Gold (XAU/USD) Breakout & Retest: Next Stop $3,080?🔍 Key Observations:

🔹 Ascending Triangle Breakout:

📈 Price was consolidating in an ascending triangle (🔺) and has broken out above resistance.

🚀 Bullish momentum is in play.

🔹 All-Time High (ATH) Resistance Zone:

🛑 Resistance Area (🔵) is where price has struggled before.

🔵🔵 Rejection signs at this level indicate a possible pullback.

🔹 Fair Value Gap (FVG) Retest:

🔽 Price may pull back into the Fair Value Gap (FVG) (📦) before moving higher.

🎯 This zone ($3,030 - $3,040) could act as a buying area.

🔹 Target Point at $3,080:

🎯 Main target for bulls is $3,080 (📈).

🔝 Price could retest the ATH zone before a push

🔹 Dynamic Support (DEMA 9):

📊 DEMA 9 (📉) at $3,052.80 is acting as support.

🔮 Expected Price Action:

⚫ Scenario 1 (Bullish) 🚀

➡️ Pullback into FVG zone (📦) → Buyers step in → Move toward $3,080 🎯

⚫ Scenario 2 (Bearish) 📉

❌ If price breaks below FVG → Further downside risk

✅ Conclusion:

🟢 Bullish bias remains strong unless price falls below FVG.

📌 Traders may look for entries in the FVG zone for a move to $3,080 🎯.

🔥🚀 Gold could be setting up for another push!

Indicators

$PEP $150 retest Hi, liking NASDAQ:PEP here for a retest of mental price $150. NASDAQ:PEP is at 4 year lows, was at four year lows and bounced twice off $141 zone. Short term $150c could be a play here for April expiration but also could be patient and see if it retests the supply zone of $140. This is on watch. Just acquired Poppi brand as well. Overall it could be forming a rising wedge, not definitive on that thesis just yet, though.

NFA

WSL

LULU Lululemon Athletica Options Ahead of EarningsIf you haven`t bought LULU before the previous rally:

Now analyzing the options chain and the chart patterns of LULU Lululemon Athletica prior to the earnings report this week,

I would consider purchasing the 337.5usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $20.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bitcoin (BTC/USD) 4H Chart Analysis: Bullish Breakout Ahead?📈 Ascending Channel:

🔹 The price is moving upward within a parallel trend channel.

🔹 Blue arrows (🔵) indicate resistance points where the price struggled.

🔹 Red circles (🔴) highlight support areas where the price bounced.

🟦 Fair Value Gap (FVG) Zone:

🔸 The blue-shaded area (FVG zone) suggests a possible retracement before a bullish move.

🔸 If the price dips into this zone, it may find liquidity and bounce back up.

📊 Projected Price Movement:

⚡ Expected pullback → into FVG zone (🔽), then a bullish push (🚀) towards $90,686.72 🎯.

🟡 Yellow arrow shows the anticipated price path.

📉 Support & Resistance Levels:

✅ Support: Around $86,000 - $86,500 (FVG zone).

🚀 Target: $90,686.72 (next major resistance).

📌 Exponential Moving Average (DEMA - 9):

🔹 The blue line (DEMA 9) at $87,414.57 is acting as dynamic resistance.

🔹 A break above this could confirm further upside movement.

💡 Conclusion:

🔸 Bullish bias remains strong 📈.

🔸 Watch for a dip into the FVG zone before a potential rally 🚀.

🔸 If Bitcoin holds support, it may reach $90K+ soon 🎯🔥.

XAG/USD (Silver) 4H Trading Analysis📍 Current Price: 33.0990 (Near Entry Zone)

🔹 Trading Setup:

🟢 Entry Zone: 32.97654

🔴 Stop-Loss (SL): 32.48368 ❌

🔵 Take-Profit (TP) Levels:

TP1: 33.30512 🎯

TP2: 33.62431 🎯🎯

Final Target: 34.19599 🚀

📊 Price Action Insights:

✅ Bounce from Demand Zone (Gray Box) 📈

✅ Potential Bullish Move if price holds above entry 🚀

⚠️ Risk if SL is hit (Red Box) ❌

GBPUSD Sell Trade March 26 2025- Sell Limit ActivatedHello Traders!

