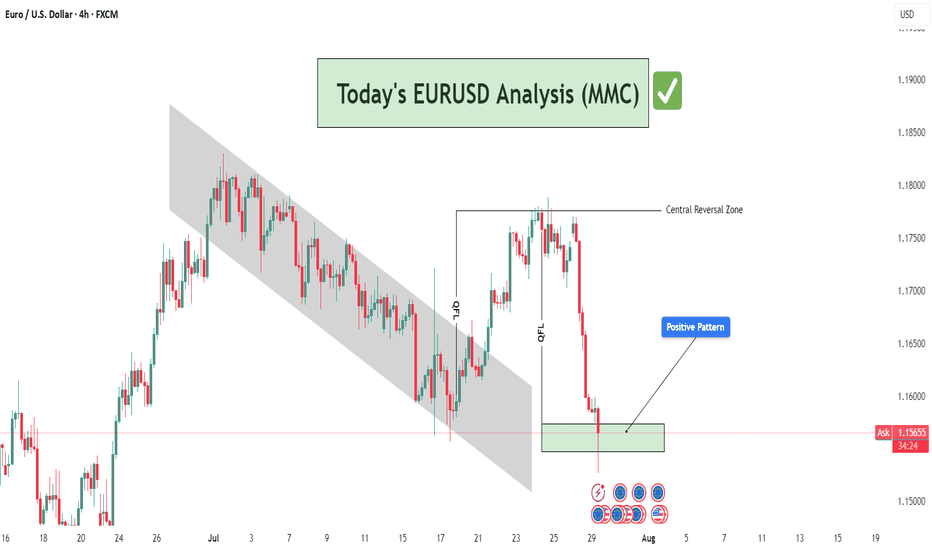

EURUSD Analysis : Rejection at Demand – Institutional Buy Setup🔍 Technical Storyline – What the Chart Tells Us:

🔸 1. Previous Bearish Structure – Descending Channel:

Price has been moving within a well-respected bearish channel, signifying structured sell-side liquidity control.

This channel served as a trap zone, where retail sellers were induced while institutions accumulated buy-side positions below the range.

The controlled movement inside the channel ended with a breakout to the upside, signaling a disruption in bearish control.

🔸 2. QFL Zone Formation – Manipulation & Liquidity Grab:

QFL (Quasimodo Failure Level) is evident in two phases here:

The first QFL acts as a reaction point where the market dropped to test demand and rallied aggressively.

The second QFL near the highs shows price swept previous liquidity before dumping, hinting at institutional profit-taking and possible redistribution into discount areas.

🔸 3. Central Reversal Zone (CRZ):

Price reversed sharply from this CRZ, which acted as a major supply level. The CRZ marks the top of the manipulation range.

This was a liquidity sweep targeting trapped long positions that entered too late at the highs.

🔸 4. Demand Revisit + Positive Rejection Pattern (Current Phase):

Price has now reached the MMC-validated demand zone, which previously launched a strong bullish move.

The long lower wick in the latest candle shows buyer absorption, suggesting early signs of a Positive Reversal Pattern.

This area is marked with high probability for bullish continuation, as it aligns with both technical support and smart money logic.

💡 Trading Plan & Market Mindset:

🔸 📈 Bullish Scenario (High-Probability Play):

Wait for bullish confirmation, such as:

Bullish engulfing on 1H/4H

Break of minor intraday structure (e.g., break of internal LH)

Strong volume surge from the zone

Entry zone: Within the demand block – 1.15500 to 1.15750

Stop-loss: Just below the demand zone (1.15250)

Target 1 (TP1): 1.16500 – minor intraday resistance

Target 2 (TP2): 1.17500–1.18000 – retest of QFL high and Central Reversal Zone

🔸 ❌ Bearish Invalidator:

A 4H candle close below 1.15250 would break the demand zone structure.

Invalidation of MMC reversal – move toward deeper liquidity (1.14500–1.14800)

🧠 Trader’s Psychology & Institutional Mindset:

Institutions often induce price spikes to trap both buyers and sellers.

This entire structure reflects classic accumulation → manipulation → distribution → reaccumulation.

The retest of the original demand zone allows institutions to re-enter at discount before pushing price back toward the highs.

“In MMC, patterns are not just shapes – they are footprints of institutional intent.”

Institutionaltrading

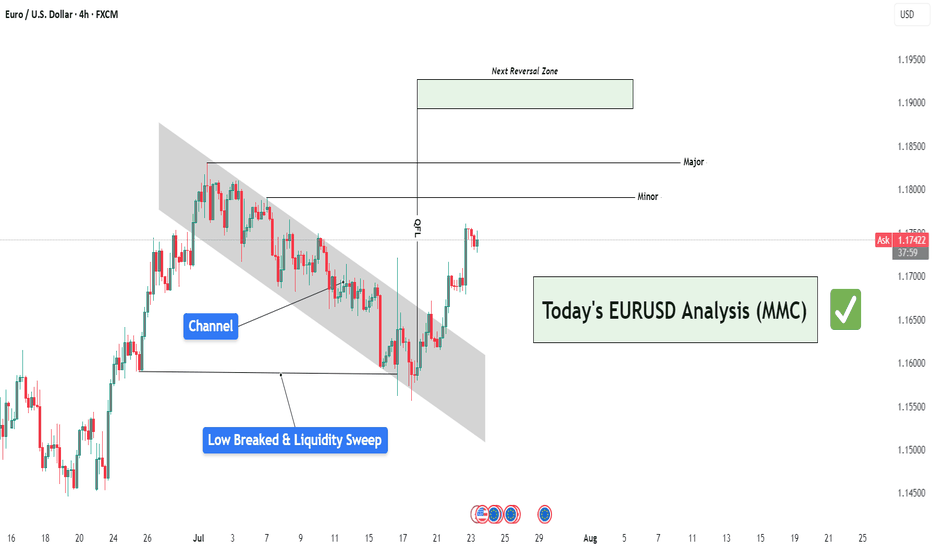

EURUSD Analysis : Liquidity Sweep – EURUSD Targets TO Reversal🧠 Institutional Context & Big Picture

EURUSD has been in a tightly controlled descending channel for several weeks—a classic sign of a market being engineered for liquidity collection. Rather than a naturally trending bearish market, this price action reflects stealth accumulation and market maker manipulation.

