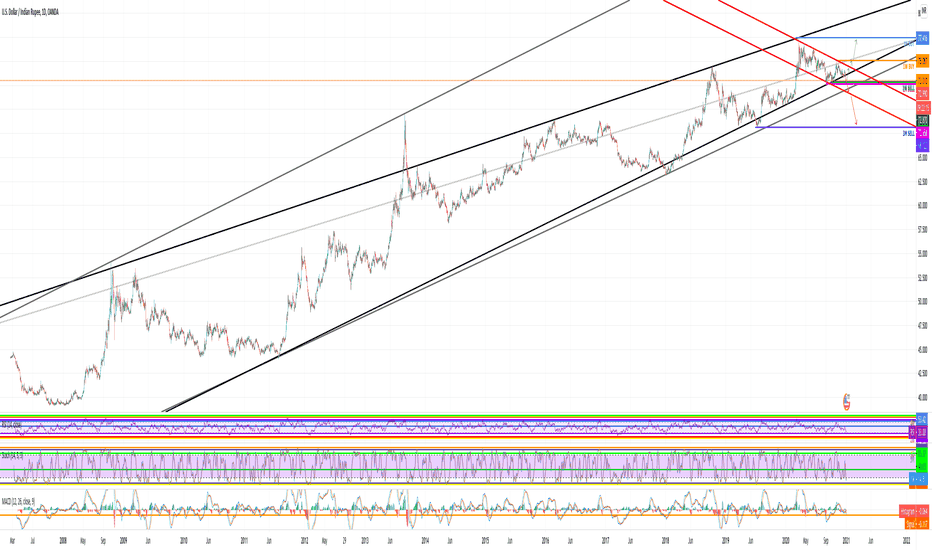

USDINR STRONG IMPORTANT LEVELHello friends,

First, I love India and the Indian people. I made an analysis for the Indian rupee and I think it is on a very important level now. You see the huge rising channel, in which a small falling one is formed. I have indicated the important levels on monthly and weekly charts, which were just hit. We saw a strong rejection from these levels, which means that the price is struggling to fall down further. If the daily candle closes today with a bullish candlestick pattern, I drew the path upside. However, my opinion is that we would only make a price correction in order to break those levels and fall further. Downside levels are really strong and if those are broken we might see a massive crash of the price. I advise you to follow the fundamental analysis of the Indian economy because it is an integral part of this trade. I will also upload pictures under this trade in order to see closer daily candle and fibonacci levels. I will update this trade and follow it closely!

This information is not a recommendation to buy or sell. It is to be used for educational purposes only.

Namaste! I wish you all the best and bags of profits during the new year.

India

NIPPON LIFE INDIA ASSET MANAGEMENT LIMITED - CHART ANALYSIS📊 Script: NAM_INDIA (NIPPON LIFE INDIA ASSET MANAGEMENT LIMITED)

📊 Nifty50 Stock: NO

📊 Sectoral Index: N/A

📊 Sector: Financial Services

📊 Industry: Asset Management Company

📈 There is crossover at MACD.

📈 Doble Moving Average Crossover.

📈 Trading at upper band of BB.

📈 Right now RSI is around 60.

✅ BUY ABOVE - 300

🟢 Target 🎯🏆 - 336

⚠️ Stoploss ☠️🚫 - 279

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

MH Indicator: Intra-day case study- Nifty 50 Vs. HULDuring the month of October 2022 (30 September 2022 to 25 October 2022), the pair strategy of Nifty 50 Vs Hindustan Unilever (HUL) was executed in the Future segment for which a total investment of INR 3,00,000 was required. MH Indicator was used for identifying the opportunities of Buying one asset (under valued) and simultaneous Selling of another asset (over valued) and vice-versa. The details of execution of strategy have also been duly marked in the chart given above.

Results: The pair strategy gave a return of 8.09% (Profit 24,275).

However, the return on Nifty was only 3.17% and on HUL it was -6.29%

NIFTY short term bearish target 16000 Nifty is bouncing off on a critical support 200 SMA and lower end of the channel. If it breaks below the 200 SMA and lower end of channel, expect it to test the gap fill levels 17016, 16641, 16340, 16049 eventually 16000. Timing the 16000 target is difficult but I expect it to hit before 2022 end or earlier. On flip side if earnings are good and dollar prices fall down, we can expect 19000 soon.

NIFTY is looking Bearish🤑 Nifty is likely to be Bearish till it's below 17375.

❓ Reason: Because Trailing Stop Loss is above the Price of Nifty in ATM Machine Indicator Hourly Chart.

🚧 Dowside Hurdles: 17245, 17115, 16980.

🌈 Advice: 1.) Take reversal trade near these levels, or 2.) Wait for Breakout and Sustainability.

🔴 Positional Trend is Negative.

🟡 Long Term Trend is Neutral.

📢 Disclaimer: We are NISM Certified so we don't hold any position in Nifty Future or Options as per SEBI guidelines. Take trades as per your own technical analysis, we are just educating you. We are not using any type of indicators for finding out of levels.

