Massive GER30 Short 1. This trade is at an all-time high and has made a double top on weekly with massive divergence

2. H4 is overbought and has a double top with divergence as well

3. This will indicate a fall until H4 is oversold to compensate for the sharp movement up

4. Stop loss of 250 pips

5. There is a Deep Crab pattern on M15

Index

US30: Local Bearish Bias! Short!

My dear friends,

Today we will analyse US30 together☺️

The market is at an inflection zone and price has now reached an area around 41,170 where previous reversals or breakouts have occurred. And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 41,039..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

US100 WILL GO DOWN|SHORT|

✅US100 price grew again to retest the resistance of 20,300

But it is a strong key level

And we are already seeing

A local bearish pullback

So I think that there is a high chance

That we will see a bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX Correction Ahead! Sell!

Hello,Traders!

DAX is trading in a strong

Uptrend but the index is

Locally overbought so after

The retest we will be expecting

A local pullback and a

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY (Dollar index) Shorts from 1hr supply zone My general outlook on the DXY this week leans bearish, as I expect price to continue trending lower. I’ve identified a nearby 1H supply zone, where we could see price react and begin pushing lower. There is also a larger supply zone further above, but it’s currently out of reach unless price pulls back significantly.

Looking back, the 2-day demand zone I marked over a week ago has played out well, with a strong bullish reaction from that level — price is still rising from that zone. During this move, a new 11H demand zone has formed, which also led to a change of character to the upside. If price revisits that zone, we may see another bullish continuation from there.

Key Points:

Overall bearish trend expected to continue in the short term.

1H supply zone nearby is a potential trigger point for a sell-off.

2D demand zone previously marked is still holding and influencing price.

11H demand zone has caused a bullish shift and could provide another long opportunity if price returns.

P.S. This is my general DXY outlook for the week. I don’t trade the dollar directly, but I use it as a key confluence when analysing and executing trades across other major pairs.

DXY Will Fall! Sell!

Hello,Traders!

DXY keeps strengthening

These last days and the index

Has almost reached a horizontal

Resistance level of 100.500

From where we will be expecting

A local bearish pullback and

A local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

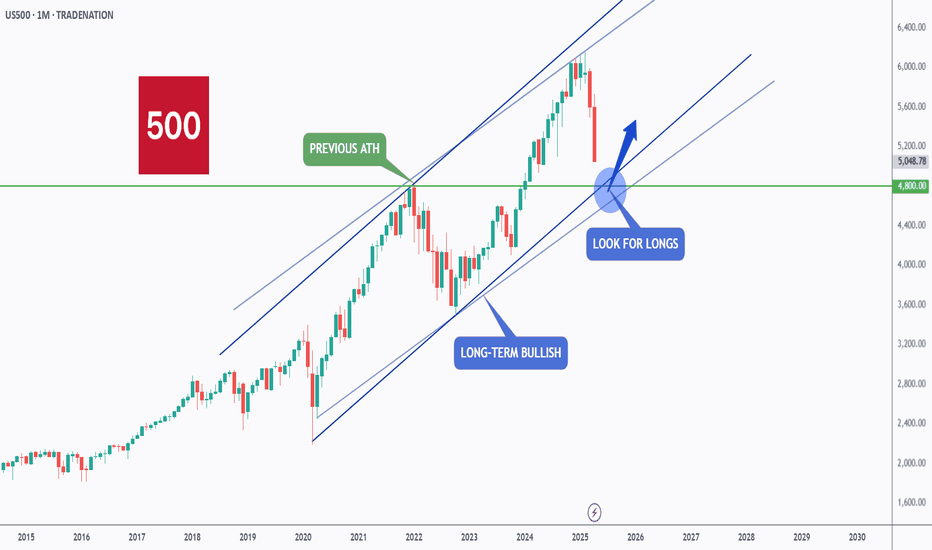

US500 - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting its previous all-time high at $4,800 and round number $5,000.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of previous ATH and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$JPINTR -BoJ Holds Rates but Cuts GDP Growth Outlook (May/2025)ECONOMICS:JPINTR

May/2025

source: Bank of Japan

-The Bank of Japan (BoJ) kept its key short-term interest rate at 0.5% during its May meeting, in line with expectations.

