Infosys on getting ready for new high? - {20/07/2025}Educational Analysis says that Infosys (Indian Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS on trades you take from my setup educated analysis.

My Analysis is:-

Short term trend may be go to the Internal demand zone.

Long term trend breaks the creates all time new high.

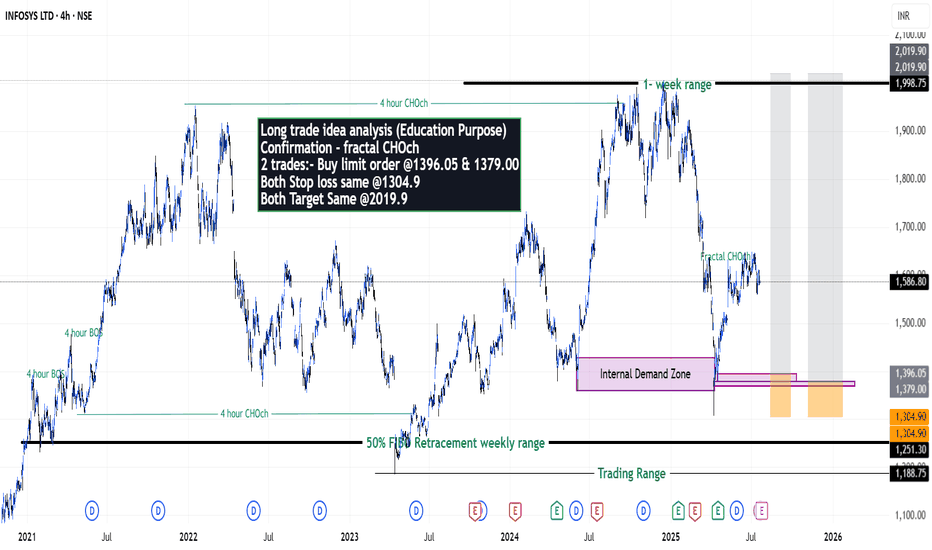

Long trade idea analysis (Education Purpose)

Confirmation - fractal CHOch

2 trades:- Buy limit order @1396.05 & 1379.00

Both Stop loss same @1304.9

Both Target Same @2019.9

Happy Trading,

Stocks & Commodities TradeAnalysis.

Infosystechnicalanalysis

INFOSYS 📊 Chart Analysis – Infosys Ltd (INFY)

Currently, the stock is testing a key resistance zone between ₹1620–₹1630.

If the price breaks and closes above this resistance, it can signal a strong bullish breakout.

---

💼 Trade Setup (Based on Cup and Handle Pattern):

Entry (Buy): On a closing above ₹1640

Stop Loss: ₹1570

Target 1: ₹1700

Target 2: ₹1780

---

This is a classic Cup and Handle breakout setup, which often indicates the start of an upward trend.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

Infosys is building up positive information for investorsInfosys Ltd. is a digital services and consulting company, which engages in the provision of end-to-end business solutions. It operates through the following segments: Financial Services, Retail, Communication, Energy, Utilities, Resources, and Services, Manufacturing, Hi-Tech, Life Sciences, and All Other. Infosys is one of the top Indian companies and an Indian global MNC.

Infosys Ltd. CMP is 1879.80. The positive aspects of the company are Company with No Debt, Company with Zero Promoter Pledge, MFs increased their shareholding last quarter, FII / FPI or Institutions increasing their shareholding and Company able to generate Net Cash - Improving Net Cash Flow. The Negative aspects of the company are high Valuation (P.E. = 29).

Entry can be taken after closing above 1880 Targets in the stock will be 1943. The long-term target in the stock will be 1993. Stop loss in the stock should be maintained at Closing below 1732 or 1719 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

INFOSYS trading analysisInfosys the IT giant of India is going to form a reverse cup with handle chart pattern. The company although giving consistent profits has not formed a new high in the previous 2.5 years. Now after forming this chart pattern it may break its previous high. The buy point is 1910 an selling point is 2500. This will give a 31% return. The stock will achieve this target before 2025 Diwali giving a 30% return in approximately 15-16 months.

Hope you like my analysis.

Please do your own analysis before investing.

Do like and follow and share among your friends and family.

Thank you.

Head & Shoulder pattern on Infosys Dear Fellows,

As shown on chart, we can witness the early signs of head & shoulder pattern on daily chart with neck line @ 1353 /- which means if this patterns as per our prediction then INFY will fall up to 1300 level after the formation of right shoulder and breakdown from 1353 level.

Note : this post is just for the information, please consult your financial advisor before any trade.

What if you have infosys in your portfolio? Many of you must be having Infosys in your portfolio. Even I have it. There is a short term pain for all of you but here is some data that can help you in making your decision. I will be holding it but it is not necessary that you should do the same.

