russian rates bonds and stocksHi all! I feel the approach of good times in Russia!!💓

On the chart - at the top in black is the rate of the Central Bank of the Russian Federation, next to it in blue - the yield rates on short-term bonds, at the bottom - the RTS.

There will be a meeting of the Central Bank of the Russian Federation soon and everyone will be given the message that “the Central Bank should raise the rate by 2%.”

Short debt is already trading at 18%+.

How to practically apply this? The phase of raising rates always ends for stocks with a vigorous decline, a bang. The shares follow the RGBI index, so clients do not have any Russian shares.

But! The main thing will begin after the Central Bank begins to reduce the rate - the stock market in currency terms can grow by 100..300% in €£$

It would be better for conservative comrades at this moment of lowering rates to withdraw money from deposits and invest in long bonds, both corporate and government.

While we are in no hurry to switch to rubles and Russian shares, we need to wait

- corrections

- a real decrease in profitability on the Russian market (see two-year plans, ticker RU02Y)

- changing the Central Bank’s narrative to lower rates.

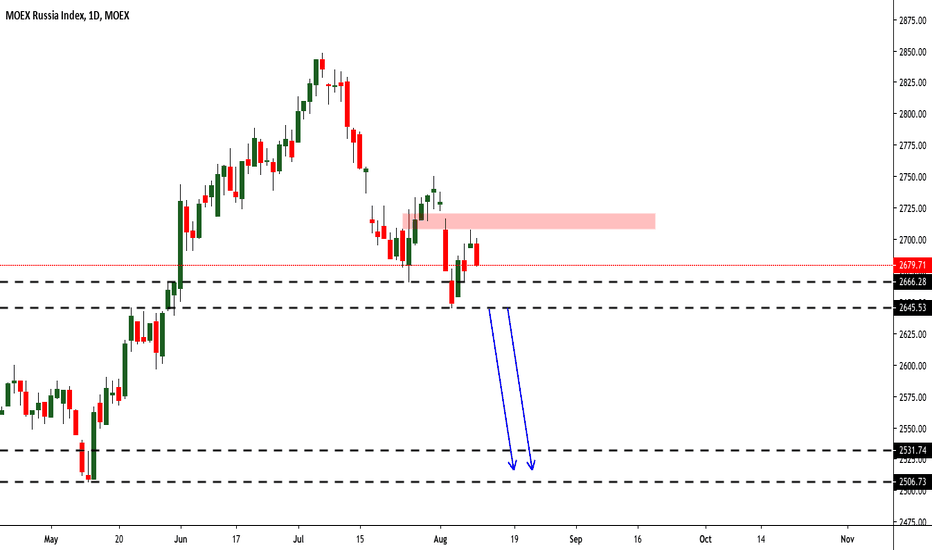

MICEX Index

MOEX Russia Index. The epic 52-weeks breakthrough expectedRussia’s trapped domestic investors push stock market to 2-years high.

Russia’s stock market (so-called, Moscow Exchange Index MOEX:IMOEX ) has climbed recently to its highest level in 2 years as domestic retail investors with nowhere else to go snap up the dividend-paying stocks that sold off heavily following the Russia-Ukraine conflict.

A rise of more than 100 per cent since March, 2022 low has pushed the MOEX index to levels last hit in early February 2022, before Russian President Vladimir Putin announces so-called "special military operation" that sent Russia’s equity market into freefall.

The market’s partial rebound over the two years has come despite the imposition of countless western sanctions designed to cripple Russia’s financial system.

The Kremlin responded to the measures by blocking most foreign traders from exiting their investments and capping the amount of money Russians can stash in foreign bank accounts.

Due to U.S. Department of Treasury and Euroclear sanctions, money is trapped.

Where do you put it but on the exchange?

Deprived of investment opportunities abroad (because of stupid, a nazi-like sanctions), Russians have piled their savings into the likes of Lukoil, Gazprom and Sberbank, which combined account for about 40 per cent of the stock market’s total value.

“Russian retail investors have always been about dividends,” said Sofya Donets, chief Russia economist at Renaissance Capital, a Moscow investment bank.

The Russian stock market’s recent rally bears some resemblance to the surprisingly strong performance of the Borsa Istanbul 100 last year.

Russia’s economy has also held up better than expected.

For many domestic Russian retail investors, nothing has changed compared to before the conflicted started, as the economy is doing OK.

Big dividend payers like state-owned Sberbank, whose shares are up 71 per cent trailing 12 months, are attractive to most Russians and now they’re some of the few investment options available.

Even so, foreign investors not banned by sanctions have kept well clear of the Moex since an exodus last February, when central bank figures show non-residents shed about Rbs170bn ($2.2bn) worth of Russian stocks. Trading volumes on the Moex slumped 41 per cent year on year in 2022.

There is a “close-to-zero chance” that foreigners whose Russian holdings have in effect been frozen will be allowed to sell out of their positions.

Perhaps there could be an artificial settlement, some kind of exchange for holdings frozen for Russian investors outside of Russia.

In technical terms, IMOEX graph is near to break 52-weeks highs, following 26-weeks SMA, with further upside opportunities to reach 4000 points and new historical highs.

IMOEX Marco technical - One more massive correction or...?

My macro work on Russian MOEX Index illustrates how ElliotWave in conjunction with major fibonacci retracements can be useful in providing the context or the operational frame work for every investor and trader to operate and execute one's strategy.

