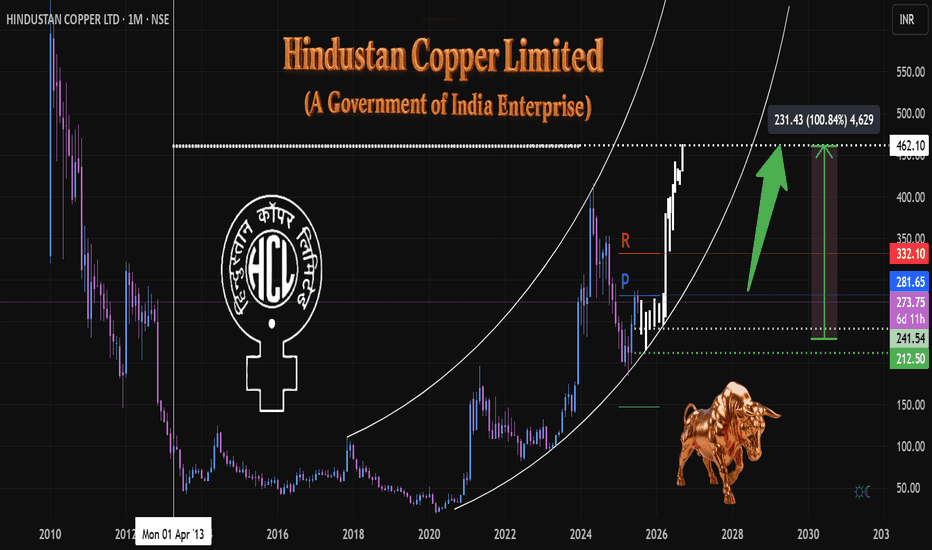

HCL Copper 1M, TF Anticipating Growth & Key Levels ⚙️ Materials: Commodity Cycle Turnaround

(Green energy metals, China recovery)

Government of India Enterprise

Hindustan Copper Limited (HCL)

The company is undergoing a significant mine expansion, projecting a 5x increase in output. This positive development is already reflected in institutional interest, with DIIs increasing their exposure by 8.2% in Q1.

At the time of this analysis, the price stood at 273.

We've observed a volume climax at the bottom, suggesting a potential exhaustion of selling pressure and a base formation.

The white ghost candles pattern illustrate an anticipated future price path, which I project based on current market dynamics and patterns. This projection outlines a potential trajectory we will monitor closely as price develops.

A strong engulfing bullish candle formation above the 281 pivot (🔵) would signal significant bull strength and confirm a strong upward momentum.

A confirmed breakout above the monthly resistance level (🔴) would be a critical bullish signal. initiating further long positions upon a successful retest of this breakout level.

My primary accumulation zone for potential entries is identified in green (🟢 dotted), ranging between 241 and 212. This range represents an area where I anticipate favorable risk-reward for entry.

Target & Time Horizon:

While precise timing is always challenging, I estimate the projected target up to 100% ( above in the white dotted line) could be reached around Q2 2026 or before as markets perform.

Disclaimer:

This analysis represents a personal projection

based on current market observations.

Trade Safely,

Always DYOR

#हिन्दुस्तान कॉपर लिमिटेड

#indianeconomygrowth

Indianstocksanalysis

VI Stock(India) Looking for bullish Rally! {5/07/2025}Educational Analysis says that VI Stock (India) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

KBCGLOBAL Looks bullish!A potential entry is identified at 0.46. The first target is 0.62, representing a +34.78% gain from the entry point. If the upward momentum continues, the long-term target is set at 0.87, offering a total potential gain of +89.13% from the initial entry. This trade presents a strong risk-to-reward profile for both short-term traders and long-term investors. Proper risk management is essential, especially if price action weakens below the entry level.

IDIA Range Accumulation – Bullish Only With Fundamental TriggerThe stock is currently trading inside a tight range, indicating a phase of consolidation.

📉 Buy Zone: ₹6.38

I’m planning to accumulate if price drops near this zone. From a technical view, it’s a strong demand area. However, for the bullish breakout to sustain, we’ll need strong fundamental support — like earnings, news, or sector momentum.

🔍 If fundamentals align, this could become a long-term multibagger setup.

✅ Strategy:

Wait for ₹6.38 zone

Accumulate small quantities

Hold for long-term with regular news tracking

💬 What do you think?

Would you wait for breakout or buy inside the range?

#TechnicalAnalysis #SwingTrade #LongTermView #SupportZone #BreakoutSetup #StockMarketIndia

Cochin Shipyard – Key Level Retracement & Long SetupCochin Shipyard is perfectly retracing to a key support zone, showing strength for a possible bounce.

🔹 Entry: ₹2149

🎯 Target 1: ₹2543

📈 Potential Gain: ~18.3%

🕒 Plan: Holding position unless structure shifts

This setup aligns with the current trend — looking for a continuation after healthy retracement. Tight stop-loss recommended for capital protection.

💬 What's your view on this trade?