The unanimous decision came amid growing concerns over the impact of U.S. tariffs.

In its quarterly outlook, the BoJ slashed its FY 2025 GDP growth forecast to 0.5%, from January’s estimate of 1.0%.

The growth outlook for FY 2026 was also lowered to 0.7% from the prior forecast of 1.0%.

US30 LOCAL SHORT|

✅DOW JONES is going up now

But a strong resistance level is ahead at 40,947

Thus I am expecting a pullback

And a move down towards the target of 40,314

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Price Action + Fundamentals Point to Dollar StrengthThe current market environment presents compelling evidence for a bullish move in the US Dollar Index (DXY). While some patience is required, the setup is increasingly favorable for the dollar to appreciate in the coming weeks and months.

Key Factors Supporting a Bullish Move:

Monthly Close Above 100.160:

A critical technical level to monitor is the monthly close above 100.160. If achieved, it would signal a strong bullish breakout, setting the stage for a continuation higher. Given current price action and market dynamics, this scenario looks highly probable. However, if the price fails to close above 100.160 and instead breaks below it, we could potentially start looking for short opportunities.

Bond Market Strength (30Y, 10Y, 5Y):

This past week, we witnessed notable strength across the US bond market. Yields declined as prices rose, typically a positive signal for the dollar as it reflects capital inflows into US assets.

COT Report Insights:

The Commitment of Traders (COT) report reveals a critical shift: commercial traders, often considered the "smart money," are beginning to accumulate long positions in the dollar. This change in positioning historically precedes significant bullish moves.

Seasonal Patterns:

Seasonality also favors the dollar during this period. Historically, the dollar tends to strengthen in the mid-year months, aligning perfectly with the current technical and fundamental landscape.

Targets:

Initial Target: 106.120

Given the accumulation signs and supportive macro backdrop, a move towards 106.120 seems very realistic.

S&P 500: Key Levels and Potential ScenariosThis analysis of S&P500 will explore both bullish and bearish scenarios, incorporating key levels and considering possible market and crowd psychology.

Bullish Scenario: Potential Uptrend Resumption

From a bullish perspective, if the S&P 500 maintains a position above the 5482 level, it could suggest a potential end to the current correction and a resumption of the major uptrend. A hold above 5482 might reinforce bullish sentiment, encouraging further buying activity, as traders may view this as confirmation of renewed strength. The index could then potentially retest the 5801 level, where it's possible that the index may encounter resistance on the first attempt. A successful break above 5801 would then open the path towards the 6135 zone, which represents a key upside target.

Bearish Scenario: Potential Retest of Support Zones

Conversely, if the S&P 500 fails to hold above the 5482 support level might trigger increased selling pressure, as traders liquidate positions. The index could then potentially retest the 5092 to 4833 support zone. This zone represents a critical area where buyers may step in, but a break below it would signal further weakness.

Concluding Remarks

In conclusion, the S&P 500's price action around the identified key levels will be crucial in determining its short- to medium-term direction. A sustained hold above 5482 could favor a bullish continuation towards 5801 and potentially 6135, while a break below 5482 might lead to a retest of the 5092 to 4833 support zone.

Seems like Bearish Divergence is somewhat Sync now.

Closed just above Weekly Trendline Support

(i.e. above 115000)

as mentioned during last week.

However, the Daily Candle Closed below the

Trendline Support; that means 116000 is the

Immediate Resistance that needs to Cross &

Sustain.

In case of Selling, we may witness 112800 - 112900

as Important Support.