Another great movement of GBPUSD, 1H and 15min TF confluence.

Entry: 5min TF with validity of OB (check charts for detailed annotation)

Note: This trade was a sell limit order in MT4 aiming for 1:5RR. You can see also Distribution Schematics in Higher Timeframe.

#wyckoff

#proptrader

#Riskmanagement

FART/USDTSEED_WANDERIN_JIMZIP900:FART Cup and Handle on 1D chart! 🔥

✅ The cup is nicely rounded - a sign of bullish accumulation.

✅ Neckline around 0.5561-0.6119 (V-WVWAP) - price is hitting resistance here.

✅ Volume is increasing during the breakout attempt - which is a positive signal.

✅ Possible "eye" - price may correct back to support before further growth.

Targets:

🔹 Cup height measurement: Bottom around 0.3194, neckline 0.5561, gap ~0.2367.

🔹 Target level: 0.5561 + 0.2367 = ~0.7928 (possible bull target on patterning confirmation).

🔹 Fib levels may help - I see first resistance around 0.6176.

How to play it?

📌 Ideal entry: after a pullback to neckline (retest) or during a confirmed breakout with volume.

📌 Stop-loss: Below the last low of the neckline or below the neckline if it becomes support.

📌 Confirmation.

Overall, the pattern looks very bullish, but the reaction to 0.5561-0.6119 will be important. If it fails there, the ears may go lower.

XAU/USD Analysis: Bearish Pullback Towards $3,000 SupportXAU/USD (Gold Spot vs. U.S. Dollar) Technical Analysis - 1H Chart

1. Price Action & Trend Analysis

The market has been in a strong uptrend, characterized by higher highs and higher lows.

Recently, the price faced resistance near the $3,040 level, leading to a rejection.

A pullback is currently in progress, suggesting a possible retracement to a demand zone.

2. Key Levels

Resistance Zone (Supply Zone): Around $3,040 - $3,045 where price has been rejected multiple times.

Support Zone (Demand Zone): Around $3,000 - $3,005, a previous accumulation area.

Current Price: $3,023.695

3. Market Structure & Expected Move

The price tested the resistance zone, failed to break above, and is now reacting downward.

A bearish projection (as shown in the chart) suggests a potential move toward the $3,000 - $3,005 support zone.

If the price reaches this level and finds buying pressure, we could see a reversal or continuation of the uptrend.

4. Indicators & Confluence Factors

Support-Resistance Flip: The previous support at $3,000 could act as a strong support again.

Bearish Momentum: Short-term price action suggests sellers are gaining control after rejection at resistance.

Liquidity Zones: The highlighted purple zones represent institutional order blocks where significant buy/sell orders exist.

5. Trading Plan & Strategy

Bearish Scenario: If price breaks below $3,000, we could see further downside pressure.

Bullish Scenario: A bounce from $3,000 could provide buying opportunities for another attempt at breaking $3,040.

6. Conclusion

The market is currently retracing from resistance, and a short-term bearish move is expected toward $3,000.

Traders should watch for price reaction at $3,000 to determine if it holds as support or breaks for further downside.

Gold (XAU/USD) – Possible Reversal from Resistance XAU/USD (Gold Spot vs. U.S. Dollar) on the 1-day timeframe and shows an ascending channel with key price levels and technical annotations.

Key Observations:

Trend Direction:

The price has been in a strong uptrend since late 2024.

It is currently near the upper boundary of the ascending channel.

Liquidity & Market Structure:

INT.LQ (Internal Liquidity): This suggests an area where liquidity is expected to be taken before a potential move.

MB Unfilled (Market Balances Unfilled): These indicate inefficiencies in price movement that the market may revisit.

Projected Price Action:

The chart shows a potential short-term pullback from the upper boundary.

Expected retracement towards the "fair value range" around $2,800–$2,850.

If this scenario plays out, it would align with price rebalancing and a healthier uptrend continuation.

Key Levels:

Resistance: Around $3,050, which aligns with the upper trendline.

