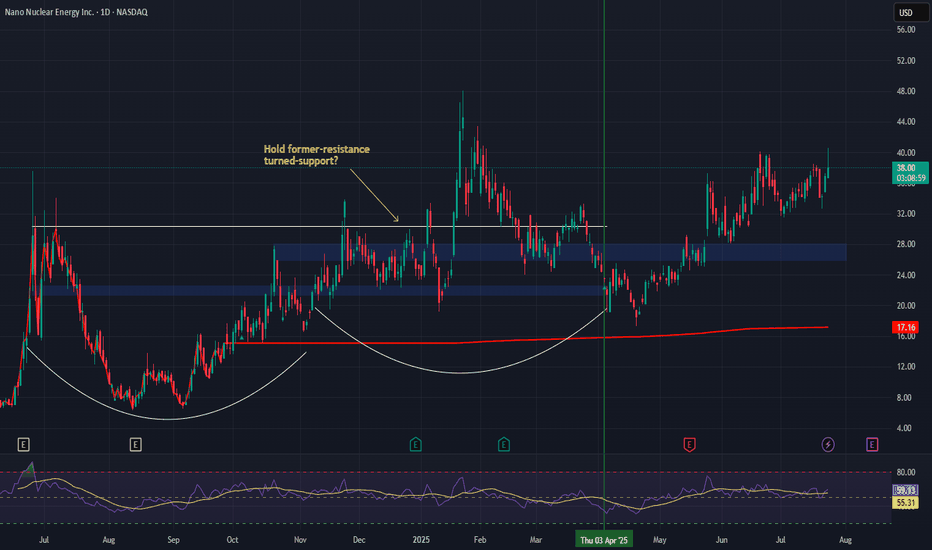

Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

Innovation

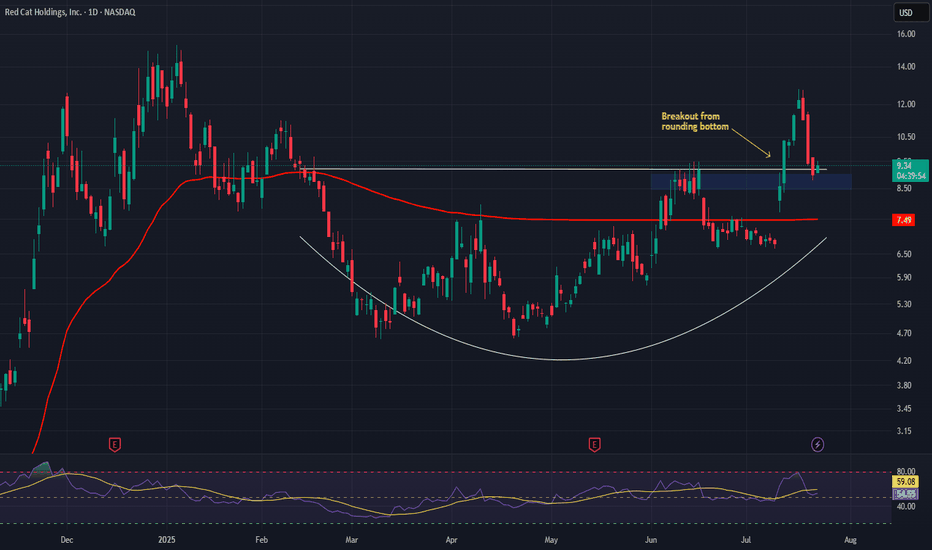

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

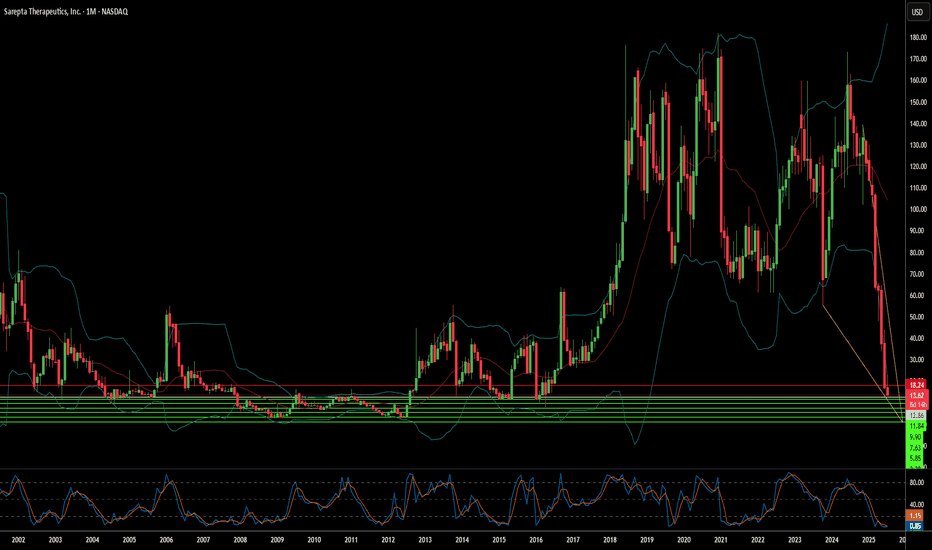

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

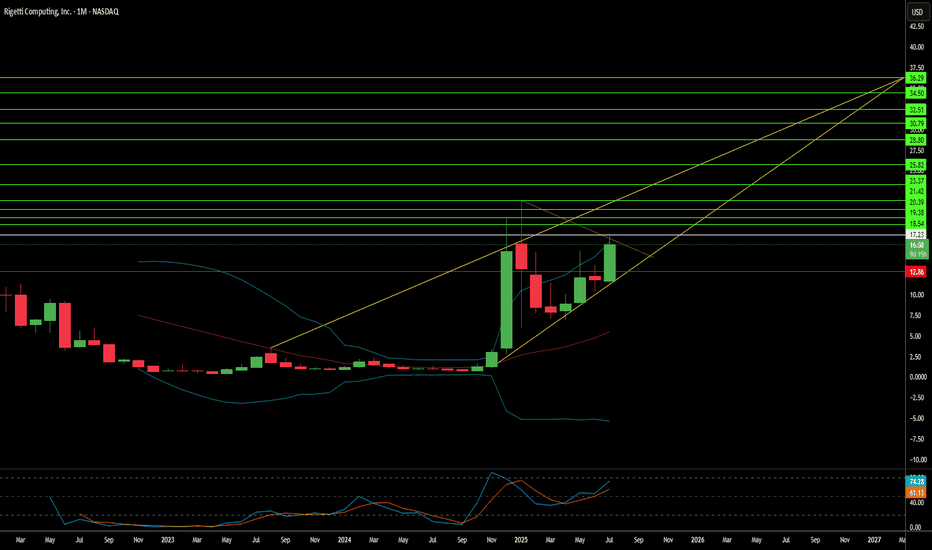

Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward practical quantum applications. Rigetti's superconducting qubits offer gate speeds over 1,000 times faster than competing modalities like ion traps, leveraging semiconductor industry techniques for scalability. The company plans to launch its 36-qubit system by mid-2025 and aims for a 100+ qubit system by year-end, underscoring its rapid technological roadmap.

Beyond technical achievements, strategic partnerships and government contracts bolster Rigetti's position. A substantial $100 million manufacturing deal and a $35 million equity investment from server giant Quanta validate Rigetti's modular architecture. Government backing also provides a stable revenue stream, including a $1 million DARPA award for developing "utility-scale quantum computing" and a $5.48 million Air Force consortium award for advanced chip fabrication. The company further secured three UK Innovate awards for quantum error correction. These collaborations signal confidence from both private industry and national defense initiatives, crucial for a sector still in its nascent stages of commercialization.

Despite these positives, Rigetti's financial metrics reflect the high-risk, high-reward nature of quantum investment. While its market capitalization stands at a robust $5.5 billion, Q1 2025 revenue declined over 50% year-over-year to $1.5 million. Operating expenses remain substantial, with the company operating at a loss. Rigetti's valuation hinges on future potential rather than current profitability, trading at a high price-to-sales ratio. This places immense pressure on the company to meet ambitious technological milestones and rapidly scale revenue in the coming years, transforming speculative bets into tangible commercial success.

The broader quantum computing landscape is marked by intense competition and geopolitical implications. Giants like IBM and Google, also leveraging superconducting qubits, race alongside Rigetti. The sector's projected market size varies wildly, reflecting ongoing uncertainty about widespread commercial adoption. From a geostrategic perspective, quantum computing poses both a national security threat to current encryption and an opportunity for military advancement, driving a global race in post-quantum cryptography. Rigetti's extensive patent portfolio, comprising 37 quantum computing patents, underscores its intellectual property differentiation. However, macroeconomic factors, including rising interest rates, could tighten venture capital funding for speculative high-tech ventures, adding another layer of complexity to Rigetti's path forward.

