BANKNIFTY Double Bottom BreakoutThe idea here is about Bank Nifty:

My view is Neutral for the below observed technical factors.

Points as per TA observed on a Weekly daily & Hourly Chart:

1. Cup & Handle formation completed awaiting breakout as per below:

2. Doji candle formation on weekly chart as per below:

3. Bearish Bat harmonic pattern completed on a daily & Hourly chart as per below:

4. Double bottom pattern completed on 1H chart & 07th Nov market opened with breaking the neckline, price was pushed below the neckline in 1st Session, However, price recovered & the day closed above neckline as per below :

5. Divergence observed on 1H chart for RSI, Commodity Channel Index & Momentum as per below:

6. Trading way above 20& 200 EMA on a weekly, daily & 20 EMA support established on hourly chart at the time of publishing.

7. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a weekly, daily & hourly is very strong upward momentum at the time of publishing.

8. RSI is at 66.86 on a weekly Chart, 64.76 on daily & 65.77 on hourly chart at the time of publishing.

9. MACD almost way above signal line on weekly, daily & hourly chart at the time of publishing.

Projected Targets: Double Bottom & Bearish Bat harmonic pattern provided in chart.

Stop Loss: provided in chart.

Entry point: If price sustains above the double bottom neckline in the next trading session then long entry can be confirmed. If price breaks below the double bottom support short entry can be confirmed.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So

Please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & subscribe for more analysis. The more boost & comments further more motivation for publishing.

Let the Trading community & family know about your opinion with comments.

Cheers.

Indianstockmarket

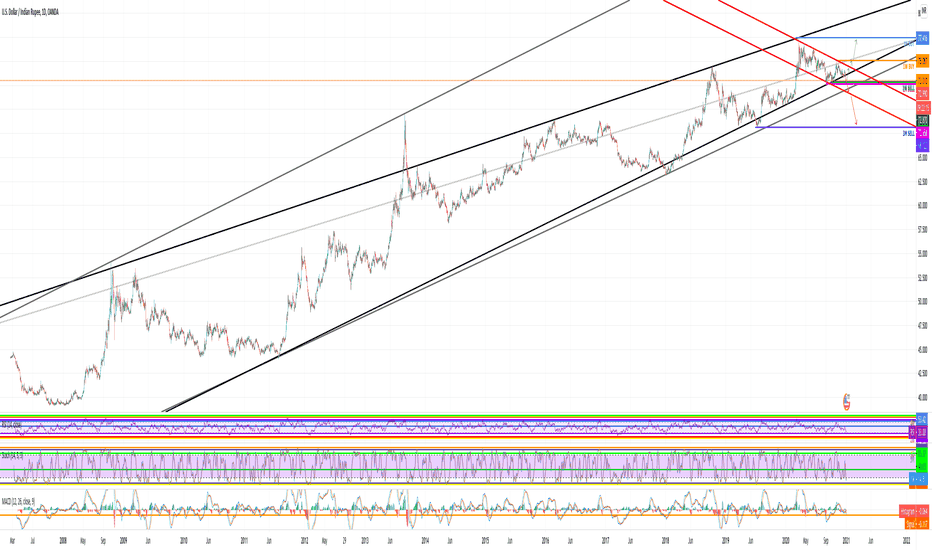

USDINR STRONG IMPORTANT LEVELHello friends,

First, I love India and the Indian people. I made an analysis for the Indian rupee and I think it is on a very important level now. You see the huge rising channel, in which a small falling one is formed. I have indicated the important levels on monthly and weekly charts, which were just hit. We saw a strong rejection from these levels, which means that the price is struggling to fall down further. If the daily candle closes today with a bullish candlestick pattern, I drew the path upside. However, my opinion is that we would only make a price correction in order to break those levels and fall further. Downside levels are really strong and if those are broken we might see a massive crash of the price. I advise you to follow the fundamental analysis of the Indian economy because it is an integral part of this trade. I will also upload pictures under this trade in order to see closer daily candle and fibonacci levels. I will update this trade and follow it closely!

This information is not a recommendation to buy or sell. It is to be used for educational purposes only.

Namaste! I wish you all the best and bags of profits during the new year.