Support Zones: Around $2,950 and deeper at $2,800.

Potential Trading Strategy:

Bearish Case: If rejection occurs at $3,050, short opportunities could exist targeting $2,900–$2,850.

Bullish Case: If price retraces and finds strong support in the fair value range, it could resume its uptrend.

BRIEFING Week #12 : Alt-Season might be coming soonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

About the Volume OBV indicator...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I think TradingView is attractive because users can create charts as they want.

However, since the number of indicators that can be added to the chart is limited depending on the plan, you have to add indicators that fit your plan.

As a result, I ended up integrating multiple indicators into one indicator.

-

The HA-MS indicator in this chart is a public indicator.

If you search the Internet, you can find detailed explanations on how to interpret the OBV indicator.

I expressed it as follows to make this interpretation method more realistic.

The body color of the candlestick is indicated by the 4-stage OBV indicator.

The OBV indicator is distinguished in the same way as the Price Channel indicator.

You can interpret it like the Bollinger Band.

That is, if the middle line that divides 2 and 3 rises by more than 3, you can interpret that the buying force is increasing.

1: It means below the lower line of the Price Channel and is indicated in dark red.

If you enter this section, there is a high possibility of a sharp decline.

You should check the support and resistance points because it is likely to stop falling soon and rise to 2.

2: It means between the lower line and the middle line of the Price Channel and is indicated in red.

This section is likely to show a weak downward sideways movement.

Therefore, if it rises from 1->2, there is a possibility of a short rise. However, if it fails to rise to 3, it is likely to fall back to 1, so it is recommended to make short trades.

3: It means between the middle line and the upper line of the Price Channel and is displayed in green.

This section is likely to show a weak upward sideways movement.

If it rises from 2 -> 3 and shows a sideways movement, you should focus on finding a buying point.

4: It means above the upper line of the Price Channel and is displayed in dark green.

If it enters this section, there is a high possibility of a sharp rise.

Since it is likely to stop rising soon and fall to 3, you should check the support and resistance points.

-

What we should pay attention to is when it changes from 1 -> 2, 4 -> 3.

As explained above, 1 is a section located below the lower line of the Price Channel, so there is a high possibility of a sharp fall.

4 is a section located above the upper line of the Price Channel, so there is a high possibility of a sharp rise.

Therefore, you can proceed with an aggressive buy when it changes from 1 -> 2, and you can proceed with a sell when it changes from 4 -> 3.

In the case of futures, it can be used as reference information for entering and liquidating LONG and SHORT positions.

-

They say that the only things you need on a chart are price and trading volume.

However, it is not easy to interpret this in reality.

To compensate for this, we hid the colors of the existing candles and displayed them in 4 stages of OBV so that you can intuitively see which stage the current price is at.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

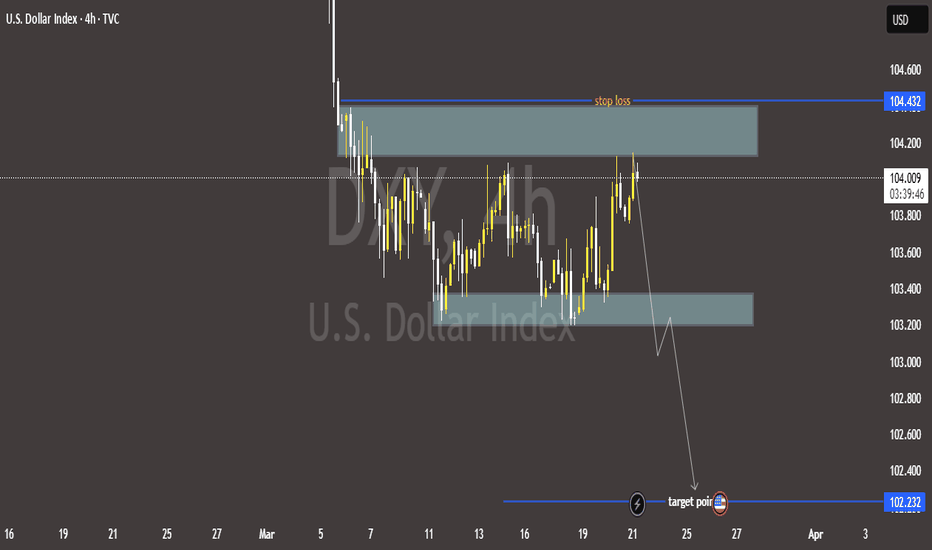

U.S. Dollar Index (DXY) – Bearish Outlook with Key Levels📉 Bearish Bias on U.S. Dollar Index (DXY) – 4H Chart