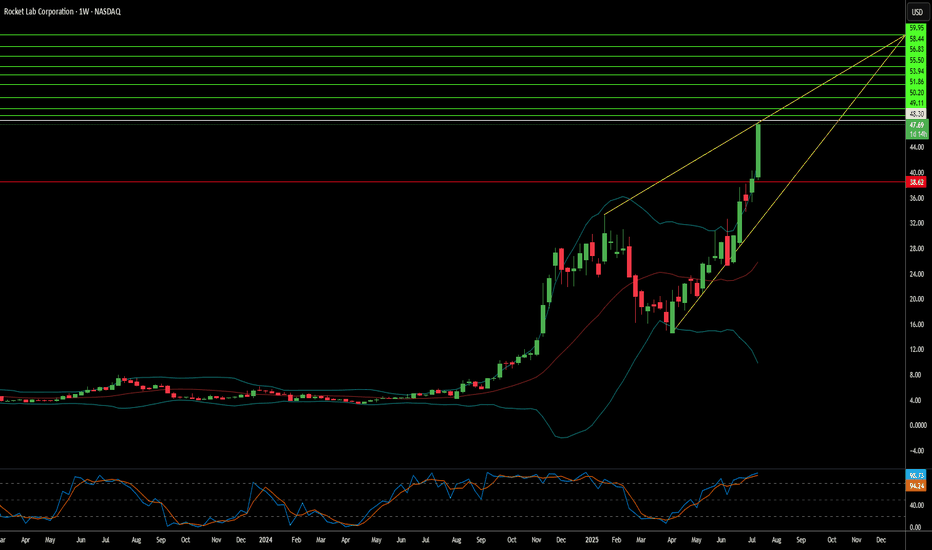

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

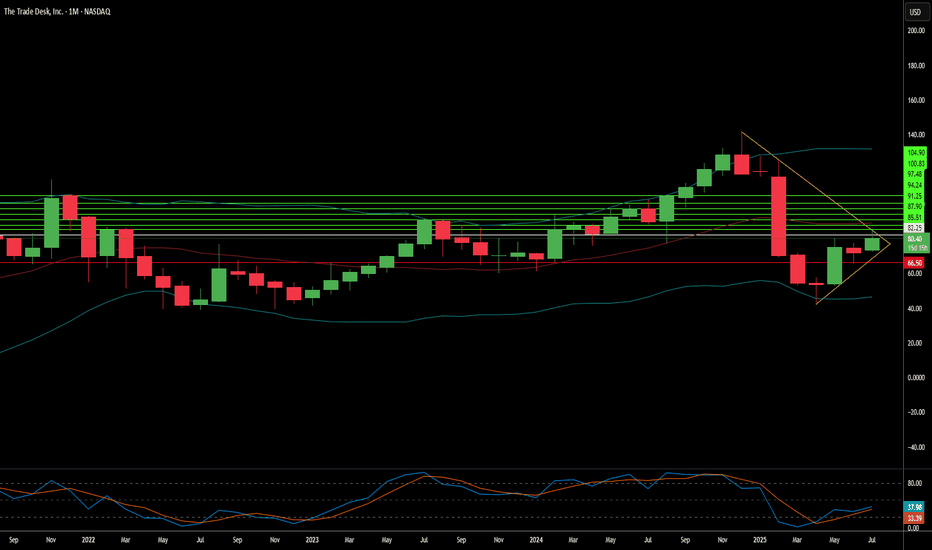

The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately triggered mandated buying from index funds and ETFs. Such inclusion validates TTD's market importance and enhances its visibility and liquidity. This artificial demand floor, coupled with TTD's $37 billion market capitalization, underscores its growing influence within the financial landscape.

Beyond index inclusion, TTD benefits from a significant structural shift in advertising. Programmatic advertising is rapidly replacing traditional media buying, expected to account for nearly 90% of digital display ad spending by 2025. This growth is driven by advertisers' need for transparent ROI, publishers avoiding "walled gardens" through platforms like TTD's OpenPath, and AI-driven innovation. TTD's AI platform, Kokai, greatly lowers acquisition costs and enhances reach, resulting in over 95% client retention. Strategic partnerships in high-growth areas like Connected TV (CTV) further reinforce TTD's leadership.

Financially, The Trade Desk demonstrates remarkable resilience and growth. Its Q2 2025 revenue growth of 17% outpaces the broader programmatic market. Adjusted EBITDA margins hit 38%, reflecting strong operational efficiency. While TTD trades at a premium valuation - over 13x 2025 sales targets-its high profitability, substantial cash flow, and historical investor returns support this. Despite intense competition and regulatory scrutiny, TTD's consistent market share gains and strategic positioning in an expanding digital ad market make it a compelling long-term investment.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

Can Ondas Holdings Redefine Defense Tech Investment?Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers. A pivotal partnership with Klear, a financial technology firm, provides Ondas and its growing ecosystem with non-dilutive working capital. This off-balance-sheet financing mechanism is crucial, enabling rapid expansion and strategic acquisitions within the capital-intensive defense, homeland security, and critical infrastructure sectors without shareholder dilution.

Furthermore, Ondas's American Robotics subsidiary, a leader in FAA Type Certified autonomous drones, recently cemented a strategic manufacturing and supply chain partnership with Detroit Manufacturing Systems (DMS). This collaboration leverages U.S.-based production to enhance scalability, efficiency, and resilience in delivering American Robotics' advanced drone platforms. This domestic manufacturing focus aligns seamlessly with initiatives like the "Unleashing American Drone Dominance" executive order, which aims to bolster the U.S. drone industry, fostering innovation while safeguarding national security against foreign competition.

The company's offerings directly address the paradigm shift in modern warfare. Ondas's private industrial wireless networks (FullMAX) provide critical secure communication for C4ISR and battlefield operations, while its autonomous drone solutions (like the Optimus System and Iron Drone Raider for counter-UAS) are integral to evolving surveillance, reconnaissance, and combat strategies. As geopolitical instabilities intensify, driving unprecedented demand for advanced defense capabilities, Ondas’s integrated operational and financial platform is primed for significant growth, attracting considerable investor interest with its innovative approach to capital deployment and technological advancement.

Is Decentralization the Future of Cell Therapy?Orgenesis Inc. (OTCQX: ORGS) champions a revolutionary approach to cell and gene therapy (CGT) manufacturing. The company focuses on decentralizing production, moving away from traditional, centralized facilities. This strategy, centered on their POCare Platform, aims to drastically improve accessibility and affordability of life-saving advanced therapies. Their platform integrates proprietary therapies, advanced processing technology, and a network of clinical partners. By enabling onsite therapy production at the point of care, Orgenesis directly addresses critical industry hurdles like high costs and complex logistics, which currently limit patient access.

Orgenesis's innovative model is already yielding promising results. Their lead CAR-T therapy candidate, ORG-101, targeting B-cell Acute Lymphoblastic Leukemia (ALL), showed compelling real-world data. A study demonstrated an 82% complete response rate in adults and an impressive 93% in pediatric patients. Crucially, ORG-101 also exhibited a low incidence of severe Cytokine Release Syndrome, a common safety concern with CAR-T therapies. These positive clinical outcomes, coupled with a cost-effective, decentralized production method, position ORG-101 as a potentially transformative treatment option.