HDFC Accumulation Breakdown Setup?HDFC seems to be building an accumulation range with:

Range High: ₹1955

Range Low: ₹1908

Currently, price is consolidating within this zone. I'm biased to the sell side for now, expecting a potential breakdown below the ₹1908 level.

⚠️ No confirmation yet — it's a “wait and watch” scenario. A strong close below the range low could trigger momentum selling.

💬 What's your view on this setup?

HERO MOTOR- MAJOR CORRECTIONHero Motor Corp- Almost a 3x from March 2023 to Sept 2024. Now under a severe correction, macro and tech factors in play.

Demand zone is 3600-3850, if breaks crucial 4K level.

Sideways in that zone will be good for accumulation for target back 4500+.

Large caps getting attractive in this fall.

Mangalam Cement: Profitable Long TradeTrade Overview: Mangalam Cement demonstrated a strong bullish move on the 15-minute chart, with all targets (TP1 to TP4) successfully achieved using the Risological Swing Trading Indicator . The trade capitalized on a well-timed entry near ₹919.05, with a stop loss (SL) set at ₹907.45, and hit the final target of ₹994.05, showcasing high accuracy.

Key Levels:

Entry Price: ₹919.05

Stop Loss: ₹907.45

Take Profits:

TP1: ₹933.35

TP2: ₹956.55

TP3: ₹979.75

TP4: ₹994.05

Fundamental Analysis: Recent news supports the price movement:

Strong Quarterly Earnings: Mangalam Cement reported a net profit of ₹32.8 million for the September quarter, signaling financial resilience.

Improved Profitability: The company has shown consistent growth in quarterly profits, boosting investor confidence.

Market Stats:

Current Price: ₹1,007.75 (+1.66%)

Volume: 142.78K (above average)

52-Week Range: ₹610.30 - ₹1,093.70

Mangalam Cement's robust fundamentals and the Risological Indicator's precision have once again delivered a profitable trade setup.

HEG Skyrockets! All Targets Nailed with RisologicalHEG on the 1-Hour timeframe successfully executed a long trade with all targets from TP1 to TP4 hit with remarkable precision.

Trade Highlights:

Entry: ₹428.35

Targets Hit:

TP1: ₹448.85

TP2: ₹482.00

TP3: ₹515.20

TP4: ₹535.70

Stop Loss: ₹411.75

Technical Insights:

This trade showcased the accuracy and reliability of the Risological Trading Indicator in identifying optimal entry points and scaling through multiple target levels. The upward trend was well-sustained, demonstrating confidence in the tool's ability to manage trades effectively.

Rolex Rings Ready for Takeoff: Long Trade Targets ₹2741!Rolex Rings on the 4-hour timeframe is presenting a fresh long trade opportunity, with the price currently hovering around the entry level. This setup, identified using the Risological Swing Trading Indicator, is primed for a strong upward move targeting 2741.60 at TP4.

Rolex Rings Key Levels:

TP1: 2267.90

TP2: 2448.85

TP3: 2629.80

TP4: 2741.60

Technical Analysis:

The entry price is set at 2156.05, with a stop-loss at 2065.55, ensuring effective risk management.

The price recently broke through a significant resistance zone, signaling bullish momentum. With the Risological trend line confirming the upward bias, this trade setup offers a high-reward opportunity for traders looking to capitalize on the next potential rally.

Namaste!

OLA ELECTRIC Plummets as Complaints Soar – BUT, We Made Money!OLA ELECTRIC Stock Analysis:

Ola Electric (OLAELEC) recently experienced a significant downturn, with all targets met in a notable short trade on the 15-minute timeframe. The ongoing downtrend can be attributed to multiple external pressures:

Massive Customer Complaints: India’s Central Consumer Protection Authority (CCPA) reported over 10,000 complaints within a year related to Ola’s after-sales services, billing inaccuracies, and delays. This high volume of complaints is unprecedented, prompting government intervention.

Consumer Protection Action:

Ola Electric received a show-cause notice from Indian authorities, demanding an explanation for the alleged violations of consumer rights and trade practices. The repercussions could include directives for customer compensation or even financial penalties.

Service Overload at Centers:

Numerous reports indicate that Ola’s service centers are struggling to keep up with demand, leading to extensive backlogs and dissatisfied customers. According to analysts, many centers appear overwhelmed, further deteriorating Ola's brand image.

Market Sentiment Impact:

Following these revelations, Ola’s share value has sharply fallen, reversing the gains from its August IPO. The stock has lost nearly 40% in recent weeks, with negative sentiment further amplified by viral customer complaints on social media.

With external pressures mounting and consumer confidence waning, Ola Electric’s stock faces a challenging recovery path. The short trade setup capitalized on this decline, achieving all preset targets amidst the company’s reputational crisis.

Key Levels:

Entry: 93.86

Targets Achieved: TP1 at 90.87, TP2 at 86.04, TP3 at 81.21, TP4 at 78.22

Stop Loss: 96.27

Ola Electric’s road ahead remains uncertain as regulatory scrutiny intensifies and consumer trust continues to erode.