🔹 Resistance Zone & Stop Loss 🚫

📍 Resistance: 104.200 - 104.432

🛑 Stop Loss: 104.432 (Above resistance zone)

🔸 Support Zone 🛠️

📍 Intermediate Support: 103.300 (Possible bounce)

🔻 Target Point 🎯

📍 Target Price: 102.232 (Expected downside)

📊 Price Action Outlook:

✅ Bearish Scenario:

Price rejected from resistance 🔽

Lower highs forming ⚡

Breakdown expected toward 102.232 🎯

❌ Invalidation:

If price breaks above 104.432, bearish setup fails 🚫

🔥 Conclusion:

⬇️ Sell Bias below 104.200 targeting 102.232

❌ Cut losses if price closes above 104.432

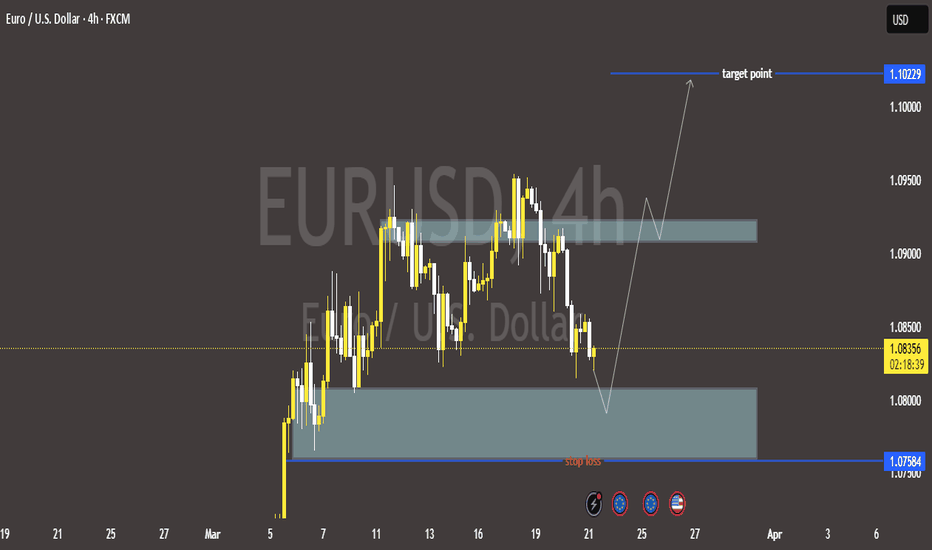

EUR/USD 4H Trading Plan: Buy Setup & Target Projection📊 EUR/USD 4H Analysis

🔵 Support Zone (1.07584 - 1.0800) 🔵

📌 Expected Reversal Area – Buyers might step in here.

⚠️ Stop-Loss Below ❌ (If price breaks lower, trade is invalid).

🟦 Resistance Zone (~1.0875 - 1.0900) 🟦

📌 First Hurdle – Price may face resistance here before moving higher.

🎯 Target Point: 1.10229 🎯

✅ Final Take-Profit Level – If price reaches here, trade is successful!

📉 Plan:

🔻 Expect a drop into support first…

🔄 Bullish reversal from support…

🚀 Uptrend toward 1.10229!

🔴 Stop-Loss Below 1.07584 (🚫 Safety Net).

🟢 Entry Around Support Zone (✅ Buy Opportunity).

🔵 Exit at Target Point (1.10229) (💰 Profit Zone).

📝 Final Thought:

If the price respects the support zone 🟢, a BUY trade is valid. If it breaks lower 🔴, it's best to step out! 🚀

BTC 4h Trade Setup: Potential Long Opportunity

Use the 12-hour chart for additional buy confirmation. For optimal entry, refine your position using lower timeframes.