The channel structure was used to:

Establish a visible bearish trend (to trap sellers)

Trigger emotional bias for continued shorting

Build up stop orders below swing lows

This phase was about building energy, not continuation.

🔍 Detailed Breakdown of the Chart Elements

📌 1. Descending Channel – Controlled Manipulation

The pair moved within a well-defined bearish channel for multiple weeks.

Each touch respected the top and bottom perfectly—not random, but institutional structure.

It fostered retail confidence in the downtrend while market makers prepared for a reversal.

💥 2. Liquidity Sweep & Trap (Low Breaked & Liquidity Grabbed)

Price spiked below the previous low, clearly sweeping liquidity on July 21.

This is the "engineered breakdown", meant to trigger breakout sellers and stop out early longs.

Immediately after the sweep, the price violently reversed—clear evidence of a liquidity trap.

This is classic MMC logic: induce, trap, reverse.

🟩 3. QFL Base Formed – Bullish Engine Ignited

At the point of reversal, the chart shows the formation of a QFL (Qualified Liquidation Failure) zone.

This QFL base is the core of smart money accumulation—price broke below a base, then quickly reclaimed it.

It's not just support—it’s the true origin of the reversal and an optimal entry point.

📈 4. Breakout from the Channel – Structure Shift Confirmed

Price broke out of the descending channel with strong momentum, confirming:

Structure shift from lower lows → higher highs

Momentum shift in favor of bulls

Entry confirmation for MMC-based long setups

This breakout invalidates the bearish trend and signals a fresh leg up, likely toward unmitigated supply zones.

🟨 5. Current Price Action – Healthy Bullish Consolidation

After the breakout, price is consolidating just above the broken channel, forming a mini-flag or base.

This indicates:

Smart money is accumulating more

No significant selling pressure

Likely continuation toward next supply

🎯 6. Next Targets – Reversal Zones

Minor Resistance: ~1.1800

Major Resistance: ~1.1850 – 1.1880

Next Reversal Zone: 1.1900–1.1950

This zone is highlighted as a potential sell-off area where institutions may offload positions or create new traps.

Watch for signs of exhaustion or redistribution here.

📌 Trade Plan Based on MMC Structure

✅ Bullish Scenario (Currently Active)

Entry Area: Ideally at QFL base or breakout retest (~1.1700–1.1720 zone)

Confirmation: Bullish price action (engulfing, flag break, or liquidity wick)

Targets:

🎯 TP1: 1.1800

🎯 TP2: 1.1850

🎯 TP3: 1.1950 (Reversal Supply Zone)

❌ Invalidation:

A break below the QFL base (~1.1670) with bearish volume would invalidate the bullish MMC structure.

🧠 Smart Money Insight & Logic Recap

This entire move reflects a classic Market Maker Strategy:

Build a trend (descending channel) to shape trader bias

Trigger liquidity events (false breakdown)

Accumulate at the lows via QFL logic

Shift structure (channel breakout)

Target unfilled institutional supply (1.1850–1.1950)

This isn’t random—it’s engineered movement. Your job as a trader is to identify footprints, not follow the crowd.

The "True Close" Institutions Don't Talk About — But Trade On█ My Story from the Inside

I worked at a hedge fund in Europe, where I served as a Risk Advisor. One thing I never expected before joining the institutional side of the market was this:

They didn’t treat the current day’s close as the "true" close of the market.

Instead, they looked at the first hour of the next day — once all pending flows had settled, rebalancing was done, and execution dust had cleared — that was the true close in their eyes.

Here’s why that changed everything I knew about trading:

█ Institutional Reality vs Retail Fantasy

⚪ Retail traders are taught:

“The daily close is the most important price of the day.” But institutions operate under constraints that most retail traders are never exposed to:

Orders too large to fill before the bell

Internal compliance and execution delays

Batch algorithms and VWAP/TWAP systems that extend into the next session

So while the market might close on paper at 17:30 CET, the real trading — the stuff that matters to funds — might not wrap up until 09:30 or 10:00 the next morning.

Although the official “close” prints here, institutional volume ends quickly. It drops off sharply, almost immediately. Once the books are closed and final prints are done, big players exit — and what's left is thin, passive flow or noise.

The first hour of the New York session reveals structured flows, not random volatility. This is where institutions finalize yesterday’s unfinished business, which is why many consider this the “true” close.

And that’s the price risk managers, portfolio managers, and execution teams internally treat as the reference point.

█ Example: The Rebalance Spillover

Let’s say a fund needs to offload €100 million worth of tech stocks before month-end. They start into the close, but liquidity is thin. Slippage mounts. They pause execution. Next morning, their algo resumes — quietly but aggressively — in the first 30 minutes of trade.

You see a sharp spike. Then a reversal. Then another surge.

That’s not noise. That’s structure. It’s the result of unfinished business from yesterday.

█ Why the First Hour is a War Zone

You’ve probably seen it:

Prices whip back and forth at the open

Yesterday’s key levels are revisited, sometimes violently

Big moves happen without any overnight news

Here’s what’s happening under the hood:

Rebalancing spillovers from the day before

Late-position adjustments from inflows/outflows

Risk parity or vol-targeting models triggering trades based on overnight data

The market’s not reacting to fresh news — it’s completing its old to-do list.