Starting from the market Oct'98, we may observe how the price structure has accurately finished its cyclical five wave move lasting almost exactly 23 years to Nov'21 finishing its run just 2.5% bellow an proper (though extended) target for the cyclical wave "V".

The EW theory, first elaborated by Ralph Nelson Elliott in 1930s, and later perfected to the most practical investing/trading principals by Avi Gilburt from elliottwavetrader.net, states that most of corrective structures develop in three waves: A-B-C.

After finishing what I consider to be first cyclical macro five wave advance in Nov21, the price moved into deep and abrupt correction, straight to the ideal golden ratio

(0.618) support zone where it is most typical for any correction (macro and micro) to establish a bottom. That was not particular to average character of the three wave corrective structures (being so abrupt), but the support parameters were met.

Never the less in my global technical thesis, I still lean towards the macro correction from the Nov'21 highs NOT being complete and the price is yet to start its third wave decline to 1650 (double bottom) or even 930 zone. I am 55/45 on that regard.

That being sad, I cannot completely rule out the possibility of price to have established long-term macro bottom on Feb22 and that we may be already in the very early process of the new (generational?) bull-cycle. As strange as it may sound in today's global political landscape, new macro generational potential for IMOEX, could be very much considered in the realms of several important circumstances happing in Russia:

1. Currency devaluation (bullish for equities);

2. Inflation (typically bullish for equities);

3. Internal barriers to withdraw capital (indirectly bullish);

4. Redomiciliation of large corporations and their capital;

5. Record interest of citizen to local stock market, resulting in record breaking numbers of new accounts opening on Moscow Stock Exchange.

6. Perspective budget deficit that will result in point #1 (bullish for stock)

Macro parameter to differentaite between Macro-Bearish and Macro-Bullish scenarios is simple: until price is bellow 3700 area, macro-bearish case cannot be rule-out.

The Mid/Short-Term Analysis

Until price decisively breaks 2800, I cannot consider the mid-term bullish advance in either cycle wave "B" (macro bearish case), or wave (3) (in generational-bullish case) toped and expect at least one more wave up to 3370-3650 area in Q4 or Q1'24.

It is yet early to consider that price has finished its Sep's correction at 3000 area and until price is bellow 3220 resistance zone, I expect one more decline to 2800. If price moves above 3200, than I will shift to yellow/green alt. scenario that wave 4 correction has finished and the price is on its wave to new 2023 highs.

OIL: Expected to rebound to $80

The oil price also rose nearly $2 under the stimulus of data, reaching a high near $77. On the 30-minute chart, oil underwent a wave of pullback after consolidating near 76.6, and its current position is the previous consolidation level, which has some resistance but not strong. The short-term strong resistance should be around 77.4.

From a technical standpoint, the current process resembles the formation of a U-shaped bottom, with the MACD indicator in a crossover state. If a death cross occurs, it means that oil prices will experience a short-term pullback to seek support, which is likely to be around 75.6-76.

On the 4-hour chart, oil has been oscillating within a box range, and the range of 81-82 is a strong pressure level. The MACD indicator has formed a golden cross, and unless there are unexpected events, the oil price is expected to touch near 81 in the near future.

Therefore, I believe that the current focus should be on long positions for oil, with buying points around the support level near 76. The first target is around 78, and the second target is around 80. If it breaks through 80, it can go up to around 82.

The probability of a one-step trend is not high, and oscillating upward is the most likely event. Every pullback after each rise will be a very good long entry point.

Thank you for your attention and trust. Please continue to follow me, and I will bring you more wonderful insights and help you gain more profits!

SBER - largest Russian fintech company - 30-50% growth til AprilHere is my look at the largest Russian bank and fintech company - Sberbank (shorted from "sberegatelniy bank" - "bank for savings"). It's bee called Sber for several years because it's more of a fintech company than just a bank now.

The idea is simple. You can see a sine wave which is mirrored relatively to the symmetry center (centerline). The timing it: 205 rub minimum, maybe 240 rub per 1 stock till the end or March.

It should mean that overall Russian stocks market would feel great too.

MOEX reopens after 1 month haltedImportant restrictions as Moscow's Exchange reopens 4 hours a day:

- Short-selling banned

- Selling of shares banned for foreign investors

- Only 33 stocks available for trading

After being halted for 1 month, the Russian market reopens with important restrictions. Also, many institutional brokers from the EU and other NATO countries banned trading on Russian assets. From the technical analysis perspective, it's impossible to assess accurate price movement with so many restrictions and market manipulation by the Russian Federal Bank that is trying to avoid a market crash. So far, the measures have been successful and the aim is to keep holding the market until this crisis is resolved. The downtrend though, it's still there with an important resistance line, even with short-selling banned and other restrictions, Russian investors could panic and sell at market. This is absolutely historic.

IMOEXRF . A strong buyback was indicated last week, but there is still no mid term long signal. If everything goes well this week it might show up later this week.

Meantime, the index in the potential strong turning point at 3650 which we'll touch this week I suppose. The second week may turn down with a local dip of the month around Feb 9-14. Let's check.

For sure, any dips I will use to get in long. Now I have 50% cash in my wallet.

-kc

TMOS Tinkoff iMOEX ETF - Feb, 03, 2021Currently TMOS Tinkoff iMOEX ETF seems in a Cypher pattern continuation.

We hold the upward line for a while, and looking for 1-hour SMA 200 as a resistance.