Trade Setup: Long (Buy) Position

📍 Entry:

Enter around 80,800 USDT or 81,800 USDT in the next few hours.

A recent BUY signal and RSI near oversold territory suggest a potential reversal.

🛑 Stop Loss:

Set a stop loss below 80,000 USDT, around 79,500 USDT, to limit downside risk.

If the price breaks below 80,000, the next support is at 78,252.1 USDT.

🎯 Take Profit Targets:

1st TP: 86,500 USDT

2nd TP: 88,000 USDT

📌 This setup offers a favorable risk-to-reward ratio, with potential gains outweighing risks.

On the higher timeframe, the 21 EMA is still below the 50 EMA, indicating a prevailing downtrend. Trade cautiously and ensure you take profits accordingly.

📢 Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results. Always conduct your own research and consult with a professional before making any investment decisions.

XAU/USD 1H – Bullish Continuation from Demand Zone?📊 XAU/USD (Gold) 1H Analysis – Bullish Continuation Setup

🔹 Market Structure: Gold has been in a strong uptrend, with price currently consolidating near a key demand zone.

🔹 Key Levels:

🔴 Resistance: $3,050 - $3,060 (Potential target)

🟣 Demand Zone: $3,030 - $3,035 (Support area)

🟠 Deeper Support: $3,025 (Break below weakens bullish bias)

📈 Potential Trade Setup:

1️⃣ A possible pullback into the demand zone could attract buyers.

2️⃣ Price may wick below liquidity before reversing.

3️⃣ If support holds, we anticipate a move toward $3,050+.

✅ Entry Zone: $3,030 - $3,035

🎯 Target: $3,050 - $3,060

🚨 Stop Loss: Below $3,025

⚠️ Watch for price action confirmation before entering. A strong bullish candle from support could signal entry. Let the market show its hand! 🚀✨

BTCUSD 15MINUTES. SHORT TRADE SETUP, CHECK CAPTAIN..This is a Bitcoin (BTC/USD) 15-minute chart from TradingView, showing a trade setup. Here’s what it means:

1. Resistance Level (Black Line at $84,355-$84,457): Price tested this zone but failed to break above it.

2. Short Trade Setup:

The red arrow indicates a sell entry at the resistance level.

The red box above represents the stop-loss area ($85,223), meaning if the price moves above this, the trade would be invalidated.

The green box below is the take-profit area, with a target around $81,956.

3. Price Rejection: BTC/USD attempted to break resistance but was rejected, suggesting a potential move lower.

4. Liquidity Zone (Blue Box): A previous demand zone where buyers stepped in, indicating a possible support level.

Overall, this chart suggests a bearish trade setup, where the trader expects Bitcoin to decline from the resistance zone.

Chart Analysis and Trading Strategy (2)

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

If you look at the candle that the finger is pointing to, you can see that it is a bearish candle with Open > Close.

If you look at this on a 30m chart, you can see that it moves as follows and forms lows and highs.

These candle movements come together to form a candle arrangement, and by looking at this, we ultimately set support and resistance points.

As your understanding of candles deepens, you will study charts in various ways.

The reason is that you may know it when you look at the chart, but you cannot when you trade.

That is, because the understanding of candles is not clear.

As you study the charts over and over again, you will learn that charts tend to converge to the median and average values.

You learn that they converge to the median and average values while studying various indicators, but you end up not knowing what you can learn from them.

What is important in the arrangement of candles is that the arrangement of the Open and Close bodies and the Low and High tails that make up the candles play an important role in setting support and resistance points.

I recommend that you understand this explanation through the Internet or a book.

The reason is that it is something that requires a lot of time investment to acquire.

-

The HA-MS indicator was created to quickly display support and resistance points as objective information.

Therefore, you can see that when the channel composed of the HA-Low indicator and the HA-High indicator is broken, a trend is formed, and if not, a sideways movement is shown.

The HA-Low, HA-High indicators are indicators created by combining the arrangement of candles and the RSI indicator on the Heikin-Ashi chart.

