TF yesterday before end of trading day we show price bounce off the the horizontal lines and that is used as my support area, going into the New York session we can expect price to retest the break after it breaks below the support which will than become my resistance.

Hopefully today we can see price run our liquidity resting below(equal lows).

My name is Teboho Matla but you don’t know me yet..#Salute

Ictconcepts

EUR/USD pullback from last week’s bull run!!Good day traders, this past week was filled with so much volatility and momentum but now we focus on the new week, new opportunities, new challenges and all things new😂

EURUSD here we want to take advantage of last week’s run, we expecting price to pullback and already we have had confirmations agreeing with the idea in mind, we’ve already had a shift in structure on the hourly TF and we also see price left equal lows that we also wanna see price run through them this coming week.

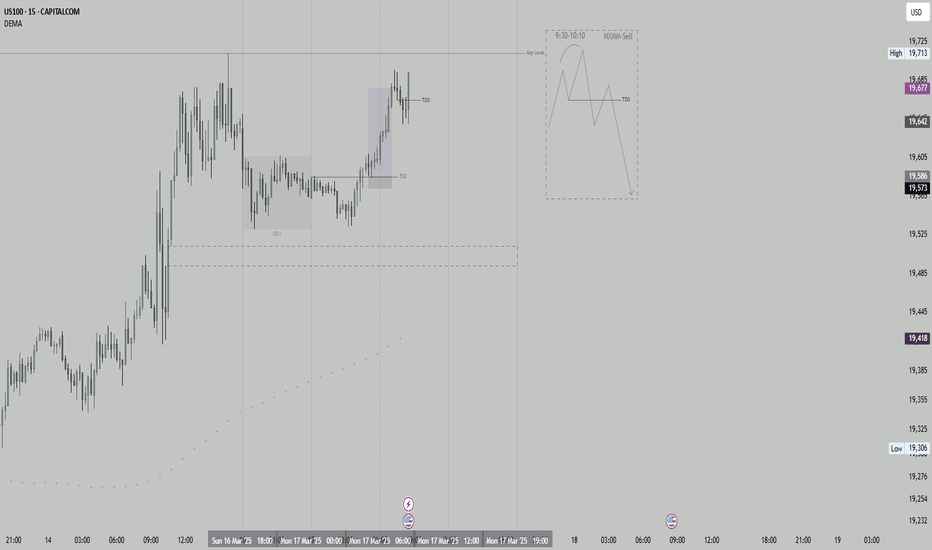

NQ! Short Idea (MXMM, Quarterly Theory)Dear Traders,

today I present you once again my current idea on the Nasdaq. We have swept a High Liquidity Area marked as my lower HTF PDA. Because of that we might see a stronger Pullback as shown on my Chart.

However, I will still keep my eyes open and wait for the 9:30 (UTC-4) Manipulation to look for a Market Maker Sell Model which I will only consider a after a Pullback into my Key Areas and Price Action showing interests of a bearish continuation.

(09:30 Manipulation, Liquidity Sweep + SMT Divergence, Break Of Structure, Any PD-Array)

Praise be to God

-T-

GOLD Bullish Trend Continues After FVG Test🟢 GOLD is maintaining strong bullish momentum after successfully testing a Fair Value Gap (FVG). A Break of Structure (BOS) confirms the uptrend, with higher lows forming—a clear sign of continuation.

📊 Analysis:

✅ Bullish Trend: The price structure confirms an uptrend with higher highs and higher lows.

✅ Fake Reversal Break of Structure (BOS): A key level has been broken, signaling reversal but based on current momentum that follows it shows Buyers continued strength.

✅ FVG Test Success: Price respected the Fair Value Gap, reinforcing buying pressure.

✅ 🎯 Target: , aligning with .

✅ 📈 Momentum: Strong upward drive suggests further gains ahead.

🔮 Potential Scenario:

The price is likely to continue climbing, forming a new higher high toward the target level.

📢 Confirmation Signals to Watch:

📌 Volume: Increasing volume on bullish moves.

📌 Candlestick Patterns: Bullish signals at key support levels.

📌 Moving Averages: Price holding above critical moving averages.

📌 🚨 Disclaimer: This is not financial advice. Trade responsibly and conduct your own research.

