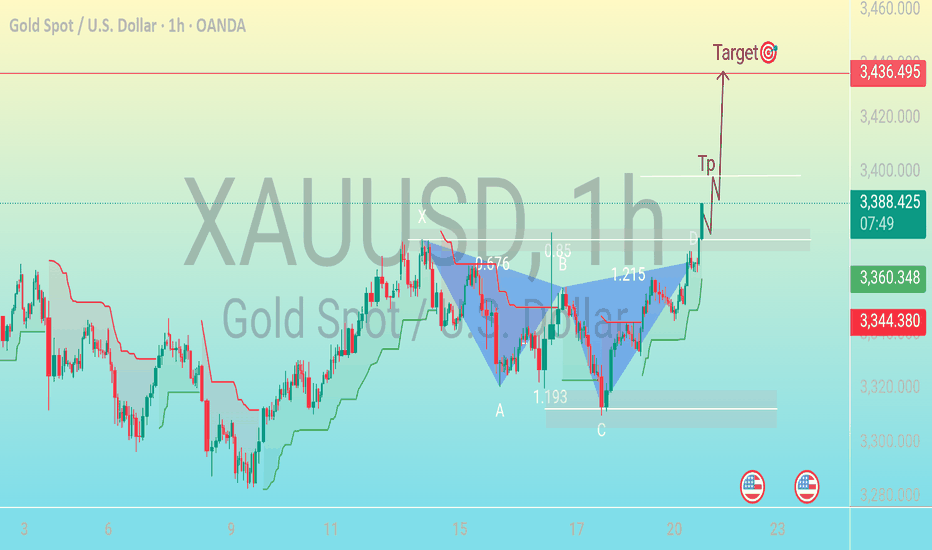

Bullish Breakout Toward 3,436 TargetThis chart shows a technical analysis setup for XAUUSD (Gold Spot vs US Dollar) on the 1-hour timeframe using harmonic and pattern trading strategies. Here's a discretionary breakdown:

---

🔍 Pattern Identified:

A Bullish Gartley Pattern or potentially ABC-D Harmonic Pattern is forming:

Points X-A-B-C-D are labeled, with D just completed.

D point completion indicates a buy (long) opportunity, as the price reversed upward from point C to D.

---

📊 Current Market Action:

Price is currently at 3,386.770 (green candle).

A breakout from the potential neckline or resistance zone around the D point is observed.

There's a small bullish consolidation marked as “TR” (likely Trading Range or Temporary Resistance).

---

🎯 Target Projection:

The price target is labeled at 3,436.495, which is:

Based on the harmonic projection or previous swing high.

~+50 points above the current level (around +1.5%).

---

🧩 Support & Resistance Levels:

Immediate support: 3,360.125 (gray zone)

Next major support: 3,344.380 (lower red line)

Resistance/Target: 3,436.495 (red line/target zone)

---

📈 Discretionary Insight:

Bullish Bias: The pattern suggests a bullish reversal or continuation.

Breakout confirmation: If price holds above the D point and TR zone, it could accelerate to the target.

Risk consideration: Watch for potential pullbacks into the support zone near 3,360. A break below that could invalidate the setup.

---

✅ Potential Trading Plan (Discretionary):

Entry: Already triggered above the D point (confirmation breakout).

Stop Loss: Below C or below the gray support zone (around 3,344).

Target: 3,436.495

Risk-Reward Ratio: Appears favorable if stop is tight and target is reached.

Indecision

The btcusd weekly.Week that ends with a candle of indecision, the price after a two-week ride has found a level on which to rest. The market is currently recharging its batteries for the next attack on the resistance at 58k USD, which I consider to be much more important than the one it stopped at this week. A scenario that seems to be taking hold when looking at the data on derivatives (futures and options) could be to see the price correct on the support around 49/48k USD, the most classic of pullbacks, both scenarios enter the bullish context, therefore As soon as buyers see lower prices, they will probably increase their purchases.

Still Bullish if Bitcoin above $28,300Daily Chart

You can check my previous idea here:

Bitcoin has broken down the trend line then touched and bouncing back from $28,300 besides, BINANCE:BTCUSDT has the resistance around $29,300

Bitcoin's still in Bullish Trend if it can hold above $28,300 then break out the resistance

Otherwise, Bitcoin will sideway in range $25,300 - $28,400 if it breaks down the support $28,300

Wait for next move

SPY DIAMOND PATTERN ALMOST FINISHED - UP OR DOWN?I've been tracking this for approx 9 months - I thought it had finished its form much earlier however I kept re-drawing trend lines - checking time frames high and low like a mad man.

The consensus I keep coming too is we have a huge opportunity here. Diamond patterns are characterized as very rare however extremely reliable bc of how rare they are. They higher the time frame and the longer the pattern takes form the more solid it can be relied upon .

We have a few options here:

1. The last touch of the bottom trend line (lower right trend line) has already been touched and once we clear the orange line the breakout will be official - time to go long.