WAAREE Short Trade Targets in Play, Massive Drop to 1571!WAAREE (15m time frame), Short Trade

Entry: ₹1,763.00

Current Price: ₹1,571.00

All Targets Done!

Key Levels:

Entry: ₹1,763.00 – After confirming a strong bearish signal, short entry was executed.

Stop-Loss (SL): ₹1,767.60 – Placed above key resistance to protect against potential reversals.

Take Profit 1 (TP1): ₹1,757.30 – First target triggered, confirming downward movement.

Take Profit 2 (TP2): ₹1,748.10 – Critical support level broken.

Take Profit 3 (TP3): ₹1,738.90 – More aggressive downside level confirmed

Take Profit 4 (TP4): ₹1,733.25 – Final target hit for deep correction in this trend.

Trend Analysis:

WAAREE’s price continues to plunge after a decisive break below multiple support levels, confirming strong selling pressure. With the current price at ₹1,571, this trade has captured a significant move, with further downside potential still in play.

BANKNIFTY can be bearish from 51466-51647 51466-51647 Levels are very important for BankNifty to sustain. If it break above these levels, then a new all time high can be seen in Sep month. Mostly likely, BankNifty could fall from here to be bearish again and break 49,815 levels. This level is a pure selling level above the fair value gap that was created on 5th Aug.

Power Finance, Target Reached, 295 % Profit _ Complete AnalysisIn Power Finance Corporation a "Symmetrical Triangle Pattern" formed and Breakout, Reached the Target. Buy in February 2023 at the Price of 113 rupees and Sell in January 2024 at 450 rupees. This Result in a Total PROFIT of 295 % within a Year (11 months).

NLC India 334 % PROFIT and Reach the Falling Wedge Target 267Rs.I have identified and Analyzed a "Falling Wedge Pattern" on 21-06-2022, at that Time the Price was 61 rupees. Now SUCESSFULLY Breakout the Pattern and Reach the Falling Wedge Target 267 rupees. After Breakout, Target Reached within a YEAR.

Overall PROFIT 334 % within 2 years. So the "Pattern" is most Crucial in stock market. Thank you.

I want to help people to Make Profit all over the "World".

Big moves incoming ZEELZEEL. #Indian futures. The direction of movement that I am projecting is indicated. From my last analysis we see a movement in the direction indicated. Patience is required. Lows will be taken and we will see a reversal pattern forming.

SOTL-A Monthly VCP Breakout & Retest candidate, 30% ROIExpecting ROI - 30%

As mentioned in multi time frame analysis charts,

1) Monthly 6 year old VCP Breakout, Retest done , consolidated for 2 months,

now ready to move out of the consolidation zone.

2) Compressing at major supply region with minimal

sellers strength

3) Expecting BO soon, SL at prev week low.

How to trade GSFCIn consolidation phase now from 323,

Can correct till 243.7 (done ), 219.3, 195

and then might rise towards 322, 401, 450

in 2 years

So, buy few now, and buy on lower levels and hold

so many chemical stocks are in consolidation , giving opportunity to accumulate , can invest 5-10% capital and hold for very good gains in 4 to 6 months.

How to trade SMSPHARMASMSPharma, now at 186.15, on March-14-2024 :

Per EW, this has retraced till 0.618 at 162.5 twice and rising.

Looks like swing trade happening here, and so buy on dips is adviced

Buy few, Buy until 162.5, 152.8, 143.2

Uptrend confirmation comes after 194 and

Target prices thereafter --> 212.85, 224.75, 234.5, 244

Expected gains from current price --> 31

Sl below 135 is okay

Buy on Dips would be good in this.

How to Trade BLS InternationalBLS Intl, now at 343 on March-14-2024 :

2 ongoing patterns can be seen

#1. Per EW, the major Motive wave is completed and retracement is done closer to 0.382 and rising again, So, invest few now, invest until 256 for target of 604.5 in 1-1.5 yr holding period

#2. Per another ongoing pattern ( highlighted zone ), One can invest until 300 for a target of 604

As strict stoploss of 255

Expected Gains from curent price --> 76.2%

Prefer to invest regularly in this

BF UTILITIES LTD. - LOOKS GOOD!Following a brief pause, the previous upward trend is poised to resume.

A Continuation Wedge (Bullish) represents a temporary interruption to an uptrend, taking the shape of two converging trendlines both slanted downward against the trend. During this time the bears attempt to win over the bulls, but in the end the bulls triumph as the break above the upper trendline signals a continuation of the prior uptrend.

The pattern formed over 37 days which is roughly the period of time in which the target price range may be achieved, according to standard principles of technical analysis.

This bullish pattern can be seen on the Daily chart of $NSE:BFUTILITIE.

PLEASE NOTE THAT:

This chart analysis is only for reference purpose.

This is not buying or selling recommendations.

I am not SEBI registered.

Please consult your financial advisor before taking any trade