🔗 Tags:

#GOLD #XAUUSD #Bullish #TechnicalAnalysis #TradingView #FVG #BreakOfStructure #TrendAnalysis #PriceAction #MarketAnalysis

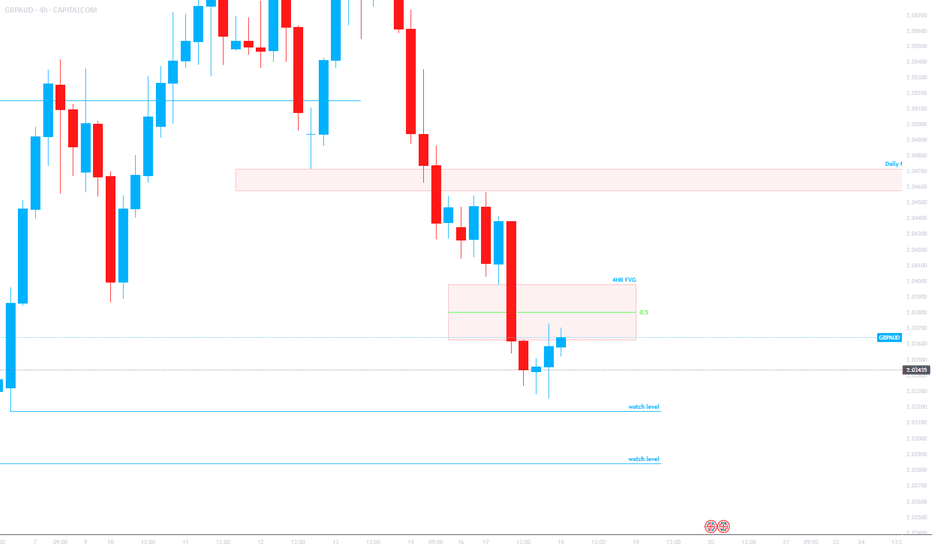

Trading GBPUSD | Judas Swing Strategy 25/03/2025We had a good trading session with the Judas Swing Strategy two weeks ago, as the strategy delivered 3 solid setups, 2 on FX:EURUSD and 1 on $GBPUSD. And guess what? All three hit their targets!

That’s a massive 6% gain for the week! And with these impressive results we wanted to see how the strategy will perform last week.

The strategy did not produce any setups on the currency pair we monitor ( FX:EURUSD , FX:GBPUSD , FX:AUDUSD , OANDA:NZDUSD ) on Monday 24th March and instead of forcing setups like other traders would we sat that day out. Why was this possible? we had backtested the strategy and had enough data to prove that when we stick to this strategy long term we'd be in putting ourselves in a profitable position.

On Tuesday, we returned to the trading desk, scouting for setups, when we noticed a potential opportunity on $GBPUSD. The currency pair had swept liquidity at the high of our zone, signaling a possible shift in direction. We then shifted our focus to selling opportunities for the session. Our strategy required waiting for a break of structure to the downside, followed by a retracement into the FVG before executing a trade

After waiting for an hour and 15 minutes, we finally got the break of structure to the downside. The only step left was a retrace into the FVG. After some patience, the retrace materialized, meeting all the criteria on our entry checklist. We executed the trade, risking 1% of our account with a target return of 2%

Trade Details:

Entry: 1.29513

Stop Loss: 1.29611

Take Profit: 1.29311

After entering the trade, price consolidated around our entry point for a while, showing no clear direction. However, we remained unfazed, trusting our well-backtested strategy, which has a 50% win rate. With a 1:2 risk-reward ratio, we know that consistently following our strategy will yield profits in the long run. Since we had risked only what we could afford to lose, the slow price movement didn’t shake our confidence

Unfortunately, this trade didn’t go in our favor and ended up hitting our stop loss. This serves as a reminder that not every trade will reach take profit and that’s perfectly okay. Losses are an inevitable part of trading, but what truly matters is maintaining a solid risk management strategy, sticking to a proven system, and thinking long-term. As traders, our edge comes not from winning every trade, but from executing consistently and letting probabilities play out over time

Another Good Trade for GOLD (XAUUSD) Today

My overall forecast for this week is that Gold will do classic expansion week where monday will go up then tuesday will most likely go up to sweep mondays high then do the reversal so that wednesday and thursday will be expansion going down and target the daily imbalances below. For today i was expecting a bullish push upwards for GOLD before it will reverse so i followed my steps by combining my multi timeframe analysis. From daily for the overall bias to 1H for that confirmation and alignment then 5m for my entry timeframe. Once i saw those 3 timeframes align with combination confirmation that i saw with the price action then i entered the trade. My original target was 1:3R but then i saw the weakness after price came to my 1:2R level so i manually pulled out with a 1:2R gain for today....

