European Central Bank is holding rates untill Q3 Market Insight:

ECB policymaker Francois Villeroy de Galhau has emphasized that the decision on rate cuts in 2024 will be data-driven, rejecting a fixed timeline. ECB President Christine Lagarde, while suggesting a potential rate cut in the summer, emphasizes the importance of data in timing the decision. Central bank officials are cautious about immediate easing but acknowledge a long-term trajectory of lowering borrowing costs.

Rationale:

Anticipating the likelihood of a delayed rate cut by the European Central Bank (ECB), potentially impacting businesses' cost of borrowing and consumer spending, which could lead to lower revenues for companies in the European stock index.

Trade Strategy:

Short Position on European Stock Index: Consider initiating a short position in the European stock index (e.g., Euro Stoxx 50).

Entry Point: Look for technical signals indicating a reversal or weakness in the index.

Stop-Loss: Place above a recent significant peak to manage potential upward movements.

Take-Profit: Target the next support level, considering potential downward pressure on index components.

Index

GOLD |BULL OR BEAR?Hello guys, gold could not continue the upward trend of last week and now I see that it has started a downward trend again.

I have identified the important supply and demand areas on the chart to enter trading positions.

Enter into the positions according to the time priorities and after getting confirmation.

Don't rush, if the market doesn't go as you think, stop trading at all, the market is always full of opportunities.

Inflation Higher = Stock Market LowerWhile higher inflation should be an indicator of a booming stock market since the consumers are spending more and the companies make more profit, this time the case is different.

The simple macroeconomics behind it:

Higher Inflation=Higher Interest Rates, which=Higher Borrowing Costs for the S&P companies

And as you have already connected the dots higher borrowing costs mean less profit, so that is indeed what we are expecting to see in the stock market.

The Seasonality for January for the S&P tends to be neutral to slightly bullish which is another confluence that we can see some pain in the coming weeks.

This is our second trade on the S&P as the first one was with half of the risk and tight stop loss which was triggered, so now is the perfect opportunity for our second part of the trade.

REMEMBER- Patience is the key for being consistently profitable

.

.

.

Comment your opinion below:)

Navigating Market Moves Amidst Geopolitical TensionsRecent geopolitical tensions triggered a 'flight to safety' impacting Asian equities. Japan's Nikkei fell by 0.6%, while Chinese equities, including the Shanghai Composite and Hong Kong's Hang Seng, experienced declines of 0.6% and nearly 2%, respectively.

Exercise caution regarding potential short squeezes, especially with markets at all-time highs.

Keep an eye on Japanese economic indicators influencing the yen.

Stay tuned for any announcements from Chinese authorities impacting market sentiment.

In times of geopolitical tension, a balanced approach is crucial. Watch equities and currencies, stay updated on economic indicators, and be prepared for short-term market fluctuations.

S&P500_4HAnalysis of the S&P index in the medium and long term

The market is in an upward wave and until we are above the number 4742, it is still an upward trend, and for short-term transactions, we can trade from buying to selling.

But for the long-term, we have the resistance of 4914, which is likely to react to this number, and the index can enter a fall, which can be considered as a target of 4440

EURUSD|The probability of breaking the support zoneHello friends, I hope you are doing well, let's go to the popular currency pair EURUSD.

In EURUSD, the selling pressure seems to be more, we can understand this from the powerful candles, broken trends.

For this reason, short positions have a higher winning percentage.

By reaching the supply area (1.1015), we can enter a sell position with confirmation until the price (1.90).

In the future, if it can break the demand area, we expect the price of 1.080 to continue falling

DXY Long From Support! Buy!

Hello,Traders!

DXY was falling down

Sharply but then hit

A horizontal support level

Of 100.57 from where

We are already seeing

A bullish reaction and

I think that we will see

A further move up

Buy!

Like, comment and subscribe to help us grow!

Check out other forecasts below too!

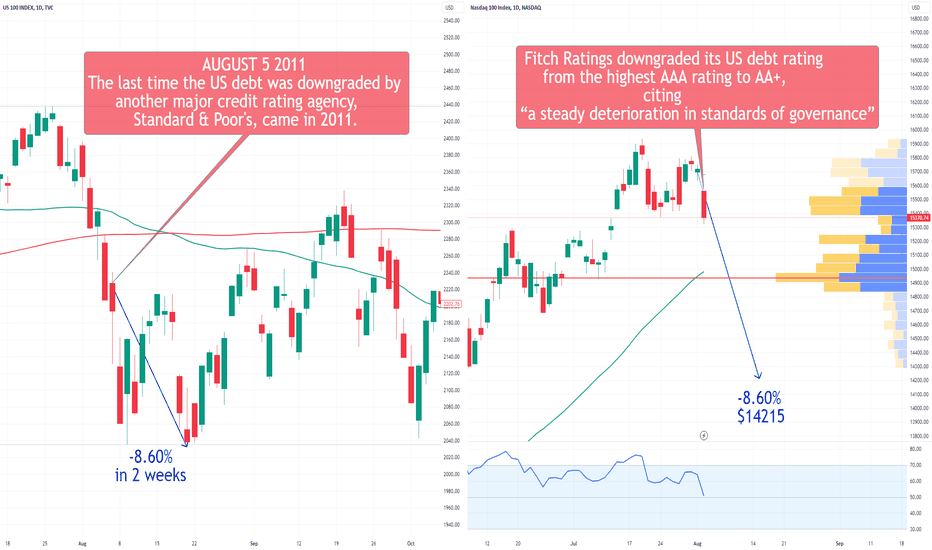

NDX Nasdaq100 Fell 8.60% After the Last U.S. Credit Downgradeitch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance."