NMDC Harmonic & downtrend Potential BreakoutThe idea here is about NMDC:

NMDC Limited (NMDC) is an India-based iron ore producer and exporter. The Company operates in two business segments: iron ore and other minerals and services. The Company is engaged in the exploration of a range of minerals including iron ore, copper, rock phosphate, lime stone, dolomite, gypsum, bentonite, magnesite, diamond, tin, tungsten, graphite, and beach sands.

My view is very bullish for the below observed technical factors & News.

NEWS: MCA (Ministry Of Corporate Affairs) has approved the demerger of NMDC steel from NMDC with ratio of 1:1. Do your own research for more information.

Points as per TA on a Weekly & daily Chart:

1. Currently under downtrend & support has been re established @ 129.00 on a weekly chart as per below:

2. Gartley Harmonic Pattern completed with confirmed entry & target 1 completed at the time of publishing on a weekly chart as per below:

3. Bearish Nen Star Harmonic CD leg under progress on a weekly chart as per below:

4. Trading way above 20 & 200 EMA on a weekly chart & 20 EMA cross over expected soon.

5. Trading above 20 & below 200 EMA on daily chart.

6. Bullish flag pattern on weekly chart observed as per below:

7. Multiple divergence confirmed in the same direction on weekly chart as per below:

8. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily is neutral, weekly is strong downtrend & monthly chart is consolidating at the time of publishing.

9. RSI is at 51.46 on a weekly Chart and 53.56 on daily chart at the time of publishing.

10. MACD above signal line on weekly & below signal line on daily chart.

11. Hull Moving average on daily & weekly is a sell and other moving averages on a daily,weekly & monthly chart is a buy.

12. ADX (Average directional index ) trend strength is at 20.53 on a weekly, which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) and 25.32 on a daily chart.

Projected Target with %: Provided in the chart as per Gartley & Bearish Nen Star harmonic pattern.

Stop Loss: Provided in the chart as per Gartley.

Note : Any further dip can be considered to accumulate & Average it down.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

Godfrey Phillips Possible BreakoutThe idea here is about Godfrey Phillips:

Godfrey Phillips India Ltd. operates as a holding company. It engages in the manufacture and marketing of tobacco related products. The firm operates through the following segments: Cigarette, Tobacco and Related Products and Retail and Related Products. Its cigarette brands include Marlboro, Red & White, Cavanders, Four Square, Stellar, and North Pole and Tipper.

My view is bullish short term(Swing trade) for the below observed technical factors.

Points as per TA on a Weekly Chart:

1.Contracting or Symmetrical Triangle formation on a weekly chart as per below:

2. Double Bottom formation on a weekly chart as per below:

3. Possible Bearish Gartley harmonic pattern in progress at the time of publishing as per below:

4. Ichimoku cloud Senkou Span A support established on weekly chart as per below:

5. Support established on 20 EMA & trading way above 200 EMA on a weekly chart as per below:

6. Trading above 20 & 200 EMA on daily chart.

7. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily, weekly & monthly chart is Strong for an upward momentum at the time of publishing.

8. RSI is at 52.44 on a weekly Chart and 53.73 on daily chart at the time of publishing.

9. MACD above signal line on weekly & daily chart.

10. Hull Moving average and other moving averages on a daily,weekly & monthly chart is a strong buy.

11. ADX (Average directional index ) trend strength is at 10.69 on a weekly and 8.70 on a daily chart which indicates a absent or weak trend ( ADX between 0-25 is a Absent or weak trend).

Projected Target: provided in the chart.

Stop Loss: Provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

NIFTY Weekly Volatility Forecast 31/10 - 04/11 2022 NIFTY Weekly Volatility Forecast 31/10 - 04/11 2022

Currently the volatility for this week is around 2.21% , down from expected 2.23% last week.

According to ATR calculation, currently the volatility is located around 3th percentile.