DAX WILL FALL|SHORT|

✅DAX has been growing recently

And the index seems locally overbought

So as the pair is approaching a horizontal resistance of 22,444

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Analysis of Nasdaq 100 (US100) based on Price ActionThis analysis examines the recent price action of the Nasdaq 100 (US100) and identifies potential scenarios based on key technical levels.

Current Situation:

The price has recently moved above a short-term downtrend line, which could indicate a shift in momentum. This development suggests a possibility of upward movement.

Potential Bullish Scenario:

A decisive break and sustained close above the recent resistance level of 19,224 may open the door for further gains. In such a scenario, the index might target the 20,329 level. A successful move beyond that could potentially lead to a test of the historical peak at 22,245.

Potential Bearish Scenario:

Conversely, if the index fails to overcome the 19,224 resistance, there is a chance it could retest previous support levels. These levels are identified at 17,592 and, subsequently, at 16,322.

Conclusion:

The US100 is currently at a critical juncture. The ability of the price to sustain a move above 19,224 may determine its short-to-medium-term trajectory. Both bullish and bearish scenarios remain possible, and traders should monitor price action closely around these key levels.

DAX Resistance Ahead! Sell!

Hello,Traders!

DAX is trading in a strong

Uptrend, recovering itself

From the trade-war lows

And the index is locally

Overbought so after the

Retest of the horizontal

Resistance above at 22,500

We will be expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Graveyard Of Hope!The Graveyard of Hope is littered with "Buy The Dippers."

How many times can "Buy The Dippers" lick the stove before they finally learn their lesson not to believe anything Trumpchenko says?

The Elona MAGA algorithm goes like this

Over promise

Under deliver

Lie

Declare victory

Leave or Victim Blame

Meanwhile, the economy falls into an economic recession/depression abyss!

I am A political. I call it as I see it. My religion is Economics, Charts, and money. They don't lie!

Click Boost, follow, and subscribe. Let's get to 5,000 followers so I can help more people navigate these crazy markets.

Don't smoke the hopium crackpipe. It will financially ruin you.

DXY BEARISH BIAS|SHORT|

✅DXY is trading in a downtrend

And the index is making a local

Bullish correction so after the

Resistance is hit around 100.500

We will be expecting a local

Bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Europe Vs US Break Out!This chart suggests huge long-term implications after breaking for the 2nd time this 16-year downtrend. EU since Trump took office has outperformed the US by 23%!

More than half of that has occurred since the ambush on Zeleneskyy in the Oval Office.

While no new high has been made yet to confirm, it is noteworthy that money may be flowing toward the EU more than the US for a decade or more.

EU has a much lower debt to GDO at 80% than the US at 125%. Stock valuations are much more attractive than in the US. So much so that I labeled the EU as a value trap. Not anymore!

The biggest obstacle right now is how much would a US recession impact the EU. Even if it does, I expect the EU to perform much better than the US. As such this chart should continue to outperform.

I have another post up you may want to follow.

META Screaming CAUTION!The hardest thing is to call a short in a recession-proof stock, especially in the tech space. However, only so many dollars are available in the advertisement space, and it can't go up forever. Make this excuse at any price.

As such, I rely on the chart screaming CAUTION!

Again like most of my trade setups, this is a simple trade.

Bulls should take their profits and smile.

Bears short as high as possible with the internet to short more should it form a double top.

The chart has spoken. Like it or not.

Remember I am a macro trader so don't expect tomorrow to play out. My trades take time but have much bigger moves. ;)

MARKETS NOT OVERSOLD CAUTION!While only 36% of stocks are over the 20-day MA, they are nowhere near oversold conditions. As such, there is still room for the downside.

While this indicator is only suitable for short-term trading, tomorrow new making event could push markets way lower.

While I would not suggest trading news events. I know some do, as such bottom picking is not advisable.

CAUTION!

DXY / Dollar Index Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (103.300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (101.700) Day / Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

💰💸💵DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