Possible breakout of downtrend in Danish cable company RoblonThis stock has shown strength the last weeks and seems to be ready to break out of the downtrend. If we see the price go trough the black resistance line and have a continuation as shown with the arrows (retracement and then further up), I would be a buyer in 187 DKK.

Industrial

Congrats to Subscribers! Fastenal up over 15%It is very easy to read price action if you have a reference point. These support/resistance lines are there to help you read where the buyers and sellers are likely to make a stand.

MasterChartsTrading Price Action Indicators show good price levels to enter or exit a trade.

The Blue indicator line serves as a Bullish Trend setter.

If your instrument closes above the Blue line, we think about going Long (buying).

For commodities and Forex, when your trading instrument closes below the Red line, we think about Shorting (selling).

For Stocks, I prefer to use the Yellow line as my Bearish Trend setter (on Daily charts ).

Be sure to hit that Follow button! Please find me on social networks via the link on my profile page for more ideas from MasterCharts!

Historical Analysis of the DIAHistorical Analysis and Monthly Chart :

The DIA showing Strong Major Bull Trednd with serveral interaction with the Return Line (RL).

Note the Pick in Momentum since February 2016 (or B3), the next Major bottom made above the Major Trend Line (MUT), and therfore showing the failure of the Bears to take the price downward.

But, we dont see strong sign of buyers either.

The DIA is inside big Consolidation that lasted for almost 2 years (since Oct 17).

Weekly Chart :

The Resistance Area between 265.88 - 267.53 Established in Jan 2018, the second attempt to go above that level accured 1 year ago (Sep 2018) and the reaction was very violent and took the price to far down levels.

Since then the price hit the Resistance Area 3 Times :

1) April 2019 - the price got into resistance reaction and made New High Bottom.

2) June 2019 - the price go through the Resistance Area, Failed to continue, and made new higher bottom bellow that level.

3) September 2019 (these days) - the price close above the area last week, but with relatively low volume.

We need to keep an eye on the price this week and look for the power of the buyers, how far they can take the price up (if any).

Notice also the Volume Activity in the Consolidation Area - Pickup on down moves, and diminsh on the Rallies - weakness .

Daily Chart :

The Daily chart does not give us alot of new information.

But we can see the Trading Zone (sort of Rectangle), and the price movement above it.

The Minor picture is Bullish.

Conclusion :

Since B4, the overall picture looks positive.

But the Key for understanding the coming moves relly on the reaction to the Resistance Area, and the examination of the Bulls Power.

Any High Volume Bullish Activity above the Resistance Area, can take us again to the Return Line (RL).

If we will see Second Failure on the Resistance Zone,we need to examine the power of the Beats, and the next areas to look for are the bottom of the trading zone, and B4.1.

If the Bears will act Aggresivley and take the price bellow B4.1, the picture is very negative and the next level is the MUT.

You should keep an eye on the Industrial ETFNote the Rectangle Pattern on the daily Timeframe :

The price heading toward the Supply line (Resistance) for the 3rd attempt.

Note the Volume Pick on the Demand line Reaction (Support), note also the 2 Bottoms that formed before the last Rally,

The price is still above the MUT (Major Trend Line), and the overall picture is positive.

In a case of Rectangle Up Penetration, Im looking for long above the resistance of 80.07.

SELL THE NEWS EVENT! FED TO CUT ONLY 25%Fed will cut rates by only 25% on Wednesday and will be a sell the news event. Expect the Dow Index to retest previous resistance around 26,550. We are also on a 9 Weekly come Monday on the Tom Demark Sequential system, so expect next Monday to start a 1 to 4 week correction, then HIGHER. SHORT THE FALL , BUT BUY THE DIP! STOCKS ARE GOING TO GO HIGHER TO NEW HIGHS. Viva endless money printing!

$STXIND Change of polarity on the JSE's Industrial sectorThe above chart is a perfect display of the concept of 'change in polarity'. This principle asserts that once breached, a support level becomes a resistance level.

You'll notice how this level of +- R72.30 was a major support level in 2018 that held on multiple occasions. Eventually we got the break through in Sept 2018 and the bulls caved in completely, seeing the index fall another 15% to reach a level of 61.00. Since seeing those lows the index has done well to move higher and retest this significant level which has now become clear resistance. We tested this level as recently as early May and failed. We are currently retesting this level once more and it looks like the market is rejecting and failing for the second time at R72.30. Likelihood here is that the components of this index will find it very difficult to gather enough steam to breach this point of polarity and we could see the chart move lower in time. Also notice how price has managed to equal the same level but RSI has made a lower high which is also an indication of bearish divergence and further adds conviction to a possible move lower in this chart. Naspers and Richemont make up the bulk of this index, so be careful in those two counters specifically!

DJI AnalysisTraditional markets have taken a beating, but should see some sideways action or even a bounce leading up to the Midterm Elections in the United States.

Bears will be looking for a dead-cat bounce to exit at a better price, and bulls will want buy prices back near year to date lows.