Under this circumstances the expected movement of the candle is :

BEAR : 1.609% from the opening point of the weekly candle

BULL : 1.909% from the opening point of the weekly candle

At the same time, currently there is 33.9% that the movement within this weekly candle is going to

break and close either above or below the next channel:

TOP: 18309

BOT: 17510

Lastly, taking into account the previous weekly high and low there is a :

75% chance that we are going to touch the previous week high

25% chance that we are going to touch the previous week low

Chart Patterns - Bear Market Scenario Hi there,

i have been sharing the chart patterns which are seen on any type of price charts. (CANDLESTICK CHART) and after research and experience, i see that the price move via various ways or concepts.

as per my experience, i see that the price move via waves & correction, and react to supply and demand levels. please share it and one may need it. and this is seen any type of instruments like stocks, forex, commodities, Futures & options. crypto. etc. in time frame for BEAR MARKETS ONLY.

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

Tradelikemee Academy

JPPOWER Wait for Bulls & Trend ReversalThe idea here is about Jai Prakash Power Ventures:

Jai prakash Power Ventures Ltd. engages in the generation of power. It operates through the following segments: Power and Transmission, Coal, and Other. The Power and Transmission segment includes generation, sale, and transmission of power. The Coal segment refers to the coal mining for captive use in energy generation. The Other segment consists of cement grinding.

My view is short term bearish & long term Bullish for the below observed technical factors.

Points as per TA on a Monthly, Weekly & daily Chart:

1. Contracting or symmetrical triangle formation observed with ABCD completed and expected move towards E on Elliott’s triangle pattern on a weekly chart as per below:

2. Cup & Handle formation observed on a Monthly chart & under ranging market at the time of publishing as per below:

3. Bearish Anti Butterfly Harmonic pattern completed swing target 2: A Swing = 6.45 which is also contracting or symmetrical triangle support zone as per below:

4. Bullish Gartley Harmonic Pattern CD leg in progress, min & max XD distance on Fib is 0.786 for Gartley which is 6.30. Which is also approx to contracting or symmetrical triangle support zone & Target 2 on Bearish Anti Butterfly Harmonic Pattern as per below:

5. Possible Inverse Head & Shoulder Pattern observed & price to be rejected @ 8.50 due to resistance zone & Bearish Anti Butterfly B point on a weekly chart as per below :

6. Elliott’s Bullish triangle ABCD points completed and Price direction towards E point on a weekly chart as per below:

7. Possible Head & Shoulder pattern observed on daily chart with support zone @ 6.75 as per below:

8. Trading way above 20 & 200 EMA on a weekly chart & 20 EMA cross over expected soon.

9. Trading above 200 EMA & 20 EMA Support on weekly chart.

10. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily & weekly is strong uptrend & monthly chart is consolidating at the time of publishing.

11. RSI is at 54.17 on a weekly Chart and 49.44 on daily chart at the time of publishing.

12. MACD above signal line on weekly & daily chart, However it is converging towards signal line on weekly chart.

13. Hull Moving average on daily is a sell and other moving averages on weekly & monthly chart is a strong buy.

14. ADX ( Average directional index ) trend strength is at 23.43 on a weekly & 11.70 on daily chart, which indicates a absent or weak trend ( ADX between 0-25 is a Absent or weak trend).

Projected Target with %: Wait for bulls to take over once the price hits 6.60 to 6.45 and enter long since the Risk to Reward looks damn good(Final % provided in chart), since the Earnings report which was on 22nd Oct 2022, looks good this week will give more clarity on Entry points,

Stop Loss: Entry only once we have confirmation for long.

Note: Any dip can be considered as accumulation.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

IRCTC Potential BreakoutThe idea here is about IRCTC:

Indian Railway Catering & Tourism Corp. Ltd. provides railway related services. It engages in Catering and Hospitality, Internet Ticketing, Travel and Tourism.

My view is bullish (Swing trade) for the below observed technical factors.

Points as per TA on a weekly & daily chart:

1.Falling wedge pattern observed on a weekly chart & near the breakout point as per below:

2. Cypher Harmonic completed on weekly chart at the time of publishing as per below:

3. EMA 20 support established on weekly chart as per below:

4. Trading above 20 & 100 EMA on daily chart at the time of publishing.

5. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily & monthly chart is Neutral & Weekly is strong downtrend and weak at the time of publishing.