2. There is still one more swing low to go, we should curl down to make one last touch of the lower right trend line.

a. That could lead to a total breakdown - signaling a bearish continuation diamond

b. Price could stabalize on lower right rend line only to rebound to make its true BULLISH break of the orange upper resistance line marking the high of peak #3

With the downtrend as strong as it was - with the way the market has been moving up the last 2-3 weeks it makes the bull case very good looking, but i can't shake the possibilty that its a rug pull and we are going down.

Any critiques or ideas are more than welcome

www.tradingview.com

^^^ i still cant figure out how to just get the stock chart without the indicators to load here. anyway thats a link to the tradingview website chart for spy

usdjpy is throwing bearish reversal signalsThe dollar has been very strong versus the Yen lately. Price has reached yet another high and i believe its like to retrace bearish. The sellers have stepped in a provided some indecision and buy exhaustion. The blue 8 exponential moving average crossed to the dowside below the 21 simple moving average and price began a minor downtrend. This usually occurs before a breakout and upon a retest of that bearish candle that initiated the downward movement.

I'm awaiting a re-test of $13.868- $144.155 so signal if price would like to continue bullish intraday or retrace bearish and sell for lower lows now.

Gold to retest its lows, reversal potentiallyGold has taken over 7 days to decline back to its lower low. I don't believe that price is prepared to push lower. I will await a re-test of the lows to indicate whether I will go long on gold at the bottom of its consolidation range. As long as price continues to decline with these indecision candles I'm under the impression that it will suddenly become bullish after a reversal candlestick retest at the low of 4H bullish engulfing confirmed.

usdjpy consolidating before breakoutUSDJPY is hinting at a momentum swing. The overall trend is still up however price has not been making any new higher highs on the daily, In fact, volatility at the high forms a bearish reversal signal. I believe price is pulling back intraday bullish, but this push isn't very strong. Another daily rejection at the high will trigger a short setup for me.

AUDUSD Bullish indecisionAUDUSD has been uptrending for a few days towards a very strong resistance. Price has been rejected many times in this area. Candlestick analysis suggests that price is slowing down. The candles have a lot of wicks and small bodies. However ADX suggests price is still very bullish. I will be awaiting a daily signal for a short. Anytime price is approaching a very strong buy exhaustion area, I become alert for reversal signals. Price usually decides to retrace from strong areas of interest.

Golden Evening Star for the Re-testGold is all overall Bullish. Long term. However, since forming a strong Evening star variation at an all-time high re-test my sentiment has since shifted from an uptrend to a short term and definitely intraday downtrend. The weekly chart is still bullish. I believe the Daily chart just formed its higher low, price will now either created a new higher high or attempt to. The 8 exponential moving average has crossed to the downside of the 21 simple moving average. There's a 4-hour double top at the weekly resistance. I have confluence at the neckline, 61.8, as a well as a valid indecision pullback.

XAUUSDDear Traders,

Gold has given us a mixed signal.

The 4H trendline is broken and the bullish impulse move was strong. In the first scenario of retest, it may give a nice opportunity for buying continuation to 1665 level which either push price lower to 1645 levels forming consolidation, or will break and go up to 1682 area of previous year demand zone.

I will turn my bias to bullish if it breakes the upper level which I pointed out, and continue up with strong momentum candles cosnecutively.

The strength of the dollar seems that has found an edge and we may see a further rise for gold.

But if there is no the abovementioned breake of structure with HH and HL, the maintrend will remain bullish pointing down to 1570 and 1475 levels of interest.

Also, I am thinking that the banks have moves the older demand zone of 1680 to the 1620 area, so I am pretty cautious. Can you imagine seeing gold touching several times the 1615-1620 price areas for the upcoming months without breaking it down, while at the same time, it will form higher prices above 17xx and 18xx levels? it will happen sth similar in terms of pattern and demand zone like that of 1680 area?

Lets's see.

Good luck!!!

BITCOIN- What now?1. possibility:

BTC continues to move down as it gets rejected by the trendline and key levels.

Possible bottoms:

1) -0.382 fib level (12219)

2) -0.5 fib level (10550)

3) even lower points, some even say 3k

2. possibility:

BTC breaks the June 2022 big drop trendline, breaks key fib levels and visits the moon. 100k? 150k? 200k??? Who knows...

Enjoy the show!

Be a part of it too!

We will see how this plays out...

There is even a 3. possibility:

BTC continues to move sideways for another long period of time...

BITCOIN PRICE ACTION AND MARKET ANALYSIS w/ NEWS and COT REPORTWelcome back to another video, today's video is about analysing BITCOIN (BTC) using the monthly, weekly and daily timeframe to understand and see price movements for possible next direction (either downwards or upwards trend).

P.S NOT A FINANCIAL ADVISOR... JUST EDUCATIONAL AND LEARNING PURPOSE ONLY...

NZDJPY: Zoom Out 🔍Everyone is focusing on the lower time frames without noticing the higher monthly supply holding right above current price.

Be careful selling before this zone! We are seeing lots of indecision suggesting price may well want to travel up into the supply before any signs of reversals.

Bear this in mind when trading this pair.

Please let me know what you think in the comments 💬