PG - A stock to buy for the long termFor long-term investors, Procter & Gamble presents a compelling opportunity due to its strong fundamentals and growth prospects. PG’s consistent financial performance, characterized by steady revenue growth and robust profit margins, underscores its resilience and ability to generate shareholder value. The company’s strong brand portfolio and market leadership in key product categories provide a competitive moat, ensuring long-term revenue stability.

The company’s strong balance sheet and cash flow generation capabilities provide a solid financial foundation for dividend growth and share buybacks while also investing in growth opportunities. For long-term investors, this translates to both income and potential capital appreciation.

Incomestocks

BPT Regular Flat in (B) Simple Zig Zag in ((2))Expecting price to correct upwards between $13.73 and $16.49 in minor C followed by intermediate (C) in ((2)) to between the 61.8% or the 85.4% trend based fib extension. Invalid below 0.5525 cents.

GSK Glaxo Smith Kline - Multi Year Lows, A Bargain To Be Bought?GSK is trading around the multi year lows having bounced off of the long term support zone at 1300. I think this is a relative bargain at these levels with GSK being one of the Big Pharma Companies that is still trading way below the starting price for the year.

Pfizer, Johnson & Johnson and Roche are all either positive or around net zero YTD. Novartis is trading slightly lower and so is Merck and Co but not to the extent of GSK making it a bargain in the big Pharma world.

Dividend Yield is current around 5.3% which is high enough to warrant it being a good income stock even if the share price was to remain flat for the next 5 years.

Upside targets are at 1720 which is the next major price resistance zone and and 1850 which is the 18 year highs (formed in 2019).

There is a chance that price could fall back down to 1300 or even the multi year lows at 1235 which would make for a real bargain. But even at the current price of 1378.00 I think over the next 5 years this is a good stock to hold.

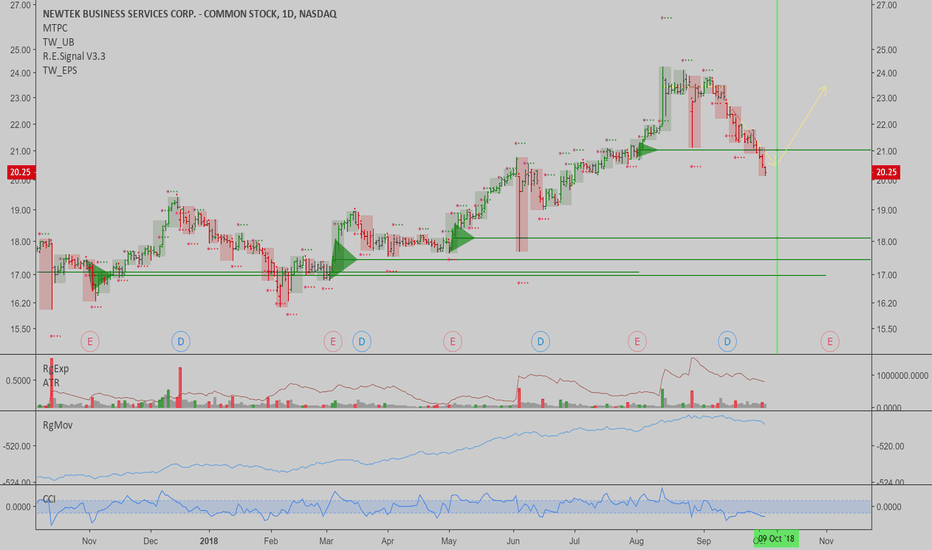

NEWT: Downtrend target hit, time expires soon...$NEWT is one of the stocks we monitor in our income stock watchlist. I like how it's setting up for a buy here, normally it falls after going ex-dividend, since investors leg into it ahead of the dividend being paid, and exit after receiving it. This is a reliable pattern in this stock.

Technicals show price met a downtrend target slightly ahead of time, and as soon as it turns up over a previous day high, it will be safe to be long this stock. Additionally, we could wait for time to expire, by the date shown with the green vertical bar on chart.

I estimate price will act as per the yellow arrow on chart, if it follows 'Time @ Mode' rules by the book (which is likely overall).

Best of luck,

Ivan Labrie.