█ What the Research Really Says About Morning Volatility

The idea that "the true close happens the next morning" isn’t just insider intuition — it’s backed by market microstructure research that highlights how institutional behaviors disrupt the clean narrative of the official close.

Here’s what the literature reveals:

█ Heston, Korajczyk & Sadka (2010)

Their study on intraday return patterns shows that returns continue at predictable 30-minute intervals, especially around the open.

The key driver? Institutional order flow imbalances.

When big funds can’t complete trades at the close, they spill into the next session, creating mechanical, non-informational momentum during the first hour. These delayed executions are visible as persistent price drifts after the open, not random volatility.

█ Wei Li & Steven Wang (SSRN 2010)

This paper dives into the asymmetric impact of institutional trades. It shows that when institutions are forced to adjust positions — often due to risk limits, inflows/outflows, or model-based triggers — the market reacts most violently in the early hours of the day.

When funds lag behind the clock, the next morning becomes a catch-up window, and price volatility spikes accordingly.

█ Lars Nordén (Doctoral Thesis, Swedish Stock Exchange)

In his microstructure research, Nordén found that the variance of returns is highest in the early part of the session, not at the close. This is especially true on days following macro events or at the end/start of reporting periods.

The data implies that institutions “price in” what they couldn’t execute the day before, making the next morning more informative than the actual close.

█ Bottom Line from the Research:

The first hour isn’t wild because it’s full of emotion.

It’s wild because it’s full of unfinished business.

These studies reinforce that price discovery is a rolling process, and for institutional flows, the official close is just a checkpoint, not a final destination.

█ How to Use This as a Trader

⚪ Don't assume the official close is final

Treat it as a temporary bookmark. Watch what happens in the first hour of the next day — that’s when intentions are revealed.

⚪ Volume in the first 30–60 minutes matters

It’s not noise — it’s flow completion. Often non-price-sensitive. Often mechanical.

⚪ Design strategies around “true close” logic

Test fade setups after the first hour’s range is established. That’s often the real “settled” level.

⚪ Use the first-hour VWAP or midpoint as a reference

Institutions may anchor to that — not the official close — for mean reversion or risk metrics.

█ Final Thought

The first hour is not the start of something new.

It’s the conclusion of yesterday’s market.

And unless you understand how institutions truly close their books — and how long that takes — you’ll always be a step behind.

So next time you see chaos at the open, stop calling it random.

👉 It’s just the market putting yesterday to bed — late.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

EURJPY Technical Breakdown (MMC Strategy) : Target Zone 🧠 Concept Focus: MMC – Mirror Market Concept

The Mirror Market Concept (MMC) helps identify pattern inversions, price reflection zones, and structural symmetry that hint at upcoming market turns. This chart reflects a curve-based reversal logic rooted in smart money behavior, volume analysis, and pattern exhaustion.

📊 Technical Structure Breakdown

🔹 1. Volume Contraction + Breakout (June 6–7)

Early signs of bullish pressure were detected with volume contraction, forming a tight range wedge/triangle.

This is often a liquidity trap where weak hands sell into strength.

Smart money absorbed sell-side liquidity before impulsively breaking out.

This is a common MMC move: contract > trap > expand.

🔹 2. 50% Area Used – Smart Money Trap (June 9)

After the breakout, price tapped into the 50% equilibrium zone of the previous major move.

This level often acts as a liquidity sweep zone, ideal for smart money to unload or build counter positions.

The rejection wick here confirms that institutional traders reacted at this level.

🔹 3. Curve Bending Pattern – Exhaustion in Play

The market has now entered a curve bending phase, visible with the arching price movement.

This signifies momentum exhaustion, where bullish attempts get weaker.

Think of this curve like a mirror ceiling — as each high gets tapped, it bends, showing the market can't sustain higher levels.

🔹 4. Next Reversal Zone (Projected Target: ~164.150–164.200)

Based on MMC symmetry and previous demand zones, the area highlighted as Next Reversal is a key structure zone.

This is where we expect price to react — either bounce (for buyers) or break (for continuation shorts).

A clean bounce here could mirror the earlier pattern in reverse, hence the Mirror Market Concept.

🔁 Summary of Market Psychology

🧲 Volume contraction signals manipulation.

🎯 50% zone rejection shows trap completion.

🪞 Curve bending shows buyers losing strength.

🔻 Price likely to drop into the reversal zone, completing the mirror leg.

🧩 What Traders Should Watch

Indicator/Zone Notes

50% Area Used Smart Money Exit or Entry Trap

Curve Bending Reversal Geometry (Momentum Exhaustion)

Next Reversal Zone Smart Money Demand Zone (~164.150)

Break Below 164.100 Confirms deeper bearish continuation

🎯 Trading Strategy Outlook

🔍 Short Bias: Look for confirmation (e.g., bearish engulfing, BOS on lower TFs) to enter shorts below curve zone.

🛑 Invalidation Level: Clean breakout above 165.500 would invalidate the mirror structure and shift to continuation long.

🎣 Reversal Scouting : If price respects the Next Reversal Zone, there could be a potential long scalp back into mid-range.

🧠 Educational Note: MMC in Action

The Mirror Market Concept is powerful for intraday trading. It uses pattern reflection, liquidity logic, and price symmetry to forecast reversals before typical indicators catch up. If mastered, this concept can give early reversal entries and trap avoidance.

JPYUSD Smart Money VIP Analysis – Eyeing High-Probability Target📈 Market Context:

The JPYUSD (Japanese Yen vs. US Dollar) is currently navigating through a critical structure phase where price is reacting to previously established institutional zones. Recent price movements reveal a clean and structured setup — one that aligns perfectly with Smart Money Concepts (SMC) and CHoCH (Change of Character) theory.

This 2H chart provides a roadmap for anticipating the next high-probability reversal, giving traders an edge in both short-term scalps and mid-term swing trades.