From a chartists perspective the DJI is showing a confirmed bullish reg divergence on the RSI and Stoch. For a tight stop any daily close below 24400 is a quick exit signal, otherwise several consecutive daily closes below 24400 will invalidate the divergence.

I believe it is likely we will see a few days of action between 24300 and 25000 before a break above that level. Price has entered a short term bearish trend and secondary sideways trend within the primary bull trend.

Bullish divergence - bottom is in for now unless above condition met.

DOW JONES INDUSTRIAL AVERAGE DAILY CHARTDOW JONES INDUSTRIAL AVERAGE DAILY CHART

10th October, 2018

Back in July 26th we expected the recent sharp

drop. As showing in the chart this could be or even

get better level to buy for eventual all time high target

around 28000 area during the forthcoming weeks.

Watch BOMBARDIER - ChannelTechnicals - Bombardier is in a parallel channel. The upper limit and 180EMA are overlapping and form a strong resistance. Price could bounce down, or break above and get a good run-up. If it happens to go up, it could go back to recent highs around 5.40. I am just waiting for a trend confirmation to get into the trade.

Fundamentals - Bombardier made good progress on their airplane sales, especially with their C-Series planes. However, in a recent article, Financial Times warned about the difficulties the company has with railways products. In addition, the Motley Fool described Bombardier as a "shaky" investment as of now.

Remember that the stock was trading as low as $0.80 in 2016. Such an improvement in this industry is huge. That is why I advise caution if you want to go long.

Trade safe!

KEYS - buy and holdSector: Industrials

Sub-Sector: Industrial Machinery & Equipment

Keysight Technologies, Inc. is a measurement company engaged in providing electronic design and test solutions to communications and electronics industries. 5G test solutions as one example, automated driving another testing solution, IoT and high-speed data centers another. Keysight generated revenues of $3.2B in fiscal year 2017. In April 2017, Keysight acquired Ixia, a leader in network test, visibility, and security. More information is available at keysight.com.

Liked the MACD on this one and rare to see here, as everyone is looking for short or mid-term trades. 12.3B company with 5.8B assets and 1.7B profits on 3.2B in 2017, so 12.3B means sales growth. No dividend.

DJI Dow Jones Industrial Avg. Correction? We may be in trouble!Lets keep this one super simple! :)

Let me start off by saying I do not trade the DJI, but what it may do may reflect on many other stocks, so here is the long shot chart.

SHORT TERM (bullish trade) - I placed a buy zone near the bottom of my wedge, with one more rise with the sell zone, before our big decent!

You can see the Ichimoku crossed bearish this month on the 4 hr. The DAILY is pushing that direction, but not there yet.

We also have sell signals on the DAILY since June, with no buy signals popping up, approaching the end of the wedge. Momentum is also still bearish, with no change on the DAILY.

(CHART BELOW)

This chart will be posted in the comments with a different view zoomed out to see the bigger picture.

LONG TERM (bearish trade) - Now for the super super fun time trade. Everything requires a correction, DJI is no different.

I've placed some areas of interest, with new years coming up, I think we can see the 236 again, with a short term bounce to the sell zone.

Also have the 382 level with the following year in place, with another short term bounce level.

This area could very well be the bottom, but I like to think every worst case scenario has to play out before a bull run. With that said...

We have the "LOL really" zone at the 618 level.

If this breaks, I would assume all of the selloff money was due to switching funds from the regular market into the crypto market (lol), which at that time will be thriving much more. (Only makes sense)

Honestly though we should see a bounce at that point. If it breaks, its because of some world wide catastrophic event in our economic system. (at this point, you will wish you bought silver at $16 a ounce)

Happy Trading, Debating and Speculating! I want everyone to win!

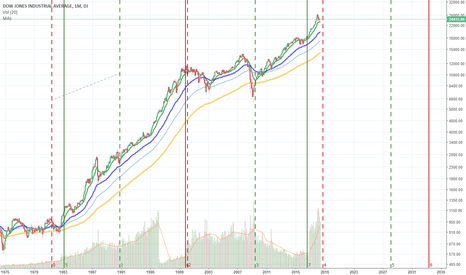

DJIA Dow Jones - Market Cycles LESSON TWO - Studying 2 cyclesLesson Two

The market is more predictable that we have been led to believe.

We will now study the effects of both the 17 year half-cycle and the 9 year half-cycle which are occurring at the same time.

There are many other cycles or sine-waves occurring in DJIA and in other markets as well, but for now we will just focus on these two cycles.

Please see the Lesson One link below for an introduction to how market cycles work.

As I said in the other ideas, the Green line occurs at the trough (low-point) of the cycle and the Red Line occurs at the peak of the cycle. The GREEN ZONE is the period starting at the GREEN LINE to the red line. The RED ZONE starts at the RED LINE and goes to the GREEN LiNE. Growth is strongest in the GREEN ZONE, especially at the end of the green zone. Growth is weakest during the RED ZONE, especially at the end of the RED ZONE.