6. RSI is at 55.36 on a weekly Chart and 58.75 on daily chart at the time of publishing.

7. MACD Just crossed signal line on daily chart which is a signal for upward momentum as per below:

8. MACD way above signal line on weekly chart.

9. Hull Moving average and other moving averages on a daily,weekly & monthly chart is a strong buy.

10. ADX (Average directional index ) trend strength is at 11.81 on a weekly and 14.09 on a daily chart which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) However, the trend seems to be picking up.

11. Enter long position once the breakout is confirmed with retest on daily/weekly chart as per below:

Projected Target with % : provided in the chart as per Cypher harmonic pattern.

Stop Loss: Provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

Shree Renuka Sugar Clean BreakoutThe idea here is about Shree Renuka Sugar:

Shree Renuka Sugars Ltd is a fully integrated player focused on manufacturing and marketing of sugar, power and ethanol. The Products portfolio of the company includes: Sugar, the company manufactures refined sugar confirming to EU standards it is the higher end product consumed by European and African Countries and is also used for Industrial purpose.

1. Broken out of Symmetrical Triangle & retested with heavy volume at the time of publishing.

2. Navarro 200 Advanced harmonic completed from 26th May to 20th June 2022.

3. Trading above 20 & 200 EMA on daily chart.

4. Kumo Breakout & Kumo Twist on a daily chart is Strong for an upward momentum.

5. RSI is at 69.59 on a Daily Chart at the time of publishing.

6. MACD Way above signal line on daily chart.

7. Hull Moving & other moving average is a strong Buy Daily, Weekly & monthly chart.

8. Long Entry confirmed Target 1 achieved.

Projected targets as per Navarro 200 & Symmetrical triangle provided in the chart.

Stop Loss: provided in chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

JP ASSOCIATES WEEKLY TIME FRAME#JP ASSOCIATES....

The Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

Tradelikemee Academy

IDBI Bank Ltd Bat pattern Trade Set UpThe idea here is about IDBI Bank Ltd:

IDBI Bank Ltd. engages in the provision of commercial banking services to retail and corporate customers. It operates through the following segments: Corporate and Wholesale Banking; Retail Banking; Treasury; and Other Banking and Group Operations. The Corporate and Wholesale Banking segment includes corporate relationship covering deposit and credit activities other than retail, as well as corporate advisory and syndication, project appraisal, and investment portfolio.

My view is bullish (Swing trade) for the below observed News & technical factors.

News: There is a potential merger up news in air at the moment of publishing this idea. Do your own research to find out more information.

Points as per TA on a Daily & Weekly chart:

1.Downtrend channel breakout & retested & trading above 200 EMA & 20 EMA support established on daily chart as per below:

2. Trading below 200 EMA & 20 EMA support established on a weekly chart as per below:

3. Anti Cypher pattern completed on weekly chart, Target 1 achieved from entry point & due to lack of momentum or global uncertainty price has been pushed below Target 1. Price has taken support on 20 EMA as per below:

4. Bat Pattern completed on daily chart, Entry point confirmed price towards target 1 as per below:

5. MACD Converging towards signal line on daily as well as monthly chart which is a signal for upward momentum as per below(daily MACD):

MACD above signal line on weekly chart.

6. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily chart is strong upward momentum at the time of publishing. However on weekly it’s neutral.

7. RSI is at 53.68 on a weekly Chart and 52.63 on daily chart at the time of publishing.

8. Hull Moving average and other moving averages on weekly & monthly chart is a strong buy & on Daily Hull Moving average is sell.

9. ADX (Average directional index ) trend strength is at 20.54 on weekly & 16.58 on daily, which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) and 31.81 on monthly chart which indicates a strong trend .The trend seems to be picking up.

10. It is also suggested to keep a look on Bank Nifty, as its taken support on 20 EMA on Weekly and below on daily as per below :

11 Ichimoku cloud is strong upward moment for Bank Nifty on weekly and daily chart as per below :

Projected Target with %: provided in the chart as per Bat Harmonic pattern, coincidentally Target 4 of Bat is almost aligned with Target 3 of Anti Cypher.

Stop Loss: Provided in the chart for Bat .