The broader pharmaceutical industry stands at a pivotal juncture, with cell and gene therapies driving unprecedented innovation. The global CAR T-cell therapy market alone anticipates substantial growth, projected to reach \$128.8 billion by 2035. This expansion is fueled by increasing chronic disease prevalence, significant investment, and advancements in gene-editing technologies. However, the industry grapples with high treatment costs, manufacturing complexities, and logistical challenges. Orgenesis's decentralized GMP-validated platform, along with their recent acquisition of Neurocords LLC assets for spinal cord injury therapies and the MIDA Technology for AI-based stem cell generation, directly confronts these barriers. Their approach promises to accelerate development, enhance production efficiency, and reduce costs, potentially democratizing access to advanced medicine.

Howmet Aerospace: Navigating Geopolitics to New Heights?Howmet Aerospace (HWM) has emerged as a formidable player in the aerospace sector, demonstrating exceptional resilience and growth amidst global uncertainties. The company's robust performance, marked by record revenues and significant earnings per share increases, stems from dual tailwinds: surging demand in commercial aerospace and heightened global defense spending. Howmet's diversified portfolio, which includes advanced engine components, fasteners, and forged wheels, positions it uniquely to capitalize on these trends. Its strategic focus on lightweight, high-performance parts for fuel-efficient aircraft like the Boeing 787 and Airbus A320neo, alongside critical components for defense programs such as the F-35 fighter jet, underpins its premium market valuation and investor confidence.

The company's trajectory is deeply intertwined with the prevailing geopolitical landscape. Escalating international rivalries, particularly between the U.S. and China, coupled with regional conflicts, are driving an unprecedented surge in global military expenditures. European defense budgets are expanding significantly, fueled by the conflict in Ukraine and broader security concerns, leading to increased demand for advanced military hardware incorporating Howmet’s specialized components. Simultaneously, while commercial aviation navigates challenges like airspace restrictions and volatile fuel costs, the imperative for fuel-efficient aircraft, driven by both environmental regulations and economic realities, solidifies Howmet’s role in the industry’s strategic evolution.

Howmet's success also reflects its adept navigation of complex geostrategic challenges, including trade protectionism. The company has proactively addressed potential tariff impacts, demonstrating a capacity to mitigate risks through strategic clauses and renegotiation, thereby protecting its supply chain and operational efficiency. Despite its premium valuation, Howmet’s strong fundamentals, disciplined capital allocation, and commitment to shareholder returns highlight its financial health. The company's innovative solutions, crucial for enhancing the performance and cost-effectiveness of next-generation aircraft, solidify its integral position within the global aerospace and defense ecosystem, making it a compelling consideration for discerning investors.

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

Is AMD Poised to Redefine the Future of AI and Computing?Advanced Micro Devices (AMD) is rapidly transforming its market position, recently converting a Wall Street skeptic, Melius Research, into a bullish advocate. Analyst Ben Reitzes upgraded AMD stock to "buy" from "hold," significantly raising the price target to \$175 from \$110, citing the company's substantial progress in artificial intelligence (AI) chips and computing systems. This optimistic outlook is fueled by a confluence of factors, including surging demand from hyperscale cloud providers and sovereign entities, alongside colossal revenue opportunities in AI inferencing workloads. Another upgrade from CFRA to "strong buy" further underscores this shifting perception, highlighting AMD's new product launches and an expanding customer base, including key players like Oracle and OpenAI, for its accelerator technology and the maturing ROCm software stack.

AMD's advancements in the AI accelerator market are particularly noteworthy. The company's MI300 series, including the MI300X with its industry-leading 192GB HBM3 memory, and the newly unveiled MI350 series, are designed to deliver significant price and performance advantages over rivals like Nvidia's H100. At its "Advancing AI 2025" event on June 12, AMD not only showcased the MI350's potential for up to 38x improvement in energy efficiency for AI training but also previewed "Helios" full-rack AI systems. These comprehensive, plug-and-play solutions, leveraging future MI400 series GPUs and Zen 6-based EPYC "Venice" CPUs, position AMD to directly compete for the lucrative business of hyperscale operators. As AI inference workloads are projected to consume 58% of AI budgets, AMD's focus on efficient, scalable AI platforms puts it in a prime position to capture a growing share of the rapidly expanding AI data center market.

Beyond AI, AMD is pushing the boundaries of traditional computing with its upcoming Zen 6 Ryzen CPUs, reportedly targeting "insane" clock speeds, well above 6 GHz, with some leaks suggesting peaks of 6.4-6.5 GHz. Built on TSMC's advanced 2nm lithography node, the Zen 6 architecture, developed by the same team behind the successful Zen 4, promises significant architectural improvements and a substantial increase in performance per clock. While these are leaked targets, the combination of AMD's proven design capabilities and TSMC's cutting-edge process technology makes these ambitious clock speeds appear highly achievable. This aggressive strategy aims to deliver compelling performance gains for PC enthusiasts and enterprise users, further solidifying AMD's competitive stance against Intel's forthcoming Nova Lake CPUs, which are also expected around 2026 and feature a modular design and up to 52 cores.