With TWO CYCLES, there are Green zones and Red Zones. When it is a time period where both cycles are GREEN ZONES, GROWTH is the strongest. When one is red and one is Green, the forces counteract each other. When both zones are RED, growth is the weakest and corrections are stronger.

All of the cycles are still part of a very long term growing economic cycle. It's hard to calculate when this long-term cycle began due to lack of data in the 1700s and 1800s. So due to that, it is hard to know when this long-term cycle will end. But this long-term growth cycle is what keeps the markets overall moving up, despite various corrections.

In this chart the SOLID GREEN Lines are the green lines from the 17 year cycle. The 17 year cycle is stronger, but it takes longer to complete. The DOTTED Lines are the 9 year (approx) cycle which I showed you on the Nasdaq. This 9 year cycle also fits the DOW, I suppose because they are both US Stock market indexes.

You can see how these cycles interact with each other. Growth is stronger when both cycles are green. The DOT.COM Bubble burst after both the 17 year GREEN cycle and the 9 Year Green cycle ended around the same time. They both went into a RED cycle until 2009 where the 9 year cycle became GREEN. The 17 year cycle did not become green until 2016, and afterwards the market growth really picked up. Now we are approaching the end of the GREEN 9 year cycle which ends around November 2018. Stay with my ideas and will will try to calculate shorter cycles to determine where the current market peak is going to end.

I think it points to a recession coming, maybe 2019. But due to the 17 year green cycle, it probably won't be end-of-the-world type market crashes. The 9 year cycle will be red until 2028 where it turns green. The 17 year cycle is green until 2033. There is still the possibility of doing something like the predepression bubble after 2028 when both cycles are green at the same time. Even if not like that, it is likely to have a bubble of some sort after 2028 due to both cycles being green.

Please click like if like the idea. Give comments or questions for clarifications how two cycles interact together. I hope I have explained this well enough.

Stay tuned, we will try to focus on a closer cycle to see if we can get a more accurate time period for a market top in 2018.

S&P500 short targets: 2.592,80 / 2.533,00 or long 2.689,5I invest in Crypto currencies and I trade CFD's. When you want to invest in crypto, I advise you to buy 'real coins' because on long term that will give you far more profit than speculate the chart with CFD's. I have bought XRP-Ripple, Bitcoin, Bitcoin Cash, Ethereum, ReddCoin, FeatherCoin, Adcoin ( ACC ), Bunny Token and looking for NEO!

-------------------------------------------------------------------------------------------------------------------------------------------

What about my ' Cycle phenomenon' ? read here:

My main strategy is called 'cycle-trading'. After years of learning and practicing after I bought a teaching-package from a visionair, I found a way of how to trade successful with CFD's on the stock-market. Every stock is following an certain cycle which repeats itself. So, movements are often appearing in the same percentage, aswel long as short. This cycles appear at all levels; when you analyse the chart at 1 month, 1 week, 1 day, 1 hour. (others I don't use). This is the case, because all in life is build by the fibonacci sequence. When you analyse the chart, you'll also see the stock market is behaving itself as the fibonacci sequence. But, still the most difficult part and what it's all about, is where does a long or a short start? and which point is telling you that the cycle is started, so that you know it will probably go to the next fibonacci resistance? .... therefore I have developed some own indicators!

The exact positions of where to open, to close and the stop loss position and take profit position is very important to be successful with trading!

My strategy is to never trade on volatile markets. You will lose your money when you do! Trade on technical-chart analysis! not on news and volatility!

One of my other strategies is that trades are only interesting and ‘safe’ to open when: you can possibly lose 1/3rd of the possible profit. So; when you set the indicators after analysing resistances, and you can lose 100 but win 300, it is worth the try!

How do I decide to open a position or not? First I analyse:

- sentiment on the market > are people in buy mode or short mode

- I have some own created indicators, some I show in my charts. Therefor I use the fibonacci sequence. My indicators tell to open a position or not and in combination with other own created indicators I decide where to place the stop loss and take profit positions.

- and this own indicators tell me when probably a new long position starts or a new short > these are the positions where I place my orders! or open directly.

- and again other own created indicators tell me how far long or short it probably goes. The take profit and stop loss positions are other positions than the resistances in the market!

- the moving-averages and bollinger-bands are very important indicators also. They are helping a lot! by making decisions.

And that is Why I win more than I lose in the end. Patience is everything, we’ll wait for the right moment! But don't forget; trading means investing. Sometimes you lose more than you win in the beginning of a period!

Most of the times the sentiment changes on Monday! please consider that when you start a position on Monday. Tuesday, Wednesday and Thursday are on steady markets normally calm trading days. Than, my strategies work at their best!

Don't forget to follow me, so you get updated when I post new analysis. Also read my account and the 'status updates' to be informed.

Thank you for following and Succes with trading !

Richard from Rich.Exclusive.Trading