Infosys on getting ready for new high? - {20/07/2025}Educational Analysis says that Infosys (Indian Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS on trades you take from my setup educated analysis.

My Analysis is:-

Short term trend may be go to the Internal demand zone.

Long term trend breaks the creates all time new high.

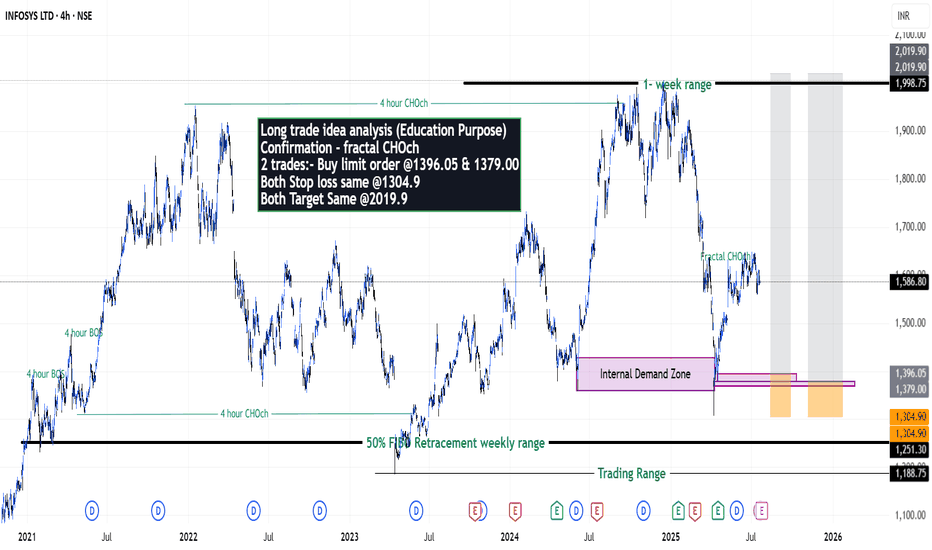

Long trade idea analysis (Education Purpose)

Confirmation - fractal CHOch

2 trades:- Buy limit order @1396.05 & 1379.00

Both Stop loss same @1304.9

Both Target Same @2019.9

Happy Trading,

Stocks & Commodities TradeAnalysis.

Infosysanalysis

INFY - Infosys Ltd (2 hours chart, NSE) - Long PositionINFY - Infosys Ltd (2 hours chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume & support structure integrity risk}

Risk/Reward ratio ~ 2.83

Current Market Price (CMP) ~ 1480

Entry limit ~ 1455 to 1435 (Avg. - 1445) on April 28, 2025

1. Target limit ~ 1485 (+2.77%; +40 points)

2. Target limit ~ 1530 (+5.88%; +85 points)

Stop order limit ~ 1415 (-2.08%; -30 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

Navigating Infosys: A Trade Insight

Currently, Infosys is making its way down to a 15-minute Demand Zone. Let's unpack this potential trade:

Zone Quality Check 🕒:

The 15-minute Demand Zone Infosys is approaching exhibits notable strength, characterized by a robust follow-through. This suggests a compelling setup for potential trades.

Intermediate Frame Exploration 🔄:

Zooming out to the 75-minute Intermediate Time Frame (ITF), Infosys finds itself comfortably within the zone, with the trend pointing upward. This aligns well with the broader context.

Daily Location Analysis 📊:

Shifting to the daily timeframe, which acts as our higher time frame (HTF) for location analysis, we find Infosys trading in an affordable area. This positioning enhances the appeal of the trade execution.

Trade Execution Plan 🎯:

Here's the plan:

- Entry: Enter at the 15-minute Demand Zone or slightly above AROUND 1445.

- Stop Loss: Place it below the 15-minute Demand Zone.

- Target: Aim for a minimum risk-to-reward ratio of 1:3.

🚀 Trade Insight:

This trade aligns well with the strength of the 15-minute Demand Zone, the upward trend in the 75-minute timeframe, and Infosys' affordable position on the daily chart.

📝 Note: This analysis is for educational purposes only. I'm not a SEBI registered analyst.

Trade Smart, Execute Confidently! 💹✨

Picking up infosys is an informed choice1. Infosys ltd. is an Indian multinational IT company that provides business consulting, IT services and outsourcing services. The company is the top employer for the third consecutive year in 2023 and have presence in more than 56 countries.

Infosys CMP is 1335.50. Negative aspects of the company are declining cash from operations and FIIs are decreasing stake. Positive aspects of the company are improving annual net profits, no debt, MFs are increasing stake, promoter holding increasing and zero promoter pledge.

Entry after closing above 1337. Target of the call will be 1365 and 1386. After closing above 1420 the long-term targets in the stock will be 1485. Very long-term target for a long run are 1574 and 1623. Stop loss in the stock should be maintained at closing below 1189.

INFY Infosys Limited Options Ahead Of EarningsLooking at the INFY Infosys Limited options chain ahead of earnings , I would buy the HKEX:20 strike price Calls with

2023-10-20 expiration date for about

$0.45 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

INFOSYS, TECHNICALS and its WAVES!!INFOSYS is showing a RSI DIVERGENCE, with H&S.

i have drawn correction waves, after that it needs to get its bull run, since from past few days, nifty IT, IS getting corrected a lot, because of American news, so this made its bearish trend to continue, and reach its support(which started before the bull run).

this month will be a bearish nature of INFOSYS.

Infosys levels & strategy for coming days?Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please consult your financial advisor before trading.

Dow Jones has taken nose dive and closed with deep cut of 1000 plus points and Nasdaq closed below 500 plus points based on outcome of Jackson Hole meeting.

Will these negative market sentiments push Infy & other IT stocks further down?

Is Infosys trading direction is negative? Infy has formed inverse flag & pole pattern. Will Infy achieve pattern target in coming day?

Shall we look sell on rise strategy till global cues are negative?

Shall we invest for long term in case of decent corrections near 52 W low from current levels?

Please do share your comments as well. Wish you all a very happy, healthy & profitable days ahead!

INFOSYS - Good results declaredWell !!! the result says it all........

Over the days to come as we would end the financial year we should see some more good postings when it comes to the results section.

Hopefully ease of business will be much improved by the slowness in Covid-19

A good stock to accumulate as IT has a very bright future in the coming year ahead !!!!

Infosys profit Booking zone. Good morning all,

Of course, Infosys is a Good Investment stock for the long term but you also must know when to book the profit and when you can make a new entry to get the max profit. Harmonic PRZ in the weekly time frame and there are 80% chances to give the correction from this point. Investors and swing traders can book the profit at this point and can make a new entry on 733-811.

Disclaimer: I am not a SEBI Registered Research Analyst and all the information provided here is for educational purposes Views are shared based on market research and study and personal in nature. Others can take different views and opinions.

Good Luck and Happy Trading

Virendra Pandey