Can Geopolitics Power Tech's Ascent?The Nasdaq index recently experienced a significant surge, driven largely by an unexpected de-escalation of tensions between Israel and Iran. Following a weekend where U.S. forces reportedly attacked Iranian nuclear sites, investors braced for a volatile Monday. However, Iran's measured response - a missile strike on a U.S. base in Qatar, notably without casualties or significant damage - signaled a clear intent to avoid wider conflict. This pivotal moment culminated in President Trump's announcement of a "Complete and Total CEASEFIRE" on Truth Social, which immediately sent U.S. stock futures, including the Nasdaq, soaring. This rapid shift from geopolitical brinkmanship to a declared truce fundamentally altered risk perceptions, alleviating immediate concerns that had weighed on global markets.

This geopolitical calm proved particularly beneficial for the Nasdaq, an index heavily weighted towards technology and growth stocks. These companies, often characterized by global supply chains and reliance on stable international markets, thrive in environments of reduced uncertainty. Unlike sectors tied to commodity prices, tech firms derive their value from innovation, data, and software assets, which are less susceptible to direct geopolitical disruptions when tensions ease. The perceived de-escalation of conflict not only boosted investor confidence in these growth-oriented companies but also potentially reduced pressure on the Federal Reserve regarding future monetary policy, a factor that profoundly impacts the borrowing costs and valuations of high-growth technology firms.

Beyond the immediate geopolitical relief, other crucial factors are shaping the market's trajectory. Federal Reserve Chair Jerome Powell's upcoming testimony before the House Financial Services Committee, where he will discuss monetary policy, remains a key focus. Investors are closely scrutinizing his remarks for any indications regarding future interest rate adjustments, particularly given current expectations for potential rate cuts in 2025. Additionally, significant corporate earnings reports from major companies like Carnival Corporation (CCL), FedEx (FDX), and BlackBerry (BB) are due. These reports will offer vital insights into various sectors' health, providing a more granular understanding of consumer spending, global logistics, and software security, thereby influencing overall market sentiment and the Nasdaq's continued performance.

Who Silently Powers the AI Revolution?While the spotlight often shines on AI giants like Nvidia and OpenAI, a less-publicized but equally critical player, CoreWeave, is rapidly emerging as a foundational force in the artificial intelligence landscape. This specialized AI cloud computing provider is not just participating in the AI boom; it is building the essential infrastructure that underpins it. CoreWeave's unique model allows companies to "rent" high-performance Graphics Processing Units (GPUs) from its dedicated cloud, democratizing access to the immense computational power required for advanced AI development. This strategic approach has positioned CoreWeave for substantial growth, evidenced by its impressive 420% year-over-year revenue growth in Q1 2025 and a burgeoning backlog of over $25 billion in remaining performance obligations.

CoreWeave's pivotal role became even clearer with the recent partnership between Google Cloud and OpenAI. Though seemingly a win for the tech titans, CoreWeave is supplying the critical compute power that Google then resells to OpenAI. This crucial, indirect involvement places CoreWeave at the nexus of the AI revolution's most significant collaborations, validating its business model and its capacity to meet the demanding computational needs of leading AI innovators. Beyond merely providing raw compute, CoreWeave is also innovating in the software space. Following its acquisition of AI developer platform Weights & Biases in May 2025, CoreWeave has launched new AI cloud software products designed to streamline AI development, deployment, and iteration, further cementing its position as a comprehensive AI ecosystem provider.

Despite its rapid stock appreciation and some analyst concerns about valuation, CoreWeave's core fundamentals remain robust. Its deep partnership with Nvidia, including Nvidia's equity stake and CoreWeave's early adoption of Nvidia's cutting-edge Blackwell architecture, ensures access to the most sought-after GPUs. While currently in a heavy investment phase, these expenditures directly fuel its capacity expansion to meet an insatiable demand. As AI continues its relentless advancement, the need for specialized, high-performance computing infrastructure will only intensify. CoreWeave, by strategically positioning itself as the "AI Hyperscaler," is not just witnessing this revolution; it is actively enabling it.

What Fuels Cisco's Quiet AI Domination?Cisco Systems, a long-standing titan in networking infrastructure, is experiencing a significant resurgence, largely driven by a pragmatic and highly effective approach to artificial intelligence. Unlike many enterprises chasing broad AI initiatives, Cisco focuses on solving "boring" yet critical customer experience problems. This strategy yields tangible benefits, including substantial reductions in support cases and significant time savings for customer success teams, ultimately freeing resources to address more complex challenges and enhance sales processes. This practical application of AI, coupled with a focus on resiliency, simplicity through unified interfaces, and personalized customer journeys, underpins Cisco's strengthening market position.

The company's strategic evolution also involves a nuanced embrace of Agentic AI, viewing it not as a replacement for human intellect but as a powerful augmentation. This shift from AI as a mere "tool" to a "teammate" enables proactive problem detection and resolution, often before customers even recognize an issue. Beyond internal efficiencies, Cisco's growth is further fueled by shrewd strategic investments and acquisitions, such as the integration of Isovalent's eBPF technology. This acquisition has rapidly enhanced Cisco's offerings in cloud-native networking, security, and load balancing, demonstrating its agility and commitment to staying at the forefront of technological innovation.