ES1 2025-03-31 SPOOZ 15minOBHello everyone, I hope you won, stayed out, or learned something form the market today 😂.

Today was a easy grab.

Drawdown: 17. Tics

TP: 111. Tics Grabbed (out of 438)

Spooz Open Manipulation,

Broke near high,

Retraced to 15min Order Block,

TP Hit at 3 equal Highs (volume).

If you found this inciteful, join our group discussion! (link in bio)

Gold is eyeing highs after a bullish daily candleThis is def a consolidation range so keep your eyes sharp and pay attention to what happens as we break into the highs. Will we displace with longs or will be be saturated by the bearish imbalances above the current hourly range?

Share with a friend in need 🔑

Wednesday Market Outlook: Bearish Trend Expected📉 Wednesday Market Outlook: Bearish Trend Expected

Tuesday’s price action played out as expected, confirming my bias. While price didn’t fully tap into my POI before the rally, the movement remains valid.

---

📊 Wednesday’s Forecast

For Wednesday, I’m expecting:

✅ Monday’s high to be taken out

✅ Tuesday’s high to be taken out

✅ Price to reach my bearish POI at 1.29794

From there, I’ll be looking for a drop to 1.28835.

---

📉 Overall Bias: Bearish

Given this setup, I’m maintaining a bearish stance for Wednesday. Now, it’s all about patience and execution.

Let’s see how price unfolds. Are you bullish or bearish this week? Drop your thoughts below! 👇🏾

join our community for more market insights.

#Forex #MarketOutlook #TradingPlan #GBPUSD

Trading GBPUSD | Judas Swing Strategy 18/03/2025Last week, the Judas Swing strategy only gave us 2 setups on FX:AUDUSD , but both hit their targets, locking in a solid 4% gain! Proof that patience and discipline always win in the long run. After these results, we were eager to see how the strategy would perform this week. And sure enough, a setup emerged on FX:GBPUSD on Tuesday! Let’s take you through how this trade played out

On Monday, we scanned our usual currency pairs ( FX:GBPUSD , FX:AUDUSD , FX:EURUSD , OANDA:NZDUSD ) for potential setups, but none met our criteria so we stayed on the sidelines. Then came Tuesday, and a promising setup started taking shape on $GBPUSD. That got us excited and we were eager to see how this trade would unfold!

After liquidity was swept from the lows of our range, our focus shifted to potential buying opportunities. To confirm our bias, we needed to see a break of structure to the upside before committing to the trade. Twenty-five minutes later, we got a break of structure to the upside, confirming our bias. This move left behind a Fair Value Gap (FVG), signaling an inefficiency in pricing. We now anticipate a retracement to fill this imbalance once that happens, we'll be ready to enter the trade

The next five minute candle entered and closed in the imbalance which meant we could execute our trade using 1% of our trading account and aiming for a 2% return, ensuring our winners outweigh our losers. With this strategy maintaining a win rate of around 50%, sticking to it consistently positions us for long-term profitability

After executing the trade, we faced a deep drawdown, a moment where many traders who over-leverage might panic as price edged closer to the stop loss. But we remained unfazed. Why? Because we only risked what we could afford to lose, staying disciplined and accepting whatever outcome the trade would bring—win or lose.

Upon checking the trade once again, we noticed price had turned around and begun moving in our intended direction which was good to see but the objective had not been met so we had to be patient and wait for the final outcome of the trade

After 3 hours and 15 minutes, our FX:GBPUSD trade finally hit take profit, securing a 2% gain so far this week, all from a well-managed 1% risk

SP500 (E-mini Futures) - Decision TimeBigger Picture SP500 Futures Update - Decision Time

- Powell (FED) ruled out a recession in todays FOMC Press Conference (Bullish)

- Powell announced drastically slow down QT beginning next month (Extremely bullish for risk assets)

- The Asian and European stock market indices are still showing strength forming new ATHs week by week.