🔍 In-Depth Chart Analysis:

🧱 Resistance Zone (0.007020–0.007040):

This area has been tested multiple times in the past and acted as a strong supply zone. Institutional orders have previously caused significant bearish pressure from this level. Unless a strong bullish breakout occurs with volume, this zone is likely to hold again.

🔁 Next Reversal Zone (0.006975–0.006985):

Price is currently climbing from the SR Interchange Zone, heading toward this marked reversal area. Here's why this zone matters:

Confluence of past resistance and imbalance

Potential liquidity sweep above minor highs

Perfect setup for a bearish reaction to form a lower high

Traders should watch for signs of weak bullish candles, wicks, or a bearish engulfing here.

🔄 SR Interchange (Support-Resistance Flip):

This level held firm, showing buyer interest after a previous structure break. It signals a healthy correction phase — a typical SMC signature before larger moves occur. The market is offering a retracement opportunity.

🟡 CHoCH Zones:

Minor CHoCH (0.006900): A break and close below this level would invalidate bullish correction and confirm the shift in momentum.

Major CHoCH (0.006840): The final confirmation of bearish dominance. A breach here opens the door for new lows, targeting long-term support areas.

⚔️ Smart Money Playbook:

Current Move: Price is in bullish retracement from previous demand zone

Watch Zone: 0.006975–0.006985 (Potential Smart Money sell zone)

Reaction Setup:

Bearish structure forms (e.g., M pattern, liquidity sweep, bearish engulfing)

Price breaks minor CHoCH

Sell Entry: After confirmation, with stops above reversal zone

TP1: SR Interchange level

TP2: Major CHoCH zone

📅 Fundamental Triggers Ahead:

Watch for upcoming USD economic data (CPI, PPI, interest rate decisions) between June 11–14, which could act as catalysts for volatility and confirm technical setups.

🧠 Educational Note:

This setup is a classic example of market structure shift, liquidity engineering, and order block theory — concepts used by banks and smart money traders. Retail traders often get trapped on the wrong side of these zones. Your edge lies in anticipating the trap, not reacting to it.

🎯 Conclusion:

JPYUSD is offering a textbook Smart Money setup. The current retracement gives an opportunity to position early into a likely bearish continuation, provided structure confirms at the next reversal zone. Patience, discipline, and precise timing will be key to capitalizing on this move.

USDJPY Short Setup: OB Rejection + Fib Premium Sell-Off IncomingUSDJPY (1H Chart) | Institutional Short Setup with OB + Fib Confluence

The market is showing clear Smart Money Distribution behavior — with a rejection from a high-confluence zone combining Order Block, Premium Fib Levels, and bearish momentum shift.

🔍 Smart Money Setup Breakdown:

🔻 Bearish Order Block Zone (OB)

Price wicked into OB zone and got instantly rejected

OB located precisely at the 70.5% – 79% premium range

Mark of institutional sell-side interest

📐 Fibonacci Retracement + Premium Zone

Retracement from swing high (144.973) to swing low (144.436)

Premium zone between 61.8% to 79% aligns with OB (144.700–144.973)

Entry taken from this zone for high-probability sell setup

📉 Bearish Confirmation

Aggressive bearish reaction post-OB tap

Market structure flipping bearish

Momentum candle breaks previous bullish leg

🔻 Target Zones (Measured Fib Extensions)

-27%: 144.200

-62%: 144.000

-100%: 143.803

-161.8%: 143.300 (extended liquidity draw)

🧠 Chart Ninja Entry Plan:

🔹 Entry Zone 144.784 – 144.973 (OB + Premium Fib + FVG rejection)

🔻 SL Above 145.000 (above OB wick)

📉 TP 1 144.200 (first fib extension)

📉 TP 2 143.803 (full -100% extension)

⚖️ RRR Approx. 1:4+ — stealthy sniper precision

💬 Pro Tip from the Ninja Dojo:

The market doesn’t move because of indicators — it moves because of liquidity.

Find the OB. Wait for the imbalance. Strike where Smart Money hides. 🥷📊

This isn’t retail — this is calculated execution.

🎯 Save this chart before price melts to 143.8

💬 Drop your entry zone & SL idea in comments

USDJPY | Smart Money Long Setup – Deep Fib + OB Reaction💴 USDJPY | Institutional Long Play with Perfect OB + Fib Confluence

Price gave us an aggressive push off the demand zone, showing clear Smart Money accumulation behavior. This setup is high probability based on Smart Money Concepts (SMC).

🔍 1. Technical Breakdown

Strong impulse move upward

Clean pullback into the Order Block

Confluence with 70.5%–79% Fibonacci retracement zone

Price respected the OB zone and printed higher highs

That reaction was institutional — no cap 🧢.

🧱 2. Bullish Confluences

🔥 Order Block (OB): Purple demand zone = unmitigated

📐 Fib Sweet Spot: 70.5%–79% = institutional re-entry levels

✅ Strong Wick Rejection: Shows absorption of sell-side liquidity

📈 Market Structure Shift: Break of structure to the upside

🎯 3. Trade Plan

Entry: 142.89 (within OB + 70.5%)

Stop Loss: 142.00

Take Profit: 145.49 zone

This setup targets the -27% fib extension — a classic institutional TP level.

⚖️ 4. RRR (Risk-Reward Ratio)

💰 Entry: 142.89

🔒 SL: 142.00

📍 TP: 145.49

✅ RRR ≈ 1:2.9

Solid intraday-to-swing play with clean structure.

🧠 5. Key Confirmation Points

Break and close above 144.36 = confirmed bullish intent

Price respecting 143.44 OB = bulls still in control

SL below OB = protected by demand block

💬 Comment “SMC Long Sniper 💹” if you caught this move!

