Imxusdtlong

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.599.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.602

First target: 0.649

Second target: 0.682

Third target: 0.721

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.390

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.407

First target: 0.426

Second target: 0.449

Third target: 0.480

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.503.

Entry price: 0.0528

First target: 0.540

Second target: 0.560

Third target: 0.587

#IMX/USDT Ready to launch upwards#IMX

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.30

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.46

First target 1.56

Second target 1.64

Third target 1.74

#IMX/USDT Ready to go higher#IMX

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 2.00

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.02

First target 2.08

Second target 2.17

Third target 2.29

#IMX/USDT#IMX

The price is moving in a descending channel on the 12-hour frame upwards and is expected to continue.

We have a trend to stabilize above the moving average 100 again.

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards.

We have a support area at the lower limit of the channel at a price of 1.35.

Entry price 1.50.

First target 1.62.

Second target 1.78.

Third target 1.90.

IMX: Early Bird Gets the Breakout!This should break out with force from here. CRYPTOCAP:IMX

I’m jumping in now, and if it gets invalidated, I’ll exit and re-enter below $1.16.

It seems to be lagging compared to other coins, and the trend isn't even confirmed on the weekly yet, so I think we're early—buying before the expansion and confirmation.

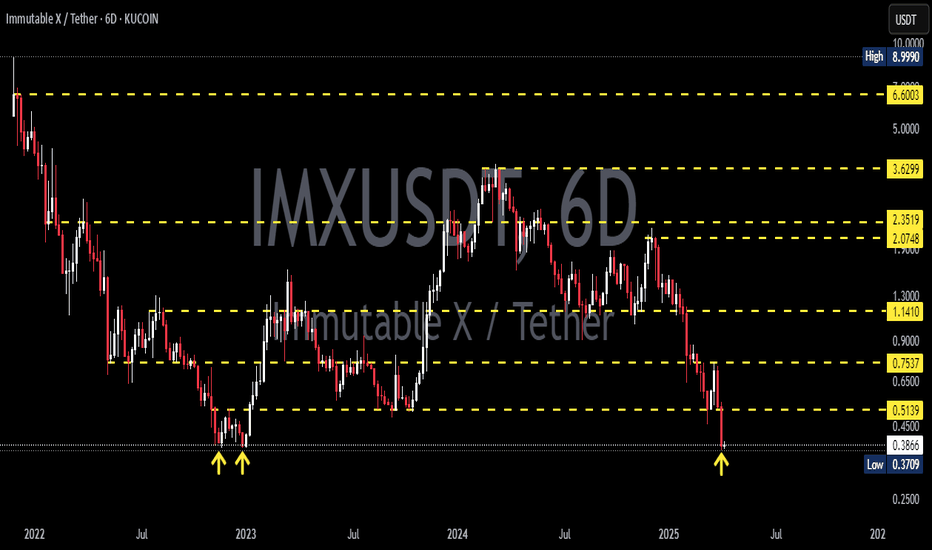

IMX Looks Bottomed Here – Ready for the Next Leg Up?The weekly chart has just confirmed another bullish signal at macro support. What can we expect?

Ideally, a continued uptrend from here would be the best scenario, and it’s something I’m anticipating before any potential reversal and the formation of a new monthly trend.

There are no new lows in sight after retesting the previous monthly support levels, with clear demand around $1.

If things continue to develop positively, a 5-week consolidation period could provide a stronger signal. For now, this setup is sufficient for me to look for long positions, aiming to hold into $2.5 as a primary target. If momentum and overall market conditions are favorable, new all-time highs could be on the horizon.

CRYPTOCAP:IMX LONG!

IMXUSDT Resistance Zone BreakoutIMXUSDT Technical analysis update

IMX price breaks the resistance zone on the 4H chart after multiple rejections. The 4H candle closed above the resistance zone, and the price is trading above the 100 and 200 EMA. We can expect a strong bullish move from here.

Buy Level: $1.66

Stop Loss: $1.46

Regards

Hexa

#IMX/USDT#IMX

We have a bearish channel pattern on a 1-hour frame, the price moves within it and adheres to its limits well, and the breakout was made to the upside.

We have a green support area at 2.00

We have a tendency to stabilize above moving average 100

We have a downtrend on the RSI indicator that supports the price higher

Entry price: 2.12

First goal 2.24

The second goal is 2.33

The third goal is 2.43

#IMX/USDT

#IMX

We have a bearish channel pattern on a 4-hour frame, the price moves within it, adheres to its limits well, and is expected to break it upwards in a strong manner.

We have a support area at the lower border of the channel at $1.60 from which the price rebounded

We have a tendency to stabilize above moving average 100

We have an uptrend on the RSI indicator that is about to break higher, supporting the price higher

Entry price is 2.20

The first goal is 2.74

The second goal is 3.18

The third goal is 3.72

#IMX/USDT#IMX

The price is moving in a head and shoulders pattern on a 4-hour frame,

and we are now at the end of the formation of the right shoulder.

We have stability above Moving Average 100.

We have an uptrend on the RSI indicator that supports the rise and is about to break higher

Entry price is 2.60

The first goal is 2.77

The second goal is 2.91

the third goal is 3.06

the fourth goal is 3.20

#IMX/USDT#IMX

The price is moving in a triangle on the 12-hour frame and we have a green support area at the 2.80 level

We have a higher stability moving average of 100

We have a good bounce being prepared from the lower border of the triangle once the downtrend breaks to the upside

The RSI indicator has a downtrend that is about to break higher

Entry price is 2.90

First goal 3.19

The second goal is 3.50

Third goal 3.85