Cisco's robust financial performance and strategic partnerships, particularly with AI leaders like Nvidia and Microsoft, underscore its market momentum. The company reports impressive growth in product revenues, especially in its Security and Observability segments, signaling a successful transition toward a more predictable, software-driven revenue model. This strong performance, combined with a clear vision for AI-driven customer experience and strategic collaborations, positions Cisco as a formidable force in the evolving technology landscape. The company's disciplined approach offers valuable lessons for any organization seeking to harness the transformative power of AI effectively.

Is Digital LiDAR the Eye of Autonomy's Future?Ouster, Inc. (NYSE: OUST), a key player in the small-cap technology landscape, recently experienced a significant boost in its share price following a crucial endorsement from the United States Department of Defense (DoD). This approval of Ouster's OS1 digital LiDAR sensor for unmanned aerial systems (UAS) validates the company's technology. It highlights the growing importance of advanced 3D vision solutions in both defense and commercial sectors. Ouster positions itself as a foundational enabler of autonomy, with its digital LiDAR distinguishing itself through enhanced affordability, reliability, and resolution compared to traditional analog systems.

The DoD's inclusion of the OS1 sensor within its Blue UAS Framework represents a strategic victory for Ouster. This rigorous vetting process ensures supply chain integrity and operational suitability, making the OS1 the first high-resolution 3D LiDAR sensor to receive such an endorsement. This approval significantly streamlines procurement for various DoD entities, promising expanded adoption beyond Ouster's existing defense engagements. The OS1's superior performance in weight, power efficiency, and rugged conditions further underscores its value in demanding applications.

Looking ahead, Ouster actively develops its next-generation Digital Flash (DF) Series, a solid-state LiDAR solution poised to revolutionize automotive and industrial applications. By eliminating moving parts, the DF series promises enhanced reliability, longevity, and cost-efficient mass production, addressing critical needs for autonomous driving and advanced driver-assistance systems (ADAS). This forward-looking innovation, combined with the recent DoD validation, firmly establishes Ouster as a pivotal innovator in the rapidly evolving landscape of autonomous technologies, driving its ambition to capture a substantial share of the $70 billion total addressable market for 3D vision.

Why QuickLogic? Unpacking its Semiconductor Surge.QuickLogic Corporation, a vital developer of embedded FPGA (eFPGA) technology, currently navigates a rapidly evolving semiconductor landscape marked by intense technological innovation and shifting geopolitical priorities. Its recent inclusion in the Intel Foundry Chiplet Alliance signals a pivotal moment, affirming QuickLogic's expanding influence in both defense and high-volume commercial markets. This strategic collaboration, combined with QuickLogic’s advanced technological offerings, positions the company for significant growth as global requirements for secure and adaptable silicon intensify.

Critical geopolitical imperatives and a profound shift in semiconductor technology fundamentally drive the company's ascent. Nations are increasingly prioritizing robust, secure, and domestically sourced semiconductor supply chains, particularly for sensitive aerospace, defense, and government applications. Intel Foundry's efforts, including the Chiplet Alliance, directly support these strategic demands by cultivating a secure, standards-based ecosystem within the U.S. QuickLogic’s alignment with this initiative enhances its status as a trusted domestic supplier, expanding its reach within markets that value security and reliability above all else.

Technologically, the industry's embrace of chiplet-based architectures plays directly into QuickLogic’s strengths. As traditional monolithic scaling faces mounting challenges, the modular chiplet approach gains traction, allowing for the integration of separately manufactured functional blocks. QuickLogic's eFPGA technology provides configurable logic, perfectly suited for seamless integration within these multi-chip packages. Its proprietary Australis™ IP Generator rapidly develops eFPGA Hard IP for advanced nodes like Intel’s 18A, optimizing power, performance, and area. Beyond defense, QuickLogic's eFPGA integrates into platforms like Faraday Technology's FlashKit™-22RRAM SoC, offering unparalleled flexibility for IoT and edge AI applications by enabling post-silicon hardware customization and extending product lifecycles.

Membership in the Intel Foundry Chiplet Alliance offers QuickLogic tangible advantages, including early access to Intel Foundry's advanced processes and packaging, reduced prototyping costs through multi-project-wafer shuttles, and participation in defining interoperable standards via the UCIe standard. This strategic positioning solidifies QuickLogic’s competitive edge in the advanced semiconductor manufacturing landscape. Its consistent innovation and robust strategic alliances underscore the company’s strong future trajectory in a world hungry for adaptable and secure silicon solutions.

Beyond Bits: Is D-Wave Quantum the Unseen Power?D-Wave Quantum is rapidly solidifying its position as a transformative force in the burgeoning field of quantum computing. The company recently achieved a significant milestone with its Advantage2 system, demonstrating "beyond-classical computation." This breakthrough involved solving a complex simulation problem for magnetic materials in minutes, a task that would have required nearly a million years and the equivalent of the world's annual electricity consumption from the most powerful classical supercomputers. This distinct achievement, rooted in D-Wave's specialized quantum annealing approach, sets it apart from other industry players, including Google, which primarily focuses on gate-model quantum architectures.

D-Wave's unique technological focus translates into a formidable commercial advantage. It stands as the sole provider of commercially available quantum computers, which excel at solving intricate optimization problems—a substantial segment of the overall quantum computing market. While competitors grapple with the long-term development of universal gate-model systems, D-Wave's annealing technology delivers immediate, practical applications. This strategic differentiation allows D-Wave to capture and expand its market share within an industry poised for exponential growth.