🙏🏻 Come to Learn, Go to Earn🙏🏻

✅ We are NISM Certified. ✅

☔If you find us useful, Please help the helpless near you.☔

☺Happy to Help.☺

TCS Mid term Bearish Channel - Target 2810, 2700 and 2458. TCS is currently oversold, and might see technical bounce 3229 short term. But mid term trend has been bearish and we could see TCS hitting lower prices while have technical bounces on the way. Parallel channel trending towards, price will test lower end of the channel, expect levels 2810, 2700 to break and gap fill at 2458 . Projecting time with target is difficult, but expect this to happen in next 3-6 months or even earlier.

Largest car company in India - Maruti SuzukiBased on Market share and Turnover Maruti Suzuki is the largest car company in India with a market share of ~45%, nearly half of the cars sold in the country.

Some macro...

If India's economy continues to grow as predicted, by 2025 the Indian middle class will number 583 million people, or 41 percent of India's projected population,1 almost twice the current population of the United States (Columbia.edu).

India’s real GDP is projected to grow at 9% in both 2021-22 and 2022-23 and at 7.1% in 2023-24. This projects India as the fastest growing major economy in the world in all these three years.

Source: Ministry of Finance

India has the third-largest group of scientists and technicians in the world and the population of India is expected to rise from 121.1 cr to 152.2 cr during 2011-36 an increase of 25.7% in twenty five years.

Source: National Commission on Population, Ministry of Health & Family Welfare

Nifty 50 vs S&P 500:

Website:

www.marutisuzuki.com

This a long term hold

Why is Anil Ambani’s Reliance Power up 40%? Shares of Reliance Power (NSE: RPOWER) have been volatile after the Indian electric company secured a long-term debt agreement for up to 12 billion rupees ($150.4 million) from private equity firm Varde Partners, a US based investment firm focused on distressed assets in India.

RPOWER announced the deal on Sept. 5, sending its shares surging and at close of trading, the company stock price had risen 9.9% to 23.30 rupees. On Sept. 6, the company’s stocks dropped 6.0% at close of trading to 21.95 rupees.

The abrupt increase in Reliance Power's stocks, albeit short lived, elicited a warrant for explanation from the National Stock Exchange of India Ltd. and BSE Ltd. In its response, the company said it couldn't comment on the price movement and assured that it will make an announcement when necessary.

Perhaps more alarming is the climb in RPOWER’s share price before the announcement. In the two days before the announcement was confirmed, RPOWER’s shares climbed 37%.

Reliance's Power in India

Reliance Power is an electric power generation, transmission and distribution company based in Mumbai, India. It is the country's leading private sector power generation and coal resources company with one of the largest portfolio of power projects in the private sector, based on coal, gas, hydro and renewable energy. It has an operating portfolio of 5,945 megawatts.

A member of the Reliance Group conglomerate, the power company has a market capitalization of $992.8 million. In the quarter ended June 30, the company recorded a loss attributable to owners of its parent at 708.4 million rupees against a profit of 122.8 million rupees in the prior-year period.

To support its future plans, the company is considering raising fresh capital from both domestic and international investors. Apart from the recent agreement with Varde Partners, Reliance Power is considering an issuance of equity shares, equity-linked securities or convertible warrants to amass funds that it can utilize in the long run. The company's board will meet September 8 to consider future fund-raising plan.

Operating Within the Ambani Conglomerate

Reliance Power forms part of the Reliance Anil Dhirubhai Ambani Group, which is founded majority-owned by Anil Dhirubhai Ambani. Anil is also the chairman of Reliance Power.

Anil is the youngest son of Indian billionaire Mukesh Ambani, the chairman and managing director of Fortune 500 company Reliance Industrial (NSE: RELIANCE), which is also the most valuable company in India.

The brothers divided their father's business empire a decade ago. While Mukesh, who was Asia's richest man until fellow Indian billionaire Gautam Adani surpassed him, continued expanding his businesses, Anil is currently having troubles with companies defaulting and being put under administration. Nikkei Asia reported that Anil even declared himself to have a personal net worth of zero.

Reliance Power's affiliate, Reliance Capital, is currently on the market with an investor group including the Hinduja Group and Oaktree Capital offering 45 billion rupees for the diversified financial services company, Economic Times of India reported. Also on offer are India's fifth-largest privately owned general insurance company, a stockbroker, a stake in an asset manager and Reliance Capital's 51% share in a life insurance venture with Japan's Nippon Life, among other assets.

While it is yet to be seen if the current troubles of its affiliates will spill through Reliance Power, its recent loss will definitely not boost investor confidence. Furthermore, the company's fundraising initiatives are hardly proving that it is in a very secure position in terms of capital.

Short term pick for upto 100% returns.NSE:NAZARA

one of the best companies at very cheap valuation we can see a gap on the chart which shows us high selling level from upside and now we have also seen high buying level so we can consider a buy side from this level for target of previous selling level.

Edelweiss Fin Services Bullish Scenario Bullish outlook on Edelweiss. This could potentially be a turning point from the weekly chart, resulting in this market shirting into a 'buy program' and seeking high prices.

The eye symbol resides above old highs - a place where liquidity would be resting in the form of buy-stops. Think of the sellers who are making money selling short, were would there stops be? Exactly, where old highs reside! Those are our short term targets.

Interesting to see what happens.