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

BOROSIL LTD : Potential BreakoutThe idea here is about Borosil Ltd:

Borosil is India's most trusted glassware brand since 1962. Synonymous with heatproof glassware, it is the market leader for consumer glassware in India, USA & Netherlands.

mentioned below are the points to be considered.

Points as per TA on a Hourly, Daily &Weekly Chart:

1. Trading in Ranging Market(Daily chart) since 11th July 2022 after breakout of falling wedge as per below chart:

2. Gartley Harmonic Pattern completed on weekly chart since 23rd August 2021 till 20th June 2022. B Swing completed & momentum heading towards C Swing at the time of publishing as per below chart:

3. Bearish Bat pattern completed on daily chart since 4th August 2022 till 12th September 2022, price may touch B swing on the pattern since 20 EMA is just below the B swing point as per below chart:

4. Cup formation completed on daily & hourly chart since 4th August 2022 till 12th September 2022. Handle formation under process with a downtrend channel on hourly chart. Price did break out of trend on 14th September 2022 between 12.15 PM to 1.15 PM but was rejected as per below chart :

Expecting the price to break through the trend in tomorrow’s session.

5. Trading above 20 & 200 EMA on daily chart & daily chart.

6. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily is Strong buy for an upward momentum. Weekly & Monthly chart is Neutral at the moment.

7. RSI is at 63.94 on a Daily Chart & 58.68 on a weekly chart at the time of publishing.

8. MACD Way above signal line on daily & weekly chart .

9. Hull Moving & other moving average is a strong Buy on Weekly, monthly & sell on daily chart. If price sustains above 362.22 by end of the week then it is a very strong signal for upward momentum.

10. Long entry if price breaks above 379.55 & sustains, then we are in upward momentum. However, keep in watch list for the week & alert for price momentum.

Projected targets provided in the chart.

Stop Loss: Enter only once cup & handle & bearish Bat pattern Break out.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

Hindalco Bearish Move

Possible retest for HINDAlCO INDS. Demand could change into supply.

Sinds the end of March Hindalco has been facing a strong downtrend. Which could be resulting from the high Dividend payout Q1 2022 as investors have taken profit both from the bullish run and it's dividend higher payout.

Approaching the shorter time frames for a more intra-day trade, there is possibility for shorting. The stock's volume is corresponding with a most likely retest, as their is a little barrier occurring right at the previously mentioned formed supply. I recommend a risk reward of 3 due to the enormous selling pressure.

- David van Delden

VIP Industries Clean BreakoutThe idea here is about VIP Industries:

V.I.P. Industries Ltd. engages in manufacturing and marketing of luggage, bags, and accessories. The firm's product includes hard and soft luggage-trolleys; suitcases, duffle bags, overnight travel solutions, executive cases, backpacks, and travel accessories. Its brands include VIP, Carlton, Caprese, Footloose, Alfa, Aristocrat, and Skybags.

My view is bullish (Swing trade) for the below observed technical factors.

Points as per TA on a Daily & Weekly chart:

1.Contracting or Symmetrical triangle breakout & retested on weekly chart as per below:

2. Bearish Crab Harmonic CD leg under formation at the time of publishing as per below:

3. EMA 20 support established on weekly chart as per below:

4. Trading above 20 & 100 EMA on daily chart.

5. Double Bottom formation competed & Neck line breakout completed as per below:

6. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily,weekly & monthly chart is strong upward momentum at the time of publishing. This is a very good signal for upward momentum.

7. RSI is at 62.82 on a weekly Chart and 66.72 on daily chart at the time of publishing.

8. MACD above signal line on daily & weekly chart which is a signal for upward momentum.

9. Hull Moving average and other moving averages on a daily,weekly & monthly chart is a strong buy.

10. ADX (Average directional index ) trend strength is at 10.45 on a weekly which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) and 32.57 on a daily chart which indicates a strong trend .The trend seems to be picking up.

Projected Target: provided in the chart as per Cypher harmonic pattern.

Stop Loss: Provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

Deepak Nitrite Breakout of wedgeThe idea here is about Deepak Nitrite:

Deepak Nitrite is a leading manufacturer of organic, inorganic, fine and specialty chemicals. The company`s product range includes a spectrum of chemicals which caters to a wide range of industries including Colorants, Agrochemicals, Pharmaceuticals, Rubber, Specialty & Fine chemicals.