🔄 Share this if you love OB + fib sniper entries

📌 Save this setup for your next demand zone playbook

XAUUSD | Institutional Sell Setup – OB + 79% Fib Confluence🪙 XAUUSD | Gold Sell Setup Based on Smart Money Concepts

This is a classic example of how institutions lure in retail traders — tap the golden zone, reject hard, and leave a trail of liquidated longs.

🔍 1. Technical Breakdown

Price aggressively climbed into a strong Order Block zone

Rejection from the 70.5%–79% Fibonacci retracement area

Broken ascending channel confirms shift in momentum

Bearish BOS already occurred = Smart Money in control

This zone (3332–3357) is a magnet for institutional sells.

🧱 2. Bearish Confluences

💀 OB Rejection: Previous up candle before the sharp drop

📐 Fib Overlap: 70.5–79% = premium zone for shorts

📉 Structure Shift: Channel break + bearish order flow

⚠️ No Candle Close Above OB: = market respecting supply

🎯 3. Trade Plan

Entry: 3332–3357 (executed)

Stop Loss: 3360 (above OB)

Take Profit: 3120 zone

This is a deep sell-side liquidity hunt.

⚖️ 4. RRR (Risk-Reward Ratio)

📥 Entry: ~3345

🔒 SL: 3360

💰 TP: 3120

✅ RRR ≈ 1:15

This is a "swing short with conviction" kind of setup, where patience = profit.

🔁 5. Key Confirmation Points

Watch for lower lows and lower highs to continue

Price closing below 3290 = full confirmation

If Gold reclaims 3360 = setup invalidated

💬 Comment “Sniped Gold 🥷💰” if you took this short!

📌 Save this chart for OB + Fib zone study

🎯 Post your entry/exit levels — let’s compare setups

BTCUSD Rejection Setup – Order Block Hit, Weak Lows in Sight!📉 BTCUSD is setting up a textbook bearish reversal — Smart Money style.

This 1H chart shows Bitcoin tapping into a high-timeframe Order Block at ~$104,190–104,560, with a clear rejection from the premium zone and confluence with the upper trendline.

📊 Technical Breakdown:

✅ Order Block tapped at $104,190–104,560

✅ Strong rejection candle near the trendline resistance

✅ Price failed to break above the Strong High — a sign of Smart Money distribution

✅ Targeting Sell-Side Liquidity at $101,420

✅ Final target? Weak Low and liquidity pool around $99,189

🔍 Smart Money Confluence:

Price has moved into a premium selling zone, aligning with the upper bounds of market structure

Order Block rejection suggests institutional selling interest

Weak lows below $100K are prime targets for liquidity grabs

Retail longs are likely trapped — ideal conditions for a downward sweep

🧠 Institutional Logic:

Smart Money doesn’t chase price — it delivers it. This move likely represents a "Mitigation and Distribution" phase before a deeper selloff:

📌 Mitigation of previous long positions inside the OB

📌 Distribution at the highs before targeting the next liquidity pool

📉 Trade Idea:

Short Entry Zone: $104,200–104,500

Targets:

TP1: $101,420 (Sell-side Liquidity)

TP2: $100,000 (Psych level / Weak Low)

TP3: $99,189 (Liquidity Magnet)

Invalidation: Clean break and close above $104,800 (above the OB and Strong High)

🧠 Tip for Traders:

Wait for a confirmation bearish structure shift or lower high on the LTF (15m/5m) before entering full size. Smart Money leaves clues — not impulses.

💬 Comment "BTC Setup" if you’re trading this drop

🔁 Save this analysis — this is how Smart Money dominates crypto markets.

GBPJPY Trap & Reversal | Smart Money Loading from OB Zone!We’re analyzing a high-probability bullish reversal setup forming on GBPJPY 1H, built on clean SMC logic. Here’s how this trade is setting up:

🔄 Market Structure:

Prior bearish move into a reversal area

Equal highs (liquidity built up)

Clean sweep below short-term lows ➝ Liquidity grab ✅

Price now reacting from a defined Order Block zone

🧱 Order Block Zone:

Purple OB zone marked at 192.753–192.118

This zone is resting between 61.8% and 70.50% fib levels – high confluence 🔥

💸 Liquidity Levels in Play:

Sell-side liquidity already swept

Buy-side liquidity sitting above the recent highs @ 196.413 (target zone)

🚀 Entry Plan:

Entry Point: Reacting from OB near 192.753

Stop Loss: Below the strong low (192.118)

TP Zone: 196.413 = Buy side liquidity ➝ Weak High marked for potential sweep

🧮 RRR (Risk-to-Reward):

Massive potential ➝ Approx 1:8+ RRR

This is the kind of setup institutions dream of. 🚀

📈 Key Confluences:

Equal highs = liquidity magnet

OB sitting at golden zone

Strong low protecting entry

Institutional pattern: Sweep ➝ OB reaction ➝ expansion

📉 Watch for Pullback/Entry Reconfirmation:

Price may tap deeper into the OB before expanding

Wait for bullish momentum confirmation (CHoCH on 15M or 30M TF = better entry sniper style)

📢 Pro Tip (Trader Mindset):

This setup screams “liquidity engineering”. Retail traders shorted the lower high; Smart Money is about to flip the script. Be the shark, not the fish 🦈

GBPUSD Retests Bullish Order Block – Smart Money Loading Up!📈 GBPUSD SMC Bullish Setup – Institutional Re-Entry Into Power Zone

Traders, this is a prime example of how Smart Money manipulates liquidity, taps deep into premium OBs, and prepares for explosive continuation moves. Let’s break it down step-by-step…

🔍 Market Structure Insight:

We’ve seen a clear bullish BOS (Break of Structure) after a strong impulsive move that broke past previous highs.

Now price is retracing into the bullish Order Block, giving a golden opportunity for re-entry — but only if you know what to look for.