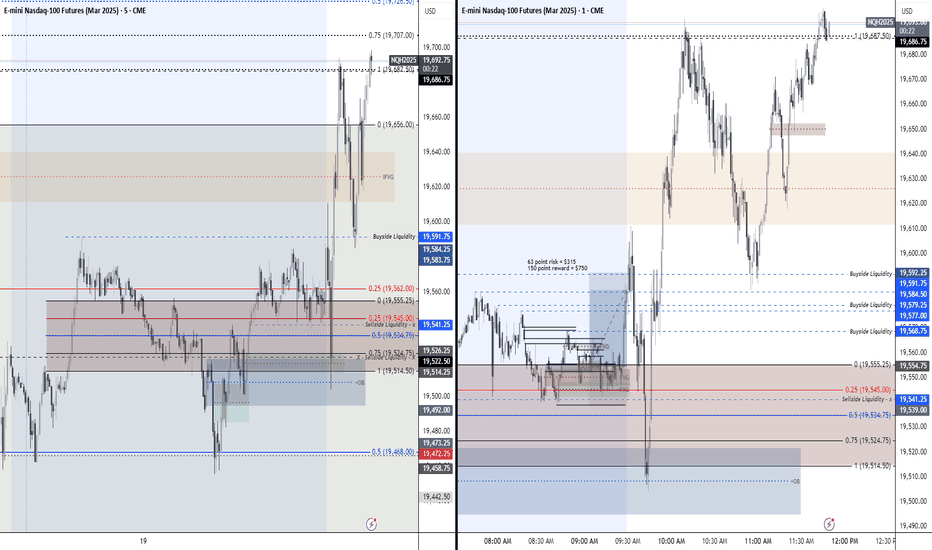

Review of my NQ Morning trade before FOMCThis is me going over the trade we took today that was a loss. Had we kept SL under the low of 19,541.25 we would've hit TP and caught our trade. We are done trading for today, just wanted to hop on here to share with you guys the result of the trade and outcome.

Give it a like ♥ and a 🚀 if you found this insightful.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

US500 StanceThe equal lows from the 4H price action had me thinking. If we look at it from a range perspective, there is still a wide gap left from the 4H change of character, ever since it took the last low of the lower lows, it never gave a single percent to the area's retracement. This might be a daily timeframe FOMO trap. whereby recovery of the market from sells to buys will be pumped to only drop again. In terms of entry. There is a zone with mind for us to consider seeing if it holds. because right now there is some dying triangle pattern towards it. should it delay, but keep showing some sell intent. we will wait for the session to sweep its high and sell it. should it fail, a further analysis will take through

Missed trade opportunity on MNQ due to Tight SLOnce again, we shifted sl too soon and got stopped out of a good trade. It was nice to see the outcome, it ended up tapping inside of that Volume imbalance once again before falling over quickly for the remaining sellside liqudity.

If my SL was kept at the highs we would've captured the whole move. This week I have been feeling a little tired and my birthday is this thursday guys!! lol I would hate to have a bad trading week on my BDAY 😢. I don't know if that's why I am being so cautious, I wanna enjoy my week. haha

Anyways, I will post any new trades if I get into another one. But I might call it here depending on where price is at after I post this video.

If you guys enjoyed this give it a like and share with your friends(:

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

GBPAUD 4HR Trade OutlookGBPAUD made a strong bearish move yesterday and formed a 4HR imbalance, we are now watching how price reacts to that 4HR imbalance created. If it respects it, we'll dial down to a lower timeframe and look for Sells, if it breaks it, we can look for Buy Setups. Remember, Patience is your edge. PEPPERSTONE:GBPAUD

AMD short term bullish. Price is expected to have sought its SSL and Receiving nice reaction from Previous Bull POI which was that Bullish Breaker and thus Seeking new Price discovery for short term.

Thus it is very good chance that Price will visit that Bearish Breaker first in next few weeks.

DYOR. This isn't a financial advice. This is just educational and speculative idea.

Your gains or losses are your own responsbility.

If you like this idea, please give it a thumbs up.