1. Broken out of Falling Wedge on a weekly chart at the time of publishing.

2. Retesting of support line & breakout point completed on a daily chart as per below image. However, would recommend for a weekly retest of the breakout point.

3. Support established on 20 EMA & 200 EMA on a daily chart as per above image.

4. Trading above 20 & 200 EMA on Weekly chart.

5. Bearish Sea Pony (Advanced Harmonic pattern) formation on a weekly chart.

6. Sea Pony Pattern: Explained in the below image.

7. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily & monthly chart is Strong for an upward momentum. However, weekly chart is on a strong downward momentum at the time of publishing.

8. RSI is at 50.78 on a weekly Chart at the time of publishing.

9. MACD Way above signal line on weekly chart.

10. Hull Moving average on a daily & weekly is sell & on a monthly chart is a buy other moving averages are strong buy on Daily, Weekly & monthly chart.

11. Wait for retest completion for long entry. However, keep in watch list for the week & alert for price momentum.

Projected targets as per Sea Pony Pattern provided in the chart.

Stop Loss: Enter long only if retest & upward momentum continuation.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas !!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

United Spirits (McDowell_n) Waiting for Breakout.The idea here is about United Spirits (McDowell_n).

Mentioned below are the points to be considered

Points as per TA on a Weekly Chart:

1. Engulfing candlestick formation on a weekly chart at the time of publishing.

2. Anti Cypher Pattern looks ahead.

3. Downtrend Channel resistance tested might break the channel in coming week.

4. Resistance on 20 EMA on a weekly chart, support established on 50 EMA & Trading above 200 EMA on weekly chart.

4. Kumo Twist & Breakout on a weekly chart is neutral & currently consolidating. However, Kumo Breakout & kumo Twist on daily chart is strong for a upward momentum.

5. RSI is at 49.34 on a weekly Chart at the time of publishing.

6. MACD Crossover signal line on weekly chart.

7. Hull Moving Average is a Buy Signal on Daily, Weekly & monthly chart.

8. Enter long if Price breaks above the resistance. In, any case keep a price alert.

9. Volume Spike in weekly chart signals strong Momentum.

Projected targets as per Anti Cypher Pattern & Downtrend channel provided in the chart.

Stop Loss: Enter only if price breaks the trend & Retests.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

Madras Fertilizers Traiangle breakout The idea here is about Madras Fertilizers:

Madras Fertilizers Ltd. engages in the manufacture and marketing of ammonia, urea, and complex fertilizers. It also produces bio-fertilizers and markets organic fertilizers and neem pesticides.

I am short term bullish on Madras Fertilizers due to below observed technical factors.

1. Contracting or Symmetrical triangle formation on a weekly chart as per below:

2. Possible bearish Butterfly pattern under formation as per below:

3. Trading above 200 EMA & Support established on 20 EMA on a weekly chart as per below:

4. Ichimoku Cloud analysis: Senkou Span B support established on a daily chart as per below:

5. Ichimoku Cloud analysis: Kumo Break out and kumo twist strong buy for upward momentum on daily & Weekly chart.

6. RSI is at 49.47 on a Daily Chart & 55.97 on a weekly chart at the time of publishing.

7. MACD below signal line on weekly chart & way converging towards signal line on daily chart.

8. Hull Moving average on daily & monthly chart is buy & sell on Weekly chart & other moving average is a strong buy on Weekly & monthly chart.

9. ADX (Average directional index) trend strength is at 24.93 on a weekly and 25.83 on a daily chart which indicates a strong trend ( ADX between 25 - 50 is a strong trend) in the current direction.

Projected targets as per bearish butterfly patterns provided in the chart.

Stop Loss: provided in chart as per contracting or symmetrical triangle.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Note : use the Load new Bars forward button to know the current movement.

Cheers.

MISHRA DHATU NIGAM WEEKLY TIME FRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: its my view only and its for educational purpose only. only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. we anticipate and get into only big bullish or bearish moves (Impulsive Moves).

Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

buy low and sell high concept. buy at cheaper price and sell at expensive price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

Tradelikemee Academy