🔲 Key Confluences:

💎 Order Block:

Marked between 1.3332 – 1.3290, this purple zone aligns with:

Breaker candle after a liquidity sweep

Prior imbalance zone

Institutional volume spike

📐 Fib Retracement:

From the swing low to high:

61.8% → 70.5% golden zone nested inside the OB

79% just below — great stop loss placement

📉 Weak High Above:

Current price action shows the market stalling near a weak high at 1.3400 — ripe for targeting in the next expansion.

📌 Strong Low at 1.3245:

Protected unless structure breaks. This helps confirm bullish bias remains intact.

🧠 Smart Money Logic:

This isn't retail "support."

Smart Money took out early sellers, pushed price impulsively, then returned to mitigate orders inside the OB before continuing the expansion.

This retracement = institutional reloading zone.

That red candle into purple? That’s the bait. 🧨

🎯 Entry Plan:

✅ Wait for bullish confirmation inside OB (engulfing, MS shift, or liquidity wick)

✅ Ideal entry at 1.3332–1.3300

✅ Stop below 79% Fib (~1.3289)

✅ Target:

TP1: 0% Fib (~1.3400)

TP2: -27% Fib extension (~1.3445)

TP3: Moon mission? 😏

RRR ~ 1:3.5+ — solid trade for swing traders and intraday scalpers alike!

🧘♂️ Psychology & Patience Reminder:

Let price come to you.

This setup rewards discipline and confirmation — don’t FOMO early.

Watch for trap wicks and engineered fakeouts at the OB zone.

You’re not chasing price.

You’re sitting where Smart Money leaves footprints. 👣

⚠️ Risk Tip:

✅ Stick to your model

✅ 1–2% risk max

✅ Scale partials at key levels

✅ Don’t revenge trade if price reacts first without you — next setup is always coming

🔁 Summary:

This GBPUSD chart is a masterclass in Smart Money structure:

Bullish BOS

Return to Order Block

Fib confluence

Weak high liquidity target

Perfect RRR setup

🧠 Let’s play it like a pro. If OB holds — the market flies. If not, we step out, risk-managed, and wait.

📣 Comment “GBPUSD SNIPER” if you’re ready for the OB bounce.

📈 Tag your trading fam to keep them on the money wave!

XAUUSD Hits FVG in Premium Zone — Bearish Setup in Play!📉 XAUUSD (Gold) has just tapped into a key Fair Value Gap (FVG) after a clean, impulsive rally — now we’re watching for Smart Money distribution and a potential reversal from this high-risk premium area.

📊 Chart Insights:

✅ Price retraced into the FVG zone between $3,225 – $3,240

✅ This zone aligns with the 79% Fibonacci retracement, making it a premium zone for shorts

✅ Market structure shows previous bearish impulse → this could be a retracement before continuation

✅ Current PA is reacting to the imbalance left on the drop

✅ Massive downside potential to rebalance price near $3,120

🧠 Smart Money Confluence:

FVGs are often rebalanced after price trades away impulsively

The retrace into this inefficient pricing zone is classic Smart Money mitigation

Price now sits in an area where institutions may look to offload long positions

📍 Potential Play:

Short Entry Zone: $3,225 – $3,240

Targets:

TP1: $3,200

TP2: $3,170 (mid-level liquidity)

TP3: $3,120 (full FVG fill and higher TF draw)

Invalidation: Clean break and hold above $3,240

💡 Pro Tip:

Watch for a lower timeframe structure shift (15m/5m) or confirmation candle to stack entries. The market loves to sweep highs before the real move begins — patience pays. 🧠💰

📈 This setup offers 3:1+ RR and aligns with Smart Money’s tendency to sell into imbalance and hunt liquidity below.

💬 Comment “Gold Setup” if you’re trading this one!

🔁 Share or save if you're watching for the drop.

XAUUSD Bearish Setup: Retracement Trap Before the Next Sell-Off?🚨 Gold (XAUUSD) is showing signs of a classic Smart Money retracement trap!

If you're trading gold this week, this is the kind of setup that separates the retail guessers from the Smart Money followers.

📉 The Setup Breakdown (30m Chart):

After a violent sell-off, XAUUSD found temporary support near $3,168, marking a key liquidity zone.

Current price is rebounding, but not randomly — it's heading straight toward the 50% - 61.8% Fibonacci retracement zone, which aligns perfectly with previous imbalance.

📍 Supply Zone (Red Box):

The red area marks a likely Smart Money sell zone — between $3,207 and $3,219.

This zone aligns with the 50% - 61.8% retracement and broken structure area — a classic point for redistribution.

🧠 What Smart Money Might Be Doing:

They're not buying this bounce — they’re setting the trap.

Price is retracing into a premium zone, tempting late buyers, while institutions prepare to re-enter shorts.

📉 Bearish Confluence:

The down-sloping channel supports the current bearish momentum.

Any rejection from the red zone could be the start of another impulsive leg down toward $3,170, then $3,168 and possibly lower.

🎯 Key Target Zones:

TP1: $3,170 — minor liquidity shelf

TP2: $3,168 — Fibonacci 0% level and key support

TP3 (extension): Below $3,160 if structure breaks aggressively

⚠️ Risk Management Strategy:

Entry near $3,207–$3,219

SL just above $3,219 for safety

RR on this play is highly favorable, but only if price respects the supply zone

⚡ Execution Plan:

Wait for bearish signs inside the red zone (engulfing candles, momentum shift)

Avoid early entries — Smart Money often pushes a few pips beyond equilibrium before reversing

Manage trade in segments, partial out at TP1 and trail stop into deeper targets

🧠 Pro Trader Tip:

This is not a breakout play — it’s a liquidity engineering setup.