Therefore, the trading strategy is used to create a trading strategy depending on whether there is support near the HA-Low, HA-High indicators.

The other indicators, BW(0), BW(100), DOM(-60), and DOM(60), are used as support and resistance to create a detailed response strategy.

-

Based on this information, trading should be divided into trading in the sideways section and trading in the trend to create a trading strategy.

This trading time is created based on whether there is support in the HA-Low, HA-High indicators.

Since it is made of indicators, I think it provides objective information for chart interpretation with others, reducing the room for controversy.

This is the fundamental reason for using indicators.

It is because we can share objective information with each other.

-

In trading within the sideways section, information about the trend is not particularly necessary.

If you set the sideways section with your own indicator or support and resistance points, you can trade based on whether there is support at the end of that section.

-

However, when you leave the sideways section, information about the trend is necessary.

That is why we use the M-Signal indicator and Trend Cloud indicator on the 1D, 1W, and 1M charts as indicators for the trend.

For short-term information, you can use the M-Signal indicator and Trend Cloud indicator on the 1D chart.

If the Trend Cloud indicator is displayed in green and the price is maintained above the M-Signal indicator on the 1D chart, it can be interpreted that there is a high possibility of a turn to an uptrend.

If not, it can be interpreted that there is a high possibility of a downtrend.

The mid- to long-term trend can be identified by checking the arrangement status of the M-Signal indicator on the 1W chart and the M-Signal indicator on the 1M chart.

That is, if the M-Signal on the 1W chart > the M-Signal on the 1M chart, it can be interpreted that the mid- to long-term trend is maintaining an uptrend.

Therefore, in order to continue the uptrend from a long-term perspective, the price must be maintained above the M-Signal indicator on the 1M chart.

If not, it is recommended to make short trades if possible.

-

To better set the support and resistance points, look at the 1M chart > 1W chart > 1M chart in that order and draw a horizontal line on the indicators (HA-Low, HA-High, BW(0), BW(100), DOM(-60), DOM(60)) displayed on the chart and mark them on the chart.

Mark the support and resistance points on the chart as above.

This marks the support and resistance points with the low and high points.

-

It is not easy to start trading at the low or high points every time.

Therefore, as I mentioned earlier, it is important to create a detailed response strategy based on the median and average values.

For this, the StochRSI 50 indicator is displayed.

In addition, the Close of the Heikin-Ashi chart of the 1D chart, which can be usefully utilized when trading below the 1D chart, is added.

-------------------------------------------------

The information I mentioned above is ultimately information that can be obtained through chart analysis.

You can create a trading strategy by deciding whether to check it directly with your eyes and indicate support and resistance points, or to use an indicator that can be checked more quickly.

Chart analysis is about understanding the movement of the chart, and actual trading is conducted according to the trading strategy.

You may think that chart analysis is the trading strategy, but it is not.

No matter how well you analyze charts with your eyes, if you analyze charts when your psychological state is unstable due to subjective thoughts based on various information other than the chart, as I mentioned earlier, you may end up trading in the wrong direction.

To prevent this, it is necessary to use indicators so that subjective thoughts are not applied.

Even if you start trading at the support and resistance points created by the indicator, and it goes in the opposite direction and you suffer a loss, the influence will be weak.

The reason is that you created a trading strategy with the support and resistance points created by the indicator in advance.

Things to consider when starting a trade in a trading strategy are:

1. When to buy or how to buy

2. When to cut loss or how to cut loss

3. How to realize profit

For this reason, it is important to set support and resistance points through chart analysis.

-

It is better to do chart analysis briefly.

If you spend too much time analyzing charts, you may end up being trapped in your own subjective thoughts, so be careful.

I think you can tell whether you will do chart analysis in an analyst-like manner or in a chart analysis necessary for trading by looking at how the support and resistance points are marked on the chart.

The ideas of chart analysis often do not include things that need to be considered when starting a trade.

Therefore, in order to apply them to actual trading, you need to create a trading strategy through chart analysis.

The chart analysis for trading reduces the need for separate chart analysis because the information necessary for the trading strategy is displayed on the chart.