Is the long term story in the company intact?

Ans: Yes.

Why will I be holding majority of my Infosys share?

Because it is a premier Indian IT services company. For me the growth has diluted but not the story. Secondly my entry point is quiet low. Infosys, TCS and Reliance in the reverse order where the first shares that I bought in my account. There is chance of recession in West and IT sector may get affected due to it as a whole. Off late I am not very very happy with some Management moves by Infosys at a deep level. I feel that TCS and LTIM and few other IT firms like Tech Mahindra and HCL Tech may out pace Infosys in a short run. But Infosys is too big an organization and can definitely surprise us by giving a great result next quarter or after next one or Two Quarters.

I have expressed my opinion. You can take a call based on your judgement.

The Chart covers almost 25 year channel of Infosys.

Support levels are: 1191, 1064 and 972.

Resistance levels: 1263, 1311, 1368 and finally 1432.

INFY Infosys Limited Options Ahead Of EarningsLooking at the INFY Infosys Limited options chain ahead of earnings , I would buy the HKEX:20 strike price Calls with

2023-10-20 expiration date for about

$0.45 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

INFOSYS, TECHNICALS and its WAVES!!INFOSYS is showing a RSI DIVERGENCE, with H&S.

i have drawn correction waves, after that it needs to get its bull run, since from past few days, nifty IT, IS getting corrected a lot, because of American news, so this made its bearish trend to continue, and reach its support(which started before the bull run).

this month will be a bearish nature of INFOSYS.

Infosys levels & strategy for coming days?Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please consult your financial advisor before trading.

Dow Jones has taken nose dive and closed with deep cut of 1000 plus points and Nasdaq closed below 500 plus points based on outcome of Jackson Hole meeting.

Is Infy trading in support zone & ready to take reversal to support index? or

Will these negative market sentiments push Infy & other IT stocks further down?

Is Infosys trading direction is negative? Infy has formed inverse flag & pole pattern. Will Infy achieve pattern target in coming days?

Shall we look sell on rise strategy till global cues are negative?

Shall we invest in Infy in small-small chunks for long term in case of decent corrections/near 52 W low from current levels?

Please do share your comments as well. Wish you all a very happy, healthy & profitable days ahead!

Infosys levels & strategy for coming days?Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please consult your financial advisor before trading.

Dow Jones has taken nose dive and closed with deep cut of 1000 plus points and Nasdaq closed below 500 plus points based on outcome of Jackson Hole meeting.

Will these negative market sentiments push Infy & other IT stocks further down?

Is Infosys trading direction is negative? Infy has formed inverse flag & pole pattern. Will Infy achieve pattern target in coming day?

Shall we look sell on rise strategy till global cues are negative?

Shall we invest for long term in case of decent corrections near 52 W low from current levels?

Please do share your comments as well. Wish you all a very happy, healthy & profitable days ahead!

Infosys Futures Key Trading level 27th June 2022Infosys Futures Key Trading level 27th June 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Infosys bull run - continuation or Declining phase startedSo far last 15 months investors were riding on the nice acceleration wave gaining almost 350-400% from March lows (like most other fundamentally strong companies). Look how beautifully it has been on the upside from 30WMA. Last 2 months were bumpy ride. It broke on 30wMA once and then hover to regain MA line . This week it has broke MA line for another upside but missing component here is VOLUME.

What are two possible scenarios here ?

(1) Momentum will regain and will continue being participant of stage 2 advance. in that case, new investors entering here need to respect 30WMA as a stoploss. Once it regains HH-HL , trail your SL to previous lows .

(2) Second option is if this again moves back below 30WMA and MA line starts on negative slope, then a short entry can be made here again with 30WMA as a SL and once it forms LH LL structure, keep trailing SL to prevoius highs.

Key component of your trade decision here should be following :

(1) Overall market structure should be in line with your direction

(2) particular sector should be in line with your trade

(3) respect your decisions with appropriate SLs.

(4) remove hope from wrong trade and exit without fear.

Wish you all good luck and if you like this analysis please do share for more reach.

Happy Trading !!

Infosys ltdInfosys is looking for pull back level 1500, one can go short with key levels.

All the key levels are mentioned in chart with Stop-loss and Targets

Key Levels

Macd in daily

Macd in hourly

Rsi in hourly

DMI ADX

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Consult with your Financial advisor before trading or investing

INFY <> Correction before a healthy move to 1574RSI : Over bought

Volatility : Going down.

Infy is probably loosing momentum and should test support in the range of 1400 - 1450 for a healthy upward moment of 1574 - 1620.

If it goes up further, it can move till 1574 and then test 1500 as a support level.