Beyond its commercial prowess, D-Wave plays a critical role in national security. The company maintains deep ties with elite U.S. national security entities, notably through its backing by In-Q-Tel, the CIA's venture capital arm. Recent installations, such as the Advantage2 system at Davidson Technologies for defense applications, underscore D-Wave's strategic importance in addressing complex national security challenges. Despite its groundbreaking technology and strategic partnerships, D-Wave's stock experiences considerable volatility. This reflects both the speculative nature of a nascent, complex industry and potential market manipulations by investment houses with conflicting interests, highlighting the intricate dynamics surrounding disruptive technological advancements.

EV Crossroads: Is BYD's Price War the Future of Mobility?The electric vehicle (EV) sector is currently navigating a period of significant turbulence, exemplified by the recent stock decline of Chinese EV giant BYD Company Limited. This downturn follows BYD's aggressive strategy of implementing sweeping price cuts, ranging from 10% to as much as 34% across its electric and plug-in hybrid models. This bold maneuver, primarily aimed at reducing a burgeoning inventory that swelled by approximately 150,000 units in early 2025, has ignited fears of an intensified price war within China's fiercely competitive EV market. While analysts suggest these discounts could temporarily boost sales, they also underscore deeper anxieties stemming from slowing EV demand, persistent economic sluggishness in China, and ongoing US-China trade frictions, leading to concerns about margin compression across the industry.

In stark contrast to BYD's emphasis on manufacturing scale, vertical integration, and aggressive pricing, Tesla distinguishes itself through a relentless pursuit of technological supremacy, particularly in autonomous driving. Tesla's foundational commitment to autonomy is evident in its Full Self-Driving (FSD) software, which has accumulated over 3.5 billion miles of data, and its substantial investments in the "Dojo" supercomputer and custom AI chip development. While BYD is also investing in advanced driver-assistance systems (ADAS), including the adoption of DeepSeek’s R1 AI model, Tesla's ambitious Robotaxi project represents a higher-risk, higher-reward proposition centered on true unsupervised autonomy, a strategy that proponents believe could fundamentally transform its valuation.

Further complicating the competitive landscape are escalating geopolitical tensions between the US and China, casting a long shadow over Chinese companies with exposure to US capital markets. Despite BYD's strategic avoidance of the US passenger car market by focusing on other international regions like Europe and Southeast Asia, the broader implications of Sino-American friction are inescapable. Chinese firms listed on US exchanges face rigorous regulatory scrutiny, the persistent threat of delisting under legislation like the Holding Foreign Companies Accountable Act (HFCAA), and the chilling effect of broader trade restrictions. This environment has led to stark warnings from financial institutions, with Goldman Sachs, for instance, outlining an "Extreme Scenario" where the collective market value of US-listed Chinese stocks could effectively vanish, highlighting how geopolitical stability is now as crucial to investment outcomes as any balance sheet.

Archer Aviation: Fact or Fiction in the Skies?Archer Aviation, a prominent player in the burgeoning electric vertical takeoff and landing (eVTOL) industry, recently experienced a significant stock surge, followed by a sharp decline. This volatility was triggered by a report from short-seller Culper Research, which accused Archer of "massive fraud" and systematically misleading investors on key development and testing milestones for its Midnight eVTOL aircraft. Culper's allegations included misrepresentations of assembly timelines, readiness for pilot-controlled flights, and the legitimacy of a "transition flight" to unlock funding. The report also criticized Archer's promotional spending and claimed stalled progress on FAA certification, challenging the company's aggressive commercialization timeline.

Archer Aviation swiftly and forcefully refuted these claims, labeling them "baseless" and questioning Culper Research's credibility, citing its founder's "shorting and distorting" reputation. Archer emphasized its strong first-quarter 2025 earnings, which saw a dramatic narrowing of net losses and a substantial increase in cash reserves to over $1 billion. The company highlighted its operational momentum, including strategic partnerships with Palantir for AI development and Anduril for defense applications, a $142 million U.S. Air Force contract, and significant early customer orders exceeding $6 billion. Archer also pointed to its progress on FAA operational certifications, having secured three of four essential licenses, and its preparation for "for credit" flight testing for Type Certification, a critical step towards commercial passenger operations.

Culper Research's past track record presents a mixed picture, with previous targets like Soundhound AI experiencing initial stock declines followed by strong financial rebounds, though some legal challenges persisted. This nuanced history suggests that while Culper's reports can cause immediate market disruption, they do not consistently predict long-term corporate failure or fully validate the most severe allegations. The eVTOL industry itself faces immense challenges, including stringent regulatory hurdles, high capital requirements, and the need for extensive infrastructure development.

For investors, Archer Aviation remains a high-risk, long-duration investment. The conflicting narratives necessitate a cautious approach, focusing on verifiable milestones such as FAA Type Certification progress, cash burn rate, successful commercialization execution, and Archer's comprehensive response to the allegations. While the "fraud" thesis might be "overblown" given Archer's verifiable progress and strong financial position, ongoing due diligence is crucial. The company's long-term success hinges on its ability to navigate these complexities and meticulously execute its ambitious commercialization plan.