Smart Money thrives on fake reversals, and this current bounce could be one of them. Watch the supply zone reaction closely.

✅ Comment "GOLD SETUP" if you’re watching this play unfold

✅ Save this analysis to sharpen your Smart Money trading edge

USDJPY Setup: Weak Highs, Smart Money Buys Liquidity!!📊 USDJPY is showing signs of a Smart Money reversal from the discount zone.

This 30-minute chart reveals institutional intentions hiding in plain sight — with clear signs of engineered liquidity grabs and the potential for a strong bullish continuation.

🧠 What’s Happening on the Chart:

✅ Price has swept sell-side liquidity below the recent lows

✅ Retraced cleanly to the 61.8% Fibonacci level at 146.26, a classic Smart Money entry zone

✅ The current price is hovering around the 50% retracement, forming a potential higher low structure

📈 Bullish Confluence:

Price is rebounding from a discount zone (golden ratio: 61.8% Fib)

There’s a clearly defined "weak high" marked around 147.00 — Smart Money typically targets these areas

Above that, there are two stacked buy-side liquidity levels:

147.670

148.282

Final target? The liquidity pool near 148.654 — a clean magnet for price

🎯 Trade Idea:

Long Bias from 146.26–146.43 zone (Smart Money re-entry)

Targets:

TP1: 147.00 (Weak High)

TP2: 147.670 (Buy Side Liquidity)

TP3: 148.282 – 148.654 (Full Liquidity Sweep)

Invalidation: Clean break below 146.20 with strong bearish volume

📌 Why This Setup Works:

This setup uses Smart Money Concepts (SMC):

Weak Highs often signal institutional targets

Fair Value Gap (FVG) + Fib confluence adds strong bullish probability

Retail shorts get trapped, thinking the rally was a pullback — while institutions accumulate at discount

🧠 Pro Tip:

Watch for confirmation with a bullish engulfing candle or break of short-term structure before full entry.

Front-running the Smart Money leads to losses. Let them move first.

💬 Comment "USDJPY MOVE" if you're planning to trade this setup

💾 Save this chart for later — this is how the big players trade FX.

Price Reacts to Every Zone I Mark – No Coincidence.Every level you see on this XAU/USD chart is mapped based on institutional moves, order blocks, and real market intent. These aren’t just random zones—each one is backed by experience and a deep understanding of how smart money operates.

Price respects precision. I deliver it every time.

Let the chart speak.

XAUMO Strategy: Institutional-Grade XAU/USD Trading FrameworkThe XAUMO Strategy is a comprehensive institutional-level trading framework designed for precision, adaptability, and profitability when trading XAU/USD. This strategy incorporates Fixed Range Volume Profile (FRVP), VWAP bands, POC, Value Areas, and Market Maker Logic to anticipate price movements with surgical precision.

Core Elements of the XAUMO Strategy

Key Levels (Dynamic Zones):

1. POC (Point of Control):

• Primary POC: $2,685.

• Secondary POC: $2,700.

• Acts as a magnet, offering breakout and retest opportunities.

2. Value Area Levels (VAH & VAL):

• VAH (Value Area High): $2,695 – Resistance Zone.

• VAL (Value Area Low): $2,675 – Support Zone.

3. VWAP Bands (Monthly Anchored):

• Lower Band: $2,670 – Buy Zone.

• Upper Band: $2,705 – Sell Zone.

4. Fair Value Gaps (FVG):

• Untested FVG: $2,675–$2,680.

• These gaps provide reversal or breakout opportunities.

XAUMO Trade Setups

Trade 1: Long from $2,680 (VAL & Lower VWAP Band)

Trigger:

• Price interacted with VAL, lower VWAP band, and untested FVG ($2,675–$2,680).

• RSI divergence confirmed a bullish reversal.

Execution:

• Entry: Buy at $2,680.

• Stop Loss: $2,670 (below VAL).

• Take Profit Levels:

• TP1: $2,690 (POC).

• TP2: $2,695 (VAH).

• TP3: $2,705 (Upper VWAP Band).

Trade Management:

• Scale out at each target:

• TP1: Close 40%.

• TP2: Close 30%.

• TP3: Hold 30% with a trailing stop.

Trade 2: Short from $2,705 (VAH & Upper VWAP Band)

Trigger:

• Price rejection observed at $2,705 (Upper VWAP band).

• Bearish divergence on RSI and liquidity sweep confirmed a reversal setup.

Execution:

• Entry: Sell at $2,705.

• Stop Loss: $2,710 (above resistance).

• Take Profit Levels:

• TP1: $2,695 (VAH).

• TP2: $2,690 (POC).

Trade Management:

• TP1: Close 50%.

• TP2: Close remaining 50%.

• Adjust SL to breakeven after TP1 is hit.

Scenarios for XAUMO

1. If Price Breaks Above $2,705:

• Enter a breakout long trade.

• TP1: $2,710 (short-term extension).

• TP2: $2,715 (macro extension).

2. If Price Breaks Below $2,675:

• Enter a breakout short trade.

• TP1: $2,670.

• TP2: $2,660 (macro target).

3. If Price Stalls at POC ($2,690):

• Tighten stop loss or scale out to lock in profits.

Confluence and Key Observations

1. POC and Volume Levels:

• Both $2,685 and $2,700 POCs have shown strong respect from price action in prior trades.

2. VWAP Bands:

• The lower band ($2,670) aligned with support (VAL) and FVG, confirming strong buy opportunities.

• The upper band ($2,705) coincided with resistance and liquidity traps.

3. RSI Divergences:

• Bullish divergence near $2,675 and bearish divergence near $2,705 validated turning points.

How to Use This on TradingView

1. Add Indicators:

• Use Fixed Range Volume Profile (FRVP) from the swing low ($2,670) to swing high ($2,700).

• Anchor VWAP bands to the monthly chart for dynamic support/resistance levels.