This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default.

In the past, a similar credit downgrade had a significant impact on the NDX, which fell 8.60% in just two weeks. Back in August 5, 2011, Standard & Poor's, one of the major credit rating firms, downgraded U.S. debt after another major debt ceiling battle.

Jim Reid, a strategist at Deutsche Bank, pointed out that while the news of Standard & Poor's being the first to downgrade 12 years ago was substantial, investors had already adjusted their perceptions of the world's most important bond market, recognizing that it was no longer a pure AAA. Nonetheless, Fitch's recent decision to downgrade is still significant.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, reaching its highest level since November 2022.

As for the price target for this year, it remains at $16650, as shown in the chart below:

Looking forward to read your opinion about it!

SPX S&P 500 Fell 10% After the Last U.S. Credit Downgrade !!!Fitch Ratings made a significant move by downgrading the US debt rating on Tuesday, shifting it from the highest AAA rating to AA+. The downgrade was attributed to a "steady deterioration in standards of governance." This decision followed intense negotiations among lawmakers to reach a debt ceiling deal, which posed a risk of the nation's first default.

The S&P 500 experienced a notable decline of 10% within three months after the previous U.S. credit downgrade. The downgrade occurred on August 5, 2011, by Standard & Poor's, one of the major credit rating firms, following another intense debt ceiling battle. The day after the S&P downgrade, the S&P 500 suffered a nearly 7% drop, dubbed "Black Monday." Subsequently, the benchmark index declined by 5.7% that month and an additional 7.2% in September.

Jim Reid, a strategist at Deutsche Bank, emphasized that the 12-year-old news of S&P being the first to downgrade was significant, allowing investors to adjust their perceptions of the world's most important bond market, which was no longer considered pure AAA. Nonetheless, Fitch's recent decision to downgrade remains impactful.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, the highest since November 2022.

As for my price target for this year, it remains at $4900, as illustrated in the chart provided below:

Looking forward to read your opinion about it!

RUT 2K Price Prediction for 2024If you haven`t bought the Double Bottom on RUT 2K:

Then you probably know that small caps haven`t participated in the 2023 market rally.

That`s why I believe investors will will for opportunities in the small cap stocks in 2024, and Russell 2000 index might offer a bigger return than the S&P this year.

My price prediction for RUT 2K is $2560 by the end of the year.

QQQ Nasdaq 100 ETF Price Prediction for 2024This was my price prediction for QQQ in 2023. I was bullish, but not enough:

Considerations about 2024:

In the July 2023 meeting, the FOMC chose to raise interest rates to a range of 5.25%–5.50%, marking the 11th rate hike in the current cycle aimed at mitigating heightened inflation. The prevailing consensus among market experts hints at a potential shift in strategy, suggesting that the Fed might commence rate cuts later in 2024 as inflation gradually aligns with the Fed's 2% target. Statistically, historical data indicates that approximately 11 months after the cessation of interest rate increases, a recession tends to manifest. This pattern places us around June 2024, aligning with my prediction of a dip in the QQQ to approximately $370.

Given that 2024 is an election year, there's an additional layer of complexity in predicting market behavior. Despite the anticipated mid-year dip, my inclination is that the QQQ will conclude the year on a bullish note. This optimistic outlook hints at the onset of a 3-5 year AI bubble cycle, with the QQQ boasting a year-end price target of $460.

The integration of artificial intelligence into various sectors is expected to catalyze market growth and innovation, propelling the QQQ to new heights by the close of 2024.

DXY - The Leading Index For 2024Hello Traders, welcome to today's analysis of Dollar Index.

--------

Explanation of my chart analysis:

DXY (Dollar Index) has been forming a triple bottom all the way back in 2008 and has been rising ever since. With the recent break above the psychological $100 level, the DXY is once again confirming the bullish strength. If DXY doesn't break below this area, I am targeting new swing highs.

--------

I will only take a trade if all the rules of my strategy are satisfied.

Let me know in the comment section below if you have any questions.

Keep your long term vision.

US500 - Potential Bearish Momentum ❗️Hello TradingView Family / Fellow Traders,

In accordance with my latest analysis, which is attached to the chart, we have been anticipating a rejection of the all-time high.

📉 For the bears to assume control and confirm the beginning of the correction phase, a break below the last major low highlighted in red is required.

Meanwhile, until the bears take control, US500 would remain bullish and could still move within the green all-time high zone.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Breakout in Dow Jones Industrial Average (DJI)...Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. Please consult your financial advisor before taking any trade.

BTC Expectations for the new year, one mfin ride. More below! BTC has shown bullish willingness. I anticipate the new year to visit the lows around 25K, and the quarterly FVG, I will be there to accumulate some. Market might decide not to even go there and just fill the inefficiency at 32K and decide to moon from there. I'd worry about BTC if we close below 19K and stay there for over a couple of days. I'm not a Crypto bull but I'm for sure a Fiat bear so it forces me to be a crypto bull to a certain extent. If the ETF goes through and it most likely will, I expect volatility but eventually the highs around 65K will get swept. I highly doubt they're safe and I want a piece of the cake. With a bearish TVC:DXY and a bearish outlook on the future of fiat in general, we might see crazy numbers on BTC. I will keep the idea updated as the market tips its hand. let's enjoy the ride.