However, it may need to change depending on your investment style or the time frame chart you are actually trading on, but it can be advantageous for trading because the support and resistance points are marked.

To ensure this, you need to create an indicator and receive support and resistance points as objective information.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Russell 2000 Year-End Price Target and Technical Rebound OutlookIf you ahven`t bought the Double Bottom on RUT 2K:

Now the Russell 2000 Index (RUT), which tracks small-cap stocks, has recently entered oversold territory, signaling that a potential technical rebound could be on the horizon. Oversold conditions typically occur when selling pressure becomes excessive, driving the index below its fundamental value and creating an opportunity for a corrective bounce.

Several technical indicators, including the Relative Strength Index (RSI), have fallen below the 30 level — a classic oversold signal. Historically, similar setups have led to strong short-term recoveries as buying interest returns once the selling momentum exhausts itself.

Additionally, market breadth indicators suggest that the recent pullback has been broad-based, with a high percentage of RUT 2K components trading below their 50-day and 200-day moving averages. This type of widespread weakness often precedes a period of mean reversion, where prices bounce back toward key resistance levels.

Given these technical signals, my price target for RUT 2K is $2,450 by the end of the year. A rebound toward this level would represent a recovery of approximately 10-12% from current levels, aligning with previous post-oversold rallies in the index. If broader market sentiment stabilizes and small caps benefit from improving economic conditions or easing rate hike pressures, the path toward this target becomes increasingly plausible.

While downside risks remain — including ongoing macroeconomic uncertainty and geopolitical tensions — the technical setup suggests that RUT 2K is primed for a recovery in the coming months.

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE before the previous earnings:

Now analyzing the options chain and the chart patterns of NKE NIKE prior to the earnings report this week,

I would consider purchasing the 73usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $3.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $12.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BRIEFING Week #11 : Are we done ? (nope)Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

TRUMP/USDTFundamental Overview of TRUMP/USDT:

Official Trump Coin (TRUMP) has gained attention due to its association with former President Donald Trump. With a current price of $11.86 and a market capitalization of approximately $2.37 billion, TRUMP ranks among the notable digital assets in the market. (coinmarketcap.com) Its popularity and volatility attract both investors and traders seeking new opportunities.

Technical Analysis:

We see that TRUMP coin is currently trading within a descending channel, respecting two trendlines that form a falling wedge pattern. If the downward momentum persists, we expect the price to drop into the $4.5-$5.0 range, where we anticipate strong buying pressure to emerge.

Key VWAP levels, highlighted with green circles, act as price magnets, making them crucial points of interest for a potential reversal. Additionally, Fibonacci retracement levels indicate significant resistance around $21.15 (0.618 Fib) and $24.22 (0.786 Fib), which could serve as key breakout targets if the price initiates an upward move.

If the price successfully reclaims these resistance levels, a bullish scenario could unfold, potentially targeting $30+ in the mid-term. However, failure to hold support around $4.5-$5.0 could lead to further downside exploration.

Gold (XAU/USD) 4H Chart Analysis: Resistance Test & Potential BrPrice Trend:

The chart shows a steady upward movement in the price of gold, starting from late February into March 2025. The price is currently around $2,917.25 and has reached near the resistance level marked on the chart.

Resistance Zone:

The resistance area, located between $2,911 and $2,920, seems to be a crucial level. Gold has faced difficulty breaking through this level multiple times, as seen in the sideways movement after hitting the resistance.

Target Level:

The target above this resistance zone is marked around $2,960, indicating the potential for further price appreciation if gold can break above the current resistance.

Price Action and Potential Breakout:

There's a potential for a breakout as the price appears to be forming a bullish structure near the resistance, indicating that if gold manages to break above this zone, it could continue its upward trajectory toward the target area.

Volume and Market Sentiment:

The volume indicators on the lower part of the chart are not heavily discussed here, but there might be a correlation with market strength. The chart suggests potential consolidation before a move upward if the resistance breaks.

Conclusion:

Gold is currently testing the resistance area, and if it successfully breaks through, it could aim for the target level around $2,960. Keep an eye on this price level as it could signal further bullish movement.