• Overlay RSI and MACD for momentum confirmation.

2. Chart Setup:

• Draw the ascending parallel channel on the 30M chart:

• Support: $2,680.

• Resistance: $2,695–$2,705.

3. Entry Markers:

• Highlight buy zones at $2,680 (VAL) and sell zones at $2,705 (VAH).

4. Targets and Stops:

• Use dynamic TP/SL levels from VWAP, POC, and FRVP zones.

Visualize the Idea

• Bullish Setup: Enter long at $2,680 with targets at POC and VWAP upper band.

• Bearish Setup: Enter short at $2,705 with targets at VAH and POC.

This strategy ensures that you are trading like an institutional player, targeting high-probability zones while managing risk dynamically.

Let me know your thoughts or drop a like if you’re ready to master XAU/USD trading with the XAUMO Strategy! 🦈

NAS100USD: Are We Seeing a False Bullish Break?Greetings Traders,

In today’s analysis, NAS100USD continues to follow bearish institutional order flow, providing an opportunity to capitalize on the current market narrative. While the overall trend remains bearish, recent price action has displayed a bullish break of structure. However, I interpret this as a false break of structure, supported by the following evidence:

Key Observations:

1. Engineered Retail Resistance:

Institutions have created a retail resistance zone with relatively equal highs. This formation entices retail traders to sell at the resistance level, placing their stop losses above it.

These stop losses are viewed as buy stops by institutions, representing willing buyers at premium prices. Institutions capitalize on this by order pairing—selling their positions against the retail buy stops.

2. Institutional Order Pairing Logic:

Large funds require opposing liquidity to fill orders efficiently without slippage. To achieve this, institutions manipulate the market by engineering liquidity through patterns such as resistance zones or equal highs.

After selling at premium levels, institutions aim to buy back positions at discount prices, targeting sell stops and liquidity pools below.

Trading Outlook:

Given this institutional behavior, my interpretation is to anticipate further bearish movement . With institutions likely targeting sell-side liquidity at discount levels, I am focusing on the sell-side liquidity pool as the primary target for this setup.

If you have any insights, questions, or analysis, feel free to share them in the comments below. Let’s collaborate and refine our strategies together.

Kind Regards,

The Architect

Have you noticed Nvidia's Range? Waiting on a decision... The price continues to fluctuate, but not even the latest earnings report has been able to break out of this sideways channel (range) shown in the analysis.

Nvidia is a powerhouse when it comes to its earnings reports, and while the price does fluctuate, it hasn’t done so with the same aggressiveness seen in previous months.

At this point, we’re simply waiting for a decision—either wait for the price to break out of the channel, or, if you want to be more aggressive, look for the price to touch the demand zone to go long. You could do the opposite in the supply zone, but I don’t recommend it, as the overall structure remains bullish.

Thank you for supporting my analysis.

TRADE SAFE!

Its OK as longest google stays above 170 ! lets go ! Last week, Google stayed above 170, which is excellent news. Within the analysis, we can see that it’s starting to show bullish convergence. I also drew an ascending channel based on its recent price movements.

In my last analysis of Google, I mentioned that once the price touched the "stacked channel," we only needed to observe the immediate candlestick structure, and from there, it would take off—and that’s exactly what happened (check out the little thumbs-up hand).

Now, it doesn’t matter if the price dips slightly here; the key is for it to stay above 170 and within the mini ascending channel I marked.

The real challenge for Google is breaking through the inflection zone where it’s currently positioned. It was rejected once, so the price will likely attempt to break through this key zone again.

Let’s see what happens in the coming days.

Thanks for supporting my channel! Best regards.

USDJPY Bearish ContinuationWe are currently looking for bearish continuations to keep selling and following the higher timeframe trend.

Following the 4H timeframe down to the 1H, we have 2 potential areas of interest we can have a minimal risk high reward trade.

AS price continues to accumilate into our areas I will keep updating for possible trade entries.

Nvidia So close to earnings report ! here is my analysis... In this chart, I haven't moved anything at all since my previous analysis of Nvidia. The price is making its natural movement just as we’ve been predicting.

As you can see, the last candle closed by bouncing off my order block and following the pattern of my forecast arrow.(yellow dotted arrow) Based on the price behavior, we can predict that as it gets closer to November 20 — the earnings report date — it will simply be accumulating.

Nvidia's last earnings reports have been phenomenal, and I don’t doubt that this report will be a trigger for the price to make a decision.

But for now, we’ll only see the price in a range until a few days before the report, when we’ll see those high-volume candles that will drive the price in a single direction.

Which direction? The one the report indicates.

Best regards!

GBPUSD Bearish SellsGBPUSD Analysis 15M entry

We are currently active on our sniper sell after NFP Fridays news event.

Price is currently distributing and going into our NFP candle. I'm waiting for a reaction out of that zone and looking to take another sell and continue the downtrend.

I will be executing the sell limit IF price comes higher first and activates the sell.

Hey SPY lovers, look at all that green! Do you believe me now?We are undoubtedly in a scenario where the price is showing a lot of strength. As we can see, the price previously attempted to break all-time highs but encountered an institutional liquidity block, trying twice and creating a double top before making a pullback for days !

This second attempt to break the all-time high will be very important because, after the pullback, we were able to forecast the limit where the price would bounce back. Just one candle with a lot of volume and buying pressure was enough to realize that the price would reverse at $544.

If you've been following this analysis for weeks or months, you'll notice that everything is playing out according to our price action and institutional analysis.

Now, we just need to wait for that ATH, and I think this time will be different, especially considering that we're in election months, and the current president's political party wants the economy to look strong before the elections. So, we can expect a bull run from now until November.

Thank you for supporting my analysis, and if you've benefited from it and made profits, congratulations, I'm happy for you.

Best regards.