What Fuels Microsoft's Unstoppable Rise?Microsoft Corporation consistently demonstrates its market leadership, evidenced by its substantial valuation and strategic maneuvers in the artificial intelligence sector. The company's proactive approach to AI, particularly through its Azure cloud platform, positions it as a central hub for innovation. Azure now hosts a diverse array of leading AI models, including xAI’s Grok, alongside offerings from OpenAI and other industry players. This inclusive strategy, driven by CEO Satya Nadella's vision, aims to establish Azure as the definitive platform for emerging AI technologies, offering robust Service Level Agreements and direct billing for hosted models.

Microsoft's AI integration extends deeply into its product ecosystem, significantly enhancing enterprise productivity and developer capabilities. GitHub's new AI coding agent streamlines software development by automating routine tasks, allowing programmers to focus on complex challenges. Furthermore, Microsoft Dataverse is evolving into a powerful, secure platform for AI agents, leveraging features like prompt columns and the Model Context Protocol (MCP) server to transform structured data into dynamic, queryable knowledge. The seamless integration of Dynamics 365 data within Microsoft 365 Copilot further unifies business intelligence, enabling users to access comprehensive insights without switching contexts.

Beyond its core software offerings, Microsoft's Azure cloud provides critical infrastructure for transformative projects in highly regulated sectors. The UK's Met Office, for instance, successfully transitioned its supercomputing operations to Azure, improving weather forecasting accuracy and advancing climate research. Similarly, Finnish startup Gosta Labs utilizes Azure's secure and compliant environment to develop AI solutions that automate patient record-keeping, significantly reducing administrative burdens in healthcare. These strategic partnerships and technological advancements underscore Microsoft's foundational role in driving innovation across diverse industries, cementing its position as a dominant force in the global technology landscape.

Honeywell: Quantum Leap or Geopolitical Gambit?Honeywell is strategically positioning itself for significant future growth by aligning its portfolio with critical megatrends, notably aviation's future and quantum computing's burgeoning field. The company demonstrates remarkable resilience and foresight, actively pursuing partnerships and investments designed to capture emerging market opportunities and solidify its leadership in diversified industrial technologies. This forward-looking approach is evident across its core business segments, driving innovation and market expansion.

Key initiatives underscore Honeywell's trajectory. In aerospace, the selection of the JetWave™ X system for the U.S. Army's ARES aircraft highlights its role in enhancing defense capabilities through advanced, resilient satellite communication. Furthermore, the expanded partnership with Vertical Aerospace for the VX4 eVTOL aircraft's critical systems positions Honeywell at the forefront of urban air mobility. In the realm of quantum computing, Honeywell's majority-owned Quantinuum subsidiary recently secured a potentially $1 billion joint venture with Qatar's Al Rabban Capital, aiming to develop tailored applications for the Gulf region. This significant investment provides Quantinuum with a first-mover advantage in a rapidly expanding global market.

Geopolitical events significantly influence Honeywell's operational landscape. Increased global defense spending presents opportunities for its aerospace segment, while trade policies and regional dynamics necessitate strategic adaptation. Honeywell addresses these challenges through proactive measures like managing tariff impacts via pricing and supply chain adjustments, and by realigning its structure, such as the planned three-way breakup, to enhance focus and agility. The company's strategic planning emphasizes leading indicators and high-confidence deliverables, bolstering its ability to navigate global complexities and capitalize on opportunities arising from shifting geopolitical currents.

Analysts project strong financial performance for Honeywell, forecasting substantial increases in revenue and earnings per share over the coming years, which supports expected dividend growth. While the stock trades at a slight premium to historical averages, analyst ratings and institutional investor confidence reflect positive sentiment regarding the company's strategic direction and growth prospects. Honeywell's commitment to innovation, strategic partnerships, and adaptable operations positions it robustly to achieve sustained financial outperformance and maintain market leadership amidst a dynamic global environment.

Is PayPal's Dominance Built on Tech and Ties?PayPal strategically positions itself at the forefront of digital commerce by combining advanced technological capabilities with key partnerships. A core element of this strategy is the company's robust fraud prevention infrastructure, heavily reliant on sophisticated machine learning. By analyzing vast datasets from its extensive user base, PayPal's systems proactively detect and mitigate fraudulent activities in real time, providing a critical layer of security for consumers and businesses in an increasingly complex online environment. This technological edge is particularly vital in markets facing elevated fraud risks, where tailored solutions offer enhanced protection.

The company actively pursues strategic collaborations to expand its reach and integrate its services into new digital ecosystems. The partnership with Perplexity to power "agentic commerce" exemplifies this, embedding PayPal's secure checkout solutions directly within AI-driven chat interfaces. This move anticipates the future of online shopping, where AI agents will facilitate transactions. Furthermore, initiatives like PayPal Complete Payments demonstrate a commitment to empowering businesses globally, offering a unified platform for accepting diverse payment methods across numerous markets, optimizing financial operations, and reinforcing security measures.

PayPal also adeptly navigates regulatory landscapes to broaden its service offerings and enhance user convenience. Responding to directives like the EU's Digital Markets Act, PayPal has enabled contactless payments on iPhones in Germany, providing consumers with a direct alternative to existing mobile payment options. This ability to leverage regulatory changes to expand accessibility and choice, coupled with its foundational technological strength and strategic alliances, underpins PayPal's assertive approach to maintaining its leadership position in the dynamic global payments market.